バセルポリオレフィンズ (Basell Polyolefins) Basellの蹉跌と欧米化学企業のゆくえ 製造拠点 能力

バセル社の概要 (2000/11/27 モンテル・エスディーケイ・サンライズ社発表から)

1.本社所在地 オランダ王国フーフドープ市

2.社長兼CEO フォルカー・トラウツ氏(Dr. Volker Trautz)

3.発足年月日 2000年10月1日

4.資本構成 英蘭シェル・グループ 50%

独BASF社 50%

5.生産能力 世界17ヶ国に63工場

ポリプロピレン:年産約510万t(世界第一位)

ポリエチレン :年産約260万t(世界第四位)1. Basell社はPPでは世界最大の生産能力および技術供与実績、PEでは世界第四位の生産能力を誇る、オランダに本拠を置く世界最大級のポリオレフィンメーカーです。

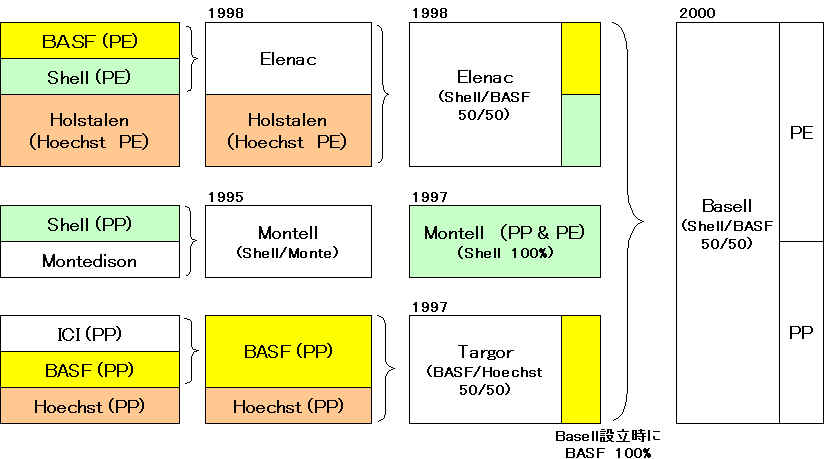

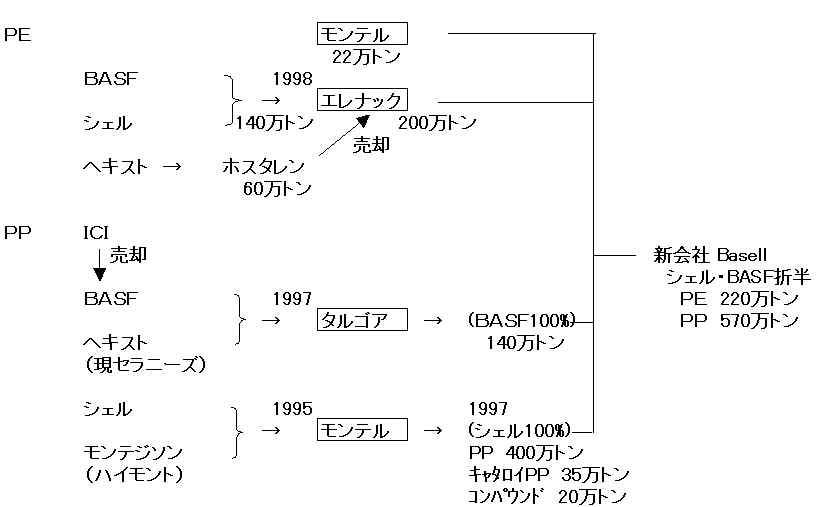

2. Basell社は2000年10月にRoyal-Dutch Shell(シェル)社とBASF社が50%ずつを出資して、旧Montell社、旧Targor社、旧Elenac社の事業を引き継ぎ、設立されました。

3. 現在のBasell社の事業規模・概要は以下のとおりです。

(1) 生産拠点:世界17カ国(SunAllomerなどJVを含む)

(2) 主要な生産能力:

ポリプロピレン 5,100千トン/年、ポリエチレン 2,600千トン/年

①. PPプラント27系列(JVの9系列を含む)

②. PEプラント10系列、キャタロイプロセス3系列、UHMW(超高分子量)PE1系列、HMS(高溶融張力)PP1系列、Hivalloy製品開発設備1系列

③. PPコンパウンド設備20系列(JVの8系列を含む)

PP製品の生産・販売量:世界No.1シェア(年間約5,1000千トン)

研究開発:7カ所の研究開発センター

従業員数:約10,000名

Basell’s complete portfolio of licensed technologies is comprised of:

. Spheripol - PP technology for the production of homopolymer, random and heterophasic copolymers.

. Spherizone - latest generation PP technology based on new multi-zone reactor technology.

. Spherilene - swing gas phase process for the production of LLDPE and HDPE.

. Hostalen - low-pressure slurry process for the production of bi-modal HDPE.

. Lupotech G - fluidised bed gas phase process for the production of HDPE and MDPE.

. Lupotech T - high pressure tubular reactor process for the production of LDPE and EVA copolymers.

歴史

2005/5 BASF と Shell、Basell を Access Industries/The Chatterjee

Groupに売却で合意

2005/8 BASF and Shell complete sale of

their stakes in Basell to Nell Acquisition

1983/11 Himont 発足 (Hercules/Montedisonの折半出資会社)

1987/2 Himont公募 (Hercules, Montedison 各38.7%)

1987/9 Himont Montedison100%に。

1995/4 モンテル発足 (シェルとモンテジソンの折半出資会社)

Shell/UCCのPP提携解消、Himont/三井の技術料プール契約解消。

シェルはシンガポールのTPCのPE、PPの販売権を放棄、人も引上げ、単なる投資者となった。

1997/7 Targorスタート(BASF/Hoechst PP JV)

1997 シェル、モンテル株を 100%取得(モンテエジソンは撤退)

1998/3/1 Elenac スタート

1998/7 Hoechst plans to sell its polyethylene business Holstalen to Elenac

2000/10/1 モンテル、タルゴア、エレナックが合併、

世界最大級のポリオレフィン製造会社であるバセル社として新たに発足。

同社のJV一覧表 別紙

2001/12 Basell's styrene plant in Wesseling shut down

2002/6 Basell announces start-up of new 260 KT polypropylene plant in Spain

2002/10 Basell introduces Spherizone process for PP manufacturing

2002/11 Polibrasil to start-up new

300kt PP plant mid-Feb 2003

Polibrasil, a 50/50 joint venture between

Basell and Brazil's Suzano group,

2002/11 PKN Orlen says Basell JV may start up by

Christmas

2003/10 Basell to license new Spherizone technology for polypropylene manufacturing

2004/2 new world-scale HDPE plants

2004/9 Basell opens new 300 kt/yr HDPE line at Wesseling, Germany

2004/4 Mexico's Alfa/Baell JV To Build New 350,000 MT PP Plant

2004/7 BASF and Shell review strategic options regarding Basell

2004/9 Basell sells 50% share in French CIPEN to ExxonMobil

2004/11 Basell confirms HDPE plant closures; buying interest in Basell high.

2005/2 Basell sells share in PP plant in Spain that it jointly owns with Repsol

2005/5 BASF and Shell to sell their stakes in Basell to consortium led by Access Industries

Chatterjee out of Basell takeover

2005/8 BASF and Shell complete sale of

their stakes in Basell to Nell Acquisition

(背景 イランのBasell買収を米国が阻止)

2005/12 Shell to sell 50% stake in the ethylene cracker at Berre to Basell

2006/4 Basell signs MoU with KazMunayGaz and SAT for petrochemical complex in Kazakhstan

2006/6 ICA Fluor awarded $108 MM US contract by Indelpro to build a PP plant in Mexico

2006/7 Basell to sell its position in Taiwan Polypropylene Company Ltd (TPP)

2006/7 Basell to build new Hostalen ACP HDPE plant at Muenchsmuenster, Germany

2006/8 Basell completes expansion of Australia polypropylene plant

Basell to Enter Kazakhstan Petchem JV Soon

CSJC Nizhnekamsk Refinery selects Spherizone technology for a new 200 KT per year PP plant in Russia

Sinopec selects Spherizone technology for a new 450 KT per year polypropylene plant in Tianjin

Basell to build new Spherilene polyethylene plant at Wesseling, Germany

2006/9 Basell expands catalyst plant in Ferrara, Italy

2006/12 Basell purchases Munchsmunster, Germany cracker from BP-PdVSA joint venture エチレン関連記事

2005/12 Shell to sell 50% stake in Société du Craqueur de l'Aubette to Basell

2007/3 Basell establishes sales and marketing team dedicated to serving Chinese plastic pipe customers

2007/4 Basell grants 50th Lupotech T technology license to QAPCO for new 250 KT per year PE plant in Qatar

Basell to expand polypropylene capacity at Bayport, Texas

2007/6 Basell announces a new expansion project for its Spherizone plant in Italy

Basell to stop producing polypropylene in Sarnia, Canada in 2008

Basell to acquire Huntsman for $25.25 per share

2007/8 Basell makes offer to acquire Shell’s oil refinery at the Berre l’Etang petroch. complex in France

2008/2 EU clears Basell to buy French refinery from Shell

2007/10 Basell achieves 20 million tons milestone in Spheripol PP process with new license in Qatar

