「人民網日本語版」2006年7月2日 西部大開発

中国、今年は西部開発12事業に1,654億元を投資

中国は今年、総額1654億元を投じて西部地域で12項目の重点プロジェクトを起工する。国家発展改革委員会が30日、公表した。北京の日刊紙「京華時報」が新華社の情報として伝えた。

12プロジェクトは次の通り。

* 太原―中衛(銀川)鉄道の敷設工事

* 西部地域の交通の便を改善するための「西部公路」の建設(貴州省都匀―新寨、寧夏回族自治区中寧―塩池、新疆ウイグル自治区・賽里木湖―果子溝などの区間)

* 西部のコミューター空港建設(陜西省楡林空港、内蒙古自治区赤峰空港の移転と、広西チワン族自治区河池空港、雲南省騰沖空港、四川省康定空港の新設)

* 西部地域の重点炭鉱プロジェクト(内蒙古自治区の勝利一号露天炭鉱、寧夏自治区の梅花井炭鉱)

* 水力発電所プロジェクト(金沙江の向家ダム、雲南省の糯扎渡水力発電所、同省景洪水力発電所の建設)

* 雲南省青山嘴ダムプロジェクト

* 耕地縮小・森林増加プロジェクトと、食料田建設プロジェクト

* 四川省でのエチレン80万トン生産プロジェクト

* 新疆自治区・羅布泊(ロブノール)でのカリ肥料120万トン生産プロジェクト

* 内蒙古での酸化アルミニウム40万トン生産プロジェクト

* 西部地域でのハイテク産業プロジェクト(陜西省での高速生産国家プロジェクト研究センター建設と、重慶市での超音波医療技術国家プロジェクト研究センター建設)

* (西部地域での教育、衛生など社会事業プロジェクト(農村における寄宿制学校プロジェクト、農村の小中学校での通信教育プロジェクト、県クラスの医療機関・農村部の健康センター建設、省クラスの化学薬品中毒・放射能救急治療センターの建設)

本年度の12計画のなかには資源、化学関連では以下の計画が含まれている。

・西部地域の重点炭鉱プロジェクト(内蒙古自治区の勝利1号露天炭鉱、寧夏自治区の梅花井炭鉱)

・四川省でのエチレン80万トン生産プロジェクト

・新疆自治区・羅布泊(ロブノール)でのカリ肥料120万トン生産プロジェクト

・内蒙古での酸化アルミニウム40万トン生産プロジェクト

エチレン計画はPetroChinaが51%、成都市が49%出資する成都石油化学(Chengdu Petrochemical Co.)によるもので、本年2月に起工式を行った。

エチレン 800千トン、HDPE 300千トン、LLDPE 300千トン、MEG

360千トンのほか、アクリル酸、フェノール、BPA、ブチルゴム等を生産する。

原料ナフサは 隣接する甘粛省と陝西省のPetroChinaの製油所から貨車で輸送する。

西部地区のエチレンセンターは現在2つだけ。

新疆ウイグル自治区の新疆独山子石油化学(エチレン22万トンで100万トン新設中)

甘粛省の蘭州石油化学(エチレン24万トンで45万トン新設中)

カリ肥料計画は「さまよえる湖」として知られる新疆ウイグル自治区の枯渇したロブノール湖の豊富な塩化カリウムを採掘して年間120万トンの硫酸カリ肥料を生産するというもの。2009年の生産開始を目指す。

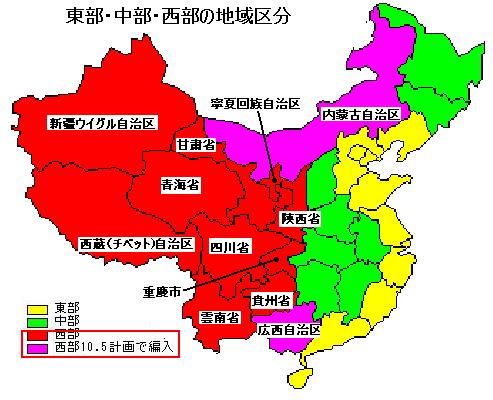

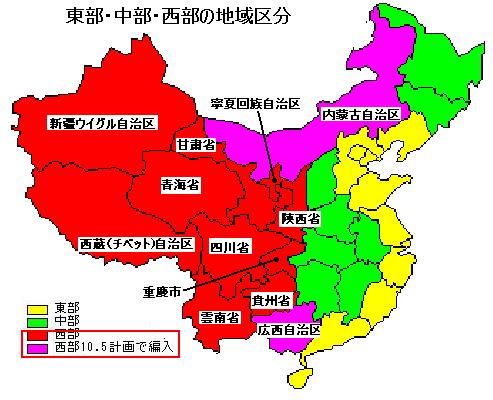

西部大開発は東部沿海地区の経済発展から取り残された内陸西部地区を経済成長軌道に乗せるために国務院が実施している開発政策で、2000年3月の全国人民代表大会で正式決定された。

当初は甘粛省、貴州省、寧夏回族自治区、青海省、陝西省、四川省、チベット自治区、新疆ウイグル自治区、雲南省及び重慶市の10省区市が含まれたが、その後、内モンゴル自治区と広西チワン族自治区を追加し、12省区市とした。

これまで70項目の事業が行われたが、目玉には「西気東輸」、「南水北調」、「西電東送」、「青蔵鉄道」がある。

「西気東輸」は西部の天然ガスを東部に輸送するもので、新彊のタリム盆地から甘粛、寧夏、陝西、山西、河南、安徽、江蘇、浙江、上海と続く総延長4000キロのパイプラインを建設した。2005年に開通。

「南水北調」は長江の上流、中流、下流からそれぞれ取水し、西北地区と華北地区の各地に引水するもので、東線、中央線、西線の3ルートがある。

西線は長江上流にダムを建設して、長江と黄河の分水嶺に輸水トンネルを掘り、長江上流の水を黄河上流に引くもので、青海省、甘粛省、寧夏回族自治区、内モンゴル自治区、陝西省、山西省等の黄河上中流域と渭河関中平原の水不足解消が見込まれる。海抜3000~5000mで工事を行う。

「西電東送」は西部の火力、水力発電の電力を東部に3つのルートを用いて送電するもの。

北通道は内蒙古自治区、山西省の火力発電所、黄河中上流域の水力発電所から北京・天津への送電網建設計画。

中通道は2009年完成予定の三峡ダムと金沙江流域の水力発電を中心に、上海、江蘇、浙江への送電網を建設する計画。

南通道は雲南、貴州、広西の境界地帯にある天生橋水力発電所から広東省に送電する計画。

7月1日に完成した「青蔵鉄道」は青海省ゴルムドとチベット自治区ラサを結ぶ鉄道で、これにより北京とラサ間が鉄道で結ばれた。

全長1142キロのうち、960キロが標高4千メートル以上で、唐古拉山の最高地点は標高5072メートルで世界一の標高。年間平均気温は摂氏0度以下で、酸素濃度は平地の半分のため、乗客の酸素不足解消のために車内拡散と酸素マスクの2方式で酸素が供給される。自然環境保護のため、トイレ用に真空保持式の汚物処理装置が設置されたほか、車両下部にも汚水処理装置が設置されている。

553キロは永久凍土層を通過するため、地球温暖化による凍土融解のおそれがあり、線路の安全性を懸念する声もある。

2006/6/26 Valpar

Valspar to Acquire Majority Interest in Huarun Paints

Leading Chinese Coatings Company Expands Valspar’s Customer Base in Fast-Growing

Market

http://www.valspar.com/val/ne/viewnews.jsp?newsid=29602

The Valspar Corporation, a leading global coatings company, announced today that it has agreed to acquire a significant majority of the share capital of Huarun Paints Holdings Company Limited (Huarun Paints), one of China’s largest independent coatings companies, from Champion Regal, a Hong Kong based investment company. Founded in 1991, Huarun Paints has grown to become one of China’s leading domestic suppliers of wood and furniture coatings and a rapidly growing supplier of architectural coatings. Huarun Paints achieved sales of approximately $180 million in 2005, primarily through its focus on the development of an extensive network of distributors and exclusive retail paint stores throughout China. The cash purchase transaction is expected to close by the end of July and to be slightly dilutive to Valspar’s earnings in fiscal years 2006 and 2007.

