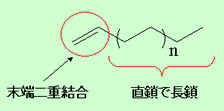

アルファオレフィン(α-olefine)

オレフィン系炭化水素のうち二重結合がαの位置(一番端の炭素と次の炭素の間)にあるものの総称。炭素数に応じて合成洗剤、界面活性剤等に使用される。また可塑剤や洗剤に使用される高級アルコールの原料となる。エチレンを重合して製造する。炭素数によって気体、液体、固体となる。

LAO

2003/5/7 BP

BP Strengthens Asian PTA Presence

BP announced today that it has increased its interests in its

Taiwanese and Korean PTA joint ventures. BP now owns 59.02 per

cent of China American Petrochemical Company (CAPCO) in Taiwan

and 47.41 per cent of Samsung Petrochemical Company (SPC) in

Korea. As a result of the two deals, BP's equity PTA capacity in

Asia has increased by 14 per cent to around three million tonnes

a year.

Steve Welch, BP group vice-president, petrochemicals, said:

"PTA is one of BP's core petrochemical products. These

acquisitions significantly reinforce our PTA business in the

important fast-growing Asian market."

Sue Rataj, Business Unit Leader, PTA Asia, added: "These

acquisitions underscore BP's commitment to our PTA business in

Asia and in particular to SPC and CAPCO. These companies were two

of the first PTA producers in Asia and are among the largest PTA

producers in the world. CAPCO and SPC run first class operations.

We look forward to an exciting future and closer connections with

the two companies."

CAPCO is the largest producer of PTA in Asia

operating six production units with a total capacity of 2.1

million tonnes per annum. BP acquired the incremental 9.02 per

cent interest in CAPCO from Central Investment Holding Company

(CIHC). As a result, BP now controls 59.02 per cent of the equity

in CAPCO while Chinese Petroleum Corporation and CIHC retain

25.00 per cent and 15.98 per cent respectively.

SPC is the third largest

producer of PTA in Asia operating four PTA units in Korea to

produce a total of 1.4 million tonnes per annum. BP and SPC

recently completed a number of transactions with minority

shareholders of SPC increasing BP's ownership of SPC from 35 per

cent to 47.41 per cent. BP's ownership of SPC is now equal with

Samsung's.

Financial details of the transactions were not disclosed.

Notes to editors:

PTA is a key feedstock for the production of polyester. The main

uses for polyester include clothing, textiles, home furnishings,

industrial applications, PET bottles and food packaging.

CAPCO was formed in 1975 as a joint venture between Amoco (50 per

cent), CPC (25 per cent) and CIHC (25 per cent). The company has

two production sites at Kaohsiung and Taichung in Taiwan.

SPC was formed in 1974 as a joint venture between Samsung (50 per

cent), Amoco (35 per cent) and Mitsui Chemicals, Inc. (15 per

cent). Samsung's interest was held by a number of its

subsidiaries and two of these (Shinsegae and CJ Corporation)

became independent of Samsung in the early 1990s. SPC has two

production sites at Ulsan and Seosan in Korea.

BP is a world leader in the

production of PTA, with worldwide production capacity of almost

seven million tonnes a year. BP produces PTA in wholly owned

plants in the United States, Belgium and Malaysia, and through

joint ventures in China, Korea, Indonesia, Taiwan, and Brazil.

Production recently started from two new PTA units in Asia. In

January, BP Zhuhai successfully commissioned a 350,000 tonnes a

year unit in southern China. In April, CAPCO started producing

from its new 700,000 tonnes a year unit in Taiwan.

2004/2/12 BP

BP Licenses Innovene Technology For Sasol Polymers Polypropylene

Expansion

BP and Sasol Polymers have signed an agreement to license BP's

Innovene polypropylene process technology for the expansion of

Sasol's polypropylene facilities located in Secunda, Republic of

South Africa. The new plant will have an annual capacity of 300,000

tonnes,

produce homopolymers, random copolymers and impact copolymers,

and start up in 2006. Sasol will use BP's proprietary high

activity CD catalyst to realize the full benefits of the

technology.

"We are very pleased that Sasol Polymers elected to use

Innovene technology to expand its well-established polypropylene

business," said Gerald Maret, Licensing Area Commercial

Manager for BP. "The Innovene gas phase technology has shown

distinct advantages over others in terms of low capital cost,

operating costs and product capabilities. The horizontal plug

flow reactor configuration is a key element of the system,

providing rapid product transitions and contributing to a high

degree of product quality and consistency."

Execution of the Sasol license concludes a very active year for

BP's polyolefins licensing business with successful plant

start-ups in the People's Republic of China, the Czech Republic

and the Netherlands.

Since 1996, BP has licensed about 2.2 million tonnes of annual

Innovene polypropylene capacity of which 670,000 tonnes are now

under construction.

Notes to editors:

Sasol, with a market capitalization of approximately USD 9

billion, is an integrated oil and gas group with substantial

chemical interests. Based in South Africa and operating in 15

other countries throughout the world, Sasol is the leading

provider of liquid fuels in South Africa and a major

international producer of chemicals, using a world leading

technology for the commercial production of synthetic fuels and

chemicals from low-grade coal. In the future Sasol expects to

apply this technology to convert natural gas to diesel and

chemicals. Sasol manufactures over 200 fuel and chemical products

that are sold in more than 90 countries and also operates coal

mines to provide feedstock for synthetic fuels and chemical

plants. The company also manufactures and markets synthesis gas

and operates the only inland crude oil refinery in South Africa.

BP is one of the largest integrated oil companies in the world,

operating in 100 countries, on six continents. It is the second

largest polypropylene producer in the world, having an annual

capacity in excess of 3 million tonnes. BP has extensive research

capabilities in the United States, France, Belgium and the United

Kingdom.

BP Plans To Sell

Over 50% Of Petrochemicals Business And Prepares For IPO

BP announced today that it plans to consolidate the Olefins and

Derivatives (O&D) division of its petrochemicals business

into a stand-alone entity able to operate separately from the BP

Group.

The new O&D business will incorporate more than half of the

$13 billion of operating capital employed in BP’s petrochemicals portfolio, giving it the

scale to be a major independent player in the global

petrochemicals sector.

It will be headed by Ralph Alexander, who was today named as

chief executive of BP’s petrochemicals business

with effect from July 1, 2004.

BP said it plans to sell O&D in due course, possibly through

an Initial Public Offering, depending on market circumstances and

necessary approvals, in the second half of 2005.

The Group intends to retain the balance of its petrochemicals

portfolio, comprising the aromatics and acetyls businesses. BP

views these as “advantaged products” where BP has leading proprietary

technology and strong positions in growing Asian markets.

Lord Browne spelt out BP’s determination to tackle

the continuing poor returns of its petrochemicals segment overall

at a strategy presentation to investors in London and New York

last month.

He said future investment would focus more on paraxylene, PTA and

acetic acid, and less on olefins and derivatives which form the

bulk of BP’s petrochemical operations

in Europe.

"We have now concluded that divesting O&D ? perhaps by

means of an IPO, subject to market conditions and any necessary

consents ? is likely to deliver the best returns to our

shareholders and to be in the best long-term interests of the

O&D business itself,” Browne said today.

Current chief executive of BP Petrochemicals, Iain Conn, said: “Our O&D sub-segment is one of the

highest-quality portfolios of its kind in the petrochemicals

industry. It has a global network of manufacturing sites, good

technology, a fine range of products and strong market positions.

As a free-standing entity it will be a significant competitor in

its sector.”

Notes to

editors

At a strategy presentation on March 29, 2004, Lord Browne said

future investment would focus more on so-called “advantaged products”, including paraxylene, PTA and acetyls

which were strong in growing Asian markets and where BP has a

proprietary technological lead, and less on olefins and

derivatives which dominated the company’s portfolio in the more fragmented and

lower-growth European markets.

The O&D business employs approximately 7,500 people in 24

locations worldwide, chiefly the US and Europe. Major

petrochemicals sites include Grangemouth in Scotland, Lavera in

France, Koln and Gelsenkirchen in Germany, and Lima, Chocolate

Bayou and Green Lake in the US and the SECCO joint venture in

China.

BP recently announced the intended sale of its Fabrics &

Fibres and its Linear & Poly Alpha Olefins businesses. The

intention to sell these businesses remains unaffected by this

announcement, but BP will consider whether or not to include the

sale of the Linear & Poly Alpha Olefins businesses in the

planned IPO of O&D.

