Samsung General Chemicals (SGC) → Samusung

Total

ビッグディール 現代石油化学と三星総合化学の統合計画

→ 2002/12/2 Atofinaと50/50JV設立 設備を移管

Samsung General

Chem,France's Atofina Sign $1.55B JV Deal

2003/5 Samsung, Atofina sign

joint chemical venture

2003/7 欧州委員会、三星/Atofina

JV承認

2003/8/1 Samsung and Atofina ratify new

Korean joint venture company

サムスン総合化学、韓中往復の出退勤営業へ

2004/9 DuPont & Samsung Announce JV

Agreement for Flexible Circuit Materials

2005/10 Samsung Total, Huge ‘Extension

Investment’

2006/7 BP to Market Share of SPC

in Korea

2006/11 Korea Samsung

Total to expand benzene,PX units by mid-2009

2006/12 Samsung

Total、SMデボトルネッキングで80万トンに

2007/8 Samsung

Total to complete Daesan metathesis unit Aug 2008

2008/8 Samsung

Total's new OCU produces on-spec propylene

2007/10 Total announces start-up

of new polypropylene production line at Daesan Plant in

South Korea

2012/2

Major Expansion and Upgrade

Project at Samsung Total Petrochemicals’ Complex in Daesan

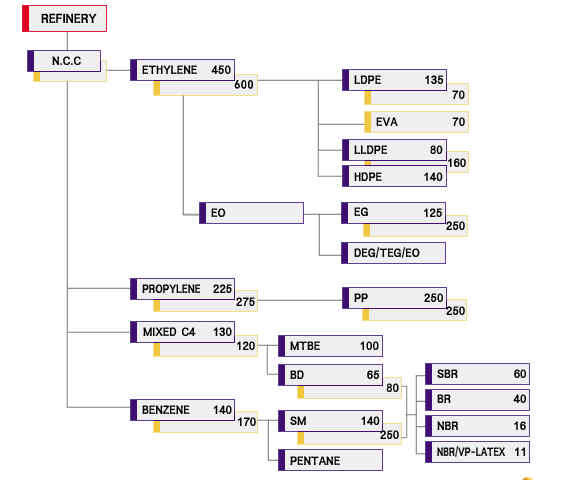

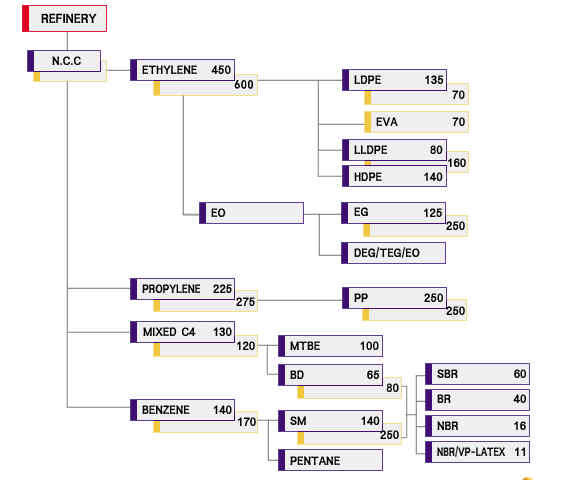

Samsung General Chemicals (SGC), a

subsidiary of the Samsung Group, is a petrochemicals company that

manufactures chemical products used as the material components of

many everyday items. Among the products we manufacture are

olefins, such as ethylene and propylene; basic petrochemicals,

such as PX; and polyolefins, such as PE and PP.

100 thousand tons of LDPE are

produced annually from LDPE plants by using the most advanced

high pressure tubular process.

SGC produces 50 thousand tons

of EVA annually, by using the most advanced tubular process.

SGC produces 125 thousand

tons of LLDPE(including MDPE)annually by using a state of the

art gas phase process with a super active catalyst.

SGC produces 175 thousand

tons of HDPE annually, using the advanced slurry process and

a super active Ziegler catalyst.

SGC produces 220 thousand

tons of PP annually by using a liquid-gas phase process with

multi-reactor system.

SAMSUNG BP Chemicals Acetic Acid, Hydrogen, VAM

Samsung Petrochemical (JV with BP) PTA

SMデボトルネッキングで80万トンに

日本経済新聞 2002/12/3

仏アトフィナの出資受け入れ サムスン総合

JV設立合意

韓国のサムスン総合化学は2日、仏石油大手トタルフィナ・エルフの化学部門であるアトフィナ社から資本を受け入れる覚書を結んだと発表した。

December 2,

2002 TotalFinaElf

TotalFinaElf

plans to set up a petrochemicals joint venture with Samsung

in South Korea

http://www.atofina.com/groupe/gb/actuComm/d_detail.cfm?IdComm=9003

TotalFinaElf,

via its chemicals branch ATOFINA, and the South Korean

company Samsung, will sign Dec. 2 a memorandum of

understanding with the aim of setting up a 50/50

joint venture in the petrochemicals sector in South

Korea, to which the assets of Samsung General Chemicals

will be transferred.

Dec. 2, 2002 Samsung General Chemicals

A Petrochemical

Joint Venture is to be established between

Samsung General Chemicals and Atofina,

the Chemicals branch of TotalFinaElf

http://www.samsungchem.com/en/SilverStream/Pages/ene236pg.html?cdate=200212031018&ndate=20021203&chcondition=&fldcondition=&page=

・ MOU signed between Samsung General

Chemicals and Atofina, the chemical Branch of the French

Group TotalFinaElf.

・ Definitive Agreements will be signed

during the 1st quarter of 2003 based on 50:50 ownership .

・The new joint venture is expected to

be competitive through a marketing and sales alliance as well

as a sound financial structure.

April 16, 2003

Financial Times

Jv paves way for expansion; Atofina and Samsung General Chemicals

cracker in Korea.

Atofina and Samsung

General Chemicals (SGC) have formally agreed to establish a 50:50 $1.5 bn

joint venture to

increase the capacity of a cracker in Daesan, South Korea,

from 650,000 tonnes/y to 1 M tonnes/y.