Huarun Paints Holdings Co.,Ltd.

Huarun Paints Holdings

Co.,Ltd. is a large-scale group company covering the trades of

chemical painting, metal package, hardware and art ware, trading,

and painting engineering, etc., with its headquarters located in

Hong Kong, China.

Among the companies of Huarun Group, China Guangdong Huarun

Paints Co. Ltd. occupies the principal status. Originally

established in 1991, it is a high and new tech enterprise

specialized in the research and development, production and sales

of the series products such as high class furniture painting,

water born paints, architectural decoration and fitment paints

and adhesives, etc.

Growing up in the “Hometown of Paints of China”, China Guangdong Shunde Huarun

Paints Co. Ltd. has become the leader in the painting industry in

China for years.

Valspar Corporation

http://www.valspar.com/val/av/av.jsp

The Valspar Corporation

is one of the largest global coatings manufacturers in the world,

providing coatings and coating intermediates to a wide variety of

customers. Since 1806, Valspar has been dedicated to bringing

customers the latest innovations, the finest quality, and the

best customer service in the coatings industry.

With more than 7,000 employees in over 80 locations around the

world, Valspar is in a truly unique position to supply customers

with the coating solutions they need. Our products include:

・Paints,

varnishes, and stains for the do-it-yourself and professional

markets

・Coatings

and inks for rigid packaging, particularly food and beverage cans

・Factory

applied coatings for industrial customers and original equipment

manufacturers

・Automotive

refinish and specialty coatings

・High

performance floor coatings for industrial, commercial, and sports

flooring applications

・Polymers

and dispersions for paint and coatings manufacturers, and more

・Interior

protective coatings and external basecoats and overvarnishes with

highest abrasion resistance for aluminium monobloc aerosol cans

and bottle cans

・Basecoats

and internal protective coatings for aluminium collapsible tubes

・Matt,

soft-feel and other special effect coatings for plastic and glass

containers for the cosmetic industry

・UV

varnishes, waterbased varnishes and laminating adhesives for the

Graphic Arts market

・Primers,

coatings and varnishes for industrial coils on steel, HDG and

aluminium for the building industry

Headquartered in Minneapolis, MN, our diverse array of products

makes us one of the most complete suppliers anywhere, and the

sixth largest paint and coatings company in the world. Please

visit our products page to learn more about a specific Valspar

offering.

2006/7/12 China

Daily

2 coal-to-oil plants to be built

http://www.chinadaily.com.cn/bizchina/2006-07/12/content_639060.htm

State-owned Shenhua

Group's Ningxia affiliate has teamed up with Royal Dutch Shell

and South Africa-based Sasol to build two coal-to-liquids plants

in the northwestern autonomous region with an investment of up to

US$12 billion.

The plants will help enhance energy security and enjoy good

market prospects because of soaring oil prices, analysts said.

Shenhua

Ningxia Coal Industry Company, a subsidiary of the biggest coal

company in China, yesterday signed a joint study agreement with Shell Gas &

Power Development BV to

build a facility to convert coal into oil products such as petrol

and diesel.

The new plant, to be set up at the Ningdong coal

production base,

will cost US$5-6 billion, said Lim Haw Kuang, executive chairman

of Shell Companies in China.

The study is expected to be completed by 2009, and the plant will

be able to yield 3 million tons of oil a year, or 70,000 barrels per

day (bpd) by

2012, Shell said.

The plant will use Shell's indirect coal liquefaction

technology,

which turns coal to gas and then liquefies it into fuels.

Another similar project is also being planned in Ningxia between Shenhua and

Sasol, one

of the global leaders in coal liquefaction technologies.

Shenhua last month signed a co-operation agreement with Sasol to

develop an 80,000 bpd coal-to-oil plant in Ningxia.

While the two Ningxia plants adopt the overseas indirect technology, Shenhua will test its own direct technology which turns coal into oil products without the gasification process in the Inner Mongolia Autonomous Region.

2006/7/15 新華社

China regulates

coal-chemical industry

The Chinese government has just issued a circular on regulating

the coal-chemical industry, urging local governments to tighten

control of new projects.

The government will not approve coal Liquefaction

projects with an annual production capacity under three million

tons, methanol or

dimethyl ether projects under one million tons and coal-to-alkene

projects under 600,000 tons, said a circular released by the

National Development and Reform Commission (NDRC) on Friday.

Experts said the move aims to contain possible overheating in the

coal-chemical industry.

According to the NDRC, constantly rising oil prices on the world

market have prompted the development of the coal-chemical

industry in trying to find alternatives for petroleum in China.

China's methanol production capacity reached 5.36

million tons by the end of 2005. According to incomplete

statistics, current methanol production capacity under

construction is nearly nine million tons, with over 10 million

tons under planning.

As the market has not been fully developed, when all the projects

go into production, a surplus capacity is inevitable, said NDRC.

According to the NDRC, as the technology is still in experimental

phase, coal liquefaction projects should

not be approved until a national development program for the

industry is completed.

Coal-chemical projects must meet environmental requirements and those that fail to meet the

safety requirements in transportation should not be allowed, said

the NDRC.

In the five-year period from 2006 to 2010, China will encourage

the development of coal-based chemical fertilizer. The industries

of coal liquefaction and coal-made alternatives for petroleum

should be developed steadily while the traditional coal-chemical

industries that have seen overproduction such as calcium carbide

and coke should be kept under control.

日本経済新聞 2006/7/19

ぺトロカザフ株 中国石油、33%売却 カザフ国有石油に 脅威論に配慮

中国国有石油最大手の中国石油天然気集団(CNPC)は昨年10月に買収した石油大手ペトロカザフスタンの株式33%を、カザフスタンの国有石油会社カズムナイガスヘ売却した。カザフ国内ではエネルギー分野で急速に存在感を増す中国に対する脅威論も広がっており、今後カザフでの事業を円滑にするため株の売却に踏み切ったとみられる。

China Chemical Reporter 2006/7/20

Acrylic Acid/Ester

Project Launched in Shandong

The ceremony for

launching the acrylic acid/ester project in Zhenghe

Group

was held in Guangrao county of Shandong province 山東省広饒郡

on July 11th. It is

one of the 9 major projects in ChemChina Group Corporation in

2006.

Zhenghe Group in Guangrao, Shandong province has clinched an agreement with Shanghai Huayi Group上海華誼集団公司 on construction of a joint venture rated at 110 kt/a acrylic acid and 160 kt/a acrylate in the Economic Development Area of Guangrao, which is deemed currently as the largest in China acrylic project.

Zhenghe Group 正和集団

http://www.cnzhenghegroup.com/cgi/search-en.cgi?f=introduction_en_1_+company_en_1_+contact_en&t=introduction_en_1_&title=aboutus

Established up in 1975,

Zhenghe group (former Shandong Guangrao Petrochemical Industry

Group 山東広饒石化) is an enterprise group

registered by Shandong Industry & Commerce Administration

Bureau, and checked and approved by China Industry & Commerce

Administration Bureau, and one of 100 strongest enterprises in

the chemistry industry of China and in the industry of Shandong

Province and one of the 136 important enterprise groups in

Shandong Province.

As the core

enterprise of the whole group, Zhenghe Group Co., Ltd. is large

stock enterprise group for many industries, including

petrochemical and fine chemical industries, rubber product, green

environment protection building material, thermal power, trade

and service, and it consists of many companies, Such as Shandong

Zhenghe Steel & Plastic Sectional Material Co., Ltd., a

hi-tech enterprise of Shandong Province, (Sino-German joint

venture)Dongying Zhenghe Woodenware Co., Ltd., the largest middle

and high density board production base in China, Shandong Zhenghe

Thermal Power Co., Ltd., Dongying Kuoke Rubber Industry Co.,

Ltd., Qifeng Plastic Woven Co., Ltd., Guangrao Chemical Raw

Material Plant, etc. and a technical development center of

provincial class.