Basell announces expansion of its polybutene-1 plant in The Netherlands

2007/10 LyondellBasell Industries to be new company name

2007/11 Basell and ConocoPhillips extend exclusive polypropylene marketing relationship

2009/7 Basell Seeks to Reject ConocoPhillips (Bayway) Supply Agreement

Solvay signs agreement to sell polypropelene compounding activity to Basell

Basell building second PP compounding facility in China

Basell and Lyondell Complete Merger Creating LyondellBasell Industries

2008/1 First LyondellBasell license granted for innovative Spherizone technology to PetroChina

2008/5 LyondellBasell to Stop Producing Polypropylene at its Morris, Illinois Plant

2008/6 LyondellBasell to Consolidate Polypropylene Compounding and Business Locations in North America

LyondellBasell's subsidiary Equistar to stop producing LDPE at its Pasadena facility

2008/7 LyondellBasell Starts up New PP Compounding Plant in Mexico

2008/8 LyondellBasell Industries subsidiary sells its Sarnia, Ontario, site to Shell

LyondellBasell grants Spheripol PP technology license to SABIC affiliate for a 525 KT plant

2008/9 LyondellBasell and partners have signed a Project Development Agreement

LyondellBasell’s Metocene PP technology selected by PolyMirae

2008/11 LyondellBasell grants Lupotech T license to Borealis

2008/12 LyondellBasell starts up new PP Compounding Plant in Nansha, China

LyondellBasell considers bankruptcy filing

2009/1/7 LyondellBasell’s U.S. Operations and one of its European Holding Companies File Chapter 11

2009/2 LyondellBasell misses Europe interest payment

2009/3 LyondellBasell to Close Chocolate Bayou Olefins

2009/7 INEOS wants to buy LyondellBasell Chocolate Bayou HDPE plant

2009/12 LyondellBasell to Shut Down One PP Production Line at Wesseling Plant in Germany

2010/2 LyondellBasell Preparing to Stop PP Production in Terni

2010/8 LyondellBasell Will Quit Iran

2011/5 LyondellBasell to Seek Buyer for Berre, France Refinery

2009/5 German investor buys 50% of LyondellBasell

2009/9 LyondellBasell to Close LDPE Unit at Carrington, U.K.

2009/11 Reliance Makes Offer for LyondellBasell

2009/12 Reorganization Plan

Reliance Raises Bid for LyondellBasell

2010/3 Lyondell Said to Reject $14.5 Billion Reliance Bid

2010/12 LyondellBasell Sells Flavors and Fragrances Business to Pinova Holdings, Inc.

(Basell Homepage) http://www.basell.com/generalInfo/0,2183,1%255F193,00.html

Basell is the world's largest producer of polypropylene, a leading supplier of polyethylene and advanced polyolefin products, and a global leader in the development and licensing of polypropylene and polyethylene processes and catalysts.

1999年11月4日

モンテル・エスディーケイ・サンライズ

新ポリオレフィン会社設立の発表について

http://www.sunallomer.co.jp/japanese/99-11-04.html

モンテル社の株主であるシェルは、BASFと共同で新ポリオレフィン会社の設立について発表を行いました。

●シェルとBASFはモンテル、エレナック、タゴールの事業を統合し、世界最大級のポリオレフィン会社を設立する計画を発表しました。この会社は、シェル、BASFそれぞれ50%の出資比率となり、本社をオランダにおきます。この統合により新会社は、ポリプロピレンでは世界最大、ポリエチレンでは世界で4番目の製造能力を持つことになります。また、新会社の年間売上金額は60億ドルを見込んでいます。

http://www.state.il.us/court/Opinions/AppellateCourt/2001/1stDistrict/June/Html/1000433.htm

Prior to November 1, 1983, Hercules was a global manufacturer of a petroleum-based plastic called polypropylene. Between 1981 and November 1, 1983, Hercules sold over $1 billion worth of polypropylene, and this amount consisted of 15% of plaintiff's net sales. Hercules, however, did not maintain the technology to economically produce polypropylene and, with the increase of oil costs, plaintiff decided to reduce its reliance on this product.

On November 1, 1983, plaintiff and an Italian corporation, Montedison, entered into a joint-venture agreement. The agreement created the corporation, Himont.

On February 12, 1987, Himont offered 22.6% of its common stock to the public in its initial public offering. Following this public offering, Hercules' and Montedison's ownership shares of Himont fell to 38.7% each. In September 1987, Montedison threatened to take over Hercules if it did not sell its remaining shares in Himont. Montedison also agreed to pay a premium for the stock owned by Hercules. Hercules then agreed to sell its shares, and in 1987 Montedison paid Hercules $1,487,500,000, or $59.50 per share, resulting in a net capital gain to Hercules of $1,338,501,966.

Hercules Incorporated http://www.herc.com/

Hercules Incorporated is a global manufacturer of chemical specialties used in making a variety of products for home, office, and industrial markets. Businesses and their key products are:

・ Aqualon, for thickeners used in water-based products such as latex paint; ・ Pulp and Paper, for total solutions to customers' pulp and paper manufacturing needs;

Industrial Specialities, for thickeners used in water-based products such as latex paint;・ FiberVisions, for staple fiber used in hygienic products and automotive textiles; ・ Pinova, for adhesives, flavor and beverage, construction, fragrance, household and industrial. Hercules, established in 1912, is headquartered in Wilmington, Delaware, U.S.A.

2006/3/6 Hercules

Hercules Tianpu - Methylcellulose joint venture begins operations in China

http://www.herc.com/abouthercules/news/06/Tianpu.htmHercules Incorporated announced the March 1st commencement of operations of Hercules Tianpu Chemicals Co. Ltd. ? a joint venture between Aqualon, a business unit of Hercules, and Luzhou North Chemical Industries Co. Ltd. 瀘州北方化学 and Jiangsu Feixiang Chemical Co. Ltd. 江蘇飛翔化学

The joint venture will be the leading producer of methylcellulose (MC) in China and will have an initial combined capacity of 6,000 metric tons at the sites in Luzhou and Zhangjiagang張家港. In addition, a new 12,000 metric ton MC facility, currently under construction in Zhangjiagang, is scheduled to start operations in the second half of 2006.

About Methylcellulose:

Methylcellulose (MC) and its companion products hydroxypropyl- and hydroxyethyl- cellulose (MHPC and MHEC) are used in a wide variety of industries and applications, including tile cements and renders, joint compounds, gypsum plasters, emulsion paints, resins and catalytic converters. Specialized food grades and premium grades are used respectively as functional food ingredients and in the pharmaceutical industry in tablet coating and controlled release formulations.

メチルセルロースは、粘性のほかに保護コロイド性、熱ゲル化性、潤滑性、保水性といった様々な特性を備えている。たとえば感熱記録紙では、顕色剤と発色染料がコーティングされ、熱が加えられる双方が反応して印字される仕組みになっているが、メチルセルロースは二つの粒子が混ざり合わないようにし、うまく分散させる作用(保護コロイド性)があるため、自然発色を防ぐ役割を果たしている。またNi-Cd電池の極板製造時にはメチルセルロースの熱ゲル化性を利用して乾燥工程中のダレを防止、均一な製品の製造に役立っている。ほかにもIC基板、ハニカム状の自動車排気ガス浄化装置などのファインセラミックス製品の押し出し成形時のバインダーとしてメチルセルロースが使用されている。(信越化学)

シェル、モンテル株を 100%取得 モンテエジソンは撤退

ロイヤルダッチ・シェルはポリプロピレンの世界最大企業であるモンテルを 100%傘下に収めることを明らかにした。モンテルの一方の親会社であるモンテジソンの保有株式を約 20億で買収する。EC委員会の承認を得て、実施する。

Basell、870万トン体制でスタート 生産拠点は19ヵ国・44工場に

BASFとシェルの折半出資によるポリオレフィンのガリバー企業「バセル(Basell)ポリオレフィンズ」が10月1日にアムステルダムに設立され、業務を開始した。

Shell and BASF announce intention to merge polyolefins businesses

http://www.basell.com/newsDetails/0,2202,5%255F268,00.html

Shell Petroleum N.V.('Shell'), a holding company in the Royal Dutch/Shell Group of Companies, and BASF announced today that discussions are at an advanced stage to combine Elenac, Montell and Targor into one of the world's largest polyolefins enterprises. Shell and BASF would each own 50 per cent of the new enterprise which would have its holding company in The Netherlands.

Montell means Montell N.V., a company wholly-owned by companies of the Royal Dutch/Shell Group of companies, and the companies directly and/or indirectly owned by Montell N.V.

Targor was founded in 1997 as 50:50 joint venture between BASF and Hoechst, with 1,600 employees.

Elenac means Elenac GmbH and Elenac S.A. companies owned on an equal basis by BASF AG and Deutsche Shell AG and Shell Chemie S.A. respectively, and the companies directly and/or indirectly owned by either or both of them.

(23 Mar 2001 発表)

Dow Acquires Former Basell plant in Cologne

http://www.dow.com/dow_news/prodbus/2001/20010323a_pb.html

The Dow Chemical Company and Basell announced today that they have reached agreement on the sale of the Basell polypropylene plant in Cologne, Germany.

In order to resolve competition concerns raised by the European Commission before the Basell merger was approved, Basell is required to divest polypropylene resin plants with a capacity to produce at least 600KT and PP compounding plants with a capacity to produce at least 130KT.

