Degussa AG at a glance http://www.degussa.com/en/home.html

Degussa AG is a fundamentally newly formed company operating

worldwide and consistently oriented towards high-yield specialty

chemicals. As the product of the merger between Degussa-Huls AG and SKW Trostberg AG in February 2001, Degussa is

Germany’s third largest chemicals company and the

worldwide number one in the field of specialty chemicals. The

strengths of Degussa lie in its high-efficiency customized system

solutions developed for clients in over 100 countries worldwide.

The roots of Degussa stretch much

further back in time: The newly created undertaking combines the

specialty chemicals activities of various predecessor companies

including Degussa, Huls, SKW Trostberg and Goldschmidt. Today

their core competences are organized into the six divisions and

23 business units which together comprise Degussa AG. Their

united strengths securely underpin the Group’s vigorous position.

6 divisions :

| Health &

Nutrition (Headquarters: Trostberg) |

| : |

Flavors & Fruit

Systems

BioActives

Feed Additives

Texturant Systems |

| |

|

| Construction

Chemicals (Headquarters: Trostberg) |

| |

|

| Fine &

Industrial Chemicals (Headquarters: Marl) |

| |

Fine Chemicals

Bleaching & Water Chemicals

C4-Chemistry

Catalysts & Initiators |

| |

|

| Performance

Chemicals (Headquarters: Marl) |

| |

Superabsorbents

(Stockhausen

)

Care Specialties

Oligomers / Silicones |

| |

|

| Coatings

& Advanced Fillers (Headquarters: Frankfurt a.M.) |

| |

Coatings & Colorants

Aerosil & Silanes

Advanced Fillers & Pigments |

| |

|

| Specialty

Polymers (Headquarters: Frankfurt a.M.) |

| |

High Performance

Polymers

Specialty Acrylics

Methacrylates (Roehm)

Plexiglas (Roehm) |

化学工業日報 2003/2/6

独RAG、デグサ株の過半取得へ

E・ON

スペシャリティケミカル最大手のデグサの過半の株式を独RAGが取得することが確実になった。RAGが持つルールガスの株式を独E・ON(エーオン)が取得することが決まり、これにともなってエーオンがデグサ株を放出するためで、RAGは2004年3月31日までにデグサへの出資比率を50.1%に引き上げる予定。

2003/1/31 RAG

RAG finalises Degussa takeover

RAG's takeover bid to Degussa AG's shareholders is to be

finalised. All bid conditions have been met in good time:

antitrust authorities had given their go-ahead to the RAG-Degussa

deal this past autumn, the Federal Republic of Germany and the

State of North Rhine-Westphalia have ratified it and RAG has sold its indirect stake in

Ruhrgas to E.ON.

Karl Starzacher, RAG Aktiengesellschaft Chairman, comments:

"This transaction makes the best strategic sense for both

RAG and Degussa, and will benefit all parties equally. Degussa

will find in RAG a dependable partner, one that views its

long-term commitment as an investment in a common future. For its

part, RAG will be able to use the Degussa takeover to make

significant progress towards realising the group's focused

reorientation. In this endeavour, we will continue to build upon

our core areas, from coal to chemicals."

All Degussa shareholders whose securities accounts contain

Degussa shares submitted for sale (security identification number

WKN 540 837) will receive a bid price of EUR 38 per share after

the completion of the RAG takeover offer. Completion is

tentatively set to take place on 14 February 2003.

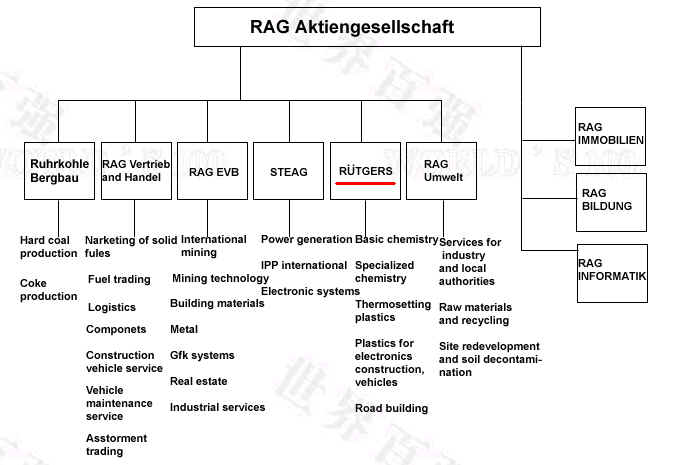

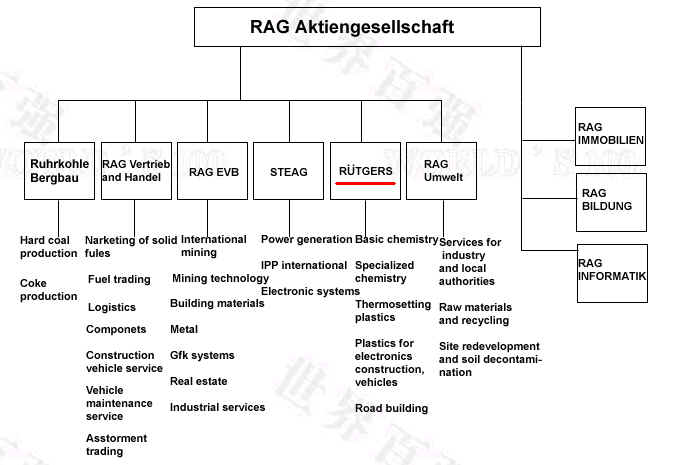

RAG Aktiengesellschaft is an industrial group,

which operators in the sectors of mining, energy, real estate and

chemicals. In 2001 sales

totalled EUR15.3bn. The group employed 87,500 staff. RAG which

was founded in 1969 under the name of Ruhrkohle AG has

transformed itself in recent years into an international mining

and technology group. Currently, over 80% of revenues are being

generated outside of coal mining.

2002/5/20 E.ON AG

E.ON Acquires Ruhrgas Stake of RAG

and Initiates Divestment of Degussa

E.ON AG, Dusseldorf, today concluded an agreement with RAG

Aktiengesellschaft, Essen. Together with the acquisition of other

stakes agreed earlier, this agreement will give E.ON a majority

interest in Ruhrgas AG. At

the same time, E.ON will initiate the divestment of Degussa AG,

Dusseldorf, as part of its strategy of focusing on the energy

business.

E.ON will purchase from RAG an 18.4 percent stake in Ruhrgas,

mainly held via Bergemann GmbH. The purchase price amounts to

approximately EUR 1.9 billion.

In return, RAG

will acquire a majority shareholding in Degussa in two stages:

- In the first stage, RAG will submit a public offer at EUR 38

per Degussa share. Including the dividend of EUR 1.10 for fiscal

2001 (which will be due on May 21), this price is 11.5 percent

above the average share price of the past three months. In the

framework of this takeover bid, the number of shares that will be

sold by E.ON will be such that, after the completion of this

process, both companies will hold equal stakes in Degussa. RAG

and E.ON will then jointly manage Degussa as equal partners. This

will enable E.ON to continue to support Degussa’s ongoing restructuring program. The

Chairman of the Supervisory Board will be nominated by RAG.

- In the second stage, RAG will increase its Degussa stake to a majority holding of

50.1 percent by May 31, 2004.

E.ON will sell RAG the shares required for this purpose at the

same price that was offered in the takeover bid. RAG will then

have control over Degussa. Any shares remaining in the hands of

E.ON after this step will preferably be floated on the stock

market. This will provide an opportunity for Degussa to continue

to be an attractive stock for investors.

Good prospects for Degussa

The transaction that has been agreed gives Degussa in the long

term a good strategic perspective and a secure business

environment. The globally operating specialty chemicals company

will be retained in its entirety. In the framework of RAG’s industrial reorientation, Degussa will

become a core business area of the RAG Group.

