他のページへ トップページ アジアの石油化学 連絡先 knak@js2.so-net.ne.jp |

Petrochemicals in Russia/CIS JSC Sibur Holding

LG International in Russian ethylene, refining jv

LG expects Tatarstan oil/petchem project financing by year-end

Nizhnekamskneftekhim to produce 1-mil mt/yr polyethylene by 2008

CSJC Nizhnekamsk Refinery selects Spherizone technology for a new 200 KT per year PP plant in Russia

Mitsui to build petchem plants for Russia's Nizhnekamskneftekhim

Ukraine's Naftogaz plans to buy 47.93% stake in petchem JV Lukor

Russia's Lukoil resumes construction of 80kt PP plant

Stavrolen's new Unipol PP plant

Kazakhstan to sign petrochemical complex deal

Foster Wheeler Awarded Detailed Feasibility Contract In The Republic Of Kazakhstan

Basell signs MoU with KazMunayGaz and SAT for petrochemical complex in Kazakhstan

Basell to Enter Kazakhstan Petchem JV Soon

Kazakhstan, Chevron to agree on Tengiz gas price for petchem unit

Lukoil, Germany's Uhde agree to build PVC plant in Ukraine

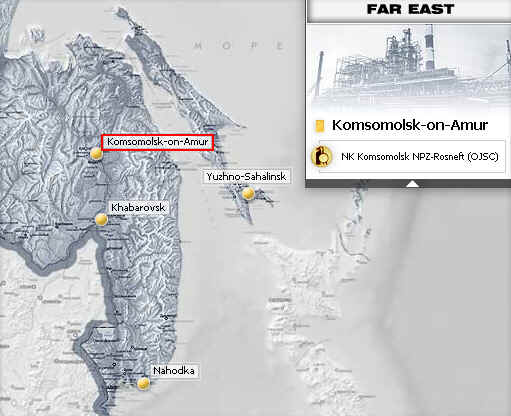

Russia's Rosneft mulls petchem complex at Komsomolsk refinery

Gazprombank planning to sell its stake in petrochemicals business Sibur

Topsoe selected for JSC Shchekinoazot's methanol project in Russia

Russian Nikochem to decide on $3 billion petchem unit by year-end

IPIC of Abu Dhabi signs a MoU with KazMunayGas for a petchem complex in Western Kazakhstan Kazakhstan

INEOS Technologies signs further agreement with Sibur LLC

SIBUR’s Tobolsk 500kt Polypropylene Plant Enters Construction Phase

UC RUSAL buys 25 pct of Russian miner Norilsk

Reliance Industries and SIBUR in a Joint Venture for Butyl Rubber Production in India

Petrochemicals in Russia/CIS

http://www.platts.com/Petrochemicals/Resources/Presentations/russia.ppt

|

日本経済新聞 2004/12/28 発表

化学プラント ロシアで200億円受注 東洋エンジなど高機能樹脂生産

東洋エンジニアリング、出光興産、旭化成ケミカルズはロシア化学大手のカザンオルグシンテツ(Kazanorgsintez、カザン市)から、高機能樹脂のポリカーボネート生産設備など化学プラントを受注した。

モスクワ南東にあり、化学工場が集積しているタタルスタン共和国のカザン市に、既存の工場インフラを活用して最新設備を建設する。ビスフェノールAを年7万トン、ポリカーボネートを同6万5千トン生産する。

ビスフェノールAは出光興産、ポリカーボネートは旭化成ケミカルズが開発した生産技術を活用する。三井物産が全体を調整した。

2004/12/28

東洋エンジニアリング

ロシア初のビスフェノールA・ポリカーボネート設備を受注

http://www.toyo-eng.co.jp/jp/news/16/20041228.html

<受注概要>

| ■客先 | : | カザンオルグシンテツ社(Kazanorgsintez;本社:カザン市)

(同国最大のポリエチレン製造会社でありボルガ河流域に位置する) |

| ■建設地 | ロシア連邦タタールスタン共和国カザン市

(モスクワ市の東方約1,000キロメートル) |

|

| ■対象設備 | 年産70,000トン・ビスフェノールA(BPA)製造設備 及び 年産65,000トン・ポリカーボネート(PC)製造設備 |

|

| ■役務範囲 | 詳細設計、機器調達 | |

| ■ライセンス | BPAは出光興産(株)、PCは旭化成ケミカルズ(株) | |

| ■プラント完成予定 2007年 | ||

Nizhnekamskneftekhim to produce

1-mil mt/yr polyethylene by 2008

Russia's Nizhnekamskneftekhim and Kazanorgsintez are to raise polyethylene output in the republic

of Tatarstan to 1-mil mt/yr by 2008, according to a government statement.