「人民網日本語版」2006年7月26日 Sinopec, Kuwait pick China's Zhanjiang for refinery

中国石油化工、クウェートと石油精製で提携 広州で

中国石油化工集団とクウェート国営石油会社(KNPC)が共同で行う、年間1200万トンの石油精製プロジェクトが、このほど国家発展改革委員会の承認を受けた。投資総額は50億ドルで、中外合弁プロジェクトとしては過去最高額。これまでの最高額は、中海殻牌石油化工公司(中国海洋石油とロイヤル・ダッチ・シェルの合弁)による南中国海での石油化工事業(投資総額43億ドル)だった。北京の日刊紙「京華時報」が、中国石油化工集団の子会社、広州石油化工総廠の25日付発表として伝えた。

国家発展改革委員会の承認により、用地は広州市南沙経済開発区に決定した。プロジェクトの主な目的は、中国国内における製品油の供給確保。毎年、エネルギー消費量の多い夏になると、広州市、時には珠江デルタ全体が石油不足に悩まされる。

広州石油化工総廠の責任者によると、業務レベルでのKNPCとの交渉は、すでに中国石油化工から広州石油化工に委ねられている。

| 2006/6/27 Sources say Sinopec has replaced CNPC to become the Chinese partner of Kuwait in the Nansha refining project.

|

Asia Chemical Weekly

To be Located in Nansha(南沙), this new approved refinery is different with the existing refinery of Guangzhou Petrochemical Co (GPC). GPC has a existing 7.7 million tonne/year refinery in Huangpu(黄埔), and which is expanding capacity to 12 million.

広州港

広州市南東部の黄埔区にある国際港。南沙港区、新沙港区、黄埔港区、広州内港港区などに分かれている。

深セン港と並んで、中国南部の物流にとって重要な港。貨物取扱量は1999年に1億トンを超え、2005年には2.5億トンに達している。また、2005年のコンテナ取扱量は468万TEUで全国第3位。

Sinopec's Nansha Petrochemical to be relocated due to environmental reason

Sinopec's Nanshan Petrochemical plant, which was planned for the Nansha District of Guangdong province, is to be relocated for fear of possible pollution, according to Wang Yang, the Guangdong provincial governor.

A Sinopec spokesman told Xinhua that the decision to relocate was made after careful consideration. Nansha District is near to Hong Kong, where the people have long opposed the refinery plan.

Guangdong province, the most economic developed region in China, has been suffering from air and water pollution in recent years. In 2008, the rate of acid rain there amounted to 50 percent.

Wang has not announced the new location but said Sinopec has already selected a new one. Market rumor goes that Zhanjiang 湛江, a coastal city in Guangdong province, may be the new location.The Nansha Petrochemical plant, a joint venture between Sinopec and Kuwait National Petroleum Company (KNPC), is designed to have a refining capacity of 15 million tons/year and ethylene production capacity of one million tons/year.

The refinery received approval from National Development and Reform Commission in 2006 but construction has yet to begin.

新華社 2006/7/26

The central government has approved a mammoth US$5 billion joint venture oil refinery project in Guangdong Province in its latest effort to reduce reliance on imported oil and chemical products.

The project will be in Nansha in Guangzhou. Top Asian oil refiner China Petroleum & Chemical Corp, or Sinopec, and Kuwait Petroleum Corp will form the joint venture.

"The final document for approval from the central government is expected to come as soon as late today (Tuesday)," an official at Sinopec's Guangzhou branch said yesterday.

The venture will become the largest Sino-foreign joint venture in terms of investment scale, overtaking a US$4.3 billion project -- also in Guangdong -- by China National Offshore Oil Corp and Royal Dutch Shell Plc.

The Nansha project is designed with an annual oil refining capacity of up to 15 million tons and a further 1 million ton production capacity of ethylene, a key petrochemical building block.

"For such big scale projects, China still needs to partner with foreign firms for help in both capital and technical support," said Yin Xiaodong, a Citic Securities Co analyst in Beijing. "And the 1 million ton ethylene plant will become the largest of its kind in China."

Major ethylene projects in China already include the CNOOC-Shell venture of 800,000 tons in Guangdong, a Shell-Sinopec venture of 800,000 tons in Shanghai and a BP Plc-Sinopec venture of 900,000 tons in Guangdong.

This month, German chemical giant BASF AG and Sinopec said they will increase annual ethylene capacity by 25 percent to 750,000 tons at a venture in Nanjing, Jiangsu Province.

China's dependence on ethylene imports rose to 57 percent last year from only 22 percent in 1990 thanks to robust demand from manufacturers.

The country plans to add more than 10 million tons of ethylene capacity by the end of 2010. The plan calls for expanding existing plants and building new ones, according to the National Development and Reform Commission.

The country produced 7.55 million tons of ethylene last year.

2006/7/18 finance.comcast.net

Dow Admits Participation

in Massive Oil Refining Project

http://finance.comcast.net/rich/news_body.html?id=comtex_CTB_en%3A1153228214&auth=

Dow Chemical Company, the

global leading provider of innovative chemical, plastic and

agricultural products and services, had participated in the

first-phase negotiation on the 15-million-ton oil refining

project in southern China's Guangdong province, as disclosed by

one of Dow's high-level officials.

He also revealed that four parties, including Sinopec, Kuwait

Petroleum Corp., Dow Chemical and another western oil company

unnamed,

were likely to cooperate in the project, which has the refining

capacity of 15 million tons annually and annual output of one

million tons of ethylene.

Recent information shows that the huge refinery may be built in Nansha of

Guangzhou,

capital city of Guangdong.

The project is beneficial to the participants. With the advantage

of crude oil supply, Kuwait Petroleum can become engaged in

China's oil production. Dow's desire of being involved in China's

ethylene production and refinery can be realized by providing

advanced technologies and capital. Sinopec, with doubt, will

consolidate its status in southern China.

Guangdong News 2006/6/27

Guangdong aims at a 5 billion US dollars oil project

Guangdong government is working to push an oil refinery project

costing 5 billion US dollars to be built in Guangzhou's Nansha

district. According to information from the Guangdong Development

and Reform Commission, the project has been submitted to central

government for approval. Since last year, Kuwait National

Petroleum Company (KNPC) has been discussing with China the

construction of a large refinery with an annual output capacity

of 15 million tons. Officials said that if the project is

approved it will become China's largest joint venture. Insiders

pointed out that the giant refinery will not only bring over an

enormous economic profit, but also be beneficial to Guangzhou

citizens.

China Chemical Reporter

2006/7/27

PTA Unit Conducts Intermediate Handing-Over

The expanded 450 000t/a PTA (purified terephthalic acid)

production line conducted intermediate handing-over on the newly

built No.3 PTA unit in Sinopec Yangzi Petrochemical Company

Ltd.(YPC), Nanjing of Jiangsu province on July 15th, 2006. After

the completion in September 2006, the PTA capacity in

YPC will reach 1.05 million t/a from existing 600 000 t/a and YPC

will become the largest PTA production base in China.

China's Sinopec Yangzi to start up new Nanjing PTA unit on Nov 20

China's Sinopec Yangzi Petrochemical Company's plans to start up a new 450,000 mt/year purified terephthalic acid unit in Nanjing on November 20, 2006, a company source said Thursday.

Once brought online, the new plant will boost the company's total PTA production capacity to 1.15 million mt/year. The company operates two other PTA plants with a combined capacity of 700,000 mt/year. (下記では 1.05 million mt)

All paraxylene feedstock for the plant will come from the company's PX unit, which was expanded to its 800,000 mt/year capacity in the first half of 2006.

