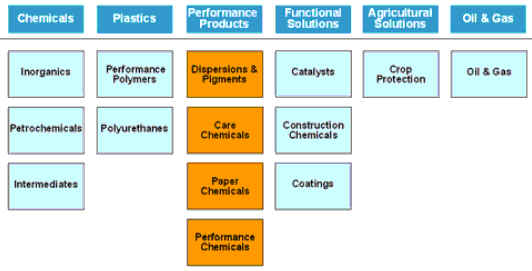

| BASF's new segment structure (Effective January 1, 2008) |

|

BASF plans transformation

into a European Company (SE)

Hambrecht: “Affirmation of an entrepreneurial

vision of Europe”

The Board of

Executive Directors and Supervisory Board of BASF

Aktiengesellschaft have resolved to propose to the Annual Meeting

on April 26, 2007 the transformation of BASF Aktiengesellschaft

into a European Company (Societas Europaea, SE) with the name

BASF SE. The company’s headquarters and chief

administrative offices will remain in Ludwigshafen, Germany.

“The European

Company is a modern legal form for a global company whose home

market is in Europe,” said Dr. Jurgen Hambrecht,

Chairman of the Board of Executive Directors of BASF

Aktiengesellschaft. The transformation into a European Company is

intended to further strengthen corporate governance at BASF. “BASF considers this legal form to

be an affirmation of an entrepreneurial vision of Europe. BASF is

strengthening the participation of European employees in the

company and thus demonstrates its pioneering role in the European

chemical industry.”

BASF’s shareholders will be provided

with more detailed information on transformation of the company’s legal form in the invitation to

the Annual Meeting, which will be sent out as of March 16, 2007.

Europe is BASF’s home market: In 2006, it posted

approximately 60 percent of its sales and employed around

two-thirds of its global workforce of more than 95,000 employees

in the region.

「欧州会社」とは2004年10月以降、EUで設立が可能となったもので、EU法に基づき設立される。正式名称はラテン語でソシエタス・ヨーロピアで通称は‘SE’。 欧州会社は登録住所の置かれた加盟国において登録され、他の加盟国では子会社を設立することなしに活動できる。

また、法的制限を伴うことなく欧州域内のリストラクチャリング、事業再編および事業統合を柔軟に行うことが可能となる。

更に、子会社の場合は親会社又は他の子会社との取引では付加価値税(VAT)が課せられるが、欧州企業の場合は社内取引となるためVATは課せられないというメリットもある。

BASF Breaks Ground In

China For Two New Manufacturing Plants

BASF broke ground for two

new plants in Pudong, near Shanghai in China, which will

manufacture polyacrylate polymers and specialty

chemicals for leather tanning. The plants will provide

customers in the growing Chinese market with a reliable supply of

high-quality chemicals. The two facilities are expected to be

completed in the first quarter of 2008. Investment details were

not disclosed.

The polyacrylate polymers plant will have a minimum capacity of 30,000 metric tons per year, while the plant for

specialty chemicals for leather tanning will have a minimum

annual capacity of 12,000 metric tons of products in liquid or powder

form. A spray dryer with a capacity of 10,000 metric tons per

year is part of the investment. The new plants will be located

next to BASF’s existing facilities for

polyacrylate polymers and leather chemicals in Pudong. 浦東

The polyacrylate

polymers marketed under the trademark Sokalan(R) are synthetic water-soluble

polymers 水溶性ポリマーused in the laundry, paper, water

treatment and textile industries. The specialty chemicals for

leather tanning carry the trademarks Basyntan(R), Relugan(R) and

Tamol(R).

BASF today (March 20, 2007) also inaugurated its polyisocyanate

plant at the

Shanghai Chemical Industrial Park in Caojing, which will serve

the entire Asia Pacific market. The plant has an annual capacity

of 8,000

metric tons

and its product is marketed under the trademark Basonat(R).

Construction work began in June 2005. Polyisocyanates are raw

materials used in the manufacture of automotive, industrial and

wood paints.

BASF 2004/8/31

BASF plans to invest in a polyurethanes specialties site in Shanghai・Site in Pudong, Shanghai establishes a new level of closeness to customers

・System house, product development and TPU production at a single site

・Chinese polyurethanes market expected to grow by about 10 percent per year in the next 10 years

BASF and Monsanto

Announce R&D and Commercialization Collaboration Agreement in

Plant Biotechnology

・Agreement

aimed at developing higher-yielding crops that are more tolerant

to adverse environmental conditions such as drought

・Potential

$1.5 billion/Euro1.2 billion devoted to joint pipeline over life

of the collaboration

・First

products to be commercialized in the first half of the next

decade

BASF and Monsanto Company today announced a long-term joint

research and development (R&D) and commercialization

collaboration

in plant

biotechnology

that will focus on the development of high yielding crops and

crops that are more tolerant to adverse environmental conditions

such as drought. The collaboration is effective immediately.

Under this

collaboration:

| ・ | The companies will establish and collaboratively manage a dedicated pipeline that will focus on the development of crops with higher yields and crops that lead to consistent yields under adverse environmental conditions, such as drought. |

| ・ | Each company will additionally maintain independent trait discovery programs. |

| ・ | From the various programs, each company will nominate specific candidate genes and the most promising candidates will be advanced for accelerated joint development and for commercialization in the Monsanto pipeline. |

| ・ | The two companies expect to generate a greater number of viable research projects than they could have done on their own, accelerate the development of new products, and bring a greater number of traits to the market at a faster speed. |

| ・ | The nominated projects will be jointly funded at a 50-50 cost sharing through each phase of development as the candidate gene works its way toward commercial status. |

| ・ | Products that emerge from the joint development will be commercialized by Monsanto. The companies have agreed to share profits associated with commercialized products, with Monsanto receiving 60 percent of net profits and BASF receiving 40 percent of net profits. |

About Monsanto

Monsanto is an agriculture company. The

company is a leading provider of technology-based solutions and

agricultural products that improve farm productivity and food

quality. Monsanto is committed to investing in products that can

make a difference for its farmer customers and the land they

farm. The company uses plant breeding, plant biotechnology and

other applications of modern science to support its commitment to

agriculture and the farmers that feed, clothe and fuel our

growing world. For more information on Monsanto, see www.monsanto.com.

2006/6/15 http://www.juno.dti.ne.jp/~tkitaba/gmo/news/06061501.htm

BASF Plant Science 干ばつ耐性GM小麦を豪分子植物育種研究センターと共同開発

ドイツの巨大化学企業・BASFが6月8日、モンサント、シンジェンタと並び遺伝子組み換え(GM)作物の開発で世界をリードするその農業部門・BASF Plant Scienceとオーストラリア分子植物育種協同研究センター(MPBCRC)との協力関係を拡充すると発表した。今後7年間に2800万ドルを投資、オーストラリアでの干ばつ耐性や真菌病抵抗性のGM小麦を共同開発するという。

共同研究プログラムの一環として、BASF Plant Scienceは収量増加・干ばつ耐性・真菌病抵抗性の候補遺伝子の大規模なコレクションを利用可能にする。MPBCRCは、典型的な農業条件の下で高度に有効な遺伝子組み換えのための専門知識と特許を持つ技術を提供する。

BASFによると、小麦は、世界で栽培されるトウモロコシに次ぐ穀物であるが、長期化する干ばつが、オーストラリアなどの乾燥地域のみならず、ヨーロッパでも二桁(%で)の収量損失を引き起こしている。また、真菌病も収量を大きく減少させている。真菌病に抵抗性をもつGM小麦は農民の一層有効な作物保護に役立つだろうという。

オーストラリアの2002年の小麦収量は、100年来と言われる干ばつで半減した。その後も、これほど厳しくはないとしても、ほとんど連年の干ばつに見舞われている。今年も多くの農業者が作付できず、牧草も枯れ始めている。こうした傾向は、今後ますます強まるだろう。

BASF to debottleneck Antwerp cracker mid Aug to end Sep

Germany's BASF has

divulged the dates of its planned debottlenecking of its naphtha steam

cracker at Antwerp, Belgium. "The turnaround will start

in the middle of August and last until the end of

September," a company source said Friday.

The Eur200 million ($246 mil) expansion project would make the

plant the largest single-train steam cracker in Europe by boosting its

ethylene capacity from 800,000 mt/yr to 1.08 mil mt/yr.

BASF opens new engineering plastics compounding plant in Shanghai

BASF today celebrated the

inauguration of its engineering plastics compounding

plant at its

Pudong

site in Shanghai,

China. The new facility came on stream in March 2007 and is a

world-scale plant with an annual capacity of 45,000

metric tons.

It is one of the most modern compounding plants in the world

today, with the highest environmental standards and the most

efficient production capabilities available.