November 4, 2004

Financial Times Information

Ethylene cracker for Irkutsk.

Sayankhimplast,

the leading PVC producer in

Russia, is to build a gas-based ethylene cracker. The plant at

Sayansk will initially process more than 500 M cu m/y of gas.

Sayankhimplast currently sources its ethylene from Angarsk Petrochemical, which is controlled by Yukos.

The Russian PE producer Kazanorgsintez is to receive a 10-year loan of $1.5 bn to modernise its facilities in Kazan, Tatarstan. LDPE capacity will be raised from 180,000 tonnes/y to 450,000 tonnes/y and ethylene production will be raised from 420,000 tonnes/y to 600,000 tonnes/y. The projects are scheduled for completion in 2006.

Novatek, Russia, is seeking a loan of EUR 1 bn to finance a planned petrochemical complex. It hopes to secure the loan with 1.6 M tonnes/y of gas condensate exports.

Russia's Lukoil resumes

construction of 80kt PP plant

Lukoil-Neftekhim, the petrochemical

subsidiary of Russia's oil major Lukoil, has resumed the

construction of an 80,000 mt/yr polypropylene facility in

southern Russia, Lukoil said in a statement Thursday.

August 5, 2005 British

Plastics & Rubber

Stavrolen opts for Unipol

Dow's Unipol technology will be used in a new polypropylene plant

to be built at Budennovsk in Russia by Stavrolen. Construction of the 120,000 tonnes

plant is

scheduled for completion in 2006. It will produce

impact-resistant and low-temperature polypropylene, as well as

grades for use in medicine and agriculture. The polypropylene

produced will be supplied to Russian producers of fibres,

threads, tubes and other consumer goods.

Unipol is currently in use on more than 35 production lines

worldwide, accounting for more than 6 million tonnes of

polypropylene.

Platts 2005/11/23

Kazakhstan to sign petrochemical complex deal by Dec 15

The Kazakhstan's government plans to sign the first agreement

with foreign companies to build petrochemical complexes by Dec 15

as the country aims at becoming a serious player on the world

market, Kazakhstan's prime minister Danial Akhmetov said

Wednesday, as reported by national Kazinform news agency.

Kazakhstan has set up

several working groups, in particular with Lukoil, which is to build a gas chemical

complex near the Khvalynskoye field in the Caspian Sea, Akhmetov

said. The project envisages processing of over 14-bil cu m/yr of

gas at the field.

Akhmetov also mentioned LG and Shell, among other companies,

negotiating the issue with the government.

Foster Wheeler Awarded Detailed Feasibility Contract In The Republic Of Kazakhstan

http://www.corporate-ir.net/ireye/ir_site.zhtml?ticker=FWLT&script=417&layout=-6&item_id=796203Foster Wheeler Ltd.announced today that its Italian subsidiary Foster Wheeler Italiana S.p.A. has been awarded a contract by KazMunaiGas Exploration and Production (KMG EP) for a detailed feasibility study for a new petrochemical complex and related facilities to be built in several locations in Western Kazakhstan. KMG EP is the state-owned oil and gas company of the Republic of Kazakhstan. The terms of the award of the study, which will be included in Foster Wheeler's fourth-quarter 2005 bookings, were not disclosed.

The proposed facilities, for which the expected final total investment cost is in excess of $4 billion, would be built in two phases. Phase 1 would include a gas separation unit to be built near the town of Kulsary to treat dry gas from the Tenghiz field and separate ethane and propane, and a petrochemical complex to be built near the city of Atyrau to process the ethane and propane and produce polyethylene and polypropylene. Phase 2 would include an additional gas separation unit to be built in Karabatan to treat dry gas from the Kashagan field and expansion of the Atyrau petrochemical complex. The final capacity of the Atyrau complex would be up to 1,500,000 tons per year of polyethylene and up to 450,000 tons per year of polypropylene.

2006/3/31 Basell Basell to Enter Kazakhstan Petchem

JV Soon

Basell signs MoU with KazMunayGaz and SAT for petrochemical

complex in Kazakhstan

Basell signs memorandum of understanding with KazMunayGaz and SAT

for first integrated worldscale petrochemical complex in Western

Kazakhstan

The project is expected to include an ethane

extraction unit in Kulsary and an integrated

petrochemical complex in Atyrau. The planned petrochemical

complex includes a worldscale ethane cracker

and polyethylene

facilities, as well as a propane dehydrogenation unit and

polypropylene

facility. Start up is planned for 2010.