China Chemical Reporter 2006/12/7

YPC Realizes 1.05 million T/A PTA Capacity

On November 18th, 2006, the 450 000 t/a PTA (pure terephthalic acid ) production line put on stream in Yangzi Petrochemical Plant in Nanjing of Jiangsu province, signaling Sinopec Yangzi Petrochemical Co., Ltd.(YPC) become the first manufacturer with PTA capacity of over 1 million t/a in China. Qualified PTA products have already been produced from the refinement unit. With a total investment of nearly RMB2 billion, the 450 000 t/a PTA project adopts the patent technology of INVESTA Corporation of UK and was jointly designed by Sinopec Shanghai Engineering Incorporation, Sinopec Shanghai Engineering Company Ltd. and Nanjing Yangzi Petrochemical Design & Engineering Co., Ltd. Before expansion, PTA design capacity in YPC is 600 000 t/a. Added by the newly built 450 000 t/a PTA production line, PTA capacity in the company today reach 1.05 million t/a.

3 still missing from

fatal chemical-plant blast in east China county 江蘇省射陽郡

Sixteen people were

killed and 29 others injured with another three still missing in

Friday's chemical plant blast in east China's Jiangsu Province,

local government sources said Saturday morning.

The explosion took place at around 8:45 a.m. on Friday (7/28) at

the Fuyuan Chemical Co., Ltd. a Sino-German

joint venture

yet to begin production in Linhai Township of Sheyang County. The

plant planned to produce fluoro benzene for industrial use. フルオロベンゼン

* a

Sino-German joint venture というのは疑問

The sources said

all of the injured, including the chairman, general manager and

vice general manager of the chemical company, have been

hospitalized.

More than 7,000 local residents who were evacuated from the blast

site have returned to their homes as local environmental

protection authorities said by Friday night, the toxic gas,

chlorine, from the blast had dispersed and had little influence

in the air.

Preliminary investigation showed improper operation by workers

was mainly to blame for the accident.

Xinhua 2006/7/28

4 people injured in chemical plant blast in Shanghai

Four people were confirmed injured with no death reported at a chemical plant blast that occurred on Friday morning in Shanghai, local government sources said.

The big fire caused by the explosion has been extinguished.

At 7:57 a.m. on Friday (7/28), a hydrogen peroxide production facility exploded at the Shanghai Yuanda Peroxides Co., Ltd., a mainland-Hong Kong joint venture, in Baoshan District, northern Shanghai. 宝山区

Four people were injured in the blast, which caused thick smoke and a big fire. They've all been hospitalized, the sources said.

The blast's influence on environment of nearby areas is being monitored and cause of the accident is under investigation.

founded in November 1998

a joint venture between Shanghai COSCO Chemical and Hong Kong Shengli Pacific 勝利太平洋

two anthraquinone-method facilities, one built in 1990 and the other in June 1999, with a combined production capacity of 50,000 tonnes per annum (counted by 27.5% hydrogen peroxide). 過酸化水素

Yancheng Fuyuan Chemical Co., Ltd. 塩城気源化工

(originally Shenyang Fudu Chemical)

http://www.chinafuduchem.com/template/about-e.htmJiangsu Yancheng Fuyuan Chemical Co., Ltd. is an innovative medium-sized company specialized in manufacturing fluorochemicals in China. It was established in 1958 and completed the reform of the property right in 1998. Today Mr. Xue Chun Lin Managing Director of the company is major shareholder. The company has 460 staffs and of them there are the most 130 specialists .In 2004 the turnover of the company is RMB200 million for export over USD15 million

Our main markets are Asia Europe and USA. We are producting more than thirty fluorochemicals with two series: inorganic fluorine products and fluorinated aromatics.

Our main products include Anhydrous Hydrogen Fluoride (10,000MT/year), Hydrofluoric acid (3000MT/year), Fluorobenzene (3500MT/year) and Ammonium Bifluoride, Potassium Fluoride, Sodium Bifluoride, 2,4-Dichlorofluorobenzene, o/p/m-fluorotoluene, 4-Bromo-2-Fluorotoluene, 4-Fluoronitrobenzene, etc.

After more than 30 years experiences in the productions of fluorochemicals, we have grown continuously during last years and today we are the biggest producer of fluorobenzene in the world. As a consequence of the great reliability the company achieved, we have won the high reputations on the market for our high quality products and the best possible services.

The company keeps quality mottoes of Socking perfect providing satisfying products and service to customers and quality targets of Ranking fast in china, catching up with the advanced level in the world. We have passed through the ISO9001 quality control system certification and received the certification of ISO14000 Environment Control System. Besides our own R&D and QC. We have very close cooperation with several Universities for developing the new items and meeting any requirements from our customers.

With good facilities of road, railway and air transport. The company is just beside the Nation Road No.204, Sheyang Port in the east and 40km away from Yancheng airport and Xinchang railway 20km from the entrance of the Ning-Jing-Yan highway. These convenience traffic provides good condition for the company's growing up.

RubberWorld 2006/7/31

PetroChina to double synthetic rubber output

PetroChina, the listed vehicle of the China National Petroleum

Corp., plans to double its synthetic rubber output in the next

four years, said a company official. The state oil company will

build four synthetic rubber plants with annual production

capacity of 530,000 tons in total over the next four years,

thereby doubling its annual capacity to 935,000 tons, said Wang

Guilun, in charge of PetroChina's synthetic rubber technology, at

the 47th annual meeting of the International Institute of

Synthetic Rubber Producers in Barcelona.

The new facilities include one 150,000-ton plant in Sichuan 四川省, one 200,000-ton plant in Fushun,

Liaoning 遼寧省撫順, and 100,000-ton and 80,000-ton

facilities in Dushanzi in Xinjiang 新疆

独山子, said

Wang.

| 「人民網日本語版」2006年8月4日 世界銀行、中国のクリーンエネルギー事業に融資

2006/8/2 IFC IFC Supports Coal

Conversion into Clean Energy, Addresses China's Energy

Security Needs |

「人民網日本語版」2006年8月4日

1億元超の新規着工プロジェクト、全面チェック実施

国家発展改革委員会、国土資源部、国家環境保護総局、国家安全生産監督管理総局、中国銀行業監督管理委員会など5部門はこのほど、共同で「新規着工プロジェクトの整理に関する指導意見」を発表し、各地方政府に対し、今年上半期に着工して統計データに組み込まれた新規着工プロジェクトで、投資額が1億元以上のものについて、全面的なチェックを行うよう求めた。鉄鋼、電解アルミ、カーバイド、鉄合金、コークス、自動車、セメント、電力、繊維などの各業界については3千万元以上のものを、石炭業界については年産3万トン以上のものを対象とする。

今回は主に▽産業政策▽プロジェクト審査手続き▽土地審査▽環境評価▽融資政策の執行状況――などについて、関連の政策・規定に対する違反行為がないかをチェックする。石炭など鉱山関連のプロジェクトではこうした項目のほか、▽安全監督管理部門や炭鉱安全監察機関の審査を受けて、安全に配慮した設備やプランを設置することに同意しているか、▽安全対策設備の設計・施行・操業(「三同時」制度)を実施しているか――といった安全管理に関するチェックを行う。

チェック基準に照らして1項目でも問題が見つかったプロジェクトは、関連部門が法律に基づく処置を行うとともに、建設の一時停止や期限内の改善を行うよう指導する。建設再開については、関連の法律・法規や政策の規定に合致し、必要な手続きを完了した後に認める方針だ。また地方政府に対し、現地の主要メディアを通じて問題点と対応措置の内容を明らかにするよう求める。(編集KS)

2006/8/5 Chianview

Project probe aims

to curb investment spree

In a bid to curb

overheated investment, the State Council has given local

governments one month to report new industrial projects that have

been approved against national rules.

The ultimatum aims

to halt some projects that fail to meet industry policies, land

and credit approval procedures and environmental regulations,

said Zhang Zhiqiang, a senior official in charge of fixed-assets

investment with the National Development and Reform Commission

(NDRC), the top economic planner.

The commission on

Friday unveiled the central government circular, which ordered

local authorities to self-examine projects launched between

January and June. Local authorities should report their final

results by the end of August.

"We are going

to punish those involved in malpractices," said Zhang,

deputy director of the commission's Department of Fixed Assets

Investment.

Zhang said that

projects with overseas investment should also be examined as

domestic ones.

