ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@āgābāvāyü[āW

2006/10/10 Eastman ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@Eastman

Eastman

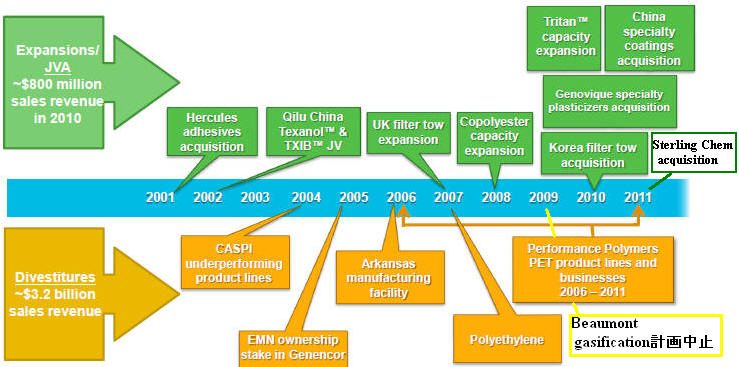

Agrees to Sell Polyethylene Business to Westlake

Eastman Chemical Company today announced it has entered into a

definitive agreement with Westlake Chemical Corporation for the sale of its

polyethylene business. The sale will include Eastman's

polyethylene and Epolene polymer businesses, related assets and

the company's ethylene pipeline. The sale is for a purchase price

of $255 million in cash at closing.

ü@ü@ü@ü@*Epolene üFpolyethylene waxes

Closing is expected in the fourth quarter of 2006, subject to

regulatory approval and customary conditions. The businesses and

assets to be divested in this transaction generated approximately

$680 million in revenue during 2005.

"Eastman has had a successful presence in the polyethylene

businesses for decades," said Brian Ferguson, Eastman

chairman and CEO. "While polyethylene is a strong business,

Eastman has an uncompetitive ethylene position because of our

older cracking facilities. In addition to divesting the

polyethylene business to a buyer with a strong ethylene position,

we will also take action to improve our olefins cost position. We

maintain our commitment to our remaining olefin derivatives

product lines at our Texas facility."

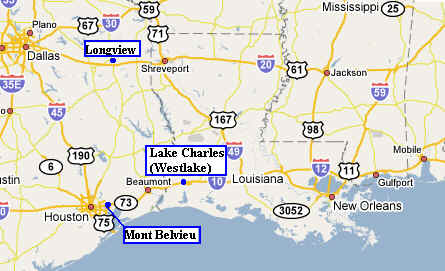

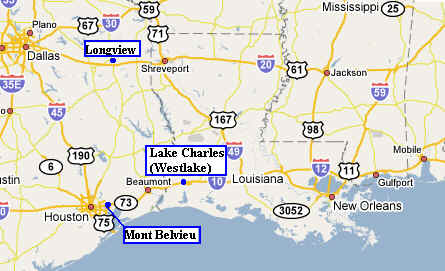

Included in the sale are three polyethylene manufacturing

plants, an

Epolene facility - all located at Eastman's Texas Operations in

Longview - and an ethylene pipeline between Mont

Belvieu, Texas, and the Texas Operations site. About 400 Eastman employees are

associated with the polyethylene and Epolene businesses. Results

from the polyethylene product lines are reported in the company's

performance polymers segment, while results from the Epolene

product lines are reported in the company's coatings, adhesives,

specialty polymers and inks (CASPI) segment.

About 255 employees will remain with Eastman and continue

producing polyethylene for Westlake. The two companies have an

agreement that will allow continued operation of the Longview

cracking facilities with a staged phase-out of older units

beginning in 2007, allowing both companies to optimize the value

of their respective olefin businesses under various market

conditions.

"We are pleased to be working with a strong strategic player

such as Westlake on this transaction," Ferguson said.

"Westlake brings a history of success in the industry, and

we look forward to further developing relationships with them as

they become a part of the operating site and community in

Longview."

Thomas J. Stevens, Eastman vice president and general manager of

the performance polymers business, said customers can expect a

smooth transition of business. "Eastman plans to continue

doing business as we have until the sale is complete. We have

long and valued relationships with our polyethylene customers,

and we are committed to working closely with Westlake to ensure a

smooth transition of these relationships."

Eastman manufactures and markets chemicals, fibers and plastics

worldwide. It provides key differentiated coatings, adhesives and

specialty plastics products; is the world's largest producer of

PET polymers for packaging; and is a major supplier of cellulose

acetate fibers. Founded in 1920 and headquartered in Kingsport,

Tenn., Eastman is a FORTUNE 500 company with 2005 sales of $7

billion and approximately 12,000 employees.

2006/10/10

Westlake

Westlake

Chemical Acquires Eastman's Polyethylene Business; Includes

200-Mile Ethylene Pipeline

Westlake Chemical Corporation announced today that it has entered

into a definitive agreement to purchase from Eastman Chemical

Company its polyethylene business. The sale will include

Eastman's polyethylene and Epolene polymer businesses, related

assets and the company's ethylene pipeline. The sale is for a

purchase price of $255 million in cash at closing. The

transaction is expected to close in the 4th quarter of 2006,

subject to standard closing conditions including regulatory

review. The business and assets to be acquired in this

transaction generated approximately $680 million in revenue

during 2005.

The acquisition includes the polyethylene business and associated

operating facilities headquartered in Longview, Texas with a

capacity of 1,125 million pounds per year of polyethylene. This

is comprised of 700 million pounds per year of low

density polyethylene (LDPE), 425 million pounds per year of

linear low density polyethylene (LLDPE) and a 200-mile, 10-inch ethylene

pipeline from Mt. Belvieu, Texas to Longview, Texas. When the

transaction is closed Westlake's total polyethylene capacity will

be in excess of 2,500 million pounds per year. Westlake will also

acquire technology for the production of specialty polyolefin

polymers including: acrylate co- polymers; and Epolene(R)

polymers for the adhesives, coatings and other consumer products

markets, as well as Energx technology for linear low density

polyethylenes designed to provide enhanced strength and

performance properties.

"The acquisition of the Eastman polyethylene business in

Longview, Texas is an excellent strategic fit for Westlake. When

completed, this transaction will further strengthen our position

in the growing North American polyethylene market and will

increase our ability to serve our customers through an improved

overall product mix and new product technology and manufacturing

capability at multiple sites where we can continue to enhance our

ethylene integration strategy. Eastman is known as a well-run

technology- oriented company with talented people and we look

forward to adding members of this workforce to our top-notch

team," stated Albert Chao, Westlake's President and CEO.

Westlake Chemical Corporation (WLK)

Westlake Chemical Corporation is a manufacturer and supplier of

petrochemicals, polymers and fabricated products with

headquarters in Houston, Texas. The company's range of products

includes: ethylene, polyethylene, styrene, propylene, caustic,

VCM, PVC and PVC pipe, windows and fence. For more information,

visit the company's Web site at http://www.westlakechemical.com .

2006/10/10 Platts

Eastman's planned phase-out of its ethylene capacity at

Longview "is positive for the industry," McCarthy

wrote. The crackers have a combined

nameplate capacity of 1.722 billion pounds per year. Of the four crackers

at the site, McCarthy said Bank of America expects that the

three smaller crackers at the site will be closed, leaving

one cracker at the site, with a listed ethylene capacity 789 million

pounds per year.

