Russia/CIS

http://www.platts.com/Petrochemicals/Resources/Presentations/russia.ppt

|

|

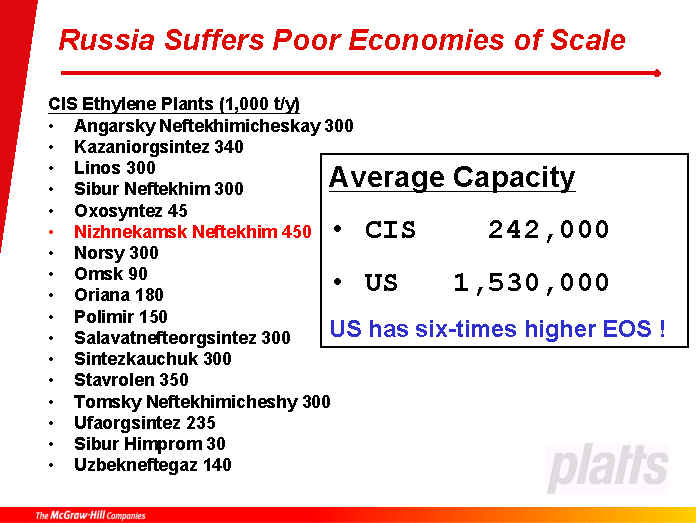

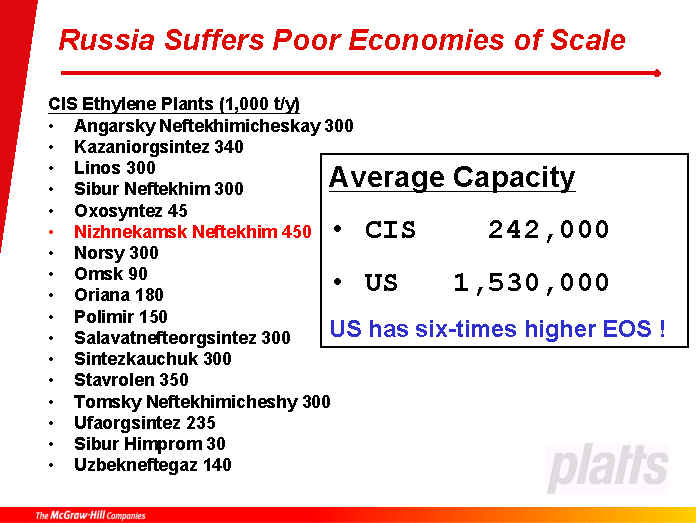

| * Nuzhnekamskneftekhim to boost ethylene by 150,000 mt/yr to 600,000 mt/yr |

|

|

|

|

|

日本経済新聞 2004/12/28 発表

化学プラント ロシアで200億円受注 東洋エンジなど高機能樹脂生産

東洋エンジニアリング、出光興産、旭化成ケミカルズはロシア化学大手のカザンオルグシンテツ(カザン市)から、高機能樹脂のポリカーボネート生産設備など化学プラントを受注した。受注額は約2億ドル(約200億円)で、2007年に完成予定。材料のビスフェノールAの設備も整備して一貫生産体制を築く。

モスクワ南東にあり、化学工場が集積しているタタルスタン共和国のカザン市に、既存の工場インフラを活用して最新設備を建設する。ビスフェノールAを年7万トン、ポリカーボネートを同6万5千トン生産する。

ビスフェノールAは出光興産、ポリカーボネートは旭化成ケミカルズが開発した生産技術を活用する。三井物産が全体を調整した。

ポリカーボネートはDVD(デジタル多用途ディスク)や電子機器の外枠、自動車部品など幅広く使われる。世界市場は年間200万トン規模とみられる。3社は追加受注を期待する。

カザンオルグシンテツは自社で生産しているアセトンやフェノールなどの原料を使ってポリカーボネートを生産、ロシア国内で販売するほか、欧州やアジアヘの輸出を検討している。

カザンオルグシンテツはロシアの化学大手で、エチレン、ポリエチレンなどを生産する。2003年の売上高は約3億6千万ドル。

2004/12/28

東洋エンジニアリング

ロシア初のビスフェノールA・ポリカーボネート設備を受注

http://www.toyo-eng.co.jp/jp/news/16/20041228.html

東洋エンジニアリング株式会社(TEC、取締役社長 山田豊)は、三井物産株式会社と協力して、ロシア連邦タタールスタン共和国のカザンオルグシンテツ社が、同共和国カザン市に建設を計画している、ロシア初となる年産70,000トンのビスフェノールA(BPA)生産設備及び年産65,000トンのポリカーボネート(PC)生産設備をこのたび受注致しました。TECの役務範囲は両設備の詳細設計及び機器調達で、プラントの完成は2007年を予定しています。本プロジェクトには、低い環境負荷と高い安全性に秀でた最新技術である、出光興産(株)のBPA技術と旭化成ケミカルズ(株)のPC技術が採用されています。三井物産(株)は、本プロジェクトの実現に向け、TEC及びライセンスを供与する出光興産㈱、旭化成ケミカルズ(株)と客先間のコーディネーションを行い、今回の早期受注に貢献してきました。

