ExxonMobil Strengthening global energy security

63年 エクソンの化学部門、石油事業から分離独立(エクソン・ケミカル・カンパニ)97年4月 ユニベーション・テクノロジー社設立(UCCとの折半出資)

ポリエチレン関連の技術ライセンス

99年11月 「エクソンモービル」の新発足

エクソンモービル・ケミカル新発足

シンガポール

97年1月 「シンガポール・アロマティックス」

エクソン50%、米アモコ(現BP)40%、台湾CAPCO10%出資

パラキシレン年産35万トン、ベンゼン9.6万トンの芳香族コンプレックス

2001年第2四半期 エチレン(80万トン)、PE(45万トン)、PP(27.5万トン)、

ノニルアルコール(15万トン)等

タイ エッソ・タイランド パラキシレン35万トン設備

中国 福建石油化工公司(FPCL)とサウジのアラムコ社との合弁

エチレン(60万トン)、PE(45万トン)、PP(30万トン)建設計画

サウジアラビア

サウジ基礎産業公社(SABIC)とエクソンとの折半出資合弁会社KEMYA

豪州 99年10月 ケノス社(Qenos)設立(エクソンモービル53%、オリカ47%)

オリカ社(Orica 旧ICIオーストラリア)とケムコア社(Kemcor エクソンケミカルと

モービルケミカルの折半出資)が、両社の石油化学事業統合

ChemChina、豪州石化会社Qenosを買収

ExxonMobil PDVSA talks progress

on Venezuela olefins JV project

Venezuela, ExxonMobil move forward on olefins

project

ExxonMobil Chemical Announces

Start-Up of New Metallocene Plant Expansion at Baton Rouge, Louisiana

Qatar Petroleum and ExxonMobil Chemical Sign

Statement of Intent for Ethane Cracker, Derivatives Complex

Pequiven, ExxonMobil sign US$3bn olefins

agreement

2004/9 Basell sells 50% share in French CIPEN to

ExxonMobil

2005/1 ExxonMobil to open two PP metallization lines at

Brindisi, Italy

2005/1 ExxonMobil Chemical to Expand Ethylene Capacity

in Singapore

ExxonMobil Chemical to Expand Oxo Alcohol

Capacity in Singapore

2006/1 Foster Wheeler

Awarded PCS Contract for Planned New Petrochemical Project in Singapore

2005/11

ExxonMobil

Chemical to Expand EXXPRO Specialty Elastomers Capacity in Baytown,

Texas

2006/11

エクソンモービルケミカル

米国テキサス州ベイタウン工場ハロゲン化ブチルゴム生産能力増強

2007/2 ExxonMobil Chemical

Upgrades LaGrange OPP Film Manufacturing Facility

2007/3 ExxonMobil Chemical Increases Production

Capacity of Polyalphaolefins by 15%

2007/4

ExxonMobil's New Olgone Aromatic

Treatment Technology Proves Successful at NPRC's Muroran Refinery

2007/6 ExxonMobil Chemical

Announces Manufacturing Facility for New Specialty Compounds for Tires

ExxonMobil Announces Successful Start-up

of PxMax Technology at S-Oil's Onsan Refinery

2007/8 ExxonMobil Chemical Begins Commercial

Production of Butyl Rubber Using a Proprietary New Breakthrough

Technology

2007/9 ExxonMobil Chemical to build 2nd

Singapore cracker

ExxonMobil Chemical

Announces Expansion of its Rotterdam Aromatics Plant

2007/10 ExxonMobil Chemical Forms New Specialty

Business to Supply High Performance Compounded Polyolefin Products

2008/9 ExxonMobil Chemical Steps Up Asia Pacific

Specialty Compounds Supply with Compounding Agreement

2008/11 SABIC and ExxonMobil Chemical sign Heads

of Agreement for new Elastomers project in Saudi Arabia

2009/10

Exxon, Sabic JV

petchem plant to cost $5 bln

2009/3

ExxonMobil to Invest at Record Levels to

Meet Future Energy Demand

ExxonMobil Chemical

Makes Technology Investment in China

2009/8- MTBE裁判

2009/11

ExxonMobil Chemical

Announces Expansion at Its Rotterdam Aromatics Plant

2011/8

Rosneft and ExxonMobil to Join

Forces for Development of Arctic and Black Sea Resources

2012/3 ExxonMobil

Plans Five-Year Investment of $185 Billion to Develop New Energy

Supplies

2012/5

Exxon Mobil plans major new U.S. chemical plant

http://www.chemlink.com.au/qenos.htm

Qenos was formed in 1999, bringing together

the people and plants which were formerly Kemcor Australia and Orica Polythene.

We are a joint venture between the Australian company Orica and one of

the biggest names in petrochemicals, ExxonMobil Chemical.

Qenos is the cornerstone of

Australia's plastics and rubber industry. Our products are a part of

every day life - the raw materials used in thousands of household,

consumer and industrial products.

At Qenos we use Australian

oil and gas feedstocks from Bass Strait and the Moomba Basin. We employ

1,200 people. Our plants in Sydney and Melbourne produce olefins,

polyethylene (HDPE, LDPE and LLDPE), polypropylene, synthetic rubber and

engineering plastics. We also supply a diverse range of specialty

polymers. That makes Qenos a vital link in the Australian manufacturing

chain, supplying industries that employ hundreds of thousands of people.

ChemChina、豪州石化会社Qenosを買収

|

Formed by the combination of two high-caliber

organizations, Exxon and Mobil, the company is

an industry leader in almost every aspect of the energy and petrochemical

business.

Manufacturing Sites

①Antwerp, Belgium

②Al Jubail, Saudi Arabia (Kemya)

③Baton Rouge, Louisiana

④Beaumont, Texas

⑤Meerhout, Belgium

⑥Mont Belvieu, Texas

⑦Notre Dame de Gravenchon, France

⑧Singapore

⑨Yanbu, Saudi Arabia

Venezuela olefins JV (ExxonMobil-Pequiven) new

Technology

Centers

①Baytown, Texas PP

②Machelen, Belgium

③Sarnia, Canada

http://www.exxonmobilchemical.com/chemical/about/locations/

(November 30, 1999)

Exxon And Mobil Confirm Federal Trade Commission

Approval Of Merger

http://www.exxonmobil.com/Corporate/Newsroom/Newsreleases/Corp_xom_nr_301199.asp

Exxon Corporation and Mobil Corporation today confirmed that the U.S.

Federal Trade Commission (FTC) completed its review of the proposed merger

and has approved a consent order for the merger of the two companies. Exxon

and Mobil have accepted terms and conditions specified by the FTC and will

comply with them fully and in a timely manner.

①Antwerp, Belgium

Antwerp Performance

Intermediates Plant

The Antwerp Performance

Intermediates Plant is the world's largest aliphatic hydro-carbon fluids

plant. It is integrated with the Antwerp Esso Refinery. The plant began

producing higher olefins in 1991. ExxonMobil Chemical also operates an

ethylene terminal connected to its two polyethylene plants in Belgium,

Meerhout and Zwijndrecht.

Products:

Aliphatic fluids,

Hydrocarbon fluids for dry cleaning, Aromatic fluids,

Naphthenic fluids, Higher Olefins, Olefins, Aromatics

Antwerp Polymers Plant

The Antwerp Polymers

Plant produces specialty low density polyethylene to meet the demands

for flexible packaging mainly in Europe and the Far East. The plant was

purchased in 1979.

Products:

LDPE, Polyethylene

copolymers

②Al Jubail, Saudi Arabia (Kemya)

Al-Jubail Petrochemical

Company (Kemya)

One of ExxonMobil

Chemical's joint ventures is a polyethylene plant located on the east

coast of Saudi Arabia at Al-Jubail. This site, in operation since 1984,

supplies products to the Asian, European, Mid-East and African markets.

Products: LLDPE, HDPE

③Baton Rouge, Louisiana

Baton Rouge Chemical Plant

Founded in 1940,

ExxonMobil Chemical's plant in Baton Rouge, Louisiana, is a modern

petrochemical processing and manufacturing facility located on 150

acres. The plant produces oxygenated fluids, ethers, olefins,

ethylene-propylene rubber, halobutyl rubber, phthalic anhydride,

plasticizers, alcohols and acids.

Products:

Olefins

Aromatics

Oxygenated fluids (MEK, SBA, IPA, Exxate fluids)

Phthalic anhydride

Plasticizers

Alcohols

Acids

Higher Olefins

Synthetic rubber

Hydrocarbon resins

Baton Rouge Plastics Plant

Founded in 1968, some of

the products produced at the 118-acre Baton Rouge Plastics Plant include

ethylene, vinyl acetate, various co-monomers and modifiers to produce

low density polyethylene. This site also manufactures Exact Plastomers,

using ExxonMobil Chemical's Exxpol catalyst and process technology.

Products:

LDPE

Polyethylene copolymers

Exxpol metallocene products (Exact Plastomers)

*Chemical Week 2002/5/1

ExxonMobil Breaks Ground on Metallocene Elastomers Project

Mitsui Engineering and

Shipbuilding has started work on the previously announced expansion

of ExxonMobil Chemical's ethylene-based metallocene elastomers plant

at Baton Rouge, LA, ExxonMobil says. The project will add 90,000

m.t./year of capacity, raising the total to 180,000 m.t./year, ExxonMobil says. The expansion is scheduled

for completion in the third quarter of 2003.

Baton Rouge Resin Finishing

Plant

Acquired in 1983, the

Resin Finishing Plant in Baton Rouge, Louisiana, is located on 63 acres.

This facility primarily serves the U.S. market. The Escorez resins

produced at the site are used primarily as raw materials in the

production of pressure sensitive tapes, adhesives and sealants.

Products:Hydrocarbon resins (Escorez resins)

Baton Rouge Polyolefins

Plant

Founded in 1955 by W.R.