2006/12/1 Westlake

Westlake Chemical Closes Purchase of Eastman's Polyethylene

Business

Westlake Chemical Corporation announced today that all

closing conditions, including regulatory review, have been

met and it has closed the previously announced acquisition of

Eastman Chemical Company's polyethylene business effective

yesterday. The purchase includes Eastman's polyethylene and

Epolene polymer business lines headquartered in Longview,

Texas, related assets and a 200-mile ethylene pipeline. The

transaction's $255 million purchase price is subject to a

working-capital adjustment and will be funded from current

cash balances. The acquired business and assets generated

approximately $680 million in revenue during 2005.

Jan. 10, 2007

Eastman Kodak

Kodak to Sell Health

Group to Onex for up to $2.55 billion

ü@Sale

fulfills strategic intention to focus investment, increase

financial flexibility

Eastman Kodak Company announced today that it has entered into an

agreement to sell its Health Group to Onex

Healthcare Holdings, Inc., a subsidiary of Onex

Corporation, in a move that will sharpen Kodaküfs strategic focus on consumer and

professional imaging and the graphic communications industry.

Under terms of the agreement, Kodak will sell its Health Group to

Onex for up to $2.55 billion. The price is composed of $2.35 billion in

cash at

closing, plus up to $200 million in additional future

payments if

Onex achieves certain returns with respect to its investment. If

Onex Healthcare investors realize an internal rate of return in

excess of 25% on their investment, Kodak will receive payment

equal to 25% of the excess return, up to $200 million.

Because of tax-loss carry forwards, Kodak expects to retain the

vast majority of the initial $2.35 billion cash proceeds. The

company plans to use the proceeds to fully repay its

approximately $1.15 billion of secured term

debt. Other

potential uses of the cash proceeds are under review and will be

discussed at Kodaküfs previously announced investor

meeting, scheduled for February 8.

About 8,100 employees associated with the Health Group will

continue with the business following the closing. Included in the

sale are manufacturing operations focused on the production of

health imaging products, as well as an office building in

Rochester, N.Y.

Kodaküfs Health Group, with revenue of

$2.54 billion for the latest 12 reported months (through

September 30, 2006), is a worldwide leader in information

technology, molecular imaging systems, medical and dental

imaging, including digital x-ray capture, medical printers, and

x-ray film.

Onex Corporation, based in Toronto, is a diversified company and

is

one of Canadaüfs largest

corporations,with

annual consolidated revenues of approximately C$20 billion and

consolidated assets of approximately C$20 billion. Onex has

global operations in health care, service, manufacturing and

technology industries. The health care operations include

emergency care facilities and diagnostic imaging clinics.

2007/1/26 Eastman

Essar and Eastman

Announce Memorandum of Understanding for Joint Oxo Project

Essar Chemicals Ltd.,

part of India's Essar Group, and Eastman Chemical Company

have announced the signing of a memorandum of understanding and

the completion of a joint feasibility study regarding potential

opportunities for the production of oxo and oxo

derivatives for the domestic market in India. (at Essar's

refinery site at Vadinar.)

The feasibility study

includes plans for a 150,000 tons per year oxo aldehyde plant and

its derivatives. Oxo and oxo derivatives are part of Eastman's

performance chemicals and intermediates segment. These

intermediates are used to manufacture a variety of end-use

products such as coatings and paints, solvents and plasticizers.

About Essar Group

Essar Group is one of the fastest growing business groups in

India. The Groups businesses span the core and infrastructure

segments of the economy - steel, oil and gas, power, mobile

telecom, shipping and construction. The Group has an asset base

of $6 billion and has approximately 20,000 employees. Essar

Chemicals Limited is part of Essar Global Limited, an investment

arm of Essar Group. This company will be a vehicle to enter into

value added chemicals business and is currently evaluating

various options available based on feedstock streams from Essar Oil

Limiteds refinery at Vadinar, near Jamnagar in Gujarat.

ü@

Feb. 20, 2007 Eastman

Chemical

Eastman to Sell Spanish Plant

Eastman Chemical Company

today announced it has entered into an agreement for the sale of

Eastman Chemical Iberia, S.A., located in San Roque, Spain, to La Seda de

Barcelona, S.A.,

located in Barcelona, Spain. The sale includes Eastman's PET polymers

manufacturing assets in Spain and the related polyester resins

business.

The sale is subject to competition authority approvals in Spain.

Terms of the transaction, which is expected to close during

second quarter 2007, were not disclosed.

"We announced

at our November 2006 Investor Day that we would be taking

strategic actions to address our non-integrated PET polymers

assets outside the United States," said Gregory O. Nelson,

Eastman executive vice president and polymers business group

head. "This agreement is a major step forward as we

implement our strategy to improve the overall financial

performance of our PET polymers business."

The sale of the San Roque

site could change the previously reported

decision to permanently

shut down the site. It does not impact Eastman's

previously announced decision to shut down its

CHDM manufacturing assets at the site. The company still

expects to record asset impairments and restructuring charges

related to the San Roque site in first quarter of 2007.

The transaction

covers the Spanish plant and an adjacent PE production line

with 134 employees. The acquisition could avert the planned

permanent closure of the 160,000 t/y PET facility, which Eastman shut down on 17

January 2007 after a labour dispute.

ü@

Form 8-K for EASTMAN

CHEMICAL CO 31-Jan-2007

Costs Associated

with Exit or Disposal Activities

Item 2.05 - Costs

Associated with Exit or Disposal Activities and Item 2.06 -

Material Impairments

On January 25, 2007,

Eastman Chemical Company decided to initiate the closure of

its non-integrated PET polymers site in San Roque, Spain. As

previously disclosed, the Company has been evaluating various

strategic options that include restructuring, divestiture or

consolidation of its non-integrated PET manufacturing assets

outside the United States. After evaluating the various

alternatives, the Company decided to initiate the actions

required to permanently shut down the San Roque site due to

an untenable labor situation. This decision will impact

approximately $45 million of net assets associated with this

site and could lead to non-cash impairment charges in the

first quarter of 2007. In addition, this decision could

result in restructuring charges, primarily severance, which

would result in future cash expenditures. The restructuring

charges are not expected to exceed $10 million, but are

subject to negotiation with third parties. Management expects

the underlying costs of and charges related to this decision

to be reported as asset impairment and restructuring charges

during the first quarter of 2007.

1997/9/25 ü@ü@CHDM

āVāNāŹüEāwāLāTāōüEāfāBüEāüā^āmü[āŗ

Eastman CHDM Plant to

be Located in Spain; San Roque Site is Adjacent to EASTAPAK

Polymers Plant.

Eastman Chemical Company today announced that San Roque will

be the location for its previously announced plant to

manufacture 1,4-cyclohexanedimethanol (CHDM).

Earnest W. Deavenport, chairman and CEO, said the 27,000 metric

ton (60

million pound) CHDM plant will be built adjacent to Eastman's

EASTAPAK polymer plant near Gibraltar, in southwestern

Andalucia. Deavenport made the announcement during ceremonies

to officially open the San Roque plant to produce EASTAPAK

polymers, Eastman's polyester resins used in bottle and

packaging applications.

"We're excited about Eastman's growth in Southern Europe

and other parts of the world," Deavenport said.