According to the

circular, the review covers every project with an investment of

more than 100 million yuan (US$12.5 million). For steel mills,

cement factories, vehicle assembly plants, power stations and

aluminum smelters, the benchmark is 30 million yuan (US$3.7

million).

NDRC spokesman Han

Yongwen said excessive investment in fixed assets remains a large

problem for the economy.

Nearly 100,000 new

projects began in the first six months of this year, 20,000 more

than during the same period last year. The investment spree

pushed China's economy to grow by 10.9 per cent during the

period, the highest rate since 1995.

The sizzling

investment rise has resulted in excessive use of land and credit

loans. Government figures showed that loans reached 2.14 trillion

yuan (US$268 billion) in the first half, accounting for 85.7 per

cent of the government's whole-year budget.

A sample survey by

the commission also found 40 per cent of the new projects have

violated regulations on land use, environmental impact assessment

or approval procedures.

In the meantime,

although the government planned to cut energy consumption per

unit of GDP by 4 per cent from that of 2005, the actual figure

rose by 0.8 per cent in the first half of the year.

The central

government is worried about the fast growth and rising energy

use, with Premier Wen Jiabao recently urging all local

governments and officials to "unify thinking and

action" in curbing the trend.

2006/8/9 Asia Chemical Reporter

Lanhua Group signs

agreements for coal chemical projects

Lanhua Group has signed agreements with three

partners to form joint ventures for coal-to-chemicals projects.

These partners include Taiwan Hon Hai (鴻海) Group, Indonesia Sinar

Mas (金光) Group and Hong Kong Huaming (華明) Group.

Associate with partners respectively, Lanhua will build PP, POM,

and mega Methanol/DME projects.

| Products | Capacity | Partners/Shares | Investment |

| PP | 600,000 tonne/year | Lanhua

51% Huaming 49% |

RMB

20 bn (USD 2.5 bn) (* 金額には疑問あり) |

| Methanol/DME | 1.5M/1M tonne/year | Lanhua

40% High Income International* 40% Sinar Mas (China) 20% |

RMB 11.5 bn (USD 1.44 bn) |

| POM | 100,000 tonnes/year | Lanhua

34% High Income International * 33% Sinar Mas (China) 33% |

RMB 2.3 bn (USD 287.5 million) |

* High Income International Limited is a subsidiary of Hon Hai Group

Based on Jincheng (晉城) city, Shanxi Province, Lanhua is one of the Coal majors in China. Lanhua will conduct the feasibility studies with these partners and firm up details such as startup dates at next stage.

Shanxi Lanhua Sci-Tech Venture Co., a subsidiary of Lanhua Group, has already started work on the project's first phase to build a 200,000 tonnes/year methanol unit and a 100,000 tonnes/year DME unit at Jincheng which will start up by the end of 2007.

In order to control

potential repeated investments on coal chemical projects in the

future, China’s NDRC has given guideline for the minimum scale. Coal-to-liquids (CTL) projects

should have a minimum capacity of 3 million tonnes/year; the

capacities for each methanol or dimethyl ether (DME) plants

should be at least 1 million tonnes/year; and coal-to-olefins

(CTO) unit should be 600,000 tonnes/year or more.

Sinar Mas Group ■シナルマス・グループの歴史

40年前に、小規模な食用油の販売業から出発したシナルマスは、多角化経営の多国籍企業に成長発展しました。

この強力な成長を支えてきたのは、次の4つの中核事業でした。

●紙・パルプ

●金融サービス

●農業関連産業・食品及び消費物資

●不動産及び土地・宅地開発

China Chemical Reporter

2006/8/8

MPC Completes 1.0

Million T/A Ethylene Production Base 茂名石化

The 640 000 t/a

ethylene cracking unit, a core facility in the ethylene expansion

project (from 360 000 t/a to 1.0 million t/a) in Maoming

Petrochemical Company Ltd.(MPC), completed intermediate

handing-over and started production preparations on July 28th. It

shows that the 1.0 million t/a ethylene expansion project in the

company has been completed. It is also the first 1.0 million t/a

ethylene production base in China.

China Chemical Reporter 2006/9/21

1.0 Million T/A Ethylene Base Puts on Stream

On September 17th, 2006, the 640 000 t/a ethylene cracking unit, a core facility in the ethylene expansion project (from 360 000 t/a to 1.0 million t/a) in Sinopec Maoming Petrochemical Company Ltd. (MPC), successfully conducted wet commissioning in Maoming, Guangdong province. It shows that the China。ッs first million t/a ethylene production base comes into reality.

2006/10/11 Asia Chemical Weekly

Sinopec Maoming Petrochemical started up new cracker

Maoming Petrochemical Co., a subsidiary of Sinopec, has started up its new 640 000 tonne/year cracker and produced on-spec ethylene product in Maoming, Guangdong Province.

Maoming Petrochem got approval from NDRC for this new ethylene project in Q4 2003, and started construction in Dec. 2004.

Originally, Maoming planned to expand ethylene capacity to 800 000 tonne/year from nameplate capacity 360 000 tonne/year, while the project was revised later, and Maoming expanded nameplate capacity to 1 million per year by built a new 640 000 unit.

Earlier, Maoming Petrochemical had started up the derivatives projects for the cracker, which include a 350 000 tonne/year HDPE unit, a 300 000 tonne/year PP unit and a 150 000 tonne/year butadiene unit.

The company has also up its BTX capacity to 460 000 tonne/year from 150,000 tonnes/year, and is building a 250 000 tonne/year LDPE unit which is expected to start up in Q1 of 2007.

2006/8/14 Asia Chemical Weekly

Shandong Dongyue starts

construction for organosilicon project 東嶽化工

Shandong Dongyue

Chemical has started construction for its large scale

organosilicon project in Zibo city, Shandong Province.

The project will be located at Dongyue International

Fluorine-silicone Material Industry Zone in Zibo city. With total

investment of RMB 4.5 billion (USD 563 million), the company

planned to build the project in two phases. In the first phase,

Dongyue will build 200 000 tonne/year dimethyl dichlorosilane

(DMCS) facility, and to be completed in December, 2007. And the

second phase is expected to be completed by the end of 2009.

The capacity of second phase is also

200,000 tonne/year. And the total planned organosilicon capacity

of Dongyue Chemical is 400,000 tonne/year.

Dongyue Chemical produces 120 000 tonne/year Methane Chloride

(CClx), 100 000 tonne/year CHClF2(フロンR-22), and Hydrogen Chloride (HCl);

these products will be used for the organosilicon project.

Over the past few years, the demand of Organosilicon Monomer and

Organosilicon Materials growed 25% per year in China. In the

future 5 years, demand for silicone products is forecasted to

grow by around 15-20%/y in China.

Global leading players speed up the investment in China market. Rhodia allied with China Blue Star planned a large-scale

organosilicon plant in Tianjin; Located at Nantong, Jiangsu

Province, GE Toshiba has planed its fourth

organosilicon manufacturing plant in China; and recently, Dow Corning and

Wacker Chemie

have got the approval from the government for the Organosilicon

jv project in Zhangjiagang, Jiangsu Province, and set up the jv

company which named as Dow Corning (Zhangjiagang) Company

Limited.