Joint Venture (同社homepageより)

http://www.basell.com/

| Japan | : | SunAllomer | : | PP | |

| : | Korea | PolyMirae | PP | ||

| Taiwan | Taiwan Polypropylene | PP | |||

| Thailand | HMC Polymers Company Limited | PP | |||

| Basell Advanced Polyolefins Thailand | PP compounds | ||||

| India | Machino-Basell India Ltd | PP compounds | |||

| Poland | Basell Orlen Polyolefins | PE/PP | |||

| Argentina | Petroken | PP | |||

| Brazil | Polibrasil | PP | |||

| Australia | PolyPacific | PP compounds | |||

| ーーーーーー | |||||

| Mexico | Indelpro | PP |

SunAllomer is one of the longest established PP producers in Japan, with manufacturing operations first commencing in late 1960's . The company is a joint venture of Basell, Showa Denko and Nippon Petrochemical Company. As such it combines the strengths of Basell's global leadership position in PP with the local strengths of two of Japan's leading industrial companies.

By building on these strengths, SunAllomer is able to offer its customers a unique combination of global product development and expertise as well as local industry, market and application know-how.

SunAllomer works tirelessly and enthusiastically with both customers and suppliers to generate value-adding, win-win business relationships. The company has a strong and deep dedication to protecting the environment and carries out all its activities with a strong commitment to quality, health and safety.

PolyMirae

PolyMirae Company Ltd. is the premier polypropylene producer in Korea. The company was formed through a strong alliance of two highly respected global companies, Daelim Industries and Basell. The company's specific charter is expanding the demonstrated properties of PP in order to provide customers with leading-edge materials that meet their demanding requirements.

Taiwan Polypropylene

Taiwan Polypropylene Co. Ltd. (TPP) is a joint venture company owned 35% by Basell and 16% by the Koos Group of Taiwan, with the remaining 49% held by more than 30,000 public shareholders.

TPP was the first polypropylene producer in Taiwan, starting with Hercules technology more than 25 years ago, and today is the leading polypropylene supplier in the country.

TPP operates two Spheripol technology production lines at its site in Kaohsiung, Taiwan, with annual capacity of 400 KT. In addition, TPP operates a polypropylene compounding line and a staple fibre plant at the same site. The company's business office is located in Taipei.

HMC Polymers Company Limited

HMC Polymers Company Limited established the first polypropylene manufacturing facility in Thailand in 1987. Since that time it has continued to expand and upgrade its facilities. Today it has the most modern technology in Thailand and, with capacity of 450 KT, is one of the largest and most advanced facilities in Asia. The company is certified for both ISO 9002 and ISO 14001.

HMC Polymers Company Limited is a joint venture between Basell and a group of leading Thai companies. HMC is a technology leader in South East Asia with a worldwide marketing distribution system to support export sales activities, producing a wide combination of homopolymer, heterophasic copolymer and random copolymer resins. HMC offers fabricators, converters and end users significant opportunities to reduce cost, produce higher value products and open new markets.

Basell Advanced Polyolefins Thailand

Basell Advanced Polyolefins (Thailand) Co., Ltd. is a Thailand-based plastics compounding company established in 1997 to manufacture and market polypropylene compounds. It is jointly owned by Basell and SunAllomer. The company's production plant is located in Eastern Seaboard Industrial Estate, Rayong, Thailand, with 15 KT compounding capacity.

The plant has been operational since mid-1999 and has been designed for future expansion of up to 30 KT. The portfolio of products produced by the joint venture includes polypropylene compounds, an extensive range of filled and unfilled products for the automotive, industrial and appliance industries.

Machino-Basell India Ltd.

Machino-Basell India Ltd. (MBI) produces an extensive range of unfilled and filled polypropylene compounds and is the major supplier of polypropylene compounds to the Indian automotive market.

MBI is a joint venture company owned equally by Basell and Machino Plastics Ltd. Based in Gurgaon, 25 kilometers from New Delhi and launched in 1998, the company operates two Berstorff compounding lines with a total annual capacity of 15 KT.

Poland

Basell Orlen

Polyolefins

Basell Orlen Polyolefins Sp. z o.o. (BOP), a joint venture company formed in March 2003, by PKN ORLEN S.A and Basell Europe Holdings B.V, and each hold 50 percent share in BOP, which was established with a Euro 217 million investment from PKN ORLEN and Basell, the world's largest producer of polypropylene.

Further, a bank credit line was approved in 2003 with a Euro 350 million investment firmly establishing strong project financing and secure funding for future manufacturing sites.

BOP manufactures, markets and sells polyethylene (PE), polypropylene (PP) and advanced polyolefin material from its operations in Plock, and the international production network of Basell. The plants are operating with feedstock and services from PKN ORLEN, which also offers strong market knowledge of the region, and a strategic geographic location.

From Basell, BOP gains industry-leading technology, access to global customers, and operational excellence. Its international management board, comprised of Hartmut Lueker, president; Marek Sep, vice president of operations; Malgorzata Wisnicka-Hincza, vice president of finance; and Wido Waelput, vice president of sales/marketing, are instilling both local market expertise, and international best-business practices for efficiency, quality and safety into the operations of BOP.

Through new marketing, sales and customer service practices, high quality product, BOP has secured 50 percent market share of polyolefin sales on the Polish market in 2003. This sales performance and the outlook for next year are strong.

During its startup year, BOP sold 45,000 tonnes of new Hostalen® and Moplen material, as well as 245.000 tonnes of existing Malen grade products. The main market segments for its products are: consumer goods, film material for packaging, modern containers for the transport of dangerous goods, such as intermediate bulk containers (IBC), and pipelines for gas and drinking water.

In this start-up year of 2003, the three most significant milestone events advancing the company's progress were: 1) securing the bank credit for the new installations, and the financial closing that demonstrated the company's fiscal stability and performance well above budget; 2) the engagement of the contractor of the new manufacturing plants; and 3) the "ground breaking" for this new construction, which is expected to be of the world's largest twin PE and PP plants; Tecnimont S.p.A., of Milan, Italy, was awarded the large-scale contract for the engineering, procurement and construction (EPC) for the polyolefin complex.

Considered to be the largest facilities of its kind worldwide when completed, the new plants are scheduled to start commercial production in June 2005.

The two new plants will produce 400,000 tonnes per year of PP utilising the Spheripol® process, and 320,000 tonnes per year of high density polyethylene (HDPE), using the Hostalen production method. There will be significant participation by local contractors and suppliers in the construction of the new manufacturing plants.

The JV is capable of producing 400 ttpa of polypropylene (PP) and

470 ttpa of polyethylene (PE) of which 150 ttpa accounts for LDPE and 320 ttpa for HDPE.

In preparation for the opening of these new facilities, BOP will build a world-class logistics and distribution centre in 2004 to serve its customers and handle the significant increase in plastics material output in 2005. VOS Logistics of the Netherlands has been engaged to support this installation.

More visible and dramatic will be the installation of the polymerization reactors for the main plants in 2004. This activity, as well as the whole "mega" construction project will take the coordination and support of more than 2000 people and will be of the scale and scope not realised before in Eastern Europe.

The new BOP plants will bring a higher level of industrial and manufacturing capability to Poland, which is creating new opportunities for development and investment in the Plock region. The local Plock government is working closely with PKN ORLEN and Basell Orlen Polyolefins to attract investment by establishing land and development incentives, as well as providing infrastructure support to attract complimentary manufacturing interests to the region. The BOP investment is opening the doors for new economic opportunities in the plastics market sector in Poland.

Petroken

Petroken, a 50/50 joint venture between Basell and Repsol/YPF, is the leading polypropylene producer in Argentina.

Petroken started up a 100 KT PP plant near the major local market in Buenos Aires in 1992. Petroken increased its polypropylene capacity to 180 KT in 1999; that year Petroken also started up a state-of-the-art compounding facility to support advanced polyolefins in the region. The compounding capacity is now 20 KT per year.

Petroken's dedication to obtain outstanding product quality and provide exemplary customer service has made it one of the premier quality suppliers in industry sectors. Petroken combines the strengths of its two shareholders - Basell delivering leading technology, catalysts and access to world markets and Repsol/YPF providing a local secure feedstock source and regional support.

Petroken has established itself as a major player in the Mercosur market as well as an export supplier of choice in many countries outside of South America.

Petroken's product portfolio includes widely used technologies: LIPP, Novolen and Spheripol process homopolymers and copolymers as well as former Montell and Targor PP compounds and Petroken's own masterbatches.

Polibrasil

Polibrasil Resinas S.A., is a 50/50 joint venture between Basell and Suzano, a Brazilian company focused on petrochemicals and the pulp and paper business.

Pioneering the production of polypropylene in Brazil since 1978, Polibrasil operates from three strategically positioned locations: Camacari, Duque de Caxias and Maua. Polibrasil has a strong commercial focus with excellent customer relationships across a wide range of conversion technologies.

The company develops polypropylene products that deliver excellent cost/benefit performance for customers. Polibrasil's PP market leadership in Latin America has been further enhanced with the start-up of a new world-scale Spheripol process plant in Maua which increased Polibrasil's overall PP capacity to 750 KT.

Polibrasil also operates a 25 KT PP compounding plant. With a broad customer base and a growing resins portfolio, Polibrasil is uniquely positioned to continue to build upon its leadership position.