Grace & Company, Paxon was acquired in 1995. The plant produces high

density polyethylene for many applications including food containers,

toys, oil and gas containers and durable drums for industrial products.

It was one of the first in the industry along with Baton Rouge

Elastomers to adopt Total Quality Management principles and achieve ISO

9000 certification. The Plant was expanded in 2000 to produce

polypropylenes.

Products: HDPE, PP

The new plant has a polypropylene

capacity of 272,000t/yr. Output will be Escorene homopolymer and

some copolymer. Propylene polymers based on metallocene technology

will also be produced at the unit.

The Baton Rouge polypropylene unit

will be fully integrated with the company's high-density

polyethylene (HDPE) lines at the facility, which are scheduled for

further expansion. In 1999 the HDPE facility increased capacity by

95,000t/yr to 726,000t/yr, but there are future plans for a further

105,000t/yr expansion.

Following the July 1997 completion of

the company's 240,000 metric ton per year polypropylene site in Baytown, TX, the combined expansions will boost Exxon's

annual polypropylene capacity in North America to 1.1 million metric

tons.

④Beaumont, Texas

Beaumont Olefins and

Aromatics Plant

In April of 1999,

production began at the expanded olefins plant in Beaumont with the

facility's ethylene manufacturing capacity increased by about 45% to

more than 1.8 billion pounds a year. The expansion also improved the

plant's operating efficiency and enhanced its feedstock flexibility.

Ethylene from the plant is used to make a wide range of household,

commercial and industrial products. It can be converted into

polyethylene that is used to make plastic bags and bottles, packaging

films, housewares and toys. It also can be used to make other derivative

chemicals that go into the making of synthetic lubricants, antifreeze,

pain, polyester fibers and resins, polystyrene packaging, electrical

components, polishes, medical products, PVC pipes, upholstery, luggage

and more.

In recent years, the Beaumont aromatics facility has been upgraded to

produce about 800 million pounds of toluene and more than 1.2 billion

pounds of benzene. A 65-million-gallon-a-year grassroots cyclohexane

plant started up in 1999. This upgrades part of the Beaumont complex's

existing benzene and hydrogen supply to cyclohexane, an intermediate

chemical used primarily to make nylon fibers and resin.

In 1997, we completed a project at Beaumont to produce 600 million

pounds of paraxylene, a basic raw material for polyester fibers and

resins used in textiles and plastics manufacturing. ExxonMobil's

proprietary MTPX catalyst technology provides a significant cost

advantage versus competing technologies.

Products: Olefins,

Aromatics

Beaumont Polyethylene Plant

Construction to expand

the Beaumont low-pressure polyethylene plant capacity by 14% to 1.6

billion was completed in October of 1998.

Products: LDPE, LLDPE,

HDPE

Beaumont Chemical Specialty

Plant

In 1997, approximately

85 million pounds of polyalphaolefins production, the base stock for

advanced synthetic lubricants, was streamed to double the capacity at

the Beaumont Chemical Products plant. Two major expansions at the

Beaumont Specialty Plant also doubled output of zeolite catalysts, used

in many refining and petrochemicals manufacturing processes.

Products:

Synthetic lube base

stocks

Lubricant additives

Zeolite catalysts

⑤Meerhout, Belgium

Meerhout Polymers Plant

The Meerhout Polymers

Plant, in operations since 1977, produces low density polyethylene. It

is supplied with ethylene via a pipeline network stretching from

Rotterdam and Antwerp to Cologne.

Products: LDPE, Polyethylene copolymers

⑥Mont Belvieu, Texas

Mont Belvieu Plastics Plant

Founded in 1979,

ExxonMobil Chemical's plastics plant in Mont Belvieu, Texas, produces

linear low density and high density polyethylenes.

Products:

Polyethylene (LLDPE,

HDPE)

Exxpol metallocene products (Exceed mLLDPE )

⑦Notre Dame de Gravenchon, France

Since 1959 at Notre-Dame de

Gravenchon, between Rouen and Le Havre in Normandy, France, ExxonMobil

Chemical has built its largest manufacturing complex outside the USA.

ExxonMobil Chemical

Polymeres SNC

The polypropylene

manufacturing unit produces raw materials for packaging films, nonwovens

and injection molding specialties.

Products:Polypropylene

ExxonMobil Chemical SAS

This plant, acquired in

2001 from Basell, produces polypropylene homopolymers, impact copolymers

and compounded materials mainly for automotive and appliance

applications.

This polypropylene manufacturing and compounding site also includes an

applications development laboratory and technical staff.

Products: Polypropylene

Cipen

This joint venture

polyethylene plant started up in 1992. Here products are made mainly for

packaging films and extrusion molding applications.

Products:

LLDPE

Exxpol metallocene products (Exceed mLLDPE)

Basell sells 50% share in French CIPEN to

ExxonMobil

Societe du Caoutchouc Butyl

(SOCABU)

The first French butyl

rubber plant known as SOCABU started up in 1959. This ExxonMobil

Chemical plant produces isobutylene, butyl rubber and ethylene-propylene

rubber.

Products:

Synthetic rubber

(Butyl rubber, EPDM rubber)

Isobutylene

ExxonMobil Chemical France

Products made at the

site include aliphatic petroleum resins used in the adhesives industry

and higher olefins.

The world's first heavy feed steam cracker was built in Notre-Dame de

Gravenchon in 1967. It provides propylene, ethylene and butadiene to

local chemical companies.

Products:

Olefins (Ethylene,

Propylene, Butadiene)

Hydrocarbon resins

Synthetic Lube Base Stocks

Plant

Constructed in 1989, the

Gravenchon facility uses state-of-the-art control technology and a

dedicated reactor train that produces low viscosity PAOs with grades

ranging from 2cSt to 10cSt. Providing superior products to the synthetic

lubricant market, Gravenchon has been ISO-9002 certified since 1992 and

has recently received ISO-14001 certification.

Products:

Synthetic lube base

stocks

Lube and fuels additives

⑧Singapore

Pulau Ayer Chawan Fluids

Plant

Our Singapore plant

supplies industrial fluids to the Asia Pacific markets.

Products:

Aliphatic fluids,

Escaid products

Jurong Petrochemical Complex

The ExxonMobil

Petrochemical Complex at Jurong integrates a world-class petrochemicals

plant with a modern fuels refinery.

With a capacity of 245,000 barrels a day, the Jurong Refinery refines

crude oil into products like liquefied petroleum gasoline, naphtha,

gasoline, kerosene, diesel and fuel oil. Output from the Petrochemicals

Complex is sold to downstream companies that transform them into

polyester fibers, nylon, textiles, carpets, plastic products, paints,

dye or polystyrene products.

The complex includes facilities with manufacturing capacities to produce

880 million pounds of paraxylene, 660 million pounds of benzene, 198

million pounds of orthoxylene, 500 million pounds of cyclohexane and 110

million pounds of toluene each year.

Products: Aromatics, Cyclohexane

Singapore Chemical Plant

This highly integrated

complex is now supplying petrochemical products to the marketplace.

Click here for our press release.

Products:

Ethylene

Propylene

Polyethylene

Benzene

Oxo alcohols

Polypropylene

⑨Yanbu, Saudi Arabia

Since completing an

expansion in 2000, the ExxonMobil joint-venture petrochemicals complex at

Yanbu, Saudi Arabia, is one of the world's largest petrochemical facilities.

The Saudi Yanbu

Petrochemical's Company (Yanpet) facility, a 50/50-joint venture with

Saudi Arabia Basic Industries Corporation (SABIC), produces more than 1.6

million metric tons of ethylene and more than two million metric tons of

derivative products annually.

The original Yanpet ethylene cracker at Yanbu came on stream in 1985.

Products:

Ethylene

HDPE

PP

Ethylene glycol

Platts 2002/7/8

ExxonMobil-Pequiven olefins JV approved by

economic team

Venezuela's delayed $2.65-bil olefins

project with JV partner ExxonMobil has been approved by the country's

economic cabinet, a spokesman for the energy ministry told Platts Monday.

The proposed 50-50 project between

Venezuela's state Pequiven and ExxonMobil is designed to produce 1-mil mt/yr

of ethylene, 780,000 mt/yr of polyethylene and 400,000 mt/yr of glycols.

Platts 2003/6/9

ExxonMobil PDVSA talks progress on Venezuela olefins JV project

ExxonMobil is making

progress in renewed negotiations with state oil company PDVSA about

developing a $2.65-bil olefins 50:50 JV project in eastern Venezuela, the

company said Monday.

The project would be

designed to produce 1-mil mt/yr of ethylene, 780,000 mt/yr of

polyethylene and 400,000 mt/yr of glycols.

2004/2/9 ExxonMobil

ExxonMobil Chemical Announces Start-Up of New Metallocene Plant Expansion at

Baton Rouge, Louisiana

http://www.exxonmobil.com/Corporate/Newsroom/NewsReleases/xom_nr_190204_1.asp

ExxonMobil Chemical has

announced the completion and successful start-up of its new commercial

metallocene ethylene elastomer manufacturing facility in Baton Rouge,

Louisiana. The facility, the first of its kind in the world, is now

operational and will add capacity of more than 90 thousand tons of product

annually.

ExxonMobil Chemical ethylene

elastomer products marketed globally include Vistamaxx TM specialty elastomers, Exact®

plastomers, Vistalon® EP(D)M, ExxelorTM chemically modified polymers, and Santoprene® thermoplastic elastomers. These products are used in a

variety of applications in markets that include automotive, construction,

electrical, food packaging and consumer goods.

2004/7/21 Platts

Venezuela, ExxonMobil move forward on olefins project

US major ExxonMobil and Venezuela's state petrochemical company Pequiven have

reached a tentative agreement on a $2.65-bil olefins

joint venture in eastern Venezuela, an

ExxonMobil official said Wednesday. "The negotiating teams have reached an

understanding on how the project would be developed," the spokesman said. "It is

now under review."