Agreement is subject to antitrust approval

The agreement concluded with RAG will only become effective if

the German Ministry of Economics grants the ministerial permit

requested by E.ON for taking over a majority shareholding in

Ruhrgas. E.ON expects a decision in this matter by mid-July. In

addition, the acquisition of Degussa by RAG is also subject to

antitrust approval.

http://www.jaif.or.jp/data/monthly/0054-2.html

ECがVEBA/VIAG合併を承認

欧州委員会(EC)は(2000年)6月13日、ドイツの2大合併のひとつであるVEBA社とVIAG社の合併を承認した。これを受けて、両社は同16日、デュッセルドルフを本社とするE.ON社を設立した。同社はエネルギーをはじめ化学、通信等の分野で約20万人を従業員を抱え、724億ユーロの年間売上を見込んでいる。また、VEBAとVIAGのそれぞれの子会社であるプロイセンエレクトラとバイエルンベルクの両社も合併し、ドイツ国内では第2位、欧州市場では第4位となるE.ONエネルギー社が誕生した。同社はミュンヘンに本社を置き、電力事業のほか熱、水道、石油、天然ガスなどエネルギー分野の事業を行う。ドイツの南北にわたる電力網を握るE.ONエネルギー社は、国内にある原子力発電所のうち12基を抱える、同国1の原子力発電会社となる。

http://www.shimbun.denki.or.jp/select2/010323-a.html

ドイツの8大電力再編劇は昨年6月、業界2位のVEBAとVIAGが合併しE.ONが誕生したことから本格化。その後、最大手RWEと第6位VEWの合併計画が持ち上がり11月には正式に合併、E.ONからドイツ第1位・欧州第3位の座を奪い取った。しかし二社の市場複占を危ぐした独連邦カルテル庁が、持ち合っていた他の電力会社株を売却することを合併の条件としたことでVEAG社株の約9割が売りに出された。売却先の決め手は東側の褐炭鉱山会社の救済にバッテンフォールが合意したこととされる。現在の焦点は最後に残ったBEWAG(ベルリン電力)の扱い。E.ONが売りに出す株は同社の約半数で、取得を巡っては米ミラント(旧サザンエナジー)とHEWが係争を続けている。

RAG http://www.rag.de/indexe.htm

Founded in 1969 as a coal mining

enterprise called Ruhrkohle AG, the company's extensive technical

know-how has since been applied extensively to other

mining-related divisions. Today, the value-added chain with

respect to hard coal has been systematically and expertly

realized on a global scale by the RAG Group. The 460 companies

that comprise the RAG Aktiengesellschaft Group offer a broad

range of products and services. At year-end 2001, with holdings

in approximately 240 companies abroad, RAG is engaged in

extensive global activity. As in the previous year also in 2001,

these foreign enterprises accounted for 30 percent of the Group's

total revenues.

In addition to international coal

mining and coal trading, the Group's IPP-related construction and

operation of power plants abroad have gained in importance. RUTGERS is a market leader

in the area of plastics for the electronic industry, while STEAG is Germany's second largest

converter of hard coal to electricity. RAG IMMOBILIEN is among

the largest real estate companies in the residential and

commercial real estate sectors in the German state of North

Rhine-Westphalia.

Applying the hard-earned know-how

from its coal mining origins to other fields of endeavor, RAG

Aktiengesellschaft has evolved into a mulftifaceted international

group with a work force approximately 87,500 strong and total

annual revenues of more than Euro 15 billion in 2001.

2003/3/5 RAG

The future beckons for a refocused RAG

Group

・ The RAG Group is to strengthen

its activities in the three core areas of mining, real

estate and chemicals

・ The power generation/gas and plastics business areas

will be sold off

As part of a strategic restructuring

programme, the RAG Group is to concentrate on the three core

areas of domestic and international mining, real estate and

chemicals. As a result, the power generation/gas and plastics

business areas will have to be relinquished. "Concentrating

on these three well-positioned pillars will help us to improve

the performance and earnings power of the Group. Domestic

bituminous coal mining will remain a core business area within

the RAG Group," explained Chairman of the Board Karl

Starzacher. Power generation/gas and plastics will no longer form

part of RAG's core business areas. "We are convinced that

those areas which are to be sold off have far more potential for

further development in the hands of new owners for whom the

relevant business areas form part of their core business

activities," stated Starzacher. RAG will relinquish earnings

of approx. EUR 6.3 billion in the medium term and around 17,800

employees will find themselves under new management. The concept

proposed by the RAG managerial board was approved by the

Supervisory Board the previous evening.

RAG reached a milestone in terms of

focussing on high return and strong growth business areas in the

middle of February when it purchased a 46.48 percent stake in

specialty chemicals company Degussa. RAG will increase this equity stake into a

majority holding in Degussa in spring 2004, when it acquires further Degussa shares

from E.ON.

As part of its strategic

concentration on three pillars, the Group will make further

significant changes to its portfolio: RAG will sell off STEAG

and the plastics divisions of RUTGERS. Likewise, in the future it is also

intended that the power generation/gas business areas of RAG

Saarberg be continued in the hands of an alternative operator.

All activities which do not fit in with the three-pillar strategy

will in future be run as non-core businesses. This will be the

case for automotive, merchant wholesaling, as well as the

industrial properties held by our subsidiary RAG Real Estate, for

example. RAG will be selling off all non-core business

activities.

Implementation of the majority of

the planned portfolio focusing process should be complete by the

end of 2004. The divestiture programme will be implemented

swiftly, clearly structured and consistently. The loan of approx.

EUR 1.9 billion which was taken up in connection with the Degussa

takeover will also be redeemed by the end of 2004.

The portfolio restructuring process

will boost long-term economic performance by improving the

earnings power of the RAG Group, and will also secure the further

expansion of future core businesses. As a result of the portfolio

restructuring process RAG will emerge as a focused and

value-oriented industrial group concentrating on mining (domestic

and international mining, coal trading and mining technology),

real estate (residential property, real estate services as well

as the development of floor and space projects) and chemicals

(including specialty and basic chemicals). "International

mining and chemicals offer high potential for growth. In the real

estate sector, we possess substantial assets and stable returns.

Our new structure as an industrial group based in

Nordrhein-Westfalen with a strong international focus puts RAG

Aktiengesellschaft in a highly competitive position," said

Starzacher.

"However, good results alone do

not provide sufficient reason to keep business areas within a

Group," continued Starzacher. "Business areas which do

not fit into the strategic focus of the RAG Group have more

potential for development with another strong partner." The

power generation/gas business areas which are due to be sold off

have registered good performances over the past few years. STEAG

AG has strengthened its profile as an Independent Power Producer

(IPP) and reinforced the strong position it has already achieved

on the international market. Including the domestic coal-fired

power stations, the company has all the necessary prerequisites

for a successful future. The same applies to SaarEnergie, SFW

(Saar Fernwarme) and Saarferngas, which belong to RAG Saarberg

AG. The plastics business area (base materials for electronics,

construction plastics and thermosetting plastics) which is also

earmarked for sale is in good shape following rigorous

restructuring measures and stands to benefit when the economy

picks up again. The Rutgers Basic Chemicals area will remain

within the RAG Group, which has coal processing synergies with

sub-group RAG Coal International.

When selling off its non-core

businesses, RAG will analyze which new owners offer the best

potential for future development. "We are well aware of our

social responsibility towards our employees," explained

Starzacher. "A significant aspect of this is to safeguard

the interests of staff when a transfer of ownership takes place

and to secure their long-term prospects." In line with this,

the company reached an agreement with the working group of the

workers' councils in the RAG group and the IG BCE (Mining,

Chemical and Energy Industrial Union) on the previous evening.

RAG began focussing on its core

business areas in 1998. In an initial wave, the number of

business areas was reduced from 41 to 21. By 2001, RAG had

conducted disinvestments with a turnover volume of EUR 2.7

billion and invested a total of EUR 4.7 billion in remaining core

business areas. The aim of this strategy was to focus the Group

on a few strong business areas. According to Starzacher:

"RAG has been laying the foundations for secure, long-term

success since 1998. We will continue to build upon this sound

basis in the future."

2003/3/5 PolymerLatex http://www.polymerlatex.com/

Degussa and Bayer sell

PolymerLatex to Soros Private Equity Partners

Degussa AG of Dusseldorf, Germany,

and Bayer AG of Leverkusen, Germany, are selling Polymer Latex

GmbH & Co. KG, their Marl, Germany-based 50:50 joint venture,

to the financial investment company Soros Private Equity

Partners. The sales price amounts to approx. Euro 235 million.

The transaction is subject to the approval of the relevant

antitrust authorities.

The sale is in line with Degussa's

strategy to focus on specialty chemicals, which it entered in

February 2001 on taking up business. This involved identifying

activities that no longer fitted in with its core operations and

giving them better possibilities of development within another

ownership structure. Along with the intended disposals in its

divestment program, now almost completed, these non-core

activities included PolymerLatex.

In fiscal 2001, PolymerLatex

generated sales of Euro 344 million with about 730 employees. The

joint venture, which was founded in 1996 by Degussa and Bayer,

produces latex products in the paper, carpet/moulded foam and

speciality applications fields, and holds a leading position

among latex suppliers. PolymerLatex has been able to expand its

leading market position even further over the past few years

thanks to significant investments in its five European production

sites, and continuous development of customized products.

Soros Private Equity Partners

("Soros") is a global private equity investor which,

together with its affiliates, currently manages in excess of

US-Dollar 4 billion of equity capital. Soros has announced that

it intends to develop PolymerLatex’s operations in the coming years and will

consider possible add-on-acquisitions to consolidate its market

share.

Platts 2003/6/11

European Commission clears

Celanese-Degussa oxo alcohols JV

The European Commission has granted

clearance under the European Union's Merger Regulation to a proposed

joint venture between

German chemical producers Celanese and Degussa in the market for

oxo chemicals, EC said in a statement Wednesday.

The Commission was initially

concerned about the parties' strong position in several of the

markets, including the oxo alcohols. But an analysis showed that

competitors would be able to keep in check any attempt by the

venture to raise prices especially in view of the spare capacity

in the sector, EC said.