BP’s products are used to make a wide variety

of plastic goods, including food and drink containers and

wrappings, pipework, automotive parts and mouldings of all kinds.

Current worldwide production capacity of O&D plants is some

20 million tonnes per year of a BP Petrochemicals total of 34.5

million tonnes.

O&D products include olefins (ethylene and propylene) and

their derivatives such as acrylonitrile, polyethylene,

polypropylene and solvents.

Iain Conn will become a Group Executive Officer of BP with effect

from July 1, 2004 and assume Dick Olver’s portfolio of responsibilities, with the

exception of the Western Hemisphere.

Platts 2004/11/16

BP chemicals spin-off to include

Grangemouth, Lavera refineries

BP plans to include two of its

European refineries in a new petrochemicals

business being spun off

from the main group, the company said Tuesday. The new unit

comprising BP's olefins and derivatives businesses is due to be

sold, possibly through an initial public offering, in the second

half of 2005.

The company has now decided to

include its refineries at Grangemouth in Scotland and Lavera in

southern France in the new venture. The two refineries have a

combined refining capacity of 425,000 b/d of crude, and produce

some 2.2-mil mt/yr of chemical feedstock, BP said. Both

refineries are closely integrated with neighboring chemicals

plants. "These two complexes are highly efficient

manufacturing sites and are already integrated with their

neighbouring petrochemicals plant. This gives us access to and

security of feedstock supply and integration benefits for two

major assets in the new company," CEO of the proposed

olefins and derivatives entity Ralph Alexander said.

Petro Chemical News 2004/4/15 (Vol. 42, No. 14)

BP Plans Sale of

LAO/PAO Business Under New 'Twin-Track' Strategy

http://www.petrochemical-news.com/P-V42N14.pdf

BP last week

announced its intention to sell its linear alpha olefins (LAO)

and polyalphaolefins (PAO) business under a new twin-track strategy for its petrochemicals

sector.

Under this strategy, explained BP, the company will now approach aromatics and acetyls

differently from olefins and derivatives (O&D), and will reduce total

annual organic capital expenditures to about $750-million in 2006

from the current level of approximately $1-billion.

Discretionary spending will target the 'Advantaged' purified

terephthalic acid (PTA), paraxylene and acetyls product lines,

'with a bias' to the Asian markets. BP said the exceptions will

be the completion of the 900,000-t/y Secco ethylene cracker

project in China and the ongoing ethylene capacity expansion at

Chocolate Bayou, Texas.

BP, noting that the "Pressure on returns is particularly

strong in the O&D business," said it will look at all

options for performance improvements in that area. Assets that it

believes have a more natural fit with other industry players will

be offered for sale. BP also disclosed plans to sell its Fabrics

and Fibers Division.

"These two management approaches recognize the differing

strategic and performance agendas for the two parts of our

portfolio," stated Iain Conn, petrochemicals chief

executive. A twin-track approach reflects growing demand in China

and BP's existing strong position in PTA and acetyls, compared to

the more fragmented nature and lower growth in the European

marketplace where O&D dominates BP's portfolio.

O&D has enjoyed significant investment in recent years and

performs well in its sector, but nonetheless, Conn added, it

needs to improve its performance relative to the rest of the BP

Group.

Worldwide, BP has almost 6-million t/y each of PTA and paraxylene

capacity and over 2-million t/y of acetic acid capacity.

The LAO and PAO business being sold has a total of 1.05-million

t/y of capacity with production facilities in the U.S., Canada

and Belgium.

BP's plan to consolidate olefins business 'no surprise': sources

BP plans

announced Tuesday to consolidate the olefins and derivatives

division of its petrochemicals business into a stand-alone

entity, came as no surprise to many of the Asian participants,

according to Platts polls on Wednesday.

One source close to the company said that murmurs of the move

have been heard a while back already. Apart from its recent joint

venture project with Sinopec in Shanghai, BP has assumed a

low-key presence in Asia over the last four years. In April 2003,

BP sold its share in Indonesia's PT Peni, one of its three joint

venture partners in Asia which includes Bataan Polyethylene Corp

and Polyethylene Malaysia. BP has been looking unsuccessfully in

selling its stake in BPC for three years now, another source

revealed. BP now intends to focus on the mid-stream petrochemical

products such as the aromatics and acetyls.

Meanwhile, market sources were concerned that BP's plan to sell

its O&D division in the second half of 2005 might not be able

to attract sufficient buying interest. The company said that the

divestment could be through an initial public offer. "A

buyer may be hard to find," one source claimed, due to the

general negative perception of the polymer business, given its

cyclical nature and the massive competition. A source close to

the company pointed out another consideration would be the

company's economic viability due to a lack of upward integration

in BP's feedstock system. At least 90% of BP's ethylene and

propylene crackers in Asia are fed by naphtha which is linked to

crude rather than gas; the latter tending to have a $200-300/mt

margin advantage over the former, the source added. The new

O&D business will be headed by Ralph Alexander, who was named

as chief executive of BP's petrochemicals business with effect

from Jul 1, 2004.

BP Steps Up

Investment In China

http://www.bp.com/genericarticle.do?categoryId=120&contentId=2018233

BP announced today that it has signed a number of agreements

covering investments totalling around $1 billion which will

deepen its presence in the growing Chinese energy market.

“China, as one of the most rapidly

expanding economies, offers significant opportunities for the BP

Group, particularly its customer-facing businesses,” said Lord Browne, BP chief executive. “We have already demonstrated the benefit

of combining our experience in operating world-class retail

service stations and our world-leading petrochemicals technology

with the local market knowledge of Chinese partners and we look

forward to expanding this through new projects in the future.”

Building on

the highly encouraging results from the BP and Sinopec acetic acid

joint venture in Chongqing where the capacity is already being

increased from 200,000 tonnes a year to 350,000 tonnes a year, BP today signed a heads

of agreement to build a 500,000 tonnes a year acetic acid plant in

Nanjing, Jiangsu province, through a 50/50 joint venture with

Sinopec. The

plant, which will incorporate BP’s Cativa technology, is

expected to come on stream by the end of 2006 and supply acetic

acid for use in such products as fibres, paint, adhesives,

pharmaceuticals and printing inks in eastern China.

The company also signed a letter of intent to examine the

viability of expanding production at the BP Zhuhai PTA plant from

350,000 tonnes a year to 1.2 million tonnes a year. The plant, which is

located at Zhuhai in the Pearl River Delta, is a joint venture

between BP (85 per cent) and the Fu Hua Group (15 per cent) and

came on stream in September 2003. Both petrochemical projects

fall within the ‘advantaged products’ portfolio which BP has said it intends to

develop further, focussing on China and growth markets in Asia.

BP’s two Chinese retail service station ventures also took a step forward

with the signing of the joint venture contracts and articles of

association for both the BP Sinopec Zhejiang Petroleum Company

Limited and the BP PetroChina Petroleum Company Limited. These

joint ventures will each acquire, build and operate 500 retail

service stations in the Zhejiang and Guangdong provinces

respectively by 2007. BP has an initial 40 per cent stake in the

BP Sinopec Zhejiang Petroleum Company and a 49 per cent holding

in the BP PetroChina Petroleum Company.

In a separate move, BP also announced that it has agreed to be a

partner in a hydrogen

vehicle demonstration project being established by the Chinese Ministry

of Science and Technology. Drawing on the experience it has

gained through participating in similar hydrogen projects around

the world, BP will design, construct, operate and supply hydrogen

refuelling facilities for the project which will see hydrogen

powered vehicles operating in Beijing and Shanghai.

The Ministry of Science and Technology, which is developing and

co-funding the project together with the United Nations

Development Programme and the National hydrogen programme, is

still in the process of finalising details with other potential

project partners but it is envisaged that it will become

operational in mid 2005.

