トップページ

2010-06-02 Xinhua

Chinese

firms buy Canadian copper mine

China Railway

Construction Corp (CRCC) and Tongling Nonferrous Metals Group

Holdings have completed a $679 million acquisition of Canadian Corriente

Resources Inc

in China's second-largest overseas copper mine takeover.

CRCC-Tongguan Investment (Canada) Co, a 50-50 joint venture

established by the two Chinese companies, gained 96.7 percent of

all Corriente shares on a fully diluted basis, Tongling said in a

statement to Shenzhen Stock Exchange.

The acquisition would allow the firms to gain mining rights to

Corriente's main assets of 17 deposits in the copper belt in southeast Ecuador. Copper reserves in the four main

mining regions total around 11.54 million tons. Media reports

said the reserves could bring a cash flow of 150 billion yuan

($21.96 billion).

Corriente Resources

Inc. is a Canadian-based resource development and exploration

company specializing in copper and copper-gold opportunities.

The company's main focus is its 100% owned Corriente

Copper Belt in Ecuador. Corriente has completed a

feasibility study on an initial starter operation at its Mirador

copper-gold deposit. Corriente looks to expand

operations at Mirador past the starter project and from other

locations in the Corriente Copper Belt.

2010-6-12 CCR

Heyuan Chemical Builds PP

and MEG Projects in Ningbo

Ningbo Heyuan Chemical Co Ltd, a wholly owned subsidiary of

Zhejiang Tiansheng Holding Group Co Ltd, held a great

groundbreaking ceremony on June 9th to build units of 300 000 t/a

polypropylene (PP) and 500 000 t/a mono-ethylene glycol (MEG) at Ningbo Chemical Industry Zone,

Zhejiang province of eastern China.

The two units are designed to cover a land of 50 hectares

together. With a total investment of RMB5.83 billion, they are

scheduled for startup in June 2012.

Zhejiang Tiansheng Holding Group Co Ltd, headquartered in Keqiao,

Shaoxing of Zhejiang province, is a large private enterprise

group engaged in the manufacture of chemical fibers, fabrics,

dying/printing, textile and other business. It owns a total asset

of RMB7.5 billion, 1.2 million square meters of land and 4 100

workforces. The group can annually produce 800 000 tons of

chemical fiber, 210 million meters of chemical fiber fabrics, as

well as other fabrics.

Heyuan project will help to complete the production chain in the

Ningbo Chemical Industry Zone.

Zhejiang Tiansheng

Holding Group Co Ltd 浙江天聖控股集團

Located in the

Shaoxing county of Zhejiang province, our company is a

large-sized comprehensive group, specializing in weaving and

dyeing, the production of chemical fibers and the development

of real estate. We were established in 1996 and become a

company nominated as a prime development base for synthetic

fabrics by the National Textile Products Development Center

of China.

We have total assets of USD 200,000,000 and staff of more

than 5,000. Within the group there are several companies,

which are Shaoxing County Qing Fang Cheng New Synthetic Fiber

Co., Ltd, Shaoxing Ronghao Textile Co., Ltd, Shaoxing

Jiecaifang Dyeing Co., Ltd, Zhejiang Yifeng Textile Co., Ltd,

Shaoxing Yongjian Real Estate Development Co., Ltd and

Shaoxing Tianjie Trading Co., Ltd.

2010/6/16 Shanghai

Ningbo Heyuan Kicks off

PP & MEG Projects in NCIZ

On June 9 2010, Ningbo Heyuan Chemical Company held an

inauguration ceremony for the PP & MEG projects in Ningbo

Chemical Industry Zone (NCIZ), Zhenhai, Ningbo , Zhejiang

Province.寧波市鎮海の寧波化学工業区

With total

investment of RMB 5.83 billion, Heyuan will build capacities of

300kt/a PP and 500kt/a MEG. It is designed to occupy an area of

500,000 square meters and use outsourced methanol as raw

material to produce ethylene and propylene. It is proposed to use DMTO

process developed by Dalian Institute of Chemistry and Physics,

Chinese Academy of Sciences (DICP-CAS 中国科学院大連化学物理研究所) and SINOPEC Luoyang

Petrochemical Engineering Company (LPEC洛陽石化工程公司). Produced ethylene will be used

in mono-ethylene glycol (MEG) production by the conventional

process route via ethylene oxide.

According to the analysis of ASIACHEM Consulting, by outsourcing

methanol and produce PP and MEG in NCIZ, Heyuan will have two

advantages: firstly, the good logistic condition of NCIZ for

methanol shipping and storage; secondly, the huge local market

volume for PP and PET products and enriched experience of

chemical fibers production & marketing owned by the parent

company, Tiansheng Group, which guarantees the product

distribution channel.

This project needs 1.8Mt/a methanol as feedstock, and most of

which will be sourced from overseas. Therefore how to secure the

low cost and large quantity of methanol supply will be the key

factor of competitiveness in the future.

Founded in March 2010, Ningbo Heyuan Chemical is invested by

Zhejiang Tiansheng Holding Group and registered in NCIZ with the

capital around RMB 5.8 billion. Tiansheng Group is a private firm

based in Shaoxing City , Zhejiang Province, which main business

covers chemical fiber and textile manufacturing, dyeing, and real

estate.

In 2009, China net import of PP was 4.12 Mt and MEG was 5.82 Mt.

なお、寧波化学工業区にはシノペック鎮海煉油化工の年産100万トンのエチレンコンプレックスが本年4月に稼動している。

同社は年産30万トンのPPと65万トンのMEGプラントを持っている。

2010/6/12 CCR

Methanol Factory Came on

Stream in Qaidam Basin

Qinghai Zhonghao Natural

Gas Chemical Co Ltd started up a 600 000 t/a

natural gas to methanol unit in the first week of June in

Qaidam Cyclic Economy Demonstration Area of Qinghai province青海省. The construction was started on

January 6th, 2007 with a total investment of RMB2.1 billion. When

full operation, it will consume 700 cubic meters of natural gas

per year and produce 666 700 tons of commodity methanol at

standard of GB338-92 of (OM232k) AA grade.

A railway has been constructed on May 21st to deliver methanol

from the methanol factory.

2007/1/16

Qinghai

Zhonghao Natural Gas Chemical Co. Ltd selects Johnson Matthey

Catalysts and Davy Process Technology to supply Methanol

Technology and Catalysts

Johnson Matthey

Catalysts (JM) and Davy Process Technology (DPT) are pleased

to announce they have entered into contracts for a methanol

technology licence, basic engineering design and catalysts

with Qinghai Zhonghao Natural Gas Chemical Co., Ltd for their

new methanol project.

The project will use JM/DPT advanced steam reforming

technology, methanol synthesis technology and catalysts for

the production of 2000 tons per day of methanol from natural

gas. The methanol plant will be

built at a new production facility at Geermu City in Qinghai

Province, China. The basic engineering of the plant is

currently being performed by DPT and the detailed engineering

of the plant will be performed by Chengda Engineering

Corporation of China.

2010-6-12 CCR

Dagu Chem to Produce HPPO

Tianjin Dagu Chemical Co Ltd (Dagu Chem 天津大沽) disclosed that it started

operation of a 1 500 t/a pilot unit that produces propylene oxide

from hydrogen peroxide (HPPO). Commercial product is expected

to enter the market at the end of 2010.

This is China's first HPPO unit with the technology patented by

Chinese firm. More over Dagu Chem is constructing a 10 000 t/a

commercial HPPO unit.

Its current 100 000 t/a propylene oxide unit was imported from

Mitsui Toatsu Chemicals, Inc.

天津大沽化工(Tianjin Dagu Chemical)

は天津渤海化工(Bohai Chemical)の子会社で、塩ビチェーンとPOおよびPO誘導品を事業化している。

天津大沽は数年前からSM、ABS等への進出を画策していたが、本年初めにSINOPECの天津エチレン計画(100万トン)へ参画することを決定した。

能力は、SM 500千トン、ABS 400千トンだが、ABSについては、原料

ANの調達が未定のためSMを先行する。

2007/8/23 天津大沽化工、天津でSM

500千トンプラント建設

Tianjin

Dagu Chemical Co., Ltd. was founded in 1939, which is a

large-scaled integrated chlorine-soda manufacturing

enterprise produces caustic soda, PVC resin, pesticide,

epoxypropane, synthetic hydrochloric acid, liquid chlorine

and special-shaped plastics of doors and windows processing

on the basis of electrolyzing sodium chloride.

Tianjin

Dagu Chemical Co., Ltd. is situated in Tanggu district of

Tianjin, which covers 2,820,000 m2 west to Tianjin Port,

TEDA, Tianjin Port Bonded Location. Near the Jing-Jin-Tang,

Tang-Jin, Jin-Bin Freeway and Tianjin International Airport.

| 2010年

06月28日 上海発 |

| 中国の

メタノールの消費、本年は2,150万トンに |

| |

2002年から2008年までの間で、中国の輸入メタノールの比率は45%から12%にまで下がった。

しかし、2009年に入り、海外の安い天然ガスを原料とする大型設備の稼動で輸入は急増した。

2009年の輸入数量は5,288千トンと、前年比で3.7倍となった。

本年1-4月の輸入実績150万トンを基にすると、2010年の輸入は450万トンと予想される。

海外のコスト競争力のあるメタノールが流入した結果、市況は下がり、国内メタノール産業に大きな影響を与えている。

多くのメーカーが敗退し、業界の操業率は下がっている。

天然ガスからのメタノール製造過程でアンモニアを生産、これを肥料にしているが、メタノールの減産で肥料業界の一部にも影響が出ている。

更に原料の天然ガス価格の上昇も業界に影響を与えている。

中国商務部は昨年6月に、サウジアラビア、マレーシア、インドネシア、ニュージーランド原産の輸入メタノールに対してダンピング調査を開始した。

メタノールメーカーはメタノールのダンピング課税で市況の上昇、販売増を狙っている。

他方、中国政府は石油・化学産業構造改革指針に基づき、設備過剰問題解決のため、旧式の設備を廃棄し、新しいメタノール誘導品の開発する必要がある。

このため、市場の見えない手で国内メタノール産業の構造改革を行うことも一つのオプションである。

商務部は本年6月24日に、本件の調査を6ヶ月延長した。

本件についてはサウジ政府やSABICが激しく反発し、サウジには中国製品に対して報復で課税すべきだとの意見もでたため、中国大使館がサウジの懸念を十分考慮するとの発表をしており、最終的にダンピング課税を行うかどうか、不明である。