本プロジェクトは、自社で生産しているアセトン、フェノールを原料にBPAを生産し、最終製品のPCまで一貫して生産することにより、原料製品の高付加価値化を目的としています。またロシア国内でも急成長しているPCへの需要を満たすとともに、需要超過状態にあるヨーロッパ、アジアマーケットに輸出することが計画されています。ロシアはソ連崩壊後の混乱時期を脱し、高度経済成長軌道に乗り国内消費は年々上向きに転じており、石油化学製品や化学品に対する国内需要の高まりと共に、国内でのプラント需要も飛躍的に増大すると予測されています。当社は同国での長年にわたる豊富な経験を生かし、一層の受注拡大を期待しています。

<受注概要>

| ■客先 | : | カザンオルグシンテツ社(Kazanorgsintez;本社:カザン市)

(同国最大のポリエチレン製造会社でありボルガ河流域に位置する) |

| ■建設地 | ロシア連邦タタールスタン共和国カザン市

(モスクワ市の東方約1,000キロメートル) |

|

| ■対象設備 | 年産70,000トン・ビスフェノールA(BPA)製造設備 及び 年産65,000トン・ポリカーボネート(PC)製造設備 |

|

| ■役務範囲 | 詳細設計、機器調達 | |

| ■ライセンス | BPAは出光興産(株)、PCは旭化成ケミカルズ(株) | |

| ■プラント完成予定 2007年 | ||

| ■ | 受注の意義 | ||||

| 1 | ) | ロシア初のビスフェノールA及びポリカーボネート・プラントであり、低い環境負荷や安全性に秀でた日本企業の最新鋭技術が適用されます。 | |||

| 2 | ) | 今回のプロジェクトは、旧ソ連邦の官営工場から新しい経済体制での民間企業となった客先が、既存設備を有効に活用し同国の輸入代替や新規需要へ積極的に対応するものであり、今後同様な形で旧ソ連邦時代の遺産を有効に活用した新しいビジネス開拓が期待されます。 | |||

| 3 | ) | 今回の受注要因は、TECの豊富なモノマー及びポリマーの建設実績、ソ連時代を含め40年間以上継続して60件以上のプラントを建設した実績、長年蓄積されたロシア設計基準などの地域ノウハウ、更にプロジェクト実現に向けて発揮された三井物産のコーディネーション機能やロシア及びタタールスタンにおける地域展開力等の高い総合力などです。 | |||

Nizhnekamskneftekhim to produce

1-mil mt/yr polyethylene by 2008

Russia's Nizhnekamskneftekhim and Kazanorgsintez are to raise polyethylene output in the republic

of Tatarstan to 1-mil mt/yr by 2008, according to a government statement.

Currently, seven other companies produce a total of 1.35-mil

mt/yr. The republic's sales revenue from petrochemicals is

expected to rise to Rubles 42.43-bil ($1.45-bil) in 2008 from

Rubles 24.96-bil in 2003.

Nuzhnekamskneftekhim announced last week a $1.5-bil deal with

Korea's LG to build a 200,000 mt/yr PE plant and

a 40,000 mt/yr polystyrene plant in the republic. The company is

expected to boost ethylene ouput by 150,000 mt/yr to 600,000

mt/yr, while raising benzene output by 53,000

mt to 220,000 mt/yr.

Meanwhile, propylene

output is expected to rise by 55,000 mt/yr to 253,000 mt/yr, while butadiene would be up 10,000 mt/yr to

67,000 mt/yr. The existing PS

output would be doubled to produce 100,000 mt/yr. Other projects

include the construction of a new 120,000 mt/yr polypropylene

plant, which would be later expanded by another 60,000 mt/yr.

Ukraine's Naftogaz plans to buy

47.93% stake in petchem JV Lukor

Ukraine's national oil and gas company, Naftogaz, is planning to

buy out the government's 47.93% stake in Lukor, the country's

largest petrochemical joint venture, according to a government decree. The

decree did not stipulate the price of the transaction, but

requires Naftogaz to assume a Eur19.9-mil ($25.3-mil) debt owned

to a German bank by the JV. The development is a setback for

Lukoil, which owns a majority stake in Lukor, and has been

seeking to acquire more shares.

Lukor, the jv that was formed in December 2000 by LUKoil-Neftekhim and

Ukrainian petrochemical complex Oriana.

Lukor (former

Oriana Chemical Corporation) -

one of the largest Ukrainian chemical companies that produces

benzene, polyethylene, propylene, ethylene and other products of

petrochemistry. Currently Lukor is a joint venture of LUKOIL (Russia) and the

Ukrainian shareholders of the former Oriana Chemical Corporation.