SAMSUNG BP

Chemicals Co.,Ltd

http://www.ssbp.co.kr/default_en.asp

SAMSUNG BP

Chemicals, a joint venture with British BP AMOCO Chemicals

(established in 1989), manufactures 350,000 tons of industrial

acid and 10,000 tons of hydrogen annually. SAMSUNG-BP Chemicals

aims at being the top Asian acetyls producer by 2000 and one of

the world's top three acetic acid manufactures by the early

beginning of the 21st century, armed with technology, capital,

and the best human resources

Products : Acetic Acid, Hydrogen, VAM(Vinyl Acetate Monomer)

History

1988.12.11

|

|

Joint Venture Agreement between

Samsung-BP Chemicals Ltd.

|

1989.07.12

|

|

Establish Samsung-BP Chemicals

Co., Ltd

|

1991.10.31

|

|

Complete Acetic Acid Plant

construction (150Ktes/yr)

|

1995.05.17

|

|

Establishment

of Asian Acetyls Co.,Ltd, a joint venture between

Samsung-BP Chemicals Ltd, and Union Carbide Corporation

*Asian Acetyls (Asacco) started

in 1995 as a joint venture between BP (34%), Samsung

(33%) and Union Carbide (now part of DOW, 33%). Asacco

produces and sells vinyl acetate monomer (VAM). |

| 1996.10.11 |

|

Complete

VAM Plant (150 ktes/yr) |

| 1997.07.30

|

|

Acetic

Acid plant debottlenecking (350Ktes/yr) |

Samsung Petrochemical Company

(SPC) http://www.myspc.co.kr/eng/about/index.html

Samsung Petrochemical Company

(SPC) was established in July 1974 as a joint venture of 50% Samsung,

35% BP (ex-Amoco) and 15% Mitsui Chemicals. Commissioned in 1980 to produce

approximately 100,000 tonnes per annum of purified terephthalic

acid (PTA) for the first time in Korea, the site contributed

greatly to the local polyester industry by supplying domestic

PTA, their significant raw material. Consequently polyester

business, a basic and core one of then booming Korean industry,

enhanced its competitiveness

| 出資変更 BP participates in a joint venture in

Samsung Petrochemical Company (SPC) to produce purified

terephthalic acid (PTA) in Korea since 1974. This PTA

joint venture is 47.4% BP, 47.4%

Samsung and 5.2% Shinsegae. PTA is the preferred

intermediate used in the manufacture of polyester resin

for fibres, films, and packaging. The venture is

headquartered in Seoul with two production sites, namely,

Ulsan, and Seosan. SPC total plant capacity for PTA is

about 1.4 million tons per year.

http://www.bppetrochemicals.com/genericarticle.do?categoryId=265&contentId=2002593&contentId=2006473&categoryId=289

|

PTA is the significant raw material of domestic polyester fibers

and also used worldwide for manufacturing polyethylene

terephthalate (PET) resin for applications such as carbonated

beverage bottles, etc. and continuously expanded its applications

in various areas based its high technology.

Now SPC having its four production units including Seosan PTA at

the end of last year produces 1,400,000 tonnes per annum enough

to supply reliably to its customers high quality PTA at low

price. In addition, it is well known with its

environment-friendly operation through advanced technology. The

company received a certificate of environment-friendly corporate

authorized by the government for the first time among Korean

petrochemical companies. Its commitment to environment for better

life will continue in the future.

蔚山 1,000千トン

大山 400千トン+200千トン Samsung General Chemicals sold PTA Unit to

Samsung Petrochemical

2004/4/26 Platts

Samsung Petchem to expand PTA capacity by end-2004 to 1.6-mil mt

South Korea's Samsung Petrochemical Co Ltd plans to boost its

production capacity of purified terephthalic acid by the end of

the year to 1.6-mil mt, up 200,000 mt/yr from its current

capacity, the company announced during a press conference on

Monday.

Platts 2006/12/11

Korea's Samsung Total commits new SM capacity to term contracts

boosting

its styrene monomer nameplate capacity at Daesan by 130,000

mt/year to 800,000 mt/year through debottlenecking.

第一毛織

Cheil

Industries http://www.cii.samsung.com/english

Since established as a parent

company of Samsung in 1954, Cheil Industries has been

the driving force behind the remarkable development of

Korea's textile industry.

第一毛織は1954年に設立。繊維業からスタートし、韓国のファッション業界の発展に大きな役割を果たしてきました。1983年に紳士服のフォーマル/カジュアル部門を立ち上げて以来、韓国内のトータルファッションのリーディングカンパニーとして成長を続けてきました。また、繊維のみならず合成樹脂などの化学素材から電子化学材料まで幅広い製品を生産しています。

1989年、韓国・麗水(ヨス)工場の稼働をきっかけに合成樹脂分野に参入。当初、麗水工場ではABSおよび PSの製造が中心でしたが、その後機能的難燃性樹脂の生産に移行し、市場で大きなシェアを占めるようになりました。

今後は、ナノ技術、次世代難燃技術などの確保を通じて、汎用技術の普及を推進していきます。

Cheil Industries has launched

a chemical industry for plastic material that bears the

vigorous mark of a secondarily launched enterprise. Indeed,

1989 brought the opportunity to move into the manufacture of ABS and PS and expand our production sector with EPS and SAN . In addition we produce and deliver

a broad range of products, including electronic chemical

materials such as CMP(Chemical Mechanical Polishing)

Slurry, CR(Color Resist), PI(Polyimide), PR(Photo Resist),

Electrolyte for second-Li battery, Paste, EMS(Electro-Magnetic

Interference Shielding), OPC(Organic Photo Conductor), Ink

and highly functional engineering plastic, and are regarded as a truly worldwide

resin manufacturer.

Chemicals

- Styrene Polymers: Flame-retardant ABS,

flame-retardant HIPS, sheet ABS, transparent ABS, and

heat-resistant ABS

- Special Polymers: PC, alloy, other EPs, and super EP

- Artificial Marble: STARON

Electronic Materials

- Semiconductor Materials: EMC, CMP Slurry

- Display Materials: Diffusion Plate, CR, ACF

- Functional Materials: Paste

Fashion

第一毛織、イランに1000万ドルの技術輸出

第一毛織、中国に合成樹脂技術を輸出

Hyundai Petrochemical

ビッグディール 現代石油化学と三星総合化学の統合計画

→ Hyundai Petrochemical 買い手

Honam Petrochemical and LG Chemical :full

ownership 希望

SK Corp : other partnersとのshare

希望

→ Korea/ LG Chem and Honam Petrochemical

acquired Hyundai Petrochemical.

現代石油化学、LG・ロッテ化学に売却へ

LG発表

Korea's Honam, LG finalize acquisition of

Hyundai Petchem

Hyundai

Petrochemical to be split into three firms

Hyundai Petrochemical Co., Ltd.

has achieved rapid industrial growth in the domestic

petrochemical industry since its inception in 1988.

Through leading edge technologies and visionary insights, Hyundai

Petrochemical has become the premier consolidated petrochemical

company in Korea. Hyundai's

Daesan Petrochemical Complex, located in the western seaboard

south of Seoul, maximizes efficiency and quality control by

employing a comprehensive computer automation system that

coordinates the entire production process.

From the Naphtha Cracking Center and throughout the production of

monomers, polymers, synthetic resins and rubbers, the system

requlates stringent quality control measures to provide products

with the highest level of quality.

