Б@СЉВћГyБ[ГWВ÷Б@ГgГbГvГyБ[ГWБ@Б@ГAГWГAВћРќЦыЙїКwБ@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@ШAЧНРжБ@knak@js2.so-net.ne.jpБ@Б@Б@Б@Б@Б@Б@Б@Б@ |

Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@

ГgГЛГRБ@Б@Б@РќЙїВћЧрОjБ@Б@Б@Б@Б@Б@ТЖЛяУМВћРќЦыЙїКwИкЧЧБ@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Back

PETKIM PETROKIMYA HOLDING A.S. Б@Б@Б@Б@privatization

Б@Б@Б@Б@Turkey Approves Sale of Petkim

Б@Б@Б@Б@Б@Б@ Privatization body cancels tender for petrochemical plant

Б@Б@Petkim: Ineos and Basell consortium among bidders

Б@Б@Kazakh consortium wins auction for 51 pct of Turkey's Petkim

DuPont Sabanci Polyester (Europe)

Sabanci Holding to Acquire DuPont's Share of DuPont Sabanci Polyester (Europe)

La Seda to acquire Advansa's PET, PTA and Preform businesse

Spain La Seda PET, PTA businesses to be re-launched as 'Artenius'

Turkey's Sabanci acquired a 99.5% stake in Chinese nylon company IQNE Qingdao Nylon from Invista

SABIC Forms Polystyrene Joint Venture with Baser Petrokimya of Turkey

Turkey's Tupras privatization bid attracts 20 potential suitors

Turkey's Sanko announces plans for petrochemical plant at Ceyhan

Turkish court rejects attempt by

trade union to halt Petkim sale

Petkim:

Authority's turnaround takes lower bid forward

Turkey' Petkim to build petrochemical plant in Iran

ЧрОjБ@БiPetkim's annual report)

The petrochemical industry has

started to develop in the second half of the 20th century and

become one of the essentials in economy in a short time due to

usage, durability, price advantages and versatility of its

products, which can substitute various natural raw materials.

The idea of establishing a petrochemical industry in Turkey was

adopted in 1962, which was the beginning of the First Five Year

Development Plan period. Petkim Petrokimya A.S. was established on

April 3, 1965 under the

leadership of TPAO, following the studies and evaluations

performed.

The new company initially decided to establish Yarimca Petrochemical

Complex and started up the

Ethylene, Chlorine Alkali, VCM, PVC and LDPE plants in 1970. The

establishment stage of the Yarimca Petrochemical Complex was

completed after the commissioning of CB, Styrene, PS, BDX, SBR,

CBR, DDB and Caprolactam plants between the years 1972 - 1976.

Due to the rapidly growing domestic demand, Yarmca Complex had

started to become insufficient to meet the increasing demand

although the production capacities of most of the plants were

expanded by 100%. The establishment of second complex of Petkim at Aliaga was agreed during the Third Five Year

Development Plan period.

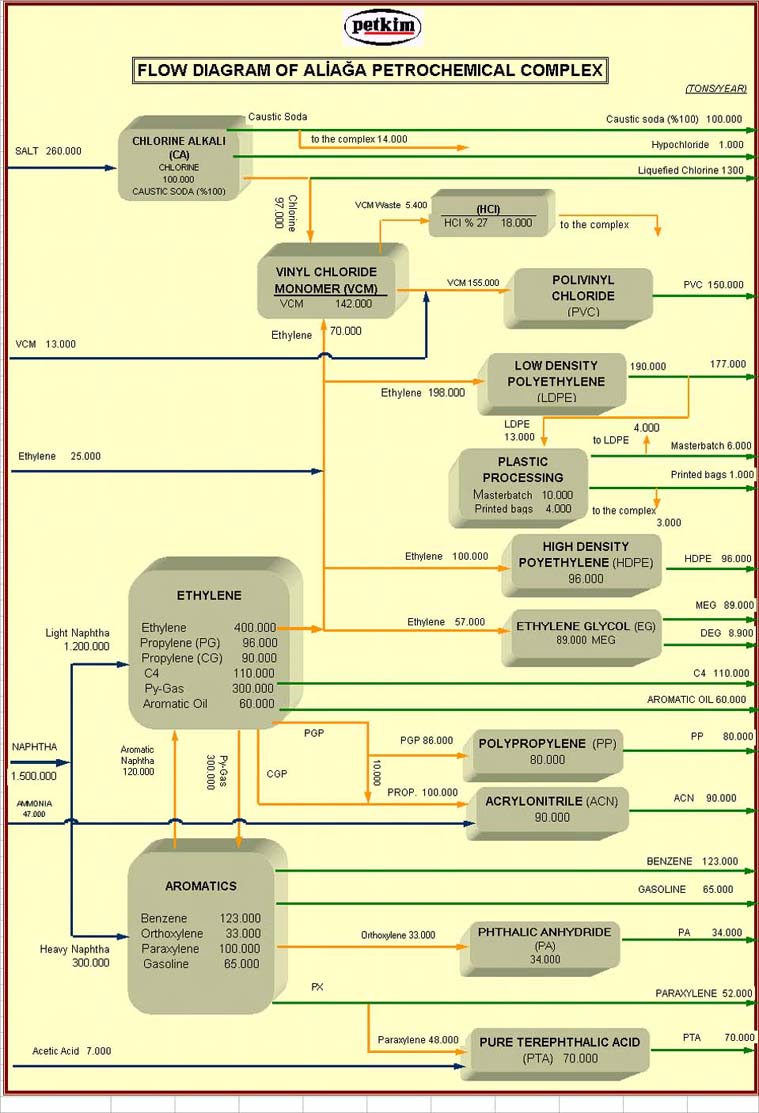

In Aliaga Complex, the plants which do not exist at Yarimca such

as Aromatics, HDPE, PP, PA, PTA, ACN and EO/EG and the plants

which exist at Yarimca but being insufficient in capacities such

as Ethylene, LDPE, Chlorine Alkali, VCM and PVC, were established

with highly advanced technologies and optimum capacities of those

days and start-ups of the plants were realized progressively

starting from the year 1985. The capacities of the plants in

Alia.a complex were increased with the first phase expansion and

modernization investments that realized between 1989 and 1993.