Platts 2005/11/23

Kazakhstan to sign petrochemical complex deal by Dec 15

The Kazakhstan's government plans to sign the first agreement

with foreign companies to build petrochemical complexes by Dec 15

as the country aims at becoming a serious player on the world

market, Kazakhstan's prime minister Danial Akhmetov said

Wednesday, as reported by national Kazinform news agency.

The government plans to sign an agreement which is to allow the

country to develop [petrochemical] sector, Akhmetov said on the

sidelines of a petrochemical conference in Kazakhstan's capital

of Astana.

Kazakhstan plans to build two large petrochemical complexes at

the Tengiz and Kashagan fields to produce up to 2-mil mt of

petrochemicals. Investments in the projects are estimated at

around $7- to $8-bil. Of the total, the country plans to invest

some $500-mil "in the near future."

"The most perspective sector of petrochemicals for

Kazakhstan is gas processing. It is this sector to allow the

country to become a serious competitor to all world

companies," Akhmetov was quoted as saying.

Kazakhstan has set up several working groups, in particular with

Lukoil, which is to build a gas chemical complex near the

Khvalynskoye field in the Caspian Sea, Akhmetov said. The project

envisages processing of over 14-bil cu m/yr of gas at the field.

Akhmetov also mentioned LG and Shell, among other companies,

negotiating the issue with the government. Usage of advances

technologies are among Kazakhstan's main conditions for

participating in the projects, Akhmetov said.

The national KazMunaiGaz is to represent Kazakhstan in the

projects, where the government plans to hold at least a 50%

interest.

Kazakhstan plans to raise gas production to 1.2-trillion cf in

2005, up 65% from 720 Bcf last year, and to increase gas output

further to 1.66-tril cf by 2010, according to KazMunaiGaz.

Foster Wheeler Awarded

Detailed Feasibility Contract In The Republic Of Kazakhstan

http://www.corporate-ir.net/ireye/ir_site.zhtml?ticker=FWLT&script=417&layout=-6&item_id=796203

Foster Wheeler

Ltd.announced today that its Italian subsidiary Foster Wheeler

Italiana S.p.A. has been awarded a contract by KazMunaiGas

Exploration and Production (KMG EP) for a detailed feasibility

study for a new petrochemical complex and related facilities to

be built in several locations in Western Kazakhstan. KMG EP is

the state-owned oil and gas company of the Republic of

Kazakhstan. The terms of the award of the study, which will be

included in Foster Wheeler's fourth-quarter 2005 bookings, were

not disclosed.

The proposed facilities, for which the expected final total

investment cost is in excess of $4 billion, would be built in two

phases. Phase 1 would include a gas separation unit to be built

near the town of Kulsary to treat dry gas from the Tenghiz field and separate ethane and propane,

and a petrochemical complex to be built near the city of Atyrau to

process the ethane and propane and produce polyethylene and

polypropylene.

Phase 2 would include an additional gas separation unit to be

built in Karabatan to treat dry gas from the Kashagan field and expansion of the Atyrau

petrochemical complex. The final capacity of the Atyrau complex

would be up to 1,500,000 tons per year of

polyethylene and up to 450,000 tons per year of polypropylene.

“We

are delighted to have been selected by KMG EP and to have the

opportunity to participate in such a large and prestigious

investment that would contribute substantially to the Republic of

Kazakhstan's industrial development. This award reflects the

quality and the depth of our technical and project execution

expertise, and also our considerable petrochemicals and gas

processing experience,” said Giorgio Veronesi, project

director and executive sponsor of Foster Wheeler Italiana's

projects in the Commonwealth of Independent States (CIS).

“We

have selected Foster Wheeler Italiana after an international

competitive tender, in accordance with Kazakhstan State

purchasing rules. We were pleased with Foster Wheeler's tender:

its competitive pricing, aggressive schedule and its proposed

execution strategy for the study,” said Roustem Bekturov, deputy

general manager of KMG Exploration and Production.

The feasibility report is expected to be completed in the first

quarter of 2006. The facilities are expected to be mechanically

completed between 2009 and 2012, depending on the final selected

configuration and execution scheme.

Foster Wheeler Ltd. is a global company offering, through its

subsidiaries, a broad range of design, engineering, construction,

manufacturing, project development and management, research and

plant operation services. Foster Wheeler serves the refining,

upstream oil and gas, LNG and gas-to-liquids, petrochemicals,

chemicals, power, pharmaceuticals, biotechnology and healthcare

industries. The corporation is based in Hamilton, Bermuda, and

its operational headquarters are in Clinton, New Jersey, USA. For

more information about Foster Wheeler, visit our Web site at

http://www.fwc.com.