注 シリコンは珪素

シランは有機珪素モノマー

シロキサンはそのポリマー

シリコーンは有機ポリシロキサンをべ一スとした材料の総称

乾式シリカ(ヒュームドシリカ)は二酸化珪素(SiO2)で主な用途はシリコーン樹脂の充填材、

他に不飽和ポリエステル・エポキシ樹脂・塗料等の垂れ防止剤などに使われる。

チャイナネット2006年8月15日

「10-5」、エタノール・ガソリンの生産を強力推進

今年上半期の中国の原油・精製油輸入量は前年同期比で伸び幅はいずれも15%を上回り、国際原油価格も当面Ⅰバレル70ドル以上の高値で推移している。経済が急速に伸び、1人当たりの石油・天然ガス資源量が世界平均レベルの1/10にも満たない発展途上国の大国として、中国は急拡大するエネルギー需要にどのように対応するかは世界各国の関心を集めている。国家発展改革委員会によると、10%のアルコールを混合したエタノール・ガソリンの普及は今後、中国の代替エネルギー戦略の重点の一つとなっており、「十一五」(第11次五カ年計画、2006年~2010年)期に、中国はエタノール・ガソリンの生産を積極的に推し進める方針である。

バイオマスエネルギーであるアルコールの原料は、トウモロコシ、イモ類などの作物からきている。これら再生可能エネルギーで精製油に取って代わることは、日増しに増大する精製油需要の緩和に役立つばかりか、排気ガス中の一酸化炭素排出量30%以上、炭化水素排出量10%以上を減少させることにもなる。

国家発展改革委員会工業司筋によると、中国の「第10次五カ年計画」期の十大重点プロジェクトの1つとして、自動車用エタノール・ガソリンのテストはすでに成功を収めている。国は4つのバイオ燃料・アルコール生産試験プロジェクトの建設を批准しており、毎年のエタノール・ガソリンの生産能力はすでに102万トンに達している。現在、黒竜江、吉林、遼寧、河南、安徽の5つの省および河北、山東、江蘇、湖北などの省の27の地域・一般都市では、自動車用エタノール・ガソリンが使用されている。中国石油天然ガス(ペトロチャイナ)、中国石油化工(シノペック)のエタノール・ガソリン生産能力はすでに102万トンに達しており、エタノール・ガソリン消費量はすでに全国のガソリン消費量の20%を占めるに至っている。

「10-5」期には、エタノール・ガソリンは代替エネルギーとして、引き続き発展を遂げると見られている。専門家たちは、「11-5」期末までに、中国の燃料アルコールの年間生産能力は現在の100万トンあまりから500万トンに達し、すなわち、毎年の燃料アルコールによる精製油代替量は500万トンに達することを意味する。中国の昨年のガソリン消費量は4366万トンで、500万トンの代替量は軽視できない数字である。

Govt aims to

rein in growth of coal liquefaction

"The

coal liquefaction project will offer an efficient way to quench

China's thirst for energy. It is conducive to reducing China's

external dependence on crude oil," said Professor Lin

Boqiang from Xiamen University in East China's Fujian Province.

China

began developing coal-to-liquid fuel technologies in the 1980s. The coal

liquefaction project was given strategic significance in the mid-1990s,

after China became a net oil importer in 1993, said Zhang Yuzhuo,

deputy general manager of Shenhua Group, China's biggest coal

producer.

In

1999, China launched its first coal-to-liquid project in

Pingdingshan, Central China's Henan Province. However, the

project, with an annual capacity of 500,000 tons, came to an

untimely end, because the type of coal proved unfit for

liquefaction.

In

2001, a high-tech research project, the 863 Programme, picked up

the pace on coal-to-liquid fuel projects.

Shenhua Group took the lead in the

process. In August 2004, it embarked on an ambitious direct

coal liquefaction project, the first of its kind in the

world, in Ordos, northern China's Inner Mongolia Autonomous

Region.

The

project is designed to have an annual capacity of five

million tons.

Estimated to cost 24.5 billion yuan (US$3 billion), it will be

undertaken in two phases. The first, designed to produce 3.2

million tons of oil products, is scheduled for production by

2007. The second phase is scheduled for production by 2010, with

a designed annual production capacity of 2.8 million tons.

Other

major coal producers have followed suit. In February 2006, a coal

liquefaction project with a designed initial annual capacity of

160,000 tons was launched by Lu'an

Group in Tunliu, Shanxi Province.

Two

months later, Yankuang Group initiated a huge

two-phase coal liquefaction project in Yulin, Northwest China's

Shaanxi Province, which will involve a total investment of 100

billion yuan (US$12.5 million). The project is expected to reach

an annual output of 10 million tons of oil products by 2020.

However,

in addition to the three projects that have won the NDRC's

approval, many other provinces and regions have blindly planned

and built coal liquefaction projects in recent years. The

businesses look forward to significant economic returns counting

on the high oil price and the current low cost of coal, despite

the impact on local resources and the ecosystem. The result a

headlong rush to launch coal-to-oil projects across the country.

It

is reported that a total of 30 coal liquefaction

projects across the country are either at the stage of

detailed planning or feasibility studies. According to

conservative estimates, the total capacity would exceed 16

million tons, and the total investment would exceed 120 billion

yuan (US$15 billion). Insiders predict that China's annual oil

output liquefied from coal will reach 50 million tons by 2020.

In

addition to domestic coal giants, foreign businesses with

coal-to-oil know-how are also attracted by the promising business

opportunities.

On

July 11, Shell Gas and Power Developments

BV and the Shenhua Ningxia Coal Industry Co (Shenhua-Ningmei) signed

an agreement on joint study of coal liquefaction technology in

Yinchuan, the capital of Northwest China's Ningxia Hui Autonomous

Region.

Under

the deal, the Anglo-Dutch company will work with Shenhua-Ningmei

on the technological and commercial feasibility of launching an

indirect coal liquefaction facility with a daily production

capacity of 70,000 barrels of oil products and chemicals at the

Ningdong coal mining centre.

"Ningxia

is not only rich in coal but in water and power supply, which are

all important for the successful development of an indirect coal

liquefaction project," said Zhang Wenjiang, chairman of

Shenhua-Ningmei.

Apart

from Shell, many other foreign businesses have come to China

seeking opportunities from coal-to-liquid fuel projects.

In

June 2006, South Africa-based Sasol, the world leader in

producing fuel from coal, joined forces with

Shenhua Group to establish two coal

liquefaction plants in Northwest China.

Chinese

industry officials have appealed to authorities and business to

keep cool about coal liquefaction.

"Although

coal liquefaction promises to help ease China's oil shortage, huge

potential risks are involved in its mass

production," said Professor Lin Boqiang from Xiamen

University.

In

addition, the unchecked growth of the sector would damage China's

already deteriorating environment, analysts said.

Coal

liquefaction consumes large amounts of water, and China especially

its northern and northwestern regions is short of this resource.

Developing coal liquefaction would greatly exacerbate such

shortages. Apart from Yunnan and Guizhou provinces in Southwest

China, most coal-rich provinces are short of water.

In

addition to its need for massive quantities of water, coal

liquefaction discharges waste gas, waste water

and industrial effluent, creating significant

environmental risks.

The

profit margins of coal liquefaction projects are closely linked

to the fluctuating international price of oil, which changes from

year to year. A coal liquefaction project takes three to five

years to build and operate.

"Coal-for-oil

technology will be economic if the crude oil price is

higher than US$25 per barrel. In this sense, it will not face

any risk in the near term," said Zhou Fengqi, a researcher

with the Energy Institute of the NDRC's Macroeconomic Research

Institute.

"But

it is hard to tell whether coal liquefaction projects will

certainly profit. If the international oil price plummets in the

future, the nation will suffer a lot," said Zhou.

Other

industry experts worry that China's coal resources are not so

rich. Verified exploitable coal reserves were 188.6 billion tons

at the end of 2002, but the average resource recovery rate was

only 30 per cent. Calculated at an annual coal output of 1.9

billion tons, the reserves would last only 30 years.

"In

fact, investment in coal liquefaction incurs a high risk when the

industry remains in its infancy. Coal liquefaction should spread

only after the success of trial efforts," said Professor Lin

Boqiang.

The

NDRC concluded that during the period of the 11th Five-Year Plan

(2006-10), the coal liquefaction industry should be developed

smoothly and steadily.

2006/8/17 新華社

China

to build its largest DME project as an alternative to oil

China is to start construction of its largest dimethyl ether

(DME) project with an annual output of three million tons to

reduce rising oil consumption.

Coal-based DME is a clean-burning alternative to liquefied

petroleum gas, liquid natural gas, diesel and gasoline.

Located in Ordos city of north China's

energy-rich Inner Mongolia Autonomous Region, the project will

cost 21 billion yuan (2.6 billion U.S. dollars), the Shanghai

Securities News reports.