2010年には中国で3つの大型計画がスタートする。

神華集団の内蒙古自治区包頭の180万トン、同じく神華集団の寧夏回族自治区の神華寧夏石炭産業(通称

Shenhua Ningmei)の167万トン、大唐国際発電による内蒙古自治区

Duolun県の167万トンで、いずれも下期に完成する。

既存設備だけでも2010年の生産量は1,563万トンと予想され、これに上記の3計画の年内生産分の約140万トンを加えると、2010年の総生産量は

1,700万トンと予想される。

このうち、新計画は全てMTO(メタノール to

オレフィン)でPEやPPの原料であり、メタノール需要の純増となる。

このほかメタノール添加ガソリン(M-Gasoline)

が中国北部で使用が増えており、これによる需要増も多い。

ASIACHEM Consultingではこれらを勘案し、2010年の生産を1,700万トン、輸入を450万トン、消費を2,150万トンとみている。

中国のメタノール消費量は2008年の1,219万トンが2009年には1,650万トンとなり、本年には2,000万トンを超えることとなる。

中国のメタノール需給実績及び予想(単位:千トン)

予想はASIACHEM Consulting

| |

Production |

Import |

Export |

Consumption |

| 2007 |

10,760 |

845 |

563 |

11,042 |

| 2008 |

11,120 |

1,434 |

368 |

12,186 |

| 2009 |

11,231 |

5,288 |

14 |

16,505 |

| 2010予 |

17,000 |

4,500 |

10 |

21,490 |

|

2010/6/28 上海発

ChemChina starts up TiO2

project in Shandong

On Jun. 20, 2010, Jinan Yuxing Chemical (裕興化学) - a subsidiary of ChemChina

started up its first stage TiO2 project in Jinan Chemical

Industry Park (JCIP), Jinan済南市, Shandong Province.

中国化工集団公司(ChemChina)の藍星グループの子会社

With total

investment of RMB 1.5 billion, the first stage project of

ChemChina has TiO2 capacity 100 kt/a, and it also includes a 300

kt/a H2SO4 project as the sulfuric acid route will be used in the

TiO2 production.

(酸化チタン製法には硫酸法と塩素法があるが、同社は硫酸法を採用している。)

Yuixing Chemical

had 30 kt/a TiO2 capacity in the Jinan City, but the plant had

been closed by the end of 2009 and relocated to the new site -

JCIP for the environmental reason.

Also, ChemChina is planning the second stage TiO2 project in the

same site, which has designed capacity of 200 kt/a. After it

starts up, ChemChina will have total capacity of 300 kt/a and

become the largest TiO2 production base in China.

ーーー

Also in Shandong,

Dupont has planned a world scale TiO2 project, but it is not

going smoothly for the environmental reason. In Nov. 2005, Dupont

signed an agreement with the local government to build a world

scale TiO2 project in Economic Development Zone of Dongying City東営市.

It would have an initial capacity of 200 kt/a.

The project has got the Environmental Evaluation approval from

government, and it is expected to start up in 2010. But up to

now, there is not updated information for the project start

construction.

デュポンは裕興化学と異なり、塩素法を採用しており、液体廃棄物は地下深くに注入している。

同社の立地は大慶油田に次ぐ中国第 2の油田の勝利油田の近くにあり、液体廃棄物が漏れ出すのではないかとの懸念が出ている。環境を理由にしているが、デュポン進出で影響を受ける中国のメーカーの反対も背景にある模様。

デュポンでは50年近く、この方法(underground

injection 技術、Deepwell法ともよばれる)で処理しており、なんら問題を起こしていないとしている。

液体廃棄物は地下深く注入されて自然の地層のなかに分散され、自然の化学反応で無害になるとしている。

http://www2.dupont.com/Media_Center/en_US/position_statements/dongying_project.html

China produced 1.05 Mt

TiO2 in 2009. China imported 244.8 kt and exported 103.6 kt TiO2

in the same year.

2010/7 CCR

PetroChina Urumqi

Petrochemical completed construction of para-xylene/aromatic

hydrocarbon integration unit

On June 30th PetroChina

Urumqi Petrochemical Company completed construction of a 1

million t/a para-xylene/aromatic hydrocarbon integration unit,

representing that the world's largest aromatic hydrocarbon unit

enters the stage of trial production.

With a total investment of RMB3.7 billion, this unit integrates

eight production facilities. UOP's two technologies are used.

2010/7 CCR

Zhonghao Methanol Plant

Began Production

The 600 000 t/a natural gas to methanol plant of Qinghai Zhonghao

Natural Gas Chemical Co Ltd (Zhonghao) came on stream at the end

of June at Kunlun Economic Development Zone, Germu of Qinghai

province, representing that the total methanol capacity in Germu

region reached one million t/a. Natural gas the new plant needed

will be supplied by the Qinghai oilfield of PetroChina Company

Limited. Zhonghao started to construct the RMB2.1 billion plant

on January 6th, 2007. Davy Process Technologies' low pressure

synthetic technology is used in the plant.

PetroChina's Germu Refinery has built a 100 000 t/a natural gas

to methanol plant in 1999 and a 300 000 t/a methanol plant in

2006.

2010/7/23 Shanghai

PetroChina Urumqi Starts

up PX project in Xinjiang

On Jul. 19, 2010, PetroChina Urumqi Petrochemical Company

(PetroChina Urumqi) started up its large scale PX project in

Urumqi , Xinjiang.

With total investment around RMB 3.8 billion, the project

includes PX capacity of 930,000 t/a and benzene capacity of

320,000 t/a. Originally, it was scheduled to start up come on-stream in 2008. But later, it was delayed.

経営陣は供給過剰を理由に操業開始を出来るだけ遅らせることを主張し、地元の景気刺激と雇用のため早期操業開始を主張する地元政府と争っていた。

UOP technology is

selected by this project. Feedstock would be sourced from the

company's own refinery at the same site. The PX products will

mainly supply to the China market and the rest will supply the

local and Middle Asia market.

After the new project startup, PetroChina Urumqi PX capacity

reached 1 Mt/a, benzene capacity of 330 kt/a. Currently,

PetroChina Urumqi has existing crude processing capacity of 6

Mt/a, ammonia capacity of 630 kt/a, urea capacity of 1.1 Mt/a and

PTA 75 kt/a.

PetroChina Urumqi company was planned a 1.5 million t/a PTA

project, but up to now, the project is shelved. Now, the company

is planned to expanded the refining capacity to 10 Mt/a from the

current 6 Mt/a.

China imported 3.7 Mt and exported 333 kt PX in 2009, and

imported 3.4 Mt and exported 448 kt PX in 2008.

2010/8/2 Shanghai

ERTISA Phenol-Acetone

project got approval from NDRC

On Jul. 30, 2010, NDRC official announced the approval of

ERTISA's phenol-acetone project in Shanghai Chemical Industry

Park (SCIP).

With total investment of USD 130 million, the project has

designed capacity of 250 000 t/a phenol and 150 000 t/a acetone.

It will be invested solely by Spain's ERTISA Chemical - a

subsidiary of CEPSA. The project got environmental approval in

2008, it was originally expected to start up by 2009, but it

delayed by the global financial crisis in H2 2008.

The project will get technology license from Sunoco/UOP to

produce phenol/acetone through the cumene route. In the initial

stage, cumene feedstock will be sourced from overseas market,

particularly from S. Korea and Japan. The output is will provide

the PC units of Bayer in SCIP. Bayer operates 200 kt/a PC plant

now (2 lines of a 100 kt/a).

In 2008, Bayer

MaterialScience signed an acetone and phenol supply agreement

with Spanish producer Ertisa. http://www.icis.com/Articles/2008/06/19/9133949/bayer-signs-supply-agreement-with-spanish-ertisa.html

Phenol and acetone

are used to produce bisphenol A (BPA), a base product for

plastics created by Bayer. Exact tonnage volumes agreed upon

were not provided.

The acetone and

phenol will be delivered via a pipeline and by rail from a

site in Antwerp, Belgium (Tank terminal named LBC-CEPSA Tank

Terminals Antwerpen) to Bayer MaterialScience's BPA

processing facilities in Europe.

(Uerdingen, Germany 330kta and Antwerp,

Belgium 240kta)

The facilities in Map Ta Phut, Thailand(270kta), and

Shanghai, China(200kta), will be supplied by sea, Bayer said.

After the

phenol-acetone complex start up in SCIP, ERTISA will supply

feedstock to the Bayer plant.

* Bayer has a plant

in Baytown, USA (260kta→350kta) and total capacity is

1,300 kta.

* In SCIP, Bayer has

BPA plant (200kta).

2008/8/19 スペインのCEPSA、上海でフェノール/アセトン生産を計画

According to the

planning, in the future, the cumene feedstock will be supplied by

the proposed 1 Mt/a ethylene cracker and a 10 Mt/a refinery in

SCIP, which will be jointly invested by Sinopec and SCIP

Development Company. But the ethylene and refinery is still

waiting approval from NDRC.

ERTISA is a wholly owned

company by CEPSA, is the sole Spanish manufacturer of phenol,

acetone, methylamines and derivatives. CEPSA is integrated

petrochemical company, whose business including petroleum

exploration and production, refining, transport and marketing of

petroleum derivatives, and manufacture of plastics, synthetic

fibres, etc.

Ertisa is one of the

largest phenol and acetone sellers in Europe, producing a total

of 600,000 tonnes/year of phenol and 370,000 tonnes/year of

acetone at a site in Huelva, Spain.