"Today we celebrate the opening of our EASTAPAK polymer

plant and anxiously anticipate Eastman's planned expansion of

CHDM at this same site."

Dr. Gerald P. Morie, vice president and general manager of

Eastman's Specialty Plastics business, said the primary

reason for locating the plant in San Roque is the ability to

serve customers in the European region from within the

region. "Locating manufacturing facilities close to our

customers is an important part of Eastman's globalization

strategy."

CHDM is a monomer used in the manufacture of Eastman's

increasingly popular SPECTAR and EASTAR copolyester plastics

as well as some EASTAPAK polymers, and is sold for

applications in coating resins. CHDM provides special

properties to polymers that are used in numerous applications

including displays, store fixtures, indoor and outdoor signs,

sports helmets, medical devices and packaging, electronic

packaging, polyester films, protective coatings and plastic

bottles.

Eastman currently produces SPECTAR and EASTAR copolyesters at

its sites in Kingsport, Tennessee, USA, and Hartlepool,

England. A plant under construction in Kuantan, Malaysia, is

expected to begin manufacturing those plastics in January

1998.

Morie said the new plant represents a 42 percent increase in

Eastman's worldwide capacity for CHDM. Once the CHDM plant is

on line, Eastman's annual manufacturing capacity for the

product will be 91,000 metric tons (more than 200 million

pounds). He said if construction begins as planned in early

1998, the plant could be on-line during the fourth quarter of

1999. The plant is expected to employ about 25 people.

The new plant is expected to incorporate an innovative blend

of three CHDM technologies developed by Eastman, Davy Process

Technology and TOWA Chemical Industry Co. Inc. of Japan.

Eastman Chemical Company manufactures and markets chemicals,

fibers and plastics. Eastman employs 17,500 people in more

than 30 countries and had 1996 sales of US$4.8 billion.

Corporate headquarters is in Kingsport.

February 23, 2006

Eastman Expands CHDM Capacity

Eastman Chemical Company has announced an expansion project

that will enable the doubling of CHDM capacity at its

Kingsport, Tenn., site. The project will come on-line in late

2006.

The capacity expansion, which was discussed in January during

the company's fourth-quarter sales and earnings conference

call and webcast, will provide the scale and integrated

assets to enhance Eastman's global copolyester manufacturing

capabilities. CHDM is used in the manufacturing of various

specialty plastics products.

CMC Research http://www.cmcre.com/jyouhoufile/petreport.htm#PET-h10

āVāNāŹāwāLāTāōŖ┬éÄØé┬āWāIü[āŗé┼é═ŚBłĻÅżŗŲÉČÄYé│éĻé─éóéķé╠é¬üC1,4ü|āVāNāŹāwāTāōāWāüā^āmü[āŗüiébégécélüjé┼üC¢Ośaā|āŖāGāXāeāŗÄ„Äēé╠ŚLŚ═é╚ī┤Ś┐é┼éĀéķéŲō»Ä×é╔āRü[āeāBāōāOāīāWāōé╚éŪātā@āCāōāPā~āJāŗĢ¬¢ņé┼éÓŚL¢]é╚Śpōré¬æĮéóüB

ébégécéléī┤Ś┐éŲéĘéķā|āŖāGāXāeāŗÄ„Äēé╠ÄĒŚ▐

| āüü[āJü[ |

āuāēāōāh |

ā^āCāvé▄éĮé═Ś¬Å╠ |

ægɼ |

ö§Źl |

| Ä_ɼĢ¬ |

āOāŖāRü[āŗɼĢ¬ |

| āCü[āXāgā}āōāPā~āJāŗ |

āCü[āXā^ü[ |

éoédéséf |

éoésé` |

ébégécélüāédéf |

ē¤ÅoüCÄ╦Åoɼī` |

| éoébéséf |

éoésé` |

ébégécélüäédéf |

Ä╦Åoɼī` |

| āXāyāNā^ü[ |

éoédéséf |

éoésé` |

ébégécélüāédéf |

ē¤ÅoüCāvāīü[āgŚp |

| āCü[āXā^ü[āAāŹāC |

ŗżÅdŹćāAāŹāC |

éoésé` |

ébégécélüāédéf |

PCéŲé╠āAāŹāC |

| āTü[ā~ābāNāX |

éoébés |

éoésé` |

ébégécél |

Ä╦Åoɼī`üCŹéæŽöM |

| éoébésé` |

éoésé`ü{ĢŽÉ½Ä_ |

ébégécél |

Ä╦Åoɼī` |

| SK╣ąČ┘ |

āXāJāCāOāŖü[āō |

éoédéséf |

éoésé` |

ébégécélüāédéf |

ē¤ÅoüCÄ╦Åoɼī` |

| éféd |

āoāŹābāNāX |

éoébés |

éoésé` |

ébégécél |

Ä╦Åoɼī`üCŹéæŽöM |

| ŗżō»ł¾Ź³ü^éméjéj |

érébéq |

ŗżÅdŹć |

émécébüäécélés |

ébégécélüāédéf |

ŗżō»ł¾Ź³éŲéméjéjé╠ŗżō»ŖJöŁ |

ébégécélé═éPéXéTéOöNæŃé╔āCü[āXāgā}āōé¬ŖķŗŲē╗éĄüCÄÕéŲéĄé─ĮĹé╠éoédéséfŚpé╔Ä®ēŲÅ┴ö’éĄé─é½éĮüBé▒é╠ŖįüCāqāģāŗāXüCōīśaē╗ɼŹHŗŲé╚éŪé¬Å¼ŗK¢═ÉČÄYéĄé─éóéĮÄ×Ŗ·éÓéĀéķé¬üCÄ└Ä┐ōIé╔é═¢±éTéOöNŖįāCü[āXāgā}āōé╠éPÄąæ╠ɦé¬æ▒éóé─éóéĮüB

éPéXéXéWöNüCŖžŹæé╠éréjāPā~āJāŗüCÉVō·¢{ŚØē╗üCÄOĢHÅżÄ¢é╠ō·ŖžéRÄąé┼ŹćĢ┘ē’Äąüuéréjü@éméiébüvéÉ▌Ś¦üCéPéXéXéXöNüCöNÄY10,000āgāōé╠āvāēāōāgīÜÉ▌éÆģÄĶüCéQéOéOéOöNéVīÄé╔Ŗ«É¼éĄéĮüB