The Daesan Petrochemical Complex is strategically positioned in

close proximity to the Hyundai Oil Refinery Co.,Ltd. to

facilitate in the supply of base petroleum and to enjoy the

wynergistic effects into our globalization strategy.

Furthermore, Hyundai Petrochemical leads the domestic

petrochemical industry, a first for a domestic petrochemical

company. As the

leading and pioneering company in the production of

petrochemicals and related technologies, Hyundai Petrochemical

has been supplying the global market of over 50% of total

production volume to over 60 countries worldwide.

Ws the future unfolds and offers new and exciting challenges, Hyundai Petrochemical will strengthen the

investments in R&D to develop new value-added materials in

fine chemistry to emerge in the 21st century as leader in the

field of petrochemicals.

| 現代石化 |

|

|

| |

http://www.seetec.com/seetec/english/daesan/index.htm

Platts 2002/5/3

Korea SK Corp to join bidding

for Hyundai Petrochemical

South Korean refiner and

petrochemical producer SK Corp has expressed interest in bidding

for financially troubled Hyundai Petrochemical Co,

officials at SK said Friday. SK would join local Honam

Petrochemical and LG Chemical, which are also lining up to place

bids for the company.

朝鮮日報 2003/1/29

現代石油化学、LG・ロッテ化学に売却へ

現代(ヒョンデ)石油化学がLG化学と湖南(ホナム)石油化学(ロツテグループ系列)のコンソーシアムに売却されることになった。

現代石油化学のメーンバンクであるウリ銀行は29日、債権銀行団とLG化学・湖南石油化学コンソーシアムが30日、ソウル・ロッテホテルで買収契約を締結すると明らかにした。

2003/1/21 Financial

Times

Korea/ LG Chem and Honam Petrochemical acquired Hyundai

Petrochemical.

Hyundai Petrochemical,

which was put up for sale in 1999 because of the size of

the parent company's debts, has finally found a buyer. A

dozen companies expressed an interest in the acquisition

(including Koch Industries). Hyundai's main creditor

finally chose to sell the company to a local consortium

led by Honam Petrochemical and LG Chem for a reported $1.45 M(Billionの誤り).

2002/12/29

Reuters

S.Korea Group

Named in Hyundai Petro Sale

The main

creditor bank for Hyundai Petrochemical Co Ltd named a

South Korean consortium Monday as a preferred bidder for

the cash-strapped company in a deal industry sources

valued at around $1.45 billion.

The

spokesman for Woori Bank said Kansas-based Koch Industries Inc was the

runner-up bidder for Hyundai Petrochemical. He

declined to reveal financial details of the bids.

http://www.kochind.com/about/default.asp

Koch Industries

owns a diverse group of companies that exercise these

capabilities on a global scale in core industries such as

trading, petroleum, asphalt, natural gas, gas liquids,

chemicals, plastics and fibers, chemical technology

equipment, minerals, fertilizers, ranching, securities,

and finance, as well as in other ventures and

investments.

Hyosung Chemical

http://www.hyosungchemical.com/index_e.jsp

Hyosung adopted Oleflex propane

dehydrogenation process of UOP, and started the DH plant

operation commercially in 1991. This is the first commercially

operated plant of this kind in the world, succeeding to the pilot

plant size operation of DH unit in USA by UOP itself.

High purity polymer grade propylene can be produced through the

catalyst packed reactors with Continues Catalyst Regeneration

section. With the state of art Distributed Control System all

process variables can be controlled automatically to maximize the

efficiency.

Hyosung Corporation started the polypropylene business with

product brand "TOPILENE" in April 1991, by introducing

the HYPOL process technology from Mitsui Chemical Inc. of Japan.

Soon after the start-up of the HYPOL PP plant, many new products

were successfully launched on the market by applying many-years

own know-how which was accumulated throughout previous synthetic

fiber polymerization experiences.

New capacity was added in 1996, based on UNIPOL PP technology of

Union Carbide Corporation of US. With the operation of UNIPOL PP

plant, the whole product range of TOPILENE can be widened and

become more customer specific, to bring Hyosung great

competitiveness worldwide in scale-wise and quality-wise.

Hyosung Corporation keeps introducing new high value-added

products in market with constant improvement and development

since we well acknowledge the customer value and satisfaction is

critical to our success in this limitless global competition era.

We are leading Korean PP industry with the introduction of the

fourth generation products such as HIPP and Butene Random

Copolymer, and will grow along with the customers.

Production

Process |

Propane

Dehydrogenation

Process |

PP-1 Process |

PP-2 Process |

| Product |

Propylene |

Polypropylene |

Polypropylene |

Polymerization

Conditions |

Gas |

Liquid bulk /

Gas phase |

Gas Polymerization |

| Capacity |

165,000 ton/yr |

120,000 ton/yr |

148,000 ton/yr |

| Licensed by |

UOP (US) |

MPC (Japan) |

UCC (US) |

| Date of Starting |

Sep. 1991 |

Apr. 1991 |

Dec. 1996 |

Honam Petrochemical (Lotte Group) http://www.hpc.co.kr/eng/

現代石化買収

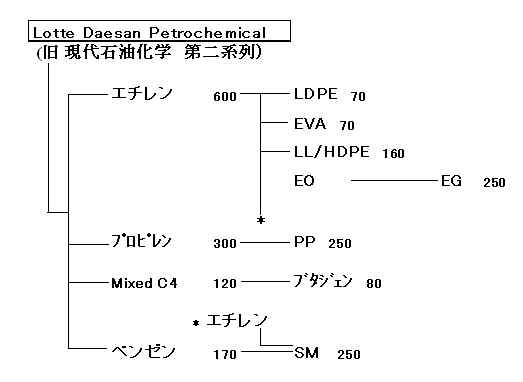

Hyundai Petrochemical to be split into LG

Daesan Petrochemical, Lotte Daesan Petrochemical and Seetec

Honam Petrochemical

completes purchase of KP Chemical

三菱レイヨン、韓国でMMA事業展開

湖南石化と合弁

MMA

Lotte Daesan to use Basell's

Spherizone Technology in new PP plant

S Korean Honam Petchem to build,

invest in $2.6 bil Qatar plant

Lotte Group working toward merger

of three petchem firms

Weifang Yaxing Signs LOI with

Honam Petrochemical

Korean

Honam takes stake in China top CPE producer

Lotte Daesan, Honam to complete

merger January 2

湖南石油化学、マレーシアのTitan

Chemicals を買収

Honam

Petrochemical to Build U.S. Plastics-Production Plant

1976/3 established

1979/12 commercial production of hdpe, pp meg

1979 ロッテが株主に(湖南エチレンは大林に)