Alongside this new plant in Shanghai, BASF has similar

compounding facilities in Malaysia and Korea, which are part of BASF's global

network of engineering plastics and compounding plants. This

network covers other countries in Europe, North and Central

America. With the new plant, BASF's total compounding

capacity in Asia exceeds 100,000 metric tons per annum.

2007/6/12 BASF

BASF considers construction of MDI plant in Chongqing

Plant to have world-scale capacity of 400 kt/a crude MDI

Startup planned from 2010 onward

Investment underlines BASF commitment to China

BASF is considering the construction of a new MDI

(diphenylmethane diisocyanate) plant in Chongqing municipality,

Western China, to meet growing demand for this product. A

corresponding memorandum of cooperation was signed today (June

12, 2007) with Chongqing Chemical and

Pharmaceutical Holding (Group) Company 重慶化醫集團and local authorities. BASF will

now carry out an in-depth evaluation of the competitiveness of

the location. The startup is planned from 2010 onward, and the

plant is expected to have a capacity of 400,000 metric tons

per year of crude MDI.

BASF already announced in early 2006 that it was considering

building another MDI plant in China with

partners.

The

decision on BASF’s additional joint

venture partners has not yet been made, and the final choice of a site

for the plant still hinges on a number of factors.

2006/11/2

BASF

BASF to mothball THF plant in Caojing, China

・Tough market conditions

・Reliable supply to customers

maintained

BASF has decided to mothball its tetrahydrofuran

(THF) plant in Caojing, Shanghai, China. The plant has an annual capacity

of 80,000 metric tons and supplies the raw material THF to the

polytetrahydrofuran (PolyTHF) manufacturing plant at the same

site. The mothballing of the THF plant will start in the first

quarter of 2007, and the PolyTHF plant will be supplied in the

future from BASF’s global production network.

The THF plant was shut down for technical reasons after a salt

leakage in the first quarter of 2006 and has not been started up

since then.

The restructuring will

enhance efficiency, strengthen competitiveness and lead to a further

increase in the capacity utilization of BASF’s THF plants in Germany, USA,

Korea and Malaysia.

Apart from the plant in Caojing, BASF produces PolyTHF at its

sites in Ludwigshafen, Germany, Geismar, USA, and Ulsan, Korea, supplying textile manufacturers

all over the world.

PolyTHF is an important component in the production of elastic spandex

fibers for

textiles such as sportswear, swimwear, underwear and outerwear.

In addition to its role in textiles, PolyTHF is also an important

intermediate for thermoplastic polyurethanes (TPU), which are used for example in

the manufacture of highly abrasion-resistant, yet flexible hoses,

films and cable sheathing.

BASF Agrees to Sell its Minority Ownership Interest in Geismar, LA Ethane Cracker and Associated Facilities

BASF Corporation today

announced that it has agreed to sell its minority

ownership interest in a 610,000 tons per year ethane cracker and

associated pipeline and storage facilities located in Geismar, Louisiana.

Subject to regulatory approvals, Williams Olefins,

L.L.C., will

purchase BASF's ownership interest in the cracker and PetroLogistics,

LLC, will

purchase BASF's interest in the associated pipeline and storage

facilities. Terms of the agreements were not disclosed. Closing

is expected to take place in July. The ethane cracker is jointly

owned by GE Petrochemicals, Williams

Olefins, L.L.C. and BASF, and operated by Williams Olefins,

L.L.C. The pipeline and storage facilities are jointly owned by

GE Petrochemicals, PetroLogistics, LLC, and BASF, and operated by

PetroLogistics.

BASF purchased its ownership stake in the cracker and associated

facilities in 1970 as part of its acquisition of

Wyandotte Chemicals.

Each owner supplies raw materials to the cracker and

independently markets its share of production from the cracker.

"BASF's strategy to more closely balance olefins supply

capability with captive demand is well served by our

world-scale joint venture naphtha steam cracker in Port Arthur,

Texas, reducing the strategic importance

of the Geismar ethane cracker to BASF," said Peter Cella,

NAFTA Group Vice President, Petrochemicals. "We believe our

investment in the Port Arthur cracker and the latest technology

deployed at this facility will provide BASF with a sustainable

first quartile competitive position in the marketplace."

Williams Olefins, L.L.C

Williams' businesses produce, gather, process and transport clean-burning natural gas to heat homes and power electric generation across the country.

Williams has been in business since 1908, when two Williams brothers began a construction company. That business grew into the world's leading pipeline engineering and construction firm. Under the Williams Brothers name, the company went public in 1957 with a net worth of about $8 million.

Williams Olefins, a business unit of Williams, is the operator of the jointly owned world class ethylene production facility located near Geismar, La., where approximately 1.2 billion pounds of polymer grade ethylene and 90 million pounds of polymer grade propylene are produced annually.

BASF/Atofina (60:40 JV)

Port Arthur, Texas

2,000百万lbs

BASF rules itself out of ICI acquisition

The German

chemicals group BASF has told Dutch newspapers it is not

interested in purchasing chemical firms, including ICI, as they

are too expensive.

Board member Stefan Marcinowski told Dutch daily newspaper Het

Financieele Dagblad that acquiring other chemical companies

is not 'financially viable'.

BASF evaluates strategic options for selected styrenics activities

BASF Aktiengesellschaft

(BASF), Ludwigshafen, announced today (July 17, 2007) that it is evaluating

strategic options for selected parts of its styrenics activities. In parallel to the evaluation

process, BASF has received an initial offer for selected parts of

its styrenics activities, and plans to start discussions with the

interested party.

BASF’s activities under consideration

include its styrene monomer (SM), polystyrene

(PS), styrene butadiene copolymer (SBC) and acrylonitrile

butadiene styrene (ABS) businesses with plants in Antwerp, Belgium;

Altamira, Mexico; São José

dos Campos, Brazil;

Ulsan, South Korea; and Dahej, India. These activities posted

sales of about Euro3.2 billion in 2006 and have approximately

1,000 employees.

Hans W. Reiners,

President of BASF’s Styrenics division, said that

BASF’s remaining styrenics activities

will in the future focus on foams and specialties for

the construction, automobile, packaging, sport and leisure

industries. “This ties in with the strategy of

BASF’s Plastics segment to supply its

customers with highly innovative, tailor-made solutions.”

In South Korea, BASF owns a 300,000 mt/year SM plant, a 250,000 mt/year ABS plant, a 320,000 mt/year PS plant and a 65,000 mt/year EPS plant at Ulsan. It procures its required benzene from other producers in Korea and Japan. (Platts)

--------------

2007/8/1 Platts

Germany's BASF in constructive talks with buyer for styrenics:CEO

BASF is in "fairly constructive talks" with one potential buyer for selected styrenics activities, Jurgen Hambrecht, CEO of the Ludwigshafen-based company, said Wednesday during the presentation of Q2 results.

--------------

Plast europe 2007/8/29

Basell : Leading contender for BASF styrenics?

Basell is being touted as a leading contender to acquire the EUR 3.2 bn styrenics activities that BASF put up for sale in July.

German press reports say that BASF and its former 50:50 joint venture (with Shell) have been in talks (now stalled) about a takeover. Both companies have declined to comment on the reports pointing to differing views about the value of the business as well as internal differences at BASF.Financial Times Deutschland

2007/8/6

BASF

BASF to increase

propionic acid capacity in Ludwigshafen and Nanjing プロピオン酸

BASF is increasing

its annual production capacity for the chemical intermediate

propionic acid at its sites in Ludwigshafen and Nanjing by 30,000 metric tons

and 9,000 metric tons, respectively. Production in

Nanjing is ensured by BASF YPC Co. Ltd., a joint venture owned by

BASF and the China Petroleum & Chemical Corporation (Sinopec

Corp.). Once the expansion of the two production facilities is

completed ? in Nanjing and in Ludwigshafen by mid-2009 ? BASF

will have the capacity to make 149,000 metric

tons of

propionic acid each year.

Ludwigshafen 80,000+30,000→110,000

Nanjing 30,000+ 9,000→ 39,000

Propionic acid inhibits the growth of mold and some bacteria and is used as a preservative for animal feed and food for human consumption. The acid is also widely used in the production of vitamin E, pharmaceutical-active ingredients, crop protection agents and solvents.

2007/8/27 BASF

BASF Catalysts expands auto catalyst plants in China and India

Rapidly growing demand in automotive industry

BASF Catalysts is expanding its automotive catalyst plants in Shanghai, China, and Chennai, India, to meet growing customer demand

over the next few years. BASF Catalysts already is a market

leader in automotive catalysts throughout Asia, and the planned

expansions will support the company’s continued leadership in the

region.