ébégécélé╠āüü[āJü[Ģ╩ÉČÄYö\Ś═Éäł┌

| āüü[āJü[ |

ŹHÅĻ |

1999öN |

2000öN |

2001öN |

ö§Źl |

| āCü[āXāgā}āōāPā~āJāŗ |

Ģ─Źæ |

ü@64,000 |

ü@64,000 |

ü@64,000 |

2006öNö{æØ |

| āXāyāCāō |

ü@ü@ü| |

ü@ü@ü| |

ü@27,000 |

Ģ┬ŹĮŚ\ÆĶ |

| īv |

ü@64,000 |

ü@64,000 |

ü@91,000 |

ü@ |

| éréjü@éméiéb |

ŖžŹæ |

ü@ü@ü| |

ü@ü@ü|ü@ |

ü@10,000 |

2001öN1īÄÅżŗŲÉČÄYŖJÄn |

| īv |

ü@ |

ü@64,000 |

ü@64,000 |

101,000 |

ü@ |

ü@

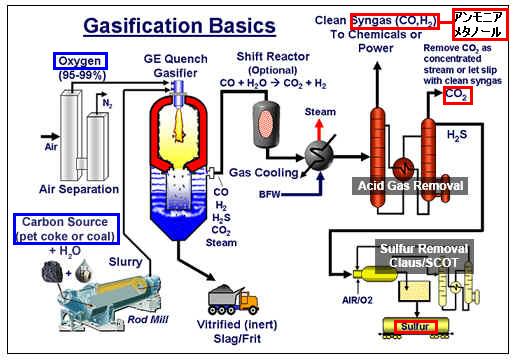

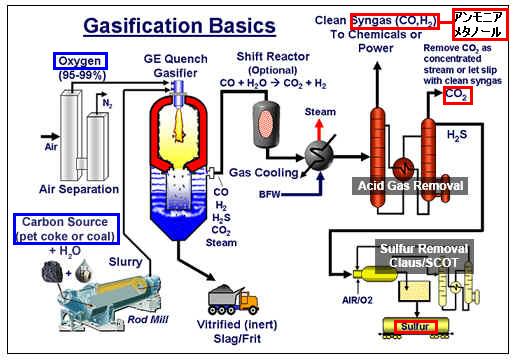

2007/4/17

Platts

Eastman to expand

coal-based petrochemical production

Eastman Chemical Company

plans to increase its coal-based petrochemical production to produce 50% of

its total chemicals volume from coal by 2015, according to a report

released by Bank of America.

Currently 20% of the company's total chemicals volume is produced

from coal. The company plans minority investments in two

gasification projects. The first project, a petroleum

coke-based, methanol to propylene (MTP) plant in Longview, TX, would be developed in conjunction

with TX energy. The plant, which is expected to come online in

2011, would replace propylene production lost via the future

shutdown of several uneconomic ethylene crackers.

Additionally, MTP via coal gasification would enhance efficiency, placing

Eastman propylene production on par with Middle East producers.

The second project involves the development of an ethylene glycol plant in North America.

The exact location, time, and partners have yet to be announced

and calls to Eastman were not returned by presstime.

2006/11/22 Eastman

ChemicalüAÉ╬ÆYāxü[āXé╠ē╗ŖwĢiÄuī³éų

2007/5/8 Eastman

Eastman Expands

Specialty Copolyester Capabilities

Eastman Chemical

Company announced today it is extending its specialty

copolyester production to its manufacturing site in Columbia, S.C. This action, coupled with the

recent expansion of CHDM capacity at

its Kingsport, Tenn., site, positions the company to

create the broadest, most competitive manufacturing position

possible for its specialty copolyester products. The expansion is

consistent with the company's previously announced plans to increase its

global copolyester manufacturing capacity by transitioning

large-scale manufacturing assets to copolyester assets at its

South Carolina site.

The Columbia site

will become the second Eastman facility in North America

producing the copolyester family of specialty plastics. The

additional copolyester production is expected to come on-line in

the first half of 2008. The CHDM capacity expansion, which came

on-line earlier this year, doubles the company's CHDM capacity

and provides the scale and integrated assets to enhance Eastman's

global copolyester manufacturing capabilities. CHDM is a key

intermediate used in the manufacture of several of Eastman's

specialty copolyesters.

July 27, 2007

Eastman

Eastman Announces Key

Roles in 2 Major Gulf Coast Gasification Projects

Projects Demonstrate Company's Continued

Execution of Growth Strategy

Gasification Is Environmentally Friendly Choice to Improve

Profitability

Eastman Chemical Company

today announced key roles in two industrial gasification projects

in the U.S. Gulf Coast, demonstrating significant progress in

leveraging Eastman's technology and operational expertise to

ensure future growth.

Eastman Chairman and CEO

Brian Ferguson said the company will be the developer, operator,

co-investor and customer of a new $1.6 billion project slated for

Texas. As a participant in the recently

announced Faustina Hydrogen Products LLC project in St. James

Parish, LA, Eastman will be the operator, a co-investor and

customer. Both projects would use petroleum coke

primarily instead of natural gas to produce industrial chemicals used in a variety of consumer end

products.

Texas

Project

Based on incentives on the order of about $100 million that have

been preliminarily approved by local officials in Beaumont,

Texas, Eastman intends to locate its gasification project there,

Ferguson said. That plant, which is expected to

be online in 2011, will produce low-cost intermediate chemicals,

such as methanol, hydrogen and ammonia.

Louisiana

Project

Eastman also plans to participate in a project recently announced

by Faustina Hydrogen Products LLC as an investor, service

provider and customer. Faustina plans to build a plant

which will use petroleum coke and high-sulfur coal as feedstocks

to make anhydrous ammonia for agriculture, methanol, sulfur and

industrial-grade carbon dioxide.

Eastman has provided

development funding for the project, with the intent to take a 25

percent equity position. Eastman will also provide

operations and maintenance services and purchase methanol under a

long-term contract, subject to customary reviews and approvals.

The facility will be built in St. James Parish, LA., and is

expected to be on line in 2010.

ü@

2007/9/17 Platts

Mexico's Alfa to buy Eastman's Latin America PET business,

assetsMexico's Alfa announced Monday that it has entered into

definitive agreements with the Eastman Chemical Company to

acquire its Mexican and Argentinian polyethylene terephthalate

assets and related businesses.

The sale, which is subject to customary approvals, includes Eastman's PET

manufacturing facilities in Cosoleacaque,

Veracruz, Mexico,

and Zarate (close to Buenos Aires), Argentina. Their production capacity is

150,000 mt/year and 185,000 mt/year, respectiv

October 22, 2007 RTTNews

Wellman Sues Eastman

Chemical For Patent Infringement

Wellman, Inc. announces the initiation of a patent infringement

lawsuit against Eastman Chemical Company for infringement of

United States Patent that cover titanium catalyzed polyethylene

terephthalate, or "PET", resins and the preforms made

from titanium catalyzed PET resins.

The complaint alleges that Eastman infringes Wellman's patent

with its ParaStar resins that are made from its IntegRex process.

The complaint also alleges that Eastman is inducing third

parties, including its customers, to infringe Wellman's another

patent when they make preforms using ParaStar resin.

Oct 22, 2007

(BUSINESS WIRE)

Wellman,

Inc. Initiates PET Resin Patent Infringement Lawsuit against

Eastman Chemical Company

Wellman, Inc. announces the initiation of a patent

infringement lawsuit (1:07-cv-00585 (SLR)) against Eastman

Chemical Company for infringement of United States Patent

Nos. 7,129,317 and 7,094,863 owned by Wellman that cover

titanium catalyzed polyethylene terephthalate

("PET") resins and the preforms made from titanium

catalyzed PET resins.

The complaint alleges that Eastman infringes Wellman's '317

patent with its ParaStar resins that are made from its

IntegRex process and Eastman is inducing third parties,

including its customers, to infringe Wellman's '863 patent

when they make preforms using ParaStar resin.

Wellman is committed to active enforcement of its rights

under these patents and remains committed to providing the

high level of quality products and support services that our

customers have come to expect. As such, Wellman welcomes any

inquiries from customers who have any questions regarding

these patents or the patented technology.

Wellman, Inc. manufactures and markets high-quality polyester

products, including PermaClear(R) brand PET (polyethylene

terephthalate) packaging resins and Fortrel(R) brand

polyester fibers.