KazMunayGas (KMG) was founded in 2002 as a

result of the merger of CJSC National Oil Company Kazakhoil and

NC Oil and Gas Transportation. This state owned company was

created with the goal of developing Kazakhstan’s oil and gas resources. KMG EP is

the operating subsidiary responsible for exploration and

distribution of oil and gas. KMG is also a shareholder in

TengizChevrOil (TCO) and Agip KCO.

SAT is a privately owned, diversified

conglomerate with industrial, commercial and service activities.

Kazakhstan, Chevron to agree on Tengiz gas price for petchem unit

KazMunaiGaz expects within a month to agree with TengizChevroil--the Chevron-led consortium developing the giant Tengiz field in western Kazakhstan--on the price of gas deliveries to a new planned petrochemical complex, a source close to the project told Platts Tuesday.

KazMunaiGaz together with private Kazakhstan's company SAT, which is operator of the petrochemical project, plans to build the facility with throughput ethylene capacity of 1.2 million mt/year.

The unit is to produce 800,000 mt/year of polyethylene, and 400,000 mt/year of polypropylene.

Kazakhstan Petrochemical Industries, a 50:50 joint venture between KazMunaiGaz and SAT, operating the petrochemical project, is currently negotiating with major foreign companies over their possible participation in the project, the source said.

Chevron

Chevron is Kazakhstan's largest private oil producer, with a 50 percent interest in Tengizchevroil (TCO) and a 20 percent stake in the Karachaganak Field. Tengizchevroil is owned 45 percent by Chevron, 25 percent by Kazakhstan state company Kazakh Oil, 25 percent by Mobil and 5 percent by LUKarco.

LukArco was formed by Arco and Lukoil in February 1997 to facilitate joint oil and gas investment in Russia and other countries

The company is a partner in TCO's Tengiz Field, the world's deepest operating super-giant oil field, with the top of the reservoir at about 12,000 feet deep (3,657 m). In December 2006, the Tengiz Field produced its billionth barrel of oil. Chevron is the largest private shareholder in the 935-mile (1,505 km) Caspian Pipeline Consortium (CPC). Tengiz Field 油田からAtyrau を経由してカスピ海の北側を通り、ロシアの黒海東岸のターミナル Novorossiysk までのパイプライン

Through the Egilik program, Chevron has provided more than $59 million in support for community health, education and social infrastructure programs within the Atyrau Oblast since 1999. From 1993 through 1997, the company sponsored the $50 million Atyrau Bonus Plan. This program, organized by TCO, supported a range of social infrastructure projects for the well-being of the Atyrau community. Chevron also sponsors small-business, education, environmental, health care and cultural programs. Chevron- and Texaco-branded lubricants are marketed throughout Kazakhstan. In April 2003, Chevron opened a $20-million polyethylene pipe plant in Atyrau, the first such facility in Kazakhstan. In 1993, Chevron became the first major Western oil company to operate in Kazakhstan.

Platts 2006/6/15

Lukoil, Germany's Uhde agree to build PVC plant in Ukraine

Russia's Lukoil-Neftekhim and German engineering company Uhde

agreed to go ahead with construction of a new suspension PVC

production facility at Ukraine's largest petrochemical

company KarpatNaftoKhim. The agreement was reached at a

recent meeting of Lukoil-Neftekhim CEO Aleksey Smirnov and Klaus

Schneiders, chairman of Uhde's executive board, KarpatNaftoKhim's

press service said Thursday.

The two companies are now expected within weeks to sign the

contract to build the 300,000 mt/year PVC facility in

Kalush, the

company said.

KarpatNaftoKhim, which is capable of producing about 370,000 mt of VCM annually, only produced 10,000 mt

of VCM in May due to weak demand. The company plans to boost VCM

production to 15,000 mt in June, according to the company.

KarpatNaftoKhim, which is a part of Lukoil-Neftekhim Group, operates all production assets of the Kalush-based joint-venture Lukor, the country's major producer of petrochemical products. Lukoil Chemical BV, a subsidiary of Russian oil major Lukoil, owns 76% stake in KarpatNaftoKhim, while the remaining 24% is owned by Lukor. Lukor itself is 52% owned by Lukoil and 48% owned by the Ukrainian government, via Oriana, a state petrochemical firm.

Ukraine's major petchem firm starts building new PVC plant

Ukraine's biggest petrochemical company, KarpatNaftoKhim, started construction of a new polyvinyl-chloride (PVC) production facility in Kalush, the company's press service said Friday.

The new 300,000 metric tons/year PVC facility, worth about $210 million, would be the first in Ukraine and the most advanced such facility in Eastern Europe, the company said.

