トップページ

Borealis

本社 デンマーク・コペンハーゲン Borealis Olefin/Polyolefin

capacities

Noretyl : Hydro Polymers とのエチレンJV

Borealis to build new 350kt PE plant, to

add 90kt PP in Austria

First

polypropylene product made from natural gas

Borealis

to expand LLDPE capacity by 80kt/yr at Porvoo, Finland

Borealis expands polypropylene plant and

Noretyl JV cracker in Norway

Borealis

sells petrochemicals site in Portugal to Repsol YPF

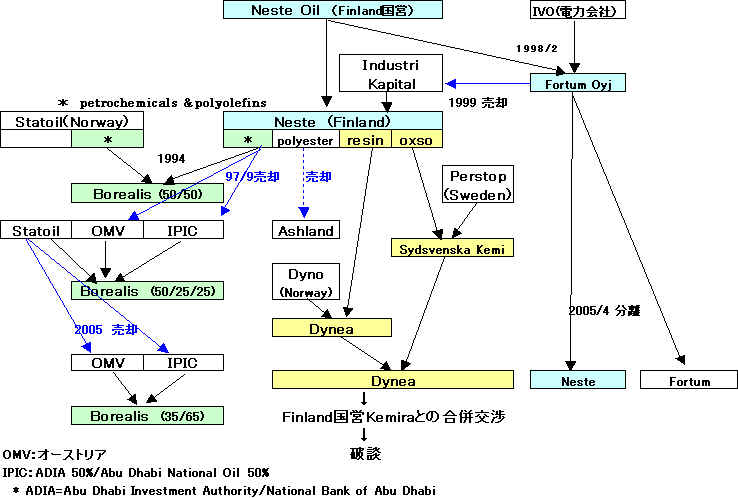

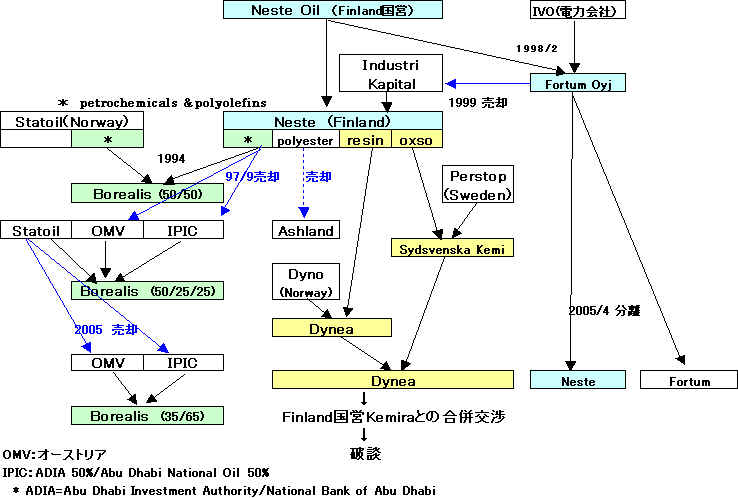

1997/9 OeMV(オーストリア) と IPIC(アブダビ)、NesteのBorealis

持ち株を買収

1998/1/1 Borealis

acquires PCD from OMV

2005/7 Statoil、Borealis株をアブダビ/OMV(オーストリア)に売却

2005/10 Statoil finalises sale of

Borealis

2006/3 Borealis

confirms Bamble HDPE closure

2006/11 OMV

announces 4 year investment programme in Bavaria of EUR 1.1 bn

OMV: ethylene

production by 110,000 tons per year to 450,000

propylene

production by 315,000 to overall 560,000 tons. (a new metathesis plant)

Borealis: 330,000 ton polypropylene plant

(capacities at

Burghausen from 415,000 to 745,000 tons of polyolefin)

Ethylen

Pipeline Süd

2006/9 OMV and Borealis celebrate joint

investment in Austria

Borealis :350,000 tonnes per

year Borstar® polyethylene plant

Borstar

polypropylene plant from 210,000 to 300,000 tonnes per year in

Schwechat (Austria)

OMV : ethylene

capacity by 150,000 tonnes to 500,000 tonnes

propylene

capacity by 100,000 tonnes to 400,000 tonnes per year.

2006/12 OMV

and IPIC to bundle chemistry activities into subsidiary Borealis

2007/1 Borealis invests

EUR 90 million to further develop its polypropylene business

2007/3 Borealis announces

EUR 370 million investment for 350,000 t/y LDPE plant

2007/6 Borealis

sells its petrochemical business in Norway to Ineos

2008/8 三菱化学、Borealisと欧米での自動車産業向ポリプロピレンコンパウンドの相互委託契約を締結

2008/9 OMV

and Borealis: Significant expansion of Burghausen site for

leading position in petrochemical industry

2008/11 LyondellBasell grants Lupotech T

license to Borealis

2009/10 Borealis acquires 24.9% of Nova

from IPIC

2010/4 Grace

and Borealis Sign Catalyst Agreement

同社の能力は以下の通り。(単位:千トン)

2006/11

| |

Austria |

Germany |

Italy |

Belgium |

Finland |

Norway |

Sweden |

USA |

Brazil |

| エチレン |

|

|

|

|

330 |

225* |

625 |

|

|

| プロピレン |

|

|

|

480 |

230 |

40* |

220 |

|

|

| PE |

595 |

175 |

|

330* |

330 |

270 |

600 |

|

|

| PP |

435 |

240+ |

|

635 |

160 |

175 |

|

|

|

| Compounds |

90 |

|

30 |

115 |

|

|

|

65 |

49 |

| フェノール |

|

|

|

|

130 |

|

|

|

|

注 ・Norwayのエチレン、プロピレンはNorsk

Hydro とのJVのNoretyl の同社持分

・他にベルギーにデュポンとのJV、Speciality

Polymers Antwerp (PE 125)

・2004年にポルトガルのBorealis Polimeros LdaをRepsolに売却(エチレン350、プロピレン

180、LDPE 145、HDPE 130)

+ 下記

2006/12/12

PRNewswire

Jacobs

Receives Borealis Contract for Polymer Facility in Germany

Jacobs

Engineering Group Inc. announced today that a subsidiary

company received a contract from Borealis to provide

engineering, design, and construction management services for

a polymer production facility in Burghausen,

Germany.

Officials

did not disclose the contract value for the new facility,

which is scheduled for commissioning in 2007.

The

330

kton/a facility will use Borealis'

proprietary Borstar(R) technology to produce polypropylene. Borealis is

Europe's second largest manufacturer of plastics and a global

leader in the industry. The Burghausen location is part of

the firm's Hub Central Europe, one of four hubs that Borealis

operates in Europe.