August 12, 2004 BNamericas

Pequiven, ExxonMobil sign US$3bn olefins agreement

The Pequiven petrochemical

subsidiary of Venezuela's state oil company PDVSA and US-based ExxonMobil Chemical Company have signed an agreement to develop a US$2.5bn-3bn olefins project at the Jose

petrochemicals complex in Anzoategui state, Pequiven said in a statement

Thursday.

The project will include a cracking plant with capacity to produce

1 million metric tonnes annually of ethylene and derivatives.

ExxonMobil and Pequiven will each have 50% in the project, which will become the main provider of petrochemical

products in Latin America and in other world markets, the statement said.

ITC-CHEM-NEWS 2002/9/6

Pequiven と ExxonMobil、百万トンエチレンプロジェクト合意か

Venezuela 国営石油精製会社 PDVSA の Mr. Edgar Paredes が昨日 9月5日明らかにしたところによると、Pequiven

と ExxonMobil が進めてきたオレフィンプロジェクトは近々合意に達し署名される予定だ、とのことである。

同プロジェクトは、過去 5年に亘って交渉されてきたものであり、サイトは Anzoategui州 Jose に位置し、出資は Pequiven と

ExxonMobil 50:50 の合弁となる。

プラント年産能力は、エチレン 1,000,000トン、PE 760,000トン、EG 430,000トン等となっている。総資金は 23億ドル。

Platts 2005/1/11

ExxonMobil to open two PP

metallization lines at Brindisi, Italy

ExxonMobil Chemical announced

Tuesday it would instal two new metallization lines at its oriented

polypropylene (OPP) films plant at Brindisi, Italy. The first line is set to

start producing commercially in the first quarter of 2005, with the second line

due to start up a few months later. The new vacuum metallizer lines have the

ability to metallize a range of gauges between 12

and 50 microns at high speeds,

providing outstanding barrier properties. "The new metallizers will give us much

more flexibility and responsiveness to growing market demand," says Carlo

Ranucci, general manager, ExxonMobil Chemical Films Europe. ExxonMobil has seven

affiliated production plants: three in Europe (Virton in Belgium; Kerkrade in

the Netherlands; and Brindisi in Italy) and four in North America (LaGrange in

Georgia; Stratford in Connecticut; Shawnee in Oklahoma; and Belleville in

Canada.)

2005/1/28 ExxonMobil Chemical

ExxonMobil Chemical to Expand Oxo

Alcohol Capacity in Singapore

http://www.exxonmobilchemical.com/public_pa/WorldwideEnglish/Newsroom/NewsReleases/chem_nr_280105.asp

ExxonMobil Chemical is expanding the

capacity of its world-class oxo alcohol plant in Singapore. The Singapore

Chemical Plant will increase its iso-nonyl alcohol capacity from

180,000 tons-per-year to 220,000 tons-per-year. Project completion is expected by 3Q 2006.

The Singapore oxo alcohol plant started up in 2001 with a capacity of 150,000

tons-per-year and subsequently increased to 180,000 tons-per-year in June 2004.

2006/1/4 Foster Wheeler

Foster Wheeler Awarded PCS Contract for Planned New Petrochemical Project in

Singapore

http://www.corporate-ir.net/ireye/ir_site.zhtml?ticker=fwlt&script=418&layout=-6&item_id=800250

Foster Wheeler Ltd. announced

today that ExxonMobil Asia Pacific Pte. Ltd. has awarded the team of Foster

Wheeler and WorleyParsons a project coordination and services contract for a

potential new project at ExxonMobil's Singapore Chemical Plant site. This

project, known as the Singapore Parallel Train (SPT), would include the possible

construction of a new world-scale ethylene cracker, as

well as downstream plants for production of ethylene/propylene derivatives.

2006/5/10 ExxonMobil

ExxonMobil Chemical Introduces

New Line of Compounded Polyolefins for Automotive Industry

ExxonMobil Chemical today introduced a line of compounded polypropylene for the

automotive industry. ExxonMobil Performance Polyolefins are available from

ExxonMobil Chemical facilities in North America, Europe and Asia.

ExxonMobil Chemical offers numerous products for a wide variety of automotive

applications. The products may be supplied from our manufacturing facilities in

North America, Europe or Asia Pacific.

-- Santoprene(TM) TPV and Vistalon(TM) EPR and EPDM

elastomers are key products used in automotive body sealing applications.

-- Jayflex(TM) plasticizers are key components in hundreds of automotive

flexible PVC applications, for both interior and exterior use.

-- Specific grades of high density polyethylene have been designed for fuel

tanks and energy management systems. These grades exhibit superior toughness and

offer long life.

-- Butyl polymers, including butyl, chlorobutyl and bromobutyl rubber, are key

components in tires for cars and trucks.

-- Lubricants based on our synthetic base stocks provide superior wear

protection and extended life to automotive oils and greases. In addition,

automotive paints incorporate our aliphatic and aromatic hydrocarbon fluids as

well as isopropyl alcohol (IPA) and methyl ethyl ketone (MEK).

2006/11/8 ExxonMobil Chemical

エクソンモービルケミカル

米国テキサス州ベイタウン工場ハロゲン化ブチルゴム生産能力増強の件

エクソンモービル ケミカル カンパニー(エクソン モービル コーポレーションの化学品部門: 以下エクソンモービルケミカル)は、当社のテキサス州ベイタウン工場におけるハロゲン化ブチルゴム(ハロブチルゴム)生産能力の大幅な増強を行うことを決定しましたのでお知らせいたします。同工場は、既存設備の改良や新設備の追加により、「エクソン・ブロモブチルBromobutyl

」ゴムの生産能力を60%増強する予定です。今回の増強は、ハロブチルゴムの国際市場やタイヤ業界における旺盛な需要や急速な成長を支えるという当社の姿勢を明確に示すもので、関連工事の完了は2008 年4-6

月期を予定しています。

エクソンモービルケミカルは、世界のタイヤ業界向けにハロブチルゴムを供給する主要サプライヤーであり、過去10 年間で生産能力を80%増強しています。

-- 2002

年にベイタウン工場を拡張し、ハロブチルゴムの生産能力を4 倍に増強しました。

--

エクソンモービル・ケミカルグループの一員であるエクソンモービル有限会社が合弁出資している日本ブチル株式会社(本社:

神奈川県川崎市)は、アジア太平洋地域の需要増に対応して、このほど同社のハロブチルゴム生産能力を年間70,000 トンに増強しました。

この他、ベイタウン・ブチル工場では、タイヤインナーライナーの空気不透過性を向上させる新技術に使われる、当社が独自に開発した特殊エラストマーExxpro(エクスプロ)の生産能力を倍増する拡張プロジェクトが進められています。同プロジェクトは2005 年に発表され、本年末までの完了を目指しています。

November 2, 2005 --

ExxonMobil

ExxonMobil Chemical to Expand EXXPRO

Specialty Elastomers Capacity in Baytown, Texas, to Support Advancements in

High-Barrier, Lightweight Tire Inner Liners

ExxonMobil Chemical has announced

today that it is doubling its production capability for its proprietary Exxpro specialty elastomers used in the construction of tire inner

liners, as a result of new investment and recent operational improvements.

The expansion of the company's plant in Baytown, Texas, is targeted for

completion in the fourth quarter, 2006.

February 12, 2007 ExxonMobil

Chemical Films Business http://www.oppfilms.com./

ExxonMobil Chemical Upgrades LaGrange

Oriented Polypropylene (OPP) Film Manufacturing Facility

The Films Business of ExxonMobil Chemical today announced plans to significantly

increase production of specialty oriented polypropylene (OPP) films in LaGrange,

Georgia.

The company will upgrade the

LaGrange facility to increase its North American capacity for multi-layer white

OPP films. The multimillion dollar investment will allow the

company to satisfy the rapid growth in demand for specialty OPP films, such as

OPPalyte(TM) white opaque film for candy cold-seal

applications, OPPalyte(TM) WOS-2 and STW white opaque films for ice cream

novelty applications and Label-Lyte(TM) films for wet glue and pressure sensitive

labeling.

About the Films Business of ExxonMobil Chemical

The Films Business of ExxonMobil Chemical is a global leader in the development

and manufacture of specialty oriented polypropylene (OPP) films, including

multi-layer white opaque films, metallized films and acrylic and PVdC coated

films, for flexible packaging and labeling applications. The Films Business has

affiliated production plants in Europe (Virton, Belgium; Kerkrade, the

Netherlands, and Brindisi, Italy), and North America (LaGrange, Georgia;

Shawnee, Oklahoma; Stratford, Connecticut and Belleville, Canada). The company

and its affiliates have sales offices to support customer needs in countries

around the world, including North America, Europe and Asia. Additional

information regarding the Films Business can be found at: www.oppfilms.com.

2007/3/29 ExxonMobil Chemical

ExxonMobil Chemical Increases Production Capacity of SpectraSyn(TM)

Polyalphaolefins

ExxonMobil Chemical has completed several debottleneck projects at its

Synthetics Plant in Beaumont, Texas, that increase capacity to produce high

viscosity SpectraSyn 40 cSt and SpectraSyn 100 cSt polyalphaolefins (PAO) by 15 percent.

SpectraSyn high viscosity PAO products are attractive blend components for

increasing basestock viscosity and upgrading quality over a wide range of

lubricant applications. These synthetic blend stocks offer improved flow at low

temperatures and increased film thickness at high temperatures.

"This high viscosity PAO capacity investment will help our customers meet the

growing demand for high-performance lubricants," says Page Greenwood, PAO

Marketing Manager, Synthetics Global Business.