Wellman, Inc., an

international corporation, sets the standard as a

manufacturer of plastic packaging, fibers and engineering

resins

With PermaClear(R) PET packaging resin, Fortrel(R) polyester

staple fiber and Wellamid EcoLon(R) engineering resin,

Wellman leads the industry in state-of-the-art manufacturing.

FIBERS

With over thirty years of consumer credibility, Fortrel

fibers represent some of the most innovative new products in

the industry: Fortrel MicroSpun, the supernatural microfiber

that changed the way we think about polyester forever.

Fortrel Spunnaire, the optically bright high-performance

fiber. ComFortrel, the fine denier fiber that combines

supersoft comfort with incredible stability. Fortrel

BactiShield, our antimicrobially treated fiber.

PET RESINS

Today, Wellman is the largest recycled polyester fiber

producer and the largest plastics recycler in North America.

As planned expansion programs fall into place, the company

has become the third largest PET resin producer in North

America, while maintaining its commitment to quality products

and efficient state-of-the-art manufacturing. For a company

that's committed to the biggest revolution in consumer

packaging, the future is very clear, indeed!

PermaClear for the container and packaging industries. Valued

for its consistency and performance, PermaClear, a co-polymer

resin produces clear bottles at the highest operating speeds

of stretch blow mold machines. Customers reap the benefits of

running this high value product and partnering with our

customer-responsive organization.

ENGINEERING RESINS

The Engineering Resins Division offers nylon 6, nylon 6,6,

nylon 66/6 and PET compounds. The division has over 30 years

experience utilizing virgin nylon, and post-industrial nylon

raw materials. An industry leader in recycling with the

latest innovation being Wellamid EcoLon, a nylon 6,6 compound

developed for Ford Motor Company utilizing 25% postconsumer

nylon from carpet.

October 26, 2007

Eastman Chemical

Eastman and Green Rock

Energy, L.L.C. Agree to Joint Investment in Beaumont, Texas

Industrial Gasification Project

ü@ü@ü@Project to Develop Facility with

Advantaged Cost Position for Intermediate Chemicals

Eastman Chemical Company

today announced that it has entered into an agreement with Green

Rock Energy, L.L.C. (Green Rock). Green Rock is a company formed

by the D. E. Shaw group and Goldman,

Sachs & Co. to

invest in gasification projects that address demand for more

environmentally friendly sources of energy production. Eastman

and Green Rock will jointly develop an approximately $1.6 billion

industrial gasification facility in Beaumont, Texas. The facility, which is expected to

be online in 2011, will use petroleum coke as the primary feedstock to produce hydrogen,

methanol, and ammonia. Eastman previously announced its

intention to co-develop the Beaumont facility as part of efforts

to leverage its technology and operational expertise for future

growth.

As previously announced,

additional participants in the Beaumont project include:

- Air Products and

Chemicals, Inc., which has signed a letter of intent to purchase

hydrogen produced

by the project on a long-term basis. Air Products will

also construct and operate new world class air separation

units to produce over 7,000 tons per day of oxygen,

essential to the gasifier operation;

- Fluor Corporation,

which is providing front end engineering design services;

and

- GE Energy, a

business unit of General Electric Co., which has

completed a Process Design Package and licensed its

gasification technology for the project.

About Green Rock Energy,

L.L.C.

Green Rock Energy, L.L.C. was formed by the D. E. Shaw group and

Goldman, Sachs & Co. to develop, own, and operate carbon

gasification projects that address demand for more

cost-effective, environmentally friendly sources of energy

production. For more information about Green

Rock, visit www.greenrockenergy.com.

http://www.knak.jp/blog/2007-08-1.htm#eastman

ü@

2008/6/3ü@Eastman

Eastman buys out Green

Rock in Beaumont gasification project

Eastman Chemical Co

announced Tuesday the acquisition of Green Rock

Energy LLC's 50% ownership interest in the Beaumont, Texas,

industrial gasification project.

With this acquisition, Eastman would become the full owner of the

Beaumont project and remains the sole developer. In addition,

Eastman announced the divestiture to Green Rock of its

25% ownership interest in the St. James Parish, La., industrial

gasification project and will no longer participate in the

project.

Richard Lorraine, Eastman senior vice president and CFO,

presenting at an investor conference in New York said, "We

have confidence in the success of both the Texas and Louisiana

industrial gasification projects, however differences in

strategic criteria

led us to agree with Green Rock to end our joint

investment."

ü@

Dec. 21, 2007

Eastman ü@ü@ü@ü@ü@ü@ü@Ä¢æOŗLÄ¢

Eastman to Sell PET, PTA

Assets in Europe

Eastman Chemical Company

today announced it has entered into definitive agreements with Indorama to sell

its PET facility and related businesses in the United Kingdom,

and its PET and PTA facilities and related businesses in the

Netherlands.

The sale, which is

subject to customary conditions and competition authority

approval, includes Eastman's PET manufacturing

facility in Workington, United Kingdom, and its PET and PTA

manufacturing facilities in Rotterdam, the Netherlands. Eastman's acetate tow production

at the Workington site is not included in the sale.

March 31, 2008ü@Eastman Chemical

Eastman Sells PET,

PTA Assets in Europe

Eastman Chemical

Company (NYSE:EMN) today announced it has completed the sale

of its European PET and PTA assets to Indorama. Included in the sale are

Eastmanüfs PET facility and related

businesses in the United Kingdom and its PET and PTA

facilities and related businesses in the Netherlands. The total cash proceeds of the

transaction are Euro224 million or approximately US $354

million, subject to adjustments in working capital. The transaction will result in

a gain on sale in the Company's consolidated financial

statements for first quarter.

"This transaction completes Eastmanüfs divestitures of its

non-strategic PET and PTA assets located outside the U.S.,üh

said Gregory O.

Nelson, Eastman executive vice president and polymers

business group head.

Eastman announced in December 2007 that it had entered into

an agreement for the sale, subject to customary approvals.

ü@

Jan. 15, 2010

Eastman Acquires

Specialty Polymers Manufacturing Facility in China ü@ü@¤┤Ź]Å╚ŗ╦ŗĮ

Eastman Chemical

Company announced that it has completed the acquisition of Tongxiang Xinglong

Fine Chemical Co., Ltd., a cellulose-based

specialty polymers

manufacturing facility located near Shanghai, China. Terms of the

transaction were not disclosed.

The acquisition will support Eastmanüfs Coatings, Adhesives, Specialty

Polymers and Inks segment, specifically its Ensure product line,

by providing additional capacity to meet the growing demand in

China. Similar to Eastmanüfs other cellulose esters, Ensure

has approximately 60 percent bio-renewable content and is used in

a variety of end-market applications such as coatings for

packaging and consumables.

ügThis

is an exciting addition to our specialty polymers product lines

that reinforces Eastmanüfs commitment to

sustainably-advantaged products like Ensure?,üh

said Brian Yoon,

Asia Pacific Regional Business Director. ügNot only will this additional

capacity allow us to grow with our customers in China, but it

will allow us to free-up capacity at our facility in Kingsport,

Tenn., to meet the growing demand for our other cellulose-based

specialty polymers worldwide.üh

Eastmanüfs chemicals, fibers and plastics

are used as key ingredients in products that people use every

day. Approximately 10,000 Eastman employees around the world

blend technical expertise and innovation to deliver practical

solutions. The company is committed to finding sustainable

business opportunities within the diverse markets it serves. A

global company headquartered in Kingsport, Tennessee, USA,

Eastman had 2008 sales of $6.7 billion. For more information,

visit www.eastman.com.