KarpatNaftoKhim is the only producer of VCM in Ukraine, but also the country's major producer of polyethylene, ethylene, propylene, caustic soda and other petrochemical products. The company is capable of producing about 370,000 mt of VCM/year.This investment follows the decision of Borsodchem, Eastern Europe's largest PVC maker, to stop buying vinyl chloride from Lukor, LUKoil's Ukrainian venture.

Hungary's BorsodChem will start test production at its new vinyl chloride monomer plant at Kazincbarcika, north-east Hungary, on Jan 3, CEO Laszlo Kovacs told Platts in a telephone interview Wednesday. The tests at the plant, which will boost VCM capacity from 180,000 mt/yr to 250,000-260,000 mt/yr, are scheduled to be completed by the end of February.

Luxembourg's Kikkolux has signed an option agreement on July 6,2006 to acquire up to a 47.99% stake in Hungarian chemicals producer BorsodChem, Kikkolux said in a statement on Monday. This would represent a 52.05% voting stake in the company.

Kikkolux said it was controlled by the Permira investment group.BorsodChem is a leading European integrated producer of isocyanate-based specialty chemicals and PVC. Isocyanates are the key building block for PU foams which are used in applications like furniture/bedding, construction, automotive or coatings & adhesives. BorsodChem is also a leading producer of PVC in the Central Eastern European region, with an estimated market share of 31%. BorsodChem’s core market is Europe and also sells its products in the Middle East, West and North Africa and Asia.

Strong underlying market dynamics combined with BorsodChem’s leading low cost production expertise provide the company with an opportunity to increase MDI/TDI capacity and to become Europe’s leading TDI and MDI producer. The company is planning to more than double the current capacity for MDI and almost treble the capacity for TDI. These new production plants will go on line in 2009 for TDI and 2011 for MDI. The company also will expand into additional specialty MDI variants and polyurethane systems and solutions.

In December 2006, funds advised by Permira and Vienna Capital Partners acquired 89% of the BorsodChem share capital. Upon redemption of approx. 3m employee shares which is expected for February 2007, the company is expected to be taken fully private through a squeeze-out. The transaction value amounts to Euro1,630m.

Lukoil-Neftekhim unites the Russian enterprises Stavrolen Ltd. (Budenovsk, Stavropol region), Saratovorgsintez (Saratov), Ukraine's CJSC LUKOR and Karpatnaftokhim Ltd. (both based in Kalush), as well as marine terminal VARS Ltd. (Ventspils, Latvia).

Karpatnaftokhim was founded in October 2004. It uses the main facilities of LUKOR Ltd. to produce vinyl chloride, hydrate of sodium and chloride, and also ethylene and propylene. The company currently has charter capital of 1.581 billion hryvni. LUKOR's share is 24%, while LUKOIL Chemical B.V. has 76%.

Apr. 10, 2006 Uhde

Uhde to supply electrolysis plant to LUKOIL Chemical Group in Ukraine

The LUKOIL Chemical Group, part of the Russian mineral oil group LUKOIL, has commissioned Uhde GmbH to engineer and supply a new chlor-alkali electrolysis plant. The plant will be located at the site of a Ukrainian subsidiary in Kalush, some 500km south-west of Kiev. The plant, which will have a capacity of 177,000 tonnes per year of chlorine and 200,000 tonnes per year of caustic soda, is to come on-stream in mid 2008.

LUKOIL Chemical Group is investing some Euro110 million in converting its diaphragm electrolysis plant to the latest generation of energy-saving Uhde membrane cells. Uhde's scope of services will include the basic and detail engineering, supply of equipment and supervision of the erection and commissioning work.

"Uhde is one of the leading suppliers of membrane electrolysis plants for the chlor-alkali industry and has built plants of this kind with an overall production capacity of eight million tonnes of caustic soda per year worldwide," said Klaus Schneiders, Chairman of Uhde's Executive Board.

---

Dec. 19, 2006 Uhde

Uhde wins follow-up contract from the LUKOIL Chemical Group for a PVC plant

LUKOIL Chemical Group has awarded Uhde the follow-up contract for a new polyvinyl chloride plant in the Ukraine. The plant, which will have a capacity of 300,000 tonnes per year of suspension PVC (S-PVC), will be constructed by Karpatnaftochim, an Ukrainian subsidiary of LUKOIL, in Kalush, some 500 kilometres south-west of Kiev. In April 2006 Uhde was already awarded a contract by LUKOIL for an electrolysis plant at the same location.