April 03, 2007 ExxonMobil Chemical

ExxonMobil's New Olgone Aromatic Treatment Technology Proves Successful at

NPRC's Muroran Refinery

Olgone is an innovative aromatics

treatment technology that provides an economical, easy-to-implement alternative

to clay treatment.

ExxonMobil Chemical Technology Licensing LLC today announced the successful

start-up of the first licensed application of its new Olgone

Process. Nippon

Petroleum Refining Company, Ltd.'s (NPRC) installed the Olgone Process at its Muroran Refinery to remove

olefins from a heavy reformate feed, replacing the traditional clay

treatment process. The mixed xylenes separated from the treated

heavy reformate are then converted to paraxylene by NPRC and others.

2006/10/9

ExxonMobil Introduces Innovative

Aromatics Treatment Technology

Olgonesm provides economical,

easy-to-implement alternative to clay treatment

ExxonMobil Chemical Technology Licensing LLC today announced the

commercialization of its new Olgone technology for more effective and

environmentally sound removal of olefins from

aromatics streams. Olgone is a catalyst-driven technology that

provides aromatics plant operators with an alternative to the clay

treaters currently used to reduce olefin content. Olgone is more effective than clay treaters

in removing olefinic materials that can interfere with downstream equipment,

adsorbents, sieves and catalysts.

June 19, 2007 ExxonMobil

ExxonMobil Chemical Company Announces

Manufacturing Facility for New Specialty Compounds for Tires

ExxonMobil Chemical Company today

announced it will begin construction of a facility to manufacture new specialty

elastomer compounds that can improve the durability of tires, make them lighter

weight by using less raw material and significantly reduce fuel consumption.

Start-up of the plant is expected

in early 2008 to satisfy demand for the products that combine the flexibility

and elasticity of rubber with the low air permeability of plastic.

The plant will manufacture a dynamically vulcanized 加硫

alloy (DVA) of proprietary ExxproTM specialty elastomers and nylon.

This new Exxpro-based alloy can be

blown into films and used as the air barrier inner liner of tires. ExxonMobil

Chemical expects to commercialize the technology in late 2007. Exxpro marks the

first major technology advancement to tire inner liner raw materials since

ExxonMobil started producing halobutyl products in 1961.

The initial market development

facility for manufacturing will be located in Pensacola, Florida. The investment will fully leverage the company's existing proprietary extrusion technology at

this location. The facility will supply customers globally.

In 2004, ExxonMobil

Chemical and Yokohama Rubber Company announced significant technical

advancements in the area of Exxpro polymer and dynamically

vulcanized alloy technology for tire inner liners.

In 2006, ExxonMobil Chemical

Company completed an expansion at the company's plant

in Baytown to double production capability for its

proprietary Exxpro specialty elastomers.

October 5, 2006

ExxonMobil Chemical and Yokohama

Rubber Co. Ltd. Achieve Winter Test Qualification for Jointly Developed

Advanced Tire Inner Liner

A milestone in the development of

improved tire inner liners was announced today by ExxonMobil Chemical

Company and The Yokohama Rubber Co., Ltd. (YRC) following tests to qualify

their jointly developed technology for use in passenger vehicle tires in

harsh winter conditions.

The companies' development of DVA (dynamically vulcanized alloy) advanced

tire inner liner technology is based on proprietary Exxpro polymers and alloys of

those polymers developed by ExxonMobil, as well as alloys and application

technology developed by YRC. The DVA advanced inner liner technology used

in the film liner materials combines the flexibility and elasticity of a

rubber with the low-air permeability of a plastic.

2007/6/20 ExxonMobil

ExxonMobil Announces Successful Start-up of PxMax

Technology at S-Oil's Onsan Refinery

PxMax is ExxonMobil's State-of-the-Art Technology

for Selective Toluene Disproportionation

ExxonMobil Chemical Technology Licensing

LLC and S-Oil Corporation today announced the successful start-up of

ExxonMobil's PxMax

technology at S-Oil's Onsan refinery and chemical complex in

South Korea. The PxMax process licensed by ExxonMobil and implemented at the

Onsan refinery replaced a non-selective toluene disproportionation

不均化 (TDP) process that produced equilibrium mixed

xylenes. The selective nature of the PxMax process

provides S-Oil with a paraxylene-enriched mixture that is further processed into sales grade

paraxylene product at S-Oil's facility.

PxMax SM(Selective

Toluene Disproportionation)

|

Disproportionation 不均化とは、同一種類の分子が2個以上互いに反応して2種類以上の異なる種類の生成物を与える化学反応のこと。

トルエンの不均化

トルエン2分子の反応によってベンゼンとキシレンを生成する。

- 2 C6H5CH3

→ C6H6

+ C6H5C2H5

|

ExxonMobil Chemical now offers its PxMax

technology for commercial licensing. PxMax is the new process name for our

state-of-the-art Selective Toluene

DisProportionation (STDP) technology, previously know as MTPX, and first put into

commercial operation in 1996. PxMax services provide full support for licensees

from initial consultation through technology transfer and on-going improvements.

Compared to its predecessor MSTDP, the PxMax process offers:

- Higher purity paraxylene-rich

xylenes (90%+)

- Higher total xylenes yield

- Superior xylenes/benzene ratio

These advantages, combined with lower

operating temperatures and reduced H2/hydrocarbon requirements, can result in

increased profits and significant debottleneck opportunities.

The PxMax process flow is typical for a

vapor-phase reaction in a fixed bed reactor. Toluene feed, combined with

hydrogen-rich recycle gas, is preheated and passed through the catalyst bed.

Here, disproportionation occurs, at moderate temperature and pressure, to

produce a paraxylene-rich xylene product along with co-product benzene. The

by-product yields are small.

The reactor effluent is cooled by heat exchange and the liquid products are

separated from the recycle gas. The separated liquid is stripped to remove the

light ends and then fractionated to recover a very high purity benzene product

and a highly enriched paraxylene stream for recovery of paraxylene. Unreacted

toluene is recycled to extinction.

July 31, 2007 ExxonMobil

ExxonMobil Chemical Begins Commercial

Production of Butyl Rubber Using a Proprietary New Breakthrough Technology

ExxonMobil Chemical announced today that

it has begun commercial production of butyl rubber at its Notre Dame

de Gravenchon (NDG) plant in France using a new proprietary breakthrough process

technology that it pioneered.

The new technology enables

ExxonMobil Chemical to significantly increase its butyl rubber production

capacity from its existing plants. Moreover, the technology also improves energy

efficiencies as it enables the butyl rubber polymerization process to be run at

more efficient temperatures.

September 24, 2007 ExxonMobil

Chemical

ExxonMobil Chemical Announces Expansion

of its Rotterdam Aromatics Plant

ExxonMobil Chemical today announced it

will invest in an expansion of its Rotterdam Aromatics Plant.

The expansion will make this world-scale plant ExxonMobil's largest paraxylene production facility,

increasing its paraxylene production capacity by 25 percent

and

benzene

production capacity by 20 percent.

Rotterdam Aromatics

Plant

・Aromatics: Benzene, Toluene, Paraxylene,

Orthoxylene, Mixed Xylenes

・Cyclohexane

Rotterdam Oxo Alcohol Plant

・Alcohols: Oxo-alcohols

・Vammar products

Rotterdam Plasticizers Plant and

Phthalic Anhydride Plant

・Jayflex plasticizers

・Phthalic anhydride

October 8, 2007 ExxonMobil

Chemical

ExxonMobil Chemical Forms New Specialty

Business to Supply High Performance Compounded Polyolefin Products

ExxonMobil Chemical Company today

announced that it has formed a new specialty compounds and

composites business to focus on the development, production and

marketing of engineered polyolefin compounds. The new business is organized to provide

customers with efficient delivery of innovative products that fully utilize

ExxonMobil's polymer and process development capabilities and global reach.

The business portfolio includes a

new line of ExxonMobil Performance

Polyolefins for automotive applications. Products range from soft and flexible compounds

to reinforced composites. This is made possible by ExxonMobil's extensive slate

of polypropylene, polyethylene, and elastomer base polymers that can be produced

globally and tailored for specialty compounds.

September 3, 2008 ExxonMobil

ExxonMobil Chemical Steps Up Asia

Pacific Specialty Compounds Supply with Compounding Agreement

ExxonMobil Chemical will improve the

supply of its specialty compounds in Asia Pacific following the establishment of

a compounding agreement with Resin & Pigment Technologies Pte.

Ltd. (R&P), a subsidiary of EnGro Corporation Limited.

Under the agreement, R&P will manufacture a broad range of ExxonMobil Chemical's specialty compounds for use in automotive

interior and exterior applications, appliances and consumer products.

The R&P facility is located on Jurong Island, Singapore, just two kilometers from ExxonMobil

Chemical's petrochemical complex. ExxonMobil Chemical will leverage its global

portfolio of specialty plastics and elastomers using the Singapore complex as

the primary source of polyolefins for the production of its specialty compounds.

The R&P facility is ISO 9001 certified and recently achieved ISO/TS 16949

automotive certification.

-------

EnGro is a leading slag-cement producer in Singapore.

Since 2005, the Group has strengthened the supply-chain by leveraging on its

GGBS 高炉スラグ微粉末

joint venture production base in

China coupled with its Pulau Damar Laut bulk-terminal cum logistics services

undertaken by Top-Mix ready-mix concrete operations.

EnGro has built 2 core businesses, namely the specialty cement and the specialty

polymer. Operationally, it is driven by 2 growth engines supplemented by

evergreen venture capital (VC) investment activity in technology-driven

businesses.

Resin & Pigment

Technologies (R&P) is one of the regions leading companies in

customized polymer processing and compounding, offering solutions to enhance

material performance as well as colour appearance for major polymer

producers.

Established in 1989, R&P has since grown to become the preferred value

creation partner with compounding expertise across a wide range of polymers

for applications in the electrical, electronics, automotive, construction

and civil engineering, household and consumer, packaging and agriculture

sectors.