Most of the

plants in Yarimca Complex were closed in the period 1993-1995 because they had

completed their economic lives and had lost their

competitiveness.

Petkim transferred Yarimca Complex with its 5 plants (SBR, CBR,

CB, BDX, PS) in operating position to TUPRAS on November 1, 2001.

Petkim, as the sole producer of basic petrochemicals and the

biggest producer of thermoplastics and intermediates, is the

leader company of Turkish petrochemical industry. Apart from

Petkim, the other petrochemical companies in Turkey are SASA (240 000 tons/year

DMT), TUPRAS (33 000 tons/year SBR, 20 000 tons/year CBR, 40 000

tons/year CB, 33 000 tons/year BDX, 27 000 tons/year PS) and

Bafler Petrokimya (40 000 tons/year PS).

PETKIM PETROKIMYA HOLDING A.S.Б@Б@Б@Б@Б@

Petkim Petrokimya Holding A.S.,

founded 1965, is one of the biggest enterprises in Turkey and is

the main producer and dealer of petrochemicals. Its products are

used in the manufacture of plastics, synthetic fibres,

fertilizers, synthetic rubber and automobile tyres. Petkim

exports products to the EU Countries, America, the Middle East

and Africa, Asia and Far East, Eastern Europe and other

countries.

BUSINESS PROFILE

| Established | Б@ | 06/03/1965 | Б@ |

| Main Business Line | Б@ | Basis Petrochemical Products | Б@ |

| Head Office | Б@ | Aliaga / Izmir | Б@ |

| General Manager | Б@ | Turgut Bozkurt | Б@ |

| Number of Employees | Б@ | 6,592 (as of 12/31/2000) | Б@ |

| Authorized Capital | Б@ | 300,000,000,000,000 TL | Б@ |

| Issued Capital | Б@ | 117,000,000,000,000 TL | Б@ |

| Б@ | Б@ | Б@ | Б@ |

| Б@ | Б@ | Б@ | Cracker growth/ by Petkim |

2007ФN

Б@

Б@

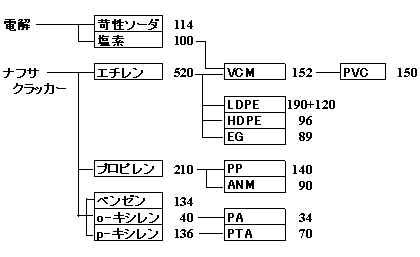

Production Capacities Б@Б@Б@Б@Petkim Annual Report 2005

| Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@tons/year | ||||||||||||||||||||||||||||||||

|

Б@

Turkey's Petkim privatization to be completed Q2 2003

Turkish Petrochemical firm, Petkim Petrokimya, expects its privatization process to be complete within the first half of the year. On Jan 20, the government launched a tender for the block sale of a 51% controlling interest in Petkim, company sources confirmed.

Petkim is currently 93% owned by the Turkish government, and 7% by private investors.

London (Platts)--30May2003

Four companies to bid for Turkey's Petkim 51% stake Jun 6Four companies are set to submit bids in Turkey's tender for the sale of a minimum 51% shares in the country's sole petrochemical producer, Petkim, on Jun 6, a Petkim source told Platts, Friday.

The tender was floated on Apr 2. The four bidders are Standard Kimya AS, a Turkish chemicals company, Sanko Kimya Ltd, a Turkish chemicals and textiles group, ChemOrbis, a Turkish e-marketplace for chemicals and plastics, and Vakiflar Bank, one of Turkey's largest public banks.

Platts 2003/6/6

Standart Kimya acquires 88.86% of Petkim for $605-milTurkey's privatization office has announced the results of the tender for the sale of 88.86% of the shares in the state owned petrochemical producer Petrokimya Holding AS (Petkim). The highest bid of $605m was entered by a Turkish company, Standart Kimya Petrol Dogalgaz San. Tic. A.S.

Standart Kimya has no production facilities of its own, and is wholly owned by Turkey's Rumeli Holding, itself owned by Turkey's controversial Uzan family.

Jul 04, 2003 Chemical Week

Turkey Approves Sale of PetkimThe Higher Privatization Council (Ankara) has approved the sale of the Turkish government's 88.86% stake in petrochemicals manufacturer Petkim (Izmir) to Standart Kimya Petrol Dogalgaz Sanayi ve Tikaret (Istanbul).

9 July, 2000, Turkish Probe issue 390, Turkish Daily News

Raids on Two Uzan Companies Expose Mismanagement History

The Uzan family's Rumeli Holding, which is engaged in far-ranging activities from media to telecoms, the cement industry and finance to power distribution, is accused of sucking its two publicly traded affiliates dry and illicitly pumping their profits into its other subsidiaries.

August 7, 2003 Financial Times

Turkey/ Privatization body cancels tender for petrochemical plantA statement of the board said that Standart Kimya Inc. which was awarded with the Petkim tender did not fulfil conditions of the decision of the board taken on 30 July 2003 within 30 days of time.