The LUKOIL Chemical Group, part of the Russian mineral oil group LUKOIL, is investing some US\$ 200 million to add PVC to its range of products. Uhde’s scope of services will include the basic and detail engineering, supply of the equipment, supervision of construction and commissioning and training of customer’s personnel. The new plant is scheduled to go on stream in early 2009.

The plant for the production of S-PVC will be based on the modern polymerisation process using the High-Performance Reactor of Vinnolit, Uhde’s engineering partner and the leading PVC manufacturer in Germany. S-PVC has a wide range of applications - from the building to the medical sector.

LUKOIL

LUKOIL is one of the

world’s leading vertically integrated

oil & gas companies. Main activities of the Company are

exploration and production of oil & gas, production of

petroleum products and petrochemicals, and marketing of these

outputs. Most of the Company's exploration and production

activity is located in Russia, and its main resource base is in

Western Siberia. LUKOIL owns modern refineries, gas processing

and petrochemical plants located in Russia, Eastern Europe and

near-abroad countries. Most of the Company's production is sold

on the international market. LUKOIL petroleum products are sold

in Russia, Eastern and Western Europe, near-abroad countries and

the USA.

LUKOIL is the second largest private oil Company worldwide by

proven hydrocarbon reserves. The Company has around 1.3% of

global oil reserves and 2.3% of global oil production. LUKOIL

dominates the Russian energy sector, with almost 19% of total

Russian oil production and 18% of total Russian oil refining.

LUKOIL proven reserves at the beginning of 2007 were 15,927 mln

barrels of crude oil and 26,597 bcf of natural gas, totaling

20,360 mln boe.

LUKOIL owns significant oil refining capacity both in Russia and

abroad. In Russia the company owns four large refineries at Perm,

Volgograd, Ukhta and Nizhny Novgorod. Total capacity of LUKOIL

facilities in Russia is 44.1 mln tons of oil per year. LUKOIL

also has refineries in Ukraine, Bulgaria, and Romania, with total

capacity of 14.0 mln tons per year. In 2006 LUKOIL refined 48.9

mln tons of oil at its own refineries, including 39.5 mln tons at

its Russian refineries.

Petrochemicals

Since 1997 LUKOIL has been dynamicly developing its

petrochemistry segment in order to increase the share of

higher-value product and to lower its dependance on the global

market volatile environment.

LUKOIL's petrochemical business is the biggest in Russia and

Eastern Europe. Company plants in Russia, Ukraine and Bulgaria

make pyrolysis products, organic synthesis products, fuel

fractions and polymer materials. LUKOIL meets a major share of

Russian domestic demand for various chemicals as well as

exporting chemicals to more than 50 countries.

LUKOIL has been steadily increasing production of chemicals with

high value-added (polymers, monomers and organic synthesis

products) over the last five years, in line with the Company's

strategy for development of its petrochemical business. At the

same time production of chemicals with low value-added (pyrolysis

products and fuel fractions) has been reduced. Output of

polymers, monomers, and organic synthesis products grew by 11%

from 2002 to 2006, while output of pyrolysis products and fuel

fractions declined by 11%.

LUKOIL petrochemical plants produced 2.038 million tonnes of

marketable chemicals in 2006, including 798,000 tonnes of

polymers and monomers, 648,000 tonnes of organic synthesis

products, and 584,000 tonnes of pyrolysis products and fuel

fractions. Output included 447,300 tonnes of polyethylene (4.8%

less than in 2005), 232,500 tonnes of propylene (2.7% less than

in 2005) and 70,200 tonnes of polypropylene (3.3% more than in

2005). Overall reduction of petrochemical production volumes in

2006 was due to scheduled repair and upgrading work at the

Company's petrochemical plants.

Price environment on petrochemical markets was favourable in

2006. Polyethylene prices increased by 17% in Russia and by 22%

in Europe, and sale prices for polypropylene in Russia and Europe

rose by 16% and 13% respectively. The market price for benzene

rose by 21% in Russia and 12% in Europe. Net profit in the

petrochemical sector was $96 million.

LUKOIL pursued its strategy for development of petrochemical

business in 2006 with a number of measures for modernization of

existing production and creation of new facilities. Capital

expenditures in the petrochemical sector were $172 million.

A key project for implementation in the next few years is

construction of the Caspian Gas-chemical Complex, which will

process natural gas and gas condensate, produced by LUKOIL in the

Caspian region. The purpose of the project is to increase

value-added by deeper processing of gas feedstock and to ensure

efficient chemical processing of ethane, natural gas liquids and

condensate. The Caspian Complex will refine natural gas and its

components to produce basic organic synthesis products,

polyethylene, polypropylene and other petrochemicals. Work on a

feasibility study for the complex proceeded in 2006 and should be

completed in the second quarter of 2007.