2009/3/5 ExxonMobil

ExxonMobil to Invest at Record Levels to Meet

Future Energy Demand

Exxon Mobil Corporation today announced

plans to invest at record levels -- between $25 billion and $30

billion annually over the next five years -- to meet expected long-term growth in world

energy demand.

Tillerson outlined ExxonMobil's major achievements in 2008 and plans for the

future. Highlights include:

-- Production started at eight major

projects in 2008, which at their peak are expected to add the net equivalent of

260,000 barrels per day to the company's production. A further nine major

projects are expected to commence production in 2009, and at their peak are

expected to add the net equivalent of an additional 485,000 barrels per day to

production.

-- In the chemical business, the company

has ramped up construction activity on world-scale petrochemical

projects in China and Singapore, and continues to invest for specialty business

growth, including a new plant in South Korea to

manufacture lithium ion battery separator film to meet expected demand growth including

batteries for hybrid and electric vehicles.

March 16, 2009 Exxonmobil

ExxonMobil Makes Technology Investment in China

ExxonMobil Chemical

Company

announced today that it has made the final decision to build a technology center in Shanghai,

China to provide product applications support for its growing business in the

Chinese and Asian markets.

“Over the next 10

years, we expect roughly 60 percent of the world's petrochemical growth to occur in Asia, and we

are rapidly expanding our manufacturing footprint through major capacity

additions in Fujian, China and Singapore," said Steve Pryor, president,

ExxonMobil Chemical Company. "The decision to build a technology center in

Shanghai reinforces our long-term commitment to China and the region. The new

investment will support our growing sales of premium products by providing

innovative solutions to customer needs.”

The technology center in Shanghai is

expected to be operational in 2010.

2009/10/26 Gulf Times

October, 2009,ExxonMobil in talks with

QP for mega petchem JV

ExxonMobil is in discussions with QP to develop a world-scale petrochemical

complex in Qatar, ExxonMobil senior vice-president Mark W Albers has said.

“The

proposed project would position Qatar very well in the global petrochemical

industry,” he said in an exclusive interview with Gulf Times

yesterday.

ExxonMobil Chemical Qatar and QP have signed a heads of agreement to do

‘progress studies'

for the proposed petrochemical

complex in Ras Laffan.

Albers said he hoped there would be ‘significant opportunities'

to develop the North Field

resources, the largest non-associated gas field in the world.

“As we

understand more about the reservoir, we will be able to take a decision on new

investments in Qatar,” he said.

Albers said ExxonMobil is looking towards the start-up of Al Khaleej Gas-2

before the year-end.

AKG-2 is the second phase of Al Khaleej Gas project, which is being developed

with QP to meet Qatar's long-term domestic gas supply requirements.

AKG-2 will supply approximately 1.25bn cu ft per day of gas as well as

condensate, ethane and LPG.

“And we

are working with QP towards a mechanical completion of RasGas Train 7 by the

year-end,” he said.

Train 7 is being set up under RasGas III (RL 3) and will have the capacity to

produce 7.8mn tonnes a year of LNG, about 50,000 bpd of condensate and 24,000

bpd of LPG. RL3 customers will include those in the US and Asian markets.

Asked about the impact of the global financial crisis on ExxonMobil, Albers

said, “Our approach has always been long-term. We always

look through the low and high price cycles.

“We commit

investments only after a thorough study. So we don't have to change our policy with price

fluctuations. Our timeframe for investments is decades ? often up to 40 years.

“Our

investment plans have not really changed with the current economic crisis. We

plan to invest some $25bn to $30bn globally over the next three or four years.

We have not retrenched our personnel on account of the economic downturn. That

gives us a competitive advantage to focus on the long term.”

Albers said it is important that

countries around the world have stable fiscal environments that facilitate sound

investments. Companies must be able to invest with confidence ? not just in

energy, but in other industries as well. He said ExxonMobil embraces the four

pillars of Qatar's National Vision 2030 of human, social, economic

and environmental development.

November 30, 2009

ExxonMobil Chemical Announces Expansion at Its Rotterdam Aromatics Plant

ExxonMobil Chemical announced the completion and start-up of an expansion at its Rotterdam Aromatics Plant. The expansion has made this world-scale plant

ExxonMobil's largest paraxylene production facility.

Paraxylene capacity at the plant has been increased by 25

percent to 700,000 tons, and benzene capacity increased by 20 percent to

830,000 tons per annum. The

expansion at the Rotterdam complex, owned and operated by ExxonMobil Chemical

Holland B.V., was announced in 2007 and completed on schedule.

The expansion is part of ExxonMobil Chemical's strategy to develop world-scale,

highly integrated chemical facilities with globally competitive cost structures.

The new unit in Rotterdam benefits from integration with existing facilities and

captures a number of synergies with the base plant.

“This

expansion demonstrates ExxonMobil's commitment to invest, across the business

cycle, in order to meet the longer term, growing customer demand for these

products,” said T.J. Wojnar, senior vice president,

ExxonMobil Chemical Company. “This project is an example of our continued

efforts to meet the supply and quality needs of our global customers."

The new unit employs ExxonMobil's proprietary PxMaxSM technology to produce

paraxylene and benzene. The PxMax process improves selectivity, generates less

waste and reduces energy requirements versus existing technologies.

August 30, 2011

ExxonMobil

Rosneft and ExxonMobil to Join Forces for

Development of Arctic and Black Sea Resources, Expand Technology Sharing and

Implement Joint International Projects

- US $3.2

billion exploration program planned for Kara Sea and Black Sea

-

Establishment of a joint Arctic Research and Design Center for Offshore

Development in St. Petersburg

- Rosneft

participation in ExxonMobil projects in the U.S. and other countries

with a focus on building offshore and tight oil expertise

- Joint

operations to develop Western Siberia tight oil resources

- Companies

form partnership to undertake projects in the Russian Federation and

internationally

Rosneft and ExxonMobil have executed a

Strategic Cooperation Agreement under which the companies plan to

undertake joint exploration and development of

hydrocarbon resources in Russia, the United States and

other countries throughout the world, and commence technology and

expertise sharing activities.

The agreement, signed by Rosneft President

Eduard Khudainatov and ExxonMobil Development Company President Neil Duffin in

the presence of Russian Prime Minister Vladimir Putin, includes approximately US

$3.2 billion to be spent funding exploration of East Prinovozemelskiy Blocks 1,

2 and 3 in the Kara Sea

and the Tuapse License Block in the Black Sea,

which are among the most promising and least explored offshore areas globally,

with high potential for liquids and gas.

In the course of these projects, the

companies will use global best practices to develop state-of-the-art safety and

environmental protection systems.

The agreement also provides Rosneft with an

opportunity to gain

equity interest in a number of ExxonMobil's exploration

opportunities in North America,

including deep-water Gulf of Mexico and tight oil fields in Texas (USA), as well

as additional opportunities in other countries. The companies have also agreed

to conduct a joint study of developing tight oil resources

in Western Siberia.

Tight Oil : 孔隙率および浸透率の低い油層からの原油、Shale Oil

米国北部からカナダにかけて分布するBakken Shaleが代表的

The companies will create an

Arctic Research and Design Center for Offshore

Developments in St. Petersburg, which will be staffed by Rosneft and

ExxonMobil employees. The center will use proprietary ExxonMobil and Rosneft

technology and will develop new technology to support the joint Arctic projects,

including drilling, production and ice-class drilling platforms, as well as

other Rosneft projects.

“We have a clear vision for Rosneft's

strategic direction – building world-class expertise in offshore business and

enhancing oil recovery,” said Rosneft president Eduard Khudainatov, following

the signing ceremony. “The partnership between Rosneft with its unique resource

base, and the largest and one of the most highly capitalized companies in the

world reflects our commitment to increasing capitalization of our business

through application of best-in-class technology, innovative approach to business

management, and enhancement of our staff potential. This venture comes as a

result of many years of cooperation with ExxonMobil and brings Rosneft into

large scale world-class projects, turning the company into a global energy

leader."

ExxonMobil Development Company President Neil

Duffin said: "Today's agreement with Rosneft builds on our

15-year successful relationship in the Sakhalin-1 project. Our

technology, innovation and project execution capabilities will complement

Rosneft's strengths and experience, especially in the area of understanding the

future of Russian shelf development.”

Rex Tillerson, chairman and chief executive

officer of Exxon Mobil Corporation, who attended the ceremony, said ExxonMobil

will benefit Russian energy development by working closely with Rosneft.

“This large-scale partnership represents a

significant strategic step by both companies,” said Tillerson. “This agreement

takes our relationship to a new level and will create substantial value for both

companies.”

The agreement provides for constructive

dialogue with the Russian Federation government concerning creation of a fiscal

regime based on global best practices.

Additionally Rosneft and ExxonMobil will

implement a program of staff exchanges of technical and management employees

which will help strengthen the relationships between the companies and provide

valuable career development opportunities for personnel of both companies.

NOTE TO EDITORS:

The East Prinovozemelskiy License Blocks have

a total area of 126,000 square kilometers (30 million acres) in water depths

ranging between 50 and 150 meters (165 feet and 500 feet).

Tuapse Block in the Black Sea has the total area of 11,200 square kilometers

(2.8 million acres) and water depths ranging from 1,000 to 2,000 meters (3,300

feet and 6,500 feet).

Rosneft equity interest in both joint

ventures will be 66.7 per cent, while ExxonMobil

will hold

33.3 per cent.

Oct. 19, 2011

Badger Licensing to Provide Cumene Technology to Lihuayi Weiyuan Chemical

Company in China

Badger Licensing LLC (Badger) today announced that it was awarded a contract by

Lihuayi Weiyuan Chemical Co., Ltd. (Lihuayi)利华益维远化工有限公司 to provide its

proprietary technology for a 300,000 metric tons

per annum grassroots cumene plant in Dongying City東営市,

Shandong Province, People's Republic of China. The contract includes technology

license, engineering, start-up services and corresponding training for Lihuayi.