1988/4 2nd hdpe

1988/11 2nd pp

1991/5 2nd meg

1992/4 ethylene and btx

1997/6 3rd meg

1998/4 pet

1000/6 synthetic paper

1999/9 3rd hdpe

2000/3 eoa

2001/6 mma

2001/11 revamping of echylene btx

2001/11 3rd pp

出資

|

→ |

|

ロッテ

57.3%

一般 32.7%

第一化学 10.0%(当初は35%) |

|

ロッテ

57.3%

一般 42.7% |

| *ロッテはロッテホテル、ロッテ物産、ロッテ(日本)の合計 |

第一化学 持株売却、解散

*第一化学:三井化学

60.13%、三井物産 32.17%、新日本石油化学 7.7%

| 1973/11 |

三井石油化学、三井東圧化学、三井物産の3社、第一化学を設立 |

| 1974/6 |

日本石油化学、第一化学に資本参加 |

| 1976/3 |

第一化学、韓国の麗水石油化学と湖南石油化学を設立 |

| |

当初は麗水石油化学

35% (ロッテ80%)、第一化学 35%、一般株主

30% |

| 2002/12 |

第一化学、湖南石油化学持株売却完了 |

| 2003/6 |

第一化学 解散 |

2006/6/23 Plastemart

Lotte Daesan to use Basell's Spherizone Technology in new PP

plant

http://www.plastemart.com/plasticnews_desc.asp?news_id=8882

Lotte Daesan

Petrochemical Co. Ltd. has selected Basell's Spherizone

technology for a new 250,000 tpa polypropylene

plant to be

built at Daesan, South Korea. Start up of the plant is planned

for Q4-2008. The Spherizone process is an advanced manufacturing

process for the production of polypropylene, using a unique,

state-of-the-art, multi-zone circulating reactor system.

Spherizone plants can produce the full range of polypropylene

grades, as well as new families of propylene based polymers.

Lotte is the Basell's second Spherizone licensee this month, and

globally the seventh plant to be built with this technology.

Almost 2 mln tons of capacity has already been licensed since the

Spherizone process was commercialized about three years ago,

reflecting the industry trend to seek additional value through

product differentiation.

Chemnet Tokyo 2003/5/30 発表

三井化学、韓国・湖南石化投資会社「第一化学」解散

三井化学は30日、韓国・湖南石油化学への日本側共同投資会社として設立した、第一化学を6月30日付で解散すると発表した。

第一化学は1973年、当時の三井石油化学、三井東圧化学、三井物産、日本石油化学4社が韓国に進出し、同国麗水石油化学と折半出資して湖南石油化学を設立したさい、日本側投資会社として4社共同で設立した。

湖南石化は、79年に第1期を完成していらい順調に発展してきたが、すでに30年が経ち、韓国側パートナーの変更や、株式上場などもあって、設立当初の戦略的意義や使命は終えたと判断した。

湖南石化の株主構成は大きく変わり、2002年3月には韓国ロッテグループ57.2%、第一化学10%、残りは一般株主となっていた。第一化学はその後保有株式を市場売却し、同年10月には売却を完了、事実上同事業から撤退していた。

2003/5/30 三井化学

連結子会社の解散に関するお知らせ

当社は、下記のとおり当社の連結子会社である第一化学工業株式会社(以下「第一化学」という。)を2003年6月30日付で解散することを決定いたしましたのでお知らせいたします。

第一化学の概要

| (1)所 在 地 |

|

東京都千代田区 |

| (2)代 表 者 |

|

富永紘一(当社専務取締役) |

| (3)資 本 金 |

|

3,929百万円 |

| (4)株主構成 |

|

当 社 |

60.13 % |

| |

|

三井物産

新日本石油化学 |

32.17 %

7.70 % |

2004/11/10

S Korea's Honam Petrochemical

completes purchase of KP Chemical

2004/3/22 AsiaPulse

Honam Petrochemical Chosen as

Final Bidder for KP Chemical

KP Chemical today said that

through a public offering it has chosen Honam Petrochemical

as the final preferred bidder for the company. The consortium

of KC Holdings Co. Ltd. was chosen as preparatory preferred

bidder.

KP Chemical will go through due

diligence and price negotiations with Honam before concluding

the takeover by the first half of this year, if possible, an

official of the lead-manager for the sale, Samjung KPMG,

said. The offered price and exact contract schedule have not

yet been publicly released.

KP Chemical, which has been

under a workout program by about 40 creditors, led by Woori

Bank, since

its separation from troubled Kohap Corp. in December 2001, produces materials for polyester

products.

It produces nearly 400,000 tons

of packaging resin for PET (polyethylene terephthalate)

bottles annually, which is 34.5 per cent of the domestic

market, the nation's largest share, according to Samsung

Securities Co.

KP Chemical's net profit was 20

billion won (US$17.26 million) in January and February, a

Woori Bank official said.

The creditors claim 87 per cent

of its stake, and the total debt of KP Chemical as of the end

of last year was 606.9 billion won.

"If Honam acquires KP

Chemical, both companies could enjoy a great synergy

effect," a Samjung KPMG official said.

Honam Petrochemical, the

sixth-largest domestic producer in the petrochemical

industry, turns out 2.57 million tons of 15 petrochemical

products annually, according to industry sources.

Honam Petrochemical

produces 40,000m.t MMA, and sells the whole production to

the domestic market, as a result, although its capacity

is lower than LG MMA, Honam Petrochemical supplies the

most in domestic market currently.

In the end of 2001, when

Honam Petrochemical participated in the market by

introducing technology from Japan

Kuraray,

price started falling rapidly and dropped to wan1,200/kg,

and to make matters worse, as Formosa started operating

70,000m.t. and planned to participated in the domestic

market, Honam Petrochemical had no choice but price

cutting to prevent Formosa from participating in domestic

market.

2000年05月24日 Chemnet Tokyo

韓国・湖南石油化学、MMAモノマー設備建設を再開

来年5月完成、7月商業運転開始へ

韓国の湖南石油化学は、中断していたMMA(メチルメタクリレート)モノマー設備の建設を再開、来年5月に完成、7月から営業運転を開始することになった。

同設備は1997年に三井東圧化学(現三井化学)とクラレが共同で開発した直接酸化法技術をライセンス、1999年完成をめどに年産4万トン設備建設を目指していたが、1997年末の通貨危機を発端とする経済混乱から建設を中断していた。

しかし、昨年後半からMMAモノマーのアジア各国での需要が急回復、韓国でも好調に国内需要が推移していることもあり、建設の再開に踏み切ったもの。

技術ライセンスをした三井化学とクラレでは、両社で年間1~1万5,000トンの引き取り枠を持っていることから、設備完成後はアジア地区への輸出を行うことになると見られている。

|

Korea Petrochemical Ind.