Notes to Editors:

| ・ | BP has been operating in China since the early 1970s and has invested over $3 billion in commercial projects. Its activities in China include production and import of natural gas, supply of aviation fuel, import and marketing of LPG, fuels retailing, lubricants blending and sales, and petrochemical manufacturing |

| ・ | BP employs over 3,000 staff in China, either directly or through joint ventures. |

| ・ | BP’s biggest single equity investment in China is the SECCO (50/50 joint venture with Sinopec) $2.7 billion integrated petrochemical complex under construction outside Shanghai which is expected on stream in 2005. The complex will have a capacity of around 2.3 mtpa of various products. BP is committed to continuing this development which will form part of a new olefins and derivatives petrochemicals entity. |

| ・ | BP’s Gas, Power and Renewables business is a 30 per cent partner in the development of the Guangdong LNG import terminal and associated pipelines. BP also has a contract to supply China’s second LNG import terminal at Fujian. |

| ・ | BP is the biggest importer of LPG into China and has a number of storage, bottling and marketing operations. |

| ・ | Air BP is the only foreign company participating in China’s aviation fuels business, supplying fuel at Shenzhen airport and 16 airports across south and central China. |

| ・ | BP also has a 40 per cent holding in the recently commission Nansha oil terminal in Guangdong. The terminal has over 360,000 cubic metres of storage space for oil and chemical products and a 80,000 dwt jetty. |

BP Announces

Phased Exit from Two Manufacturing Plants at Hull, U.K.

http://www.bp.com/genericarticle.do?categoryId=120&contentId=7002580

BP today

announced a phased exit from its DF2 and DF3 acids and acetone

manufacturing operations at Saltend, Hull, and with it a phased withdrawal from its formic

acidギ酸 , propionic acidプロピオン酸 and acetone businesses, leading to a reduction in

its European acetic acid production capacity.

Production on the DF3 unit will cease at the end of April 2005

and on the DF2 unit late 2006/early 2007. A total of

approximately 190 job losses are expected as a result of this

announcement though the company hopes that the majority will be

through voluntary redundancy and redeployment.

Over the past 5 years BP has invested over £300m at Hull. All the remaining plants are

of world-scale and utilise state of the art technology. The

closure of the DF plants will improve the overall competitiveness

of the Hull site, which will remain the second largest Acetyls

manufacturing site in the world and the largest in Europe.

Making the announcement today, Hull’s Works General Manager,

Gareth James, said, “It is with regret that I

have to announce the phased closure of the DF plants at Hull. A

review of our business has made it clear that it is not viable to

continue to operate these assets. Unfortunately, this will mean

that the number of BP jobs at Hull will be reduced but we will

seek to limit the effects of this through voluntary early

retirement and redeployment throughout the rest of the BP Group.

“For those who need to seek work outside

BP, we will be providing a comprehensive career guidance facility

and providing help to retrain and re-skill each individual. BP

will also be contributing £500,000 to the Sirius

Enterprise Agency to support the creation of new businesses and

jobs in the local area.”

Murli Nathan,

Performance Unit Leader for the European Acetyls business,

confirmed that the decision to close is due to an increasing lack

of competitiveness. He added, “high feedstock prices,

which are linked to the oil price, coupled with the conversion

costs on these assets mean that they are no longer economically

viable to operate”.

Gareth James continued “The DF plants have been an

important part of the Hull site for more than 30 years. However,

they utilise a previous generation process technology which

cannot compete against latest generation methanol carbonylation

acetic acid production technology. BP will continue to produce

acetic acid, acetic anhydride, vinyl acetate and ethyl acetate at

its Hull site.”

Saltend Site,

Hull:

Hull is part of the Aromatics and Acetyls business which in turn

is part of the Refining and Marketing segment of the BP Group.

Acetyls is a global business with operations in Europe (Hull),

USA, Korea, Malaysia, Taiwan and China.

The DF2 and DF3 plants were commissioned in 1967 and 1972

respectively. They

use naphtha as a feedstock to produce acetic acid, formic acid,

propionic acid and acetone. The propionic acid, formic acid and

acetone businesses will be exited. BP is committed to ensuring

continuity of supply to its customers until the final closure

date. Acetic

acid will continue to be produced on other manufacturing assets on the site.

The combined output from DF2 and DF3 is approximately

380,000te/yr of product.

The remaining businesses of acetic acid, acetic anhydride, ethyl

acetate and vinyl acetate have a combined production capability

of in excess of 1 million tonnes/yr. Hull remains one of the

largest sites of its kind in the world.

There are currently approximately 800 BP employees and 300

contract staff on the site.

Following a restructuring of the site in 1999 the Saltend

Community Development Company Ltd, trading as Sirius, was formed

to support the economy and community around the manufacturing

site. The aim of the enterprise is to encourage new enterprises

starting in the area, create local jobs, develop young people and

support training and education in small and medium local

companies. To date Sirius has been successful in creating 550

jobs in the area since its creation. Following this announcement £500,000 will be committed to further

support the local community through Sirius.

Formic acid, propionic acid and acetone businesses:

Formic acid is widely used in treating and dyeing manmade fibres

and hides and is also used in farming to suppress salmonella.

Propionic acid is utilised in the production of herbicides,

perfumes, flavourings and food preservatives; it is also used to

protect stored grain against fungi.

Acetone is used in the production of plastic coatings,

pharmaceuticals and printing inks.

2004/11/30 BP

Grangemouth Grows Linear Low Density Polyethylene to Meet Rising

Demand

http://www.bp.com/genericarticle.do?categoryId=120&contentId=7002583

BP has introduced higher rate

production runs of linear low density polyethylene at

Grangemouth, Scotland, to meet growing market demand. This has

been possible due to the successful introduction of a new best-in-class

catalyst, NOVACAT® T, jointly developed between BP and NOVA

Chemicals.

It is particularly suited for producing BP’s range of linear low density blown and

cast polyethylene film grades.

The Innovene 4 production unit uses proprietary BP Innovene® gas phase technology and has achieved daily and monthly

production records throughout this year. Sales in 2004 from this

unit are expected to be around 10% up on 2003, with further

growth expected in 2005.

“Our customers have really

appreciated the full availability of BP’s hexene-based linear low density

polyethylene products for

both blown and cast applications, in line with their requirements

to produce films with enhanced strength, optical performance and

consistency,” said Carlino

Volpone, PE Sales Manager.

Notes to Editors:

Linear low density polyethylene (LLDPE) is used widely in

producing polyethylene film, a tremendously versatile material,

used extensively in packaging, building and agriculture. BP’s polyethylene grades allow films to be

produced with combinations of strength, transparency, gloss,

sealing, barrier and surface properties optimised for different

applications. (See “products”

and “polymers” website at

http://www.bppetrochemicals.com)

BP announced its Ziegler-Natta catalyst collaboration with NOVA

Chemicals in 2001 and extended this collaboration to Metallocene

and single site catalysts in 2002.

BP has licenced BP Innovene PE technology to 25 licensees in 15

countries.

BP’s gas phase Innovene

plant at

Granegmouth has a capacity of 320,000 tonnes per year which

produces hexene-based LLDPE.

BP has a second European plant using gas phase BP Innovene

technology of 220,000

tonnes capacity, located at Koln, Germany which produces

butene-based LLDPE.

Last month, BP and NOVA Chemicals announced plans to form a European styrene polymers joint venture starting in 2005.

BP to Close U.S. Linear Alpha

Olefin Production Capacity

http://www.bp.com/genericarticle.do?categoryId=120&contentId=7003032&PC=100e177441a00

BP announced today that it would

close its Linear Alpha Olefin (LAO) production facility in Pasadena, Texas, by the end of 2005. The company will

continue the manufacture of linear alpha olefins at its other two

facilities in Alberta, Canada and Feluy, Belgium.

Closure of the Pasadena site will reduce BP’s global linear alpha olefin capacity by 500,000 tonnes (1.1 billion pounds) per year.

According to George Tacquard, Senior Vice President of BP’s Global Derivatives business, the closure

is the result of an extensive review of the company’s global linear alpha olefins business and

prospects for the LAO industry.

“The LAO industry has faced

a very difficult environment for the past few years, with overcapacity, slow demand

growth, and high feedstock and energy costs. The Pasadena site is our oldest production

site, and the closure of these older assets will allow our LAO

business to focus resources on keeping our two newer sites at

Feluy and Joffre competitive,” Tacquard said.

BP’s worldwide production

capacity grew to 1.05 million tonnes (2.3 billion pounds) with

the startup of the Joffre, Alberta plant in 2001. Expansions by

BP and other producers during the last several years have added

over 450 thousand tonnes (1 billion pounds) of capacity,

resulting in an industry overcapacity.