Compared with the current annual output of 120,000 tons of DME

each year, the project will make a huge difference to China's

alternative energy sector, said a statement from the National

Development and Reform Commission (NDRC).

A pipeline will be built to

transfer the DME from Ordos to the port city of Tangshan 唐山in north

China's Hebei Province. This would then enable it to be

shipped to provinces in east and south China which are crying out

for energy sources.

The participants in the project include power giants China

National Coal Group Corporation (ChinaCoal), China

Petroleum and Chemical Corporation (SINOPEC) and the

Shanghai-based Shenergy Group.

Facing oil

shortages, China is speeding up efforts to develop an oil

substitution program to reduce its reliance on oil imports and

offset the effects of rising oil prices.

But as a sustained coal supply has remained a challenge for

China, NDRC has banned any coal-based DME project with a design

capacity lower than one million tons.

Shenergy Group Limited

申能集団有限公司(上海市の電力・ガス供給会社)

2006年8月21日 Chemnet Tokyo

中国に新しいDME計画

内蒙古自治区でDME計画のための新会社が設立された。NDRCが発表した。

参加するのは国営の中国中煤能源集団公司(ChinaCoal)、SINOPEC、Shenergy Group (申能集団有限公司:上海市の電力・ガス供給会社)、Yintai Investment (銀泰)、内蒙古 Manshi (滿世) Coal Groupの5社で、それぞれ、32.5%、32.5%、12.5%、12.5%、10%を出資する。

計画では内蒙古のオルドスで年間20百万トンの石炭採掘を行い、420万トンのメタノール、300万トンのDMEを生産、135MWx2基の発電所を建設する。投資額は26億米ドルで、2010年のスタートを目指す。

特筆されるのは、内蒙古のオルドスから河北省の港湾都市の唐山市(天津市の東)までの長距離パイプラインの設置で、これによりDMEをエネルギーが不足する中国東部及び南部へ輸送することが可能となる。

既報の通り、中国政府は石炭化学産業を規制する通達を発表している。NDRCは年間300万トン未満の石炭液化計画、年間100万トン未満の石炭からのメタノールまたはDMT生産計画、年間60万トン未満の石炭からのオレフィン生産計画を承認しないとの通達をだしている。

2006/8/19 China Chemical Reporter

Dimethyl Ether Unit to Launch in Inner Mongolia

The National Development and Reform Commission announced on August 11th that the project of 3.0 million t/a dimethyl ether and matched facilities in Erdos of Inner Mongolia, jointly funded by China National Coal Group Corporation, Sinopec Corp., Shenneng (Group) Co., Ltd., China Yintai Investment Co., Ltd. and Inner Mongolia Man Shi Coal Group Co., Ltd. has established its engineering group. The total investment of the project is around RMB21.0 billion and the equity split of partners is 32: 32.5: 12.5: 12.5: 10. It is a dimethyl ether project with the biggest scale and the largest investment in China today. Production is expected to start around 2010. The project includes 20 million t/a coal mining, 4.2 million t/a methanol, 3.0 million t/a dimethyl ether and 2X135MW power plant. What is the most attractive is that a long-distance transmission pipeline from Erdos to Beijing and Tangshan Port will be constructed.

Cabot Corporation Announces Start-Up of New Carbon Black Facility in Tianjin, China

Cabot Corporation announced today the start-up of its new, world-class carbon black facility located in Tianjin, China. The state-of-the-art facility is a project of Cabot Chemical (Tianjin) Co., Ltd., an equity joint venture between a Cabot subsidiary, Cabot (China) Limited, and Shanghai Coking Chemical Company, a member of the Huayi Group. Cabot Chemical (Tianjin) Co., Ltd. invested approximately US$60 million to construct the plant with an annual capacity of 105,000 metric tons.

The new facility includes two production units that utilize the latest Cabot manufacturing technology incorporating advanced environmental systems for both energy recovery and flue gas de-sulphurization. Both new units are operating at full capacity to support the growing demand in the China market.

The facility includes two production units, one of them has capacity of 61 000 tonne/year and has been completed on Feb. 2006.

The newly added is second carbon black unit, it has capacity of 44 000 tonne/year, and which make the total capacity of Cabot reached 105 000 tonne/year in Tianjin Economic Development Area (TEDA), Tianjin city.

Cabot Corporation

Announces Completion and Start-Up of First World Class Fumed

Silica New Facility in Jiangxi Province, China

Jiujiang (九江)、江西省

Cabot Corporation announced today the start-up of China's first world-class fumed silica manufacturing facility located in Jiangxi Province, China. The facility is a project of Cabot Bluestar Chemical (Jiangxi) Company Ltd., a joint venture between a Cabot subsidiary, Cabot (China) Limited, and Bluestar New Chemical Materials Co., Ltd., a member of the ChemChina Group. Cabot Bluestar Chemical (Jiangxi) Company Ltd. invested approximately US$27 million to construct the plant with an annual capacity of 4,800 metric tons.

2006/8/21 Solvay

Solvay to launch fluorochemicals production in China

Joint Venture Paves the Way for Development of High-Value

Fluorine Business in Asia

Solvay announces today that it has signed an agreement with Zhejiang Lantian

Environmental Protection Hi-Tech Co. Ltd for the creation of a joint

venture for the production and supply of hydrogen fluoride (HF ふっ化水素), an essential building block for

many high-value added fluorinated products.

Pending the relevant regulatory approvals, the joint venture is

scheduled to start operating in 2007, under the name Zhejiang

Lansol Fluorchem Co. Ltd. The production unit, with a total

annual production capacity of 20.000 tonnes, will be located in

the Zhejiang Quzhou 衢州Hi-Tech Industrial Park, some 500

kilometres south-west of Shanghai. Lantian will own 70% of the

joint venture, while Solvay will hold the remaining 30%.

China Chemical Reporter 2006/8/21

Nanning Chemical to Acquire Nanning Chia Tai

Nanning Chemical Co.,

Ltd.(南化) announced on August 4th that it

has decided to to purchase 100% equity from Nanning Chia Tai

Building Material Co., Ltd. with RMB140 million.

Nanning Chemical Co., Ltd. is the biggest comprehensive chemical

enterprise in Guangxi 広西自治区. It mainly produces caustic soda,

hydrochloric acid, liquid chlorine and PVC.

Nanning Chia Tai Building Material Co., Ltd. owns a capacity of

500 000 t/a cement. It is close to Nanning Chemical Co., Ltd. and

has advanced equipment and large production site. After the

purchase, Nanning Chemical Co., Ltd. will conduct technical

renovation to the cement production line in Nanning Chia Tai

Building Material Co., Ltd. so as to satisfy the requirements in

the

treatment of calcium carbide residues from Nanning Chemical Co.,

Ltd. The

capacity of cement in Nanning Chia Tai Building Material Co.,

Ltd. will hopefully reach 800 000 t/a at that time. Not only

calcium carbide residues from Nanning Chemical Co., Ltd. can be

effectively used, the high-load production of PVC can also be

ensured and the capacity of cement can increase.

Nanning Chemical Industry Company Limited.

The Group's principal activities are the research, development, manufacture and sale of chlorine and alkali chemical products, farm chemicals, disinfectants, non-organic and organic chemical products. Other activities include technological consultancy, domestic trade and import and export. Major products include trichloroisocyanuric acid, crystal sorbitol, sodium diacetate, calcium acetate, ethyl sorbate, sorbic acid, potassium sorbate, dipterex powder, polyvinyl chloride resin powder, chloroacetic acid and dihydro-terpineol.

2006/8/25 Asia Chemical Weekly

PetroChina's 3

large-scale projects get go-aheads

Recently, PetroChina has pushed forward for its 3 large-scale

projects in northwest and northeast China.

In northwest China, PetroChina Tarim (塔里木) Petrochemical Co, has broke ground for the

large-scale ammonia-urea project. The gas-based project located

at Korla (庫爾勒), Xinjiang, will produce 450,000

tonne/year of ammonia and 800,000 tonne/year of urea.