Co 大韓油化(KPIC) http://www.kpic.co.kr/english/

Ever since its establishment

in Jun. Of 1970, Korea Petrochemical Ind. Co., Ltd has

completed the first polypropylene plant in the 1972 in the

spirit of challenge and pioneering.

Through annual increase in its establishment, it has opened

the new field of petrochemical industry on this land

furnishing the productivity of polypropylene 350 thousand

metric tons and high density polyethylene 270 thousand metric

tons a year.

2004/8 TEC、大韓油化向けにプロピレン増産プラントを受注

1993/8/30 「法定管理」(会社更生法)の申請

KPICの累積債務は 7,000億W

(当時のレ−トで 900億円)で、前年の赤字は

546億W、93年赤字は 1,000億Wと言われている。

同社は 1991 年に 4,500億Wをかけて 250千t/年のエチレンクラッカ−を建設したが、これが経営悪化の要因となった。

1993/8/12 に丸紅が

41.59% の株を放棄し撤退した。

株主は以下のとおり。

創業者一族 42% (従来 25%)

政府(財務部) 29% ( 17% )

チッソエンジニアリング 14% (

8%)

丸紅 0%

( 41.59%)

May 29, 2003 Dow

Jones

Samsung General

Chem,France's Atofina Sign $1.55B JV Deal

South Korea's

Samsung General Chemical Co. (Q.SGC) said Wednesday it signed

a final agreement with French chemical company Atofina to

launch a $1.55 billion joint venture in South Korea.

Platts 2003/5/28

Atofina secures

joint venture with Samsung GC May 27

Atofina, the

chemicals branch of France's Total, Tuesday finalized its

50:50 joint venture with South Korea's Samsung General

Chemicals an Atofina's spokesman confirmed Wednesday.

朝鮮日報 2003.07.04

サムスン総合化学、韓中往復の出退勤営業へ

サムスン総合化学が6月末から、中国と韓国を毎週行き来する出退勤システムを稼動した。月曜の午前に中国に出勤し、土曜日には韓国に帰って来るシステムだ。

2003/5/29 朝鮮日報

Samsung, Atofina sign joint chemical

venture

Samsung General Chemicals Co.

signed an agreement with France-based Atofina yesterday to

form an equal $1.55-billion chemical joint venture.

Half the

equity of Samsung, which is not yet publicly traded, will be

handed over to Atofina for $775 million and the joint venture will be

officially launched in August.

In return, the deal will secure for Atofina a strategic base in

Asia to enter China and other regional markets.

The new company will be named Samsung-Atofina.

Dow Jones Business News

2003/7/18

EU OKs Samsung and Total S.A $1.55

Billion JV

The European Union Commission

Friday approved South Korean Samsung Group's $1.55 billion

chemical 50-50 joint venture with France's Total S.A. (TOT).

EU 2003/7/18 http://europa.eu.int/

Commission clears Samsung's

and Total Holding's acquisition of Samsung Atofina Ltd

The European Commission has cleared the acquisition of joint

control of the undertaking Samsung Atofina Ltd.

("JV"), Korea, by Samsung General Chemicals Co.

Ltd. ("Samsung"), Korea, belonging to the Samsung

Group and Total Holdings UK Ltd. ("Total Holdings")

belonging to the Total Group ("Total"), France.

Samsung Atofina is active in the manufacture of basic

petrochemical products and commodity polymers. Samsung is

incorporated under the laws of Korea and belongs to the

Samsung Group. It is engaged in the manufacture of basic

petrochemical products and commodity polymers. Total Holdings

is a subsidiary of Total Holdings Europe Ltd. which belongs

to the Total Group. Total is involved in oil exploration,

development, refining, marketing, trading, shipping and

production of base chemicals and commodity polymers. (The

operation, notified 18 June 2003, was examined under the

simplified merger review procedure)

Chemnet Tokyo 2003/8/4 Homepage

三星とアトフィナの合弁会社発足

韓国の三星グループとフランスのアトケムは8月1日、50/50の合弁会社サムスンアトフィナを発足させた。両社は昨年12月2日に合弁会社設立の覚書を結び、その後細目を詰め、5月27日に契約を締結した。7月18日にはEUの承認を得ている。

両社の協議で三星総合化学の価値を1550百万ドルと評価、アトフィナは非公開の三星総合化学の株式の半分を775百万ドルで購入し、50/50JVとした。

サムスン・アトフィナ(旧三星総合化学)は大山に石化コンビナートを持ち、実質能力はエチレン63万トン、プロピレン32万トン、LDPE 10万トン、lLDPE 125千トン、HDPE 175千トン、EG 11万トン、SM 67万トン、PP 22万トンなど。ほかにBPとのJVで三星石油化学(PTA 140万トン)、三星BP化学(酢酸、酢ビ)をもつ。

三星総合化学は現代石油化学とともに大山に石化コンビナートをもっているが、1998年に韓国政府の5大財閥事業再編計画(ビッグディール)で両社の統合が図られた。日本商社の参加も考えられたが、結局統合は失敗に終わった。その後、両社とも負債増加で経営困難となり、現代石化は先にLG化学と湖南石化に買収された。

新会社サムスン・アトフィナはアトフィナの投資で財務構造を改善する。アトフィナはこれにより中国をはじめとするアジアへの戦略基地を得ることとなる。

August 4, 2002

Samsung-Atofina

Samsung, Atofina launch chemical

joint venture

http://www.samsungatofina.com/en/SilverStream/Pages/index.html

Samsung General Chemicals Co.

and Atofina, the chemical branch of the French Group

TotalFinaElf, launched a 50-50 joint venture, called

Samsung-Atofina, yesterday.

2003-8-7 Asia Chemical

Weekly

Atofina grasps opportunity for Asia growth

Atofina has to prove now

that it can reap real rewards from its investment in

South Korea’s

Samsung and make the gains it wants from more active

participation in China’s petrochemicals markets.

October.26, 2005

Samsung Total Petrochemicals

Samsung Total, Huge ‘Extension Investment’

- NCC・SM Extension and PP Factory

Establishment…Invest 550 billion won by 2007 600億円

- Initiative in

main products, ‘Selection and concentration’, Energy-saving and expansion of

high 550 value-added products

- Acquiring future growth engine with huge reinvestment..

Presenting successful joint-venture model

Samsung Total(CEO Hong-shik Goh) is initiating new investment of

550 billion won in total to Daesan petroleum chemical complex,

South Choongchung, for its world-class competitiveness through

complex rationalization.

This investment by Samsung Total is implemented for main products

according to its ‘selection and concentration’

strategy. The core

plan of the investment includes to increase 200,000 ton of

ethylene, 230,000 ton of propylene, and 200,000 ton of SM(Styrene

monomer) for NCC(naphtha decomposition factory) and to establish

a new factory which produces 300,000 ton of PP(polypropylene).