---

Standart Kimya of the Uzan family was initially awarded the bid for the Petkim Privatization for $605 million. This was the minimum floor value set for this privatization--one of the first privatization announcements for this year. Due to current actions against the Uzan family, Standart Kimya was not able to make its initial down payment for Petkim during the 30 days allotted following the award announcement.

http://www.petkim.com.tr/ing/ytrbilgileri1.htmБ@

MAJOR INVESTMENT PROJECTS Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Recent Progress

Last Updated :April 1,2003

INVESTMENT PROJECT |

PROJECT COST (MILLION US $) |

CAPACITY INCREASE (TONS / YEAR) |

BEGINING - COMPLETION DATE |

L :

LICENSOR BE : BASIC

ENGINEERING DE : DETAILED

ENGINEERING P

: PROCUREMENT SC : SITE CONTRACTOR |

| ADDITION

OF AN OXY-CHLORINATION LINE TO VCM PLAN |

13.8 |

15,000 EDC (MODERNIZATION OF THE WHOLE UNIT) |

1997-2000 | VINNOLIT - GERMANY (L) KRUPP UHDE-GERMANY (BE,DE,P)

ÇÝLTUÐ A.Þ - TÜRKÝYE (SC) |

| CHLORINE-ALKALI

PLANT (CONVERSION

TO MEMBRANE CELL TECHNOLOGY) |

35.1 |

20,000 CHLORINE (FROM 80,000 TO 100,000) 22,000 CAUSTIC (FROM 90,000 TO 112,000) 400 000 -> BRINE

|

1998-2001 | CEC - JAPAN (L,BE,DE,) CEC + PETKÝM (P) PAKPAÞ ÝNÞ-TÜRKÝYE

(SC) MESSO-CHEMIE TECHNIK (BE,DE,P) ALKE-TÜRKÝYE (SC) |

| ADDITION

OF A SECOND 20 MW CONDENSING TYPE TURBO GENERATOR

TO THE POWER PLANT/ ADDITION OF COOLING TOWER |

12.1 | 56 MW (FROM 95 MW TO 151 MW) |

1997-2001 | ABB - SWEDEN (BE,DE,P) SETA ÝNÞ - TÜRKÝYE

(SC) / SPIG - ITALY (BE,DE,P) EREN ÝNÞ- TÜRKÝYE (SC) |

| ADDITION

OF 17th REACTOR TO THE 4th PRODUCTION LINE OF PVC PLANT |

0.8 | 10,000 (FROM 140,000 TO 150,000) |

1998-2001 | SOLVAY ? BELGIUM (L) PETKÝM (BE,DE,P) TERBAY A.Þ.-TÜRKÝYE (SC) |

| 2nd EXPANSION OF HDPE PLANT | 18.5 | 30,000 (FROM 66,000 TO 96,000) | 1998-2001 | MITSUI CHEM- JAPAN (L,BE) LURGI - GERMANY (DE,P) ÇOLAKOÐLU ÝNÞ-TÜRKÝYE (SC) |

| ADDITION

OF A NEW LIQUID-SOLID WASTE TREATMENT UNIT AND MODERNIZATION OF THE EXISTING UNIT |

20.2 | INCINERATION OF 17,500 T/Y WASTE, 11.5 TONS/ HOUR STEAM GENERATION |

1999-2002 | VINCI (SGEE) - FRANCE

(BE,DE,P) SÝSTEM YAPI-TÜRKÝYE (SC) |

| EXPANSION

OF THE WATER PRE-TREATMENT UNIT |

5.2 |

3,000 M3/HR (FROM 4,500 M3/HR TO 7,500 M3/HR)

|

1999-2003 | OTV - FRANCE / HIDRO OTV - TÜRKÝYE

(BE,DE,P) AKFEN-TÜRKÝYE (SC) |

| VCM PLANT REHABILITATION AND HCL PRODUCTION | 19.8 | 10,000 (FROM 142,000 TO 152,000) |

1999-2003 | VINNOLIT - GERMANY (L) KRUPP UHDE - GERMANY

(BE, DE, P) PASÝNER-TÜRKÝYE(SC) |

| EXPANSION

OF ETHYLENE PLANT |

82.0 | 120,000 (FROM 400,000 TO 520,000) |

1999-2004 | S&W ? U.KINGDOM (L, BE) IFP (FRANCE (L,BE)(C3-C4 H.) MITSUI ENG.-JAPAN+GAMA-TR (LUMP SUM TURNKEY) |

| ADDITION

OF 3rd PRODUCTION LINE TO LDPE PLANT |

65.0 | 120,000 (FROM 190,000 TO 310,000) |

1999-2004 | DSM - STAMICARBON - HOLLAND (L,

BE) TECHNIP - FRANCE (DE, P) TOKAR-TÜRKÝYE (SC) |

| 2nd EXPANSION OF PP PLANT | 25.6 | 64,000 (FROM 80,000 TO 144,000) |

1999-2004 | MITSUI CHEM-JAPAN (L,BE) MITSUI ENG.(MES)- JAPAN (DE,P) |

| DEBOTTLENECKING OF STEAM GENERATION UNIT | 48.1 | CAPACITY INCREASE OF THE EXISTING BOILERS AND MODIFICATION FOR UTILIZATION OF NAT. GAS IN ADDITION TO FUELOIL | 2001-2005 | Б@ |

| REHABILITATION

OF COOLING WATER SYSTEM |

12.3 | CAPACITY INCREASE OF THE EXISTING COOLING WATER SYSTEM | 2001-2004 | SALINE WATER SPEC. -ITALY(DE,P) |

| REHABILITATION

OF DEMINERALIZED WATER SYSTEM |

5.1 | CAPACITY INCREASE OF THE EXISTING DEMINERALIZED WATER SYSTEM |

2001-2004 | OTV-FRANCE (BE,DE,P) |

| TOTAL | 363.6 | Б@ | Б@ | Б@ |

RECENT PROGRESSES OF MAJOR

INVESTMENT PROJECTS Б@Б@As of : May 20, 2004

Expansion of Ethylene Plant : The basic engineering of the

project which will increase ethylene production capacity from

400.000 tons/year to 520.000 tons/year, has been performed by

Stone & Webster (UK) which was the original engineering

designer of the plant. For engineering, procurement and

construction phases, bidding was started on a lumpsum turn-key

basis. bids The tendering was finalized leading to signing of the

82.200 thousand US Dollars contract with MES/GAMA on August 8,

2002. The consortium is continuing the detailed engineering and

procurement services as well as construction work. Construction

of Heavy Metal Removal System was contracted separately to ONCU

INS. A.S. on December 30, 2003 with the amount of

356.623.340.000.-TL. HMR System construction work is continuing.