On Dec 18, 2002, EC received a

notification according to which Celanese and Degussa would

contribute most of their oxo chemicals business to a 50/50 joint

venture company, to be called European Oxo Chemicals (EOC). EOC will be active in the

production of several oxo chemicals, including butyraldehyde,

butanol, 2-ethylhexanol, dioctyl phthalate, butyl acetate, and

carboxylic acids.

Nov 26 2002 Celanese AG

Celanese and Degussa complete

negotiations on joint venture for C3-oxo chemicals in Europe

Degussa AG of Dusseldorf and

Celanese AG, Kronberg, have successfully completed their

negotiations to

establish a joint venture for propylene-based oxo chemicals in

Europe.

Both companies will hold a 50% share in the European joint venture. The joint

venture will merge the commercial, technical and operational

C3-oxo business activities of Celanese in Oberhausen, Germany,

with those of Degussa’s

Oxeno subsidiary in Marl, Germany. Oxo chemicals are primarily

used as chemical intermediates in solvents and plasticizers.

The integration of both businesses

is expected to begin immediately after regulatory clearance by

the respective authorities. The companies currently expect the

joint venture to start up operations during 2003.

On a 2001 pro-forma basis, the new

joint venture would have a sales volume of around Euro 410

million and approximately 240 employees. With the creation of the

joint venture, both partners will deconsolidate their C3-based

oxo businesses.

Celanese AG is a global chemicals

company with leading positions in its key products and world

class process technology. The Celanese portfolio consists of five

main businesses: Acetyl Products, Intermediates, Acetate

Products, Technical Polymers Ticona and Performance Products.

Celanese generated sales of around Euro 5.1 billion in 2001 and

has about 11,700 employees. The company has 30 production plants

and five research centers in 11 countries mainly in North

America, Europe and Asia. Celanese AG shares are listed on the

Frankfurt stock exchange (stock exchange symbol CZZ) and on the

New York Stock Exchange (symbol CZ).

Degussa is an entirely newly-formed,

multinational corporation consistently aligned to highly

profitable specialty chemistry. With sales of Euro 12.9 billion

and a workforce of some 53,400, it is Germany's third-largest

chemical company and world market leader in specialty chemicals.

In fiscal 2001, the corporation generated operating profits

(EBITA) of more than ?1 billion. Degussa's core strength lies in

highly-effective system solutions tailored to the requirements of

its customers in over 100 countries throughout the world. Its

activities are led by the vision "Everybody benefits from a

Degussa product - every day and everywhere".

Jul 30, 2003 Chemical Week Newswire

Degussa Sells Makroform to Bayer;Methanova to Ineos

Degussa says it has agreed to

sell its 45.5% share in polycarbonate (PC) sheeting joint venture

Makroform (Darmstadt, Germany) to its partner, Bayer Polymers. Bayer and Degussa

subsidiary Rohm (Darmstadt) established Makroform in 2000. Makroform generated sales of

Euro100 million ($115.4 million) in 2002. It produces) sheeting

using Bayer's PC, resins, as well as pentaerythritol tetranitrate

semifinished products. It employs 300 and has production at

Darmstadt and Weiterstadt, Germany; Milan; and Tielt, Belgium.

Separately, says Degussa has sold

its Methanova (Mainz-Mombach, Germany) subsidiary to Ineos

Capital. Methanova produces methanol derivatives, including

formaldehyde and paraformaldehyde, used in melamine, phenolic,

and urea resins, and has sales of E45 million/year.

化学工業日報 2003/9/18

デグサ、ベルギーにメチオニンの新工場建設へ

デグサは飼料添加剤事業を拡大するため、必須アミノ酸であるDL−メチオニンの新工場の建設を始めた。インフラが整い、物流面でも優位性のあるベルギーのアントワープに新設するもので、年産15万トンのプラントを建設する。2005年までに建設を終える予定。投資額は3億5000万ユーロで、2001年にデグサ・ヒュルスとSKWトロストベルグが合併して発足した現在のデグサにとって最大規模の投資になる。

September 01, 2003 Degussa

Degussa sells Vitamin B3 Business to Reilly

http://www.degussa.com/en/press/news.html

Degussa AG, Dusseldorf, and

Reilly Industries, Inc., Indianapolis, announce a two-stage

transaction to transfer Degussa’s vitamin B3 business in Antwerp/Belgium

to Reilly’s wholly owned

Belgian subsidiary, Reilly Antwerp N.V. The parties have signed

all contracts necessary to complete both stages of the

transaction and are waiting for final Belgian government approval

to complete the purchase by Reilly. The purchase price will not

be disclosed, by agreement. In 2002 Degussa generated sales in

the double-digit millions euros with this business.

Until approvals can be obtained, Degussa Antwerpen N.V., a wholly

owned Degussa subsidiary, will toll manufacture all vitamin B3

products currently made at its Antwerp site exclusively for

Reilly. Once the governmental approvals have been received,

Reilly and Degussa AG will close the transaction to transfer the

assets of the B3 business to Reilly Antwerp N.V. Reilly will be

responsible for the business from the date the toll manufacturing

begins on September 1st, 2003. Degussa will continue to sell

vitamin B3 into the feed market as an agent for Reilly.

Upon completion of both transactions, Reilly will have all assets

and know-how necessary for continuing and growing the business.

Once this stage of the transaction closes, Reilly Antwerp N.V.

will produce the vitamin B3 products at Antwerp with the same 34

experienced staff members currently employed at the facility.

The Degussa Management Board Chairman Prof. Utz-Hellmuth Felcht

stated: “Divestment of the

B3 business is a logical consequence of our strategic decision to

focus our feed additives resources on amino acids for animal

nutrition.”

Dr. Hubert Wennemer, President of

the Feed Additives Business Unit added: “We are firmly convinced that our B3

activities will continue to develop favorably under Reilly’s management, since they will be part of

its core business. This strategic step will simultaneously enable

us to continue strengthening our worldwide leadership position in

amino acids.”

“This acquisition makes good

business sense for several reasons,” said Reilly Chief Executive Officer and

President Robert D. McNeeley. “First, it advances Reilly’s position as a major supplier of vitamin

B3. With this acquisition we will have the world’s largest capacity for food grade vitamin

B3 and we will be the second largest producer of feed grade

vitamin B3 as well. Second, as Reilly is the world’s largest supplier of beta picoline, a key

raw material for vitamin B3 production, this acquisition fits

well with our growth strategy. Finally, it demonstrates Reilly’s commitment to being a world-class

supplier of vitamin B3 and its derivatives.”

This transaction will have no direct

impact on Reilly’s

Indianapolis operations since vitamin B3 production will remain

in Antwerp. “In

Indianapolis we currently produce raw materials for Degussa’s vitamin B3 business,” said Reilly Vice President Jacqueline

Simmons. “It is our

intention to continue to make those raw materials in Indianapolis

and become a much stronger integrated supplier of vitamin B3.”

Reilly and Degussa have a

longstanding relationship since 1982 when both companies formed

joint ventures for the production and sale of vitamin B3 in North

America and Europe.

Degussa is

the only manufacturer to market all three of the important amino

acids for animal nutrition DL-methionine, L-lysine (Biolys®) and L-threonine. These amino acids are produced at five

sites in four countries. Degussa’s Feed Additives Business Unit sells its

products in 100 countries throughout the world and generated

sales of - 568 million in fiscal 2002.

Reilly Industries is a leading world producer of specialty

chemicals in the B3, pyridine, carbon and esters businesses. It

employs 625 people in eight facilities across the United States,

Europe and Asia.

Degussa is a multinational corporation consistently aligned to

highly profitable specialty chemistry. With sales of 11.8 billion

Euro and a workforce of some 48,000, it is Germany’s third-largest chemical company and the

world market leader in specialty chemicals. In fiscal year 2002,

the group generated operating profits (EBIT) of more than 900

million Euro. Degussa’s

core strength lies in highly-effective system solutions that are

tailored to the requirements of its customers in over 100

countries throughout the world. Degussa’s activities are led by the vision

"Everybody benefits from a Degussa product ? every day and

everywhere“.

Degussa 2004/9/16

Degussa enters into research alliance with Korean partner

Targeting the next generation of materials for electronics

applications

http://www.degussa.com/en/press/news.news.details.1318.html

Degussa AG,

Dusseldorf, Germany and LG Chem, Ltd., Seoul, Korea, have agreed

on joint

strategic research into the next generation of highly functional

materials for electronics and IT applications. The aim is to develop

products and systems solutions for and with the Korean chemicals

company LG Chem.

“Alliances at all stages in the value-added

chain - with partners like LG Chem - allow rapid

commercialization of scientific knowledge through marketable

products and technologies,” explains Dr. Alfred

Oberholz, Member of Degussa’s Board of Management and

responsible for research and development. In technology-driven

markets with rapid innovation cycles it is especially important

to start working with customers on the development of new

solutions as early as possible.

Innovation and intelligent linking are Degussa’s core competencies. That includes

collaborating with customers as well as universities. “Strategic alliances are a key to gaining

and main-taining new market positions in the global marketplace,” says Dr. Oberholz. Degussa is planning to

step up its research capacity in Asia significantly and Korea is

to be integrated into the Group’s global R&D network.