2006/3/31 Basell

Basell signs MoU with KazMunayGaz and SAT for petrochemical

complex in Kazakhstan

Basell signs memorandum of understanding with KazMunayGaz and SAT

for first integrated worldscale petrochemical complex in Western

Kazakhstan

Following a meeting with Daniyal Kenzhetayevich Akhmetov,

Kazakhstan’s Prime Minister, Basell has

signed a memorandum of understanding (MOU) with KazMunayGaz

Exploration & Production (KMG EP) and SAT & Company (SAT)

confirming their intention to construct and operate a new

petrochemical project in Kazakhstan.

The project is expected to include an ethane

extraction unit in Kulsary and an integrated

petrochemical complex in Atyrau. The planned petrochemical

complex includes a worldscale ethane cracker

and polyethylene

facilities, as well as a propane dehydrogenation unit and

polypropylene

facility. Start up is planned for 2010.

“The

signing of this MOU highlights the rapid progress achieved and

marks a key milestone in the preparation of this important

project,” said Volker Trautz, CEO of Basell,

who participated in the recent meeting with the Prime Minister. “When operational in 2010, this

facility will establish a new benchmark for the polyolefins

industry. The polypropylene and polyethylene units will use

Basell’s latest generation process

technologies, so manufacturing costs will be among the lowest in

the industry, while benefiting from a broad product capability.”

Trautz added, “They will also benefit from

advantaged feedstocks, since they will be integrated with local

gas supplies. As the leading polyolefins supplier worldwide and

the largest polyethylene producer in Europe, Basell will provide

sales and marketing support for the project.”

In addition to

providing technology and sales and marketing services, Basell

intends to participate directly as a shareholder in the project.

KazMunayGas (KMG) was founded in 2002 as a

result of the merger of CJSC National Oil Company Kazakhoil and

NC Oil and Gas Transportation. This state owned company was

created with the goal of developing Kazakhstan’s oil and gas resources. KMG EP is

the operating subsidiary responsible for exploration and

distribution of oil and gas. KMG is also a shareholder in

TengizChevrOil (TCO) and Agip KCO.

SAT is a privately owned, diversified

conglomerate with industrial, commercial and service activities.

Basell is the world's largest producer of polypropylene and

advanced polyolefin products, a leading supplier of polyethylene

and catalysts, and a global leader in the development and

licensing of polypropylene and polyethylene processes. Basell,

together with its joint ventures, has manufacturing facilities

around the world and sells products in more than 120 countries.

Additional information about Basell is available at

www.basell.com.

Platts 2006/6/15

Lukoil, Germany's Uhde agree to build PVC plant in Ukraine

Russia's Lukoil-Neftekhim and German engineering company Uhde

agreed to go ahead with construction of a new suspension PVC

production facility at Ukraine's largest petrochemical

company KarpatNaftoKhim. The agreement was reached at a

recent meeting of Lukoil-Neftekhim CEO Aleksey Smirnov and Klaus

Schneiders, chairman of Uhde's executive board, KarpatNaftoKhim's

press service said Thursday.

The two companies are now expected within weeks to sign the

contract to build the 300,000 mt/year PVC facility in

Kalush, the

company said. The new complex, worth $200 million, is expected to

be completed by 2009, the company said. "This would be the

first, modern, PVC production facility in Ukraine,"

KarpatNaftoKhim CEO Serhiy Chmykhalov said in a statement.

After the new facility is launched in operation, the company

plans to start massive exports of the produced commodity not only

to Eastern European countries, but also to Russia. "There is

no such plant in Russia and will not be in the coming years. We

should not only fill the domestic market, but also to expand on

markets of Russia, Hungary and Poland," Chmykhalov said.

The new facility would allow the company to use vinyl chloride

monomer that it produces as raw materials to produce PVC.

KarpatNaftoKhim, Ukraine's only producer of VCM, is currently

exporting most of its VCM to Russia, the European Union and

Turkey.

KarpatNaftoKhim, which is capable of producing about 370,000 mt of VCM annually, only produced 10,000 mt

of VCM in May due to weak demand. The company plans to boost VCM

production to 15,000 mt in June, according to the company.

KarpatNaftoKhim, which is a part of Lukoil-Neftekhim Group,

operates all production assets of the Kalush-based joint-venture

Lukor, the country's major producer of petrochemical products. Lukoil Chemical

BV, a subsidiary of Russian oil major Lukoil, owns 76% stake in

KarpatNaftoKhim, while the remaining 24% is owned by Lukor. Lukor itself is 52% owned by

Lukoil and 48% owned by the Ukrainian government, via Oriana, a

state petrochemical firm.

Foster Wheeler 2006/9/19 PE PP

Foster Wheeler Awarded Front-End Design for New Complex of

Refining and Petrochemical Plants in Tatarstan

Foster Wheeler Ltd. announced today that its Paris-based

subsidiary Foster Wheeler France S.A., part of its Global

Engineering and Construction Group, has been awarded the

front-end engineering design (FEED) by CJSC Nizhnekamsk

Refinery for

a new Complex of refining and petrochemical plants to be

constructed in Nizhnekamsk, in the Republic of

Tatarstan,

Russian Federation.