When Samsung Total possesses production capacity of 830,000 ton

of ethylene, 550,00 ton propylene, 870,000 ton SM, and 570,000

ton PP after 2007 of investment completion, it will be one of the

best petroleum chemical complex in the world.

[See Table 1 and 2]

[Table 1] New Extension, Investment Plan for Daesan Youhwa

Complex of Samsung Total

| Factory |

Current capacity

(ton) |

Newly-extended

size

(ton) |

Expected

completion year |

Yearly

production capacity

(ton) |

| NCC |

|

|

Fist half of

2007 |

|

| -Ethylene |

630,000 |

200,000 |

|

830,000 |

| -Propylene |

320,000 |

230,000 |

Fist half of

2007 |

550,000 |

| SM |

670,000 |

200,000 |

Second half of

2007 |

870,000 |

| PP |

270,000 |

300,000 |

|

570,000 |

[Table 2]Product Purpose

for Newly- Factory

| Product |

Purpose |

| Ethylene |

Basic material

for Polyethylene, synthesized resin, and Ethyleneglycol

of synthesized textile material |

| Propylene |

Basic material

for polypropylene of synthesized resin |

| SM (Styrene

Monomer) |

Material for PS,

ABS, which is exterior/interior parts of

electric/electronic products and automobile |

PP

(Polypropylene)

(PP , Polypropylene) |

Exterior/interior

parts of electric/electronic products and automobile |

The PP unit will use

Basell's Spherizone technology--the first time the process

has been used in Asia and the first time Total has employed

it at one of its PP plants, Total says.

同社は2003年に三星グループとフランスのアトフィナが50/50のJVとして設立し、トタルグループから8億ドルを導入して旧三星綜合化学を引き継いだ。

1998年に五大財閥の構造調整案が策定され、当初は同じ大山に石化コンプレックスを持つ現代石油化学と三星綜合化学の統合が検討されたが、前提となる外資導入が難航して結局失敗、最終的に現代石油化学は第1系列をLG化学、第2系列をロッテグループに売却され、三星はアトフィナとの50/50JVとして再出発することとなった。

Platts 2006/11/14

Korea Samsung Total to

expand benzene,PX units by mid-2009

South Korea's Samsung

Total Petrochemicals Company (SPC) is looking to expand its

benzene capacity at its No 2 aromatics reformer by 90,000 mt/year

by mid-2009, company sources said Monday.

Alongside with the

expansion of its No 2 aromatics reformer, the company's current 600,000

mt/year paraxylene plant will also be increased by 270,000

mt/year to 870,000 mt/year.

The sources added that

after SPC's No 2 aromatics reformer expansion was completed, the

benzene output will be fully channeled into its expanded styrene

monomer plant. Following the company's increase of its SM plant capacity

by 200,000 mt/year to 840,000 mt/year at the end of June next year, SPC

will be short of almost 6,000mt of benzene each month until

mid-2009, when the expansion of its No 2 aromatics reformer was

completed.

Oct 17, 2007 (M2

EQUITYBITES via COMTEX)

Total announces start-up of new polypropylene production line at

Daesan Plant in South Korea

Total, an oil and gas group, declared on 16 October that the new

polypropylene production line at its Daesan plant in South Korea

is currently online.

The new unit has a capacity of 300,000 tons per year, bringing

the total polypropylene capacity of the plant, in which it owns a

50% interest in partnership with Samsung, to 554,000 tons per

year.

In addition, the company has completed the expansion of the

naphtha cracker, with the updating of the associated downstream

units, boosting the ethylene capacity of the cracker from 600,000

to 820,000 tons per year.

The company also said one styrene monomer unit has been expanded

from 380,000 tons to 600,000 tons per year, including the

conversion of the ethylbenzene section from gas to liquid phase,

and incorporating energy-efficient multi-effect distillation in

the purification section. The styrene production in the Daesan

facility is currently 850,000 tons per year.

According to Total, the Daesan facility expansion project will

allow it to consolidate its commercial position in the Asian

countries, in particular on the Chinese markets.

Oct 16 (Reuters)

French energy group Total on Tuesday announced the start-up

of a new polypropylene production unit at South Korea's

Daesan plant, which it jointly owns with Samsung Group.

The new unit, with a capacity of 300,000 tonnes per year,

will bring the total polypropylene capacity of the plant to

554,000 tonnes per year, Total said in a statement, adding

the expansion project would allow it to strengthen its

position in Asia, and China in particular.

Total has recently completed an expansion of the naphtha

cracker at Daesan, boosting its ethylene capacity to 820,000

tonnes per year, from 600,000 tonnes per year.

The Samsung Total Petrochemicals joint-venture was created in

April 2003, with Total and Samsung each holding a 50 percent

stake.

In June, the Korea Economic Daily said Samsung Total would

invest another 400 billion won ($384.3 million) next year to

raise its output capcity, and that it was considering

building a production plant in the Middle East.

But Total Petrochemical, a unit of Total, denied this was the

case.

2009/12/29 中央日報

- 第一毛織、中国に合成樹脂技術を輸出

第一毛織はペトロチャイナ子会社の吉林石化とABS樹脂生産工場設立と生産のための技術協力契約を締結したと22日、明らかにした。

この契約で第一毛織は吉林石化に2012年までABS生産技術などを伝授し、技術支援費と教育訓練費として2814万ドルを受けることになる。

Yes, it is the new

400 kt/a ABS project of PetroChina Jilin Petrochemical Co.

Jilin

Petrochemical held a groundbreaking ceremony in Jul. 2009 for

2 ABS line and a 10 Mt/a refinery.

2010/1/8

CB&I awarded

contract from Jilin

CB&I announced

today that Petrochina Jilin Petrochemical Company (Jilin) has

awarded a contract to Lummus Technology, a CB&I company,

for the license and process design of a grassroots

ethylbenzene and styrene monomer (EB/SM) plant in Jilin,

China. It has a design capacity of 320,000 metric tonnes of

styrene monomer per annum and will utilize proprietary

technologies provided by Lummus/UOP to minimize costs while

providing exceptional reliability and product quality.

The plant, expected

to start up in 2011, is the second EB/SM plant awarded to

Lummus Technology by Jilin. Styrene is used to make products

in the plastics and rubber industries including food

containers, insulation and automobile parts.

2009/11/26

PetroChina Expands

Jilin Refinery Capacity by 43%, Xinhua Says

PetroChina Co. is

expanding its refinery in the northern province of Jilin, the

official Xinhua News Agency said, citing an unnamed official

at the plant.

The company is

increasing the refinery’s capacity to 10 million

metric tons a year, or 200,000 barrels a day, from 7 million

tons annually, the news agency said.