LG Chem, Ltd., is the leading chemicals company in Korea. As part

of the LG Group it manufactures a wide range of products, from

petrochemicals and high value-added plastics to high-performance

industrial materials. It is also expanding its chemical expertise

in the field of high-tech materials for electronics and

information technology, rechargeable batteries and display

materials.

Degussa is a multinational corporation consistently aligned to

highly profitable specialty chemistry. In fiscal 2003, its 47,000

employees generated sales of ? 11.4 billion and operating profits

(EBIT) of ? 878 million, making it Germany's third-largest

chemical company and the global market leader in specialty

chemicals. Innovative products and system solutions enable

Degussa to play a valuable and indispensable role in the success

of its customers, as summed up by our claim “creating essentials”.

November 17, 2004

Degussa 広西チワン族自治区南寧

Degussa’s new China L-Methionine plant completed

successfully

http://www.degussa.com/china/en/home/communication/china_news/2004_11_17_l_methionine_plant.html

The new Degussa

L-Methionine plant was officially inaugurated on Nov. 11, 2004,

at the Nanning

Only-Time Rexim Pharmaceutical Co., Ltd. (NOTR). The plant is

situated in Wuming, Nanning City, capital of Guangxi Zhuang

Autonomous Region, South China.

With the establishment of this plant, Rexim S.A., a 100%

subsidiary of the Degussa Group, has “confirmed its strong

commitment to the infusion solution industry and all other

segments of application,” said Mr. Manfred Mueller,

President of Rexim at the inauguration ceremony. Degussa started

the production of L-Methionine in the 1980s in Constance,

Germany. After closing of the plant in Constance in 2001, Degussa

decided to transfer its technology to Wuming and furthermore

increase capacity from 250 tpa to 340 tpa. The L-Methionine plant, the world’s largest, will cover more than 50% of the

world’s market demand.

NOTR is a joint venture that was founded in 2001 between Nanning Only-Time

Pharmaceutical Co., Ltd. and Rexim S.A, France . The first phase of the

joint venture was to build an amino acids refining unit with a capacity

of 500 tpa,

which was inaugurated in Nov. 2003. The new L-Methionine plant is

the second phase of the joint venture, which increased the total

Degussa investment in Wuming to 35 million Euros.

The plant, operated by the Exclusive Synthesis & Catalyst

Business Unit, represents Degussa’s state-of-the-art

technology. Running a continuous enzymatic reaction process, the

plant will ensure consistency and stability of quality according

to Degussa’s high standards. “The new L-Methionine plant opens a new

chapter in our book of China operations. We are proud that from

now on we will be able to deliver the highest quality materials

from here in Wuming,” said Mr. Eric Baden,

President of Degussa China.

Degussa (China) Co., Ltd. was founded in November, 2002. It is to

unite and expand Degussa’s activities in the China

region. Today, Degussa operates in China a total of seventeen

companies with production sites in Beijing, Guangzhou, Nanning,

Qingdao, Shanghai and Hongkong. In China, Degussa now has a

workforce of more than 1,300 employees. In fiscal 2003, the Group

generated total sales of Euro280 million in China. Degussa’s mission for China is to become its most

committed partner in special chemicals.

Degussa is a multinational corporation consistently aligned to

highly profitable specialty chemistry. In fiscal 2003, its 47,000

employees generated sales of Eruo11.4 billion and operating

profits (EBIT) of Euro878 million, making it Germany's

third-largest chemical company and the global market leader in

specialty chemicals. Innovative products and system solutions

enable Degussa to play a valuable and indispensable role in the

success of its customers, as summed up by our claim “creating essentials”.Contact:

2004/12/7 Degussa

Degussa Signs a Precontract with Jilin University on high

performance polymers PEEK and PES

http://www.degussa.com/en/press/news.news.details.1354.html

Prof. Dr.

Utz-Hellmuth Felcht, Chairman of the Board of Management of

Degussa AG, signed a precontract with Prof. Zhou Qifeng,

academician President of Jilin吉林

University,

to buy an equity stake of 80% of Changchun Jida High Performance

Materials Co., Ltd. (“Jida New Materials”長春吉大高新材料有限公司), a subsidiary of Jilin

University in Changchun長春, northern China. The

document was signed in the presence of German Chancellor Gerhard

Schroeder and Wen Jiabao, Premier of China温家宝国務院総理. The Degussa Management

Board Chairman is a member of the business delegation that is

accompanying the Chancellor on his current China trip.

The precontract governs the cooperation concerning the two high

performance polymers PEEK and PES, both developed by Jilin

University. Earlier this year, Degussa already signed a letter of

intent with Jida New Materials for the joint development,

production and marketing of PEEK and PES. The final joint venture

contracts are subject to supervisory board approval.

Felcht commented this deal: "With this successful project we

have established a new model for cooperation between German

companies and Chinese universities: In this particular case,

Jilin University has developed these high-tech materials, while

Degussa will utilize its sales, marketing, project management

experience and capital resources."

The cooperation with Jilin University will enable Degussa to

strengthen its High Performance Polymers Business Unit, which

produces specialty polymers as well as high-quality high

performance polymers ー some of them unique ー based on polyamide 12 and

polybutylenterephthalate.

The high temperature polymers developed by Jilin University will

broaden High Performance Polymers' range of these polymers, which

mainly find use in automotive engineering, aviation and

electronics. This will take High Performance Polymers a further

important step forward in positioning itself as a broad supplier

of customer-tailored solution systems in the field of polymeric

materials. The Business Unit is part of the Specialty Polymers

Division, which generated sales of approx. Euro1.3 billion in

fiscal 2003.

In 2003, Degussa increased its sales in China by 17 percent to

approx. Euro 280 million. The Group currently operates 17

companies in the country and opened a new research and

development center in Shanghai this spring. Above and beyond

this, the foundation stone for a multi-user site, a location at

which Degussa will be setting up the new activities of several

business units, was laid at Shanghai Chemical Industry Park

(SCIP) early November.

Degussa is a multinational corporation consistently aligned to

highly profitable specialty chemistry. In fiscal 2003, its 47,000

employees generated sales of Eruo11.4 billion and operating

profits (EBIT) of Euro 878 million, making it Germany's

third-largest chemical company and the global market leader in

specialty chemicals. Innovative products and system solutions

enable Degussa to play a valuable and indispensable role in the

success of its customers, as summed up by our claim “creating essentials”.

2004/5/7 Degussa

Degussa acquires all shares of Agroferm from Kyowa Hakko

http://www.degussa.com/en/press/news.news.details.1280.html

Degussa AG,

Dusseldorf, is acquiring all of the shares of Agroferm Hungarian -

Japanese Fermentation Industry Ltd. (“Agroferm”), currently a wholly owned subsidiary of

Kyowa Hakko Kogyo Co., Ltd. (“Kyowa Hakko”), Tokyo. Degussa will also obtain

exclusive rights to Kyowa Hakko‘s intellectual property

for L-lysine, L-threonine, and L-tryptophane in the field of feed

amino acids. Upon finalizing the transaction, Degussa will begin

selling Tryptophan produced by Kyowa Hakko’s subsidiary under a toll manufacturing

agreement. Silence has been agreed on the financial aspects of

the deal. The deal is subject to the approval of the relevant

regulatory authorities.

This transaction will further strengthen Degussa’s activities in the field of essential amino-acids used for

animal nutrition. The Hungarian company with sales of

approx. EUR 25 million and approx. 160 employees will be

integrated into the Business Unit Feed Additives of Degussa as of

summer this year. Degussa is the only manufacturer in the world

to produce all three of the important animal feed amino acids

DL-methionine, L-lysine (BiolysR) and L-threonine. The feed

additives are currently manufactured at five locations in four

countries, with sales in over 100 countries worldwide. The

Business Unit Feed Additives generated sales of EUR 613 million

in fiscal 2003 with around 1,000 employees.

The sale of Agroferm to Degussa will allow Kyowa Hakko to further

concentrate management resources on pharmaceutical-, food-, and

industrial-use amino acids. Kyowa Hakko has for some time scaled

back its feed-use amino acid business. At a meeting on April 27,

2004, the Board of Directors of Kyowa Hakko Kogyo Co., Ltd.

therefore resolved to sell all of the shares of Agroferm to

Degussa.

Degussa is a multinational corporation consistently aligned to

highly profitable specialty chemistry. In fiscal 2003, its 47,000

employees generated sales of Euro 11.4 billion and operating

profits (EBIT) of Euro 878 million, making it Germany's

third-largest chemical company and the global market leader in

specialty chemicals. Innovative products and system solutions

enable Degussa to play a valuable and indispensable role in the

success of its customers, as summed up by our claim “creating essentials”.