Petrochemical Plants

Saratovorgsintez: Saratov (Russia)

Acrylonitrile and other organic synthesis products

15,000 tonnes of sodium cyanide 青酸ソーダper year. DuPont technology

Stavrolen: Budennovsk (Stavropol Region, Russia)

Polyethylene and other products

polypropylene

unit with 120,000 tonnes dow technology

Karpatneftekhim: Kalush

(Ukraine)

Polyethylene, vinyl chloride and other products

LUKOIL Neftokhim Burgas: Burgas (Bulgaria)

Polymers and organic synthesis products

Karpatnaftokhim was founded in October 2004. It uses the main facilities of LUKOR Ltd. to produce vinyl chloride, hydrate of sodium and chloride, and also ethylene and propylene. The company currently has charter capital of 1.581 billion hryvni. LUKOR's share is 24%, while LUKOIL Chemical B.V. has 76%.

In July 2004, the LUKOIL-Neftekhim Group (a holding company which runs the petrochemicals business of OAO LUKOIL) purchased 87.42% of OAO Stavropolpolymerproduct shares from “Moskovski Promishlenno-Torgoviy Tsentr Integratsii i Razvitiya” State Unitary Enterprise.

UNIPOL process technology for

polypropylene, to be used in the project, was engineered by Dow

Chemicals (USA). This method excludes any hazardous emissions and

thus features better ecological safety compared with other

methods. This technology will allow to produce impact-resistant

and low-temperature polypropylene and also its various

modifications used in medicine and agriculture. The polypropylene

produced will be supplied to Russian chemical plants where fiber,

thread, tubes and other consumer goods will be manufactured.

Startup of the line with an annual production capacity of 80 thousand tons is scheduled for 2006.

Foster Wheeler

2006/9/19 PE PP

Foster Wheeler Awarded Front-End Design for New Complex of

Refining and Petrochemical Plants in Tatarstan

Foster Wheeler Ltd. announced today that its Paris-based

subsidiary Foster Wheeler France S.A., part of its Global

Engineering and Construction Group, has been awarded the

front-end engineering design (FEED) by CJSC Nizhnekamsk

Refinery for

a new Complex of refining and petrochemical plants to be

constructed in Nizhnekamsk, in the Republic of

Tatarstan,

Russian Federation.

The Complex consists of an oil refinery, aimed at processing

seven million tons of crude oil per year, a deep conversion plant

and a petrochemical plant. The oil processing part of the Complex

includes aromatics units and deep conversion section with a

fluidized catalytic cracker, a distillate hydrocracker, a delayed

coker and a gasification plant. The petrochemical part of the

Complex will include purified terephthalic acid,

polyethylene terephthalate, linear alkylbenzene and polypropylene

units, plus

the associated power generation facilities. The expected total

investment cost of the Complex will be in excess of three billion

US dollars. The current plan of CJSC Nizhnekamsk Refinery is to

complete the complex in three different phases between 2008 and

2010.

Russia's Rosneft mulls petchem complex at Komsomolsk refinery

Russia's state-run Rosneft is

considering building a petrochemical complex at the Komsomolsk

refinery

in Far East Russia, to process around 1-million mt of naphtha,

Valery Yezhov, the refinery's general director said Thursday.

"We are looking into a

possibility to produce some 500,000mt of ethylene and

over 200,000mt of propylene to process our naphtha rather than

export it," Yezhov said.

http://www.rosneft.com/english/about_rosneft/

Rosneft is a vertically-integrated Russian oil and gas company with upstream and downstream operations in each of Russia's oil-producing regions. Headquartered in Moscow, compared to public companies it is the world's second largest company in terms of proved SPE oil reserves and Russia's second-largest hydrocarbon producer.

Rosneft operates ten oil and gas producing enterprises across Russia and is involved in over ten world-class exploration projects. In addition to its strong upstream operations, the Company also owns two refineries, which have a combined capacity of 10 million tons per year, as well as four main oil export terminals and a nationwide network of over 600 service stations.

Topsoe selected for JSC

Shchekinoazot

New 450,000 MTPY methanol plant

project in Russia

Topsøe has recently concluded a

contract with JSC Shchekinoazot, Russia for the supply of its methanol

technology for a new 450,000 MTPY methanol plant to be located at JSC

Shchekinoazot existing site in Shchekino, Tula.

The new methanol plant is scheduled for start-up by the end of

2009. After the start-up of the new methanol plant the annual

production of methanol at JSC Shchekinoazot site will reach 600,000

MTPY. (?)