In response, BASF Catalysts will nearly double

manufacturing capacity in Shanghai, and triple capacity in

Chennai.

Both sites’ technical capabilities will also

be upgraded in order to deliver the most advanced

emission-control technologies that will meet anticipated new

emissions standards in China and India. Capacity expansions at

both locations will be complete by early 2009.

BASF ready to take out 10 bln eur in debt to finance acquisitions - CFO

BASF AG is ready to take out about 10 bln eur in additional debt to finance acquisitions, less than a year after buying catalyst maker Engelhard Corp, the Germany company's chief financial officer Kurt Bock told the Wall Street Journal Europe in an interview.

BASF is 'underleveraged' and could 'easily' double debt to twice its operating profit, adding about 10 bln eur to acquisition funding, Bock said, according to the newspaper.

BASF increases ethylene oxide capacity in Europe for EO derivatives

BASF is at the moment

successively increasing its production capacity for ethylene

oxide at its Ludwigshafen and Antwerp sites. Most of the work

will be performed during the next planned shutdowns in 2008 and

2009. This will increase BASF’s capacity for ethylene oxide in

Europe from 705,000 to 845,000 metric

tons per

year. A total of 345,000 metric tons per year will

be produced in Ludwigshafen and a further 500,000 metric tons per

year in Antwerp.

BASF mainly

produces ethylene oxide for its own use. The most important

derivatives of ethylene oxide are surfactants,

ethanolamines, glycol ethers and polyols.

“Germany

and China - Moving Ahead Together” in Nanjing:

BASF presents innovative products

and solutions for sustainable development

| ・ | Pavilion featuring energy-efficient and environmentally friendly solutions for housing and the automotive industry plus a Kids’ Lab |

| ・ | High-level corporate social responsibility round table |

| ・ | BASF to sponsor Nanjing taxis with its Keropur(R) fuel additive |

| ・ | Expert symposium on city life and construction |

BASF, Official Partner of

the “Germany and China - Moving Ahead

Together” initiative, today announced its

contributions to the first station in Nanjing, capital of Jiangsu

Province. The initiative will run from autumn 2007 to 2010 and

will tour a number of major cities throughout China to promote

technological and cultural aspects of Germany. BASF’s most visible activity will be a

pavilion on the Germany Esplanade in Nanjing that will be open to

the public from October 19 to 27, 2007. Other activities include

a high-level corporate social responsibility (CSR) round table,

the sponsorship of Nanjing taxis with BASF’s Keropur(R) fuel additive, and an

expert symposium on city life and construction.

| BASF

Pavilion: Construction and living, mobility and Kids’

Lab The pavilion will feature three main areas: |

|

| ・ | In the “low-energy apartment” BASF will show how its innovative products for the construction industry reduce both energy consumption and emissions while enabling a modern lifestyle. In addition, there will be hands-on exhibits related to topics such as smart temperature management, sound absorption and heat-reflecting surfaces. |

| ・ | The second area focuses on how BASF helps to make cars more environmentally friendly with a wide range of solutions for the automotive industry. Exhibits include water-based coatings and emission-control catalysts, as well as plastics that reduce the weight of cars and cut fuel consumption. |

| ・ | Finally, the pavilion will contain a Kids’ Lab in which children aged between 6 and 12 years can discover the world of chemistry through exciting specially designed experiments. Here again, two of the six experiments deal with aspects of environmental protection: wastepaper recycling and wastewater purification. |

BASF inaugurates two new plants at its Freeport, Texas, site

BASF today (October 8,

2007) inaugurated two new manufacturing plants at its site in

Freeport, Texas - a production line for polyamide 6

(nylon) and a plant for superabsorbent

polymers (SAP).

The polyamide production line replaces a

facility in Enka, North Carolina. The new line has an annual capacity

of 120,000 metric tons per year, and the caprolactam

feedstock is supplied by another BASF plant at the Freeport site.

The new superabsorbent polymers manufacturing facility

is supplied with a key raw material, acrylic acid, from another

BASF plant at the Freeport site which provides major competitive

advantages in terms of logistics and product quality. The new SAP

plant has a capacity of 180,000 metric tons per year and replaces existing

facilities in Aberdeen, Mississippi and Portsmouth, Virginia.

BASF further expands its position for engineering plastics in Europe

BASF has signed an agreement with SABIC Innovative Plastics on the acquisition of SABIC Innovative Plastics'shares in the PBT joint venture, BASF GE Schwarzheide GmbH & Co. KG. PBT (polybutylene terephthalate) is an engineering plastic.

BASF has a proven track record in Europe with firms who have co-located at the company’s two major German sites --Ludwigshafen and Schwarzheide.

JV with GE Plastics thrives at BASF’s Schwarzheide site

In 1997, General Electric’s GE Plastics Europe BV and BASF AG teamed up to create BASF GE Schwarzheide GmbH & Co., a 50/50 joint venture that manufactures and markets polybutylene terephthalate (PBT), a thermoplastic polyester used in auto components, appliances and consumer products. When the new company sought a home for its world-scale 60,000 tonne per year facility, it looked at several options. The company decided to co-locate at BASF’s Schwarzheide site because of the cost advantages there and the fact that a compounding facility was already on site. Today, the joint venture is the largest customer for services at the Schwarzheide site. The BASF GE venture is integrated into the whole energy structure of the site, and pays for site services as they would anywhere else. Executives at BASF GE Schwarzheide describe the investment as a success and consider it a well-run operation.

The purchase of SABIC Innovative Plastics'shares in BASF GE Schwarzheide marks BASF’s fifth acquisition in the sector of engineering plastics within the last five years. In 2003, Honeywell’s worldwide engineering plastics business and Ticona’s polyamide 66 business were bought and have been successfully integrated. This was followed in 2005 by the takeover of Leuna-Miramid GmbH and the engineering plastics business of LATI USA Inc. Moreover, BASF has started up operations in the growth market of Asia within the last 18 months, including a new production joint venture for PBT together with Toray in Malaysia and a new compounding plant in Pudong near Shanghai, China.

May 22, 2006

More polyamide specialties

- Leuna-Miramid to be renamed BASF Leuna

- New brand concept for BASF's polyamide plastic

Leuna-Miramid GmbH - a manufacturer of special polyamide compounds at the chemical site in Leuna, Germany - which was taken over by BASF in November 2005, is to be renamed BASF Leuna GmbH. The name change reflects the complete incorporation of this site into BASF's integrated network (Verbund). The brand name Miramid®, however, will be retained in BASF's product portfolio.

2005/12/8

BASF to acquire major North American engineering plastics business of LATI Engineering plastics portfolio strengthened with additional nylon, PBT, POM resins

BASF Corporation and LATI USA Inc., the U.S. affiliate of the Italian engineering plastics compounder LATI Industria Termoplastici SpA, have reached an agreement in which BASF will acquire the nylon 6 and nylon 6,6, polybutylene terephthalate (PBT) and polyoxymethylene (POM) business of LATI USA Inc., effective December 30, 2005. Financial details of the transaction are not being disclosed.

BASF will not acquire any manufacturing sites, equipment or related assets as part of the transaction. Also, no LATI employees will be transferred to BASF. For a period of time, LATI will supply its nylon (Latamid®, Kelon®, Latilub®, Latiblend®), PBT (Later®) and POM (Latan®) product lines to BASF under a transitional supply and services agreement.

LATI USA Inc. and BASF jointly expressed their commitment to a successful transition and will work closely to support customers to ensure no disruption of product supply and services occurs.

参考 Bayer/GE

Bayer MaterialScience is to transfer EXATEC shares to GE Plastics

Bayer MaterialScience is to transfer its shares in EXATEC to GE Plastics. This transaction will be completed subject to the approval of the relevant antitrust authorities. No statement will be made concerning the financial aspects.

With this decision, Bayer MaterialScience has opted to carry out its own independent development of polycarbonate automotive glazing, a market that is set to enjoy future growth. EXATEC was founded in 1998 as a 50:50 joint venture between Bayer and GE with the aim of developing technologies to produce automotive glazing systems from polycarbonate. gration mean it can also be used for rear windows, and open up further areas of application within the automotive industry.

BASF reorganizes its businesses: Faster to market, closer to customers, increased efficiency and greater cyclical resilience

BASF's new segment structure (Effective January 1, 2008)

BASF expands plasticizers business in Asia Pacific

・Oxo-C4

production capacity in Nanjing to be expanded to 305,000 metric

tons

・Plasticizer

applications laboratory inaugurated in Shanghai

・Focus

on innovative products Hexamoll(R) DINCH and Palatinol(R) 10-P

BASF today (January 9, 2008) outlined several key initiatives for

its Asia Pacific plasticizers business. To meet growing demand

for solvents and plasticizers the company plans to expand the

annual production capacity of its oxo-C4 plant in

Nanjing, China, by 55,000 metric tons to 305,000 metric tons by the fourth quarter of 2008.