PolyPacific

PolyPacific Pty. Ltd. is an Australian-based company jointly owned by Basell Australia (Holdings) Pty Ltd. and Mirlex Pty Ltd. The company manufactures a full range of polyolefin compounds, masterbatches and modified elastomers, and has become the leader in its field in Australia, with a growing market presence also in the Asia-Pacific region.

(Joint press release of BASF and BASELL 2002/1/29)

Basell's styrene plant in

Wesseling shut down

http://www.basell.com/newsDetails/0,2202,2%255F330,00.html

BASF and Basell, a 50:50 joint venture between BASF and Shell, shut down the styrene plant at Wesseling at the end of 2001. The plant, which had an annual capacity of 410,000 tonnes, first started producing over 30 years ago and covered part of BASF's styrene requirements in Europe. The main reason for the closure is a worldwide drop in demand for styrene and styrenic polymers.

2002/6/27

Basell

announces start-up of new 260 KT polypropylene plant in Spain

http://www.basell.com/newsDetails/0,2202,5%255F1057,00.html

Basell is announcing today the start-up of its new 260 KT polypropylene plant ー Tarragona PP III -- at the Tarragona East complex. The world-scale plant manufactures a wide range of homopolymer and heterophasic copolymer grades for diverse markets.

Hoechst plans to sell its

polyethylene business to Elenac - Letter of intent signed

http://www.archive.hoechst.com/english/news/98/01157500.html

Hoechst AG and Elenac are envisaging the sale of the Hostalen polyethylene business to Elenac, a leading supplier of polyethylene in Europe. The two companies agreed to this in a letter of intent.

1998/1/16

Name and start-up date decided for BASF/Shell Polyethylene joint

venture

http://www.gasandoil.com/goc/company/cne81092.htm

Following approval by the EU Commission, the planned BASF/Shell joint venture can now be implemented, which will include the acquisition of Montell* European PE business. It will operate under the name Elenac and will start-up on March 1st, 1998.

Targor Gets the Green Light from

Brussels

Joint Press Release from BASF and

Hoechst

http://www.archive.hoechst.com/english/news/97/00483500.html

The European Commission in Brussels has approved the formation of Targor , the 50:50 polypropylene joint venture between BASF Aktiengesellschaft and Hoechst AG. The new company, which is headquartered in Mainz, will thus start operating as planned on July 1, 1997.

Platts 2002/11/11

Polibrasil to start-up new 300kt PP plant mid-Feb 2003

Polibrasil, a 50/50 joint venture between Basell and Brazil's Suzano group, is set to start up its new 300,000 mt/yr polypropylene plant at Maua, Sao Paulo state, in mid-February 2003, a company source said Monday.

Platts 2002/11/14

PKN Orlen says Basell JV may start up by Christmas

Poland's downstream oil company Polski Koncern Naftowy (PKN Orlen) today said a joint venture with polyolefin producer Basell Europe Holdings BV may be ready to start up by Christmas.

The formation of Montell Polyolefins

US FTC JUNE 1, 1995 http://www.ftc.gov/opa/1995/06/montell2.htm

The Federal Trade Commission has

given final approval to a consent agreement with Montedison

S.p.A. and the Royal Dutch/Shell Group of Companies, the world's

largest polypropylene producers. The agreement, requiring

divestiture of Shell's U.S. polypropylene business, settles

charges that the

formation of Montell Polyolefins, a $6 billion joint venture between

Montedison and Shell, could substantially reduce competition in

several polypropylene and polypropylene-related production and

licensing markets, and reduce U.S. export sales.

Polypropylene is used in a wide variety of consumer goods

including playground equipment, storage containers and toys.

Total U.S. polypropylene sales are approximately $4 billion a

year, according to industry trade sources.

The consent order involves significant export markets in excess

of $250 million annually. "This action demonstrates the

ability of the antitrust laws to protect U.S. export

commerce," said William J. Baer, Director of the FTC's

Bureau of Competition. "By requiring the divestiture of

Shell's polypropylene and catalyst business, the consent order

protects the opportunity to compete in the polypropylene

licensing business. This will help protect competition in this

important market," Baer said.

"This is the first order issued in an international

antitrust case since the International Antitrust Guidelines were

issued, and it illustrates the Guidelines' theme of cooperation

with foreign antitrust authorities," Baer continued. Both

the FTC and the European Commission took remedial action against

the joint venture. Baer stated that "consultation at the

staff level helped the Commission consider whether the EC's

remedy eliminated competitive problems in the United States and

helped assure that the Commission's order was coordinated with

the EC's remedy."

Montedison, an Italian firm, is the leading competitor in world

polypropylene markets through its wholly-owned, indirect

subsidiary, HIMONT Incorporated. HIMONT, also named in the FTC

complaint detailing the charges in this case, is based in

Wilmington, Delaware. The complaint also names Royal Dutch

Petroleum Company, based in The Netherlands, and The

"Shell" Transport and Trading Company, p.l.c., based in

London. Both of these companies are public holding companies of

the Royal Dutch/Shell Group of Companies (collectively referred

to here as Shell), the world's second largest producer of

polypropylene. Finally, the complaint names Shell Oil Company, of

Houston, Texas, a member of the Royal Dutch/Shell Group of

Companies.

The final order requires Shell and Shell Oil to divest to Union Carbide, of Danbury,

Connecticut, or to another Commission-approved acquirer, within

six months, all

of Shell Oil's polypropylene assets including its interest in the

Unipol/SHAC polypropylene technology and catalyst licensing

business and the Seadrift polypropylene plant, both conducted jointly with Union Carbide

Corporation. Under an existing agreement between Shell Oil and

Union Carbide, any transfer of Shell Oil's rights to Unipol/SHAC

and Seadrift prior to March 1997 requires Union Carbide's

consent. The order provides that if Union Carbide declines to

acquire these assets at an appraised price or if it objects to

another acquirer, the divestiture period can be extended until

March 31, 1997. The ultimate acquirer, if other than Union

Carbide, and divestiture agreement must be approved by the

Commission.

→ ダウーUCC合併

→ Union Carbide shutdown Seadrift Plant in September 2003

To preserve competition pending

divestiture, the respondents also have signed a separate

agreement requiring Shell to hold separate and manage the assets

to be divested independently of Shell and Montell, pending

divestiture. In addition, Montedison is required to manage its

polypropylene technology and polypropylene catalyst businesses

independently of Shell and Montell until Shell has completed the

required divestiture. If the divestiture is not completed on

time, the settlement permits the Commission to appoint a trustee

to complete it.

The settlement also resolves charges regarding a royalty and

profit-sharing agreement between Montedison and Mitsui

Petrochemical Industries Ltd.,

Montedison's partner for the licensing of both polypropylene

technology and polypropylene catalyst. The FTC charged that the

accord restricts price competition and constitutes an illegal

agreement to allocate markets. The Commission's action makes the

consent order provisions binding on the respondents. The order prohibits

Montedison and Montell from sharing in royalties from future

polypropylene-related technology licenses granted by Mitsui for use in the United States, and from

entering into similar agreements to allocate markets.

Finally, the settlement requires Shell, Montedison and Montell,

for 10 years, to obtain Commission approval before acquiring any

interest in a company that is engaged either in the polypropylene

technology, polypropylene licensing or polypropylene catalyst

business anywhere in the world, or in the manufacture or sale of

polypropylene polymers in the United States or Canada.

"In an increasingly global marketplace, it is critically

important that we cooperate with our foreign colleagues,"

said Baer. "Cooperation is good for consumers and, by

diminishing the likelihood of inconsistent remedies, it is good

for business." Cooperation with foreign authorities was a

major theme of the Antitrust Enforcement Guidelines for

International Operations, issued by the FTC and the Department of

Justice on April 5, 1995. "In the future, under the

International Antitrust Enforcement Assistance Act of 1994, the

FTC and the Department will be able to cooperate more fully with

foreign antitrust authorities; if they enter into reciprocal

agreements that meet the act's requirements, they will be able to

share confidential information," Baer said.

The consent agreement was announced for a public-comment period

on Jan. 11. The Commission vote to issue it in final form

occurred on May 25, and was 5-0.

Platts 2004/2/11

Basell to close down three HDPE

sites, one PP unit by 2005

(once its two new world-scale HDPE

plants come on stream)

Trautz said the closures would affect about 300,000 mt/yr of HDPE capacity and would take place once its two new world-scale HDPE plants come on stream.

The two new HDPE plants--located at Wesseling, Germany, and at Plock, Poland--are currently being built and capable of producing 320,000 mt/yr each. The latter, scheduled to start up in 2005, is a joint venture between Basell and PKN Orlen. Both plants are back integrated into crackers and refineries, to optimize the production chain.

Platts 2004/9/15

Basell opens new 300 kt/yr HDPE line at Wesseling, Germany

Polyolefins major, Basell has successfully started production at its latest high density polyethylene line at Wesseling, Germany, a company source told Platts Wednesday. The 300,000 mt/yr line using the Hostalen process started operations Sep 14, joining two existing gas phase HDPE lines. The two existing HDPE lines have a total capacity of over 300,000 mt/yr.

April 28, 2004 Dow Jones

News Service

Mexico's Alfa Unit To Build New 350,000 MT Plastics Plant

Mexican conglomerate Alfa said Tuesday its unit Indelpro plans to

build a new polypropylene plant with a capacity to produce

350,000 metric tons a year of the plastic.