2005/9/12 デグサ

ドイツ・デグサ カーギル社に食品原材料事業を売却

http://www.degussa.co.jp/japan/ja/press/news/0.html

デグサAG(本社:デュッセルドルフ、ドイツ)は、アメリカ・ミネソタ州ミネアポリスのカーギル社に対して、食品原材料事業を5億4000万ユーロ(6億

7000万米ドル)で売却することに合意しました。今回の売却は、デグサ監査役会及び関連する監督官庁の承認後に発効します。

ウツ・ヘルムート・フェルヒト取締役会長は、「食品原材料事業は、カーギル社のようなグローバルで優れた食品企業にとって、戦略上最適であり、理想的とも言えるものです。私たちは、当事業を優良な企業に委ねることができたと確信しており、売却には全体として非常に満足しています。」と述べています。

合併・統合を続ける食品原材料産業界にあって、デグサ取締役会は、2004年8月に食品原材料事業を売却することを決定しましたが、それは、この部門が世界で主要な地位へと更に発展するための機会を提供するためでした。

「この度の合意は、カーギルが、スペシャリティ原材料や成分システムを世界中の食品飲料会社に提供するトップ企業となるための戦略において、非常に重要なステップです。」とカーギル社の会長及びCEOであるウォレン・ステーリー氏は語っています。「今回の買収は、2002年にセレスターを買収して以来、最大の案件です。これによって、弊社のテクスチュラントシステムズやフレーバー事業の体制が大きく拡充します。弊社が、食品飲料会社に対して成功の架け橋となる革新的なソリューションを提供することは、世界が認めるリーダーとなるという我々の戦略を支えてくれるものです。」

2005年初めのフルーツ・システムズ事業売却後、デグサの食品原材料事業は、テクスチュラント・システムズ及びフレーバー事業で構成されています。テクスチュラント・システムズの製品群は、増粘多糖類、ブレンド、レシチン、カルチャー及び機能性食品素材の分野が中心です。フレーバー分野では、飲料、乳製品、製菓その他の加工食品の品質の鍵となる食品香料を様々な技術サービスと共に提供しています。食品原材料事業に従事する社員の技術・技能は、現在のカーギル社の体制を補完し、強化します。

デグサ

デグサはグローバルに展開している世界有数のスペシャリティケミカル企業です。現在、デグサAGと世界のデグサグループの総従業員数は約45,000人です。2004年度の年間総売上は112億ユーロで、税・利息控除前利益(EBIT)は9億6,500万ユーロを計上しました。デグサは革新的な製品とシステムソリューションを提供することで、ビジネスの成功には欠かせない貴重な役割を担っています。「クリエイティング・エッセンシャル」-本質を創造する-それが私達デグサの仕事です。

デグサ フードイングレデイエント ビジネスユニット(食品原材料事業)グローバルな食品産業の提携パートナーとして、専門的ノウハウおよび優れたサービスに基づいて、革新的なソリューションをテクスチュアライジング、香料や生物活性の分野で提供します。フルーツ・システムズ事業の売却に関する調整を行い、傘下にあるそれぞれの他事業を加えて、フードイングレデイエント ビジネスユニットでは、2004年度に4億4100万ユーロの売上を計上しました。当ビジネスユニットは2005年6月30日現在、アメリカとフランスを中心に総計で2,088人の従業員を擁しています。その内、およそ200人は、ドイツで雇用され、ハンブルク、フライジング、トロストベルクおよびボーネンの事業所に勤務しています。

カーギル社

カーギル社は、食品、農製品及びリスク・マネジメント製品やサービスを提供する国際的な企業です。カーギル社は、59か国に124,000人の従業員を擁し、2004/05年度にはおよそ710億米ドルの売上を計上しました。

2005/9/20

Degussa

Degussa

acquires additional know-how in manufacturing polyaryl ether

ketones

http://www.degussa.com/en/press/news.news.details.1459.html

In a move

to further consolidate its expertise in the area of

high-temperature polymers, Degussa AG, Dusseldorf, is acquiring all the know-how

and patents of Ticona GmbH, Kelsterbach, in the field of polyaryl ether

ketones. Patents and know-how for the

manufacture and use of these polymers had been developed in the

Technical Polymers Division of Hoechst AG in the 1990s and had

been assigned to Ticona when Hoechst spun off its non-pharma

businesses in 1999. With the acquisition, Degussa is combining

the experience gained by the former Hoechst AG from almost ten

years of researching, manufacturing and using polyaryl ether

ketones with the results of 20 years of research by Jilin University,

Changchun, China, along with its own research

and development.

This

will strengthen Degussa's High Performance Polymers Business

Unit, which is preparing for the start of the Chinese joint

venture JIDA Degussa High Performance

Polymers Changchun Co. Ltd. that was agreed in early June

2005. The joint venture, in which Degussa holds an 80 percent

share and Jilin University 20 percent, will produce polyether

ether ketones (PEEK*). "The comprehensive know-how and

patents that Degussa has now acquired will ensure us successful

entry into the technology-driven PEEK* market," states Dr.

Joachim Leluschko, the Business Unit's Head. "This package

is buying considerable time for High Performance Polymers to

start the first developments with customers, as soon as all

permits for the start of JIDA Degussa High Performance Polymers

Changchun have been obtained."

High

Performance Polymers manufactures high-performance polymers based

on polyamide 12 and various other specialty polymers. Products

from the PEEK* family will enable the business unit to expand its

range of products in the attractive segment of high-performance

plastics, which need to meet extreme mechanical, thermal, and

chemical requirements. As a comprehensive systems supplier for

polymer materials Degussa is thus setting its sights in

particular on the automotive engineering and electronics end

markets, as well as the aerospace industry.

*

PEEK is the official ISO 1043 abbreviation for polyether ether

ketones.

As

the global market leader in specialty chemicals, Degussa uses its

innovative products and system solutions to create something

indispensable for its customers' success. It's an approach we sum

up in our claim of "creating essentials". In fiscal

2004 its 45,000 employees generated sales of 11.2 billion euros,

and operating profits (EBIT) of 965 million euros.

November 21, 2005 Degussa

Degussa: New Joint

Venture to Manufacture Rubber Silanes in China

http://www.degussa.com/en/press/news.news.details.1504.html

Degussa AG, Dusseldorf,

and Rizhao Lanxing Chemical Industry Co., Ltd. (Lanshan-Rizhao日照市嵐山, Shandong Province, People’s Republic of China) have signed

an agreement to establish a joint venture for the manufacture of sulfur-functional

silanes for rubber applications. This agreement represents a

successful conclusion to the negotiations that followed a

memorandum of understanding signed by the two companies in July

2005. Degussa will own a 50 percent share in the new joint

venture, and Lanxing 40 percent. A financial investor will assume

the remaining 10 percent. Degussa is the worldwide leading

manufacturer of silanes for rubber applications. Lanxing has been

a well-established local manufacturer on the Chinese market since

1998. The new joint venture company will begin operating under

the name Degussa Lanxing (Rizhao) Chemical

Industrial Co., Ltd.,

following approval by the responsible bodies, and having obtained

all licenses from the Chinese authorities. The company is

scheduled to produce sulfur-functional silanes in liquid form and

as a blend with carbon black.

ゴム用有機シラン:ゴム用に使用されるシリカの大半は、硫黄官能基を含む有機シランと組み合わせることで、その優れた性能を発揮します。

Along with silica,

sulfur-functional silanes are used to manufacture high-quality

rubber compounds for use in tires, technical rubber articles, and

sports shoes. In tires, the use of the silica/silane system ー

a pioneering

development by Degussa ー allows a significant reduction in

rolling resistance and therefore a reduction in fuel consumption.

“The

demand for the kind of high-quality rubber silanes produced by

Degussa's Advanced Fillers & Pigments Business Unit is

continually growing ー not least because of the current

fuel prices. Robert Wissner, head of the business unit, explains

the company’s commitment to China: “By building a production plant in

Asia we are supplementing our production facilities in Europe and

the United States, and further expanding our position as world

market leader. Our joint venture facility in China will produce

for our customers from the rubber and tire industries in

Asia/Pacific who need our silanes to manufacture products that

meet international standards."

Together with an increasing production of tires and other rubber

products the demand for rubber silanes in China is growing

strongly. China has already become the worldwide largest market

for truck tires and the third largest for all kinds of tires.

Powering this leap in demand is the increased involvement of

global automobile manufacturers and big international tire

producers, as well as the massive expansion of China’s network of roads and highways.

Degussa, which has been producing specialty chemicals in China

since 1988, now has 20 companies in the country, operating

production facilities in Beijing, Guangzhou, Nanning, Qingdao,

Shanghai and Hong Kong. Its broad spectrum of products ? ranging

from carbon blacks, amino acids, polyurethane foam additives,

high-performance water treatment chemicals, construction

chemicals, and initiators used in the production of plastics ? is

aligned to customers not only in China but in the whole of Asia.

As parent corporation of the Degussa Group in China, Degussa

(China) Co., Ltd., Beijing acts as a holding company for the

Group’s activities in China, supporting

Degussa’s business units through an

efficient and expert platform of services.

Degussa’s Advanced Fillers & Pigments

Business Unit is one of the largest producers of carbon black in

the world. As a specialist in surface chemistry and surface

physics, the business unit concentrates on the production and

application of carbon black, performance silicas, matting agents,

and functional organo-silanes. The business unit serves a broad

clientele, including manufacturers of tires and technical rubber

articles, as well as customers from the printing, paint and

polymer industries.