“By taking this action, BP

will position the LAO business for a profitable future in our

portfolio, despite the continued challenging environment”

Tacquard added. “BP will continue to supply customers from

its Joffre and Feluy facilities”

The Pasadena site is the oldest of

BP’s three operating LAO

plants and dates back to the 1960s when it was originally built

to make linear alcohols for use primarily in detergents. In 2002

BP ceased production of linear alcohols at the Pasadena site.

BP also operates a polyalphaolefin (PAO) plant in Deer Park, near

the Pasadena site. Operations at this unit are not affected by

the closure of the LAO unit.

After the restructuring, BP will have an annual linear alpha

olefin production capability of 300,000 tonnes (660 million pounds) at

Feluy, Belgium and another 250,000 tonnes (550 million pounds) at

the Joffre, Alberta plant.

BP Petrochemicals is one of the world’s largest petrochemicals companies with

chemical production capacity of about 34.5 million tonnes (76

billion pounds).

Note to editors:

Linear alpha olefins find application in a wide variety of end

uses including comonomers for polyethylene, synthetic lubricants,

surfactant intermediates, base oil for synthetic drilling fluids

& lubricant additives.

アルファオレフィン(α-olefine)

オレフィン系炭化水素のうち二重結合がαの位置(一番端の炭素と次の炭素の間)にあるものの総称。炭素数に応じて合成洗剤、界面活性剤等に使用される。また可塑剤や洗剤に使用される高級アルコールの原料となる。エチレンを重合して製造する。炭素数によって気体、液体、固体となる。LAO

2005/3/21 BP

BP Announces New Identity for Petrochemicals Company

http://www.bp.com/genericarticle.do?categoryId=2012968&contentId=7004959&PC=102c9a208a400

BP announced today that the name

of its new olefins and derivatives subsidiary will be Innovene.

Innovene will be formed as a separate entity within the BP Group

in April, with more than $9 billion in assets and $15 billion in

third-party sales globally. The new company will be headquartered

in Chicago and have more than 8,500 employees at 26 principal

sites around the world.

“Innovene combines the best

in our BP heritage with the focus and discipline of being

independent. Our new name speaks to our aspiration to challenge

ourselves and the status quo in our sector,” said Ralph Alexander, CEO. “Like BP, we are a truly global company,

with major operations in Asia, North America and Europe.”

The choice of name for Innovene was

built upon interviews and research conducted among the company's

employees, customers and industry analysts worldwide.

Innovene will be among the five largest petrochemical companies

in the world and a Fortune 150-scale company, with global

production of more than 15 million tonnes of petrochemicals a

year.

Notes to editors:

Innovene's new company's logo can be downloaded from the link

below:

Innovene logo

Innovene will be created as a wholly owned subsidiary of BP on

April 1, 2005. BP expects to sell the company later in 2005,

possibly by way of an IPO, subject to necessary approvals and

market conditions.

Innovene's major manufacturing sites include Grangemouth in

Scotland, Lavera in France, Koln in Germany and Lima, Chocolate

Bayou and Green Lake in the US. SECCO, the joint venture with

Sinopec and SPC in Shanghai and the largest petrochemical complex

in China to date, is due to become fully operational in the next

few months.

Innovene manufacturers petrochemicals, including olefins

(ethylene and propylene) and their derivatives such as

polyethylene, polypropylene, acrylonitrile, linear alpha olefins,

polyalphaolefins, and solvents, as well as gasoline, diesel and

other refined products made in the Grangemouth and Lavera

refineries. These chemicals are used to make a wide variety of

plastic goods, including food and drink containers and wrappings,

pipe work, automotive parts and mouldings of all kinds.

May 19, 2005 Nova

BP and NOVA Chemicals sign binding agreements for European

Styrenics Joint Venture

New venture names two senior officers

http://www.novachemicals.com/08_news/NI_0505.html

BP and NOVA Chemicals

Corporation today announced they have signed binding agreements

to

merge their European styrenic polymers businesses into a 50:50

Joint Venture.

As previously announced in November 2004, the transaction to form

the Joint Venture will be cashless.

The Joint Venture will be named NOVA Innovene, after its shareholders NOVA

Chemicals and Innovene, BP's newly formed olefins and derivatives

business.

Also today, Innovene and NOVA Chemicals announced the nomination

of two senior managers to lead the Joint Venture.

Martin Pugh, currently Vice President and Managing Director for

NOVA Chemicals in Europe, will serve as Managing Director of NOVA

Innovene. Chris de la Camp, currently the Controller of the

Innovene Styrenics business, will be Finance Director of the new

Joint Venture.

NOVA Innovene plans to deliver market-leading styrenic polymers

to its customers and to become the most cost-effective producer

in the European market. Innovene and NOVA Chemicals expect to

commence operations of the Joint Venture, following regulatory

and other approvals, in the third quarter of 2005.

NOVA Chemicals produces commodity plastics and chemicals that are

essential to everyday life. Our employees develop and manufacture

materials for customers worldwide who produce consumer,

industrial and packaging products. NOVA Chemicals works with a

commitment to Responsible CareR to ensure effective health,

safety, security and environmental stewardship. Company shares

are traded on the Toronto and New York stock exchanges as NCX.

Visit NOVA Chemicals on the Internet at www.novachemicals.com.

BP separated its $15bn turnover olefins and derivatives business ・now called Innovene ・with effect from 1 April 2005

ready for a possible IPO in second half of 2005, subject to

market conditions and receipt of all necessary approvals. The

NOVA Innovene joint venture will form an important part of the

new company.

Shanghai Secco Olefins JV

to Stay with BP After Innovene Spin-Off

BP says its 50% stake in the Shanghai

Secco Petrochemical joint venture will remain with the BP group following the spin-off of BP's

Innovene olefins and derivatives business later this year. BP

originally intended to include the Secco stake with Innovene. The

decision leaves Innovene without a production base in China.

Secco recently began production at a $2.7-billion olefins and

derivatives complex at Caojing, near Shanghai. BP's partners in

the jv are Sinopec and Sinopec's Shanghai Petrochemical

affiliate. BP says it decided to keep the Secco stake because the

jv proved "contractually difficult to disengage from."

Secco also builds on BP's strong relationship with Sinopec, BP

says. That includes the Yaraco acetyls jv at Chongqing, China and an acetic acid jv

that is under construction at Nanjing, China. "The overall value

of Secco to BP shareholders is likely to be higher," BP

says. Secco is based on a 900,000-m.t./year ethylene plant and

produces acrylonitrile, aromatics, polyolefins, polystyrene, and

styrene. BP plans to float Innovene on the New York Stock

Exchange by the end of this year. Innovene has operated as a

stand-alone entity within the BP group since April 1. Meanwhile,

Innovene is planning a $2-billion ethylene and derivatives jv at

Al Jubail, Saudi Arabia that it says will sell mainly to Asian

markets.

Yahoo Finance September 2, 2005

India's Reliance may be

preparing to bid for BP unit Innovene - report

Reliance Industries Ltd is believed to be putting together the

finishing touches of a plan to bid for Innovene, the wholly-owned

subsidiary of BP PLC, the Economic Times reported, citing

industry sources.

In April 2004, BP announced plans to separate its olefins and

derivatives business into a separate company to enable a possible

sale through an IPO some time in the second half of this year.

That company, Innovene, was formally established in April this

year with about 15 bln usd in revenues and 9 bln in assets.

Though BP had committed to Innovene employees at the time of the

separation that it would list the company through an IPO

and not sell it to a strategic investor, the company may be keeping other

options also open, the newspaper cited industry sources as

saying.

But it is not known whether BP has begun a formal process to sell

a stake in the company, the report said.

Reliance officials could not be reached for comment, it said.

Reuters 2005/9/12

BP chemical unit Innovene sets $1 billion IPO

The main petrochemical subsidiary of oil giant BP Plc, Innovene

Inc., said late on Monday it was planning a U.S. initial public

offering (IPO)

to raise $1 billion.

BP, which said last year it would either sell or float the

business, did not say what percentage of Innovene it would sell.

Analysts had expected BP to float 20 to 30 percent of the

business, which has been valued at around $6-7 billion.

The IPO could see BP boost its cash returns to shareholders,

Citibank said in a research note on Tuesday.

The decision to go ahead with IPO plans may force

the hand of Reliance Industries Ltd.,-- a $24 billion listed Indian

petrochemicals firm which has been linked to a possible bid for

BP's olefins and derivatives arm.