Manufacturing

Sites http://www.borealisgroup.com/public/about/where/where_are_we.html

Finland

|

Porvoo |

A fully integrated

petrochemical complex located east of Helsinki is

concentrating on manufacturing and selling petrochemical

products such as olefins (ethylene, propylene and

butadiene) phenol and aromates (acetone, benzene and

cumene), as well as polyolefins − polypropylene, polyethylene and

compounding products. |

Norway

|

Ronningen |

The

Ronningen site southwest of Oslo produces PE, PP and

compounded products. Ethylene and propylene feedstock is

provided by a joint venture known as Noretyl. |

| Rafnes |

Noretyl AS |

| Sweden |

Stenungsund |

The site at

Stenungsund north of Gothenburg is a fully integrated

petrochemical complex. A unimodal PE plant is being

upgraded with Borstar technology to a bimodal plant with

a capacity of 225 KT annually. |

| Belgium

|

Beringen |

Borealis

Polymers N.V.

Located in the north-east of Belgium, this Borealis site

produces PE, PP and compounds. Beringen houses technical

support units for PP fibre and BOPP film applications, as

well as support units for both PE and PP moulding. |

| Kallo |

Borealis

Kallo N.V.

Borealis in Kallo produces PP includes also NSP Olefins,

a former J/V with Shell until December 31, 2002. Borealis

has in total a 480,000 t/a of propylene capacity. |

| Zwijndrecht

|

Borealis

Antwerpen Compounding N.V. |

| Zwijndrecht

|

Speciality

Polymers Antwerp N.V.

Speciality Polymers Antwerp is a 50-50 joint venture

between DuPont and Borealis. The company manufactures

polyethylene at a 125.000 tonnes/year high pressure

polyethylene plant. |

| Germany |

Burghausen |

Borealis

Polymere GmbH

Borealis in Burghausen, east of Munich is a part of the

"South East Bavarian chemical triangle". It

produces both PE and PP. The site is a fully integrated

part of Borealis in Austria. |

| Austria |

Schwechat |

Borealis

GmbH

The Schwechat site near Vienna airport produces both PE,

PP and compounds, and is Borealis' first commercial

production site of Borstar PP. The new plant has an

annual production capacity of 200 kilotonnes per year

(KT/y). Start up was in May 2000. 2005/8/12 Platts

Borealis to increase LLDPE, PP capacity at Austria's

Schwechat

LLDPE capability was set to rise by 350,000 mt/yr at a

cost of Eur200-mil. Three existing lines with a total

capacity of 200,000 mt/yr were to be mothballed, meaning

the net gain in output at the site would be 150,000

mt/yr.

The company said capacity of the existing PP plant at the

site, Borstar, would rise by 90,000 mt/yr to 300,000

mt/yr. The new capacity was due to come onstream in 2005.

|

| Italy |

Monza |

Borealis

Italia S.p.A

Compounding Unit |

| Portugal |

Sines |

Borealis

Polimeros, Lda

The Sines site is a fully integrated petrochemical

complex, producing both olefins and polyolefins, located

near a small community south of Lisbon. The Technical

Centre provides support to the PE and Pipe Business UnitsBorealis sells petrochemicals site

in Portugal to Repsol YPF

|

| USA |

Rockport,

N.J |

Borealis

Compounds LLC

Borealis Compounds LLC is a materials specialist with a

line for superclean cable insulation products, plus

compounding units for other cable materials including

carbon-filled semiconductor grades. |

| Brazil |

Sao Paolo |

Borealis-OPP

Borealis-OPP is a joint venture of Borealis (80%) and the

Brazilian company Braskem S.A. (20%). The joint venture

has taken over OPP’s

(now Braskem) current 50,000 tonnes/year (t/a)

compounding business and assets in Brazil, and is serving

customers in the automotive and home appliances

industries in South America.

Borealis-OPP has two production sites in Brazil: in

Triunfo, with a capacity of 26,000 t/a; and in Itatiba,

with a capacity of 24,000 t/a. The J/V employs

approximately 130 employees. |

| U.A.E. |

Ruwais |

Abu Dhabi Polymers

Company Limited (Borouge)

Borouge (Abu Dhabi Polymers Company Ltd.) is the

production company of a joint venture between Borealis and the

Abu Dhabi National Oil Company (ADNOC), owned 60% by ADNOC and 40% by

Borealis.

The construction of the petrochemical complex in Ruwais,

United Arab Emirates, was completed December 2001.

The site consists of an ethylene-based cracker with an

annual output capacity of 600 KT and two polyethylene

lines of 225 KT each which utilise Borealis' Borstar PE

technology.

The complex will have approximately 400 employees.

http://www.borealisgroup.com/ |

Borealis takes its name from

aurora borealis, also known as the northern lights.

The result of the merger of the petrochemicals and

polyolefins businesses of Finland's Neste and Norway's Statoil

Borealis' main business is

polyethylene (PE) and polypropylene (PP). We are one of the

leading producers in Europe and also a significant supplier in

key markets around the world. Our head office is in Denmark, just

outside Copenhagen.

The Borealis Group produces over 3 million tonnes of PE and PP

each year, and employs nearly 5,200 people. The output from our

main manufacturing sites and compounding units is plastics raw

material that can be found in thousands of everyday products from

diapers, food packaging and houseware, to cars and trucks, pipes

and power cables.

Borealis' foundation for growth is Borstar, an innovative

technology developed by us which offers PE and PP materials that

are stronger and more easily processed than conventional

materials.

1994/3/1

BOREALIS STARTS UP ON MARCH 1

A New Star in the Petrochemicals Sky

http://www.borealisgroup.com/public/news/press_releases/articles/article_195.html

The official start-up of Europe's newest major petrochemicals

and polyolefins company, Borealis, took place today. The

result of the merger of the petrochemicals and

polyolefins businesses of Finland's Neste and Norway's

Statoil, Borealis

represents the single most important step forward yet in the

restructuring of the industry in Europe. Borealis is also the

largest industrial merger between Nordic companies to date.

July 15, 2003 Financial

Times

Austria/ new polyethylene plant and extra polypropylene capacity

for Borealis.

Borealis has announced that

it is to spend EUR 200 M on extra polyolefins capacity at

Schwechat, Austria. A new 350,000 tonnes/y polyethylene plant is due online in 2005, using

the Borstar process, enabling 3 older polyethylene production

lines to be closed. The capacity of a polypropylene plant on

the site is to be increased by 90,000 tonnes/y.

2003/9/16 Borealis

First polypropylene product made from natural gas

http://www.borealisgroup.com/public/news/press_releases/articles/2003_09_15_rex09_MTP.html

As a result of co-operation

between Lurgi, Statoil and Borealis, the world’s first Borstar® polypropylene cups have been created

using propylene from Lurgi’s new MTP® (Methanol-to-Propylene)

process.