Indelpro is jointly owned by Alfa's petrochemicals group Alpek and by

Netherlands-based Basell, the

world's biggest polypropylene producer.

The new plant, in the northeastern industrial center of Altamira,

will increase Indelpro's capacity to 570,000 metric tons a year, Alfa said.

2004/7/29 Basell

BASF and Shell review strategic options regarding Basell

http://www.basell.com/

BASF and Shell announced today that they are reviewing strategic alternatives regarding their joint venture Basell, a global leader in polyolefins, in which they both hold a 50 percent equity interest. The options being reviewed by the shareholders include the sale of their stakes and an equity market transaction.

Basell sells 50% share in French

CIPEN LLDPE plant to ExxonMobil

Polyolefins producer Basell announced Friday that it has sold its

50% share in the Compagnie Industrielle des Polyethylenes de

Normandie linear low density polyethylene plant in

Notre-Dame-de-Gravenchon, France to ExxonMobil.

*CIPEN

Exxon Polymeres and Shell Chimie created a business entity entitled Compagnie Industrielle Des Polyethylenes De Normandie ("CIPEN"), the sole purpose of which was to own and operate a plastic manufacturing plant in Notre-Dame-De-Gravenchon, France.

CIPEN was structured as a Groupement d'Interet Economique ("GIE"), a form of business entity under French law resembling a partnership. Exxon Polymeres and Shell Chimie each controlled 50% of CIPEN's stock and jointly elected CIPEN's sole director. By agreement of its member corporations, CIPEN's sole pursuit was the manufacture of plastic from the raw material ethylene provided by Exxon Polymeres and Shell Chimie.

November 4, 2004 Financial

Times Information 事前報道

Basell confirms HDPE plant closures;

buying interest in Basell high.

Basell has confirmed it is to shutter three HDPE plants in Europe

with a total capacity in excess of 300,000 tonnes/y after the end

of 2004. The plants are at Frankfurt and Knapsack, Germany; and

Tarragona, Spain. The

shutdowns will coincide with the commissioning of a 320,000-tonnes/y HDPE

plant at Plock, Poland that

is part of a polyolefins joint venture of Basell and PKN Orlen,

and of a similar-sized facility at Wesseling, Germany.

Meanwhile, there have been more potential buyers for Basell than expected.

2005/2/14 Basell

Basell announces that it intends to sell share in PP plant in

Spain that it jointly owns with Repsol

http://www.basell.com/portal/site/basell/?epi_menuItemID=d9d887b2d711ac55c87d7fc1a0f034a0&VCMChannelID=a841159b59e3af00vcm100000000c53f3cc3____&VCMContentID=32c83be4aef02010vcm100000000c53f3cc3RCRD

Basell announced today that it

intends to sell to Repsol YPF its 50% share in the 160 KT per

year polypropylene plant in Tarragona, Spain that is operated by

Transformadora De Propileno A.I.E., a company jointly owned by

Basell and Repsol.

“Basell’s goal is to focus on its wholly owned

production facilities in Tarragona, which currently have an

annual capacity of 360 KT of polypropylene,” said Manuel Fraga, president of Basell

Iberica. ”We will continue

to supply our customers from those plants and other regional

sources.”

2005/5/5 Shell/BASF BASF

and Shell review strategic options regarding Basell

BASF and Shell to sell their stakes in Basell to consortium led

by Access Industries

http://www.corporate.basf.com/en/presse/mitteilungen/pm.htm?pmid=1833&id=mGVN16lGdbcp40T

BASF and Shell Chemicals are to

sell their 50-50 joint venture Basell, one of the world's leading

manufacturers of polyolefins, to a consortium led by New York-based Access

Industries together with The Chatterjee Group. A corresponding agreement was signed.

The sale price will total Euro 4.4 billion, including debt.

The transaction is subject to approval by the relevant antitrust

authorities and closing is expected in the second half of 2005.

Access

Industries

Access Industries, founded by company Chairman and President Len Blavatnik in 1986, is a privately held, US-based

industrial holding company with investments worldwide. Access has

long-term strategic interests in the oil, aluminium, coal and

telecommunications sectors.

The

Chatterjee Group

The Chatterjee Group (TCG) is a privately held, US-based

investment organisation with a significant business presence in

India. Dr. Purnendu Chatterjee is the chair-man of TCG, which has

a controlling interest in Haldia Petrochemicals Ltd, a major integrated petrochemical company

that utilises Basell technology.

| 化学業界でも、最近のRoyal Dutch ShellとBASFの石油化学合弁会社Basellの売却では、複数の買収ファンドが興味を示し、初めはBlackstoneとApolloの連合が有利と報道されていたが、これにBain

CapitalとGoldman Sachs Capital Partnersが加わり、一大買収ファンドコンソーシアムを作ったと報道されていた。しかし、結果インドのChatterjeeと米Access

Industriesの事業会社連合がHaldia

Petrochemicalを買収母体会社として44億ユーロで勝ち取ることとなる(その後直近では更にChatterjeeが脱退すると発表。Accessのみで進められる模様)。 |

Len Blavatnik holds a Master's degree from Columbia University and an MBA from Harvard Business School.

Mr. Blavatnik is a founder and principal shareholder of Access Industries Inc., a global private equity investment firm with a diversified portfolio in energy, minerals and mining, telecommunications and financial services.

He is Chairman of Access Industries. Director of the Siberian Urals Aluminum Company (SUAL), and Svenska Bredbandsbolaget AB. Mr. Blavatnik is also a member of the Global Advisory Board of the Center for International Business and Management at Cambridge University and a member of the board of Dean'sAdvisors at the Harvard Business School. He serves on the Board of Directors of the Eurasia Group in New York, and is Vice Chairman of the Kennan Council at the Woodrow Wilson Center in Washington, D.C.

Access is controlled by its CEO and President, Leonard Blavatnik who owns 100% of its capital stock. Blavatnik emigrated from the Soviet Union in 1978 is a U.S. citizen residing principally in New York and serves as a director of TNK. Access is a controlling shareholder of TNK through a series of companies.

2005 Forbes The 400 Richest Americans

#61 Leonard Blavatnik

Net Worth: $3.5 billion

Source: Oil/Gas, Access Industries

Self made

Age: 48

Marital Status: Married

Hometown: New York, NY

Raised in Russia, immigrated to U.S. with family at age 21. Worked way through college, founded industrial holding company Access Industries in 1986. Later teamed with Russian school chum Viktor Vekselberg, then Russian billionaire Mikhail Fridman. Trio made fortune setting up TNK-BP, joint partnership between their Tyumen Oil Company and British Petroleum; became Russia's second-largest oil company. Recently bought plastics manufacturer Basell from Shell and BASF for $5.7 billion. Also owns stakes in Siberian-Urals Aluminum (SUAL), power company in Kazakhstan, real estate in Argentina and the U.K. Less lucky in New York: reportedly bid to buy Mary Tyler Moore's Manhattan apartment and was rejected by co-op board.TNK-BP is a major Russian vertically integrated oil company, established in September 2003 as a result of the merger of Russian companies TNK (Tyumen Oil Co.) and SIDANCO with the majority of BP’s Russian oil assets.

The company is 50% owned by BP and 50% by a group of prominent Russian investors: Alfa Group, Access Industries and Renova (AAR). The shareholders of TNK-BP also own close to 50% of Slavneft. This interest will eventually be integrated into TNK-BP.

TNK-BP is headquartered in Moscow and is governed by a multinational management team, which consists of Russian and international executives who have worked in more than 50 countries worldwide. The team combines the best of Russian and international talent and experience and includes executives from BP, TNK, Sidanco and other international companies.

Today, TNK-BP is Russia’s second largest oil company. The company employs close to 100,000 people and operates in nearly all of Russia’s major hydrocarbon regions, including:

West Siberia (in the Tyumen, Khanty-Mansiysk, Yamal-Nenetsk and Novosibirsk Regions);

the Volga-Urals (in the Orenburg and Saratov Regions and the Republic of Udmurtia);

East Siberia (in the Irkutsk Region); and

the Far East (Sakhalin).

In 2004, average crude oil production totaled 1.44 million barrels per day (bpd), or 72 million tons per year. Current oil production is roughly 1.5 million bpd.

TNK-BP operates five refineries in Russia and Ukraine, and markets products through over 2,000 retail service stations operating under TNK and BP brands. Through its retail network, TNK-BP is among the market leaders in petroleum product sales in European Russia, including Moscow, and is the market leader in Ukraine.

Based on the independent reserve audit conducted by DeGolyer and MacNaughton, as of December 31, 2004, TNK-BP’s proved reserves were 8 billion barrels of oil equivalent on the basis of US SEC standards (life of fields basis), and 9.0 billion barrels under SPE standards. The company aims to replace 100% of its annual production with new reserves (all figures exclude gas).

In 2004, TNK-BP increased crude oil production by 13%, growing above the industry average. TNK-BP’s strategy envisages annual capital investment of approximately $1.5 billion until 2007, excluding potential spending on asset acquisitions.

British Plastics &

Rubber on-line 2005/6/27

Chatterjee out of Basell takeover

http://www.polymer-age.co.uk/news.htm#Chatterjee%20out%20of%20Basell%20takeover

As the takeover of Basell

progresses it has emerged that The Chatterjee

Group is

no longer involved, and that Basell is being bought by Access

Industries alone.

Both companies are American-based investment groups and were

linked as a consortium throughout the Basell takeover saga.