---

Besides, Sinopec-Mitsui Chemical Co., Ltd (Sinopec-Mitsui)

operates a 124 kt/a phenol and a 76 kt/a acetone and a 162.4 kt/a

cumene facilities in SCIP. It is self-supplying feedstock for the

operating 120 kt/a BPA of Sinopec-Mitsui in the same site. Also,

Sinopec-Mitsui has planned another 250 kt/a phenol and 150 kt/a

acetone in SCIP.

Originally, Sinopec

Shanghai Gaoqiao Company has two phenol/acetone complexes,

the old one (60 kt/a) is located in Gaoqiao, and the new one

(200 kt/a) is located in SCIP. Later, the new one in SCIP is

transferred to the jv of Sinopec-Mitsui.

Also, Ineos has shifted

the planned world scale phenol/acetone project to Nanjing

Chemical Industry Park (NCIP) from the previous proposed in

Zhangjiagang, Jiangsu Province. The projects will produce 400

kt/a phenol and 250 kt/a acetone as well as 550 kt/a cumene. It

is expected to set up joint venture between Ineos Phenol and

Sinopec Yangzi Petrochemical, but there is not detailed

information disclosed.

| 1. 所在地 |

上海市・上海化学工業区

|

| 2.

出資比率 |

50:50 |

| 3.

生産能力 |

| |

フェノール |

アセトン |

BPA |

| 今回新設 |

25万トン |

15万トン |

|

| 既設(上海中石化三井化工) |

|

|

12万トン |

| 既設(上海中石化高橋分公司) |

12.5万トン |

7.5万トン |

|

| 合計 |

37.5万トン |

22.5万トン |

12万トン |

|

| 4.

新プラントプロセス |

三井化学技術 |

| 5.

営業運転開始時期 |

2013年第2四半期 |

BPAは帝人化成に供給

立地:浙江省嘉興市

能力:PC 100千トン(60千トン)

2009/11/4 三井化学、シノペックとの合弁事業の基本合意

Also, Ineos has shifted

the planned world scale phenol/acetone project to Nanjing

Chemical Industry Park (NCIP) from the previous proposed in

Zhangjiagang, Jiangsu Province. The projects will produce 400

kt/a phenol and 250 kt/a acetone as well as 550 kt/a cumene. It

is expected to set up joint venture between Ineos Phenol and

Sinopec Yangzi Petrochemical, but there is not detailed

information disclosed.

2010/1/7 INEOSとシノペック、南京にフェノールJV設立を検討

2010/8/11

上海

BPとシノペック揚子石化、南京で酢酸の生産開始

BPとシノペック揚子石化は8月5日、南京化学工業パーク(NCIP)で酢酸の生産を開始した。

13.9億人民元を投じたもので、BPとシノペック揚子石化の50/50JVのBP YPC Acetyls Company (Nanjing)

Ltd. (BYACO)が運営する。能力は年産50万トンで、BP

Amoco がモンサント技術を基に開発したCativa 法を使用する。

2007年に建設を開始し、当初は2009年の生産開始の予定であったが、原料COの供給の遅れで遅延していた。

2008年7月に揚子石化はNCIPで天然ガスベースの合成ガス工場の建設を開始した。

Technipの天然ガス変性技術と Air Productsの深冷分離技術を使用して、CO 年産250千トン、水素36.8千トンを生産し、2009年下期にCOを酢酸原料として供給する計画であった。

しかし、このプラントは本年7月末にようやくオンスペックとなった。

BYACO では酢酸は中国の国内市場で販売する。

BP と Sinopec揚子石化 は重慶にも両社のJVのYangtze River Acetyls Company

(YARACO) を持つ。

1995年にBP 51%、Sinopec 44%、地元 5%のJVでYARACOを設立、当初能力は15万トンであったが、現在は35万トンで、このほか8万トンのエステルも生産している。

両社は2008年に65万トンの酢酸の新工場建設の覚書に調印した。2011年に生産開始の予定で、完成後の能力は100万トンになる。

南京のNCIPではセラニーズがワールドクラスの酢酸工場を操業している。

自社のAO Plus法を使用するもので、第一期60万トンは2007年にスタート、第二期60万トンが2009年に完成、現在能力は120万トンとなっている。

中国の2009年の酢酸生産量は312万トンで、298千トンを輸入し、65千トンを輸出している。

2010/8/18 Shanghai

Jialong Petrochemical

started up PTA in Fujian

In early Aug. 2010, the

local government announced that the Shishi Jialong Petrochemical

Fiber Co., Ltd (石獅佳龍石化紡織) has started up the PTA project

and entered the trial operation period in Shishi (石獅), Fujian Province.

With total investment of

RMB 2.238 billion, the project has PTA capacity of 600 kt/a.

Using Invista process, the PX feedstock will mainly sourced from

Fujian Refining & Petrochemical Company Limited (FJREP) - the

jv invested by Fujian Petrochemical Company Limited, ExxonMobil

and Saudi Aramco with shares of 50:25:25. Fujian Petrochemical

Company is a 50:50 jv between Sinopec and Fujian Provincial

Government.

The PTA product will

provide to the local PET fiber producers in Fujian.

The Jialong PTA project

was approved by NDRC in 2006 and was listed in the petrochemical

stimulus package in 2009, and was completed constrction in Q1

2010. In Feb. 2009, China government

approved a petrochemical stimulus package, which aims to support

the petrochemical industry revival and redevelopment during the

global economic downturn. At that time, the Jialong PTA project

was included named as ”Shishi 600 kt/a PTA project”.

Jialong

Pertrochemical home page says as follows :

Jialong Pertrochemical Fiber(Shishi) Co.,Ltd is the biggest

joint-stock company since the establishment of Jialong Group.Now

Jia Long Group decides to select Shi Hu industrial zone in Shi

Shi city and take up an area of 50.2 hectares.The auxiliary

facility is complete in the district;the gross investment of the

first stage of the project is 2.238 billion yuan.

This project will divide into three parts, the first and the

second stage is PTA production line, and the third stage is PX

production line.

After this project is built and put into production,it will be a

world-class manufacturing enterprise with basic raw

materials(PTA) of chemical fiber, the product will alleviate

demand of chemical

fiber industry both Fujian Province and even domestic.

In early Aug. 2010, the

Jialong Petrochemical Company disclosed the preliminary planning

in Shishi, Fujian.

According to the company, the 600 kt/a PTA project is the first

stage, and the proposed 1.1 Mt/a PTA is the second stage. The

second is expected to start up in the next 2-3 years. Then the

Jialong Petrochemical will have total PTA capacity of 1.7 Mt/a in Shishi,

Fujian.

Jialong Petrochemical is

a subsidiary of Jialong Group - a Beijing based private firm with

diversified business including petrochemicals, hotels and real

estate.

China imported 5.08 Mt

and exported 1.2 kt PTA in 2009, and imported 4.98 Mt and

exported 8.9 kt PTA in 2008.

2010/8/24 CCR

Adisseo Started

Methionine Project

On August 2nd, Bluestar Adisseo Nanjing Company Limited held a

groundbreaking ceremony for its 140 000 t/a

methionine

project in the Nanjing Chemical Industry Park, Jiangsu province.

Construction expenditure was RMB3.3 billion, according to the EIA

report filed on December 8th, 2009. The plant is expected to be

on line in the second semester of 2012.

2010/8/24 CCR

Yankuang Adds 100 000 T/A

Acetic Anhydride Production

Lunan Chemical Fertilizer

Factory of Yankuang Group announced on August 2nd the completion

and startup of a 100 000 t/a acetic anhydride

project at

its existing factory site in Mushi town, Tengzhou, Shandong

province. It is the largest of its kind in China. Wet

commissioning for the main equipment had been done on June 26th.

The investment was US$1.1 billion and construction was started on

May 25th, 2009.

2010/8/24 CCR

CNSG Launches PVC Project

in Delingha

China National Salt Industry Corporation (CNSG) held a ceremony

on August 3rd to announce the official opening of CNSG Qinghai

Chlor-alkali Chemical Company Limited and to begin construction

of a 400

000 t/a polyvinyl chloride (PVC) project in the Delingha

Industrial Park in Haixi of Qinghai province. The new company

will invest RMB5.785 billion in the project that includes units

of 360

000 t/a ionic membrane caustic soda, 400 000 t/a PVC, 640 000 t/a

calcium.............

2010/8/24 CCR

Zhonggu Breaks Ground 600

000 T/A Chlor-Alkali Project

Inner Mongolia Zhonggu Mining Industry Company Limited (Zhonggu)

held in early July a groundbreaking ceremony for a chlor-alkali

project at Mengxi Industry Zone, Erdos, Inner Mongolia. Zhonggu

was a joint venture between Guangdong Hongdaxingye Group and its

controlling subsidiary Inner Mongolia Wuhai Chemical Company

Limited. The construction will be proceeded in two phases. Total

investment will be RMB12 billion. The project will have a total

capacities of 600 000 t/a polyvinyl chloride

resin, 600 000 t/a caustic soda, 2 million t/a semi coke, 1

million t/a calcium carbide, 1.5 million t/a cement, 200 000 t/a

chlorobenzene, 200 000 t/a sodium formate. The new plant is expected to add

5 000 jobs.

2010/8/24 CCR

Zhongtai to Start up

Chlor-Alkali Project

Xinjiang Zhongtai

Chemical Co Ltd announces on August 10th that it has completed

main equipment installation for its phase two project including a

360

000 t/a polyvinyl chloride unit and a 300 000 t/a caustic soda unit at the end of July and will

start up in December this year.