Platts 2003/10/22

Borealis to expand LLDPE capacity

by 80kt/yr at Porvoo, Finland

Scandinavian polyolefin producer, Borealis, would increase its

linear low density polyethylene production capacity at its Porvoo

facility, Finland, by 80,000 mt/yr, a company source said

Tuesday.

2004/6/17 Borealis

Borealis expands polypropylene plant and Noretyl JV cracker in

Norway

http://www.borealisgroup.com/public/news/press_releases/articles/Rex06_2004_Borealis_expansion_in_Norway.html

Borealis will expand its Noretyl

ethylene cracker, a 50:50 joint venture with Hydro Polymers at Rafnes with 100,000 tonnes, and

debottleneck its own polypropylene plant at Ronningen. The two

Norwegian projects will be completed in the autumn of 2005.

The annual polypropylene

production capacity will increase from 105,000 to 175,000 tonnes.

Noretyl AS http://www.noretyl.com/engelsk/index.htm

Noretyl AS owns and operates

the Ethylene plant (cracker) at Rafnes*. The Ethylene plant

started up in 1977.

(* adjacent to Hydro Polymers' Rafnes plant)

Noretyl AS was established 1. January 2001 and is owned by

Hydro and Borealis with 50% each. The owners are responsible

for providing feedstock and selling products. The

mainproducts are used as raw materials in the owners

production of VCM, polyethylene and polypropylene.

Feedstock: Ethane, propane and butane

Main products: Ethylene and propylene

Capasity: 450 000 tons ethylene and 68 000 tons propylene per

year

By-products: Crude C4's pyrolysis gasoline and pyrolysis oil

Employees: 165

2004/10/8 Borealis

Borealis sells petrochemicals

site in Portugal to Repsol YPF

http://www.borealisgroup.com/public/news/press_releases/articles/2004_10_08_Sinces_Oct8_2004.html

Repsol YPF announced that its Chemicals Division has

signed an agreement with Borealis A/S to purchase Borealis Polimeros Lda. that includes all assets of the

petrochemical complex at Sines, Portugal. The completion of the

transaction is subject to authorisation by the European

Commission.

Based on 2003 capacities, the site comprises a cracker with a

volume of approximately 350,000 tonnes of ethylene and 180,000

tonnes of propylene and two polyethylene plants, a low density

plant with a production capacity of 145,000 tonnes and a high

density plant of 130,000 tonnes.

This agreement strengthens Repsol YPF’s strategic lines and allows for new

development in two core businesses, olefins/base petrochemicals

and polyolefins. This purchase gives Repsol YPF stronger presence

in European markets and complements its product portfolio with

new applications currently not manufactured at the Puertollano

and Tarragona complexes in Spain.

The implication of this deal is a 38% increase in Repsol YPF’s cracker production capacity. In

addition, it means a 28% increase in production capacity in total

polyolefins and a 55% increase in polyethylene.

Following the signing ceremony, Ramon Blanco, Repsol YPF’s Chief Operating Officer, noted, “This acquisition reflects the importance

to Repsol YPF of its Portuguese clients and it highlights the

increasing economic exchanges between both countries and the

strength of their mutual business activities.”

Borealis is a leading, innovative

provider of plastics solutions with main production sites in

Europe and the Middle East. John Taylor, Borealis’ Chief Executive, commented that, “This divestment will allow us to

concentrate on our four major European sites: Austria, Belgium,

Finland and Scandinavia, thus strengthening competitiveness and

sustaining future growth.” Iberia

remains an important market for Borealis and it will maintain its

Customer Service Centre in Barcelona.

This agreement is in line with both companies’ strategies, enhancing competitiveness and

improving efficiency, in a challenging plastics industry

environment.

Borealis Olefin/Polyolefin capacities pre/post Portuguese

divestment (Kt p.a.)

| |

Current 2004 |

Post deal |

Ethylene

|

1,535

|

1,185

|

Propylene

|

634

|

454

|

LD

|

895

|

755

|

LLD/HD

|

1,320

|

1,190

|

(PE)

|

(2,215)

|

(1,945)

|

PP

|

1,459

|

1,459

|

Total PO

|

3,674

|

3,404

|

Notes

Data refers to end 2003 capacity to align with EU commission

submission.

Figures not updated for expected 2004 changes.

1997/9 OeMV(オーストリア) と IPIC(アブダビ)、NesteのBorealis

持ち株を買収

OeMV(オーストリア) と IPIC(アブダビ)

は,フィンラン ドの Neste Oy が

Borealis に保有していた50%の権益を1997年9月に買収(各25%)した。なお,Neste

は現在,フィンランドの Fortum グルー

プの一員になっている。

1997/9/15 Borealis

Borealis plans to acquire PCD, welcomes new owners

http://www.borealisgroup.com/public/news/press_releases/articles/article_44.html

Borealis, Europe’s leading producer of polyolefins

plastics, today announced plans to acquire PCD of Austria.

According to the memorandum of understanding, Borealis will

acquire PCD from its current owner, OMV, as of January 1, 1998. The

acquisition is related to another move announced today regarding

the future ownership structure of Borealis.

Neste

has disclosed plans to sell its 50% shareholding in Borealis to

International Petroleum Investment Company (IPIC) of Abu Dhabi,

and OMV, the

integrated Austrian oil and gas company. IPIC and OMV will

each have a 25% shareholding; Statoil will retain its 50% shareholding. With some 1,000

employees, PCD produces approximately 445,000

t/a of polyethylene and 410,000 t/a of polypropylene at sites in Austria and Germany.

IPIC (International

Petroleum Investment Company)

IPIC was created in 1984 as a 50-50 venture

between ADIA and the

Abu Dhabi National Oil Co. (ADNOC) to

focus on oil-related acquisitions overseas.

ADIA:Jointly owned by the Abu Dhabi Investment Authority (ADIA)

and the National Bank of Abu Dhabi (NBAD)

, the company is now one of the leading Gulf based financial

institutions.

2005/6/30 Borealis

Change in Borealis ownership structure underpins future growth

http://www.borealisgroup.com/public/news/press_releases/articles/2005_06_30_Borealis_ownership_structure.html

The International Petroleum

Investment Company (IPIC) of Abu Dhabi and OMV Aktiengesellschaft

of Austria

have announced today their agreement to purchase Statoil’s 50% shareholding in Borealis

A/S.

As a result, the new Borealis ownership will be 65% IPIC and 35%

OMV. Statoil

will continue as a major long-term feedstock supplier to

Borealis.

Borealis is also

joint owner with the Abu Dhabi National Oil Company of the

Borouge polyolefins company in Abu Dhabi.