As the global market leader in specialty chemicals, Degussa uses

its innovative products and system solutions to create something

indispensable for its customers’ success. It’s an approach we sum up in our

claim of “creating essentials”. In fiscal 2004 its 45,000

employees generated sales of 11,2 billion euros, and operating

profits (EBIT) of 965 million euros.

2005/12/15 デグサ

ジャパン

独デグサ、5事業部廃止など来年1月から意思決定プロセス加速へ組織を簡素化

ドイツ・デグサ 収益力ある成長に焦点 − 組織の簡素化へ

デグサAG(本社:ドイツ デュッセルドルフ)は収益力ある成長をさらに追求し、マネジメント組織を合理化します。これまで20のビジネスユニットを5つの事業部(ディビジョン)に束ねて管理していましたが、事業部を解消し、ビジネスユニットが直接、取締役会に報告する体制とします。同時に、ビジネスユニットも類似した事業内容のユニットをより統合し、17に削減します。このマネジメント組織の戦略的構想は、12月13日にデグサの監査役会により承認されました。今回の組織変更による人員削減は予定しておりません。新組織は2006年1月1日に発足します。

デグサは2001年から2004年にかけてスタート・アップ期間を完了しました。その後、過去6ヶ月間にわたり"戦略と組織"プロジェクトを推進し、事業ポートフォリオおよび組織の見直しを検討し、今回の決定に至りました。これによりデグサは基本概念である分権型の会社組織を強化し、意思決定プロセスを加速させ、さらに市場における柔軟性を高めます。

デグサのウツ ヘルムート・フェルヒト取締役会長は「前進あるのみ、私たちは更に市場に身近な存在となり、より簡素化された組織でグローバルなスペシャリティケミカル市場に立ち向かいます。これを基盤として経営戦略プログラム"デグサ2008年計画"を遂行し、デグサは長期的に目標とする高収益率と高成長率を達成します」と述べています。

解消する5事業部に代わって、デグサは2006年1月から、レポーティングセグメントを導入します。レポーティングセグメントとは、事業部のような独自の体制を持つ組織ではなく、ビジネスモデルならびに戦略上の成功事例など様々な活動の成果を共有する単位です。新たに発足するレポーティングセグメントは4つあり、(1) テクノロジー スペシャリティ、(2) コンストラクション ケミカル、(3) コンシューマー ソリューション、(4) スペシャリティ マテリアルに分かれ、別紙のように、全体で17あるビジネスユニットを束ねます。

過去数年間にわたり、ポートフォリオに焦点を当て、事業を再編成し、コアビジネスを強化してきたことにより、デグサがリーディングスペシャリティケミカル企業として強固な基盤を築き上げたことを"戦略&組織"プロジェクトは示しました。しかしながら企業戦略、ポートフォリオおよびマネジメント組織は、企業が自ら設定した経営目標を達成するために、常に改善され続けなければなりません。

今後も、「重要かつ成長力のあるコア分野」、「安定した収益が見込める事業」、「厳しい市場環境にある事業」のポートフォリオにビジネスを分類し、高利益率を維持した成長に一層焦点をあてます。「重要かつ成長力のあるコア分野」には、無機スペシャリティ、コーティング&粘着材用応用分野、化粧品業界用材料、ハイパフォーマンスプラスチックなどが含まれます。デグサの取締役会は、今後数カ月間にわたって、高利益率を維持した成長を実現するための優先順位と具体的なアクションプランを検討します。

デグサの4つのレポーティングセグメント

社外報告は4つのレポーティングセグメントを軸に行われます。以前の事業部と異なり、レポーティングセグメントは独自の体制をもつ組織ではありません。

テクノロジー スペシャリティは、長年にわたりデグサが開発してきた画期的なスペシャルテクノロジーに基づくビジネスユニット(精密化学品・中間体、受託合成・触媒、C−4ケミストリー、アエロジル&シラン、アドバンスドフィラーズ&ピグメント)から構成されています。例えば、医薬業界で用いられる医薬用中間体や、バイオ・ディーゼル用触媒などは、長年にわたりデグサで開発された技術およびプロセス・ノウハウの結果として生まれています。(ラボ・スケールの合成法開発から、基盤となる原料のインテグレーションを含む大量生産まで)また、微粒子テクノロジーにおける物理・化学の専門知識・技術を生かし、ゴム強化剤や光メディアの研磨分野において、デグサはリーディング・ポジションを有しています。

コンストラクション ケミカルは建設業界の顧客を対象とした化学システムとフォーミュレーションから成り立ちます。デグサはグローバルマーケットリーダーとして、強固な流通ネットワークを築き、アプリケーション開発の豊富な経験を蓄えています。このセグメントに含まれるビジネスユニットは混和剤システム(北米)、混和剤システム(ヨーロッパ)、混和剤システム(アジア/パシフィック)、建材システム(アメリカ)、建材システム(ヨーロッパ)です。

コンシューマー ソリューションは、消費者向け製品および素材用にカスタムメードした原料をグローバルに供給する事業から構成されます。開発段階での協業により、デグサは主要な最終製品メーカーと密接な関係を築いています。スーパーアブゾーバー、ケア&サーフェス スペシャリティ、飼料添加物のビジネスユニットは全て、このレポートセグメントに組み込まれます。

スペシャリティ マテリアルはデグサのハイパフォーマンスマテリアル事業から成り立ちます。優れた素材、製法と応用技術から、デグサはこの市場においても優位に立っています。これらの製品の多くはメタクリル酸メチル(MMA)から製造され、Verbundと呼ばれる統合された製造ネットワークが駆使されています。このセグメントはコーティング原料、ハイパフォーマンスポリマー、メタアクリレート、スペシャリティ アクリリクスのビジネスユニットから構成されます。統合製造ネットワーク、Verbundの高い競争力は、これらの事業が組織的に、製薬ポリマーや光学エレクトロニクスといった特殊分野の応用市場へ進出することを可能にします。

合理化された組織と、より効果的なリーダーシップ

今後、デグサの取締役会は、より多くの経営上の役割を担います。取締役会には新たに2人のメンバーが加わり、計6名となります。監査役会は現在ファイン&工業用ケミカル事業部責任者であるベアンハート・ホフマンと、スペシャリティ ポリマー事業部責任者であるマンフレッド・シュピンドラーを新メンバーに任命しました。

デグサAG CEOとしてウツ ヘルムート・フェルヒト会長はグループ戦略の責任を担います。ベアンハート・ホフマンはテクノロジー スペシャリティとコンストラクション ケミカルにおける責任者となり、マンフレッド・シュピンドラーはコンシューマー ソリューション、スペシャリティ マテリアルの責任者となります。他の取締役員であるアルフレッド・オーバーホルツ、トーマス・シェーネベルグ、ハインツ ヨアヒム・ワーグナーの権限に大きな変更はありません。

コーポレート・センターとサービス部門においても、効率性がさらに追求され、運営面において取締役会を補佐します。コーポレート・センターはより一層、デグサ グループにおけるリーダーシップを発揮することになります。グローバルに運営するサービス機能は、今後、責任者である各取締役員に個々に直接報告します。一方、その他のサービス機能は、該当するコーポレート・センターユニットに報告します。これにより組織が簡素化され、サービス部門におけるより効率的なマネジメントが可能になります。

さらに、デグサはグローバル組織の合理化を行っています。今後、7つの地域(北米、南米、西ヨーロッパ、東ヨーロッパ、インド、中国、日本)には各リージョン責任者がおかれ、取締役メンバーに直接報告をします。その他の国々は、その地域で最も売上高が大きいビジネスユニットに組み込まれます。

レポーティングセグメント概要

デグサはグローバルに展開している世界有数のスペシャリティケミカル企業です。現在、デグサAGと世界のデグサ グループの総従業員数は約45,000人です。2004年度の年間総売上は112億ユーロで、税・利息控除前利益(EBIT)は9億6,500万ユーロを計上しました。デグサは革新的な製品とシステムソリューションを提供することで、ビジネスの成功には欠かせない貴重な役割を担っています。「クリエイティング・エッセンシャル」−本質を創造する−それが私達デグサの仕事です。

2006/2/8 デグサ

デグサ 中国で新合弁会社設立

デグサ、ウェリンク

グループとパフォーマンスシリカ生産の合弁事業契約調印

http://www.degussa.co.jp/japan/ja/press/news/fotv.html

デグサ(本社:ドイツ、デュッセルドルフ)は、ウェリンク

グループ(Wellink

Group)の福建南平信元投資有限公司(Fujian Nanping Xinyuan Investment

Co., Ltd.)(本社:中国、福建省南平市)と、パフォーマンスシリカ(沈降シリカ、シリケート)を生産および販売する合弁会社を設立する事業契約の締結を行いました。近々予定されている関係当局の最終認可を受け次第、事業を開始します。新会社の名称は、「デグサ・ウェリンク・シリカ(南平)(以下