Topsoe specialises in the production of heterogeneous catalysts 不均一触媒 and the design of process plants based on catalytic processes. Focus areas include the fertiliser industry, the chemical and petrochemical industries, and the energy sector (refineries and power plants).

We are at present 1600 employees worldwide including subsidiaries, branch offices, and representative offices. The headquarters are located in Lyngby, a northern suburb of Copenhagen, Denmark. Manufacture of catalysts and certain specialised equipment is carried out in Frederikssund, Denmark and in Houston, Texas, U.S.A.

United Chemical Company Shchekinoazot is a company which represents interests of large Russian chemical companies that specialize in manufacture of industrial chemicals, engineering plastics, synthetic fibers, cord fabrics, special and consumer commodities. They are JSC Shchkinoazot, JSC Shchekino Khimvolokno, Efremov Chemical Plant.

JSC Shchekinoazot

Products: methanol, caprolactam, hexamine, ammonium sulphate, neutral cake soda, alkaline adipate plastificator, ion-exchange membranes, consumer goods (household chemicals)

Foundation date: year of 1955

Production capacity: Methanol - 365 thousand tons per year Caprolactam - 50 thousand tons per year Ammonium sulfate- 160 thousand tons per year Hexamine - 15 thousand tons per year ーーー

Efremov chemical palnt (affiliated branch of JSC Shchekinoazot)

Products: sulphuric acid, oleum

Production capacity: 500 thousand tons per yearAt present moment the plant is in the process of modernization. Also we are searching for new products that will increase the level of sulphuric acid technological processing.

ーーー

JSC Shchekino KhimvoloknoFoundation date: year of 1970

Production capacity: Polyamide 6 - 17,8 thousand tons per year engineering plastics - 3 thousand tons per year Textile yarns - 4,1 thousand tons per year Technical yarns - 22,65 thousand tons per year Cord fabric - 19,2 thousand tons per year JSC Shchekino Khimvolokno and JSC Shchekinoazot are in the close technological connection (caprolactam is the prime raw material for production of polyamide 6) and have neighbouring production grounds.

The Company has the certificate of the international quality management system ISO 9001:2000

2007/8/21 Platts

Russian Nikochem to decide on $3 billion petchem unit by year-end

Russian caustic soda and polyvinylchloride producer, Nikochem, is

considering building a $3 billion petrochemical complex in the

Volgograd region of central Russia, the company's general

director Eldor Azizov said Tuesday.

The company expects to start construction of the complex which

will produce 500,000 mt/year of

polyvinylchloride, 450,000 mt/year of polyethylene and 400,000

mt/year of polypropylene by the end of 2008, he said.

Nikochem

is also negotiating with US Dow Chemical and Lukoil's

petrochemical arm Lukoil-Neftekhim their possible participation in

the project, Azizov said, adding that the outcome of the talks

would be clear only after all the project's details were

finalized.

2008/4/24 Reuters

UC RUSAL buys 25 pct of Russian miner Norilsk

United Company RUSAL completed the purchase of a one-quarter

stake in Norilsk Nickel on Thursday, paving the way for

the creation of a Russian mining giant headed by the country's

richest man, Oleg Deripaska.

UC RUSAL and Prokhorov's investment vehicle, Onexim Group, issued

a joint statement saying Onexim would receive an

unspecified cash amount plus a 14 percent stake in UC RUSAL in exchange for its stake in

Norilsk.

The deal gives UC RUSAL and its majority owner Deripaska control

of a

25 percent-plus-one-share stake in Norilsk -- enough to block any major

board decisions.

Uralkali Agrees on $7.8

Billion Takeover of Silvinit

OAO

Uralkali

agreed to acquire domestic rival OAO Silvinit for cash and shares to form the

world’s largest maker of the crop

nutrient after Canada’s Potash Corp. of Saskatchewan.

Uralkali will purchase 20 percent of Silvinit from Otkritie

Financial Corp. for $1.4 billion, or $894.50 a share, the

Berezniki-based company said today in a statement. It will buy the rest for

new shares worth $6.4 billion as of Dec. 13.

The takeover is the third-largest announced this year in basic

materials after Newcrest Mining Ltd.’s purchase of Lihir Gold Ltd. and Vedanta Resources

Plc’s proposed Cairn

India Ltd. acquisition, Bloomberg data show. The

combined entity would be worth $23.9 billion, based on Dec. 17

prices, said Uralkali, which expects to complete the deal in

early May 2011.

Potash producers are consolidating as an increase in grain

prices, driven up this year by drought in Russia, flooding in

Canada and parched fields in Kazakhstan and Europe, boosts

fertilizer purchases by farmers. Uralkali and

Silvinit combined would account for 17 percent of global potash

output,

creating the second-largest producer after

Potash Corp.

of Saskatchewan Inc., according to U.K.-based industry consultant

Fertecon Ltd.