Coincidentally

Borealis has anounced a Eur 36 million investment at its

Porvoo site in Finland where ethylene capacity will increase

from 330,000 to 380,000 tonnes and propylene from 200,000 to

223,000 tonnes in 2007.

2005/10/14 Statoil

Statoil finalises sale of Borealis

Stock market announcement

http://www.statoil.com/STATOILCOM/SVG00990.nsf/UNID/41256A3A0055DD32C1257099003B29B9?OpenDocument&kat=nyhet

Statoil ASA has

closed the sale of its 50 per cent holding in the Borealis

petrochemicals group.

Statoil has received EUR 1 billion (NOK 7.8 billion) for the

transaction which gives a book profit of NOK 1.5 billion.

The buyers, International Petroleum Investment Company (IPIC)

and OMV Aktiengesellschaft, which earlier together owned 50

per cent of the petrochemicals group, now own 65 per cent and

35 per cent respectively.

Statoil has long-term agreements to supply Borealis with

feedstock from the Norwegian continental shelf.

British Plastics &

Rubber 2006/3/10

Borealis confirms Bamble HDPE closure

Borealis today confirmed

that its 110,000 tonnes HDPE plant at Bamble in Norway will close

later this year, as expected from the company's announcement at

the beginning of February. Around 100 employees will be affected

by the closure.

A statement from Borealis says: 'Our aim is to now focus on

improving the competitiveness of our low density polyethylene and

polypropylene plants in Bamble in synergy with the total

operations of hub Scandinavia and on cost competitive feedstock

opportunities in the region. This is a further step by Borealis

to strengthen its European operations.'

2006/12/28 OMV

OMV and IPIC to bundle chemistry activities into subsidiary

Borealis

・OMV

and IPIC intend to incorporate their holdings in AMI Agrolinz

Melamine International into their joint subsidiary Borealis within the first half of 2007

・Changes

in the AMI Supervisory Board as of 1 January 2007

・OMV

continues to focus on core business

OMV, Central Europe's leading oil and gas group, continues to

focus on its core business: Exploration & Production,

Refineries & Marketing and Gas. In this context OMV, together

with its core shareholder IPIC, is planning on incorporating AMI

Agrolinz Melamine International GmbH (AMI), one of the leading

producers internationally of melamine and plant

nutrients, into Borealis. OMV and IPIC each hold 50% of

AMI. The final decision will be made in the course of the first

half of 2007. Borealis is Europe's second largest producer of

plastics and is headquartered in Vienna. As a holding company,

Borealis will provide excellent support for AMI's further

international expansion. AMI's headquarters will remain in Linz

(Upper Austria).

For OMV this has the advantage that its strategic focus on its

core business will be further strengthened, while at the same

time OMV will profit from the growing plastics market enhanced by

the assets of AMI via its investment in Borealis. Overall, this

measure constitutes the last step in AMI's strategic

repositioning, which started in May 2005 with IPIC's

acquisition of 50% of the company.

The establishment of a production facility for melamine

in Ruwais- also located in Abu Dhabi - is

being pursued by AMI and ADNOC. This site will have an annual

capacity of 80,000 tons. In 2005 the AMI Group had a workforce of

around 1,000 and sales of EUR 470 million. Borealis had sales of

EUR 4.8 bn and a workforce of 4,543.

AMI Agrolinz Melamine

International GmbH

http://www.agrolinz.com/asp/frameset.asp?MMARK=PRESSENTRY_EN&COID=535982&MVER=EN

AMI Agrolinz Melamine

International GmbH is a 50% owned OMV and IPIC (International

Petroleum Investment Company) subsidiary, which upgrades natural

gas into high-value agricultural and industrial raw materials. The company's main products are

melamine and plant nutrients. In the melamine sector, AMI is the

market leader in Europe and the global number two. It also

occupies a leading ranking in the plant nutrients market in the

Danube region.

The AMI Group consists of the core companies AMI Agrolinz

Melamine International GmbH, located in Linz (A), the fully

owned subsidiary Agrolinz Melamine International

Italia S.r.l.,

based in Castellanza (I), the Agrolinz Melamine

International Deutschland GmbH located in Piesteritz /

Saxony-Anhalt and the Trading Company for fertilizers LINZER AGRO TRADE

GmbH, sales

companies in Hungary, the Czech Republic and Slovakia, as well as

the sales companies Agrolinz Melamine International North America

Inc., Chicago, USA and Agrolinz Melamine International Asia

Pacific Pte Ltd., Singapore. The AMI Agrolinz Melamine

International Group has a workforce of around 1,000 and sales of

EUR 394 million.

in May

2005 with IPIC's acquisition of 50% of the company.

Everything started

with nitric acid !

Linz has been a location for large-scale, industrial

chemicals production for 60 years.

The beginning was formed by Stickstoffwerke Ostmark AG

(renamed in 1946 as Osterreichische Stickstoffwerke AG and in

1973 as Chemie Linz AG), which utilized the coke oven gas

produced by the neighboring "Reichswerken Hermann

Goring" iron and steel plant.

During the post-war economic boom, the plant gradually

expanded its production. Fertilizer production developed into

Agro-Chemie, which manufactured a wide range of agricultural

pesticides, growth regulators and animal feed additives.

Using nitrogen as a basis, Chemie Linz AG extended its

program to include acrylonitrile, urea and melamine, for

which a new and highly attractive process was created.

Furthermore, the Linz chemical industry attained an

international standing in the area of organic chemicals.

Pharmaceuticals also have long traditions in Linz. Apart from

an extensive program of medicines, Chemie Linz AG developed

an international business with active substances,

intermediate products and fine chemicals.

Research and development was and is the core of company

activities. In addition, application technology, project

planning and realization, as well as certain engineering

services are provided in the Linz Chemiepark. The result is a

pool of experience and know-how, which now extends from basic

products to performance chemicals.

Specialization and a concentration on core business are

modern business maxims, which in combination with intensified

competition have given the Upper Austrian chemicals industry

location a completely new face. The Chemiepark has evolved

from the multi-divisional Chemie Linz AG and now provides a

home to around 40 companies, which take full advantage of the

location synergies.

2007/1/15 Borealis

Borealis invests EUR 90 million to further develop its

polypropylene business

Borealis, a leading provider of innovative, value creating

plastics solutions, will invest EUR 25 million to expand the

capacity of its PP plant in Porvoo, Finland, by 65,000 tonnes

per annum (tpa) to 220,000 tpa by the end of 2008. The increased

capacity will meet rapidly growing customer demand for innovative

plastics solutions in the pipe and advanced packaging markets and

better supply the developing Russian market.

The

remaining Eur65 million would be spent on the extension of

its product range at its units at Schwechat, Austria with a

combined capacity of 435,000 mt/year.