This award has been made within the framework of an existing

project management consultancy (PMC) contract awarded to Foster

Wheeler France by CJSC Nizhnekamsk Refinery in 2005. The terms of

the FEED award, which will be included in Foster Wheeler's

third-quarter 2006 bookings, were not disclosed.

The Complex consists of an oil refinery, aimed at processing

seven million tons of crude oil per year, a deep conversion plant

and a petrochemical plant. The oil processing part of the Complex

includes aromatics units and deep conversion section with a

fluidized catalytic cracker, a distillate hydrocracker, a delayed

coker and a gasification plant. The petrochemical part of the

Complex will include purified terephthalic acid,

polyethylene terephthalate, linear alkylbenzene and polypropylene

units, plus

the associated power generation facilities. The expected total

investment cost of the Complex will be in excess of three billion

US dollars. The current plan of CJSC Nizhnekamsk Refinery is to

complete the complex in three different phases between 2008 and

2010.

Foster Wheeler has to develop a complete FEED package, including

definition of scope and configuration for all of the new process

units, which is currently being undertaken by Foster Wheeler,

using the experience and expertise of its operations in Milan,

Paris, Reading and Moscow. The selection of licensors for the oil

processing and petrochemical plants of the Complex has been

completed by CJSC Nizhnekamsk Refinery with the support of Foster

Wheeler.

Foster Wheeler's Moscow office intends to supervise and

coordinate the FEED activities being undertaken by the Russian

Design Institute JSC VNIPIneft (Moscow) for the non-licensed

refinery units, including the atmospheric crude distillation and

the vacuum distillation units, as well as utilities and offsites.

"We are delighted to receive a further award for this major

complex in Tatarstan," said Umberto della Sala, chief

executive officer of Foster Wheeler's Global Engineering &

Construction Group. "This latest award recognizes the

excellent work already fulfilled by Foster Wheeler for CJSC

Nizhnekamsk Refinery and confirms our commitment to delivering

successful projects in the Russian Federation. Working on the

project of Nizhnekamsk Complex we are using the considerable

refining and petrochemical strengths and skills of three of our

major engineering centers, and also our recently established

Moscow operating office."

"We have been working successfully with Foster Wheeler since

2001 and it is no surprise that we selected them as a Project

Management Consultant for our Project," declared Khamza A.

Bagmanov, general director of CJSC Nizhnekamsk Refinery. "We

are pleased with Foster Wheeler's professionalism, responsiveness

to our needs and its capability to mobilize highly qualified

resources from its European offices as well as from its Moscow

operations."

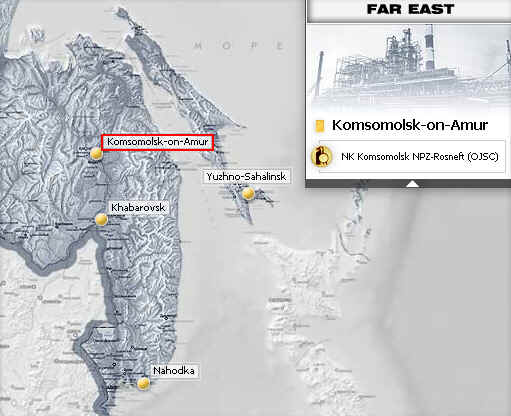

Russia's Rosneft mulls petchem complex at Komsomolsk refinery

Russia's state-run Rosneft is

considering building a petrochemical complex at the Komsomolsk

refinery

in Far East Russia, to process around 1-million mt of naphtha,

Valery Yezhov, the refinery's general director said Thursday.

The naphtha is currently exported to China, but the company was

hoping to produce olefins and other petrochemical products

instead. "We are looking into a possibility to produce some 500,000mt

of ethylene and over 200,000mt of propylene to process our naphtha

rather than export it," Yezhov said.

The plan was one of several possible options for the plant's

development, he said, adding that there were also possibilities

to produce methanol or other products at the site. "But,

this seems to be the most effective [option] at the moment,"

he said.

Rosneft's investment committee was to make a decision on the

issue by the end of the year. Should the committee decide to go

ahead with the petrochemical project, the complex could be built

by 2009-2010, Yezhov said.

http://www.rosneft.com/english/about_rosneft/

Rosneft is a vertically-integrated Russian oil and gas company with upstream and downstream operations in each of Russia's oil-producing regions. Headquartered in Moscow, compared to public companies it is the world's second largest company in terms of proved SPE oil reserves and Russia's second-largest hydrocarbon producer.