DWS)社」で、同社の株式は、デグサが 60 %、ウェリンクがシリカ事業を共同出資している信元(Xinyuan)社が 40 %保有します。

DWS 社は中国に3箇所の生産拠点を有し、地域顧客向けにパフォーマンスシリカを供給します。現在は、中国のゴム製造業者が主要顧客となっていますが、DWS 社は今後、特にシリコーンゴムと歯磨き粉事業での成長を見込んでいます。

DWS 社は福建省南平市内に自社研究所を擁し、顧客の特定の需要に合った新製品の開発に取り組んでいます。

新合弁会社の設立により、デグサは世界におけるパフォーマンスシリカ生産のトップメーカーとしてのポジションをさらに強化します。現在デグサは、アジア・太平洋地域においてパフォーマンスシリカ生産のトップの地位を占めており、

5 カ国の

8 製造拠点で年間合計

17 万

5 千トンの生産能力を有しています。

新会社 DWS 社の中国側提携先であるウェリンク

グループは、 1994

年にパフォーマンスシリカの生産を開始。今日では中国におけるパフォーマンスシリカ製造のトップ企業となっています。

デグサはカーボンブラック、パフォーマンスシリカ、ゴム用有機シランの全てを供給できる世界唯一のメーカーです(革新的な

3 製品製造システムを提供)。またデグサ

グループは中国の顧客に向け、 3箇所の研究開発センターが支援する

5 製造拠点より多様な製品を提供しています。

デグサはグローバルに展開している世界有数のスペシャリティケミカル企業です。現在、デグサAGと世界のデグサ

グループの総従業員数は約45,000人です。2004年度の年間総売上は112億ユーロで、税・利息控除前利益(EBIT)は9億6,500万ユーロを計上しました。デグサは革新的な製品とシステムソリューションを提供することで、ビジネスの成功には欠かせない貴重な役割を担っています。「クリエイティング・エッセンシャル」-本質を創造する-それが私達デグサの仕事です。

February 10, 2006 Degussa

Degussa Acquires

Superabsorbent Business from Dow

http://www.degussa.com/en/press/news.news.details.1538.html

Degussa AG, Dusseldorf,

is acquiring the superabsorbent business of The Dow Chemical

Company, Midland, MI, USA. The Parties agreed not to disclose

financial terms of the transaction. The agreement involves the acquisition of

Dow's superabsorbent facility in Rheinmuenster/Baden-Baden,

Germany and

a

toll manufacturing arrangement with Dow's superabsorbent facility

in Midland.

In addition, Degussa and Dow will enter into a long term

agreement for Dow to supply glacial acrylic acid 精製アクリル酸

to Degussa with

opportunities for future growth of this volume over time. Glacial

acrylic acid is the most important raw material used in the

manufacture of superabsorbent polymers. The transaction remains

subject to regulatory approvals.

Degussa Management

Board Chairman Prof. Utz-Hellmuth Felcht states: “The arrangement with Dow marks a

milestone in the strategic expansion of our superabsorbent

business. Over the next few years we intend to adequately

participate in the accelerated growth of this attractive market.

Moreover, the arrangement allows for further backwards

integration.” “The market for superabsorbents has

been growing significantly in the recent past. The development in

Eastern Europe and Latin America is particularly promising”, adds Gunther Wittmer, President

of the Degussa Business Unit Superabsorber.

As part of the

agreement, Degussa will gain Dow's worldwide

existing superabsorbent business. The acquisition, combined with a

debottlenecking at Degussa's facilities in Garyville, LA,

Greensboro, NC, as well as capital investments at the new

Rheinmuenster facility, will result in a considerable expansion

of Degussa's present global superabsorbent manufacturing

capacity. The conclusion of the long-term glacial acrylic acid

agreement secures upstream integration also for the new

capacities in Europe and NAFTA for Degussa. This has become

increasingly important in light of fluctuations in the

availability of raw material.

Degussa is the

market and innovation leader in the superabsorbents market. In

2004 its Business Unit Superabsorber generated sales of 432

million euros with a workforce of around 500. The Business Unit

has production facilities in Germany (Krefeld and Marl) and in

the USA (Garyville, Greensboro and Deer Park, TX).

Superabsorbents

excel through their extreme absorbency and high-capacity fluid

storage. They are used in products such as baby diapers and

feminine and adult hygiene articles.

Degussa is the

global market leader in specialty chemicals. Our innovative

products and system solutions make an indispensable contribution

to our customers' success. It's an approach it sums up in its

claim of "creating essentials". In fiscal 2004

Degussa's 45,000 employees worldwide generated sales of 11.2

billion euros and operating profits (EBIT) of 965 million euros.

2006/3/30 Ashland

Ashland signs agreement

to acquire Degussa water treatment business

http://www.ashland.com/news/news.asp?function=detail&rowid=car&news_uid=1441&lobpass=

Ashland Inc. announced

today that it has signed a definitive agreement to purchase the water treatment

business of Degussa AG, branded under the Stockhausen name, in a transaction valued at

approximately $144 million (120 million euros). Five

manufacturing facilities located in Germany, China, Brazil,

Russia and the United States are included in the transaction. The

Degussa water treatment business posted 2005 sales of nearly $250

million.

“This

transaction demonstrates Ashland’s continuing strategy to build

shareholder value by expanding our products, services and

geographical reach in market segments where we already compete,”

said James J. O’Brien, chairman and chief

executive officer of Ashland. “Water management is an essential

and growing part of the world economy, and the addition of the

Degussa water treatment business to Ashland will help us

participate in that growth.”

"This

acquisition expands our technology base, product line and service

levels -- strengths that already distinguish us and that we

continue to build upon," said Len Gelosa, senior vice

president, Water Technologies, Ashland Specialty Chemical, a

division of Ashland Inc. "It also helps us develop our

presence in the important BRIC nations (Brazil, Russia, India and

China) where the economic future offers significant potential for

growth."

The closing, which is anticipated to take place in May 2006, is

conditional upon a number of standard closing conditions,

including regulatory review.

Degussa Management Board Chairman Prof. Utz-Hellmuth Felcht said,

“Our

Water Chemicals business is an ideal strategic complement to

Ashland’s portfolio. We have passed our

business into good hands.”

Ashland Water

Technologies, a business of Ashland Specialty Chemical, is a

supplier of specialty products and consulting services to the

manufacturing and institutional markets through its Drew

Industrial business group and a leading supplier to the global

marine industry through its Drew Marine business group. Drew

Industrial provides industrial, commercial and institutional

water treatments, wastewater treatment, pathogen control, paint

and coating additives, pulp and paper processing and mining

chemistries. Drew Marine provides boiler and cooling water

treatments, fuel treatments, welding, refrigeration and sealing

products; and fire fighting, safety and rescue products and

services.

Ashland Specialty Chemical, a division of Ashland Inc., is a

leading, worldwide supplier of specialty chemicals serving

industries including adhesives, automotive, composites, metal

casting, merchant marine, paint, paper, plastics, watercraft and

water treatment. Visit www.ashspec.com to learn more about these

operations.

Ashland Inc. is a Fortune 500 chemical and transportation

construction company providing products, services and customer

solutions throughout the world. To learn more about Ashland,

visit www.ashland.com.

2006/6/2 Degussa

Fine Chemicals: Degussa and Lynchem establish a joint venture for

exclusive synthesis in China

http://www.degussa.com/degussa/en/press/news/details?NewsID=1593

Degussa AG of Dusseldorf,

Germany, and Lynchem Co., Ltd.(大連緑源), Dalian, Liaoning Province,

China (“Lynchem”), have signed a contract to

establish a joint venture. The goal of the new company is to

enhance Degussa’s and Lynchem’s manufacturing asset base for the

production of custom-manufactured fine chemicals

and to

provide the customer base of Degussa and Lynchem with more

competitive solutions. Degussa (China) Co., Ltd.,

Beijing, an affiliate of Degussa AG, will acquire 51 percent of

Lynchem. The

remaining 49 percent will be held by the current owners. Closing

of the transaction is expected before the end of 2006, and will

be subject to governmental and antitrust authority approvals. The

new company will operate under the name of Degussa Lynchem

Co., Ltd.

The joint venture will be a cornerstone for the implementation of

the Asia strategy of Degussa’s Exclusive Synthesis &

Catalysts Business Unit. It will combine Lynchem’s track record in the efficient

production of custom-made fine chemicals with Degussa’s strength as a market leader in

technology development as well as for good manufacturing practice

(GMP) intermediates and active pharmaceutical ingredients (APIs)

for the pharmaceutical industry. Degussa will become the first

European supplier to implement the concept of horizontal

integration in the custom-manufacturing market. This will allow

cost competitive manufacturing of on-patent intermediate and API

steps, off-patent APIs and other special chemicals in the Chinese

joint venture. At the same time, the customers will benefit from

Degussa’s extensive portfolio of leading

technologies available at its European sites and Degussa’s track record of compliance with

all regulatory and intellectual property requirements for

on-patent intermediates and APIs.

Degussa Lynchem will be fully integrated into Degussa’s global production infrastructure

and marketing network, and will continue the commitment to

Lynchem’s existing customers and projects.

This will ensure that all customers will be provided with better

services and solutions, but served from one key contact.