Borealis recently

announced that it is expanding its plant at Burghausen in Germany

to manufacture

330,000 tpa Borstar(R) PP.

2007/3/21 Borealis

Borealis announces EUR 370 million investment for the wire and

cable market

Borealis

invests EUR 370 million in its wire and cable business

New

350,000 t/y low-density polyethylene (LDPE) plant

Modernisation

and streamlining of compounding

Shutdown

of old 230,000 t/y high-cost polyethylene capacity

Borealis, a leading provider of innovative, value creating

plastics solutions, will invest EUR 370 million in Stenungsund,

Sweden, enhancing its capability to provide advanced materials

for the growing wire and cable market, as well as for the Nordic

packaging market.

The project, due for completion at the end of 2009, includes a new 350,000 t/y

high-pressure LDPE plant, modernisation and streamlining of

compounding, and related material handling facilities. 230,000 t/y of

old, high-cost polyethylene capacity will be shutdown.

The total polyethylene capacity at Stenungsund will increase from 580,000 t/y

to 700,000 t/y,

making it a leading world-scale facility for advanced

infrastructure applications.

2007/6/5 Borealis Ineos

Borealis sells its petrochemical business in Norway to Ineos

Sale of Norwegian polyolefins business and share in Noretyl gas

cracker to Ineos

Creation of independent innovation company

Group support functions remain in Norway as a separate unit

Continuing with the restructuring of its Norwegian operations,

Borealis AS announces that it has reached an agreement to sell its

petrochemical business in Bamble, Norway, to Ineos for EUR 290 million. It has also

been decided to create a new independent innovation company to

take over its innovation centre in Bamble and to retain the

existing group support functions at the location as a separate

unit.

The facilities sold to Ineos comprise a 175,000 tonne per

year (t/y) polypropylene (PP) unit and a 140,000 t/y low density

polyethylene (LDPE) unit, as well as a 50% share of the

557,000 t/y Noretyl gas cracker. The polyolefin units manufacture

plastics mainly for the growing moulding, film and fibre, and

extrusion coating industries in Northern Europe.

注 Borealis Home Page ではPE能力は270千トンとなっている。

LDPE 140

HDPE 130 →110 →閉鎖(検討)

Noretyl →Ineos

100%

Borealis 50% →Ineos

Norsk Hydro 50% →Norsk HydroのHydro PolymerをIneos

が買収

2006/2/2 Borealis

Borealis evaluates possible

closure of HDPE

plant in Norway

The HDPE plant in

Norway is one of three production units in Bamble, 160

kilometers southwest of Oslo. The plant started up in 1979

with a capacity of 50,000 tonnes per year and after several

debottleneckings, the capacity is today 110,000

tonnes

per year. The main products are in the areas of blow moulding

and rotomoulding e.g. materials for bottles and leisure

boats.

2007/6/5 Ineos

The acquisition of

Borealis AS follows the recent announcement made by INEOS

Capital, to buy Norsk Hydro ASA's polymers

business (Kerling) and completes the

total purchase of the Noretyl cracker, a 50:50 Joint Venture

between Norsk Hydro and Borealis AS. The opportunity to

purchase both shareholding interests in the Noretyl cracker

presents INEOS with unique benefits by bringing the

businesses at Rafnes under a single ownership.

The acquisition of Borealis AS provides a complementary fit

with its existing Olefins and Polyolefins portfolios,

technology and expertise. It also improves integration into

key feedstocks allowing the company to optimise across its

existing assets in Scotland (Grangemouth), Benelux (Antwerp,

Lillo and Geel), Germany (Köln and Wilhelmshaven) and

France (Lavéra) giving INEOS an extended

geographic reach in European Markets.

2008/9/10 Borealis

OMV and Borealis: Significant expansion of Burghausen site for

leading position in petrochemical industry

| * |

OMV

and Borealis invest EUR 840 mn in the expansion of their

petrochemical production capacities |

| * |

Increase

of ethylene production to 450,000 t per year; increase of

propylene production to 560,000 t; increase of

polypropylene production to 570,000 t |

| * |

New

plants successfully on stream with the implementation of

the innovative Borstar(R) and metathesis technologies |

| * |

Expansion

of polypropylene capacities to address growing demand for

advanced packaging products and medical applications |

| * |

Inauguration

Ceremony on September 10, 2008 under the patronage of

Emilia Muller, State Minister of Bavaria for Economy,

Infrastructure, Transportation and Technology |

| |

2006/11/10 OMVとBorealis、オーストリアとドイツで石化増強

2008/11/10 Basell

LyondellBasell grants Lupotech T license to Borealis

Borealis AG has selected LyondellBasell’s Lupotech T technology for a new 350 KT per year

low density polyethylene (LDPE) plant; start-up is expected in

2013.

The location has yet

to be decided. It is the second LyondellBasell license taken

by Borealis in the past three years.

Apr 06, 2010 W.R.Grace

Grace and Borealis Sign Catalyst Agreement

W.R.Grace & Co. today announced a new multi-year agreement to

supply polypropylene catalysts to Borealis AG, a leading provider

of chemical and innovative plastics solutions. Financial terms

were not disclosed.

The catalysts are used in the production of polypropylene, a

plastic polymer that is a versatile substitute for wood, metal,

glass and other plastics. Grace polypropylene catalysts are used

to make specialty plastics for applications in automobile parts,

household appliances and consumer product packaging.

"This agreement is a reflection of our ongoing strategic

direction to expand into the polypropylene catalyst segment

through greater collaboration with a technology leader,"

remarked Tony Dondero, Vice President and General Manager of

Grace Davison Specialty Catalysts and Process Technologies.

"We are working together to meet the growing demands for

this versatile polymer."

"Borealis is an established industry innovator and we are

extremely pleased to continue to expand our relationship,"

commented Greg Poling, Vice President of W. R. Grace & Co.

and President of Grace Davison. "We look forward to

developing new and next generation catalyst technologies and

greater manufacturing capabilities with them."

Grace and Borealis have worked together for many years. In 2002, Grace acquired

Borealis catalyst manufacturing assets, including catalyst production

facilities in Stenungsund, Sweden and catalyst manufacturing

equipment located in Porvoo, Finland. Through that transaction

and a related licensing agreement, Grace began to produce, market

and sell Borealis' proprietary catalysts on a global basis.