LDPE Plant Revamp and Debottlenecking : Upon project completion

the production capacity of the plant will have been raised from

190.000 tons/years to 310.000 tons/year. On November 7, 2001

license agreement of Euro 9.000.000 was signed with STAMICARBON

BV (Holland) and engineering-procurement agreement of Euro

47.000.000 was signed with TECHNIP (France). Licensing firm

completed and submitted the process design package on June 23,

2001. Detailed engineering and procurement work has been

completed. After tendering for the construction job TOKAR A.S.

has been awarded the contract amounting to 10.313.076.645.000.-TL

which was enacted on September 2, 2002. Construction work is

progressing.

Second Expansion of PP Plant : The basic engineering of this

project which aims to increase the production of polypropylene

from 80.000 tons/year to 144.000 tons/year, has been performed by

Mitsui Chemicals (Japan). Engineering, procurement and

supervisory services contract with the amount of 19.700 thousand

US Dollars has been awarded to Mitsui Engineering Shipbuilding

Co. Ltd. (Japan) and the agreement was signed on August 8, 2002.

The firm has completed the detailed engineering work. Equipment

and materials are being shipped. Bidding for construction work

has been started.

DuPont Sabanci Polyester (Europe) Б@Б@Б@http://www.dupontsa.com/

known more generally as DuPontSA

DuPont Sabanci Polyester

(Europe), known more generally as DuPontSA, was formed in January

2000 as a result of the merger of the European polyester

businesses of both Haci Omer Sabanci Holding AS of Turkey and EI DuPont de Nemours and Company (DuPont). The businesses encompass the full range

of polyester production - fibres, resins, intermediates and

bottles.

Sabanci is one of the two largest industrial conglomerates in

Turkey. It employs over 30,000 employees and has existing joint

ventures with many major blue chip multinationals.

DuPont, founded in 1802 in Wilmington, DE in the USA is the

largest chemical company in the world, employing over 90,000

employees in its operations in 65 countries.

This joint venture married DuPont's prestigious manufacturing and

branded product heritage with Sabanci's sound business sense to

establish DuPontSA as Europe's number one player in all sectors

of the Polyester market.

Since formation we have evolved and leveraged this unique

position to provide service and product solutions that are

tailored to the needs of the customers of a dynamic industry. We Бc

| БE | manufacture and sell polyester intermediates, fibres and resin across the European, Middle East & Africa (EMEA) region. |

| БE | research and develop products and processes, either in house or with partnerships with universities, suppliers and customers. |

| БE | provide technology and product solutions, some directly and some in partnership with DuPont for the brands and processes they owe, and we have the right to in EMEA. |

| БE | provide a range of services and solutions to polyester and other producers, using our practical experience to advise them on how to run their operations more safely, efficiently and effectively as well as in a more environmentally-friendly way. |

Our corporate headquarters is in

The Netherlands, with our main manufacturing locations based in

The United Kingdom, Germany and Turkey. These are fully supported

by our network of sales and support offices around Europe.

ТНБ@ВhВbВh

Г|ГКГGГXГeГЛОЦЛ∆Б@ВXВWФNВQМОБ@ХƒГfГЕГ|ГУО–В÷ФДЛp

2004/10/8

Sabanci Holding to Acquire DuPont's Share of Their Polyester

Fibers, Resins & Intermediates Joint Venture

http://www.dupontsa.com/

Haci Omer Sabanci Holding, A.S. (Sabanci Holding) announced today that it has reached agreement with E.I. du Pont de Nemours & Company (DuPont) to acquire DuPont's 50% share of DuPont Sabanci Polyester Europe B.V., known as DuPontSA. Following the acquisition, Sabanci Holding will own 100% of DuPontSA. DuPontSA will retain exclusive licenses in Europe, the Middle East and Africa, Russia and the CIS countries to all its current technology, patents and trademarks for polyester fibers, resins and intermediates. Б@Б@Б@ADVANSA

DuPontSA, established in 1999 by DuPont and Sabanci Holding, has annual revenues of more than US$ 1 billion and is a leading integrated producer of polyester fibers, resins and intermediates in Greater Europe. At its production sites in Wilton (U.K.), Uentrop (Germany) and Adana, Kurtkoy and Inegol (Turkey), DuPontSA has manufacturing capacity of over 1.3 million tonnes per annum of PTA, DMT, Polyester Filaments, Polyester Staple, PET Resin and Preform. DuPontSA also has state-of-the-art research and development facilities in Adana (Turkey) and marketing offices in Paris (France), Barcelona (Spain) and Milan (Italy).

Sabanci Holding's agreement to acquire DuPont's interest in DuPontSA is subject to appropriate regulatory approvals.

"DuPontSA is a true leader in its target markets in the dynamic polyester industry and we are pleased with this acquisition. Based on DuPontSA's state-of-the-art technology, globally recognized brands and talented international work force of 3,500, we foresee profitable growth ahead for DuPontSA and benefit to the entire industry through the delivery of superior products and services" said Dr. Celal Metin, CEO of Sabanci Holding.

"We believe that Sabanci is positioned to achieve excellent business results from DuPontSA going forward and, as DuPont moves on from polyester, we will continue to look for business opportunities to partner with Sabanci where complementary capabilities exist" said Richard R. Goodmanson, DuPont Executive Vice President and Chief Operating Officer.