This move will ensure reliable supplies of the precursor alcohols

n-butanol and 2-ethylhexanol. In Asia, and in China especially,

demand for plasticizers is expected to grow by 4 to 5 percent per

year through to 2015.

At the same time, BASF inaugurated the region’s first plasticizer

applications laboratory in Shanghai.

February 12, 2008 Thomson

Financial

BASF interested in acquiring Albemarle for 4.9 bln US$

BASF SE is interested in acquiring the US' chemicals company

Albemarle Corp for 4.9 bln usd, a 30 pct premium on its current

market capitalization, Capital reported on its website, not

citing where it got the information.

It said the German chemicals company declined to comment

respective rumours that according to the report were making

rounds on Wall Street.

Albemarle is a client of BASF.

The report said BASF would mostly be interested is Albemarle's

profitable refinery operations, which account for 40 pct of its

sales.

Albemarle Corp

Albemarle Corporation, incorporated in 1993, is a global developer, manufacturer and marketer of highly engineered specialty chemicals. The Company sells a diversified mix of products to a range of customers, including manufacturers of consumer electronics, building and construction materials, automotive parts, packaging, pharmachemicals and agrichemicals, and petroleum refiners. As of March 1, 2007, the Company and its joint ventures operated 43 facilities, including production, research and development facilities in North and South America, Europe, Australia and Asia. It serves more than 3,400 customers in over 100 countries.Albemarle Corporation's operations are managed as three operating segments: Polymer Additives, Catalysts and Fine Chemicals.

Total sales 2,369 million $

Polymer additives 39%:Flame retardants、Antioxidants、Curatives、Stabilizers

Catalysts 35%:FCC、HPC、Polyolefin、Specialty catalysts

Fine chemicals 26%:Fine chemistry services、Pharmaceuticals、Bromine chemicals、Other industrial specialties

BASF secures alternative

raw material supply for polyamide 6.6 business

* BASF and INVISTA enter into ADN supply agreement

* Proposed closure of ADN plant at Seal Sands in early 2009

BASF announced today that it has secured an alternative raw

material supply for its strategically important polyamide

business. BASF will purchase adipodinitrile (ADN) from the global

network of U.S.-based company INVISTA. ADN is used as a raw

material to produce hexamethylenediamine (HMD) at BASF’s Seal Sands site, Teesside, U.K.

HMD is a key intermediate for BASF’s Ultramid A (Polyamide 6.6).

Supply from INVISTA will commence at the start of 2009, and once

a reliable delivery has been established, BASF aims to close and

dismantle its ADN plant in Seals Sands. Both companies will

ensure that customers are not affected by the raw material supply

changes.

BASF is producing Ultramid A (Polyamide 6.6) from the key

intermediates HMD and adipic acid at its site in Ludwigshafen,

Germany. In addition, BASF operates fully backward-integrated

production plants for Polyamide 6 (Ultramid B) at its Verbund

sites in Ludwigshafen, Antwerp, Belgium and Freeport, USA.

Ultramid A and B are used to produce engineering plastics which

go into the automotive, electric&electronics, furniture and

leisure industries. In addition, Polyamide 6 and 6.6 are used to

produce fibers for textile, carpet and industrial applications.

BASF Plant Science and Academia Sinica (Taipei) to cooperate on gene discovery

BASF Plant Science and

Academia Sinica 台湾中央研究院, the leading research institute

in Taiwan, today signed a cooperation agreement. Focus is on the discovery of genes

that increase yield and improve stress tolerance in major crops

such as rice and corn. Financial details have not been

disclosed.

After agreements with CFGC (South Korea) and

NIBS (Beijing),

the agreement with Academia Sinica is the third cooperation

agreement that BASF Plant Sci-ence has entered within the past

eight months. “BASF Plant Science highly values

the quality of work carried out by research institutes in

Asia-Pacific,” said Logemann.

January 24, 2008

BASF

BASF Plant Science and National Institute of Biological Sciences,

Beijing enter cooperation and license agreement

・ BASF

Plant Science intensifies biotech cooperation activities in Asia

Pacific

・ Research

focuses on higher yield in major crops such as corn (maize),

soybeans and rice

BASF Plant Science and

the National Institute of Biological Sciences, Beijing (NIBS) 北京生命科学研究所 today announced a cooperation and

licensing agreement in biotechnology. It is the first cooperation

to be made by BASF Plant Science in the People’s Republic of China and focuses on

increasing yield in staple crops such as corn, soybeans and rice.

About the National Institute of Biological Sciences, Beijing

The National Institute of Biological Sciences, Beijing (NIBS,

Beijing) was established to advance the frontier of basic

research in the life sciences in China. Founded in 2003 as part

of a strategic government initiative to further national

development of science and technology, NIBS aims to become a

first rate, internationally competitive research institution. Its

faculty will educate future generations of life scientists and

explore a new model for operating scientific institutions in

China. NIBS currently has six plant biology laboratories with

focus on research in the mechanisms of plant development and how

plants respond to internal and environmental signals. Many of

their research discoveries have direct implications to

agribiotechnology and improvement of crops.

BASF Plant Science and Crop Functional Genomics Center sign R&D agreement in South Korea

BASF Plant

Science and Crop Functional Genomics Center (CFGC), the

leading Korean consortium for crop research, today

(October 4, 2007) signed a coopera-tion and licensing

agreement in Seoul, South Korea. The agreement includes

the discoveries by 200 top researchers from 40 renowned

research institutes over 10 years. |

| About CFGC: The Ministry of Science and Technology of Korea has developed in 2000 the 21st Century Frontier R & D Program to boost national competitiveness in science and technology, improve the quality of life, and benefit humanity. The Crop Functional Genomics Center (CFGC), which belongs to the program, focuses on the func-tional genomic study for crop improvement. Unraveling the complex relationship between genes and phenotypes and applying this information to the development of better crops are dependent on cooperative works in genomics, transformation, and molecular breeding, and should eventually make a significant contribution to global food security. CFGC is a virtual institution supporting research projects that are carried out in universities, research institutes and industries throughout the nation and about 250 PhD scientists are working for the program. For 10 years of the program pe-riod, the CFGC will run target-oriented basic research and their application pro-jects in the fields of plant functional genomics, crop transformation, and plant mo-lecular breeding. Science and technology have made extraordinary progresses in the last century, contributing tremendously to the improvement of human life. We are among those responsible for leading 21st century science and technology, being convinced that all our goals can be achieved through establishing a new paradigm for global collaboration. To find more about CFGC, please visit our Internet website at: www.cfgc.snu.ac.kr |

BASF delayed styrenics sale because of low offers

BASF SE did not meet its June 30 deadline to sell parts of its styrenics operations because potential buyers were struggling to find funding and were offering too little.

Suitors are facing stricter requirements to provide own equity while interest rates have gone up, BASF chief executive Juergen Hambrecht told analysts at a conference in London.

'We are not selling it under conditions which are not justifiable,' he said, adding the process continues.

In February, the company said it is in negotiations with one party and that it plans to clinch a deal in the first half.

BASF has described the divestment as inevitable, saying standard styrenics will not have enough of an edge over rival products in the long run.

Jul 30, 2008

Reuters

BASF looking at takeover targets

German chemical group BASF is considering taking over U.S. rival W. R. Grace &

Co, the

Financial Times Deutschland said on Wednesday, citing middle

management and banking sources.

As well as assessing Grace, which has $3.1 billion in annual

turnover, BASF will also be looking closely at the strategy,

company structure and business development of U.S. group Rockwood and Germany's Cognis COGN.UL with a view to acquisitions, the

paper said.

All three potential targets have been given project names, a sign

that they are being considered seriously for takeover, the report

said.

2007/9/20 BASF、新しい買収?

W. R. Grace & Co

Grace is a premier specialty chemicals and materials company.

First Choice for Packaging Assurance

Grace Materials and Packaging Technologies provides sealants, coatings and closures to the food and beverage industries that are used in more than 300 billion containers each year.

Worldwide Leader in Construction Products

For more than 50 years, Grace Construction Products has offered commercial and residential construction products used in projects ranging from major infrastructure to minor home repair.

Global Specialty Chemical Supplier

Grace Davison is the second longest continually operating chemical company in the United States, offering discovery sciences, engineered materials, packaging technologies, catalysts and refining technologies.