"Badger is committed to bringing reliable, proven technology to our customers at

a low operating and capital cost," said Mark Healey, president of Badger. "We

believe this plant will help Lihuayi become a major player in the Chinese

phenolics industry."

Cumene, a precursor to the production of phenol, bisphenol A and polycarbonate,

has seen strong worldwide growth recently, particularly in China. More than nine

million metric tons of cumene capacity has been licensed by Badger and its

predecessor companies since the technology was introduced in 1995.

Badger Licensing LLC, headquartered in Cambridge, MA, USA, is a venture of

affiliates of The Shaw Group SHAW -1.96% and ExxonMobil Corporation XOM +0.09% .

Badger Licensing is principally engaged in marketing, licensing, and developing

technologies for ethylbenzene, styrene monomer, cumene, and bisphenol A. The

venture also supplies basic engineering packages for the licensed processes

through Shaw. Catalyst is supplied to Badger's licensees by ExxonMobil Catalyst

Technologies LLC.

Editor's Notes:

1. Badger Licensing LLC is a joint venture between Badger Technology Holdings

LLC (affiliate of The Shaw Group Inc.) and Alkylation Licensing LLC (affiliate

of ExxonMobil Corporation).

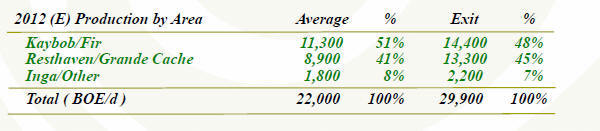

March 08, 2012 ExxonMobil

ExxonMobil Plans Five-Year Investment of $185 Billion to Develop New

Energy Supplies

Exxon Mobil Corporation plans to invest approximately $185

billion over the next five years to develop new supplies of energy to

meet expected growth in demand, Chairman and CEO Rex W. Tillerson said today in

a presentation at the New York Stock Exchange.

“During challenging times for the global economy, ExxonMobil continues to invest

to deliver the energy needed to underpin economic recovery and growth,”

Tillerson said in a presentation to investment analysts.

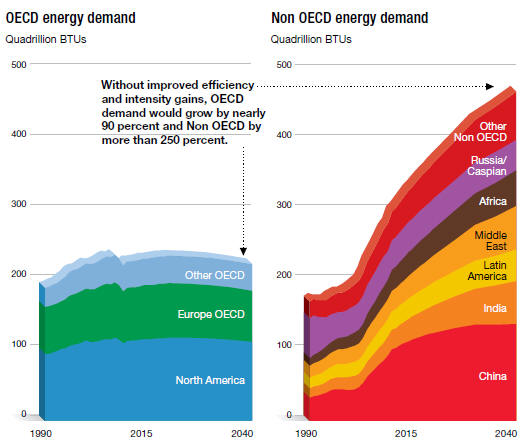

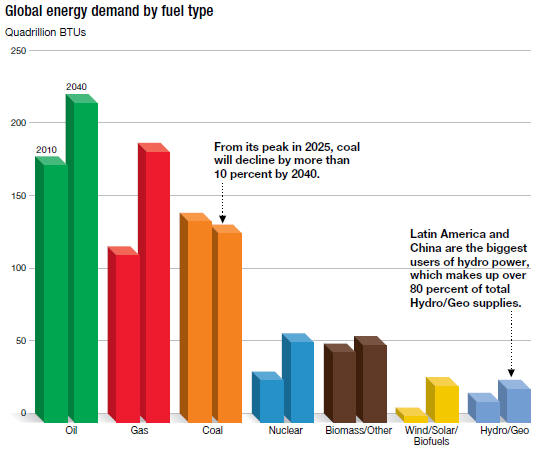

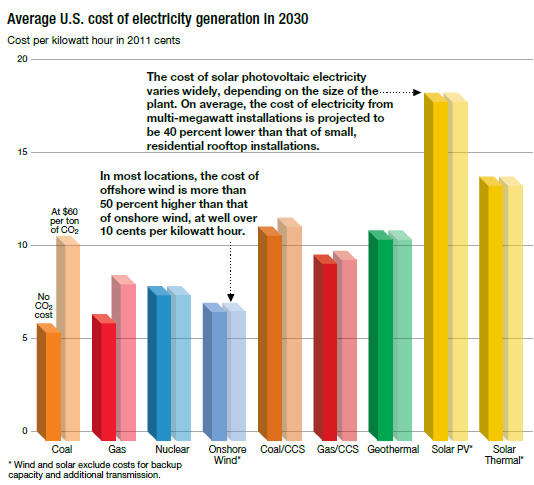

Tillerson said that even with significant efficiency gains, ExxonMobil expects

global energy demand to increase by 30 percent by 2040, compared to 2010 levels.

Demand for electricity will make natural gas the fastest growing major energy

source and oil and natural gas are expected to meet 60 percent of energy needs

over the next three decades.

To help meet that demand, ExxonMobil is anticipating an investment profile of

approximately $37 billion per year through the year 2016.

“An unprecedented level of investment will be needed to develop new energy

technologies to expand supply of traditional fuels and advance new energy

sources,” said Tillerson. “We are developing a diverse portfolio of high-quality

opportunities across all resource types and geographies.”

A total of 21 major oil and gas projects will begin

production between 2012 and 2014. In 2012 and 2013, the company expects to start

up nine major projects and anticipates adding over 1 million net oil-equivalent

barrels per day by 2016.

At the meeting the company outlined its major achievements in 2011 and plans for

the future. Highlights include:

ExxonMobil replaced 107 percent of its 2011 production (116 percent excluding

asset sales), increasing proved reserves to 24.9 billion oil equivalent barrels.

It was the 18th consecutive year the company replaced more than 100 percent of

its production, with proved reserve additions of 1.8 billion oil-equivalent

barrels.

Nine major upstream projects are expected to start-up in the next two years

including four in West Africa, Kashagan Phase 1 in Kazakhstan and the Kearl Oil

Sands project in Canada.

In the downstream, the company completed a large project at the

Thailand refinery, which is expected to increase

the supply of lower sulfur motor fuels by more than 50 thousand barrels per day.

Additional projects are under way, including new facilities at ExxonMobil's

Singapore refinery and at a joint-venture refinery in Saudi Arabia.

A major expansion at the

Singapore chemicals facilities is nearing completion. Commissioning and

startup activities are expected to continue through 2012 and will provide a

world-scale integrated platform with unparalleled feedstock flexibility. The

expansion will add 2.6 million tonnes per year of additional capacity and will

help meet demand growth in Asia Pacific.

This is the 10th year that ExxonMobil has made an annual presentation to

analysts at the New York Stock Exchange.

ーーー

Bloomberg 2012/3/9

Fracking Failing to Crack China, Europe Shale, Exxon Says

Some shale formations in Europe and China are impervious to drilling techniques

that opened vast reserves of natural gas and oil from Texas to Pennsylvania,

said Rex Tillerson, Exxon Mobil Corp.'s chief executive officer.

New methods and tools will need to be invented to tap many of the shale fields

that energy companies and governments expect eventually to yield a bonanza of

fuel, Tillerson said during a meeting with analysts in New York today.

Exxon, the largest U.S. gas producer after its 2010 acquisition of

shale driller XTO Energy,

failed in its first two efforts to crack gas-rich shale fields

in Poland. Gas discovered in a pair of wells finished during the final

three months of last year didn't flow, even after the company used high-pressure

jets of water and sand to create fissures in the rocks.

“Some of the shales don't respond as well to hydraulic fracturing,” Tillerson

said during a meeting with reporters after his presentation to analysts. “It's

going to take research and time in the lab to understand that.”

Some parts of U.S. shale formations also have

proven impervious to hydraulic fracturing, or fracking, he said. The company is

studying whether using different fluids, proppants or pumping techniques will be

successful, Tillerson said. Proppants are tiny granules of sand or ceramic used

to hold open fissures that allow oil and gas to flow through rock.

‘Cash Cow'

“Parts of some of these well-known shale plays everyone's all excited about

don't work,” Tillerson said. The geologic obstacles may stem from the

depositional history of the formations and factors such as high temperatures

deep under ground, he said.

Yet-to-be developed fields in shale rock and under deep seas are expected to

contribute 1 million barrels a day of new oil production by 2025, Yves-Louis

Darricarrere, president of exploration and production for Paris-based Total SA

(FP), said on March 6 at the CERAWeek conference in Houston.

Exxon's U.S. shale holdings include 400,000 acres in the Bakken region of North

Dakota and Montana, 800,000 acres in the Permian Basin in west Texas and New

Mexico, and 170,000 acres in the Oklahoma's Woodford Shale, Tillerson said.

Argentina, China

Despite the Polish setback, Tillerson said shale and other so-called

unconventional geologic formations will become a “cash cow” for Exxon.

Exxon agreed last year to explore shale fields in China

with China Petrochemical Corp. The company also has shale projects under

way in Argentina's Vaca Muerta formation.

Tillerson is spending $37 billion this year to find and produce oil, gas,

chemicals and motor fuels. Spending on capital projects will continue at that

pace through 2016, he said today.

Oil and gas production will fall 3 percent this year because of surging oil

prices that will curb the company's share of output from wells in some nations.

The production forecast is based on a $111 a barrel average price for Brent

crude.

The output decline stems from contracts in countries such as Nigeria that reduce

the company's share of production as crude prices escalate.

Tillerson plans 21 major oil and gas projects that will begin production between

2012 and 2014. This year and next, the company expects to start up nine major

projects and anticipates adding the equivalent of more than 1 million net

barrels a day by 2016.

“An unprecedented level of investment will be needed to develop new energy

technologies to expand supply of traditional fuels and advance new energy

sources,” Tillerson said in remarks prepared for today's meeting.