Access Industries is owned by Russian-born oil billionaire

Leonard Blavatnik and has worldwide interests in oil, aluminium,

and coal. Chatterjee, which also has substantial interests in

India, has a controlling interest in India's Haldia

Petrochemicals, and has been negotiating to buy out the Bengal

government's stake in the company. Haldia's portfolio includes

capacity for 260,000 tonnes of LLDPE and HDPE made under a Basell

Spherilene Gas Phase licence and 300,000 tonnes of polypropylene

made under a Basell Spheripol II licence. An involvement -

directly as was at one time speculated - or through the

Chatterjee link would give it access to Basell's polyolefins

markets and its technology.

But plans for the new financial structure for Basell refer to a

Luxembourg based acquisition vehicle Nell Acquisition Sarl (Nell

was originally the code name for the Basell sale project) which

is a 100 per cent owned affiliate company of Access Industries. A

spokesman for Access confirmed that The Chatterjee Group is no

longer involved in the acquisition and said that 'Access Industries

will be the sole new shareholder of Basell. Neither The

Chatterjee Group nor Haldia Petrochemicals are currently

participating in the transaction'.

2005/8/1 BASF/Shell BASF

and Shell to sell their stakes in Basell

Chatterjee out of Basell takeover

BASF and Shell complete sale of their stakes in Basell to Nell

Acquisition

Ludwigshafen/London, August 1, 2005 - BASF and Shell Chemicals

have completed the sale of their 50-50 joint venture Basell - one

of the world’s leading manufacturers of

polyolefins - to Nell Acquisition S.a.r.l., an

affiliate of New York-based Access Industries. The sale price totals Euro 4.4

billion, including debt. The relevant merger control approvals

had already been granted.

Basell

Basell is headquartered in Hoofddorp, the Netherlands. The

company has sales activities in more than 120 countries and

operates production sites in 21 countries worldwide. Basell

employs a workforce of 6,600 employees: about 5,200 in Europe and

about 1,000 in North America. In 2004, Basell posted sales of

?6.7 billion.

Basell is the world’s largest producer of

polypropylene and advanced polyolefins, and is a leading supplier

of polyethylene and catalysts. The company is a global leader in

the development and licensing of polypropylene and polyethylene

processes. These plastics are used in a wide number of

applications, for example in the packaging and automotive

industries and for consumer goods.

BASF

BASF is the world’s leading chemical company: The

Chemical Company. Its portfolio ranges from chemicals, plastics,

performance products, agricultural products and fine chemicals to

crude oil and natural gas. As a reliable partner to virtually all

industries, BASF’s intelligent solutions and

high-value products help its customers to be more successful.

BASF develops new technologies and uses them to open up

additional market opportunities. It combines economic success

with environmental protection and social responsibility, thus

contributing to a better future. In 2004, BASF had approximately

82,000 employees and posted sales of more than ?37 billion. BASF

shares are traded on the stock exchanges in Frankfurt (BAS),

London (BFA), New York (BF), Paris (BA) and Zurich (AN). Further

information on BASF is available on the Internet at www.basf.com.

Shell

Shell Chemicals collectively refers to the companies of the Shell

Group engaged in the chemicals business. With a multibillion

dollar turnover and major manufacturing facilities around the

world, Shell Chemicals focuses on the production of bulk

petrochemicals and their delivery to large industrial customers.

These products are widely used in plastics, coatings and

detergents. For further information:

www.shell.com/chemicals/news.

Access Industries

Access Industries, founded by company Chairman and President Len

Blavatnik in 1986, is a privately held, US-based industrial

holding company with investments worldwide. Access has long-term

strategic interests in the oil, aluminium, coal and

telecommunications sectors.

BBC 2005/5/4

US 'blocking Iran plastics deal'

http://news.bbc.co.uk/1/hi/business/4514171.stm

Iran's National

Petrochemical Company says it is being excluded from buying a

major Dutch plastics maker by US political pressure.

Polypropylene maker Basell is being sold by its joint owners,

Anglo-Dutch oil group Shell and chemicals giant BASF of Germany.

INPC

has been "unofficially told Iran cannot buy Basell", the ISNA news agency cited the

firm's boss as saying.

Sanctions risk

Business Telegraph

2005/5/6

Until yesterday, the Iranian state oil company was leading the

race for Basell. However, a promise not to include Basell's

Louisiana plant in the deal was not enough to placate stiff US

opposition.

2005/5/4 Aljazeera

Iran blames US for buyout bid failure

http://english.aljazeera.net/NR/exeres/A17C6B0C-B004-49F3-B4D7-E6286A43EDF7.htm

Intense US pressure has

scuppered the possible acquisition of a European plastics firm by

an Iranian state-owned company, Iran said, clearing the way for

its purchase by an Indian-led consortium.

Iran's National Petrochemical Company was favoured to buy Basell,

the world's top producer of the plastic polypropylene, from oil

giant Royal Dutch/Shell and Germany's BASF, in a deal worth 4.4

billion euros ($5.7 billion).

"Although NPC won all aspects of the Basell tender, due to

US pressures we are unofficially told Iran cannot buy

Basell," semi-official Iranian news agency ISNA quoted NPC

Managing Director Mohammad Reza Nematzadeh as saying on

Wednesday.

A State Department official told Reuters over the weekend that

the department had expressed its concerns to BASF and Shell,

which each own 50% of Basell.

He said the US was concerned about potential

misuse of Basell technology and the fact that, under the US

sanctions regime, US companies would not be able to deal with

Basell if Iran took it over.

Shell to sell 50% stake

in Socie'te' du Craqueur de l’Aubette to Basell

Shell Chemicals companies and Basell today signed agreements for

the sale of Shell Petrochimie Mediterranee’s (SPM) 50% share in Socie'te' du Craqueur de l’Aubette (SCA) to Basell.

SCA owns the ethylene cracker at Berre in southern France and Basell currently

holds 50% of the SCA shares. Once the transaction is completed,

the cracker will be wholly-owned by Basell.

As part of the agreement, Basell will also acquire the butadiene

business of Shell at Berre, including the butadiene assets,

as well as logistic assets associated with the cracker operation

in Aubette, Berre and Fos.

Basell to sell its

position in Taiwan Polypropylene Company Ltd (TPP)

Basell announced today that it has agreed to sell its 36% share in

Taiwan Polypropylene Company Ltd (TPP) to Lee Chang Yung Chemical

Industry Corporation of Taiwan. In conjunction with the sale,

Basell will acquire all shares currently held by TPP in other

Basell joint ventures in the region: SunAllomer in

Japan (16.7%), PolyMirae in South Korea (10%) and HMC Polymers

Company in Thailand (5%).

The transactions are expected to be completed in August.

“Basell

and its predecessor companies have had an excellent shareholder

relationship with TPP for more than three decades,”

said Ian Dunn,

president of Basell International, “and TPP has had a very good track

record. The decision to sell was not an easy one, but we believe

this path forward is best for the long-term future of TPP. It is

also consistent with Basell’s strategic intent to focus in

areas where we have built advantaged feedstock positions.”

Dunn added: “The opportunity to increase our

shareholding in HMC, PolyMirae and SunAllomer will better

position Basell to support the further development of these

companies in the strategically important Asia Pacific region.”

Lee Chang Yung

Chemical Industry Corporation is a leading global thermoplastic

elastomer manufacturer. Established in 1966, its head office is

in Taipei City.

Basell is the world's largest producer of polypropylene and

advanced polyolefin products, a leading supplier of polyethylene

and catalysts, and a global leader in the development and

licensing of polypropylene and polyethylene processes. Basell,

together with its joint ventures, has manufacturing facilities

around the world and sells products in more than 120 countries.

Additional information about Basell is available at www.basell.com.

台湾ポリプロは1974年にハーキュレス(Basellの前身の一つ)の技術でスタートした最初の台湾のPPメーカーで、Basell(当初35%、現在36%)と 台湾のKoos Group(16%)が出資、残りは一般株主。高雄に

Spheripol技術の2系列合計400千トンのプラントをもつ。

李長栄化学工業は1965年に設立された化学会社で、TPEのほか、メタノール、アセトン等の溶剤、ペンタエリスリトール、フォルムアルデヒド、ヘキサミン等のファインケミカル、高純度薬品等の製造販売を行っている。

Basellはアジア・太平洋では以下の拠点を持っている。

日本:サンアロマー

日本ポリオレフィン(昭和電工/新日本石油化学)とのJV

日本側が50%、Basellが33.3%、台湾ポリプロが16.7%

韓国:PolyMirae

韓国大林産業が50%、サンアロマーが30%、

Basellが8%、台湾ポリプロが12%でスタート

(今回の発表では台湾ポリプロは10%となっている)

タイ:

①HMC Polymers

Bangkok Bank、Hua Kee Groupその他とのJV

台湾ポリプロが5%出資していた。.

②Basell Advanced Polyolefins Thailand

Basellとサンアロマーの50/50のコンパウンドJV

オーストラリア:

①Basell Australia (唯一のPPメーカー)

②PolyPacific(Mirlex Pty Ltd.との50/50のコンパウンドJV)

マレーシア:PolyPacific

Basell Australia とMirlex Pty Ltd.とのコンパウンドJV

インド:Machino-Basell India Ltd.(Machino Plastics Ltd.との50/50のコンパウンドJV)

Basell to build new

Hostalen ACP HDPE plant at Muenchsmuenster, Germany

Basell announced

today that it plans to build a new Hostalen

Advanced Cascade Process (ACP) high density polyethylene (HDPE) plant at the Muenchsmuenster

industrial site near Munich, Germany. Basell’s first generation Hostalen

process plant at Muenchsmuenster was damaged by an explosion and

fire in December 2005.