We help biorefineries manufacture alternatives to gasoline and diesel that promote clean energy sources.グレースケミカルズは米国コンクリート混和剤の最大手メーカーであるW.R.グレースの実績とセメント・特殊混和材メーカーの電気化学工業㈱の開発を結び、多様化するニーズに対応しております。

April 2, 2001

W. R. Grace & Co. today announced that the Company has voluntarily filed for reorganization under Chapter 11 of the United States Bankruptcy Code in response to a sharply increasing number of asbestos claims. This Chapter 11 filing includes 61 of Grace's domestic entities. None of the Company's foreign subsidiaries are included in this filing.

Grace is the sixth major company to cite asbestos claims as their reasons for filing chapter 11 since January. Twenty-six companies have made such filings since 1982.

Rockwood

Rockwood Holdings, Inc. is a world-class specialty chemicals and advanced materials company committed to delivering exceptional value through continued leadership in customer service, quality, on-time delivery and innovative technology and is currently composed of 15 individual business units.

2007 net sales by end-use market

Chemicals and Plastics 13%

Life Science 8%

Electronics and Telecommunications 11%

Consumer Products 4%

Metal Treatment ang General Industrial 16%

Paper 3%

Construction 14%

Specialty Coatings 7%

Automotive 14%

Environmental 2%

Others 8%Cognis COGN.UL

ドイツ・モンハイムに本社を置き、世界30カ国に拠点を持ちます。 油脂化学をバックボーンに、160年に及ぶ経験と実績を有する、世界的な総合化学会社です。自然由来の機能性食品、栄養補助食品素材など健康の向上を目的とする製品、低刺激な化粧品や洗剤、そして塗料・インクなどの原料、が私たちの製品群です。

Cognis is a leading specialty chemicals company with activities around the world. Utilizing its 160 years of experience in oleochemicals, Cognis markets innovative products and solutions for personal care, home care and modern nutrition, as well as high-performance products for numerous industrial markets.

Care Chemicals Nutrition & Health Functional Products PulcraChemicals Cognis Oleochemicals ・Hair / Body / Oral Care

・Home Care

・Industrial & Institutional

Cleaning

・Skin Care

・Silicates・Dietary Supplements

・Pharmaceuticals & Healthcare

・Food Technology

・Functional Food &

Medicamental Nutrition

・Adhesives

・Consumer Coatings

・Emulsion

Polimerization

・Graphic Arts

・Industrial Coatings

・Polymer

Building Blocks

・Synlubes Technology

・AgroSolutions

・Mining Chemicals

・Ion-Transfer Technology・Textile Technology

・Fiber Technology

・Leather Technology

・Fatty Acids

・Glycerin / Triacetin

・Ozon Acids

・Plastic Additives

・Oilfield Chemicals

BASF takes a further step

in the divestment of its styrenic activities![]()

BASF is continuing the

divestment process of its global styrenic business and plans to

reorganize the business into new subsidiaries as appropriate. The new companies

are expected to be established in January 2009.

In addition, the scope of the activities to be sold will be

expanded to include the styrene copolymer business. This expansion includes styrenic

copolymer production plants in Ludwigshafen and Schwarzheide,

Germany as well as the styrene copolymer global marketing, sales

and logistics activities.

The new subsidiaries will operate the global styrenics business

independently. They will combine the commodities styrene monomers

(SM), polystyrene (PS),

styrene butadiene copolymer (SBS) and acrylonitrile butadiene

styrene (ABS) as

well as the styrene copolymers consisting of the Luran®

(SAN), Luran®

HH (AMSAN), Luran®

S (ASA), Terblend®

N (ABS/PA),

Terluran® HH (ABS-HH), Terlux®

(MABS) and

Styroflex® (SBS) brands. The styrenic

commodities and copolymers with around 1,600 employees had total

sales of about Euro 4 billion in 2007 and production sites

located in Antwerp, Belgium; Ludwigshafen and

Schwarzheide, Germany; Altamira, Mexico; São José dos Campos,

Brazil; Dahej, India; and Ulsan, South Korea. BASF will concentrate its

remaining styrenic plastics activities on its foams business

for the construction and packaging industries as part of the

Performance Polymers division.

commodities

SM

PS

SBS スチレン-ブタジエン-スチレンブロック共重合体

ABS

コポリマー

Luran®

(SAN) スチレン/アクリロニトリル

コポリマー

Luran®

HH (AMSAN) α-Methylstyrene-acrylonitrile copolymers

Luran®

S (ASA) styrene acrylonitrile copolymers that have

been impact-modified with acrylic ester rubber

Terblend®

N (ABS/PA)

Terluran®

HH (ABS-HH) (High Heat:modified ABS that meets the requirements

for thermally stressed components)

Terlux®

(MABS) Methyl methacrylate-acrylonitrile-

butadiene-styrene-polymer

Styroflex®

(SBS) Styrene/butadiene

block copolymer

2008/9/15 BASF

BASF makes offer to acquire Ciba

* Cash offer of CHF 50.00 per share provides attractive premium

* Ciba’s Board of Directors supports

offer

* BASF to expand its leading position in specialty chemicals with

additional products and services

* Repositioning and restructuring of paper chemicals operations

to create leading supplier with extensive portfolio

* Basel to remain an important site for parts of the combined

business

* Conference call at 9:00 a.m. CEST, press conference in Zurich

at 11:00 a.m.

BASF plans to acquire Ciba Holding AG, Basel, Switzerland, a leading

specialty chemical company, and will make a public takeover offer

to Ciba’s shareholders. BASF will pay CHF

50.00 in cash for each nominal share in Ciba. BASF and Ciba have

reached a transaction agreement in which the Board of Directors

of Ciba supports BASF’s attractive offer and recommends

its acceptance to Ciba’s shareholders. The offer

corresponds to a premium of 32 percent above the closing price

for Ciba’s shares on September 12, 2008 and

a premium of 60 percent above the volume-weighted average share

price for Ciba shares in the 30 days prior to announcement of the

public takeover offer. Based on all outstanding Ciba shares and

including all net financial liabilities and pension obligations,

the enterprise value would be CHF 6.1 billion (approximately Euro 3.8 billion).

2008/9/15 polymer-age.co.uk/

The acquisition of Ciba would benefit BASF on a number of fronts.

In plastics Ciba's additives business would augment BASF's own, particularly with the addition of UV stabilisers and antioxidants, and expand the total plastics materials package it is able to offer. Allied to this is Ciba's strong position in coating effects which would also extend BASF's existing range.

Both companies are significant players in paper chemicals, although Ciba has had difficulty in maintaining adequate profitability, and said in August that it was "considering options" for the future of the business. Combining the two businesses would create a market leader, and enable the "extensive restructuring" that BASF sees as needed.

Ciba has a strong position in water treatment chemicals, which would boost BASF's own operations in this area.

As well as the sectorial benefits from combining the two companies, there are geographic and strategic advantages. BASF is a global chemicals company, but the addition of Ciba's portfolio, particularly in water purification, gives it potential to increase its presence in emerging economies. And BASF's global presence offers more potential for Ciba's niche market businesses, such as oil and mining. The two companies also complement each other in research and development, and the merger would bring to Ciba the advantages of BASF's upstream materials integration.

As part of its offer terms BASF has made assurances over the future of Ciba sites in Switzerland and says it will set up an operating division with global responsibilities in Basel.チバ・ジャパンは16日、BASFからチバ・ホールディングAG のすべての発行済株式を一株当り50スイスフランで公開買付するとの提案を受けたと発表した。

チバは、プラスチック添加剤、コーティング機能材、製紙・水処理剤における卓越したイノベーション能力とアプリケーションの専門的知見を通して、スペシャライズド・ケミカル・エンジニアリングの分野で、BASFの戦略とオペレーションを強化する。

同時に、BASFのグローバルな研究、生産、マーケティング基盤とともに、重要な原材料および中間体についての共同後方統合は、チバにとって大きなメリットとなる。両社は、これまで長期にわたり、広範囲なサプライヤーと顧客の関係を維持してきた。Public tender offer by BASF for Ciba

* Board of Directors of Ciba recommends shareholders accept offer * Industrial logic: Integration into BASF will strengthen Ciba’s businesses through access to BASF’s global research, production and marketing platform, raw materials and intermediates * Commitment to strategically important production sites in Switzerland and R&D site in Basel * Fair price for shareholders Ciba strengthens BASF’s strategy and operations in the field of specialized chemical engineering through its leading innovation capabilities and application expertise in Plastics Additives, Coating Effects and Water & Paper Treatment. At the same time, Ciba benefits from BASF’s global research, production and marketing platform, as well as the associated backward integration into important raw materials and intermediates. The two companies already maintain long-standing and extensive supplier and client relationships.