The company's 2012 exploration portfolio includes projects in Tanzania, Guyana

and Ireland, according to the presentation materials.

Exxon fell 1.2 percent to $84.83 at the close in New York. The shares are little

changed in the past year.

環境汚染の懸念残る 米欧では規制強化の動き

【ニューヨーク=小川義也】世界のエネルギー地図を塗り替えつつあるシェールガスだが、「水圧破砕法」(ハイドロリック・フラクチャリング)と呼ばれる開発手法を巡っては環境汚染の懸念が根強く、規制の動きが広がっている。フランスに続き、今月18日にはブルガリアでも水圧破砕法を使った探査・採掘の禁止が決まった。各国の規制動向次第では、開発の遅れやコストの上昇につながる可能性もある。

米国ではニューヨーク州、ペンシルベニア州、ウェストバージニア州などで水源周辺など特定区域における水圧破砕法の使用を禁止または凍結する自治体が増加。テキサス州などは水圧破砕法で使用する化学物質の情報開示を義務付けた。

オバマ米大統領は24日の一般教書演説で、シェールガスの「安全な開発」に向け、あらゆる可能な対策を講じると表明。公有地で水圧破砕法を使用する場合、化学物質の情報開示を義務付ける方針を示した。

より厳しい規制に動いたのがフランスとブルガリア。フランスでは昨年7月、水圧破砕法による石油やガスの探査・採掘を禁止する法案が成立。同国内で採掘は事実上不可能になった。仏政府は当初、開発に積極的だったが、環境汚染や地球温暖化を懸念する住民らの抗議活動が活発化。大統領選挙を控え、サルコジ大統領が世論に配慮したとみられている。

ブルガリアでも今月18日、議会で水圧破砕法によるシェールガス探査・採掘を禁じる決議案が可決された。環境汚染などに対する懸念から、各地でデモが発生。政府は17日にシェブロンへの許可も取り消した。

2012/01/19

ブルガリア議会、水圧破砕法による石油・ガス開発禁止法案を可決

ブルガリア議会は18日、水圧破砕(はさい)法を利用したシェール(油分を含む頁岩)からの石油と天然ガスの抽出を全面的に禁止する法案を可決した。地元のソフィア通信社(電子版)が伝えた。天然ガス採取を目的とした水圧破砕は、地震の発生や地下水の汚染につながるといった批判が高まっていた。

同法案では、水圧破砕法の利用禁止に加え、ブルガリアの領土・領海内のシェールだけに限らず、石炭やオイルサンド(油砂)、オイルシェール(油母頁岩)からの天然ガスと石油の抽出も禁止するとしている。

また、現在、すでに水圧破砕法を使って探鉱や生産を行っている石油・ガス開発事業者は直ちに操業を停止することも盛り込まれており、すでに許可を受けている事業者は3カ月以内に水圧破砕法とは別の資源開発手法の提出が求められる。期限内に代替案を示すことができなければ許可が取り消される。同法に違反した場合には10万ブルガリア・レフ(約500万円)の罰金と設備の没収も規定されている。

ブルガリア政府は昨年6月、米石油会社シェブロンに対し、北東部ドブルジャ地方での試掘を認めた。ロシア産ガスへのほぼ全面的な依存度を改めるため、シェールガス開発で資源自給率を高める狙いがあった。だが、環境問題への懸念から各地で反対デモが発生。政府は今月17日、シェブロンへの採掘許可を取り消していた。

The prohibition of hydraulic

fracturing by Law No.2011-835

On July 13, 2011, France enacted Law No.

2011-835 aimed at prohibiting the exploration and exploitation of liquid

or gas hydrocarbon mines using hydraulic fracturing and repealing exclusive

exploration permits including projects involving such technique (the

"Law"). This Law was initiated by a bill that had been submitted to the

Parliament by the majority party.

According to Article 1 of the Law, the

exploration and exploitation activities using the hydraulic fracturing

technique are now prohibited. This prohibition is grounded on the 2004

Environmental Charter ("Charte de l'environnement") and on the

principle of preventive and corrective action set forth by Article L.110-1

of the Environment Code.

Law does not prohibit Shale Gas

exploration itself but only the technique of hydraulic fracturing. As a

consequence, the Law leaves the door open to the development of alternative

techniques by petroleum companies allowing them to be granted Shale Gas

exploration or exploitation permits.

Three exploration permits, which had been

granted to US company Schuepbach in Nant (Aveyron) and Villeneuve-de-Berg (Ardèche)

and to French company Total in Montélimar (Drôme), were repealed on October

3, 2011.

April 16, 2012 ExxonMobil

Rosneft and ExxonMobil Announce Progress in Strategic Cooperation

Agreement

Joint ventures being created to explore in Russian Black Sea and Kara

Sea; initial planning and exploration steps taken at the license areas in

those waters;

Rosneft subsidiaries take equity in promising exploration and development

projects in the United States and Canada

Russian government's new tax approach strengthens incentives for offshore

operations

Rosneft and ExxonMobil today signed agreements to implement

a long-term Strategic Cooperation Agreement concluded in August 2011

to jointly explore for and develop oil and natural gas in Russia and to share

technology and expertise.

The agreements were signed by Rosneft President Eduard Khudainatov; Rex W.

Tillerson, chairman and chief executive officer of Exxon Mobil Corporation;

Stephen M. Greenlee, president of ExxonMobil Exploration Company; and Neil W.

Duffin, president of ExxonMobil Development Company, in the presence of Russian

Prime Minister Vladimir Putin and Deputy Prime Minister Igor Sechin.

The agreements signed today form joint ventures to manage an exploration program

in the Kara Sea and Black Sea. They also set the terms for investments to be

made by the partners in Russian offshore projects. The initial cost of

preliminary exploration is estimated at over US $3.2

billion.

Neftegaz Holding America Limited, an independent indirect subsidiary of Rosneft

registered in Delaware, concluded separate agreements on the acquisition of a

30 percent equity in ExxonMobil's share in the La Escalera

Ranch project in the Delaware Basin in West Texas in the United States.

Neftegaz Holding America Limited will also be given the right to acquire

a 30 percent interest in 20 blocks held by ExxonMobil in

the U.S. Gulf of Mexico, one of the most oil and gas rich basins in the

world. The ExxonMobil blocks are located in prospective areas of the Western

part of the Gulf.

In addition, RN Cardium Oil Inc., an independent Rosneft subsidiary, acquired

30 percent of ExxonMobil's stake in the Harmattan acreage

in the Cardium formation of the Western Canada Basin in Alberta, Canada.

The Cardium formation is an active unconventional oil play in which ExxonMobil

has a significant acreage position. The execution of that project may become a

source for the development of technologies for unconventional reservoirs in

Russia.

Commenting on the agreements, Eduard Khudainatov said: “Today Rosneft and

ExxonMobil enter offshore projects of unprecedented scale in the Russian Arctic

and Black Sea regions, which are home to the world's largest hydrocarbon

resources base. In so doing we lay the foundation for long-term growth of the

Russian oil and gas industry. I am certain that 15 years of Rosneft and

ExxonMobil partnership, as well as the use of the latest environmentally safe

technologies and unique experience will allow Rosneft to become one of the

global leaders in the oil and gas industry.”

Rex Tillerson said the agreements are a critical step forward in strategic

cooperation.

“These agreements are important milestones in this strategic relationship,” said

Tillerson. “Our focus now will move to technical planning and execution of safe

and environmentally responsible exploration activities with the goal of

developing significant new energy supplies to meet growing global demand.”

Eduard Khudainatov and Rex Tillerson said they were encouraged to proceed with

these projects by the Russian government's efforts to reform taxation of the

high-potential oil industry sectors and improve investment conditions for

foreign and Russian oil companies.

As part of implementation of the Strategic Cooperation Agreement, exploration

activity began in the Tuapse license Block in the Black

Sea in Russia in September 2011. The seismic program is now 70 percent

complete. Interpretation of data collected will be carried out following program

completion, which is scheduled for the second quarter of 2012. Drilling of the

first exploration well is planned for 2014-2015.

In the Kara Sea, plans are under way to undertake seismic and environmental

programs of East Prinovozemelsky blocks later this year in anticipation of a

potential exploration well in 2014.

Rosneft and ExxonMobil have also signed an agreement to

jointly develop tight oil production technologies in Western Siberia.

This will enable the companies to later discuss undertaking joint projects to

explore and develop prospective areas with unconventional oil potential in

Russia.

A program of technical and management staff exchanges

has been agreed to by the companies and their affiliates including

positions in geology, geoscience, field development, well drilling, finance,

logistics, safety, health and the environment. The knowledge and experience

exchange will not only strengthen relationships between the two companies and

their affiliates but also provide career development opportunities.

The Arctic Research and Design Center for Offshore

Developments will provide a full range of research and design services to

support the development of offshore fields. The main roles of the center include

supporting all stages of oil and gas field development on the Arctic shelf and

helping ensure projects are environmentally safe, including through the

provision of technical support in environmental monitoring. The center will also

support offshore safety. A special Offshore Accident and Emergency Warning and

Prevention Service will be created to help prevent and respond immediately to

any emergencies or accidents.

Rosneft and ExxonMobil will provide an update on their Strategic Cooperation

Agreement in a presentation to investment analysts on Wednesday, April 18, 2012

at 8:30 a.m. CT. A webcast of the presentation will be available in English and

Russian at www.exxonmobil.com.