Sabanci Holding is one of Turkey's largest industrial groups. Employing over 35,000 people in 66 companies, it has interests in chemicals and fibers, as well as banking and insurance, food, retail, textiles, energy, cement, automotive, tires and tire reinforcement materials, telecommunications, paper and packaging materials. The companies operate in about a dozen foreign countries and export products world-wide. Sabanci Holding, which has controlling interests in 12 companies listed on the Istanbul Stock Exchange, has an aggressive strategy of growth through acquisitions and expansion of existing businesses.

DuPont is a science company. Founded in 1802, DuPont puts science to work by creating sustainable solutions essential to a better, safer, healthier life for people everywhere. Operating in more than 70 countries, DuPont offers a wide range of innovative products and services for markets including agriculture, nutrition, electronics, communications, safety and protection, home and construction, transportation and apparel.

| The formation of ADVANSA

brought together prestigious DuPont manufacturing and

branded product heritage with Sabanci's sound business

sense to establish ADVANSA as Europe's number one player

in all sectors of the Polyester market. ADVANSA is a wholly owned company of Haci Omer Sabanci AS of Turkey. The businesses encompass the full range of polyester production - fibres, resins, intermediates and bottles. Sabanci is one of the two largest industrial conglomerates in Turkey. It employs over 35,000 employees and has existing joint ventures with many major blue chip multinationals. Since formation ADVANSA have evolved and leveraged this unique position to provide service and product solutions that are tailored to the needs of the customers of a dynamic industry. We Бc

|

Б@

Baser Kimya Б@Б@Б@Б@http://www.baserkimya.com.tr/Б@Б@

The Baser Group of Companies is a leading Turkish industrial group with activities in the chemicals, plastics, textiles, finance, food and international trade. The Baser Group's steady and fast growth has been guided by its corporate policies of unconditional customer satisfaction, investment in human resources and total quality management.

Baser Chemical, Baser Group's first investment in the industrial sector and the Group's flagship company, was established in 1974 to produce chemical ingredients for the detergent and cosmetic industries in Turkey and international markets. Baser Chemical is one of the largest chemicals manufacturers in Turkey and is investing steadily in the capacity and advanced technology required to compete successfully in this highly dynamic sector.

Baser Group Б@Б@http://www.baserkimya.com.tr/en/kurumsal.asp?grup=2

Baser Group is one of the leading industrial groups of Turkey with its companies operating in such sectors as chemistry, foodstuff, packing, textile and factoring.

The foundations of Baser Group were laid in 1951 when Mr. Mustafa Baser started textile business in Adana.

Baser Kimya runs a 40,000 mt/yr polystyrene plant in south Turkey.

Б@

Platts 2003/9/2

Turkey's Tupras privatization bid attracts 20 potential suitors

Turkey's privatization authority confirmed that 20 companies have purchased bid documents for the tender to buy 65.76% stake in state oil refiner and petrochemical producer Tupras, officials said late Monday. The tender deadline was recently extended to Oct 2.

Tupras also operates the Korfez petrochemical complex, at Yarimca, 70km west of Istanbul, which houses a 33,000 mt/yr butadiene extraction plant, 20,000 mt/yr polybutadiene rubber plant, 40,000 mt/yr carbon black unit, 27,000 mt/yr polystyrene unit and a 33,000 mt/yr styrene butadiene rubber plant.

October 13, 2004

EUROPEAN CHEMICAL NEWS

Cracker growth/ by Petkim, Turkey.

Petkim, Turkey, is to increase its cracker capacity at Aliaga,

Turkey, from 400,000 tonnes/y to 520,000 tonnes/y of ethylene and by 70,000 tonnes/y to

240,000

tonnes/y of propylene, 120,000 tonnes/y to 310,000 tonnes/y low

density polyethylene (LDPE). The cracker will be shut from Dec 2004-

Mar 2005 for the $400 M expansion. Polymer plants will continue

to operate with bought in ethylene during this time.

2006/7/28Б@Advansa

La Seda to acquire Advansa's PET, PTA and Preform businesse

H. O. Sabanci HoldingБfs subsidiary Advansa

BV (Advansa)

chaired by Engin Tuncay and La Seda de Barcelona, S.A. (LSB) chaired by Rafael Espanol

have signed today a Share Sale and Purchase Agreement which will

result in the acquisition by LSB of the PET, PTA

and Preform businesses currently operating in the UK, Turkey and

Romania within Advansa. Completion is subject to

necessary regulatory approvals and is expected to take place by

1st October 2006.

The acquisition of AdvansaБfs PET plants in UK

and Turkey with combined capacity of 280 kte will result in LSB increasing its

total PET capacity to around 800 kte per annum and becoming the largest producer

in the European region with the broadest market coverage. It will

also enhance LSBБfs backward integration by adding 670 kte of

PTA capacity in Wilton UK to its existing position

in MEG production in Tarragona, Spain.

ФДЛpМгВћAdvansa

manufacture and sell polyester intermediates (DMT),

fibres and polyester polymer solutions across the European,

Middle East & Africa (EMEA) region.

With close to 300 thousand metric tons of fibre extrusion,

ADVANSA is, by far, the largest manufacturer of polyester fibre

products in its operating region of Europe, Middle East and

Africa.

ADVANSA produces polyester staple fibre and filament yarn, both

POY and textured, serving customers in the main enduse markets of

apparel, home textiles, and technical textiles with an extensive

range of products for all sectors.

Production takes place at three different sites, based in two

countries : Germany and Turkey. All sites are ISO registered with

integrated quality management and customer support services.

ГhГCГcБiUentropБjБ@Polyester Staple Б@40РзГgГУ

ГgГЛГRБiAdana)Б@Б@DMT 280 ktpaБ@

Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@POY Б@115 ktpa

Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Staple Fibre 125 ktpa

2006/5/17Б@AFX News

La Seda still studying PET acquisitions in Europe; no decision on Advansa

La Seda de Barcelona SA said it is still studying growth through acquisitions in the European polyethylene terephthalate (PET) sector, but has yet to make a decision on Turkish PET producer Advansa.