Bacteria-free surfaces

BASF's new Luran®

S BX 13042 kills

bacteria

First antimicrobial BASF plastic

BASF is now offering a

plastic that has the property of killing microbes. This material

belongs to the specialties found in the styrene plastic product

line. It goes by the name Luran® S BX 13042 and is currently the

only ASA (acrylonitrile-styrene-acrylate copolymer) with an

antimicrobial effect. The product will be presented at the FAKUMA

2008 in October in Friedrichshafen, Germany. Sample amounts are

already available in the color white.

The antimicrobial material contains silver compounds that are

incorporated into the plastic in order to impart its surface with

a germicidal effect. Interesting areas of application for this

material are not only hand dryers, soap dispensers or entire

sanitary units in public washroom facilities, but also other

products that come into contact with bacteria and other

microorganisms and that need to be sterile such as, for instance,

hospital beds, medical treatment chairs or computer keyboards in

public offices. The combination with the classic ASA properties

such as weathering resistance, high thermal-ageing stability,

good chemical resistance and outstanding surface quality yields a

new material with an extraordinary property profile.

BASF looking to sell its

shares in PEC-Rhin

BASF SE intends to sell its 50 percent holding in PEC-Rhin. PEC-Rhin is a 50-50 joint

venture between BASF SE and GPN. The company produces ammonia, nitric

acid and fertilizers in Ottmarsheim, France.

BASF's fertilizer business currently comprises production

activities in Ludwigshafen (Germany), Antwerp (Belgium) and

Ottmarsheim (France).

In contrast to Ottmarsheim, the fertilizer activities in

Ludwigshafen and Antwerp are based on Verbund integration with

other value chains.

PEC-Rhin was founded in 1967. The joint venture has a workforce

of about 200 employees and in 2007 generated sales in the low

three-digit million Euro range.

BASF reduces production

worldwide

*

Massive decline in demand in key industries

*

Previous year’s earnings level will not be

achieved

BASF is taking measures to avoid the creation of overcapacities

as a result of a massive decline in demand. The company is

temporarily shutting down around 80 plants

worldwide. In

addition, BASF is reducing production at

approximately 100 plants. This was already announced for

polystyrene and caprolactam. Scheduled maintenance work is being

brought forward.

“We

already drew attention to the difficult economic situation at the end of

October.

Since then, customer demand in key markets has declined

significantly,” said Dr. Jurgen Hambrecht,

Chairman of the Board of Executive Directors of BASF SE. “In particular, customers in the

automotive industry have canceled orders at short notice.”

In addition, sales

volumes are being negatively impacted by increased

reduction of inventory by customers and a lack of credit in

customer industries.

“In

2008, BASF will therefore not achieve the previous year’s excellent EBIT before special

items. How the coming year will develop is difficult to foresee.

BASF is preparing for tough times,” said Hambrecht.

BASF abandoned its goal of matching last year's 7.61 billion euros ($9.6 billion) in operating profit

The adjustments are primarily being carried out in units that supply the automotive, construction and textile industries.

Production will be reduced at a further 100 factories, including a site in Malaysia, BASF said. Forty factories in the company's industrial hometown in the Rhineland-Palatinate region of Germany will be idled, as well as 10 in North America and 15 in Asia, spokesman Daniel Pepitone said. U.S. closures include factories in Geismar, Louisiana, and Freeport, Texas, that make dispersions ディスパージョン製品and toluene diisocyanate, or TDI, used in foams and adhesives. An ethylene plant in Port Arthur, Texas, is running at reduced capacity, Pepitone said.

The capacity reduction is to last until January for individual plants and may continue with shorter working times after that, should weak demand continue, the company said.

`BASF is preparing for tough times,'' Hambrecht said. ``Going forward visibility isn't as clear as we'd like. It's like driving into fog and you can't see very far in front of you,'' he said.

BASF Halts Plan to Move Styrenics Business Into New Subsidiary

BASF SE, the world's biggest chemical producer, abandoned plans to move its styrenics businesses into new subsidiaries after the company couldn't find a buyer.

BASF will reexamine options for styrenics and the business will remain within the company instead of being separated on Jan. 1 as originally planned, the Ludwigshafen, Germany-based company said in a newspaper for employees.

2009/1/15 BASF

BASF to change PolyTHF feedstock supply in Korea

* Shutdown of local BDO and THF production

* Local PolyTHF production will continue to operate

* Supply of BDO and THF to customers will continue via global

network

BASF plans to permanently close its production facility for

1,4-butanediol (BDO) and tetrahydrofuran (THF) in Ulsan, which

has been temporarily shut down since August 2008, and the company

will continue to supply related customers via its global network.

BASF's PolyTHF plant in Ulsan will continue to operate with

feedstock from the network accordingly.

BASF will continue to maintain a reliable supply of BDO and THF

to its PolyTHF plant at Ulsan from BASF's global network,

including the company's THF plant in Caojing, China, which is

operating with a new BASF-owned technology.

BASF produces THF at its plants in Ludwigshafen (Germany), Geismar (USA), Caojing (China) and Kuantan (Malaysia). With BDO produced at these plants and at BASF's Chiba (Japan) site, the total global capacity for BDO equivalents amounts to 535.000 metric tons per year. In addition to Ulsan, BASF produces PolyTHF in Ludwigshafen, Geismar and Caojing with an annual capacity of 185.000 metric tons.

Both units have been temporarily closed since August 2008 to help the company cope with the ongoing economic downturn, which has caused severe drops in demand for many chemicals. BASF says that under current conditions it cannot produce BDO and THF at the plant at competitive prices. 27 jobs will be affected, the company says.

| BDO | THF | PolyTHF | ||

| Ulsan (Korea) | ○→X | ○→X | ○ | |

| Ludwigshafen (Germany) | ○ | ○ | ○ | |

| Feluy (Belgium) | ○→X | 2005年停止 | ||

| Geismar (USA) | ○ | ○ | ○ | |

| Caojing (China) | ◎ | ○ | ○ | 当初は独自の新技術でブタンから直接THF製造 技術的問題からTHF停止、その後改造してBDOから製造 |

| Kuantan (Malaysia) | ○ | ○ | BASF Petrobras | |

| 千葉 | ○ | BASF千葉:BASF 67%(当初は50/50の出光BASF) | ||

| 四日市 | ○→X | ○→X | 2006年停止 |

BASF got environmental

approval for MDI project in Chongqing

On Jan. 12, 2009, BASF got environmental approval from China?s

Ministry of Environment Protection (MEP) for its proposed MDI

project in Chongqing Chemical Industry Park (CCIP), Changshou,

Chongqing.

The total investment is USD 1.18 billion (RMB 8 billion), among

them, the investment for environment protection is USD 102

million (RMB 696 million). The project includes 400,000 t/a

nitrobenzene, 300,000 t/a aniline, 400,000 t/a crude MDI and

refining facility, 20,000 t/a MDI pre-polymer, storage facility

and other utilities.

According the BASF, the MDI project will use the most advanced

technologies in environmental protection and met China's standard

for discharge of pollutants.

BASF has announced a world-scale capacity of 400 kt/a crude MDI

in Chongqing, to meet growing demand for this product in China. A

corresponding memorandum of cooperation was signed in Jun. 2007

with Chongqing Chemical and Pharmaceutical Holding (Group)

Company and local authorities.

Orginally, BASF announce the startup is planned from 2010 onward

depending on the time of approval, but now, the project is

expected to start up in 2012.

2008/10/13 BASFの重慶MDI計画,進展か

BASFは上海に、ハンツマン、上海クロルアルカリ、上海華誼、シノペック上海高橋化学と共同でイソシアネートコンプレックスを建設、TDI

16万トン、粗MDI 24万トンを生産し、MDI精製を行っている。

BASFは2006年1月、上記計画の第2弾として、BASF、ハンツマン及び中国側パートナーが中国でのMDI増設を考えていることを明らかにした。

能力はワールドクラスの40万トンで、2010年以降のスタートとし、いくつかの立地を評価しているとしていた。

2007年6月、重慶でMDI工場の建設を検討していること、重慶化醫集団及び市当局との間で協力の覚書を締結したことを明らかにした。

MDI能力は40万トンで、経済性について評価を行っており、2010年以降のスタートを考えているとし、JVの相手はまだ決まっていないとしていた。

環境保護省の情報では、BASFは今回の上記計画を単独で実施する。

BASFは当初、2010年スタートとしていたが、現在では2012年のスタートが予定されている。

なお、更に上流の原料については、協力覚書を締結した重慶化醫集団が供給する。

重慶化醫集団はBASFのMDI計画に合わせ、次の4つの子会社を設立し、昨年8月29日に建設開始の式典を行った。

クロルアルカリ:300千トン(天原化学)

硫酸:400千トン(建峰化学)

フォルムアルデヒド:400千トン(長風化学)

クロロプレンゴム:40千トン(長壽化学)