Subject to the

necessary approvals, there will be a complete rebuild of the damaged 120 KT polymerization unit based on the

latest generation Hostalen ACP technology as well as a new

extrusion unit. Start-up is planned for beginning of 2009. The

plant design will accommodate future expansion

to 150 KT.

Basell completes

expansion of Geelong polypropylene plant

Basell announced today that is has completed the expansion of its

Geelong,

Australia polypropylene plant, increasing capacity from 60 KT to 130

KT per year.

2006/8/16 Chemweek's Business Daily

Basell to Enter Kazakhstan Petchem JV Soon

Basell will acquire a 35% stake in Kazakhstan Petrochemical Industries (KPI; Almaty) from Sat & Co. (Almaty) by the end of this summer, paving the way for KPI to build a previously announced $4-billion petrochemicals complex at Atyrau, Kazakhstan, KPI says. Sat & Co.'s stake in KPI will fall from 85%, to 50% following the transaction. The remaining 15% of KPI is held by government energy group KazMunayGaz Exploration & Production (Almaty).

The complex will use Basell technology and have capacity for 400,000 m.t./year

each of low- or

high-density polyethylene; linear low density

polyethylene;

and polypropylene (PP).

A

400,000-m.t./year propane dehydrogenation unit will provide feedstock to the PP

plant.

CSJC Nizhnekamsk Refinery selects Spherizone technology for a new 200 KT per year PP plant in Russia

CSJC Nizhnekamsk

Refinery

has selected Basell’s Spherizone technology for a new 200 KT per year

polypropylene

plant to be built at Nizhnekamsk, Russia as part of a major

refinery and petrochemical complex expansion. The project is

scheduled for completion in 2011.

2006/8/1 Basell

Sinopec selects Spherizone technology for a new 450 KT per year

polypropylene plant in China

Sinopec

Tianjin Petrochemical Company has selected Basell’s Spherizone technology for a new 450 KT per

year polypropylene

plant to be built at Dagang, Tianjin in the People’s Republic of China. Start up is

planned for 2009.

Basell to build new

Spherilene polyethylene plant at Wesseling, Germany

Basell announced today that it plans to build a new Spherilene S

polyethylene plant at its Wesseling industrial site near Cologne,

Germany. The plant will be based on Basell’s new Spherilene S single reactor

gas phase design. Start up is planned for 2008.

Basell currently operates an 80 KT Lupotech G polyethylene plant at Wesseling. This plant

will be

converted into a new Spherilene S plant based on latest generation

technology including the installation of a new reactor system.

Spherilene

S technology

is designed to produce products with narrow and medium molecular

weight distribution. Both butene and hexene modified LLDPE can be

produced as well as HDPE.

2006/9/14 Basell

Basell expands catalyst plant in Ferrara, Italy

Basell has successfully completed an expansion of its catalyst

manufacturing facility located in Ferrara, Italy.

The Ferrara plant can produce 3rd, 4th and 5th generation

Ziegler-Natta catalyst systems. These catalysts are sold under

the Avant trade name:

・ Avant

ZN - Ziegler-Natta catalysts for polypropylene

・ Avant

Z - Ziegler catalysts for polyethylene

・ Avant

C - Chromium catalysts for polyethylene

・ Avant

M - Metallocene catalysts for polypropylene

Jansz added, “Basell’s Ferrara plant is the largest

polyolefin catalyst manufacturing facility in the world. When

combined with our Edison, NJ, catalyst plant, which we acquired earlier this

year

from Akzo Nobel,

and our other catalyst manufacturing facilities in Ludwigshafen and

Frankfurt,

Germany, Basell is uniquely positioned to serve the global

polyolefins catalyst market.”

Basell establishes sales

and marketing team dedicated to serving Chinese plastic pipe

customers

Basell, one of the world’s leading suppliers of resins used

by customers in pipe applications, has set up a team of sales and

marketing staff in its Chinese locations dedicated to addressing

the polyolefin requests of the expanding plastic pipe industry

in that country.

Located in the company’s Shanghai, Beijing and Guangzhou

sales offices, the team is designed to effectively serve Chinese

customers who select Basell’s high-performance,

energy-saving and reliable polypropylene and polyethylene resins

for their pipe applications in the Chinese growing market.

Basell to expand polypropylene capacity at Bayport, Texas

Basell announced today that it plans to expand capacity at its Bayport, Texas site by restarting a polypropylene plant that has been inactive since 2001. The company currently operates two Spheripol process plants at Bayport with a combined annual nameplate capacity of 530 KT.

The plant to be restarted also uses the Spheripol process and has a nameplate capacity of 220 KT. This plant will be fully refurbished and upgraded with state-of-the-art innovations. Start-up is scheduled for the second quarter of 2008.

Basell announces a new

expansion project for its Spherizone plant in Italy

Basell announced today that it plans to implement a new

debottlenecking and revamping project for its Spherizone process

plant in Brindisi, Italy. As a result of the investment,

the capacity of the unit will be increased by 50 KT, bringing the

total to 235 KT per year.

The revamped unit is expected to start up in the first quarter of

2009. This expansion follows a first debottlenecking project

which was completed earlier this year.

2007/6/22 Basell

Basell to stop

producing polypropylene in Sarnia in 2008

Basell announced

today that it will stop producing polypropylene in Sarnia, Ontario in mid-2008. The plant is

expected to continue normal operations until the time it ceases

production.

“When the Sarnia

plant began operation in 1978, it was one of the last plants to

be built in North America with old generation slurry process

technology,” said Michael Mulrooney, president

of Basell North America. “Annual production has averaged

only

100 KT the

past two years, and the reality is that the operating costs there

are no longer competitive."

Basell currently

operates two polypropylene lines in

Bayport, Texas and

is in the process of re-starting a third line at that site. The company also

has two polypropylene lines in Lake Charles,

Louisiana,

and one in Varennes, Quebec. All of these units use Spheripol

process technology.

Basell’s joint venture in Mexico, Indelpro, operates a Spheripol process line

and is building a new 350 KT Spherizone polypropylene plant at

Altamira which is scheduled to start up in early 2008.

24 Apr 2007

Basell announced today that it plans to expand capacity at its Bayport, Texas site by restarting a polypropylene plant that has been inactive since 2001. The company currently operates two Spheripol process plants at Bayport with a combined annual nameplate capacity of 530 KT.

The plant to be restarted also uses the Spheripol process and has a nameplate capacity of 220 KT. This plant will be fully refurbished and upgraded with state-of-the-art innovations. Start-up is scheduled for the second quarter of 2008.Lake Charles, La 1,000百万lbs

Indelpro is Mexico’s leading supplier of polypropylene and is a joint venture between Basell and Alpek, the petrochemical group of ALFA. It’s plant is located in Altamira, Tamaulipas and has a current capacity of 240 K tons/yr. By the end of 2007, with its new reactor, the plant will be over 600 KT per year. Indelpro successfully commercialized its brands Valtec and Pro-fax within NAFTA and Central America.

Basell to acquire

Huntsman for $25.25 per share

Hoofddorp, The Netherlands, The Woodlands, Texas, Salt Lake City,

Utah, USA - June 26, 2007 ? Basell, the global leader in

polyolefins’ technology, production and

marketing, and Huntsman Corporation (NYSE: HUN), one of the world’s largest manufacturers and

marketers of differentiated chemicals and pigments, announced

today that they have signed a definitive agreement pursuant to

which Basell will acquire Huntsman in a transaction valued at

approximately $9.6 billion, including the assumption of debt.

Huntsman Chemical は Basell Polyolefins による56億ドルでの買収に合意した。26日、両社が発表した。

現在の株価に34%のプレミアムをつけるもので、負債引継ぎを含めると96億ドルになる。

同社の57%を所有するHuntsman一族が買収に賛成した。

年末までに手続きが終了する予想。Basell はGEプラスチックの買収にも乗り出したが、SABICに敗退している。

Huntsmanは最近、スイスのClariantやCiba Specialty Chemicalの買収に関心を示していた。Huntsman については下記参照

2006/10/3 SABIC、Huntsmanから英国の石化子会社を買収なお、Basell Polyolefinsを所有するAccess Industries のオーナーのLen Blavatnik は最近、Lyondell Chemical の株を「戦略的目的で」購入しており、LyondellとBasellの合併の可能性も噂されている。

June 27, 2007 The Associated Press

Basell-Huntsman Has $200M Breakup Fee

Huntsman Corp. said Wednesday that it will be required to pay a $200 million fee to Basell AF under certain circumstances if their proposed merger is terminated.

According to a Securities and Exchange Commission filing, the Salt Lake City-based chemical manufacturer will have to pay the fee if its board recommends another proposal.

Basell achieves 20

million tons milestone in Spheripol PP process with new license

in Qatar

Qatar Petroleum, a global leader in the energy sector, has

selected Basell’s Spheripol technology for a new 700 KT per

year polypropylene plant that will be built in Mesaieed,

Qatar, as part of the Qatar Petrochemical Complex project. The

unit will be operated by a joint venture between Qatar

Petroleum and Honam Petrochemical of Korea. Start-up is expected in 2011.