Spain La Seda PET, PTA businesses to be re-launched as 'Artenius'

The polyethylene terephthalate and purified terephthalic acid businesses of Spain's La Seda are to be re-launched under a new name, Artenius, according to a customer letter obtained by Platts, Wednesday. The change is already being affected for the UK, the letter said.

Б@

ADVANSAБ@Europe's polyester leader

http://www.advansa.com/

The formation of ADVANSA brought together prestigious DuPont manufacturing and branded product heritage with Sabanci's sound business sense to establish ADVANSA as Europe's number one player in all sectors of the Polyester market.

Sabanci Holding to Acquire DuPont's Share of DuPont Sabanci Polyester (Europe)

ADVANSA is a wholly owned

company of Haci Omer Sabanci AS of Turkey. The businesses

encompass the full range of polyester production - fibres,

resins, intermediates and bottles.

Sabanci is one of the two largest industrial conglomerates in

Turkey. It employs over 35,000 employees and has existing joint

ventures with many major blue chip multinationals.

Since formation ADVANSA have evolved and leveraged this unique

position to provide service and product solutions that are

tailored to the needs of the customers of a dynamic industry. We Бc

БEmanufacture and

sell polyester intermediates, fibres and resin across the

European, Middle East & Africa (EMEA) region.

БEresearch

and develop products and processes, either in house or with

partnerships with universities, suppliers and customers.

БEprovide

technology and product solutions, some directly and some in

partnership with DuPont/INVISTA for the brands and processes they

owe, and we have the right to in EMEA.

БEprovide

a range of services and solutions to polyester and other

producers, using our practical experience to advise them on how

to run their operations more safely, efficiently and effectively

as well as in a more environmentally-friendly way.

Fibres

& Yarns by ADVANSA

With close to 300 thousand metric tons of fibre extrusion,

ADVANSA is, by far, the largest manufacturer of polyester fibre

products in its operating region of Europe, Middle East and

Africa.

ADVANSA produces polyester staple fibre and filament yarn, both

POY and textured, serving customers in the main enduse markets of

apparel, home textiles, and technical textiles with an extensive

range of products for all sectors.

Production takes place at three different sites, based in two

countries : Germany and Turkey. All sites are ISO registered with

integrated quality management and customer support services.

The company's leadership position is reinforced by a strong

portfolio of branded and speciality fibres, backed by significant

ongoing investment in research and development and upstream

integration into intermediates.

Resins

& Intermediates by ADVANSA

ADVANSA has a very strong intermediates business based on our PTA plants at

Wilton, UK which are currently capable of producing 650 kte per

annum and

our DMT

plant in Adana , Turkey which has a capacity of 240 kte per

annum.

Our PTA plants serve the external PET resin, fibre and film

markets across our region with a competitive cost and excellent

service. These plants also meet our internal needs for PTA for

our own PET plants in the UK and Turkey. Our DMT plant is

essentially integrated with our downstream polymer plants linked

to fibre assets ,although we do have some surplus quantity for

external sales.

We have approximately 300 kte of PET capacity with our

CP plants in UK and Turkey. These plants serve the

carbonated soft drink (CSD) and mineral water (MW) packaging

markets in our region with both branded and general purpose

resin.

We are a leading producer of both PTA and PET in our region with

strong external market positions in the established sectors while

also developing and supporting new business opportunities in

sheeting, customised containers and other specialist

applications.

2006/8/14 Platts

Turkey's Sanko announces plans for petrochemical plant at Ceyhan

Turkey's Sanko Holding conglomerate was developing plans to

construct an oil refinery and petrochemical complex close to

Turkey's Mediterranean oil port of Ceyhan, Turkey's state owned

news agency Nadolu Ajans reported Monday, in an interview with

Sanko chairman Abdulkadir Konukolu.

In 2003 Sanko formed a consortium with Turkey's Zorlu to bid in the sale of a controlling stake in

state petrochemical firm Petkim, a sale which was later

cancelled.

Ceyhan ГWГFГCГnГУОsВЌBTCГpГCГvГЙГCГУВћПIУ_

Sanko GroupБ@http://www.sanko.com.tr/eng/default.asp

Sanko Group, which started its operations with a simple hand-loom in 1904, is continuing its business activities with the same energy and confidence of the first day. Sanko has been actively involved in textile business for five generations. Since the beginning of the 1990s , Sanko group has diversified its bussiness areas in both the national and international platforms. Today, the group consists of many companies and employs over 14,000 people. The companies are active in textile, construction, finance, packaging, energy, food, automotive, white-goods, climatization, information technology, health care and education areas.

Б@

Platts 2006/11/8

Turkey's Sabanci eyes further nylon acquisitions in China: CEO

Turkey's Sabanci subsidiary, Kordsa plans to expand further into

China, CEO Mehmet Pekarun has said. Turkey's Kordsa acquired a

99.5% stake in Chinese nylon company IQNE Qingdao

Nylon Friday from Invista, which Pekarun called a

"first step."

IQNE Qingdao Nylon has an annual capacity of only 3,000 mt/yr of

nylon 6 cord, and will be turning the cord into fabric. Kordsa

would then sell the finished tire fabric to Chinese tire

manufacturers.

Kordsa, Incorporated started operations as DuPont-Sabanci International, LLC in December 2000 combining the nylon industrial heavy decitex yarn and tirecord fabric businesses of E. I. duPont de Nemours & Co. of the USA and Sabanci Holding of Istanbul, Turkey. The company has manufacturing operations in seven countries with headquarters in Wilmington, Delaware, USA.

In April 2005 Sabanci Holding purchased from DuPont its equity interest in the company, and the company was renamed Kordsa International effective July 01, 2005. Also effective July 01, 2005 the company has added and is beginning to integrate into its operations the polyester tirecord operations of Sakosa Sabanci Endustrieyel Iplik ve Kord Bezi Sanayi ve Ticaret A.S. located in Izmit, Turkey and Cobafi - Companhia Bahiana de Fibras, located in Camacari, Brazil.