SK Chemicals,

Eastman Chemical Form JV for cellulose acetate tow

April 23, 2010ü@Eastmanü@

Eastman Reviewing

Strategic Options for Performance Polymers Business

Eastman Chemical Company today announced it will review strategic

options, including a possible divestiture, for its PET

business in

the Performance Polymers segment. The company has retained Bank

of America Merrill Lynch as its exclusive financial advisor for

the strategic review.

2010/4/24 The Times

and Democrat

Eastman Chemical

Company is considering selling its Calhoun County plastic

manufacturing plant.

Eastman announced it

retained Bank of America Merrill Lynch as its exclusive

financial advisor for the strategic review of its

polyethylene terephthalate business. PET, as it is also

known, is used for plastic beverage, food and cosmetic

packaging, among other things.

Broadwater said the company has informed the 400 employees at

its Calhoun County facility about the possible sale. A

decision on the future of the plant could be made within a

year.

The plant is located on approximately 2,300 acres on the

Congaree River. It is one of the largest manufacturers of PET

polymer in the U.S. and is Eastman's only

remaining PET plant. The facility also makes some

speciality plastics.

The PET segment hasn't made a profit since 2005 and lost as

much as $62 million in 2009, according to the Kingsport,

Tenn. Times News.

Eastman Kodak Co. purchased the property in 1962. In 1967,

the company began the production of KODEL polyester staple

fiber.

In the early 1970s, Eastman Chemical announced that it would

expand the business to include the construction of chemical

plants. In 1981, construction began to provide a facility to

produce PET bottle polymer resins.

Oct. 25, 2010

Eastman to Sell

Performance Polymers PET Business

Eastman Chemical Company

today announced it has entered into a definitive agreement with DAK

Americas, LLC,

to sell the PET business and related assets

and technology

of its Performance Polymers segment. The transaction is expected

to close during the fourth quarter of 2010. The total cash

proceeds of the transaction are expected to be $600 million, with

the final purchase price subject to working capital adjustments

at closing. The company expects to recognize a modest gain from

the sale.

ügAfter reviewing

strategic options

for our Performance Polymers PET business, we determined this

action to be the most beneficial to Eastman and our stockholders,üh

said Jim Rogers,

Eastman president and CEO. ügWith the path forward for PET now

clear, we are dedicating all of our energies to leveraging our

solid core businesses and strong balance sheet to deliver value

creating growth.üh

The sale, which is

subject to regulatory approvals and satisfaction of other

customary closing conditions, is not expected to impact product

lines in the companyüfs Specialty Plastics segment.

Financial results for the Performance Polymers segment will be

reported as discontinued operations in fourth quarter 2010. The

treatment of these financial results as discontinued operations

is not expected to have a material impact on the company's

earnings from continuing operations in fourth quarter and full

year 2010. In conjunction with the sale of the Performance

Polymers PET business, the company has approved a restructuring

plan to reduce costs and will recognize severance restructuring

charges in the fourth quarter.

DAK Americas is a

globally competitive supplier of Terephthalic

acid (TPA) - Monomers, Polyethylene Terephthalate Resins(PET)

and Polyester Staple Fibers (PSF) for the western hemisphere.

The company is headquartered in Charlotte, NC with

manufacturing facilities in the Carolinas. Innovation is the foundation

for the future at DAK Americas, where the assets of

technology and experience are combined to deliver a

continuous stream of specialty products. Bringing these specialty

products to market, as well as providing highly efficient low

cost commodity products keeps customers competitive on a

global basis.

In the fall of

2001, DAK Americas was created as a new company with three

main business units, including: Fibers,

Monomers, and Resins. DAK Americas is wholly owned

and operated as a subsidiary of Alpek, the petrochemicals and

synthetic fibers business group of Alfa S.A.B.

de C.V., one of Mexico's largest corporations. At its creation, DAK

Americas acquired several manufacturing facilities in the

United States from E.I. Du Pont de Nemoursć@. Together with Alfa, S.A.B.

de C.V. both companies at that time had over a 25 year

history of working together in Mexico, sharing technology,

assets, and experiences in a variety of fiber and chemical

related industries.

In 2003. DAK Americas expanded its PET Resins capability with

the construction of a new facility near Charleston, South

Carolina, USAćA and in mid 2007 again

increased its PET Resin manufacturing capabilities with the

construction of a new state-of-the-art PET facility near

Wilmington, North Carolina, USA.ćB

By the close of

2007, DAK Americas had again increased its PET manufacturing

capabilities and its abilities to supply PET Resin across the

Americas with an acquisition of PET businesses and

manufacturing facilities in Cosoleacaque, Mexico ćCand Zarate,

Argentina ćD from Eastman

Chemical.

DAK Americas continues its focus on innovation and growth of

its PET Resin, Monomer and Polyester Staple Fiber business

units and its commitment to continually deliver the highest

quality products and services to its customers.

ü@

March 9th, 2009

DAK

America (Charlotte, NC) has established a Specialty Polymers

Business Unit built on the purchase of DuPont's Crystar

polyester resin

technology, which is used to manufacture polyester

monofilaments, nonwovens, packaging, and other engineered

products.

É╗æóÅĻÅŖ

| ć@ |

Cape Fear

Site, North Carolina |

Monomer/PET

Resins/Polyester Staple Fiber |

from

DuPont(2001) |

| ćA |

Cooper

River Site, South Carolina |

PET

Resin/Polyester Staple Fiber |

ÉVÉ▌(2003) |

| ćB |

Cedar

Creek Site, North Carolina |

PET

Resin |

ÉVÉ▌(2007) |

| ćC |

Cosoleacaque

Site, Cosoleacaque, Mexico |

PET

Resin |

from

Eastman Chemica

(2007) |

| ćD |

Zarate Site,

Zarate, Argentina |

PET Resin |

| ü@ |

ü@ |

ü@ |

ü@ |

| ŹĪē± |

Congaree River, South

Carolina |

PET Resin |

from

Eastman Chemica |

ü@

Feb. 20, 2007

Eastman Chemical

Eastman to Sell Spanish Plant

Eastman Chemical

Company today announced it has entered into an agreement for the sale of

Eastman Chemical Iberia, S.A., located in San Roque, Spain, to La Seda de

Barcelona, S.A.,

located in Barcelona, Spain. The sale includes Eastman's PET polymers

manufacturing assets in Spain and the related polyester

resins business.

The sale is subject to competition authority approvals in

Spain. Terms of the transaction, which is expected to close

during second quarter 2007, were not disclosed.