吉林石化は中国国営石油会社が全額出資した石油化学専門企業で、60余りの工場で115種類の石油化学製品を生産している。

ABSは、各種の家電製品や事務機器、自動車の内外装材に使用される代表的な合成樹脂。

イ・チャンジェ第一毛織ケミカル部門長は「イランに続き中国にABS技術を輸出することで、新しいレベルのグローバルビジネス領域を開拓した。特殊樹脂技術の開発投資を拡大し、世界的な化学企業とのパートナーシップを強化していく計画」と述べた。

第一毛織はサムソン系列で、1954年に設立された。繊維業からスタートし、紳士服のフォーマル/カジュアル部門を立ち上げて、韓国のトータルファッションのリーディングカンパニーとして成長した。 繊維のみならず合成樹脂などの化学素材から電子化学材料まで幅広い製品を生産している。

合成樹脂部門では、PS、ABS、PC、エンプラ、人工大理石を扱っている。

現在の能力はPS 14万トン、EPS 8万トン、ABS 42万トン、PC 65千トンとなっている。

2005/10

第一毛織、イランに1000万ドルの技術輸出

韓国の第一毛織がイランに合成樹脂生産技術を輸出する。同社はイラン国営石油化学グループNPCの系列会社Tabriz Petrochemicalに、家電製品と自動車内装材に使われる合成樹脂ABSと食品容器生産用SAN樹脂の生産技術を支援することにしたと発表した。

第一毛織側は今回の技術輸出で技術ロイヤルティーのほか、技術支援費、教育訓練費など計1000万ドル相当の収益が期待できると説明した。

2011/12/1 朝鮮日報

サムスン物産、米油田開発企業を買収

サムスン物産は30日、韓国石油公社と共同で、石油・ガス資源開発企業の米Parallel

Petroleumを8億ドル(約622億円)で買収したと発表した。買収後の持ち株比率は、サムスン物産90%、石油公社10%。

パラレルは、テキサス州を拠点とする油田開発企業で、テキサス、ニューメキシコの各州に生産中の油田8カ所、ガス田2カ所を保有しているほか、三つの探査鉱区の権益を持つ。同社の油田の埋蔵量は6900万バレル。

サムスン物産関係者は「パラレルの買収で、米国での資源事業を拡大する足掛かりをつかんだ」と説明した。サムスン物産はこれに先立ち、2008年にメキシコ湾のアンカー鉱区(埋蔵量7100万バレル)を取得したほか、中国、中東、南米、アフリカなどで油田、レアアース(希土類)の開発を拡大している。

PARALLEL PETROLEUM LLC is an

independent energy company headquartered in Midland, Texas, engaged in the

acquisition, development and production of long-lived oil and natural gas

properties. Parallel utilizes 3-D seismic technology, advanced drilling and

completion techniques, and enhanced oil recovery processes. The Company's

current operations are primarily concentrated in the Permian Basin of West Texas

and New Mexico, the largest onshore oil and natural gas basin in the United

States.

Parallel Petroleum LLC aggressively pursues growth opportunities in the

continental United States and is an affiliate of funds managed by Apollo Global

Management, LLC and its subsidiaries, a leading global alternative asset

manager.

January 27, 2012 Total

Major Expansion and Upgrade Project at

Samsung Total Petrochemicals’ Complex in Daesan, South Korea

Total is consolidating its positions in petrochemicals in Asia with

a new expansion and upgrading project for the Daesan

complex in South Korea, which the Group owns with Samsung as part of the

Samsung Total Petrochemicals 50/50 joint venture.

With costs approaching $1.8 billion, the project calls for the construction of a

second aromatics1 unit and an ethylene-vinyl

acetate (EVA) copolymer unit at the Daesan petrochemical complex.

The new aromatics unit will have a production capacity of

around 1 million metric tons of paraxylene and

420,000 metric tons of benzene per year and will be completed by

September 2014. Paraxylene is used to manufacture polyester, while benzene is

used to produce petrochemical products such as styrene2.

With the completion of the aromatics unit in 2014 and the upgrade of existing

paraxylene capacity (610→760千トン)in 2012, total paraxylene production capacity

will be increased to 1.76 million metric tons.

The new EVA unit will produce

240,000 metric tons per year of ethylene-vinyl acetate copolymers. This

resin is used in products such as electrical cables, adhesives and solar panels.

Environmentally friendly and versatile, EVA is expected to see continued growth

in demand.

"This investment project in partnership with Samsung is aligned with Total’s

strategy of expanding in growth markets. It gives us the strong base we need to

maintain our position as a leading supplier of value-added products to meet

demand in Asia, especially China,” said Patrick Pouyanné, President of Total’s

Refining - Chemicals business. “We are pursuing our strategy of focusing our

spending on our most efficient integrated platforms, such as the Daesan

complex.”

The Daesan petrochemical complex is a world-class facility that manufactures

four main products — polypropylene, polyethylene, styrene monomer and paraxylene.

Fifty percent of its output is exported, primarily to China.

Samsung Total Petrochemicals

Set up in 2003, Samsung Total Petrochemicals is a 50/50 joint venture between

Total and Samsung. It combines Total’s recognized technological expertise and

production capabilities with Samsung’s acknowledged operational excellence and

access to local markets. The joint venture supplies a wide range of products,

from building block intermediate chemicals to polymers used in everyday

products.

Total in South Korea

Total’s presence in South Korea extends beyond Samsung Total Petrochemicals to

lubricants, LNG, alternative energies, adhesives (through Bostik), antivibration

systems (through Hutchinson) and electroplating (through Atotech).

1 Benzene and paraxylene production unit. Derived from oil, these two base

chemicals are raw materials for polymers, which are used in the manufacture of

plastics.

2 Styrene is a building block intermediate chemical used in the manufacture of

many plastics.

November. 26, 2021

Samsung Biologics、米GreenLight

Biosciencesのワクチン候補物質を受託生産

Samsung Biologicsは11月25日、米GreenLight

Biosciencesが開発しているmRNA新型コロナワクチンの候補物質の原料医薬品を受託生産することにしたと発表した。両社は、アフリカなどの低所得国を皮切りに、全世界にGreenLight

Biosciencesの新型コロナワクチンの臨床試験、商業生産、現地普及に拍車をかける計画だ。

GreenLight Biosciencesは、2022年第1四半期に、候補物質の臨床1相試験を始める計画。Samsung

Biologicsは、臨床3相段階に使われる原料医薬品を供給する。

Samsung

Biologicsは、2022年上半期に医薬品製造および品質管理基準(cGMP)の承認を目標に、仁川松島工場にmRNAワクチンの原料医薬品生産設備を構築している。

GreenLight

Biosciencesは特別買収目的会社(事業なしの上場会社)であるEnvironmental Impact Acquisition Corp

と合併する形で上場する。

GreenLight

Biosciences, a biotechnology company dedicated to making ribonucleic

acid (RNA) products affordable and accessible for human health and

agriculture, and Environmental Impact Acquisition Corp, and Samsung

Biologics, a leading global CDMO providing fully integrated end-to-end

contract development and manufacturing services, announced a partnership

agreement in which Samsung Biologics will manufacture GreenLight’s

messenger RNA COVID-19 vaccine candidate at commercial scale.