“With

this new license we have passed the milestone of 20 million tonnes

of licensed capacity for our Spheripol process, which is the most widely used

polypropylene technology in the world,”

Just Jansz,

president of Basell’s Technology Business, said at a

signing ceremony in Qatar’s capital city of Doha. “The new project further affirms

the superior product range and cost-effectiveness of the

Spheripol process in the highly competitive polypropylene market.”

Basell to stop producing polypropylene in Varennes, Quebec in 2008

Basell announced today that it will stop producing polypropylene at its Varennes, Quebec site in April 2008. The plant is expected to continue normal operations until the time it ceases production. 180千トン

Michael Mulrooney, president of Basell North America, said, “Basell has been present in Varennes for thirty years, so this was not an easy decision. Although the initial slurry technology was replaced at Varennes in the late 1980s with a single Spheripol process plant, as a stand alone site with small capacity, the operating costs are no longer competitive.”

This past June, Basell announced that it would also stop producing polypropylene at its Sarnia, Ontario site in mid-2008. 100千トン

2007/10/18 Basell

Basell announces expansion of its polybutene-1 plant in The

Netherlands

Basell announced today that it plans to debottleneck its four

year-old, 45 KT per year PB-1 plant located

in Moerdijk, The Netherlands, which will increase its

nameplate capacity to 67 KT per year in 2008.

Basell and ConocoPhillips extend exclusive polypropylene marketing relationship

| Basell and

ConocoPhillips have signed a new long-term contract for

Basell to exclusively market the polypropylene produced

at ConocoPhillips’ plant in Linden, New

Jersey. Basell has been the exclusive marketer of polypropylene produced at this facility since it first began operations in 2003. Basell North America President Michael Mulrooney said, “For the past five years, this plant has been a reliable source of quality products. The long term extension of this marketing agreement ensures that our highly valued customers will continue to benefit from these resins for years to come.” |

Basell Seeks to Reject ConocoPhillips (Bayway) Supply Agreement

In a letter to customers today, Basell informed that they have filed a motion in Bankruptcy Court to reject the exclusive marketing agreement with ConocoPhillips, under which they act as its exclusive marketer for 100% of the polypropylene products produced at its Bayway, NJ site.

The effective date of rejection is expected to be December 31, 2009. Basell expects no changes in business conduct throughout this period, continuing to serve customers from the Bayway facility.

The letter states that Basell remains committed to the polypropylene business in North America and is actively making plans to supply, where possible, Bayway-produced grades from their facility in Lake Charles, AL and Bayport, TX.

Basell, NGC, NEC and

Lurgi have entered into MOU for integrated polypropylene complex

in Trinidad and Tobago.

Basell, the National Gas Company of Trinidad and Tobago, Ltd.

(NGC), and the National Energy Corporation of Trinidad and

Tobago, Ltd. (NEC) announced today that they have entered into a

Memorandum of Understanding (MOU) confirming their intention to

construct and operate a fully integrated polypropylene

complex in Trinidad and Tobago.

The MOU includes the construction of a methanol plant, which will exclusively supply a methanol-to-propylene

unit at the

complex. The propylene produced at the complex will be the

feedstock for a world-scale 450 KT per year polypropylene

plant based

on Basell’s Spherizone

technology. Start

up is tentatively scheduled for 2012. The whole project will be

undertaken in conjunction with Lurgi AG, the

industry leader in methanol and methanol-to-propylene (MTP)

technology.

The polypropylene complex is one of the cornerstones of the

country’s strategy to promote downstream

diversification and to build the foundation for a value adding

local plastics industry.

Basell Technology president Just Jansz said that using the Spherizone technology will give the plant a highly innovative product portfolio.

He added: “These resins enhance performance in existing applications while creating opportunities for polypropylene to expand into new end uses.”

Basell building second PP compounding facility in China

Basell has begun

construction of its second polypropylene compounding

facility in China at Guangzhou Nansha.

The new facility, to be operated by Guangzhou Basell Advanced

Polyolefins Co. Ltd., will have an initial annual capacity of 15,000 tonnes and will supply polypropylene

composites and alloy materials to the South China automotive and

appliances industry.

“In

addition to our first Chinese PP compounding

facility in Suzhou,

our second plant will help us to better serve our customers in

the south of China with high quality products and services that

meet their increased expectations,” he added.

LyondellBasell to Stop Producing Polypropylene at its Morris, Illinois Plant

LyondellBasell Industries announced today that it will stop producing polypropylene at its Morris, Ill. plant in the fourth quarter of 2008. Production will be shifted to other sites. Polyethylene production at the site will not be affected.

"The decision to stop polypropylene production at our Morris plant supports LyondellBasell's long-term strategy to rationalize and concentrate production in our industry-leading Spheripol and Spherizone process facilities," said Yves Bonte, Senior Vice President of LyondellBasell's Polypropylene Business.

LyondellBasell currently operates three polypropylene lines in Pasadena, Texas, and two polypropylene lines in Lake Charles, La. All of these units use Spheripol process technology. LyondellBasell's joint venture Indelpro, located in Mexico, operates a Spheripol process line and is building a new 350 KT Spherizone polypropylene plant at Altamira which is scheduled to start up later this year.

2008/6/5 Basell http://lyondellbasell.mediaroom.com/index.php?s=43&item=385

LyondellBasell Announces Plan to Consolidate Polypropylene Compounding and Business Locations in North America

Following its February 2008 acquisition of Solvay Engineered Polymers, Inc., LyondellBasell has announced plans to consolidate its North American-based polypropylene (PP) compounding production, sales, marketing and technology activities.

The company will close its Sales & Application Development Center in Auburn Hills, Mich. The sales, marketing and technology activities currently conducted at the Auburn Hills site will be relocated to the company's expanded Advanced Polyolefins Business & Development Center in Lansing, Mich.

LyondellBasell will also close its PP compounding facility in Grand Prairie, Texas. Production will be moved to the company's nearby Mansfield, Texas plant, and to its new plant in Altamira, Mexico, scheduled to come on-stream this year.

Both sites are scheduled to close by the end of this year.

LyondellBasell

to Boost Its Global Polypropylene Compounding Capabilities by

More Than 30 Percent by End of 2009

LyondellBasell Industries has announced plans to expand its

global polypropylene (PP) compounding capacity to 1.2 million

tonnes per

year by the end of 2009, which represents a growth rate of more

than 30 percent.

To address rapidly expanding needs in the Asian region,

LyondellBasell's Advanced Polyolefins (APO) business has recently

relocated its global headquarters to Hong Kong.

"In the coming months, a new 15 KT plant in

Guangzhou,

China will come on stream," said Paul Yeates, Senior Vice

President of LyondellBasell's APO business. "In addition,

our Saudi

Polyolefins Company

joint venture is currently constructing a new compounding plant

in Damman, Saudi Arabia. We are also considering additional plant

investment options for Russia and India."

Further expansion of the company's existing sites in Suzhou,

China; Rayong, Thailand; and Ensenada, Argentina is planned.

Yeates added, "By 2010, we aim to operate a global network

of 18

PP compounding plants on four continents that delivers 1.2

million tonnes per

year of high quality PP compounds to the automotive and appliance

industries."

2008/12/16 Basell

LyondellBasell starts up new PP Compounding Plant in Nansha,

China

LyondellBasell Industries has announced the start-up of its new

polypropylene (PP) compounding facility in Nansha, China, with a nominal capacity

of 15,000

tonnes per

year. The new facility is operated by Guangzhou Basell Advanced

Polyolefins Co., and supplies polypropylene composites and alloy

materials to the automotive and appliance industries.

Speaking at the Grand Opening Ceremony of the Nansha plant, Paul

Yeates, Senior Vice President of LyondellBasell’s Advanced Polyolefins Business,

said, “One of the most important regions

for us in terms of our future growth is Asia, and in particular,

China. We recognized the importance of the market in China back

in 2005 when we opened our first PP compounding plant in the

country in Suzhou. With the opening of our second plant in China,

our total PP compounding capacity in the country is now 50,000 tonnes annually.”

LyondellBasell

operates 15 PP compounding plants in 12 countries on four

continents, which produce 1.2 million tons per year. The company’s 16th PP compounding plant will

be on-stream in Saudi Arabia next year, and plants in India and

Russia are planned for the near future.

LyondellBasell

misses Europe interest

payment

LyondellBasell's European operations failed to make

scheduled bond interest payments on Sunday (Feb.15), a company

spokesman said on Tuesday.

The Houston-based spokesman told Reuters that the world's

third-largest petrochemicals company has a 30-day grace

period to

make the coupon before it falls into default.

LyondellBasell Statement on Reliance Industries

LyondellBasell today issued the following statement:

"LyondellBasell has received a preliminary non-binding offer from Reliance Industries Limited to acquire for cash a controlling interest in the company contemporaneously with the company's emergence from Chapter 11 reorganization. This offer is in addition to the previous non-binding equity financing proposals received by the company and represents a potential alternative to the initial plan of reorganization previously filed by the company. Consistent with its fiduciary duties, management will continue to work with all parties to design an approach that maximizes value for the company's creditors through the pursuit of a confirmable plan of reorganization and enhances the financial strength of the reorganized company."

---------

NOVEMBER 21, 2009

Reliance Makes Offer for LyondellBasell