Thai Indorama affiliates to buy

Eastman PTA, PET assets in Europe

ü@

ü@

2006/11/22 Eastman

ChemicalüAÉ╬ÆYāxü[āXé╠ē╗ŖwĢiÄuī³éų

é▒éĻéŲé═Ģ╩é╔üAō»Äąé═éoédésé╠ŖgÆŻīvēµéÓÉÓ¢ŠéĄéĮüB

ÅŃŗLé╠IntegRexé╔éµéķāvāēāōāgé═ɵö╩āXā^ü[āgéĄüAŚłöNé═éČé▀é╔ātāŗēęōŁéĘéķé¬üAŹćŚØē╗é╔éµéĶ2008öNé╔é═10¢£āgāōæØé╠45¢£āgāōö\Ś═é╔ł°é½ÅŃé░éķüB

é▒éĻé╔ē┴é”é─üAāŖātā@āCāiāŖü[é╠āpü[āgāiü[éŲægé±é┼é╠æµō±é╠IntegRexīvēµéī¤ōóÆåé┼üAö\Ś═é═70¢£āgāōéŹlé”é─éóéķéŲé╠é▒éŲüB

ü@

June 22, 2011 Eastman

Eastman to Acquire

Sterling Chemicals

Acquisition will enable company to expand its non-phthalate

plasticizer capacity to meet growing market demand

Eastman Chemical Company today announced that it has entered into

a definitive merger agreement to acquire Sterling Chemicals,

Inc., a single site North American petrochemical producer, for

$100 million in cash, subject to modest deductions at closing as

provided in the merger agreement. The transaction, which includes

Sterlingüfs plasticizer and acetic acid

manufacturing assets in Texas City, Texas, is expected to be accretive to

Eastmanüfs full-year 2012 earnings per

share in excess of Eastmanüfs cost of capital.

Sterling Chemicals é═É|Ä_üi¢kĢ─3ł╩üAāVāFāA17%üjüASMüiō»4ł╩üA11%üjüAē┬æYŹ▄üiō»3ł╩üA9%üjé╠āüü[āJü[é┼üAāXā`āīāōāéāmā}ü[é═Texas City ŹHÅĻé╠é▌é┼üAö\Ś═é═775ÉńāgāōüB

NOVA Chemicals é═2007öNé╠INEOS NOVAöŁæ½é╔ō¢éĮéĶüASterling Chemicals Inc.é╠Texas City ŹHÅĻé╠āXā`āīāōāéāmā}ü[é╠ōŲÉĶīĀéĵōŠéĄéĮéŲöŁĢ\éĄéĮüB

October 1, 2007

In a move that may aid the entire styrene industry, NOVA

Chemicals has purchased Sterling Chemicals' styrene unit in

order to shut it down

Eastman plans to modify

and restart

Sterlingüfs currently idled

plasticizer manufacturing facility to produce non-phthalate

plasticizers, including Eastman 168? non-phthalate plasticizers.

This additional capacity will enable the companyüfs Performance Chemicals and

Intermediates (PCI) segment to serve the growing market demand

for non-phthalate alternatives. In the North American and

European non-phthalate plasticizers markets, total sales volume

is expected to increase at a compounded annual rate of

approximately seven percent over the next five years.

ügThis

acquisition supports our growth strategy for our plasticizer

product line, and will enable us to keep pace with the growing

demand for non-phthalate alternatives, like our Eastman 168?,üh

said Ron Lindsay,

executive vice president, performance chemicals and

intermediates, and fibers. ügWe look forward to working with

Sterling employees as we bring this additional capacity online

and continue to grow this business.üh

The acquisition

also includes Sterlingüfs acetic acid production facility and its supply to BP Amoco

Chemical Company under

a long-term production agreement.

The transaction, which has been approved by both boards of

directors, is expected to be completed after receipt of required

regulatory approvals, approval of Sterlingüfs stockholders, and satisfaction

of other customary closing conditions. It is expected to be

funded with available cash. Oppenheimer & Co. Inc. is acting

as exclusive financial advisor to Eastman on this transaction and

Eastmanüfs legal counsel is Jones Day.

ü[ü[ü[

Sterling Chemicals, Inc.

is a North American producer of selected petrochemicals used to

manufacture a wide array of consumer goods and industrial

products. Acetic acid is currently our primary product and we benefit

from a long-term requirements contract with BP Amoco Chemical

Company for this product. Our petrochemicals facility

located in Texas City, TX, is strategically located on Galveston

Bay and offers approximately 160 acres for future expansion by

us, or by other companies that can benefit from our existing

infrastructure, facilities, management and operations expertise.

Sterling was founded in

1986 to acquire and operate Monsanto Companyüfs petrochemical plant in Texas

City, Texas. The

purchase was completed on August 1, 1986.

We are a Delaware

Corporation formed in 1986 to acquire a petrochemicals facility

located in Texas City, Texas, or our Texas City facility, that

was previously owned by Monsanto Company, or Monsanto. We are a

North American producer of selected petrochemicals used to

manufacture a wide array of consumer goods and industrial

products.

Until 2011, our primary products included acetic acid and

plasticizers.

All of our plasticizers

were historically sold to BASF Corporation.

However, on November 11, 2009, BASF elected to terminate our

Plasticizers Production Agreement effective as of December 31,

2010. As our plasticizers facility is currently

idle, acetic

acid is currently our only primary product.

| BP 1999/2/15 BP Amoco is the largest merchant

marketer of acetic acid in the world. BP Amoco owns the

technology for acetic acid production via methanol

carbonylation and the recent development of the Cativa

technology. About 70% of the world's manufacturing

capacity for acetic acid uses BP technology. Sterling is

a major US producer of acetic acid currently, with about

18% of domestic capacity. BP Chemicals markets all of

Sterling's acetic acid production and is providing

capital and improved technology for the expansion.

Sterling Chemicals, headquartered in Houston, Texas,

currently produces six commodity petrochemicals,

including styrene, acrylonitrile,

acetic acid, plasticizers, tertiary butylamine and sodium

cyanide, at its Texas City, Texas facility.

Sterling also produces sodium chlorate for the pulp and

paper industry at several locations in Canada and at a

new plant in Georgia. Also in support of the pulp and

paper business, Sterling licenses, designs and offers

construction management for large large-scale chlorine

dioxide generators. Sterling also manufactures acrylic

fibers.

In August 1992, Sterling purchased the

pulp-chemical division of Albright & Wilson, a

division of Tenneco Canada, Inc., for about 2

million. The acquisition included four Canadian

facilities for the production of sodium chlorate,

used in the bleaching of pulp for the manufacture of

paper. Canexus (formerly Nexen Chemicals)

June 5, 1995--Sterling Pulp Chemicals, Ltd., a

wholly- owned subsidiary of Sterling Chemicals, Inc.,

today announced that it will construct a 110,000 ton

per year sodium chlorate plant in Valdosta, Ga. now

owned by Erco Worldwide

January 24, 2001

Sterling Chemicals Holdings, Inc. today announced

that it intends to build a 60,000 Metric Tonnes Per

Year (MTPY) sodium chlorate plant to be located in

New South Wales, Australia.

Sterling Chemicals Holdings says it will go ahead

with plans to sell its sodium chlorate business to

secured creditors as part of its proposed

restructuring plan under Chapter 11

Sterling Chemicals had no choice but to declare

Chapter 11 bankruptcy protection in July 2001. 2005/11

Citing a history of operating losses, Houston-based

petrochemical product producer Sterling Chemicals,

Inc., reports that it is exiting the acrylonitrile

and derivatives operations. These businesses--which

sustained gross losses of $7 million during

first-half 2005 and $28 million and $36 million

during 2004 and 2003, respectively--have been shut

down since February 2005 following a force majeure

event.

2005/5

Sterling has notified DuPont, which has had a

longtime supply agreement with Sterling, that it will

no longer supply it with sodium cyanide.