The filing with the U.S. Securities and Exchange Commission also

follows Innovene's deal earlier this year to build a $2 billion plastics plant in

Saudi Arabia

in a move to orient the unit toward fast-growing Asian markets.

Under the memorandum of understanding signed with Saudi-owned

Delta International, Innovene will build a "cracker"

unit, which will convert natural gas into ethylene, the raw

material for plastic wrappings and containers.

Analysts have said the joint venture could make Innovene, which

is headquartered in Chicago, more attractive to investors.

Goldman Sachs & Co., Morgan Stanley, Lehman Brothers and UBS

Investment Bank are listed in the IPO prospectus as underwriters.

On Aug. 28, the Times of India said Reliance

Industries, flagship of the Ambani family's Reliance group and

India's largest company, may be close to launching a bid for an unnamed business that bore

a close resemblance to Innovene.

The newspaper said a bid could put Reliance among the world's top

five petrochemical companies, from 10th now.

"Speculation is rife that (chairman Mukesh Ambani) is close

to launching a bid for a $15 billion North America-based company

which in turn is a wholly-owned subsidiary of one of the world's

biggest multinational giants with a name that is synonymous with

petroleum," the newspaper said.

BP was formerly known as British Petroleum.

V.K. Sharma, director of research at Anagram Stock Broking Ltd.

in Ahmedabad, India, said Reliance was on the lookout for an

acquisition and that it was capable of raising enough money to

buy out a company of Innovene's size.

"If Reliance is serious about Innovene, then they should be

moving in quickly. If you wait for the company to get listed then

it would bring about a lot more legal formalities and even

valuations could go higher," Sharma said.

In its statement on Monday, Innovene said it plans to list its

common stock on the New York Stock Exchange under the symbol INV.

It had revenue of $11.1 billion in the first six months of 2005,

compared with $7.8 billion in the same period last year,

according to the SEC document.

On June 30, Innovene said, total petrochemical production

capacity was about 40 billion pounds per year and its refineries

had a combined crude oil distillation capacity of about 400,000

barrels per day.

BP, which is selling shares in the IPO, will receive the proceeds

from the IPO, Innovene said.

Innovene said it planned to declare a quarterly cash dividend on

each common share after the IPO, starting with the first quarter

of 2006.

BP Confirms Plans for

Second Zhuhai PTA Plant

http://www.bp.com/genericarticle.do?categoryId=2012968&contentId=7009855

BP is planning a second

world-scale PTA (purified terephthalic acid) plant at their BP Zhuhai

Chemical Company Limited (BP Zhuhai) site in Guangdong

Province, China.

BP Zhuhai, a joint venture between BP (85 per cent) and Fu Hua

Group (15 per cent), currently operates a 350,000 tonnes a year

PTA plant at the site and will also own and operate the new

plant. 富華集団

The new plant, with

a capacity of 900,000 tonnes a year, will be the first to

employ BP’s latest generation PTA technology

and, subject

to final approval from the Chinese Government, is expected to

come on stream at the end of 2007 to meet PTA demand growth in

China.

Steve Welch, BP Group Vice President, Aromatics and Acetyls,

said: “This investment will be the world’s largest single train PTA plant,

built in the world’s largest and fastest growing PTA

market with the world’s best technology - once again

reinforcing BP’s commitment to the PTA business

and to China.”

BP’s new technology enables scale and

cost efficiencies which significantly reduce both capital cost

and conversion costs. In addition, the new plant will deliver a

step change in environmental performance, reducing both

greenhouse gas emissions and other waste streams.

“The

significantly reduced environmental and energy footprint of the

new technology will help China meet its commitments to the

environment and should set a new standard for others to follow in

this important arena,” said Welch.

He added: “With the commercialisation of this

new technology, we will actively pursue additional PTA investment

options in China and extend our franchises in Europe and North

America.”

Components of the

technology to be used at Zhuhai are also applicable across BP’s global PTA system, enabling new

globally competitive expansion options. BP is actively

progressing major debottleneck projects in North America and

Europe to take advantage of its enhanced technology position to

meet regional demand growth and to improve BP’s leading supplier position in

these regions.

The Zhuhai project has already received approvals from the

Chinese Environment Protection Agency and the project application

has been submitted to National Development & Reform

Commission (NDRC).

Upon final approval from the Chinese Government, the Zhuhai

project will be built with significant local engineering,

procurement and construction in addition to applying project

experience from BP’s global system of 21 operating

PTA units.

Notes to editors

| * | PTA is the preferred raw material used to manufacture polyethylene terephthalate, a widely used polyester polymer for the production of textiles, bottles, packaging and film products. In China, 90 per cent of PTA production is used in the textile industry. Government statistics show that China’s PTA consumption in 2004 exceeded 10 million tonnes, of which only around 40 per cent was supplied by domestic production. |

| * | BP Zhuhai was formed as a joint venture between BP and Fu Hua in 1997. The venture’s first PTA plant, with initial capacity of 350,000 tonnes a year (tpa), began production in 2003 and has the capability to expand to 500,000 tpa. The site’s combined PTA production capacity after the completion of the new plant will be more than 1.2 million tpa, confirming Zhuhai as one of the major PTA production centres in China. |

| * | BP has been a leader in PTA for over 30 years, with a global market share of 21 per cent on an equity basis (or 31 per cent including joint ventures). BP operates 21 PTA plants located in Asia, the Americas and Europe with a total combined annual production capacity of more than 9 million tonnes. |

| * | BP is one of the world’s largest oil, gas and petrochemicals groups, generating 2004 profits of over $16 billion and revenues of over $280 billion. BP employs about 103,000 people worldwide and has activities in more than 100 countries. The company is one of the leading foreign investors in China, having invested over $3 billion in commercial projects in the country. Its activities in China include production and importation of natural gas, supply of aviation fuel, import and marketing of LPG, fuels retailing, lubricants blending and sales, and petrochemical manufacturing. BP employs over 3,000 staff in China, either directly or through joint ventures. |

| * | Fu Hua Group Ltd was established in 1986 and became the first Zhuhai company to be listed on the Shen Zhen Exchange in the People’s Republic of China in 1993 with a registered capital of 345 million RMB and total assets of 1.2 billion RMB. Fu Hua Group, the former Fu Hua Polyester Fibre Plant, has been developed into a comprehensive enterprise group with main activities in the fields of harbour transportation, real estate development, import and export, pharmaceutical production and distribution. |

BP Agrees Sale of

Petrochemicals Business to INEOS for $9 Billion

http://www.bp.com/extendedgenericarticle.do?categoryId=2012968&contentId=7010538

BP today announced that

it is to sell Innovene, its olefins,

derivatives and refining group, to UK-based INEOS. The $9 billion cash sale, subject

to regulatory approvals, includes all Innovene's manufacturing

sites, markets and technologies. The sale is expected to be

concluded early in 2006 at which time payment will be received by

BP.

"Innovene has proved to be a very attractive business to its

peers in the chemicals sector," said Lord Browne, BP Group

Chief Executive. "This deal is the very best of a number of

good offers. I'm delighted with the outcome which is excellent

for BP's shareholders and for Innovene's future."

BP first announced the intention of separating its olefins and

derivatives business from its petrochemicals portfolio in April

2004 with an initial public offering (IPO) as one, possible,

disposal option. In the interim, it received a number of

approaches from companies considering a trade sale leading to

this decision instead of the IPO.

Browne said that the decision to sell Innovene in its entirety

removed any uncertainty around market conditions at the time of

an IPO, as well as would-be investors' concerns about BP's

remaining stake and future intentions.

"Consistent with existing BP practice, we remain committed

to returning excess free cash flow, including the net proceeds of

this sale, to shareholders," he added.

"This is a transformational acquisition elevating INEOS to

the world's fourth largest independent petrochemicals

company," said Jim Ratcliffe, INEOS Chief Executive.

"INEOS and Innovene share a BP heritage of high quality

people, assets and technology and are highly complementary

businesses."

Innovene is the 100 per cent BP-owned group created in April

2005. It has 8,000 staff, manufacturing facilities in seven

countries in North America and Europe; $18 billion revenues in

2004; $13 billion of gross assets; $9.9 billion of net assets;

pre-tax profits (Jan-Jun 2005) of $0.7 billion; 18 million tonnes

of annual petrochemicals capacity and 412,000 barrels per day of

crude oil refining capacity.