前3つはMDIの原料で、クロロプレンゴムは塩素を原料に生産するもの。

BASF takes steps to

optimize its structures

*Performance Products segment sharpens focus on customer

industries

*New operating division Paper Chemicals established

*Preparations to integrate Ciba businesses

*BASF reviews strategic options for its leather and textile

chemicals business

Details of the

organizational changes as of April 1, 2009 are as follows:

BASF's new segment structure (Effective January 1, 2008)

BASF reviews strategic options for leather and textile chemicals

In addition to implementing this cost-reduction program, BASF is

reviewing future strategic options. In particular, these include

the formation of a joint venture or the complete sale of the

business. “The market requires this step not

just because of the fragmented supplier structure and the low

market growth,” said Reiners.

| 旧所属 | |||

| Performance Products segment | Dispersions

& Pigments ↑ (Acrylics & Dispersions) |

dispersions | Acrylics & Dispersions |

| pigments and coatings resins | Performance Chemicals | ||

| Ciba’s Coating Effects | Ciba | ||

| Care Chemicals | cleaning, personal care and hygiene | ||

| human and animal nutrition | |||

| pharma | |||

| superabsorbents | Acrylics & Dispersions | ||

| Performance Chemicals | plastics processing, automotive, refineries, oil fields and mining | ||

| leather and textiles | |||

| Ciba’s plastics additives | Ciba | ||

| Paper Chemicals (新設) |

paper chemicals business, binders and kaolin minerals | Acrylics & Dispersions | |

| Ciba’s business | Ciba | ||

| Chemicals segment | Petrochemicals | ||

| acrylics (プロピレン誘導品) | Acrylics & Dispersions |

Merger control

authorities approve acquisition of Ciba by BASF

Settlement conditions for tender

offer fulfilled

Transaction to close on April 9

The U.S. Federal Trade Commission (FTC) and the Chinese merger control authority MOFCOM approved the acquisition of Ciba Holding AG by BASF on April 2, 2009. No conditions were imposed beyond those required by the European Commission in its decision of March 12, 2009.

Furthermore, the condition imposed by the European Commission to reach a sales agreement for Ciba's business with the light stabilizer CHIMASSORB 119 FL (HALS) before closing has been fulfilled. The buyer is the Italian company Sabo S.r.l.

CHIMASSORB 119 FL

ヒンダードアミン系光安定剤(HALS)・高分子量タイプ低抽出性、低揮散性を有する高分子量型ヒンダードアミン系安定剤であり、耐NOxガス変色にも優れる。ポリオレフィン系及びスチレン系ポリマーに卓越した性能を発揮する。顔料の凝集作用が少ない。

As a result, the conditions for the settlement of the tender offer are now fulfilled (closing): The offer price of CHF 50.00 per tendered share can be paid and the Ciba shares transferred to BASF.

The planned settlement date is April 9. As of this date, BASF will hold approximately 95.8 percent of Ciba shares. Ciba shares tendered to BASF can be traded on the second line of the SIX Swiss Exchange until April 3, 2009. Ciba shares that have not been tendered can be traded on the SIX Swiss Exchange until further notice.

2009-03-12 EU

Mergers: Commission approves acquisition of Ciba by BASF, subject to conditions

The European Commission has cleared under the EU Merger Regulation the proposed acquisition of Ciba of Switzerland by BASF SE of Germany, both active in the chemicals industry. To remedy competition concerns the Commission had in relation to a number of specialty chemical products, used inter alia in the paper, dyestuffs, plastics and skin care sectors, BASF offered undertakings to divest activities in the sectors in question. In the light of these commitments, the Commission concluded that the proposed transaction would not significantly impede effective competition in the EEA or any substantial part of it.

Competition Commissioner Neelie Kroes commented "I am satisfied that the divestments offered by BASF will ensure that its takeover of Ciba will not harm competition in markets for a range of chemicals used in consumer goods such as skin care products, paper and plastics".

BASF, the ultimate parent company of the BASF Group, headquartered in Ludwigshafen, Germany, is the world’s largest chemical company. BASF is active in chemicals, plastics, performance products, agricultural and nutritional products and oil and gas. Ciba, the ultimate parent company of the Ciba (formerly Ciba Specialty Chemicals) Group, is a specialty chemicals company headquartered in Basel, Switzerland.

The Commission's investigation revealed that the proposed transaction would not significantly modify the structure of the majority of the relevant markets, as a number of credible and more significant competitors would continue to exercise a competitive constraint on the merged entity.

However, the Commission found that the proposed transaction would raise competition concerns in a number of relevant specialised markets, namely

- DMA3 (dimethylaminoethyl acrylate - a chemical intermediate)

- synthetic dry strength agents (used in the paper industry)

- bismuth vanadate (a pigment)

- indanthrone blue (a pigment)

- SA (styrene acrylic - used as a glue for paper applications)

- HALS (hindered amine light stabilisers - used in plastics) and

- UV (ultraviolet light) filters for skin care products.In the markets where the Commission identified competition concerns one or both parties held significant market shares even before the transaction and the proposed takeover would lead to further strengthening of these positions.

Divestments

To resolve these competition concerns, BASF proposed to divest DMA3 production assets at Ludwigshafen (Germany), Ciba’s entire EEA synthetic dry strength agent business and Ciba’s global bismuth vanadate business.

Regarding indanthrone blue, BASF agreed to transfer Ciba’s know-how of the finishing line, all supply contracts, customer lists and inventories.

For SA, BASF agreed to divest Ciba’s SA business (and the PVAc - polyvinyl acetate and AA ? all acrylate businesses) in the EEA at Kaipiainen (Finland).

For HALS, BASF committed to divest Ciba’s entire Chimassorb 119 FL business, including the Chimassorb 119 FL production assets, relevant know-how and customer lists.

For UV filters, BASF committed to conclude a UV Filter Licence Agreement, giving third party access to the technology behind Tinosorb S (a UV filter patented and currently solely produced by Ciba).

Following a market investigation, the Commission concluded that the divested businesses would be viable and that the commitments would resolve all identified competition concerns.

BASF to sell China

process catalysts site to Sud-Chemie

BASF today announced that it has signed a definitive agreement to

sell its catalysts manufacturing facility in Nanjing, China, to Sud-Chemie

AG, a

worldwide leading speciality chemical company for catalysts and

adsorbents headquartered in Munich, Germany. The facility is

independent from BASF’s main Verbund site in Nanjing.

Both companies have agreed not to disclose financial details of

the transaction.

The facility produces more than 30 different types of syngas

catalysts, including products for manufacturing ammonia and

methanol. A transition plan for the approximately 400 employees

working at the process catalyst site is being developed together

with Sud-Chemie. Despite the sale of the Nanjing catalyst site,

BASF remains committed to being the global leader in the process

catalysts industry and the preferred catalysts supplier for its

customers.

“China

will continue to be a major focus of our process catalysts

business. Because BASF has an extensive platform in China, we see

our best growth opportunities in leveraging BASF’s assets to capitalize on the

growing Chinese catalyst market,” said Wilfried Seyfert, Group Vice

President, Process Catalysts and Technologies. “This catalysts site did not

represent a strong fit with BASF’s other operations in China. We

therefore determined that our best strategy was to sell the site

as part of BASF’s ongoing efficiency and

restructuring programs.”

Dr. Gunter von Au,

Chairman of the Managing Board of Sud-Chemie AG, commented: “Acquiring syngas catalyst

production in Nanjing is an important strategic cornerstone for

the expansion of Sud-Chemie in China and expanding our catalyst

business in Asia. With the new site, we strengthen not only our

market position in the Chinese growth market for catalysts for

converting coal into high quality chemical products, but we also

consolidate our position as worldwide technology and market

leader in this area of business.”

About BASF’s Catalysts division

BASF’s Catalysts division is the world’s leading supplier of

environmental and process catalysts. The group offers exceptional

expertise in the development of technologies that protect the air

we breathe, produce the fuels that power our world and ensure

efficient production of a wide variety of chemicals, plastics,

adsorbents and other products.

Süd-Chemie is a highly-innovative, listed, specialty chemicals company headquartered in Munich. With its two divisions of Adsorbents 吸着剤 and Catalysts, the Süd-Chemie Group, which has around 6,500 employees, generates total sales of almost 1.2 billion euros. Süd-Chemie holds an extremely strong position on global markets, almost 80 percent of Group sales being realised with customers outside Germany. It systematically exploits the potential offered by fast-growing regions, notably in Southeast Asia and the Middle East.

The starting material for products manufactured by the Adsorbents Division is a clay mineral known as bentonite. This clayey rock binds materials dissolved in water or other liquids and can be chemically refined to create versatile adsorbents and additives.