Rosneft operates ten oil and gas producing enterprises across Russia and is involved in over ten world-class exploration projects. In addition to its strong upstream operations, the Company also owns two refineries, which have a combined capacity of 10 million tons per year, as well as four main oil export terminals and a nationwide network of over 600 service stations.

Topsoe selected for JSC

Shchekinoazot

New 450,000 MTPY methanol plant

project in Russia

Topsøe has recently concluded a

contract with JSC Shchekinoazot, Russia for the supply of its methanol

technology for a new 450,000 MTPY methanol plant to be located at JSC

Shchekinoazot existing site in Shchekino, Tula.

The methanol plant will be based on Topsøe’s two-step reforming process,

methanol synthesis and methanol distillation. The scope of Topsøe’s supply comprises license, basic

engineering, proprietary equipment and catalysts.

“The

selection of our methanol technology is based on the recognition

of our extensive experience with the technology, and I am

personally very pleased that we have entered into collaboration

with an esteemed company like JSC Shchekinoazot for this very

important project,” says Haldor Topsøe, Chairman of Haldor Topsøe A/S.

Boris Sokol, President of JSC Shchekinoazot added: “The experience of our partner, a

leading world technology company, will enable JSC Schekinoazot to

build a modern, competitive plant and to become the technology

leader on the Russian methanol market.“

The new methanol

plant is scheduled for start-up by the end of 2009. After the

start-up of the new methanol plant the annual production of

methanol at JSC Shchekinoazot site will reach 600,000

MTPY.

Topsoe specialises in the production of heterogeneous catalysts 不均一触媒 and the design of process plants based on catalytic processes. Focus areas include the fertiliser industry, the chemical and petrochemical industries, and the energy sector (refineries and power plants).

We are at present 1600 employees worldwide including subsidiaries, branch offices, and representative offices. The headquarters are located in Lyngby, a northern suburb of Copenhagen, Denmark. Manufacture of catalysts and certain specialised equipment is carried out in Frederikssund, Denmark and in Houston, Texas, U.S.A.

2007/8/21 Platts

Russian Nikochem to decide on $3 billion petchem unit by year-end

Russian caustic soda and polyvinylchloride producer, Nikochem, is

considering building a $3 billion petrochemical complex in the

Volgograd region of central Russia, the company's general

director Eldor Azizov said Tuesday.

The company expects to start construction of the complex which

will produce 500,000 mt/year of

polyvinylchloride, 450,000 mt/year of polyethylene and 400,000

mt/year of polypropylene by the end of 2008, he said.

"If we start the construction in late 2008, the complex will

be commissioned in 2012," Azizov added. Nikocehm expects to

have made a decision by the end of the year.

The new unit would be built on the site of sodium chloride

producer Kaustic, which is a part of Nikochem and located near

Lukoil's refinery.

One of the main issues to be resolved to give a kick-start for

the project is feedstock sources, Azizov said.

"The project will demand some 2 million mt/year of raw

materials and we are currently negotiating a long-term contract

on supplies of 1.5 million mt/year of gasoil from Lukoil's

refinery, which is located 500 meters away [from the would-be

petrochemical unit]," Azizov said.

The company is also negotiating with Kazakhstan for supplies of

some 500,000 mt/year of LPG from the northern Caspian region,

among other options, he said, declining to elaborate.

Gasoil supplies would be more expensive than that of LPGs or

Naphtha but Nikochem hopes to compensate the higher price with

lower expenditure on logistics, Azizov said. Lukoil's refinery in

Volgograd expects to produce some 4.5 million mt/year of gasoil

in the near future, half of which, according to Azizov, will be

exported.

The petrochemical complex will be financed with private money,

Azizov said, denying reports in the local media that the project

would require federal funding.

Nikochem has already reached a preliminary agreement with

Russia's VTB bank that it, "would become a financial partner

and consultant" in the project, said Sergei Belichenko, head

of Nikos group, which owns Nikochem.

Nikochem

is also negotiating with US Dow Chemical and Lukoil's

petrochemical arm Lukoil-Neftekhim their possible participation in

the project, Azizov said, adding that the outcome of the talks

would be clear only after all the project's details were

finalized.

Dow Chemical will take part in the project, which is still in the

discussion stage, "if the conditions meet our

expectations," Dow Chemical Russia general director Adriaan

van den Berge said in an interview with Russia's RBC daily,

published Monday.

Lukoil-Neftekhim and Dow Chemical were not available for

immediate comment.

Nikochem unites sodium chloride producer Kaustic, PVC producer

Plastkard, PVC compound producer Plastkab and household chemistry

producer European Chemical Company.

The group produces some 240,000 mt/year of caustic soda,

90,000 mt/year pf PVC, 110,000 mt/year of graining caustic soda, among other products.

Kazakhstan, Chevron to agree on Tengiz gas price for petchem unit

KazMunaiGaz

expects

within a month to agree with TengizChevroil--the Chevron-led

consortium developing

the giant Tengiz field in western Kazakhstan--on the price of gas

deliveries to a new planned petrochemical complex, a source close to the project

told Platts Tuesday.