Innovene's chief executive is Ralph Alexander and its chief

financial officer is Mark Tomkins. Innovene manufactures olefins

and related products which are the raw materials for plastics,

packaging and textiles industries; and operates two refineries in

Europe.

BP was jointly advised by Goldman Sachs and Morgan Stanley on the

IPO and sale.

Notes to editors:

BP announced the separation of its olefins and derivatives

business in April 2004. It then added two refineries

(Grangemouth, UK, and Lavera, France) to the business in November

2004, and created the 100% BP-owned Innovene subsidiary in April

2005.

BP is the world's second largest integrated oil and gas company,

operating in more than 100 countries with over 100,000 staff and

turnover of $285 billion.

INEOS is a leading global manufacturer of speciality

petrochemicals and comprises 10 business units each with a major

chemical company heritage. Its production network spans 46

manufacturing facilities in 14 countries.

Innovene assets included in sale agreement:

| North

America Chocolate Bayou, Texas Texas City (chems), Texas Hobbs Gas Fractionation Facility, Texas Battlefield (ex-Deer Park), Texas Green Lake, Texas Carson (chems), California Lima, Ohio Whiting (chems), Indiana Joffre, Canada |

Europe Grangemouth (chems/refinery), UK Lavera (chems/refinery), France Sarralbe, France Feluy, Belgium Geel (polypropylene), Belgium Lillo, Belgium Koln (excluding ethylene oxide), Germany Marl, Germany Rosignano, Italy The NOVA Innovene joint venture |

日本経済新聞 2005/10/14

BP、中国石油大手と提携交渉

英系メジャー(国際石油資本)のBPと中国の中国石油化工集団(シノペック)が提携交渉に入ったと、英フィナンシャル・タイムズ紙などが13日に報じた。同紙やロイター通信によると、BPが海外で持つ油田権益と交換に、シノペックの株式を取得することが提携の柱になるという。

Reuters 2005/10/13

BP in Talks Over China Partnership - FT

http://today.reuters.com/news/newsArticleSearch.aspx?storyID=132613+13-Oct-2005+RTRS&srch=bp

Britain's BP Plc has held

talks with Chinese officials over a possible partnership with top

oil refiner Sinopec Corp., the Financial Times reported on

Thursday.

BP Chief Executive John Browne met China's President Hu Jintao on

the sidelines of a United Nations meeting in New York last month,

the newspaper said.

"Browne has big ambitions for China," the report quoted

an unnamed BP executive as saying. "China needs the

feedstock, BP has got it and BP wants access to the market."

Top-level talks have been going on for some time, the FT said.

Browne will again meet high-level officials in Beijing this

month, a second person close to BP said, the FT reported.

The deal would be as ambitious in scope as BP's 2003 partnership

with Russia's TNK, the FT said, citing several sources including

bankers, diplomats and oil executives in China, Britain and the

United States.

A partnership with Sinopec, China's largest refiner and marketer,

would give BP unparalleled access to the most

important growing market in the world, the report said.

Sinopec

would benefit from BP's upstream exploration activities, according to the FT.

A BP spokesman declined to comment directly.

"We have a number of joint ventures in China," he said.

"We talk to our joint venture partners regularly on a number

of issues, including ongoing business and future

possibilities."

Any deal would face close scrutiny from the Chinese authorities,

the FT said. China, the world's second-largest oil consumer, has

already raised several concerns.

Financial times 2005/10/13

LORD BROWNE LINES UP ANOTHER AUDACIOUS DEAL FOR OIL MAJOR

News that Lord Browne is

negotiating a big deal with China's Sinopec will come as no

surprise to observers of his decade-long tenure as chief

executive, writes Thomas Catan in London. Lord Browne, 57, has

come to be known for his audacious takeovers of companies around

the world, which saw BP emerge as the second-largest publicly

traded oil company in the world. At the end of the 1990s, Lord

Browne masterminded the takeover of US oil companies Amoco and

Arco, followed by the purchase of lubricants and chemicals

company Burmah Castrol in 2000. In 2003, he bought 50 per cent of

Russian oil company TNK, the first and last time a foreign oil

company was allowed to gain such access to Russian oil. The

company has given BP unrivalled access to new resources, which

now account for a quarter of BP's 4m barrels a day of oil

production. Lord Browne has his critics. Some say BP's rapid

growth through mergers has contributed to a poor safety record.

Others worry that his strong grip on the company and big bets

could expose it to unnecessary risks. Last year, BP paid its

chief executive £3.75m in cash and £1.9m in shares.

ジョン・ブラウン卿 BP p.l.c.グループ最高経営責任者。

2006/3/20 BP

Restatement of

historical results following 2006 resegmentation.

http://www.bp.com/sectiongenericarticle.do?categoryId=2012027&contentId=2017688

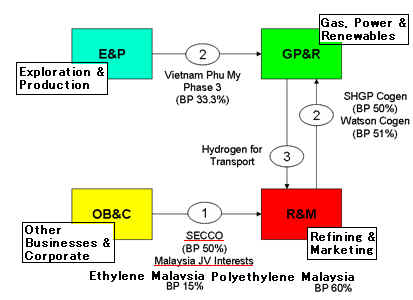

Following the launch of BP Alternative Energy in November 2005 and the sale of Innovene to INEOS in December 2005, certain assets have been transferred between segments to reflect the operational structure of the Group. These transfers are effective from 1 January 2006. Financial information for 2005 and 2004 has been restated to reflect these transfers.

| Summary of the 2006 asset transfers: | |

| 1. | following the sale of Innovene to INEOS, the SECCO and Malaysia JV interests, previously held in other businesses and corporate (OB&C) are transferred to refining and marketing (R&M) |

| 2. | the formation of BP alternative energy has resulted in the transfer of certain mid-stream assets and activities to gas, power and renewables (GP&R): |

| ・South Houston green power

(SHGP) cogeneration facility (Cogen) (in Texas City

refinery) from R&M ・Watson Cogen (in Carson refinery) from R&M ・Phu My phase 3 in Vietnam from exploration and production (E&P) |

|

| 3. | transfer of hydrogen for transport from GP&R to R&M |

These three transfers are

illustrated below:

Descriptions of the

transferred assets:

・Shanghai

Ethylene Cracker Complex (SECCO) is an integrated olefins and

derivatives site with a 900kte Ethylene cracker and a number of

downstream derivative facilities. It is a JV between BP (50%),

Sinopec (30%) and Sinopec Shanghai Petrochemical Company (20%).

The site commenced operation in 2005

・Malaysia

Interests comprise:

a 430 kte Ethylene

cracker through the Ethylene Malaysia Sdn. Bhd. (EMSB) associated

undertaking between BP (15%), Petronas (72.5%) and Indemitsu

(12.5%); and

a 310 kte

Polyethylene cracker through the Polyethylene Malaysia Sdn. Bhd.

(PEMSB) associated undertaking between BP (60%) and Petronas

(40%)

・Watson Cogen in

the Carson refinery is a 410MW cogeneration facility providing

steam and power to BP's Carson refinery in Los Angeles, CA. (and

to third parties). The cogen plant is jointly owned by BP (51%)

and Edison-Mission (49%) and first entered operation in the

mid-1980s

・South Houston

Green Power (SHGP) Cogen in the Texas City refinery is a 700MW

cogeneration facility supplying steam and power to BP's Texas

City refinery in Texas (and to third parties). The cogen plant is

a JV between BP (50%) and Cinergy (50%) and first entered

commercial operation in 2004

・Phu My phase 3

is a 720MW gas-fired CCGT located in Vietnam. The plant is an

Equity Accounted associated undertaking between BP (33.3%),

Semcorp (33.3%) and Kyushu Electric (33.3%). The plant began

commercial operation in 2003

・the Hydrogen for

Transport team participates in demonstration projects across

Europe, Asia and the US, in partnership with both governments and

auto manufacturers. BP provides the infrastructure for these

projects through hydrogen refuelling stations

2006/4/12 BP

BP Expanding European PTA and Paraxylene Production

http://www.bp.com/genericarticle.do?categoryId=2012968&contentId=7016994

BP today confirmed that

it is proceeding with its project for a major increase in purified

terephthalic acid (PTA) production capacity at its Geel,

Belgium, plant and also announced that it has recently completed

a significant increase in the plant's paraxylene (PX) production capacity.