The acquisition is “attractive”

for Uralkali

minority stockholders, Anna Kupriyanova, a Moscow-based analyst

at UralSib Capital, wrote today in a note. For Silvinit, it “translates into a share price

below the current market -- a negative for Silvinit minorities,”

she said.

Kerimov Control

Russian

billionaire Suleiman Kerimov and his partners took controlling

stakes in Uralkali and Silvinit between June and August with a

view to a merger. Solikamsk-based Silvinit, whose production

exceeds that of Uralkali, was valued at 246 billion rubles on

Dec. 17, compared with Uralkali’s 457 billion rubles.

A merger will have a “positive effect”

on the market,

Potash Corp. Chief Executive Officer Bill Doyle told analysts on

Dec. 15. Potash Corp., based in Saskatoon, Canada, last month

fought off BHP Billiton’s $40 billion takeover proposal.

The eight-largest potash miners, whose market control already

exceeds that of oil cartel OPEC, have sought to tighten their

grip on prices of potash, a form of potassium used to boost crop

yields. Uralkali exports through Belarusian Potash Co., which

controls about 30 percent of global trade.

Silvinit has traded through International Potash Co. and is

discussing a “transition period”

before switching,

Silvinit CEO Vladislav Baumgertner said on the conference call.

Double Output

Uralkali and Silvinit both mine fields at the Vernekamskoye

deposit in Perm, near the Ural mountains, which has the world’s second-largest reserves,

according to Uralkali’s website. Both companies doubled

output in the first half as fertilizer use recovered from a

global economic slump, with Uralkali producing 2.42 million

metric tons and Silvinit 2.57 million tons.

The two combined have the capacity to produce 10.6 million tons

in 2010,

behind Potash Corp. and Plymouth, Minnesota-based Mosaic Co., according to Uralkali. The

Russian companies will boost annual output by 2.4 million tons by

2012, Grachev said.

Uralkali posted net income of $274 million in the first half

under international standards, while Silvinit reported a profit

of $261 million using Russian methods.

Mosaic is the world's leading producer and marketer of concentrated phosphate and potash, two of the primary nutrients required to grow the food the world needs. Our business engages in every phase of crop nutrition development, from the mining of resources to the production of crop nutrients, feed and industrial products for customers around the globe. Our customer base includes wholesalers, retail dealers and individual growers in more than 40 countries.

Mosaic was formed in 2004 through the combination of IMC Global Inc. and the crop nutrition business of Cargill, Incorporated. Headquartered in Plymouth, Minnesota, we employ approximately 7,400 people in eight countries. Our shares trade on the New York Stock Exchange under the ticker symbol MOS.IMC Global The Group's principal activities are to produce and distribute, concentrated phosphates, potash and animal feed ingredients.

Our potash annual capacity of 10.4 million tonnes is the second largest in the world. We operate mines in Saskatchewan, New Mexico and Michigan. About 45% of our product is sold to North American customers, and the remainder is exported to other regions of the world.

We are the world's largest producer of finished phosphate products, with an annual capacity of 10.3 million tonnes--more than the next three largest producers combined. Approximately 46% of our phosphate product is shipped within North America, and the remainder is exported to other regions of the world.

Financial Times

世界の大手肥料会社は数十年にわたり2つの販売会社を通じて輸出してきた。これらは合法的ながら事実上のカルテル組織で、毎年、輸入国と秘密裏に交渉してきた。輸入国は中国が1位でインド、ブラジルがそれに続く。

2つのカルテルのうち1つはカンポテックス。カナダのポタシュ・コープ、アグリウム、さらに米国のモザイクのために北米以外でカリウムを販売している。もう1つはベラルシアン・ポタシュ・カンバニー(BPC)。ロシアのウラルカリとベラルーシのベラルーシカリのカリウムを販売している。

ロシアの肥料大手2社の合併によってシルビニトがBPCに加わるドアが開かれた。中国、インド、ブラジルといった購買国に対するロシア・ベラルーシ連合の力は一段と高まるだろう。

カリウムは2007〜08年の世界食料危機の際に投資家から注目され、価格が急上昇した。世界金融危機を受けて農民が肥料の使用を減らしたため、08年からは下落していたが、再び上昇に転じている。業界の首脳たちは来年はさらに上昇するとみている。農産品が値上がりしているため、農民は耕作地単位あたりの肥料使用量を増やし、さらに耕作面積を広げるとみられるからだ。