Sept 08, 2010

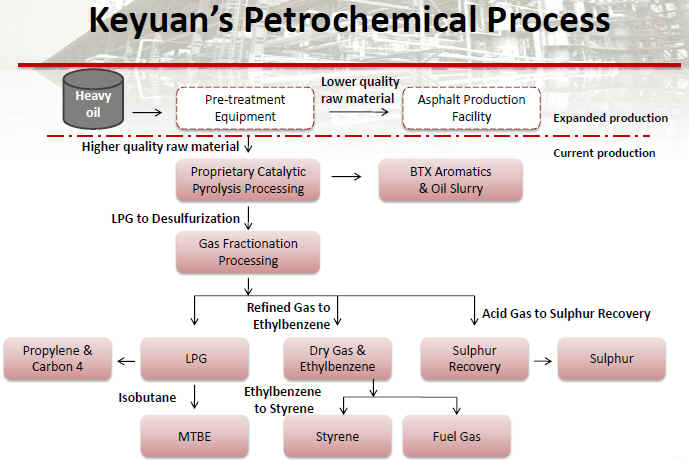

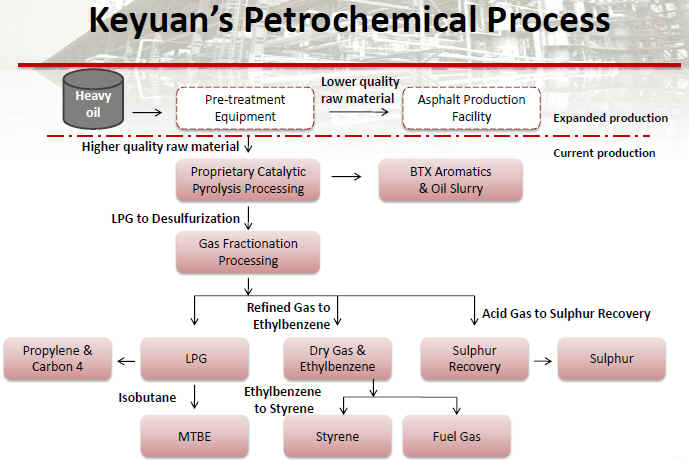

Keyuan

Petrochemicals Starts Construction on New 70,000 Ton SBS

Production Facility; Expect to Generate $110 million of Sales in

2012

Keyuan Petrochemicals, Inc.寧波科元塑膠有限公司, a leading independent

manufacturer and supplier of various petrochemical products in

China, announced that on September 1st, Keyuan commenced

construction of its first Styrene-Butadiene-Styrene

("SBS") production

facility in Ningbo, Zhejiang Province, which will be adjacent to

its current production facility.

SBS is commonly used in soles of shoes, tire treads and other

products that require a hard rubber to remain sturdy for a long

time due to its durability. The new SBS facility is expected to

add 70,000

metric tons to

Keyuan's production capacity by the end of 2011 with an estimated

cost of $17.5 million in capital expenditures. The current

estimated schedule of the SBS facility is as follows:

"Due to rising demand for SBS from products consumers as

well as basic materials and industrial customers, there is a

shortage of SBS in China" stated Chungfeng Tao, Chairman and

Chief Executive Officer of Keyuan. "Once we complete

construction of our new SBS facility, Keyuan will be one of the

leading producers of SBS in China."

China's

current production capacity of SBS is approximately 600,000

metric tons per year

while domestic demand is projected to reach 750,000 metric tons

in 2010, resulting in China importing a substantial percentage of

its needs from Japan, Korea, Taiwan and the U.S. Demand for SBS

in China is expected to grow 6%-7% per year for the next several

years. Average selling price is expected to be approximately

$2,000 in 2012. The supply shortage and value- added nature of

SBS provides healthy margins for the few domestic producers.

Keyuan expects to generate net profit margins of 10% for the SBS

it produces once it reaches normal production levels. The new

facility is anticipated to achieve 80% utilization rate in 2012,

the first full year of production, and generate approximately

$110 million of sales and $10 million to $11 million of net

income.

About Keyuan

Petrochemicals, Inc.

Keyuan Petrochemicals, Inc., established in 2007 and operating

through its wholly-owned subsidiary, Keyuan Plastics, Co. Ltd.,

is located in Ningbo, China and is a leading independent

manufacturer and supplier of various petrochemical products.

Having commenced production in October 2009, Keyuan's operations

include an annual petrochemical manufacturing capacity of 550,000

MT of a variety of petrochemical products, with facilities for

the storage and loading of raw materials and finished goods, and

a technology that supports the manufacturing process with low raw

material costs and high utilization and yields. In order to meet

increasing market demand, Keyuan plans to expand its

manufacturing capacity to include a SBS production facility,

additional storage capacity, a raw material pre-treatment

facility, and an asphalt production facility.

Jan 26, 2012 (Close-Up Media via

COMTEX)

Keyuan Petrochemicals Commences Commercial Production for

Styrene-Butadiene-Styrene

Keyuan Petrochemicals, an independent manufacturer and supplier of various

petrochemical products in China, announced that one of its production lines

for Styrene-Butadiene-Styrene has commenced commercial production after

trial production and testing in the fourth quarter of 2011.

According to a release, the Company began construction of its new 70,000 ton

Styrene-Butadiene-Styrene production facility in September 2010 and

completed construction in September 2011. After several trials and

adjustments, one Styrene-Butadiene-Styrene production line began commercial

production in December 2011. The company produced and sold approximately

2,733 MT and 2,623 MT of Styrene-Butadiene-Styrene in the fourth quarter,

respectively.

"We are pleased with the initial results from our new SBS production lines,"

said Chunfeng Tao, Chairman and Chief Executive Officer of Keyuan

Petrochemicals. "We have shipped products to 20 customers and are in active

discussions with several more. With solid demand for SBS in China and

abroad, we expect to quickly ramp production and sales throughout this

year."

-------

Jan. 25, 2011

Keyuan Petrochemicals

Inc. Receives Patent for Ethylene and Propylene Production

Keyuan Petrochemicals, Inc., a leading merchant manufacturer

of various petrochemical products in China, today announced that

it has received approval for a patent related to the Company's

proprietary production process, called MEP (Multiple

Ethylene Propylene).

MEP is an exclusive and leading technology used in Keyuan's

existing production process.

Through the ingenuity of its CEO Chungfeng Tao, Keyuan has

developed this proprietary production process that improves the

manufacturing efficiency and flexibility for a wide range of

petrochemicals. The utility model patent received,

#ZL-2010-2-0191523.6, applies to a processing technology used in

the production of ethylene and propylene. This technology allows

the Company to use lower grade feedstock (such as heavy oil) instead of

Naphtha, a higher grade feedstock commonly used in other existing

petrochemical production processes. It also allows the Company to improve the

yield and utilization rate of its production line, resulting

in a 15% cost savings.

"We are proud to receive this patent for our proprietary

production process," stated Chungfeng Tao, Chairman and

Chief Executive Officer of Keyuan. "It demonstrates our

commitment to technology advancement. Keyuan's ability to shift

feedstock from the commonly used Naphtha to heavy oil is the

Company's key competitive advantage. This advantage is reflected

in both lower raw material costs and higher production

efficiency. MEP technology allows more efficient use of natural

resources and solves the existing feedstock sourcing problem in

petrochemical industry due to the scarcity of Naphtha. With our

ongoing research and development efforts, we will remain at the

forefront of innovation in our industry."

2010/9/14 Shanghai ブログ

PetroChina Started up

Refinery in Qinzhou, Guangxi

On Sep. 9, 2010, PetroChina started up its new refinery in

Qinzhou, Guangxi.

With total investment of RMB 15.3 billion, the project is located

at the Econimic Development Zone of Qinzhou Port. It has crude

processing capacity of 10 million t/a, also includes refining

facilities jetties and other utilities.

The refinery is operated by PetroChina Guangxi Petrochemical Co.,

a whole subsidiary of PetroChina. Crude oil feedstock is sourced

from overseas, particularly from Sudan, where PetroChina has some

stakes of oil resources and it can secure the supply of crude

oil. Products will include gasoline, diesel, LPG, PP, aromatics

etc. The output is aimed to supply the Southeast China market.

According to the industrial source, PetroChina Guangxi

Petrochemical can supply 8.3 Mt/a refined oil products (gasoline,

diesel, LPG) and 900 kt/a chemicals (PP and BTX) to the market.

Before the refinery startup, PetroChina has completed the

chemical projects construction. And the detailed products and

capacities are PP 200kt/a, Benzene 100 kt/a, Toluene 100 kt/a and

Xylene 500 kt/a.

The refinery project was approved by NDRC and started

construction in 2007, it takes nearing 3 years to complete the

construction. Formerly, the refinery is proposed as a 70:30 jv

between PetroChina and Sinopec. But later, Sinopec withdrawed

from the project and had focused on its solo invested project - a

8 Mt/a refinery project in Beihai, Guangxi - which is under

construction and expected to start up in 2012.

2010/9 CCR

Baling Constructs SM

Project

Sinopec Baling Petrochemical Company シノペック巴陵石油化学started construction of a 120 000

t/a styrene monomer (SM) project on August 11th at its Yueyang

site, in Hunan province. 湖南省岳陽市雲溪區

The project that is

designed to use ethylbenzene as raw material will be competed in

July 2011. Total investment was RMB496 million.

2010/9 CCR

Tianjin Bohua to

Construct Propylene Project

Tianjin Bohua Petrochemical Company, a subsidiary of Tianjin Bohai Chemical Industry

Group,

started to design a 600 000 t/a propane to propylene project

recently. The company plans to spend RMB3.48 billion in the

construction and complete it in September 2012. The designing

contract was awarded to Sinopec Qilu Petrochemical Company and

the technology is licensed from Lummus. The factory will be

China's biggest of its kind.

Aug 11

2010

Tianjin Bohua Petrochemical has awarded the contract to build

a new propylene plant at Tianjin in China to Lummus.

The propane dehydrogenation plant will have a capacity of

600,000 t/y. It will be China's first such facility and the

largest in the world when it begins operations, expected in

2012.

The plant will use Lummus' Catofin dehydrogenation process.

This continuous process uses fixed bed reactors with a

catalyst and can achieve onstream efficiencies of 98%. The

cyclic reactor sequence is entirely computer controlled. The

process can also be used to produce isobutylene, and six such

plants are currently in operation around the world. Several

propane dehydrogenation plants are currently under

construction.