The planned debottleneck of PTA production at Geel will increase

capacity by more than 350,000 tonnes a year, making the total PTA

production capacity of the Geel site some 1.4 million

tonnes a

year.

The increase will be achieved by retrofitting the latest

generation of BP's proprietary PTA technology to Geel's two

existing PTA production units. This new process offers the lowest

capital cost per tonne of PTA capacity of any current technology

and also lowers variable costs significantly compared to

conventional PTA technology. It is already being applied to new

PTA production BP is building in Asia, such as the new 900,000

tonnes a year plant planned for Zhuhai, China.

BP has completed initial engineering design work for the Geel

debottleneck and expects the expansion to be fully operational

early 2008.

Laurence Mulliez, BP's vice president, PTA Europe, Middle East

& Africa said: 'BP is committed to maintaining our leading

position in the European PTA market and continuing to grow

capacity to meet our customers' demands. Our latest PTA

technology has allowed us to achieve this at a very low capital

cost while actually lowering operating costs, and so reinforces

Geel’s leading position in the European

market'.

Dave Miller, Global PTA President said, 'We are looking at all

our PTA plants across the world to identify other opportunities

for applying this new technology in similar debottlenecking

projects, particularly in North America. We will also be

considering what options this new technology will give us for

future capacity increases in Europe.'

As well as expanding PTA production capacity, application of the

latest advances in BP's proprietary paraxylene production technology to Geel’s PX unit in 2005 has now

increased capacity of the unit to 560,000 tonnes

a year -

over 30 per cent higher than the original design capacity of the

unit, commissioned in 2000. The use of BP's PX crystallisation

technology has made the plant one of the most energy-efficient PX

plants now operating.

'The material breakthroughs we have made in both PTA and

paraxylene technologies have made our processes even stronger

from environmental, energy efficiency and cost perspectives and

demonstrate the strength of the continuing developments we are

making in these areas,' added Mulliez. 'They clearly reinforce

our leadership position in the polyester chain globally and, we

believe, confirm us as the partner of choice for PX and PTA

developments worldwide.'

Notes to editors

PTA is the preferred raw material used to manufacture

polyethylene terephthalate, a widely used polyester polymer for

the production of textiles, bottles, packaging and film products.

Paraxylene is a key feedstock for PTA production.

BP has been a leader in PTA for over 30 years, with a strong

record of growth and innovation in this business. BP has a global

PTA production capacity share of 21 per cent on an equity basis

(or 31 per cent including joint ventures). BP operates 21 PTA

plants located in Asia, the Americas and Europe with a total

combined annual production capacity of more than 9 million

tonnes.

BP is also a leader in the PX Business with a global production capacity

share of 11%. BP's PX assets are in the Americas and Europe with

a total combined annual production capacity of 2.9 million

tonnes.

Geel

(Belgium) is

the integrated production site for BP's PTA and PX manufacturing

in Europe. Its annual production capacity for PTA & PX has

grown from 300.000 to 1.4 million tonnes over the timespan of a

decade. Cost effective rail and road connections reach all major

European markets, and make the site very attractive in terms of

logistics. The Geel site is also advantaged as part of BP's

extensive PTA & PX technology and manufacturing networks,

contributing to developments on safe, reliable and cost &

energy effective manufacturing.

Platts 2006/6/26

BP starts construction of 900 kt/year PTA unit in Zhuhai, China

BP held a ground breaking ceremony to herald the construction of

its new purified terephthalic acid plant in Zhuhai, China on

Friday. The new unit will be an expansion of BP Zhuhai, an

existing joint venture between BP and Fu Hua Group, said a

company source Monday.

When commissioned at the end of 2007, it will be the world's

largest single train PTA unit with a capacity of 900,000 mt/year,

and will bring the combined capacity from the company's Zhuhai

site to 1.4 million mt/year, the source said.

"The new technology we are deploying with Zhuhai No 2 will

result in the most efficient PTA plant in the world. Compared to

conventional PTA technology, Zhuhai No 2 will require much less

energy to operate, reduce green-house gas emissions by 65%,

liquid waste discharges by 75% and solid process waste by 40%,

meaning this investment will meet China's needs for

economic growth that efficiently utilizes resources and respects

the environment," said Dave Miller, Global PTA Business Unit

Leader.

The project will also draw heavily on local resources.

"Zhuhai No 2 will involve many Chinese companies in

engineering, procurement and construction and over 50% of

material and equipment will be sourced within China. By employing

a highly localized Chinese project execution plan, Zhuhai No 2

will deliver the world's lowest capital cost to build," said

Yan Qian, Chairman of the Fu Hua Group.

Zhuhai No 2 will significantly expand BP's in-country supply

capability to serve the fast growing China PTA demand and provide

competitive feedstock for the Chinese polyester and textile

industry, particularly those located in South and Central China,

according to Paul Lo, BP Zhuhai's president.

PTA is used to manufacture polyethylene terephthalate, a widely

used polyester polymer for the production of textiles, bottles,

packaging and film products. In China, 90% of PTA production is

used in the textile industry. Government statistics show that

China's PTA consumption in 2005 exceeded 10 million mt, of which

only around 52% was supplied by domestic

production.

The Zhuhai project has already received approvals from the

National Development & Reform Commission and the Chinese

Environment Protection Agency, said a BP company source.

2006/7/18 BP

BP to Market Share of SPC in Korea

BP announced today that it has decided to pursue a sale of its

47.41% equity interest in Samsung Petrochemical Co., Ltd.

(SPC), its

joint venture with Samsung located in South Korea. SPC is one of

the leading producers of purified terephthalic acid (PTA) in Asia

with a total production capacity in excess of 1.8 million tonnes

per year. PTA is the preferred raw material used to manufacture

polyester.

Dave Miller, president of BP's global PTA business said,"SPC

is an excellent business with a solid performance track record

and is well-positioned for continued growth. BP and Samsung

however have different views of SPC's future strategy and BP believes if it is able to

achieve an appropriate price, exiting is in the best interest of

SPC and its shareholders. BP remains firmly committed to

maintaining our global leadership position in PTA and to

providing reliable and competitive PTA supply to our customers.

We are focused on rapid deployment of our new lower cost PTA

technology as evidenced by our recent announcements regarding the

ground breaking on our new 900,000 tonne Zhuhai 2 unit in China,

and the 350,000 tonne expansion of our Geel facility in

Europe."

Note to editors

BP is one of the world's largest oil and gas companies, serving

about 13 million customers every day in more than 100 countries

across six continents. BP's business segments are Exploration and

Production; Refining and Marketing; and Gas, Power and Renewables

which includes its Alternative Energy business. Through these

business segments, BP provides fuel for transportation, energy

for heat and light, retail services, and petrochemicals products.

SPC

is currently owned by BP (47.41%), Samsung (47.41%) and Shinsegae

(5.18%). It

is staffed by Samsung personnel, headquartered in Seoul and

operates four PTA plants on two separate sites; Ulsan

Petrochemical Complex (approximately 400 km from Seoul) and

Daesan Petrochemical Complex (approximately 145 km from Seoul and

400 km from China) with a total production capacity in excess of

1.8 million tonnes per year).

PTA is the preferred raw material used to manufacture

polyethylene terephthalate (PET), a polyester polymer widely used

for the production of textiles, bottles, packaging and film

products.

BP has been a leader in PTA for over 30 years, with a strong

record of growth and innovation in this business. BP has a global

PTA production capacity share of over 20 per cent excluding JV

partner share. The number of PTA units operated by BP and its

joint ventures is 21 at sites located in Asia, the Americas and

Europe with a total combined annual production capacity of more

than 10 million tonnes (including JV partner share).

BP has enjoyed more than 30 years of success in South Korea and

remains fully committed to the country. BP's other activities in

South Korea - Samsung BP Chemicals, Asian Acetyls, K-Power,

lubricants and shipping - are unaffected by the decision to exit

SPC.

Ulsan 1,100千トン

Daesan 700千トン

Sutherland wins BP power play

Peter Sutherland, chairman of BP, yesterday stamped his authority over the energy group by forcing Lord Browne, its widely admired chief executive, to announce he would retire at the end of 2008.

Echoing words used by Mr Sutherland in private, Lord Browne said yesterday that "a company isn't about one person".