The company is one of the largest suppliers of nylon and polyester industrial yarn, tirecord and industrial fabrics and single end cord with capacity over 150 thousand metric tonnes per annum, approximately 15 percent of the global textile rubber reinforcement industry. The company operates nine manufacturing sites with a total of approximately 2900 employees and has an annual turnover of approximately $700 million.

Б@

NORTH AMERICA:

Kordsa, Incorporated

Б@Chattanooga Tennessee Б@Heavy denier N6,6 industrial nylon yarn, extensible pick yarn feed stock

Б@Laurel Hill, North Carolina Б@TCF twisting/weaving/dipping

SOUTH AMERICA:

Berazategui, Argentina (Kordsa - Argentina)Б@Heavy denier N6,6 industrial nylon yarnБ@TCF twisting/weaving/dipping

Camacari, Brazil (Kordsa - Brazil)Б@Heavy denier N6 industrial yarnБ@Heavy denier polyester industrial yarn(Cobafi)

Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@TCF twisting/weaving/dippingEUROPE:

Izmit, Turkey (Kordsa)Б@Heavy denier N6,6 industrial yarnБ@Heavy denier polyester industrial yarn(Sakosa)

Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@TCF, C-belt, Chafer twisting/weaving/dipping

Cairo, Egypt (Nile Kordsa)Б@TCF twisting, weaving, dipping

Muhlhausen, Germany (Interkordsa)Б@Single end cord twisting/dippingБ@

2001/1/8 Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@Б@In April 2005 Sabanci Holding purchased from DuPont its equity interest

DuPont

and Sabanci Holding Finalize Expanded Industrial Nylon Global

Joint Venture Agreement

DuPont and Sabanci Holding today announced the completion of an agreement to further expand their multi-regional alliance for industrial nylon. The new 50/50 joint venture creates the world's leading global supplier of heavy decitex nylon industrial yarn and tire cord fabric with over 100KT capacity. DuPont-Sabanci International, LLC, started operations at year-end 2000 and will use the tradename of DUSA International (DUSA) with headquarters located in Wilmington, Del.

"DuPont and Sabanci have a long history of cooperation dating back more than 25 years, including the formation of the DUSA yarn manufacturing joint venture in Izmit, Turkey, in 1987," said Guler Sabanci, DUSA chairperson. "Sabanci and DuPont share many core values which form the basis of our successful cooperation over the years. I am pleased to see this expansion of our alliance in industrial nylon."

"DUSA International will operate as one global business dedicated to meeting the needs of its customers in tires, mechanical rubber goods, cordage, and webbing better than any other nylon supplier," said Peter Hemken, chief executive officer of the new company. "This combination offers many benefits, among them the scale and resources to invest, renew and add value to our offerings for customers."

The new company will operate with a total of eight manufacturing sites and estimated 2,300 employees worldwide. Manufacturing facilities are currently located in the United States, Turkey, Argentina, Brazil, Germany and Egypt. North American business will be a part of the DUSA International entity. KORDSA Sabanci DuPont, the European business created in 1999 through the merger of the two companies' businesses in Europe, will become a subsidiary of DUSA International. Concurrently, DUSA Brazil and DUSA Argentina, formed in 1999, will also become subsidiaries of DUSA International.

DuPont, with over 60 years in the nylon industry, and Sabanci, with almost 30 years experience supplying dipped fabric, will combine their manufacturing and technology experience to benefit DUSA International customers. A number of facility modernizations are planned, under way or recently completed. A state-of-the-art nylon manufacturing facility began operation in Izmit, Turkey, late last year, replacing capacity that was retired with the closure of the DuPont plant in Doncaster, U.K., in 1999. A new fabric-treating unit also began operation last year in Camacari, Brazil. Twisting and weaving facilities in Camacari and also in Berazategui, Argentina, are being modernized this year, and construction of a new treating unit in Berazategui has begun with startup planned early in 2002.

The Sabanci Group has combined revenues of $10 billion and is one of the two largest industrial and financial conglomerates in Turkey. The Group employs approximately 30,000 people and operates in such diverse businesses as tire and tire reinforcement materials, banking, insurance, textiles, chemicals, automotive, cement, food and retail. The Group has grown both through expansion of existing businesses and by the formation of 50/50 joint ventures with multinationals such as Toyota, DuPont, Bridgestone, Philip Morris, Danone, Bekaert, CBR, Carrefour, Kraft foods International, BNP, Dresdner Bank and International Paper.

DuPont is a science company, delivering science-based solutions that make a difference in people's lives in food and nutrition; health care; apparel; home and construction; electronics; and transportation. Founded in 1802, the company operates in 70 countries and has 94,000 employees.

Formation of KORDSA ( Fabric Plant) 1973 Start - Up of MRG 1983 Formation of Yarn Plant (DUSA) 1987 Modernization of Kordsa 1st Mill 1991-1992 Establishment of NileKordsa 1993

Modernization of Kordsa 3rd Mill 1993-1998 Establishment of InterKordsa 1998

DUSA - KORDSA Merger 1999

Up-Grading of Dipping Units 1998-2000 Expansion Start - Up of Yarn Plant 2000

Establishment of Kordsa USA 2000 Establishment of InterKordsa USA 2000 Dusa LLC Formation 2001 Establishment of KianKordsa 2001 Relocation of Technology Center in Kordsa Izmit (Yarn) from Chattanooga USA 2003

KORDSA - SAKOSA Merger 2005

| 2001.11.30 KOSA AND SABANCI ANNOUNCE RESTRUCTURING OF SAKOSA JOINT VENTURE KoSa

and Sabanci today announced they will restructure their

SAKOSA Tire Cord joint venture in Izmit, Turkey. Sabanci

will take 100 percent ownership of the company,

increasing its stake from the current level of 50

percent. The transaction is scheduled to close in the

near future and is subject to both parties obtaining the

required government approvals. |

Б@

2007/5/29

www.plasteurope.com

Petkim: Ineos and Basell consortium among bidders

British chemicals and plastics group Ineos and polyolefins giant Basell in consortium with Demirцren Ortak

Girisim Grubu, are among 19 organisations

reported to have made prequalifying bids for a 51%

stake in Turkey's largest petrochemical corporation, Petrokimya

Holding.