水を吸うと自らの体積の10倍以上に膨張し、さらに多量の水と混合すると強力な粘性を発揮する。しかも、長時間おいても沈殿せず、無機物だから公害の心配がない。こんな不思議な粘土、それがベントナイトです。

他の鉱物には無い、こうしたユニークな性質によって、建築・土木工事の施工や鉱業製品の製造に不可欠な素材として、化粧品や医療品などの原料として、さらには小動物の排泄物を処理するペット砂として、幅広く利用されています。

In March 2003, SABIC and Süd-Chemie AG formed a partnership for the acquisition of Scientific Design Company Inc. from Linde AG. Under this changed ownership, Scientific Design remains an independent entity and continues to license its processes, provide engineering services and sell catalysts to its clients worldwide. SABIC and Süd-Chemie manage Scientific Design Company Inc. through a fifty-fifty joint venture. http://www.knak.jp/big/sabic-2.htm#sd

Süd-Chemie

| 部門 | 売上高 (百万ユーロ) |

従業員 | |

| Absorbents | 702 | 3,836人 | Absorbents

and additives Perofrmance packaging Foundry products and specialty resins Water treatment |

| Catalysts | 490 | 2,271 | Catalytic

technologies Energy and environment |

| Total | 1,191 | 6,513 |

BASF to close the Styropor (EPS) plant and further adjust its production services at its Tarragona site

BASF will shut down the Styropor® plant (EPS, expandable polystyrene) at its site in Tarragona, Spain. The closure is scheduled for August 2009. As a direct consequence of the plant closure and due to the current downturn in BASF's key markets in Spain, the company will also adjust the structure of production services in Tarragona. In total, 85 BASF employees working in production and related services such as maintenance, engineering and logistics are affected by these measures. This amounts to 9 percent of all jobs of BASF Española S.L..

The Styropor plant has become uneconomical due to its relatively small production capacity which has resulted in an unfavorable cost-structure. “The decision to close the Styropor plant does not mean that BASF will retreat from the Iberian EPS market," said Giorgio Greening, head of the Global Business Unit Foams. "BASF will continue to supply the region with high-quality EPS from Ludwigshafen, Germany and intends to defend its market share”.

BASF to reduce

polystyrene capacity in Europe by about 15 percent

One production plant in

Ludwigshafen to be permanently closed

Personnel to be transferred to

other functions within the company

Effective June 30, 2009, BASF will close one polystyrene plant at

the Ludwigshafen site. This will reduce BASF’s annual production capacity for

the standard plastic polystyrene in Europe by

80,000 to 540,000 metric tons, what comes up to a capacity

reduction of about 15 percent.

The main reason for the shutdown is the decrease in demand for

Polystyrene. The affected plant, which has been out of operation

since mid-April, will be dismantled. Personnel working at this

plant will transfer to other positions within the company.

Polystyrene will continue to be produced by BASF in Ludwigshafen

but it will serve primarily for the manufacture of the two BASF

insulation products Styrodur(R)C and Neopor(R)

(extrusion-based).

In the future, orders for Polystyrene from European customers who

had previously been supplied from Ludwigshafen will be filled

mainly from the plant at BASF’s Verbund site in Antwerp,

Belgium.

BASF reorganizes its Petrochemicals Division

BASF reorganizes its Petrochemicals division effective July 1, 2009. The future organization consists of four (formerly six) business units. The optimized organizational structures will lead to higher efficiency and effectiveness and will open up potentials to even better serve customers´ needs. Customers will benefit from a reduced number of interfaces and a broader portfolio of the respective business units. The new clustering of businesses also comes along with new business opportunities as well as synergy effects out of the BASF Verbund.

The new organizational setup is based on a thorough analysis of the market and economic situation, which has fundamentally changed over the last years. Exemplary for this change are the important BASF investments in Nanjing (China) and Port Arthur (USA).

The details of the reorganization are as follows:

| 2008/1/1から 以下の6セグメントに変更 |

|

Alkylene Oxides and Glycols、Cracker Products、Industrial Gases、Specialty Monomers、

Standard Monomers、Plasticizers、Solvents

2009-07-06

BASF specifies restructuring plans

*23 of 55 acquired production sites worldwide under review

*Synergies of at least Euro400 million per year expected

*Fair and transparent decisions

BASF has finalized its plans for the integration of Ciba Holding

AG, which it acquired in April 2009. Under the plans, former Ciba

businesses are to be integrated into the operating divisions in BASF’s Performance Products segment where their potential can best be

realized and developed. The integration will involve extensive

restructuring measures that BASF expects to generate synergies of at

least Euro400 million per year from 2012 onward. By the end of

2010, savings of approximatelyEuro300 million are to be achieved.

At the same time, the integration process is expected to entail

cash costs totaling approximately Euro550 million, about Euro150

million thereof in 2009. BASF will report details of non-cash

integration costs as part of its second-quarter interim reporting

on July 30, 2009.

BASF aims to grow above

market: Asia Pacific sales to double by 2020

*Asia Pacific Strategy 2020 targets growth of two percentage

points above market

*Earn premium on cost of capital

*70 percent of sales to be manufactured locally

*Headcount to increase by at least 5,000

*Investments of ?2 billion planned between 2009 and 2013

*Efficiency improvements to save at least ?100 million annually

by 2012

BASF today outlined its Strategy 2020 for Asia Pacific. Through

2020, BASF aims to grow on average two percentage points faster

than the Asia Pacific chemical market each year. With expected

market growth of 4 to 5 percent per year, this would double

regional sales by 2020 while earning a premium on cost of

capital.

This ambitious strategy is based on growth and new business

initiatives. Under its new strategy, BASF will initially target five key

growth industries in the region, will increase headcount by at

least 5,000 from a current figure of approximately 15,000, and

plans to generate 70 percent of regional sales from local

production. At the same time, the company will invest Euro2

billion in the region between 2009 and 2013, and aims to create

efficiency improvements that are expected to save at least

Euro100 million annually by 2012.

“BASF

has established its position as the leading chemical company

owing to its long-standing commitment to the Asia Pacific region.

The Asian growth markets will continue to provide attractive

opportunities, and our Strategy 2020 will help us to realize

them,” said Dr. Martin Brudermuller,

member of the Board of Executive Directors of BASF SE,

responsible for Asia Pacific. “The current economic situation

does not change our positive expectations of the long-term

potential of these dynamic markets.”

Investments of

Euro2 billion between 2009 and 2013

To support the goal of producing 70 percent of its sales within

the Asia Pacific region, BASF plans to invest Euro2

billion between 2009 and 2013. This amount includes BASF’s 50 percent share of the $1.4

billion expansion of its integrated chemical production joint

venture in Nanjing, China, which was approved by the

national government in July 2009. In Chongqing, China, BASF is in

the planning phase for a 400,000 ton/year plant for

MDI, a

precursor for polyurethanes. BASF and the Chongqing authorities

aim for mechanical completion of the plant by the end of 2013 and

commercial operation by early 2014. Final approvals of the

project by Chinese regulators are expected in 2009, and

subsequently the BASF Board of Executive Directors plans to

approve the investment in the first quarter of 2010.

Five key customer industries, new geographic markets

In Asia Pacific, BASF will organize its sales efforts around key

industries in order to grow faster than the market. The company

has established an initial set of industry target groups where it

intends to become a preferred supplier, including the automotive,

construction, packaging, paint and coatings, and pharmaceuticals

industries.

By looking closely at the value chains in these key industries,

BASF will better understand its customers’

needs and will be

better positioned to provide products and solutions based on BASF’s global knowledge and resources.

A few examples of chemical innovations from BASF already

introduced for these industries include engineering

plastics for lightweight cars, insulation systems and concrete

admixtures for energy-efficient housing, biodegradable packaging

materials, environmentally friendly paint ingredients, and

advanced intermediates for pharmaceutical production.

Already present in 15 countries in the region, with significant

operations in China, Japan, Korea, Malaysia and India, BASF will

also actively seek opportunities to support rapidly developing

customer markets in relatively untapped locations, including

Vietnam and inland China.

Larger local team, enhanced R&D capabilities

To achieve its goals, BASF will implement an enhanced development

plan to strengthen its existing local talent base. By 2020, BASF

expects to increase its headcount in Asia Pacific by at least

5,000. In its two challenging growth markets, China and India,

BASF has set up dedicated recruitment centers to manage the

increase in hiring. The company will double the number of

employees in research and development by 2020, especially at its

two major R&D clusters in China and India. Currently, BASF

has 300 employees working in R&D at 15 sites in Asia Pacific.

“Local

innovation and local production are driving business growth in

this region. We therefore want to develop new applications,

products and solutions together with our customers in Asia,

adapted for Asian needs, and then serve local markets primarily