Borealis is a leading provider of chemical and innovative

plastics solutions that create value for society. With sales of

EUR 4.7 billion in 2009, customers in over 120 countries, and

5,200 employees worldwide, Borealis is owned 64% by the

International Petroleum Investment Company (IPIC) of Abu Dhabi

and 36% by OMV, the leading energy group in the European growth

belt. Borealis is headquartered in Vienna, Austria, and has

production locations, innovation centers and customer service

centers across Europe and the Americas. Through Borouge, a joint

venture between Borealis and the Abu Dhabi National Oil Company

(ADNOC), one of the world's major oil companies, the company's

footprint reaches out to the Middle East, Asia Pacific, the

Indian sub-continent and Africa. Established in 1998, Borouge

employs approximately 1,400 people, has customers in more than 50

countries and its headquarters are in Abu Dhabi in the UAE and

Singapore. Today Borealis and Borouge manufacture 4.4 million

tonnes of polyolefins (polyethylene and polypropylene) per year.

For more information visit: www.borealisgroup.com and

www.borouge.com.

Grace is a leading global supplier of catalysts and other

products to petroleum refiners; catalysts for the manufacture of

plastics; silica-based engineered and specialty materials for a

wide range of industrial applications; sealants and coatings for

food and beverage packaging, and specialty chemicals, additives

and building materials for commercial and residential

construction. Founded in 1854, Grace has operations in over 40

countries. For more information, visit Grace's web site at www.grace.com.

Grace has two operating segments, Grace Davison that

provides specialty chemicals, materials and formulation

technologies, and Grace Construction Products that produces

specialty construction materials, systems and services that

strengthen, enhance and protect structures.

2013/12/23 Borealis

Borealis and First Energy Bank acquire 20.3%

of Neochim AD

Borealis, a leading provider of innovative solutions in the fields of

polyolefins, base chemicals and fertilizers, together with

First Energy Bank of Bahrain, announced today that they have formed

a joint venture in Bulgaria called FEBORAN AD. On

December 21, 2013, FEBORAN purchased 20.3% of the shares

of Neochim AD, a company listed on the Sofia stock exchange.

Neochim is Bulgaria’s leading producer and distributor of

fertilizers and accounts for a significant share of Bulgaria’s ammonium

nitrate output. Neochim is a publicly listed company under the Public Offering

of Securities Act, and operates one ammonia plant, two

nitric acid plants and an ammonium nitrate plant in Dimitrovgrad in

southern Bulgaria.

“This investment is again in line with our strategy to grow our fertilizer

business and to maintain our number one position in Central and Eastern Europe”,

says Mark Garrett, Borealis Chief Executive. “First Energy Bank is a co-investor

with sound financial credentials. This cooperation allows us to further

strengthen our position in the growing Bulgarian market at a time when Borealis

is investing into the integration of the recent acquisition GPN SA, now renamed

Borealis Chimie SAS, in France.”

“We believe that fertilizers in Europe offer attractive business opportunities

with further potential for growth particularly in Central and Eastern Europe,”

explains Markku Korvenranta, Borealis Executive Vice President Base Chemicals.

“Neochim is a well-managed dedicated fertilizer company with competitive plants

and an advantageous logistics position. Borealis L.A.T will be distributing part

of the production through its distribution network.”

“First Energy Bank welcomes the co-operation with Borealis in the joint

investment in Neochim,” says Mohamed Ghanem, Chief Executive Officer, First

Energy Bank. “This investment extends our investment portfolio both

geographically into Europe and into a fast-growing market. Furthermore, it

reinforces our strategy of participating in the energy sector and investing in a

well established petrochemical entity in Bulgaria.”

-

About First Energy Bank

First Energy Bank B.S.C.(c) (FEB) is an Islamic investment bank licensed by the

Central Bank of Bahrain and headquartered in Manama, Kingdom of Bahrain. The

Bank focuses on investments in the production, transportation, storage and

refining of hydrocarbons, as well as oilfield services and energy sector

technologies. FEB also explores new opportunities to invest in the development

of power generation capacity and renewable energy technologies.

FEB was established in June 2008, with an authorized share capital of US$2

billion, and a paid up capital of US$1 billion consisting of 1 billion ordinary

shares each with a par value of US$1. The bank’s shareholders include a range of

organizations and individuals with interests in the energy sector from the

Kingdom of Bahrain, the United Arab Emirates, Libya, the Kingdom of Saudi

Arabia, and other countries in the region.

About Neochim AD

Neochim AD is one of Bulgaria’s leading producers of fertilizers and organic and

inorganic chemicals, accounting for the majority of the country’s ammonium

nitrate output. Neochim is a public company under the Public Offering of

Securities Act.

2014/8/7 Borealis

Borealis signs long-term

ethane supply

Borealis, a leading provider of innovative solutions in the fields

of polyolefins, base chemicals and fertilizers, has signed a 10-year

agreement with Antero Resources to supply

ethane from the United States for its flexible steam cracker in

Stenungsund, Sweden. The project also includes a shipping

agreement with Navigator Holdings and a related multi-million

investment in an upgrade of the cracker and the construction of an

ethane storage tank. The ethane supplied from the US complements the

recently signed ethane supply contract with Statoil providing

Borealis with an alternative attractive source of feedstock for its

petrochemical plant in Sweden.

Supply and shipping agreements with

Antero Resources and Navigator Holdings

Antero Resources will supply ethane originating

from the Marcellus and Utica shale formations

to Borealis in Stenungsund. The company has signed parallel

fractionation, pipeline and terminal service contracts to enable

free on board (FOB) delivery at the Marcus Hook terminal operated by

Sunoco Logistics. The first delivery of ethane is planned for late

2016.

A related long-term shipping

agreement has been signed with US-listed Navigator Holdings, one of

the largest owners and operators within the handysize liquefied gas

carrier segment. For this purpose, Navigator will build a new, 35000

cbm state-of-the-art ethane vessel equipped with dual fuel engines.

The vessel will be among the most modern in the world and will

ensure cost effective, safe and reliable transport of ethane to

Stenungsund.

Related multi-million investment in

Stenungsund

The ethane supply coming to

Stenungsund by ship will be stored in a purpose-built, fully

refrigerated ethane tank. A lump-sum turnkey agreement has been

signed with TGE Gas Engineering GmbH to construct the tank. In

parallel, Borealis will also upgrade its steam cracker to enable

increased ethane cracking.

Borealis' cracker in Stenungsund

is one of the most feedstock-flexible crackers in Europe. In

addition to ethane, it can also crack naphtha, propane and butane.

Stenungsund has significant liquefied petroleum gas (LPG) storage

capacity, allowing the company to source LPG from various sources

with vessel sizes ranging up to very large gas carriers.

"We need to take advantage of the

significant shift in ethane availability triggered by the US shale

gas boom," says Mark Garrett, Borealis Chief Executive. "In an

increasingly challenging environment in Europe this is an exciting

opportunity to increase the competitiveness of our integrated

polyolefins business."

"The ethane contract with Antero

Resources in combination with the recently renewed North Sea-based

ethane contract with Statoil provides us with an ideal portfolio of

sources balancing cost competitiveness and supply security,"

comments Markku Korvenranta, Borealis Executive Vice President Base

Chemicals. "This contract and the related investments underline our

commitment to further strengthen our monomer position in Europe."