Preliminary bids closed on 14 May, with 18 of the 19 bids

received meeting required criteria. Final bids must be submitted

to Petkim by 15 June.

http://www.jetro.go.jp/biz/world/middle_east/tr/news/2003_2.pdf

ЦѓЙcЙїЛ«ВЌБAНСЙcРќЦыЙїКwМцО–(Petkim)ВћФДЛpУьОDВ…ЙЮОDµš5 КйЛ∆ВрФ≠Х\µšБB

УѓЛ«В…ВжВйВ∆БAChermobis Ortak Girisim Grubu(Ilab Holding)БAStandart Kimya Petrol Dogalgaz San.Tic.AS.БASanko holdingБATurkiye Vakiflar BankБAZorlu Petrogas Petrol Gaz ve Petrokimya Urunleri Вћ5 О–В∆В»ВЅВƒВҐВйБB

2007/7/5 AFX News

Kazakh consortium wins auction for 51 pct of Turkey's Petkim

Kazakhstan-based consortium Transcentralasia Petrochemical

Holding won

the auction for 51 pct of Turkish petrochemical company Petkim

with a bid of 2.05 bln usd.

In June

2003, Turkey

auctioned off 88.86 pct of the company to the controversial Uzan family empire for 605 mln usd, but cancelled

the sell-off two

months later after the Uzans failed to fulfil the required

conditions amid financial difficulties.

A second tender in August 2003 for the block sale of 88.86 pct

failed because of lack of investor interest.

In April

2005, 34.5

pct of the company's shares were sold to Turkish and foreign

investors in a public offering that raised 267 mln usd.

Petkim controls one-third of the petrochemicals market in Turkey

and employs about 4,000 people. Its net profit in 2006 was 40 mln

usd.

Eight companies or consortiums have presented bids for a block sale of a 51% stake in Turkish petrochemical firm Petkim.

About 40% Petkim shares are already listed on the stock market and Ankara is now selling another 51% as part of a broad privatisation programme backed by its creditor, the International Monetary Fund.The bidders are listed as follows:

Consortium listed as Socar & Turcas-Injaz joint investment group consisting of Turkish energy company Turcas and Azeri state oil company Socar and Saudi-based Injaz Projects.A consortium of Turkish Limak group (construction, energy, cement) and Israel's biggest oil refiner Carmel Olefins

Carmel OlefinsБf decision to participate in the tender was part of its strategy to expand internationally. Petrochemical Enterprises controlling shareholder David Federman managed the companyБfs bid. Petrochemical Enterprises CEO Eran Schwartz said, БgThe winning bid seemed us to be too high.Бh He added that the company would continue to review investment opportunities in the energy sector.

TransCentral Asia Petrochemical Holding OGG

Б@Б@Б@Б@a Kazakh-Russian consortium (Platts)Turkey's Zorlu conglomerate (textiles to home electronics)

Turkish-based consortium listed as Hokan Chemicals joint investment group

Indian Oil Corporation (IOC) and Calik Energy of Turkey,

Consortium listed as Naksan-Torunlar-Toray-Kiler joint investment group

Firat Plastik, Kaucuk Sanayi ve Ticaret AS

Russian bank Troika leads $2.05 billion purchase of Petkim stake

Russian private equity firm Troika Capital Partners is one of three investors behind Thursday's buyout of Turkish state petrochemical company Petkim, according to a statement from Troika Dialog, its parent company.

The other investors in Trans Central Asia Petrochemical Holding--the consortium behind the $2.05 billion purchase of a 51% stake in Petkim--are oil company Caspi Neft and investment firm Evrazia, the statement said.

According to Russian business daily Vedomosti, Caspi Neft is a full subsidiary of US-based Transmeridian Exploration, which has operations in Central Asia.

Evrazia manages investments in Turkey for Russian and Kazakh investors, according to Troika's statement. Founded by Mukhmar Ablyazov, its main businesses are power generation and real estate, Vedomosti said.

Skvortsov also told the paper Troika Capital Partners plans to exit in between four to six years. The new owners are locked in for three years under the terms of the sale, he said.Transmeridian Exploration Incorporated is an independent energy company established to acquire and develop identified and underdeveloped oil reserves in the region around the Caspian Sea.

Б@

Turkish court rejects attempt by trade union to halt Petkim sale

Turkey's highest court,

the Danistay, has rejected an application by the Petrol Is trade

union to

halt the

sale of the 51% controlling stake in Petkim, Turkey's dominant

petrochemicals producer, on the grounds that the advertising for

the tender was in breach of privatization regulations.

The tender for the sale of 51% of Petkim was completed in July

with the winning bid of $2.05 billion being submitted by Kazakh-Russian

investment company, Trans Central Asia Petrochemical Holding, controlled by a US businessman

of Armenian extraction, Ruben Vardanyan.

Earlier this month the Turkish

Privatization Administration announced that Turkey's Higher

Privatization Council (OYK), a body consisting of the Prime

Minister, senior ministers and bureaucrats, had decided to award

the tender to the second highest bidder, a

consortium of Turkish petroleum distributor Turcas, Azeri state

oil company Socar and Saudi Injazz projects, which bid $2.04 billion.

The sale of 51% of Petkim to the Turcas-Socar-Injaz consortium

now has only to be ratified by Turkey's competition board before

it can be given the final go ahead, an approval that is expected

to be issued within the next two weeks.