2012/4/17 日本経済新聞

米エクソンと露国営石油、北極海・黒海開発で合弁

ロシア石油最大手の国営ロスネフチと米石油最大手エクソンモービルは16日、北極海と黒海の大陸棚でそれぞれ資源開発を進める合弁2社を設立する合意文書に署名した。米ロを代表する資源企業が手を組み、石油と天然ガスを豊富に埋蔵する大陸棚開発を主導する形となる。ロシアのセチン副首相は同日、投資総額が2550億ドル(約20兆円)を超える巨大事業になるとの見通しを示した。

北極海のカラ海と黒海の資源開発に当たる合弁2社への出資比率はロスネフチが66.7%、エクソンが33.3%になる。16日にモスクワ郊外で開いた調印式には、ロシアのプーチン首相も出席。エクソンのティラーソン最高経営責任者(CEO)と会談して「プロジェクトが巨大なものになると期待し、確信している」と表明した。

セチン副首相は16日、カラ海の可採埋蔵量が原油49億トン、天然ガスが8兆3000億立方メートルに達し、ロシアの年間原油生産量の約5億トンを大きく超える規模になる可能性を指摘した。投資額はカラ海が2000億~3000億ドル、黒海が550億ドルに達するとの事前評価を公表。

2015年に試掘を始めると述べた。

両社は11年8月末、ロシアの大陸棚での石油・天然ガスの探査・開発に32億ドルを投じる合弁事業をはじめ幅広く業務提携することで合意。計画の詳細を詰めていた。

ロスネフチは16日、エクソンが保有する米テキサスやメキシコ湾、カナダの鉱区の権益の一部を獲得することでも合意。西シベリアで石油を生産する技術を共同開発する文書にも調印した。ロシアの北極海の資源開発に参画したいエクソンと、欧米メジャーの高い技術力を利用したいロスネフチの思惑が一致している。

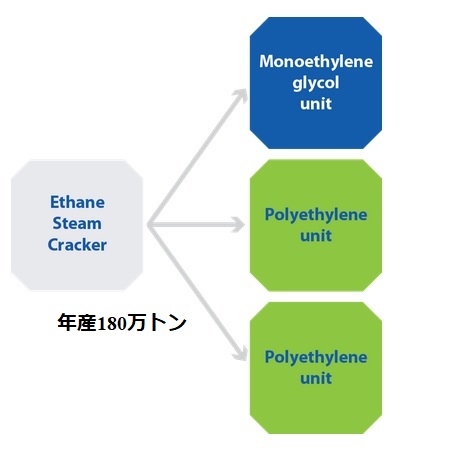

2012/5/31 Reuters

Exxon Mobil plans major new U.S. chemical plant

Exxon Mobil Corp , the world's largest publicly traded energy company, plans

to build a multi-billion dollar chemical plant in Texas

to take advantage of cheap North American shale gas,

according to a U.S. environmental filing seen by Reuters.

The plant, which could be online as soon as 2016, would sharply crank up Exxon

Mobil's chemical production capacity and help it compete more effectively with

rival Dow Chemical Co , the largest U.S. chemical maker.

Exxon Mobil has been North America's largest natural gas

producer since its 2010 purchase of XTO Energy Inc.

By using its own natural gas in chemical production

- something Dow is not able to do because it does not drill - Exxon Mobil

further slashes its costs.

ExxonMobil は2009年12月21日、XTO Energyを410億ドルで買収すると発表した。

XTOは米国のみで操業する非在来型天然ガス生産大手で、シェールガス、タイトガス、コールベッド・メタン、シェールオイルなど、合計換算

45兆立方フィートのガス資源を有しており、Barnett, Fayetteville, Haynesville,

Marcellusなど主要シェールガスの全てで開発を行っている。

今回の取引完了後、ExxonMobil は、非在来型資源のグローバルな開発と生産を管理する新たな上流部門組織を設立する。

ExxonMobilの最大の狙いはシェールガス開発技術の適用ノウハウ(人的資源)の獲得とされる。これらのノウハウは、非在来型ガスのみならず、世界の在来型及び非在来型石油に適用可能。

ExxonMobil

のCEOは1月20日、米議会で証言し、XTO買収がシェールからの天然ガス生産拡大につながり、環境に害を与えることなく米経済を押し上げるとの見通しを示した。

参考 石油天然ガス・金属鉱物資源機構

資料

The company had said as recently as last year it had no plans to expand

chemical production in the United States. However,

decades-low natural gas prices proved too much too resist.

Its decision to build the new plant also comes after a recent announcements by

Dow, as well as Royal Dutch Shell Plc , LyondellBasell and others to expand

their own U.S. chemical production.

U.S. natural gas prices have dropped more than 20 percent so far this year.

Chemical industry trade groups expect prices to remain low for years due in part

to ramped up production from the shale reserves.

That gives U.S. producers a large cost advantage over European and Asian rivals,

many of whom have to use crude oil-derived naphtha to make chemicals.

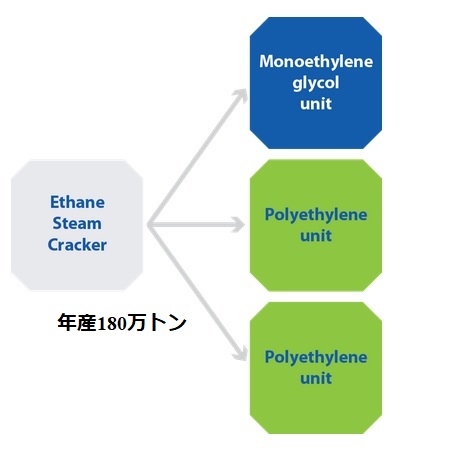

Exxon Mobil's plant, if approved, will be built at the company's

Baytown complex and is expected to produce

1.5 million tons annually of ethylene, a key

material in plastics production.

The ethylene will be piped to the company's nearby Mont

Belvieu complex, where it will be used in two

planned polyethylene production facilities, each

expected to have an annual capacity of 650,000 tons per year.

Polyethylene is commonly used to make packaging and upholstery.

The expansion should create 10,000 construction jobs and boost Exxon Mobil's

permanent work force in Baytown, Texas, by 350 to 6,850, the company said.

More than $90 million per year in additional tax revenue and 3,700 extra jobs

will be created in the local community, Exxon Mobil estimates.

Construction should begin by next March, according to the filing.

Exxon Mobil filed with the U.S. Environmental Protection Agency and Texas

officials earlier this month. It expects regulatory approval within the year.

October 17, 2012

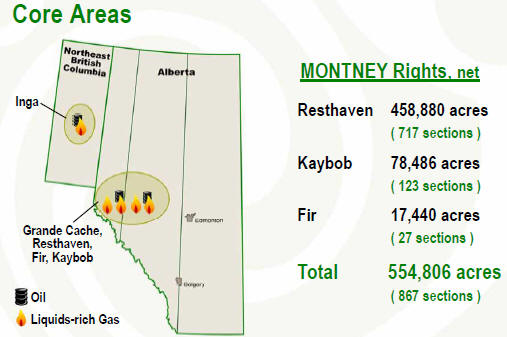

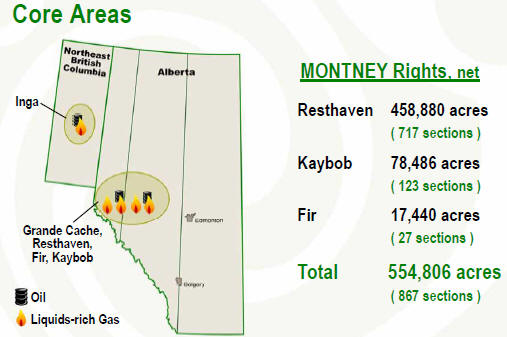

ExxonMobil Canada Acquires Celtic Exploration Ltd., Including Liquids-Rich

Montney Shale Acreage

Agreement includes

649,000 net acres in the Montney and Duvernay shales in Alberta

ExxonMobil Canada today announced an agreement with Celtic

Exploration Ltd. under which an ExxonMobil Canada affiliate will acquire

Celtic.

Under the terms of the agreement, ExxonMobil Canada will acquire 545,000 net

acres in the liquids-rich Montney shale, 104,000

net acres in the Duvernay(Kaybob) shale and

additional acreage in other areas of Alberta.

Current production of the acreage to be acquired is 72

million cubic feet per day of natural gas and 4,000 barrels per day of crude,

condensate and natural gas liquids. The assets were estimated by

Calgary-based Celtic Exploration at December 31, 2011 to include an estimated

128 million oil equivalent barrels of proved plus probable reserves, of which 24

percent are crude, condensate and natural gas liquids and 76 percent natural

gas.

Approximately 60 employees at Celtic Exploration will be given the

opportunity to transition to ExxonMobil employment.

Shareholders of Celtic Exploration will receive C$24.50 per share and half a

share of a newly established company which will hold assets not included in the

agreement with ExxonMobil Canada. These assets include acreage in the Inga area

in British Columbia, the Grande Cache area in Alberta and interests in oil and

gas properties located in Karr, Alberta.

Canadian affiliates of ExxonMobil and Celtic have entered into an

agreement for the purchase by a subsidiary of ExxonMobil Canada of all of

Celtic's outstanding common shares at a cash price of C$24.50 per share.

Additionally, Celtic shareholders will receive 0.5 of a share of a new

company, 1705972 Alberta Ltd. (“Spinco”), for each Celtic common share.

Including the amount to be paid for Celtic's outstanding convertible

debentures and including Celtic's bank debt and working capital obligations,

the transaction is valued at approximately C$3.1 billion (excluding the

estimated value of Spinco shares). The transaction is to be completed by way

of an arrangement under the Business Corporations Act (Alberta).

The agreement is subject to approval by Celtic Exploration's shareholders

and Canadian regulatory authorities.

“This acquisition will add significant liquids-rich

resources to our existing North American unconventional portfolio,” said

Andrew Barry, president of ExxonMobil Canada. “Our financial and technical

strength will enable us to maximize resource value by leveraging the experience

of ExxonMobil subsidiary XTO Energy, a leading U.S.

oil and natural gas producer which has expertise in developing tight gas, shale

oil and gas and coal bed methane.”