SEPTEMBER 17, 2010

Chevron,

Sinopec may join in shale gas deal

Major

US oil company Chevron Corp and China Petrochemical Corp

(Sinopec) may join forces to explore and develop shale gas in

southwestern China at the end of the year, the Wall Street

Journal reported Friday, citing an unnamed source.

Chevron

has identified a gas block near Guiyang, in Guizhou province,

close to an area that BP and Sinopec Group are exploring, the

paper said.

John Watson, Chevron's

chairman and chief executive, also told the Journal that the

company is talking with Sinopec about cooperating on shale gas in

China, but he did not give a timetable.

Gareth

Johnstone, the Singapore-based spokesman for Chevron, confirmed

the news to Bloomberg by e-mail today, but did not elaborate

beyond that.

Sinopec

Group said it aims to have the capacity to produce 2.5 billion

cubic meters of unconventional gas annually by the end of 2015,

including shale gas and coalbed methane, according to the paper.

Sinopec

will prioritize shale gas exploration and development over other

unconventional gas resources, the paper said, quoting Sinopec's

general manager Su Shulin.

2010-09-17 China Daily

BYD to buy into Tibet

lithium producer

BYD Co will buy 18 percent of the Tibet Xigaze

Zhabuye Lithium High-Tech Co for 201.2 million yuan ($30

million), the Oriental Morning Post reported Friday.

The Shenzhen-based battery and auto maker will buy the stake from

Tibet Mineral Development Co Ltd and its major shareholder.

Tibet Mineral

Development Co., Ltd. is engaged in the exploration and

collection of ferrous metal mine. The Company is involved in

the exploration and sale of chromite, the processing and sale

of ferrochrome and the exploration of copper, lithium and

boron. The Company’s main products include

chromite chromium iron, copper, chromic salt and lithium

salt, among others. The Company operates its business in

domestic markets. As of December 31, 2009, the Company had

six subsidiaries.

February 3, 2010

Reported by Chinese news agency, Xinhua, mining company Tibet

Mineral Development focus on developing lithium mining

project in Salt Lake. Lithium mining project is estimated to

have reserves of lithium carbonate to reach 2.4 million tons.

The company plans to produce lithium carbonate in the first

phase of 5,000 tons and the second phase of lithium

production can reach 20,000 tons.

Tibetan mining

company Mineral Development has hopes of becoming the largest

lithium producer in China and became the main platform for

restructuring the mining industry in Tibet.

Tibet Mineral

Development Co is a mining company that has a 40 percent

stake in mining company Shengyuan Mining Group Corporation.

Mining company has several exploration projects of mining

mineral resources.

Lithium mining

project development is expected to provide support to the

development of industrial and mining sectors in China.

Development of the mining company hopes to be mining lithium

mining company Mineral Tibet became the largest lithium

producer in the world.

Tibet Mineral also will

sell an additional 4 percent of Zhabuye to Tibet Jinhao

Investment Co Ltd. It still would hold 50.72 percent of Zhabuye

after the equity transfer.

Tibet Mineral said in a statement Thursday that the transaction

is to introduce a strategic investor for Zhabuye, its subsidiary,

which lost 13.3 million yuan in the first half of this year.

Zhabuye is a mining company that produces lithium, boron,

potassium, and gold, according

to the Oriental Morning Post. It also owns 20-year exclusive

mining rights over the biggest lithium mine in China, which ranks third in the world,

according to Friday's Shanghai Securities News.

BYD, 10 percent owned by billionaire investor Warren Buffett, is

a leading developer of cars that use lithium batteries. The

purchase in the lithium miner will enhance its strength in

battery businesses.

The world's exploitable lithium reserves totals only 4 million

tons, the Oriental Morning Post said, citing an earlier report

from Hamburg Institute of International Economics.

中国はチベット自治区がリチウムの産地で、中国最大のリチウム生産を誇る扎布耶(Chabyer

ザブイェ)塩湖では昨年、生産拡張工事を決めた。投資総額は10億8400万元で、拡張工事終了後には、年産能力は、リチウム2万トン、酸化リチウム

5000トン、金属リチウム500トン、高純度リチウム200トン、リチウム材30トン、リチウム化合物490トンとなるという。

---

2010-05-07 chinaview

Tibet Mineral Development

Company plans additional share issues for 1.5 bln yuan

Tibet Mineral Development Company plans to issue 68.7 million

extra A-shares to designated ten principal shareholders at a

purchase price of 21.89 yuan per share for 1.5 billion yuan

(219.73 million U.S. dollars).

The proceeds from the additional share issues will be used for

the development of the company's lithium resources and

construction of copper mine, according to an announcement made by

the company on Friday.

The Shenzhen-listed company intends to use 964 million yuan of

the raised fund to develop the Tibet Zabuye

Lithium Technologies Co., Ltd.'s projects for technical transformation and

further development.

The Tibet Zabuye Lithium Technologies Company, a major subsidiary

of Tibet Mineral Development Co.,Ltd., has ceased its operation

for many years due to heavy debts.

Zabuye

Salt Lake,

located at Zhongba County, southwestern Tibet, ranks first in

China in terms of lithium reserves and is contracted to the

company for 20 years.

The Tibet Mineral Development Company said that the first phase

of Zabuye project, which went into operation in September of

2004, is designed to have an annual production capacity of 5,000

tons of lithium carbonate products.

However, the project could not reach the designed capacity for

various reasons, including fund shortages. With further

development, the company will achieve an annual production

capacity of 8,000 tons of lithium carbonate products.

The company will also invest in the expansion of the Tinggong

Copper Mine in Nyemo County, Tibet's capital of Lhasa, and

undertake the electrolytic copper project to turn out 5,000 tons

annually, according to the announcement.

Statistics show that chromite mine has contributed the lion's

share of revenue to the company's total earnings, 69.62 percent

of the total in 2009. Lithium and copper mines currently make an

insignificant contribution to the company.

2010/9/24 Shanghai

China Huadian to Invest

Coal to Aromatics Project in Shaanxi

In Mid Sep. 2010, Shaanxi Provincial government released that

China Huadian Group 中国華電集団 has planned a Coal to Aromatics

(CTA) project in Shaanxi and the pre-feasibility study report has

been assessed by an expert panel.

Huadian's CTA project will be located in Yuheng (楡橫) Coal Chemical Park, Yulin,

Shaanxi Province. Firstly, a pilot capacity is around 300 kt/a -

will be completed and then the large scale industrial project

will be launched. With proposed total investment of RMB 28.5

billion, the project will include 3 Mt/a coal based methanol and

1 Mt aromatics by methanol to aromatics (MTA) route. Huadian will

use Fluidized bed Methanol to Aromatics (FMTA) technology sourced

from Tsinghua University 精華大学, and Hualu Engineering Company

will participate in the pilot and industrial project as the

contractor.

Huadian is one of the

largest power generation companies in China. As a wholly

state-owned enterprise, China Huadian was established in 2002

with registered capital of RMB 12 billion.

ASIACHEM considers that in the coal-rich China western region,

the Coal-to-Aromatics will be more competitive if integrate with

coal-to-MEG in the same coal chemical park, as the downstream PTA

and PET chain can be developed. On the one hand, coal

gasification, air separation and other utilities can be shared in

the same park, which will be more cost effective then an isolated

project; on the other hand, compared with the liquid aromatics

and MEG, the solid PET products will be more convenient to

transport.

According to ASIACHEM Consulting, the MTA developers in China

mainly include Tsinghua University and 中国科学院山西石炭化学研究所

(Shanxi Institute

of Coal Chemistry, Chinese Academy of Sciences:ICC-CAS). Currently, methanol is

overcapacity in China, so the coal chemical investors are paying

more attention to novel methanol derivatives, including both MTA

and methanol to olefins (MTO).

For MTO, Shenhua Baotou has started up the Coal to Olefins

project in Baotou Inner Mongolia with 1.8 Mt/a methanol

integrated 300 kt/a PE and 300 kt/a PP respectively. Both Shenhua

Ningmei and Datang are preparing for the trial run of Methanol to

Propylene (MTP) project respectively, these two MTP project are

expected to commissioned in Q4 2010.

2010/7/23 神華包頭石炭化学、秋に中国最初の石炭からのポリオレフィン生産をスタート

2010/9/26 Shanghai ブログ

PetroChina and Rosneft to

jointly invest refinery in Tianjin

On Sep. 21, 2010, PetroChina and Rosneft held a ground breaking

ceremony for their jv refinery project in Nangang (南港) Industrial Zone, Tianjin.

With total estimated investment around RMB 30 billion, the jv

will have refining capacity of 13 Mt/a. It will be operated by

Chinese-Russian Eastern Petrochemical Company (Eastern

Petrochemical) which was set up in 2007 - a 51:49 jv between

PetroChina and Rosneft.

The project will include 13 Mt/a of atmospheric and vacuum

distillation, 2.7 Mt/a of continuous reforming, 4 Mt/a of residue

hydrogenation, and other units also including aromatics and

propylene with disclosed capacities. According to industrial

sources, the proposed refinery is planned to be completed in 2015

and it will produce refined oil products 10.5 Mt/a and which will

mainly supply to China market.

Russia will secure about 70% of crude oil supply at market prices

for the jv refinery, while the other rest of 30% crude oil for

the refinery will be supplied from Asia.

Also in Tianjin, Sinopec Tianjin Petrochemical Company has 5.5

Mt/a refining capacity, and Sinopec-SABIC Petrochemical has 10

Mt/a refining capacity. After the refinery project of Eastern

Petrochemical startup, the total refining capacity will reach

28.5 Mt/a in Tianjin.

Rosneft is the state controlled oil company in Russia. In 2009,

the company produced 108 million ton curde oil (796 million

barrels). PetroChina produced 141 million ton crude oil in 2009.

Xinhua 2010-09-28

China's Chinalco to

invest 10b yuan in rare earth sector

The Aluminum Corporation of China (Chinalco), the country's top

mining company, said Monday it has signed an agreement to assume

a major stake in the Jiangxi Rare Earth and Rare

Metals Tungsten Group (JXTC) for 10 billion yuan ($1.5

billion).