"I think they will agree on the price within a month,"

the source said.

As soon as the price is agreed, the final decision on the

construction of the petrochemical complex will be taken, he said.

The parties are negotiating deliveries of some 7 billion cu

m/year of gas from Tengiz, he said.

KazMunaiGaz

together with private Kazakhstan's company SAT, which is operator of the

petrochemical project, plans to build the facility with

throughput ethylene capacity of 1.2 million

mt/year.

The unit is to produce 800,000 mt/year of polyethylene,

and 400,000 mt/year of polypropylene.

The construction of the $5 billion project is expected to start

in 2009, with the commissioning planned for late 2012.

During the first stage of the project gas from Tengiz will be the

only source of feedstock for the petrochemical unit. At the

second stage, the expansion is possible taking into account

future deliveries from Kashagan, another huge field in

Kazakhstan. The start-up of production at the Kashagan field,

operated by Italy's Eni, has been repeatedly delayed and is now

expected after 2012.

LOOKS FOR FOREIGN PARTNER

Kazakhstan

Petrochemical Industries, a 50:50 joint venture between

KazMunaiGaz and SAT, operating

the petrochemical project, is currently negotiating with major

foreign companies over their possible participation in the

project, the source said.

"They are looking for a strategic investor which will bring

into the project its own technology, access to market, and

finance," he said.

He mentioned Basell and Dow Chemical and "some Chinese

companies" among the firms with whom the talks are under

way.

Currently KPI plans to invest 30% of its own funds in the project

with the remaining 70% to come from other sources.

Ukraine's major petchem firm starts building new PVC plant

Ukraine's biggest

petrochemical company, KarpatNaftoKhim, started construction of a

new polyvinyl-chloride (PVC) production facility in Kalush, the

company's press service said Friday.

The new 300,000 metric tons/year PVC facility, worth about $210

million, would be the first in Ukraine and the most advanced such

facility in Eastern Europe, the company said.

The Kalush-based KarpatNaftoKhim is majority owned by

Lukoil-Neftekhim, a petrochemical arm of Russian oil major

Lukoil.

The new facility, after it is launched into operation in 2009,

will improve environmental conditions in the region as it will be

using vinyl-chloride monomer (VCM) as raw material for PVC

production, instead of shipping the raw material for exports, the

company said.

KarpatNaftoKhim is the only producer of VCM in Ukraine, but also

the country's major producer of polyethylene, ethylene,

propylene, caustic soda and other petrochemical products. The

company is capable of producing about 370,000 mt of VCM/year.

KarpatNaftoKhim plans to increase VCM output by 15.1%

year-on-year to 197,400 mt in 2008, up from 171,500 mt produced

in 2007.

平成20年4月15日

東洋エンジニアリング

ロシア向けエチルベンゼン(EB)生産設備を受注

東洋エンジニアリング株式会社(TEC、取締役社長

山田 豊)は、伊藤忠商事株式会社(取締役社長

小林栄三)と協力し、当社の韓国現地法人であるトーヨーコリア社(Toyo-Korea、取締役社長 菅屋直樹)とともに、ロシア連邦シブール社がペルミ市に建設を計画する22万トンのエチルベンゼン(EB)生産設備をこのたび受注いたしました。本プロジェクトには米バジャー社の技術が採用されており、Toyo-KoreaとTECは基本設計、詳細設計、機器調達及び工事テクニカルアドバイザリーサービスを実施し、プラントの完成は2010年末を予定しています。

<受注概要>

■客先

ロシア連邦シブール社(ガスプロム社の化学・石化分野子会社)

シブール社は、同国での有機合成分野でのマーケット・シェア拡大並びに国外への輸出拡大を目指して、これ以外にも数多くの大型投資を計画中。

■受注者 Toyo-Korea

■役務内容

基本設計、詳細設計、機器調達及び工事テクニカルアドバイザリーサービス

-Toyo-Koreaがメインコントラクター、TECはToyo-Koreaのサブコントラクター

■対象設備 年産22万トンのエチルベンゼン生産設備(スチレンの原料)

■建設地 ロシア連邦、ペルミ市

■摘要技術 米バジャー社の技術

■プラント完成予想 2010年末

■受注の意義

- シブール社が同時に計画しているエチレン増産、スチレンモノマー増産、発泡ポリスチレン新設とともにポリマーコンプレックスの一翼を担う。

- ガスプロムグループからの初の受注。同グループでは、今後ガス高付加価値戦略に沿って下流である石化分野への投資が期待される。

- TECとToyo-Koreaが共同で受注した「Global Toyo」(*)案件

(*)Global Toyo:Toyoという名前の下で、市場・顧客に密着しながらTECとグループ各社が相互に連携し、かつ自立的に活動する体制

- TECはソ連時代を含め40年間以上継続して60基以上のプラントを建設した実績や、長年蓄積されたロシア設計基準などの豊富な地域ノウハウを、グループ会社と共有し“Global Toyo”としてロシアでの受注拡大の突破口となる案件。

2008/4/24 Reuters

UC RUSAL buys 25 pct of Russian miner Norilsk

United Company RUSAL completed the purchase of a one-quarter

stake in Norilsk Nickel on Thursday, paving the way for

the creation of a Russian mining giant headed by the country's

richest man, Oleg Deripaska.