The two men had feuded over the announcement, with Lord Browne reluctant to commit himself to a departure date. Yesterday they reached a compromise that saw Lord Browne promising to go but extending his stay to the end of 2008, rather than February 2008, when he turns 60.

However, even as the company was trying to draw a line under the row, lingering tensions between the two camps resurfaced, particularly over a now-abandoned plan for BP to pursue a merger with Royal Dutch Shell, the company's European rival.

People close to Mr Sutherland and Lord Browne denied that the idea - resisted by the chairman and other board members - fuelled tension between the two.

The move, described earlier this week by sources close to Lord Browne as a "significant potential merger", was yesterday officially dismissed as nothing more than "scenario planning".

A senior BP executive said there was never "a serious proposal", while another said that Shell had not been prepared to discuss the idea when it was being floated by executives in the latter half of last year.

However, two insiders insisted the idea of a transformational merger had been closed down by Mr Sutherland. "Peter was less comfortable with the idea than John [Browne]," one said.

Shell last night refused to comment.

Yesterday Lord Browne gave an unequivocal pledge to leave BP on December 31 2008, adding he would decline to stay on, even if the board requested it.

He denied a rift with his chairman, saying the reason for his going was not age but tenure.

The tensions between Mr Sutherland and Lord Browne have raised questions over how much power the chief executive will exert in his remaining 18 months. Friends had mounted a weekend campaign designed to extend his tenure after Mr Sutherland had told him to "end the uncertainty" over his departure plans.

"At the end of 2008 I will have been CEO of BP for over 13 years and that is quite a long time." Lord Browne added: "This has been a matter of discussion for the chairman, the board and me for a very considerable time."

Bruce Evers, of Investec Securities, said: "Lord Browne is going to be an exceptionally hard act to follow. He is without question the leading oil man of his generation . . ."

BP yesterday reported record net replacement cost profit of $6.1bn (£3.2bn), a 23 per cent rise on last year. High oil prices and strong US refining margins helped offset a decline in production. The company announced sweeping changes to its US operations, which have been rocked by accidents in the past 18 months. BP America will get an advisory board for safety, compliance and regulatory affairs and an extra $1bn on top of $6bn - to improve operational standards and monitoring.

BP also said it would hire external auditors to ensure compliance at its trading operations which were hit recently by accusations from US authorities of market manipulation in 2004.Additional reporting by Toby Shelley in London

BP

Agrees Major Exploration and Production Deal with Libya

BP's single biggest exploration

commitment," says BP group chief executive.

BP and its Libyan partner, the Libya Investment Corporation

(LIC), today signed a major exploration and production agreement

with Libya's National Oil Company (NOC). The initial exploration

commitment is set at a minimum of $900million, with significant

additional appraisal and development expenditures upon

exploration success.

The agreement was signed today in Sirt, Libya, by BP's group chief executive Tony Hayward and NOC chairman, Shokri Ghanem.

BP and the LIC will explore around 54,000 square kilometres (km2) of the onshore Ghadames and offshore frontier Sirt basins, equivalent to more than ten of BP's operated deepwater blocks in Angola. Successful exploration could lead to the drilling of around 20 appraisal wells.

During this exploration and appraisal phase, BP will acquire 5,500km of 2D seismic and 30,000km2 of 3D seismic and will drill 17 exploration wells.

"We are delighted to be working with the National Oil Company of Libya to develop their natural resources for domestic and international markets. Our agreement is the start of an enduring, long-term and mutually beneficial partnership with Libya," said Tony Hayward, BP group chief executive.

"With its potentially large resources of gas, favourable geographic location and improving investment climate, Libya has an enormous opportunity to be a source of cleaner energy for the world," said Hayward.

"This is a welcome return to the country for BP after more than 30 years and represents a significant opportunity for both BP and Libya to deliver our long term growth aspirations," said Hayward. "It is BP's single biggest exploration commitment."

BP will spend $50 million on education and training projects for Libyan professionals during the exploration and appraisal period, and, upon success, a further $50 million from commencement of production. The education and training programmes will be designed and managed in partnership with the NOC.

"The agreement reached today is a great success for Libya, the NOC and also for BP," said Hayward.

Notes to editors

日本経済新聞 2007/6/23

BP、ロシアのガス田売却 ガスプロムに 事業の独占進む

Kovykta project Gazprom

石油メジャーの英BPは22日、ロシアの合弁会社が保有する東シベリアのコビクタ・ガス田などの権益をロシア政府系エネルギー会社、ガスプロムに売却し、同ガス田の開発から撤退する、と発表した。ロシア政府から圧力を受けたためだ。日本企業も参加するサハリン沖の石油・ガス開発事業「サハリン2」に続き、外資の権益が奪われたことで対ロ投資への不信感が一段と強まりそうだ。

政府の撤退圧力に譲歩

権益を手放したのは2003年にロシア石油大手と合弁で設立したTNK-BP。同社は1兆9千億立方メートルの世界有数の埋蔵量を持つコビクタ・ガス田の権益(62.9%分)とガスの輸送・販売会社、東シベリアガスの株式の50%をガスプロムに譲渡する。売却額は7億−9億ドル(約870億ー1100億円)。

同時にBPはガスプロムとの間で共同エネルギー事業の推進や資産交換などを盛り込んだ戦略提携の覚書に調印した。BP側は「ガスプロムとの協力拡大は将来に重要な意味を持つ」との声明を発表した。

ロシア当局はコビクタ・ガス田の生産量が計画を下回っている点を指摘、BP側に開発免許の取り消しなどの揺さ振りをかけていた。BP側は当初、コビクタから中国などアジア向けに輸出する予定だったが、輸送網を独占するガスプロムに阻止され、増産できない状態に陥っていた。

BPは油田のほかコビクタ開発にも乗り出し、ロシア事業を拡大。TNK-BPはBPグループの原油生産量の4分の1に相当する日量100万バレル以上を生産している。BPはロシア事業の命運をつなぐためにコビクタ撤退を余儀なくされた。

ロシア政府は昨年、英蘭ロイヤル。ダッチ・シェル、三井物産、三菱商事が出資する「サハリン2」にも環境問題を口実に圧力を掛け、ガスプロムに過半数の権益を売却させた。米エクソンモービルや丸紅などが主導する「サハリン1」にもガスプロムを参画させるよう迫っている。

22

June 2007 BP

BP and TNK-BP Plan Strategic

Alliance with Gazprom as TNK-BP Sells its Stake in Kovykta Gas

Field

BP and TNK-BP today announced that

they have signed a memorandum of understanding to create

a strategic alliance with the Russian gas giant, Gazprom, to

invest jointly in major long-term energy projects or swap assets

around the world.

In a move designed to extend

Gazprom's access to international markets and deepen BP and

TNK-BP involvement in Russian oil and gas, the companies will

establish a joint team to identify strategic opportunities for

investment both overseas and inside Russia.

"We will initially be looking

for projects of at least $3 billion, but the potential for

further growth could be very significant," said BP chief

executive Tony Hayward. "This historic agreement lays the

ground for powerful co-operation between BP, TNK-BP and

Gazprom."

Dr Hayward said the companies

would immediately set up a joint steering group to look for

suitable investment options "across all geographies."

"Our firm aim is to establish

a venture that is strategic and long term, with mutual benefits

for the companies, both inside and outside Russia."

Under the terms of the agreement

signed by all parties, TNK-BP agreed to sell

Gazprom its 62.89 per cent stake in Rusia Petroleum, the

company which holds the licence for the Kovykta

gas field in East Siberia. It will also sell its 50 per

cent interest in East Siberian Gas Company (ESGCo), the

company constructing the regional gasification project.

Gazprom will pay between $700-$900

million, subject to adjustments, for TNK-BP's interests in Rusia

and ESGCo.

TNK-BP said a longer-term 'call'

option for TNK-BP to buy a 25 per cent plus one share stake in

Kovykta at an independently verified market price, had also been

agreed with Gazprom. This option could be exercised once a

significant joint investment or asset swap has been agreed under

the terms of today's memorandum of understanding.

President and CEO of TNK-BP, Bob

Dudley noted: "This is an important development in the

future growth of TNK-BP. We look forward to broadening our

working relationships with Gazprom and BP and to further

developing our Russian asset base as well as securing access to

material additional opportunities for TNK-BP."

Notes to editors:

Gazprom is

Russia's largest company and the world's largest producer of