Chinalco, keen to become one of the world's leading rare earth

companies, will help JXTC develop rare earth resources in the

next three to five years, according to the agreement, which was

signed on Sept 26 at the Expo Central China 2010.

The Nanchang-based JXTC is China's largest tungsten

producer and

maintains rare earth resource deposits in Jiangxi province. 江西省南昌

The agreement came

after China's announcement early this month that it would encourage mergers and acquisitions

in the rare earth sector to quicken industry

consolidation. According to media reports, the government planned

to cut the number of rare earth firms from the current 90 to 20

by 2015.

China is the world's largest rare earth producer, supplying more

than 90 percent of the global demand.

JXTC has 37 wholly

and majority owned subsidiary enterprises with total asset

more than RMB 8.6 billion. JXTC is focusing on tungsten,

while integrated various non-ferrous metals mining, ore

dressing, smelting/refining, trading and equipment

manufacturing.

2010/10/10 Chesapeake

Energy

Chesapeake Energy

Corporation and CNOOC Limited Announce Eagle Ford

Shale Project

Cooperation Agreement

Chesapeake Energy

Corporation ("Chesapeake") and CNOOC Limited today

announced the execution of an agreement whereby CNOOC

International Limited, a wholly-owned subsidiary of CNOOC

Limited, will purchase a 33.3% undivided interest in

Chesapeake's 600,000 net oil and natural gas leasehold acres in

the Eagle Ford Shale project in South Texas. The consideration

for the sale will be $1.08 billion in cash at closing, subject to adjustment.

In addition, CNOOC Limited has agreed to fund 75% of

Chesapeake's share of drilling and completion costs until an

additional $1.08 billion has been paid, which Chesapeake expects to occur

by year-end 2012. Closing of the transaction is anticipated in

the 2010 fourth quarter.

Reliance Industries は6月24日、米国のPioneer Natural Resources

CompanyとJVを設立し、PioneerのEagle Ford Shaleの45%を取得すると発表した。

2010/7/3 Reliacne

Industries、Pioneer

Natural Resources と組んでテキサスのShale を開発

As operator of the

project, Chesapeake will conduct all leasing, drilling,

completion, operations and marketing activities for the project.

Over the next several decades, the companies plan to develop net

unrisked unproved resource potential up to 4 billion barrels of

oil equivalent (after deducting an assumed average royalty burden

of 25%). Chesapeake is currently utilizing 10 operated rigs to

develop its Eagle Ford leasehold and with the additional capital

from CNOOC Limited, anticipates increasing its drilling activity

to approximately 12 operated rigs by year-end 2010, approximately

31 rigs by year-end 2011 and approximately 40 rigs by year-end

2012. Approximately 900 wells are expected to be drilled by

year-end 2012. Currently Chesapeake has 10 horizontal Eagle Ford

wells in production with initial production rates of up to 1,160

barrels of oil and 0.4 mmcf of natural gas per day in the oil

window and 4.0 mmcf of natural gas and 1,200 barrels of oil per

day in the wet gas window. Chesapeake anticipates the project

will reach its peak production of 400,000-500,000 barrels of oil

equivalent per day in the next decade.

The assets are located

principally in the counties of Webb, Dimmit, LaSalle, Zavala,

Frio and McMullen, and are located primarily in the oil window

(~85%) and the wet gas window (~15%) of the Eagle Ford Shale and

in the dry gas window of the Pearsall Shale. CNOOC Limited will

have the

option to acquire its 33.3% share of any additional acreage

acquired by Chesapeake in the area and also the option to

participate with Chesapeake for a 33.3% interest in midstream

infrastructure related to production established from the assets.

Aubrey K. McClendon,

Chesapeake's Chief Executive Officer, commented, "We are

very pleased to announce our fifth industry shale development

transaction and for it to include CNOOC Limited, China's largest

producer of offshore oil and natural gas and one of the largest

independent oil and gas companies in the world. This transaction

will provide the capital necessary to accelerate drilling of this

large domestic oil and natural gas resource, resulting in a

reduction of our country's oil imports over time, the creation of

thousands of high-paying jobs in the U.S. and in the payment of

very significant local, state and federal taxes. In addition,

Chesapeake's embedded safety culture and integrated environmental

protection strategies will be adopted to safeguard personnel and

the surface and subsurface environment. Moreover, this project

will advance the efforts of both the U.S. and China to reduce

greenhouse gas emissions and accelerate commercial opportunities

for the development of shale gas resources in China, furthering

the objectives of the U.S. - China Shale Gas Resource Initiative

announced by the White House on November 17, 2009.

"When completed,

this transaction will successfully accomplish another component

of Chesapeake's strategic and financial plan outlined in May 2010

designed to increase shareholder value. This brings the combined

proceeds from our shale development ventures, including upfront

cash payments and drilling carries, since 2008 to approximately

$13 billion. Chesapeake has continued to maintain a majority

position in each of the five major projects subject to

development arrangements ranging from 67% to 80%. The implied

pre-development value of Chesapeake's retained interest in those

shale ventures is approximately $37 billion based on the

valuations in the sale transactions."

2010/10/13 上海

神華寧夏、メタノールからプロピレンの生産をスタート

神華寧夏石炭グループは10月4日、寧夏回族自治区銀川市の寧東エネルギー化学基地でメタノールからのプロピレン(MTP)計画の操業を開始、99.69%の純度のオンスペックのプロピレンを生産した。

これは世界最初のMTPの商業生産となる。

178億人民元を投じたもので、ポリマーグレードのプロピレン50万トンと、副産品としてガソリン、LPGを生産する。

建設は2008年4月に始まり、本年10月にメカニカルコンプリーションとなった。9月初めから試運転を行っていた。

年産52万トンのPPプラントを建設中で、これは間もなくスタートする。

隣接して年産167万トンのメタノールプラントを建設中で、ガス化設備は第4四半期に完成する。現在は神華寧夏の既存設備からメタノールを供給している。

年末には石炭からPPまでの一貫生産体制が完成する。

このコンプレックスは以下の各社の技術を使用している。

1. Air separation Air

Liquide

2. Gasification GSP

pulverized coal gasification process(微粉かっ炭の加圧ガス化)

by Siemens

3. Syngas cleaning

rectisol process (硫化水素ガス除去)by Lurgi

4. Methanol

synthesis -- Lurgi

5. MTP -- Lurgi

6. PP

polymerization -- ABB-Lummus gaseous phase PP process

ASIACHEMによれば、これは中国で2010年にスタートする石炭からのオレフィン製造の3つの計画の1つ。

8月に神華包頭石炭化学が内蒙古自治区の包頭で、180万トンの石炭ベースのメタノール、60万トンのメタノールベースのオレフィン、30万トンのPE、30万トンのPPをスタートさせた。

2010/7/23 神華包頭石炭化学、秋に中国最初の石炭からのポリオレフィン生産をスタート

更に年末までに大唐国際発電がMTPとPP

46万トンをスタートさせる。

ーーー

なお、神華包頭などのMTO(Methanol-to-Olefin)はSAPO

34ベースの触媒を使用し、3トンのメタノールから0.5トンのエチレンと0.5トンのプロピレン、及び少量のC4を生産する。

UOP、中国科学院大連化学物理研究所(DICP-CAS)、Sinopec、ExxonMobilなどが開発している。

これに対し、MTP(Methanol-to-Propyrene)はZSM-5

ベースの触媒を使用し、3トンのメタノールから0.9トンのプロピレンと、副産品としてガソリン、LPGを生産する。

Lurgiが開発している。

2010/11/16 Shanghai

中海石油化学、海南島で新しいメタノール工場の試運転開始

中国海洋石油有限公司(CNOOC)の子会社の中海石油化学(China BlueChem)は11月14日、海南省東方市で新しいメタノール工場の試運転を開始した。

Davy メタノール合成法を使用し、10億人民元を投じたもので、天然ガスを原料にし、能力は年産80万トン。2008年11月に建設を開始した。

原料の天然ガスはCNOOCの南シナ海のLedong ガス田から供給を受ける。2009年にCNOOCにガス田から同社のエネルギー・化学基地である東方市までのパイプラインが完成した。パイプラインは陸上の68kmと海底の105km。

海南島ではCNOOCはもう一つのメタノール工場を持っている。CNOOCと香港のラミネート会社、KingBoard Chemical (建滔化工集団)の60/40の合弁会社CNOOC KingBoardが2006年第3四半期に東方市に年産60万トンのメタノールの商業生産を開始した。ルルギ技術を採用、CNOOCの東方市近辺のガス田からの天然ガスを原料としている。

2007/8/20 中国のCNOOC子会社が生分解性プラスチック製造

第2工場の完成で、CNOOCの東方市でのメタノール能力は140万トンになる。

中海石油化学は中国最大級の肥料会社で、海南島東方市に2系列のプラントを有しており、アンモニア

75万トン、尿素 132万トン、複合肥料 5万トンを生産している。

同社は2006年3月に内蒙古の 天野化工(Tianye Chemical)

の株式の90%を買収し、CNOOC Tianye とした。

同社は天然ガスベースのアンモニア 30万トン、尿素52万トンとメタノール20万トンのプラントを有している。

ASIACHEMによれば、CNOOC Tianyeはまた、年産6万トンのPOM と石炭ベースのアンモニア(35万トン)・尿素(60万トン)プラントを建設している。アンモニア・尿素は華東理工大学が開発した粉状石炭ガス化技術を使用する。POMは間もなく、アンモニア・尿素は2012年に完成する予定。

2010/5/25 雲天化集団、重慶でPOM増設、年産6万トンに

2010/12/20 上海

漢邦(江陰)石化、年産60万トンのPTAの生産開始

12月10日、漢邦(江陰)石化 Hangbang (Jiangyin)