The deal brings the high-profile "divorce" between

Norilsk co-owners Mikhail Prokhorov and Vladimir Potanin a step

closer to conclusion, but could ignite another struggle between

Russian billionaires for control of the world's largest nickel

miner.

"Deripaska won't want one of his legs stuck in Norilsk

Nickel. He will want to have more," said UralSib mining

analyst Kirill Chuiko. "After the first step, a second step

is needed."

UC RUSAL and Prokhorov's investment vehicle, Onexim Group, issued

a joint statement saying Onexim would receive an unspecified cash

amount plus a 14 percent stake in UC RUSAL in exchange for its

stake in Norilsk.

The deal gives UC RUSAL and its majority owner Deripaska control

of a 25 percent-plus-one-share stake in Norilsk -- enough to

block any major board decisions.

Norilsk's Moscow-traded stock closed down 3.5 percent at 6,555.1

roubles, a steeper fall than the 1.1 percent drop in the MICEX

bourse's metals and mining index .MCXMM.

UC RUSAL and Onexim said the cash component of the deal was

supported by a syndicated loan provided by ABN AMRO, Barclays

Capital, BNP Paribas, Calyon, Credit Suisse, Goldman Sachs, ING,

Merrill Lynch, Morgan Stanley, Natixis and UniCredit Group.

Neither side confirmed the size of the loan. Banking sources have

told Reuters UC RUSAL has arranged a $4.5 billion syndicated loan

to back its acquisition of a stake in Norilsk.

Norilsk has a market capitalisation of $55.7 billion. A 25

percent stake in theory would cost $13.9 billion, but in Russia

"blocking stakes" of 25 percent plus a share are

usually valued at a premium. The cash amount will also be less as

Prokhorov is receiving a share in unlisted UC RUSAL.

GROWTH POTENTIAL

UC RUSAL Chief Executive Alexander Bulygin said the deal

"laid a solid foundation for the development of UC RUSAL as

a diversified metals and mining corporation with huge growth

potential".

In a separate statement, Norilsk Chief Executive Denis Morozov

welcomed the arrival of UC RUSAL, the world's largest aluminium

producer, as a large shareholder.

"The acquisition of such a significant stake demonstrates

once again the investment appeal and strong prospects for the

further growth of Norilsk Nickel," Morozov said.

Any further ambitions UC RUSAL might have, however, will depend

to a large extent on Vladimir Potanin, now the single largest

shareholder in Norilsk Nickel.

Potanin met outgoing Russian President Vladimir Putin on

Thursday, a Kremlin spokesman said. He declined to say if the

meeting was linked to the Norilsk stake sale, and Potanin's

Interros Group declined any comment on Thursday's deal.

Norilsk Nickel's management is also in talks about a possible

merger with Metalloinvest, the iron ore and steel firm founded by

Uzbek-born billionaire Alisher Usmanov.

"Talks between Metalloinvest and Norilsk Nickel continue.

The possibility of a merger will depend on the decision of the

majority of shareholders in both companies and on the market

estimate of their value," Metalloinvest said in a statement.

HIGHER STAKE

Prokhorov's 14 percent stake in UC RUSAL is higher than the 11

percent agreed when the companies first struck the pact.

Explaining the difference, a source close to the deal said the

original pact contained a clause stating UC RUSAL would have to

pay compensation to Onexim should it pay a higher price for any

shares it might subsequently acquire in Norilsk.

"This clause is no longer there, so the stake was raised to

14 percent," the source told Reuters on condition of

anonymity.

Deripaska and Bulygin are two of four candidates nominated to

Norilsk's board. The others are shareholder Viktor Vekselberg and

independent director Tye Burt. Norilsk shareholders will consider

their election at their annual meeting in June.

Onexim will also gain representation on UC RUSAL's board.

Prokhorov and Potanin, ranked fifth and sixth on Forbes

magazine's list of richest Russians, formed one of the country's

most successful business partnerships in the 1990s but said in

January 2007 they planned to pursue different interests.

Fifteen months later, Potanin said on April 17 they had

"managed to overcome all differences and come to a mutually

beneficial agreement".

This agreement involved Potanin buying his partner out of

KM-Invest, a jointly controlled investment vehicle that holds an

8 percent stake in Norilsk. Industry sources say this took

Potanin's stake in Norilsk to nearly 30 percent.