Note to editors

Borealis' olefins and polyolefins

portfolio in Europe is built around integrated crackers and

derivative complexes in:

- Porvoo, Finland

- Stenungsund, Sweden

- Kallo, Belgium

- Schwechat, Austria

- Burghausen, Germany

Borealis' Polyolefins

capabilities position the company among the leading and most

innovative suppliers to the polyethylene (PE) and polypropylene (PP)

market in Europe.

2014/9/1 Borealis

Borealis acquired full ownership of

Speciality Polymers Antwerp N.V.

Borealis, a leading provider in the

fields of polyolefins, base chemicals and fertilizers, announced

today that it has completed the acquisition of DuPont Holding

Netherland B.V. shares of

Speciality Polymers

Antwerp N.V.

Previously, Speciality Polymers Antwerp N.V., located in Zwijndrecht

(Antwerp, Belgium) was a joint venture between

DuPont Holding Netherlands B.V. (67%), Borealis Polymers N.V.

and Borealis Kallo N.V. (together 33%).

"The acquisition of the full

ownership of Speciality Polymers Antwerp is in line with our

strategy to grow our polyolefin business in specific market areas",

says Mark Garrett, Borealis Chief Executive. "Acrylate copolymers,

which are part of a broader portfolio of specialty polymers produced

at Speciality Polymers Antwerp, are an important building block for

our value-added products sold into our core Energy & Infrastructure

market."

Under the new arrangement, DuPont

will continue to serve the market with

ethylene vinyl acetate (EVA) and

acrylate copolymers and Borealis will supply DuPont with

ethylene vinyl acetate (EVA) and acrylate copolymers from the

Specialty Polymers Antwerp facility.

Borealis intends to fully

integrate the new site and its employees into the Borealis

organisation. The company will start the full integration of the

site and its activities, a process in which safety and business

continuity will be key.

ーーー

2014/8/7

Borealis signs an

agreement to acquire full ownership of Speciality

Polymers Antwerp N.V.

Borealis, a leading

provider in the fields of polyolefins, base chemicals

and fertilizers, announced today the signing of an

agreement with DuPont Holding Netherlands B.V. to

purchase the company's 67% shareholding in Speciality

Polymers Antwerp N.V.

"The acquisition of the full ownership of

Speciality Polymers Antwerp is in line with our strategy to grow our polyolefin

business in specific market areas", says Mark Garrett, Borealis Chief Executive.

"Acrylate copolymers, which are part of a broader portfolio of specialty

polymers produced at Speciality Polymers Antwerp, are an important building

block for our value-added products sold into our core Energy & Infrastructure

market."

Borealis, DuPont launch JV in Belgium;

will produce high-pressure copolymers

Borealis, a leading polyolefin plastics producer, and DuPont have

launched a manufacturing joint venture —

Speciality Polymers Antwerp N.V. — in Zwijndrecht, Belgium, to

manufacture high-pressure copolymers. Terms were not disclosed.

The new company manufactures

ethylene copolymers and polyethylene at an

existing 125,000 ton/year plant formerly owned and

operated by Borealis. In the new joint venture, Borealis retains

a 50% stake in the Zwijndrecht facility, while DuPont, a global leader

in specialty ethylene copolymers, acquires the other 50%. (その後、67%/37%に)

DuPont also acquires Borealis'

current "Borflex" ethylene acrylate copolymer

business and related technology. Borealis retains technology

rights for its wire and cable compounds business.

"The joint venture and the Borflex

business deliver quick growth and diversification of our ethylene

copolymers in the European region," says Jerome Smith, president of

DuPont Packaging and Industrial Polymers (P&IP).

The investment demonstrates DuPont's

intent to further develop the European ethylene copolymers market and to

increase the company's regional production capacity, according to David

McFall, P&IP's business director for Europe.

DuPont's investment will include

further development of ethylene vinyl acetate (EVA) and ethylene

acrylate copolymer technology at the joint venture site to

complement other strategic ethylene copolymer expansions and technology

investments in North America and other regions.

From Borealis' standpoint, partnering

with DuPont will help quicken realization of Borflex product potential

in the marketplace, according to Staffan Lennstrom, executive vice

president, Borealis Performance Products Division.

The existing Zwijndrecht

manufacturing workforce now operates the facility as employees of

Speciality Polymers Antwerp. The site's customers will be served by

existing Borealis and DuPont marketing organizations.

2018/3/26

Borealis and UCC sign Joint Development Agreement in Abu Dhabi for advancing

world-scale polyethylene project during the visit of the President of

Kazakhstan with the Crown Prince of Abu Dhabi

Borealis and United Chemical Company LLP

(UCC) have signed a Joint Development Agreement (JDA) for the development of

a world-scale polyethylene project, integrated with an

ethane cracker, in the Republic of Kazakhstan.

United Chemical Company is the

state-owned company in Kazakhstan established in 2009.

Samruk-Kazyna is a sovereign wealth

fund and joint stock company in Kazakhstan

Simultaneously, a government support

agreement was signed between the two companies and Samruk-Kazyna Chief

Executive Akhmetzhan Yessimov as well as the government of the Republic of

Kazakhstan, represented by the Minister of Energy, Mr. Kanat Bozumbayev.

A Memorandum of Understanding (MoU) was also signed to cooperate on a

500 ktpa polypropylene project that is currently being implemented by

Samruk-Kazyna Sovereign Wealth Fund and is under construction.

The agreements were ceremoniously signed in Abu Dhabi on 24 March 2018 by

the Ministers of Energy of Kazakhstan and of the UAE, in the presence of the

President of Kazakhstan, H.E. Nursultan Nazarbayev and the Crown Prince of

Abu Dhabi, H.H. Mohammed bin Zayed bin Sultan Al-Nahyan.

The companies, represented by Mark

Garrett, Borealis Chief Executive and by Zhenis Osserbay, UCC Chief

Executive, then also signed the agreements.

The signing of the JDA comes after the

successful conclusion of a pre-feasibility study. The project will now move

into the feasibility study phase, which is expected to run until Q1 2019.

After the successful completion of the feasibility study confirming the

attractive project parameters, a local JV with UCC will be set up*.

The scope of the JDA will include the

construction of an ethane cracker and 2 Borstar® PE

units, with a total capacity of 1.250 ktpa and with a pre-investment

in the cracker for future expansion. The final investment decision on the

project is expected to be taken in 2020 and start-up would be scheduled for

2025.

Through this strategic partnership,

Borealis and UCC are exploring the opportunities of jointly developing the

Kazakhstan polyolefin industry.