Petrochemical Companyが江蘇省江陰市でPTAの生産を開始した。

27.7億人民元を投じたもので、年産能力は60万トン。

2006年に国家発展改革委員会(NDRC)の承認を受け、2007年に建設を開始した。

PTAの技術はInvistaから導入した。原料PXは海外市場から輸入する。

漢邦(江陰)石化は澄星グループ(Chengxing Group)が85%、香港の漢邦石化(Hanbang

Petrochemical) が15%出資する。

澄星グループは江陰市に本拠を置く化学会社で、燐酸系化学品、ポリエステル、肥料を生産する中国最大の燐酸のメーカーの一つで、液体化学品の物流の大手でもある。

年間総合生産能力は50万トンを超え、主な製品は黄リン、リン酸、ナトリウムトリポリ燐酸(STPP)、第二リン酸カルシウム(DCP)、ポリリン酸、ピ

ロリン酸ナトリウム、ヘキサメタリン酸ソーダ(SHMP)、二リン酸カリウム、炭酸カルシウムとその他の金属ナトリウム、カルシウムとリン酸二カリウム等。

澄星グループは江陰市に30万トンのPETプラントを持っている。

DupontのNG3 PET技術を導入したもので、現在は原料のPTAを市場で購入している。

今後は漢邦(江陰)石化はPTAを澄星に供給し、残りは外販する。

このPTA計画は2009年の政府の石油化学景気刺激策に含まれている。

石油化学景気刺激策にはPTAでは他に、佳龍投資/新疆華凌 Jialong Investment/Xinjiang

Hualingの福建省泉州市石獅地区での60万トン計画と、東方希望の重慶市フ陵区の60万トン計画が含まれているが、前者は2010年8月、後者は2009年末に生産を開始している。

なお、江陰市では Dragon Group と大手PETメーカー三房巷グループSanfangxiang

Groupとの50/50のJV 海倫化学(Hailun Chemical)が2005年に60万トンPTAプラントの建設を開始したが、資金問題などで棚上げとなっていた。

2010年第2四半期に銀行から融資を受け、現在建設中で、2011年上期に完成する見込みとなっている。

中国は2009年にネットで、508万トンのPTA、337万トンのPXを輸入している。

2010/12/24 Platts

Far Eastern, Sinopec

Yizheng to build 1 mil mt/year PTA plant in China

Taiwan's Far

Eastern Group (遠東集團),will

build a new 1 million mt/year purified

terephthalic plant

at Yangzhou, Jiangsu province江蘇省揚州市, at a cost of Yuan 3.8 billion

($573 million) in a joint venture with China's Sinopec Yizheng

Chemical Fibre 儀征化繊, a company source said Friday.

Construction was likely to begin soon as both companies had got

the necessary approvals from local government, the source said.

The plant is expected to be completed within two years.

Far

Eastern will hold a 60% stake in the plant and Sinopec Yizheng,

40%.

Far Eastern is also involved in a new 700,000 mt/year

PET plant at

Pudong, Shanghai, also slated for completion by 2012, which will

receive PTA feedstock from the new Yangzhou plant, the source

said. The PET plant, however, is still awaiting approval from the

authorities.

Sinopec Yizheng has two PTA lines at its existing plant at

Jiangsu, one with a capacity of 350,000 mt/year

and the other, 630,000 mt/year.

The Far Eastern group owns a PET bottle grade chips plant at

Pudong, Shanghai that is capable of producing 1.16 million

mt/year.

儀征は揚州市に位置する県級市

2011/2/22

The 3rd Asia Methanol

& Derivatives Conference will be held in Sanya, China

In 2010, China imported methanol 5.19 Mt and produced methanol

15.74 Mt, the apparent consumption reached 20.92 Mt. Production

and apparent consumption increased by 3.2 Mt comparing with 2009.

ASIACHEM’s data show that China's methanol

capacity has reached 38 Mt by the end of 2010; while the

operating rate of total methanol industry is still less than 50%.

中国のメタノール需給推移 (単位:千トン)

| |

生産 |

輸入 |

輸出 |

消費 |

| 2000 |

1,987 |

1,307 |

1 |

3,293 |

| 2001 |

2,065 |

1,521 |

10 |

3,576 |

| 2002 |

2,318 |

1,800 |

1 |

4,117 |

| 2003 |

2,989 |

1,402 |

51 |

4,340 |

| 2004 |

4,406 |

1,359 |

33 |

5,732 |

| 2005 |

5,356 |

1,360 |

54 |

6,662 |

| 2006 |

7,622 |

1,127 |

190 |

8,559 |

| 2007 |

10,764 |

845 |

563 |

11,046 |

| 2008 |

11,117 |

1,434 |

368 |

12,183 |

| 2009 |

11,231 |

5,288 |

14 |

16,505 |

| 2010 |

15,743 |

5,189 |

12 |

20,920 |

In December 2010, China’s Ministry of Commerce announced

the result of methanol anti-dumping from Indonesia, Malaysia and

New Zealand, but did not levy the temporary anti-dumping duties.

China’s methanol producers, particularly

the independent ones are difficult as the overcapacity and

depressed market prices. To develop the competitive methanol

derivatives, and then to enhance profitability becomes more

significant.

3rd Asia Methanol & Derivatives Conference will be held in

March 30 to April 1, 2011 in Sanya三亜市, Hainan Province, China. The

upcoming event will focus on Industrial Policies & its

Impacts on Methanol & Derivatives; Cost Competitiveness of

Diversified Feedstock based Methanol Production; China's Methanol

Capacity: Problems & Solutions; Methanol to Gasoline and

Methanol to Olefins (MTO/MTP) Update; Innovative Technologies

& Industrial Progress of Methanol Derivatives; Methanol Fuel

& its Applications Prospect; and Industrial Park Planning and

Storage & Transportation.

For more information, please visit:

http://www.chinacoalchem.com/events/2011MEOH/AsiaMeOH2011.pdf

2011/2/27 Shanghai

Wison to strengthen

syngas business

In Mid Feb. 2011, Wison Engineering Ltd. (Wison) and Shell Global

Solutions International B.V. (Shell) announced that they have

signed an agreement on joint development of a new generation and

low-cost “hybrid” gasification technology

demonstration plant in China.

According to Shell, the “hybrid” technology, known as “dry-feed, bottom-water quench,”

will allow

processing for a wider range of coal feedstock, and offer a

simplified design at lower cost. This co-operation plays on Shell’s expertise in gasification and

energy technologies, as well as Wison’s strong experience in project

design and engineering. The hybrid gasifiers is expected to

further expand the market for syngas into the chemicals, hydrogen

and fertilizer industries.

In Nanjing Chemical Industry Park (NCIP), Wison (Nanjing) Clean

Energy Co., Ltd uses GE coal water slurry gasification technology

to produce syngas, hydrogen, and methanol for the downstream

users, which includes Celanese, YPC-BASF, and BlueStar, as well

as Ling Tian (Nanjing) Fine Chemical ? a 50:50 jv between Taminco

and Mitsubishi Gas Chemical.

ASIACHEM studies show that comparing with the traditional Shell

Coal gasification process (SCGP) - with waste heat boiler, the

new process design with bottom-water quench technology will

significantly reduce investment in gasification plant. Once be

commercialized, it will enhance the cost competitiveness of

syngas and coal chemical products.

On Feb. 9, 2011, Wison and Celanese signed a MOU for the

feedstock supply of Celanese proposed 400 kt/a industrial ethanol

in NCIP. In the future, the syngas demand in NCIP will be futher

increased and Wison will expand the capacities.

Wison’s capacities in NCIP (as of Dec.

2010)

CO 600kt/a

Syngas 11 000 Nm3/h

Hydrogen 210 000 Nm3/h

Methanol 200 kt/a

2011/3/24 Shanghai

Sinopec-KPC Complex gets

final approval from NDRC

On Mar. 16, 2011, the

official website of National Development and Reform Commission

(NDRC) announced that the Sinopec-KPC jv Complex project has got the final approval from

NDRC in Mar. 2011, which is jointly invested by Sinopec and

Kuwait Petroleum Corp (KPC) and to be located in Donghai Island,

Zhanjiang, Guangdong province.

The jv project has been planned for five years and was previously

suspended due to environmental concerns. And the site has been

relocated to Zhanjiang from former proposed Nansha district,

Guangzhou.In May 2010, the project had already get the

prelimilary from NDRC.

With total investment

around RMB 60 billion, the complex will include a refinery with

crude processing capacity of 15 Mt/a, and 1 Mt/a ethylene cracker

as well as derivatives like PE, PP, Aromatics, MEG etc.

Kuwait will supply all the crude oil for the jv complex and which

is expected to start up in 2013.

Sinopec and KPC

will hold 50% stakes in the proposed jv.

And KPC planned to sell part of its 50% stake to international

partners, which including Dow Chemical and BP. Shell had talked

with KPC for investing the jv but give it up latter. Up to now,

the financial details for investemnt is not disclosed yet.

Besides the 15 Mt/a refinery and 1 Mt/a ethylene cracker, other

main derivatives including:

PE 460 kt/a

PP 750 kt/a

BTX 710 kt/a

MEG 400 kt/a

EO 38 kt/a

EVA 200 kt/a

Butadiene 150 kt/a

2011/3/28 Shanghai

China’s MEG import will be over 7 Mt in

2011

In 2010, Influenced by factors including prosperity of textile

industry and roaring prices of cotton, the consumption of fiber

in China greatly increased and trend of thriving production and

marketing appeared.

Due to the roaring prices of polyester products, polyester

industrial players expanded production or start new projects

driven by the high profits. In 2010, there is 4.09 Mt/a new PET

capacity started up in China. The development of polyester

industry brought the sustained growth in consumption of Mono

Ethylene Glycol (MEG). According to the data from ASIACHEM

Consulting, in 2010, the output of PET of China was 22.67 Mt and

the consumption of MEG was 7.71 Mt.

(It

is estimated that the MEG production should be around 2.5 Mt and

the total consumption is around 9.14 Mt. Besides the PET

consumption, the other uses of MEG is about 1.43 Mt in 2010.)