"This transaction is a decisive step in the continued

development of our fine chemicals activities, which represent one

of our important core business areas,” states Dr. Alfred Oberholz, Deputy

Chairman of the Management Board of Degussa AG. Dr. Rudolf Hanko,

Head of Degussa’s Exclusive Synthesis Business

Line, remarks: “Customers have been waiting for

the opportunity to get the best of both regions from a single

supplier. In forming the joint venture with Lynchem we are

combining with a leading force in the Chinese

custom-manufacturing industry”.

Mr. Yuncai Wang, founder and majority shareholder of Lynchem,

comments: “Lynchem has been a pioneer in

promoting and developing in China the custom-manufacturing of

intermediates and GMP regulated products for the world markets.

The partnership with Degussa, well known as a leading player in

exclusive synthesis, will result in a competitive advantage for

the new joint venture. We are pleased to have attracted such a

strong partner.”

Lynchem is a

leading Chinese fine chemicals custom-manufacturing company of

1,200 employees with a 50 hectare facility in Dalian/ Liaoning

Province and sales of 35 million euros in 2005. The company was

established in 1995, has a reactor capacity of more than 800

cubic meters and exports over 95 percent of its products to

leading pharmaceutical, agrochemical and other highly specialized

customers in Europe, North America and Japan.

With sales of 335 million euros in 2005, Degussa’s Exclusive Synthesis &

Catalysts Business Unit focuses on the custom manufacturing of

chemical catalysts, advanced pharmaceutical intermediates and

active pharmaceutical ingredients. Through its global network of

sites and R&D facilities, the business unit offers seamless

services ranging from synthesis development on lab-scale to

commercial production in its different USFDA approved facilities.

It is also a leading supplier of catalytic system solutions,

offering a broad portfolio of catalysts as well as all-round

services for the life science, fine chemicals, industrial

chemicals, intermediates and polymer industries.

2006/6/12 Degussa

Degussa Puts Colorants and Polyesters Plants in Shanghai on

Stream - Start of Production in the Shanghai Chemical Industry

Park

http://www.degussa.com/degussa/en/press/news/details?NewsID=1599

Degussa AG, Dusseldorf,

recently celebrated the start-up of its new polyesters

and colorants plants at

its multi-user site (MUSC) in Shanghai. On June 12, 2006, Dr.

Alfred Oberholz, Dr. Manfred Spindler, and Dr. Hans-Peter

Schaufler welcomed a large number of guests from the worlds of

politics and business to the Shanghai Chemical Industry Park.

"The start-up of the first production plant at the MUSC

represents a milestone for Degussa. We're systematically

expanding our presence in China's attractive growth market,"

said Dr. Oberholz, deputy chairman of Degussa AG's Management

Board. "We’re happy to now be able to offer

our high-quality products and solutions in China too. These

plants will strengthen Degussa's core business," added Dr.

Spindler, member of the Management Board. Dr. Schaufler, head of

the Coatings & Colorants Business Unit, emphasized the

importance of the MUSC for the Coatings & Colorants Business

Unit. "We attach great importance to a long-term commitment

to China. With this step, our business unit is affirming its

confidence in the dynamic growth of the Chinese market, and is

supporting customers in the region with local production."

The new multi-user site is located in Shanghai Chemical Industry

Park (SCIP), on the southern outskirts of the city. The

investments are pooled in Degussa Specialty Chemicals (Shanghai),

a subsidiary of Degussa's Chinese holding Degussa (China) Co.,

Ltd. The polyesters and colorants plants of the Coatings &

Colorants Business Unit are the first projects at this site.

DYNAPOL coating polyesters of the Polyesters & Adhesive

Resins Business Line, which belongs to the business unit, are

used mainly in hard, but at the same time flexible, coil and can

coating systems. Light- and weather-resistant coil coatings are

obtained by combining polyesters with blocked single-component

polyester PUR systems (VESTICOAT). For the adhesives industry,

the business line offers DYNACOLL copolyesters for

moisture-curing systems and the adhesive polyester DYNAPOL S for

hot melts.

* 飽和ポリエステル樹脂(DYNAPOL)、反応性ポリエステル樹脂(DYNACOLL)、

For both in-plant

and point-of-sale tinting (in home improvement stores, for

instance), the Colorants Business Line produces and develops

high-quality pigment pastes and color tinting systems that can be

adjusted with extreme accuracy and are aimed particularly at the

paints, coatings, and related industries. Thanks to high-grade

pigment pastes, colors of paints and coatings can be adjusted as

desired with high accuracy and reproducibility. For the

decorative coatings market, pigment pastes of the COLORTREND

brand name represent an international standard for tinting of

architectural paints and DIY coatings, while CHROMA-CHEM pigment

pastes optimize the coloring of industrial paints and coatings.

Degussa is the global market leader in specialty chemicals. Our

business is creating essentials ? innovative products and system

solutions that make indispensable contributions to our customers’

success. In fiscal

2005 around 44,000 employees worldwide generated sales of 11.8

billion euros and operating profits (EBIT) of 940 million euros.

July 12, 2007 Degussa

New PMMA Plant of Degussa

and Forhouse Goes Onstream in Taiwan - Growth market PMMA Molding

Compounds for flat-panel displays

RAG subsidiary Degussa

GmbH today started up a new production facility for PMMA (polymethyl

methacrylate) molding compounds in Taichung, Taiwan, together with its joint venture

partner Forhouse Corporation 輔祥実業. Degussa holds a 51

percent share and Forhouse a 49 percent share in the joint venture

Degussa Forhouse Optical Polymers Corporation, launched in

January 2006. The construction project for the new plant, which

manufactures high-quality PMMA for optical

applications in flat-panel displays was implemented quickly after a

short planning phase.

"The Asian market for PMMA molding compounds is very

attractive. Through our strategic partnership with Forhouse and

by starting up the new facility, we have done a lot to strengthen

our position with PMMA molding compounds in Asia and are

expanding our global position as a leading supplier of

PMMA," Dr. Klaus Engel, Chairman of the Managing Board of

Degussa GmbH, said at the inauguration.

"Global demand for our high-quality PMMA molding compounds

is set to rise significantly in the next few years," added

Gregor Hetzke, President of the Methacrylates Business Unit.

"The market for liquid-crystal flat-panel displays is

currently expanding at an annual rate of more than 10 percent.

The new production facility enables us to serve this growing

market from our local site.“

The plant will have

an

initial annual capacity of some 40,000 metric tonnes and is designed for "over

the fence" production. Apart from PMMA manufacture, the

further processing of lighting modules (backlight units) for

flat-panel displays will also be located at this site. The

integrated supply chain ensures the continuous supply of the

ultra high purity optical-grade material to customers. The

PLEXIGLAS®

molding compound

used to manufacture optical light guides in TFT-LCD

(Thin-Film-Transistor Liquid-Crystal Display) flat-panel displays

has to meet the most stringent quality requirements to enable

perfect illumination of the displays.

"The start-up of the PMMA plant marks a huge advance in our

backward integration strategy and the related goal of securing

the PMMA supply for our further growth," adds Francis Pan,

President of Forhouse. "The plant also helps us achieve our

objective of improving our cost position.“

The joint venture

unites the core competencies of both partners. Degussa's

comprehensive know-how along the entire process chain of

methacrylate chemistry enables Forhouse to position itself

favorably in the technology-driven markets for optoelectronic

devices, through the joint development of innovative products.

Degussa is a leading global manufacturer of PMMA molding

compounds, with production facilities in Europe, North America

and Asia. With its wide product portfolio for all extrusion and

injection-molding applications and its strong applications know

how, the Molding Compounds Business Line offers customer-specific

solutions for a multitude of demanding applications.

Forhouse is one of Taiwan's leading companies in its field, with

substantial expertise in manufacturing and developing lighting

modules for flat-panel displays, and operates several production

facilities in Taiwan and mainland China. As one of the leading

suppliers of back light unit modules, Forhouse possesses

excellent knowledge of the market and outstanding technical

support skills. In 2006, Forhouse achieved sales of some EUR 492

million with around 6,000 employees. By combining their

strengths, the two partners will not only be able to cooperate

successfully in their existing business, but also develop

innovative products for the expanding market.

輔祥実業 http://www.smartness.com.tw/_japan/1_about/1_company.php

1989年創立以来、創造、革新という理念に基づき、画期的な製品「電子ダーツ」を開発し、自社ブランドのSMARTNESSにて、全世界に輸出され、市場占有率は50%超え、世界一の電子ダーツ専門製造工場とはいえます。更に、新しい業界に渡り、付加価値の高い製品「ルームランナー」事業をスタートしました。本来の販売ルートを運用し、室内スポーツ用品の世界的リーダーに成長しました。

1998年から積極的に光電ディスプレー関係のバックライト事業に進入し、その核心技術の開発に力尽くしてきました。社長からの社員全体の努力で、

1999年から生産に投入、同年にISO 9001の品質認定を受け、そして国内バックライト工場のトップ三位にも入りました。競争力向上に狙い、精密成形から、金型作り、精密スクリーン印刷まで社内開発生産です。