“The project is well aligned with the country’s strategy to develop its

petrochemical industry and would serve as a strong basis for establishing

Kazakhstan on the global polyolefin market,” said Samruk-Kazyna Chief

Executive Akhmetzhan Yessimov.

“This project would significantly strengthen Borealis’ position in the CIS

markets; adjacent to our home market, with growth rates above WE and

significant potential for development of advanced PE business based on our

Borstar technology,” said Borealis Chief Executive Mark Garrett.

“A polyethylene plant of this scale would

be a significant step forward in creating long term, sustainable value for

Kazakhstan from its petrochemical industry,” said Zhenis Osserbay, UCC Chief

Executive. “We look forward to continuing our work with Borealis in

developing this opportunity.”

Borealis committed to helping to solve

the problem of ocean plastic

Next phase of Project STOP Ocean

Plastics announced in Indonesia

Borealis, a leading provider of

innovative solutions in the fields of polyolefins, base chemicals and

fertilizers, announces that it has confirmed majority funding for

Project STOP Ocean Plastics (STOP).

Project STOP is a joint initiative with

SYSTEMIQ

and

Sustainable Waste

Indonesia. It works with city governments to eliminate

leakage of plastics into the ocean, increase plastics recycling and

support the wider system changes required for a plastics circular

economy. The funding secures the start of Project STOP’s second phase.

Plastics can deliver a vast range of sustainability benefits, from

increasing energy efficiency to preventing food waste. However, the

leakage of plastic litter into the ocean is a significant issue

worldwide. Borealis has jointly developed Project STOP with SYSTEMIQ, an

advisory and investment firm that aims to tackle system failures, as one

part of its approach to addressing this problem.

Phase one of Project STOP resulted in

the successful completion of feasibility and baseline studies and other

preparatory work. Phase two will see the establishment of the first city

partnership, in Indonesia. In common with other South East Asian

countries, Indonesia’s economic growth and plastics consumption has

outpaced its ability to manage plastic waste. This has made

Indonesia the world’s second largest source of

marine plastic debris, after China.

The first city-partnership project will take place in

Muncar, a major fishing port in East Java

suffering from plastic litter in its harbour, beaches and rivers.

Project STOP aims to:

- achieve

zero leakage of plastic waste into the environment, by

improving waste collection and sorting;

- increase

plastic recycling and establish a plastics circular economy,

by strengthening the supply chain from waste collection to recycling

companies, which in turn will generate new revenues and jobs; and

- benefit the local community, by

reducing the impact of plastic waste on public

health, tourism and fisheries.

“Addressing marine litter is a

critical challenge for our industry and a key focus of Borealis’ social

engagement strategy. We are pleased to continue funding this

industry-leading initiative, which is an important step towards creating

a plastics circular economy,” says Mark Garrett, Borealis Chief

Executive. “We are also happy that Borouge(Abu

Dhabi Polymers Company),

our Joint Venture with the Abu Dhabi National Oil Company (ADNOC),

is supporting this project.”

"The next phase of Project STOP is a

major milestone in our efforts to keep plastics out of the ocean,”

explains Martin Stuchtey, Founder and Managing Partner of SYSTEMIQ.

“There is a great need to accelerate circular waste management solutions

in Asia and we are hugely excited to design and deliver this new city

partnership model, together with Borealis and our government partners in

Indonesia."

-----

SYSTEMIQ is a different kind of company.

We connect people, ideas, technologies, and capital to create good

disruptions in critical economic systems.

These disruptions are vital for humanity and our planet: they also open up

immense opportunities for the businesses that drive them.

We need to transform economic systems much

faster to hit the UN targets and stop degrading natural resources.

SYSTEMIQ was launched in 2016 to accelerate these urgent transformations.

We have set out to achieve our mission

through a unique portfolio of activities which include:

-

building

and supporting coalitions of leaders with the knowledge,

experience and authority to shape policies and business strategies that will

rapidly transform economic activity in line with the UN and Paris targets

-

co-creating and

incubating the market solutions most likely to build

regenerative economic systems, in partnership with businesses, governments,

non-profits and other institutions

-

investing our

own capital and expertise in early-stage ventures with the biggest potential

to drive rapid system change

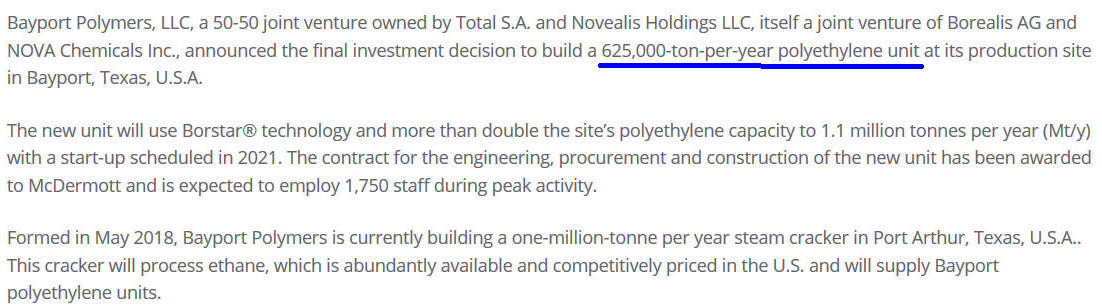

Borealis to acquire NOVA Chemicals ownership interest in Novealis Joint

Venture

Borealis AG and NOVA Chemicals Corporation

today announced they have reached an agreement for

Borealis to buy NOVA Chemicals’ 50% ownership interest in Novealis Holdings LLC.

Formed in 2018, Novealis is the joint venture

between affiliates of Borealis and NOVA Chemicals, which subsequently

formed a 50/50 joint venture with an affiliate of Total

S.A. to launch Bayport Polymers LLC in

Houston, Texas, US.

|

PE 400+625

Ethylene 1,000 |

Closing of the acquisition is subject to

customary regulatory approvals and other conditions but is not subject to any

financing condition. The parties expect the transaction to close in the first

half of 2020.

----

Bayport Polymers LLC

2018/9/27

Borealis decision to discontinue world-scale polyethylene project in

Kazakhstan

Borealis announces its decision to not

further pursue the development of

an integrated cracker and

polyethylene project in Kazakhstan.

The decision to discontinue this project is

based on a thorough assessment of all aspects of the prospective venture and

impacted by the effects of the COVID-19 pandemic as well as the increased

uncertainty of future market assumptions.

The scope of the JDA will include the

construction of an ethane cracker and 2 Borstar® PE

units, with a total capacity of 1.250 ktpa and with a pre-investment

in the cracker for future expansion. The final investment decision on the

project is expected to be taken in 2020 and start-up would be scheduled for

2025.

The partner, United Chemical Company is the

state-owned company in Kazakhstan established in 2009.