Besides, according to the statistics of China Association of

Automobile Manufacture (CAAM), China produced and sold more than

18 million automobiles in 2010. The demand automobiles used

antifreeze was increased.

ASIACHEM’s latest data shows that from Jul.

2010 to Mar. 2011, the world oil price has rebounded to 100 $/b

from the 70 $/b; meanwhile, the domestic MEG price (east China

market) has hiked to around 1515 $/t from 910 $/t. Also in 2010,

driven by the expansion of PET production, the MEG import

increased to 6.64 Mt in 2010 from the 5.82 Mt in 2009, showing a

growth of 14% year on year.

The production of MEG in China, however, is mainly concentrated

in large-scale petrochemical enterprises and traditional

technological process adopted is ethylene to ethylene oxide than

to MEG. The growth of capacity is limited by the large-scale

ethylene complex integrated with MEG unit.

According to the data from ASIACHEM, by the end of 2010, China’s total MEG capacity is around 4

Mt/a, which including the 150 kt/a Coal to MEG capacity of

Tongliao GEM Chemical. In 2011, there is not new added

petrochemical route based MEG capacity. And the new added coal

based MEG capacity is 50 kt/a only, which is invested by

Hualu-Hengsheng and is expected to start up in H2 2011.

And in 2011, the new added PET capacity is expected to be 4.7

Mt/a. By the end of 2011, China’s total PET capacity will reach

33.5 Mt/a. If we estimate that the operating rate of Chinese

polyester industry in 2011 is 75%, the output will be 25.12 Mt

and the consumption of MEG will be 8.54 Mt. For automobiles, if

the total sales are still keeping over 16 Mt, then the total

automobile-owned in China will further drive the consumption of

antifreeze used MEG.

At the beginning of 2010, ASIACHEM estimated that there is 7.05

Mt supply shortage of MEG in China in 2012. Currently, however,

according to the demand from expansion of PET and increase of

automobile antifreeze, while domestic petrochemical route or coal

based MEG capacity is still stable, that situation will emerge

earlier than the previous estimate. China’s MEG import will over 7 Mt in

2011.

2011-04-06 Reuters

Minmetals bids for

Australian miner

The Chinese company

offers $6.5 billion to secure supplies of copper and other metals

Minmetals Resources Ltd 五鉱集団, China's biggest metals trading

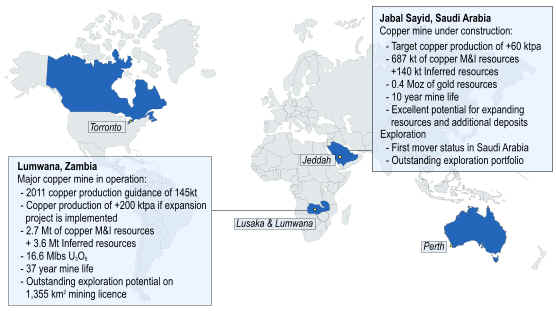

company, on Monday offered $6.5 billion to buy Equinox Minerals

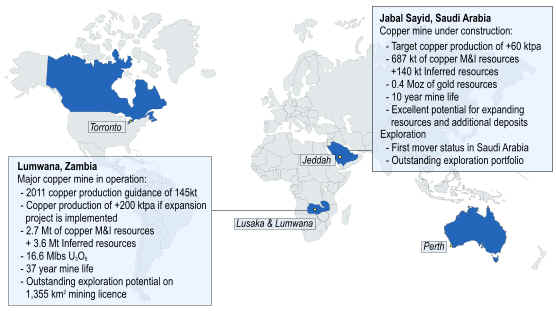

Ltd, chasing Equinox's copper assets in Zambia and Saudi Arabia.

Equinox currently

operates the Lumwana Mine in Zambia and is constructing the

Jabal Sayid Project in Saudi Arabia.

Equinox also holds a number of exploration tenements in both

Zambia and Saudi Arabia.

China, which accounts for

40 percent of the world's demand for copper, is on a

mining-acquisition spree as prices for the red metal hover near

record highs.

Minmetals, which owns

mining operations in Australia and Asia, said it will offer C$7

($7.22) for each share for Equinox, a 23 percent premium to

Equinox's close in Toronto last Friday of C$5.71.

It will be China's

fourth-biggest outbound merger and acquisition deal, according to

Thomson Reuters data.

Equinox's Australian

shares surged 29 percent to a record A$7.35 ($7.59), topping the

value of the Minmetals' offer on expectations a rival bid may

emerge.

"It's game on

now," said Ausbil Dexia Chief Executive Paul Xiradis, a

shareholder in Equinox. "They'll be looking to defend their

turf and it may entice another party to come in as well, looking

for quality assets such as those held by Equinox."

"It fits into a

strategy of building a leading international diversified

base-metals upstream business," Minmetals Chief Executive

Andrew Michelmore told a news conference in Hong Kong on Monday.

"It certainly fits

in with the strategy in terms of growing the base-metal size,

particularly in terms of copper," said Michelmore, adding

Minmetals would be the world's 14th largest copper producer after

the deal, from its current rank of 30th.

The offer is conditional

on Equinox dropping a C$4.7 billion ($4.8 billion) bid for

Canada's Lundin Mining, which has been the subject of a separate

takeover tussle between Equinox and Inmet Mining Corp.

Investors said it was

possible that rival bidders may emerge for Sydney- and

Toronto-listed Equinox, but said they may be deterred by

Minmetals' financing power.

While Minmetals has a

market value of just $2.5 billion, the metals trading company

said its bid was being funded with credit from Chinese banks and

equity investments by Chinese institutions.

"Ultimately no one

wants to get into a bidding war with Chinese-related parties,

given that Chinese companies are perceived to have a lower cost

of capital relative to Western companies," said Tim

Schroeders, a portfolio manager at Pengana Capital.

Minmetals was finalizing

a loan of around $5 billion to back its bid, Thomson Reuters

publication Basis Point reported on Monday. The banks approached

include Bank of China and China Development Bank, sources with

knowledge of the matter said. European and Japanese banks have

also been in talks with the borrower, they added.

China, and to a lesser

degree India, have been scouring the globe to secure resources to

fuel their fast-growing economies. Chinese banks have lent

African nations billions of dollars and committed to fund major

infrastructure projects as they push for access to copper, iron

ore, and other resources.

Surging global demand for

copper, plus the high cost and long lead time to bring new

resources to production, have fueled expectations of more

takeover activity and a prolonged bull run in the metal.

London Metal Exchange

copper touched a record high of $10,190 a ton in February, and on

Monday stood at $9,350. It has risen some 120 percent in the past

two years.

Investors said Minmetal's

offer premium was reasonable but not necessarily high enough, as

Equinox's shares had declined in recent weeks on concerns about

the Lundin deal.

"I will describe it

as a realistic offer but not a knock-out bid," said James

Bruce, portfolio manager at Perpetual, which recently sold its

Equinox shares.

"It's a cleverly

timed bid by Minmetals. We thought Equinox were paying too much

for Lundin and were taking on too much debt in that deal."

This will be Minmetals'

second major acquisition after it bought Minerals and Metals

Group (MMG) for $1.85 billion from State-owned parent, China

Minmetals Non-Ferrous Metals Group, late last year. It is already

planning a new share issue of $1 billion to part-fund the MMG

deal.

Equinox said in a

statement that its board will meet to consider the Minmetals bid.

It has not yet made a recommendation to shareholders to accept or

reject the bid.

A source familiar with

Equinox said the Minmetals approach caught the company by

surprise. Equinox executives are currently in Canada marketing

the Lundin offer, which the latter's board has urged shareholders

to reject.

The deal marks the latest

in a string of Australian mining takeovers involving Michelmore

of Minmetals, who has been criticized by some disgruntled

investors for his track record on mergers and acquisitions.

He was at the helm of WMC

Ltd in 2005 when it was sold to BHP Billiton for $6 billion, a

sale seen as too cheap after nickel prices rocketed shortly after

the deal was completed.

Michelmore then went to

work for the Russian oligarch Oleg Deripaska for two years,

before returning to Australia to head the zinc miner Zinifex,

which merged with Oxiana to form OZ Minerals.

A year later, the global

financial crisis sank OZ under a debt pile, clearing the way for

Minmetals to buy most of its assets for $1.4 billion.

2011/4/19

Shanghai

China Government

Regulates the Coal Chemical Industry

On Apr. 12, 2011,

National Development and Reform Commission (NDRC) the top

economic planner in China - publicly released a document (No.

635, 2011); to further regulate the development of coal chemical

industry.

According to the

document, currently, there are some issues in coal chemical

development. So, it is necessary to regulate the coal chemical

industry, which includes 4 aspects:

1. To keep the

industrial entry strictly. Particularly, the coking, carbide

projects will be limited, and the out-of-date capacity will

be phased out, and for ammonia and methanol capacities, will

conduct the capacity replacement for a particular region, it

is necessary to shut off the small plants if where new big

projects are planned.

2. The following

kinds of projects are forbidden to construct:

coal based methanol to olefins

with olefins capacity of 500 kt/a and below;

coal based methanol with

capacity of 1 Mt/a and below;

coal based DME with capacity

of 1 Mt/a and below;

coal to liquids with liquid

fuel capacity of 1 Mt/a and below;

coal to SNG with capacity of 2

billion Nm3/a and below;

coal to MEG with capacity of

200 kt/a and below.

Other

coal conversion projects which large than the above standard,

must be approved by NDRC.

3. To strengthen the

allocation of resources, and actively promote energy

assessment and environmental impact assessment.

4. The implementation

of administrative accountability.

Also, the coal chemical

demonstrations are required by the document of NDRC. NDRC and NEA

(National Energy Administration) are editing the < Planning of

Coal Conversion Demonstrations > and <Coal Chemical

Policies>, which will includes six points:

1. During 2011-2015,

the key tasks are the construction of modern coal chemical

upgrading demonstration projects.

2. To keep the

balance of coal supply and demand; and strictly regulate the

coal chemical projects with high water consumption be

constructed in the water shortage areas.

3. The coal chemical