BP and Amoco recently completed the largest industrial

merger in history. The merger combines, among other

things, Amoco's market strength in PTA, paraxylene, poly

alpha-olefins and polypropylene and BP's strength in

acetic acid, acrylonitrile, oxygenated solvents, and

polyethylene

BP Texas City Chemicals manufactures Paraxylene (PX)

and Metaxylene (MX). PX is used as a feedstock for

Purified Terephthalic Acid (PTA) and MX is used in a

variety of applications such as fiberglass, drink bottles

and outboard motors. There are four production units on

the site (three PX and one MX). The chemicals site is

integrated with BP's Texas City refinery and receives

most of its Mixed Xylene feedstock via a pipeline from

the refinery. Close to the Texas City Chemicals site,

Sterling Chemicals has a single Acetic Acid unit (annual

production capacity of approximately 580,000 tonnes) and BP markets 100% of the Acetic Acid

produced.

|

ü@

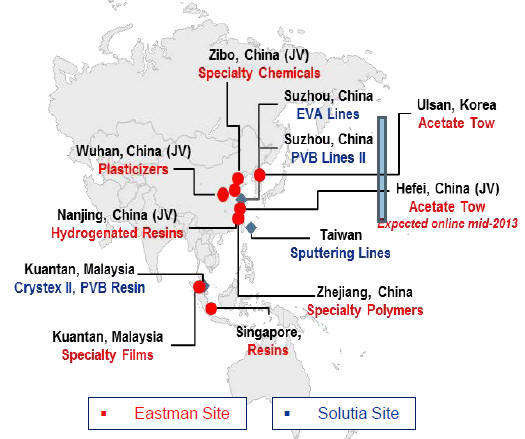

2012/1/27 Eastman Chemicalü@

Eastman to Acquire Solutia; Raises Outlook

for 2013 EPS to Greater Than $6

Eastman Chemical Company and Solutia Inc. today announced that they have entered

into a definitive agreement, under which Eastman will

acquire Solutia, a global leader in performance materials and specialty

chemicals. Under the terms of the agreement, Solutia stockholders will receive

$22.00 in cash and 0.12 shares of Eastman common stock for each share of Solutia

common stock. Based on yesterdayüfs closing prices, Solutia shareholders will

receive cash and stock valued at $27.65 per Solutia common share, representing a

premium of 42 percent and a total transaction value of approximately

$4.7 billion, including the assumption of Solutiaüfs debt.

Solutiaé═1997öN9īÄé╔Monsantoé╠ē╗ŖwĢö¢Õé¬Ģ¬ŚŻōŲŚ¦éĄé─É▌Ś¦é│éĻéĮē’Äąé┼éĀéķüB

Solutiaé═2008öN2īÄ28ō·üAē’ÄąŹXÉČÄĶæ▒é½üiChapter 11üjéÅIŚ╣éĄüAŹ─ÉČé╔ī³é»āXā^ü[āgéĄéĮüB

2008/3/4ü@SolutiaüAöjÄYÄĶæ▒é½ÅIŚ╣

ügThe acquisition of Solutia is a significant

step in our growth strategy and one that I am confident will strengthen Eastman

as a top-tier specialty chemical company with strong, stable margins,üh said Jim

Rogers, chairman and chief executive officer of Eastman. ügThe addition of

Solutia will broaden our geographic reach into emerging geographies,

particularly Asia Pacific, establish a powerful combined platform with extensive

organic growth opportunities, and expand our portfolio of sustainable products,

all of which are consistent with our growth strategy.

ügThis transaction is also expected to deliver immediate value to our

stockholders in the form of accretion and strong cash generation, as well as

create potential upside through the combination of two leading global chemical

companies,üh said Rogers.

"This complementary transaction will accelerate the growth of our businesses

around the world. The shared commitment to innovation, quality and technical

service will allow us to better serve our customers and creates opportunity for

our employees around the globe," said Jeffry N. Quinn, chairman, president and

chief executive officer of Solutia. "This transaction provides Solutiaüfs

shareholders with immediate value and an attractive premium, as well as the

opportunity to benefit from the future prospects of a leading global chemicals

producer with the financial strength, a diversified mix of premium products, and

the geographic footprint to capitalize on long-term growth opportunities."

ügI commend the excellent management team and employees of Solutia. Over the past

several years, Solutia has transformed itself into a financially strong,

innovative performance materials and specialty chemicals company, with enviable

market leading positions in virtually every market it serves,üh added Rogers.

ügThat, in addition to both companiesüf success integrating prior acquisitions,

gives me confidence we will achieve a smooth transition. We look forward to

welcoming Solutia employees to Eastman.üh

Solutia a strong, strategic fit

Eastman and Solutia share several key fundamentals, such as complementary

technologies and business capabilities, a polymer science backbone, similar

operating philosophies and a high performance culture. In addition, the overlap

of key end-markets is expected to provide opportunities for growth.

This acquisition is also a significant step in Eastmanüfs strategy

to extend its global presence in emerging markets.

In particular, it should significantly accelerate Eastmanüfs growth efforts and

offer excellent growth opportunities in Asia Pacific. By leveraging

infrastructure in the region, Eastman expects to have a compound annual growth

rate in Asia Pacific approaching 10 percent for the next several years.

Transaction expected to deliver strong earnings growth and significant cost and

revenue synergies

Eastman expects the transaction to be immediately accretive to earnings,

excluding acquisition-related costs and charges. After giving effect to the

acquisition of Solutia, including expected cost synergies, Eastman expects 2012

EPS to be approximately $5 excluding acquisition-related costs and charges.

Eastman is also increasing its 2013 EPS expectation to greater than $6.

Eastman has identified annual cost synergies of approximately $100 million that

are expected to be achieved by year-end 2013. Key areas of value creation

include the reduction of corporate costs, raw material synergies, and improved

manufacturing and supply chain processes.

Further, Eastman expects to realize significant tax benefits from Solutiaüfs

historical net operating losses and other tax attributes that are expected to

contribute to free cash flow (defined as cash from operations minus capital

expenditures and dividends) of approximately $1.0 billion through 2013.

Eastman also recognizes the potential for meaningful revenue synergies by

leveraging both companiesüf technology and business capabilities and end-market

overlaps, particularly in automotive and architectural.

Attractive capital structure, benefiting from low interest rate environment

Eastman intends to finance the cash portion of the purchase price through a

combination of cash on hand and debt. Debt financing has been committed by Citi

and Barclays Capital which are acting as financial advisors to Eastman on the

transaction, and Jones Day is acting as legal counsel. Eastmanüfs management and

Board of Directors remain committed to maintaining an investment grade credit

rating and to its current annual dividend rate of $1.04 per share.

Deutsche Bank Securities Inc. and Moelis & Company LLC acted as financial

advisors to Solutia on this transaction. Perella Weinberg Partners LP acted as

financial advisors to Solutia's Board of Directors. In addition, the Valence

Group, LLC conducted an independent evaluation of Solutiaüfs long range plan for

Solutiaüfs Board of Directors. Kirkland & Ellis LLP acted as legal counsel to

Solutia.

The transaction, which was approved by the Boards of Directors of both

companies, remains subject to approval by Solutiaüfs shareholders and receipt of

required regulatory approvals as well as other customary closing conditions. The

transaction is expected to close in mid-2012.