Founded in 2008,

GreenLight aims to solve some of the world's biggest problems by

delivering on the full potential of RNA for human health and

agriculture. In human health, this includes messenger RNA vaccines

and therapeutics.

For crop

management and plant protection, GreenLight’s most advanced

products in development are RNA-based

pesticides aimed at protecting

honeybees, which are key plant pollinators, from the parasitic

varroa destructor mite, and protecting staple food products

from destructive insect pests. The traditional chemical pesticides

currently in use face increasing consumer opposition and the threat

of outright bans due to concerns over their damage to the

environment. In addition, crop-destructive pests have developed

resistance to many traditional pesticides. Also, the non-specificity

of traditional pesticides can result in the unintended killing of

insects that are beneficial to crops.

For human

health, GreenLight is developing an mRNA manufacturing

platform aimed at providing mRNA-based therapeutics at scale and an

appropriate price for global needs. The company’s lead vaccine

programs include vaccine candidates for Covid-19 and influenza.

Earlier-stage programs are being developed to address other unmet

medical needs, such as sickle cell disease.

In

August 2021, GreenLight Biosciences announced plans to become

publicly listed through a business combination with

Environmental Impact Acquisition Corp.

GreenLight Biosciences, Inc., a biotechnology company

dedicated to making ribonucleic acid (RNA) products

affordable and accessible for human health and agriculture,

and Environmental Impact Acquisition

Corp. , a publicly traded

special purpose acquisition company, have agreed to a

business combination that will result in GreenLight becoming

a publicly-listed company.

The GreenLight team has

created a platform that can accelerate discovery,

development, scaling, and delivery of RNA products cost

efficiently and at large-scale.

GreenLight harnesses the

power of biology to develop RNA-based solutions for some of

humanity’s greatest challenges in human health through mRNA

vaccines and therapeutics and in food production through RNA

crop-protection products. The company’s breakthrough

cell-free RNA manufacturing platform, which is protected by

numerous patents, allows for cost-effective and scalable

production of RNA.

Proceeds from the

transaction are expected to provide GreenLight with the

capital needed to advance the following priorities:

2022/7/7

サムスン副会長、訪韓中の経団連十倉会長、東原副会長ら日本企業トップと相次ぎ会食

訪韓した経団連会長団の住友化学・日立会長とOLEDフィルム・半導体協力協議

サムスン電子の李在鎔副会長が訪韓した日本経済団体連合会(経団連)の加盟企業会長団と4日から5日にかけて相次いで会った。新政権発足以降、企業関係者が先頭に立って両国の関係改善の糸口となっているとの声もある。

サムスン電子が5日に明らかにしたところによると、李副会長は、韓日財界会議に出席するため訪韓した経団連の十倉雅和会長(住友化学会長)と4日、夕食を共にした。李副会長と十倉会長は韓日企業間の交流活性化とサプライチェーン安定のための協力案を話し合ったという。住友化学はサムスン電子に有機発光ダイオード(OLED)スマートフォン用偏光フィルムを供給している。

李副会長はまた、5日に経団連の東原敏昭副会長(日立製作所会長)とソウル市竜山区漢南洞の承志園で昼食会を行い、半導体協力案を協議した。サムスン電子は日本最大の電子製品メーカーである日立に半導体を納品している。

李副会長は毎年春、日本の主な取引先を訪れたり、日本の有力部品・素材企業とも定期的に交流したりするなど、日本でのビジネス・ネットワーク構築に力を入れてきた。サムスン電子が日本の二大通信事業者であるNTTドコモとKDDIに5Gネットワーク機器を供給することになったのも、李副会長の日本における人脈が大きな役割を果たしたと言われている。李副会長は日本の半導体素材・装備輸出規制で韓日関係が最悪となった2019年9月、韓国の企業関係者としては唯一、日本の財界関係者に招待され、日本で開催されたラグビーワールドカップ2019大会の開会式に出席し、開幕戦を観戦した。

November. 08, 2022 東亜日報

三星電子、世界最大の「1テラ第8世代VNAND」量産

三星(サムスン)電子は11月7日、NAND型フラッシュの世界最高容量である「1テラビット(Tb)の第8世代VNAND」の量産に入ると明らかにした。これに先立った、10月の米シリコンバレーでの「三星テックデー」にて、年内に第8世代のVNANDの量産計画を明らかにしてから約1ヶ月ぶりのことだ。

今回量産する第8世代のVNANDは、最大2.4Gbps(1秒当たりのギガビット)の速度を支援する。第7世代VNANDに比べて約1.2倍向上した速度だ。三星電子は、今回の第8世代VNANDを前面に出して、次世代企業向けの大容量サーバー市場を主導すると同時に、高い信頼性が要求される自動車市場にまで事業領域を広げていく計画だ。

今後、三星電子は、2024年に第9世代VNANDの量産、2030年までに1000段のVNANDの開発を目標にしている。7月からは、既存の京畿道華城(キョンギド・ファソン)・平沢(ピョンテク)および中国西安のNAND工程の他、京畿道平沢の第3ラインでもNAND量産を開始し、生産力を拡大した。

多様な革新技術の開発も続けている。データセンターに最適化された高性能、低電力製品とソリッドステートドライブ(SSD)の内部演算機能を強化した「コンピューティングストレージ」、大容量ストレージをより効率的に運営できる「ゾーンストレージ」などが代表的事例だ。

三星電子は、2002年からグローバルNANDフラッシュ市場でトップの座を守ってきた。市場調査機関オムディアによると、今年第2四半期(4〜6月)基準で、グローバルNANDフラッシュ市場で三星電子は3.3%のシェアで1位を記録している。2位はSKハイニックス(ソリダイムを含む・20.4%)、3位はキオクシア(16.0%)だ。

三星電子は、今回、第8世代VNANDの積層段数は明らかにしなかったが、業界では量産基準の最高段数と推定している。ライバル会社のマイクロンは7月、232段NANDの量産を発表し、SKハイニックスは8月、238段NANDの開発に成功したと明らかにした。

三星電子メモリ事業部フラッシュ開発室のホ・ソンフェ副社長は、「VNANDの段数が高くなるにつれて生じる干渉現象を制御する基盤技術も確保した」とし、「第8世代のVNANDを通じて市場の需要を満足させ、より差別化された製品とソリューションを提供していきたい」と明らかにした。