In northeast China, Dalian Petrochemical, a subsidiary of PetroChina, has

successfully started up new PP plant, and produced on-spec products in

Dalian, Liaoning Province. Propylene feedstock comes from the

company’s 20.5-million tonne/year

refinery, which has been expanded from 10.5-million tonne/year in

Q2 of 2006. Currently, the company also operates two other PP

units with the capacity of 120,000 tonne/year, one is 50,000

tonne/year and another is 70,000 tonnes/year in Dalian.

* Dalian Petrochemical has three PP units, there are 70 kt/y, 50

kt/y and 20 kt/y; while usually the 20 kt unit is mothballed as

the efficiency of this unit is relative low.

Also in northeast China, PetroChina has broke ground for Fushun

refinery-cracker project in Fushun city, Liaoning Province. After

completion, PetroChina Fushun

Petrochemical Co.

will

boost refining and ethylene capacities to about 11.5 million

tonne/year and 1 million tonne/year respectively. According to

the planning, the core refinery units will start up in September

2008 while the rest of the refining units are scheduled to start

up in June 2009, and the cracker and its downstream units will

start up in June 2010.

* Currently, Fushun Petrochemical has nameplate refining capacity

of 9.2 million tonne/year. The company processed 9.0 million tone

crude oil in 2004 and 9.6 million tonne in 2005.

Sinopec Maoming launches new 24,100 b/d catalytic reforming unit

China's Sinopec began

commercial operation of a new 1.2 million

mt/year (24,100barrels/day) catalytic reforming unit August 20 at its 13.5 million

mt/year Maoming refining and chemical complex, a MRCC official

said Wednesday.

The Maoming complex is in southern China's Guangdong province.

With total investment of Yuan 590 million ($73.75 million), the

unit will increase MRCC's total gasoline output by around 180,000 mt/year

to 1.86 million mt/year, the official said. Output growth would

mainly comprise 93 RON and 97 RON material.

On August 13 MRCC also began operating a new 2.6 million mt/year gasoil

hydrotreater dedicated

to producing Euro II and Euro III gasoil. The company produces

around five million mt/year of gasoil.

2006/8/22

Univation

SINOPEC Selects UNIPOL(R) PE for Zhenhai

Univation Technologies announced that China Petroleum

&Chemical Corporation (SINOPEC CORP) has selected the UNIPOL

PE process for a 450 kilo-tonnes-per-year

polyethylene plant at its affiliate, Sinopec Zhenhai Refining and

Chemical Company Ltd.,

in Ningbo, People's Republic of China.

Univation is a 50/50 JV between ExxonMobil Chemical Company and The Dow Chemical Company. Univation was originally formed in 1997 as a JV between Exxon Chemical Company and Union Carbide to license the UNIPOL PE Process, metallocene catalyst technology, and to sell metallocene catalysts.

中国初、繊維から燃料アルコール生産 河南

中国国内で初めて、穀物の茎などの繊維から燃料アルコール(エタノール)を生産する生産ラインが建設されることになった。河南天冠集団による「繊維アルコール年間3000トン生産プロジェクト」は28日、河南省鎮平開発区において工事開始の基礎を固めた。新華社のウェブサイト「新華網」が伝えた。

このプロジェクトは、穀物類を原料とした過去のアルコール生産の歴史を塗り替え、穀物の茎などの繊維質を原料にしたアルコール生産を実現するもの。これにより、穀物の茎などの廃棄物の科学的な利用が可能になるだけでなく、穀物の無駄を抑えることができる。

河南天冠集団の張暁陽社長董事長によると、天冠集団が現在進めている同プロジェクトへの投資総額は5100万元で、2007年上半期に完成し、操業が始まる予定だ。操業開始後は、とうもろこしの茎などの繊維原料を年18000トン消化する。

関係部門によると、現在中国において天冠集団を含む4社が燃料アルコール生産企業テストセンターとなっており、燃料アルコールは年産102万トン、バイオエタノール混合ガソリンは年産1020万トン。バイオエタノールガソリンの消費量は、全国のガソリン消費総量の20%を占めるまでになった。現在全国の5つの省および、4つの省の27カ所が、アルコール・ガソリン使用を普及するテストセンター地区に指定されている。

China Chemical Reporter

2006/8/31

4 000 T/A Fluororubber Project Breaks Ground

On August 28th, 2006, Chenguang Research Institute of Chemical

Industry held the groundbreaking ceremony for its 4 000 t/a

fluororubber project at Chemical New Material Zone of Chenguang

Industry Park in Zigong 自貢, Sichuan province. With a total

investment of RMB150 million, the project has the largest

fluororubber unit in China today.

Chenguang Research Institute of Chemical Industry http://www.chenguang-chemi.com/

Chenguang Research Institute of Chemical Industry , as a large chemical base and ISO9001 certified enterprise in China, has been engaged in researching and producing polymers and synthetic materials since 1965. We mainly deal with technical development, application research and production of silicones, fluoropolymers, special resins and adhesives, machinery for plastics processing,and anti-corrosion chemical equipments, etc..

2006/9/5 Access

Intelligence

Chinese PP Plant to Use Dow Technology

China Datang Corp. has licensed Dow Chemical's Unipol

polypropylene (PP) process technology for its new PP facility in

Inner Mongolia, China, Dow says. The plant will produce

homopolymers, random copolymers, and impact copolymers, and will

have annual capacity of 500,000 m.t./year, Dow says.

中国大唐集団公司

5大発電会社の一つ

(華能集団公司、中国大唐集団公司、中国華電集団公司、中国国電集団公司、中国電力投資集団公司)

Platts 2006/9/6

China's Sopo switching acetic acid plant to coal from methanol

China's Jiangsu Sopo 江蘇索普is in the process of modifying the

process technology of its acetic acid plant in Zhenjiang 鎮江, Jiangsu which would enable it to

use

synthetic gas feedstock derived from coal, instead of methanol

and carbon monoxide, a

company source said.

The project is slated for completion in the first-half of 2009,

and would raise Sopo's AA capacity from 500,000 mt/year to 600,000

mt/year.

Sopo has further plans to

expand it acetic acid and methanol

capacities to 800,000 mt/year and 500,000 mt/year respectively by 2010.

Shanghai

Coking has a coal-based methanol plant in Wujin which has the

capacity to produce 350,000 mt/year.

Jiangsu Sopo Chemical Limited.

The Group's principal activities are the manufacture and sale of chemical materials and products. Products include ADC blowing agent, NA0H, calcium hypochlorite and hydrogen chloric acid. Other activities include generation and distribution of steam heat and electric power. Operations are carried out in the People's Republic of China.

2006/9/12 Asia Chemical Weekly

China gets breakthrough

on Methanol to Olefins technology

In late August 2006, Chinese Academy of

Sciences

(中国科学院 CAS) and Shannxi Provincial

Government announced jointly the success of the dimethyl

ether/methanol-to-olefins (DMTO) pilot unit in Huaxian, Shaanxi

Province. 陜西省華縣市

DMTO technology is

developed Dalian Institute of Chemical Physics (DICP) - a

subsidiary of CAS, which uses methanol or DME to produce ethylene

or propylene. Methanol and DME are made from coal or nature gas

resources, so, it can be the substitute of conventional Crude Oil

and naphtha route to produce olefins and it is competitive in the

high oil price market condition.

This DMTO pilot unit is s jointly constructed by Shaanxi Xinxing

Coal Chemicals Company, and Luoyang Petrochemical Engineering

Company ? a subsidiary of Sinopec, it can process methanol 50

tonne/day.

According to CAS, through the DMTO technology, about 3 tonne of

methanol could produce 1 tonne olefin, with a more than 99%

conversion rate and the selectivity of ethylene/propylene is more

than 78%.

Following UOP/Hydro and ExxonMobil, DICP is the third

organization owned MTO technology in the world. DMTO technology

provides a new way for the development of petrochemical industry

and will license to the coal chemicals investors in China soon.

2006/9/18 Asia Chemical Weekly

China cuts down

petrochemicals export tax rebates

China's Ministry of Finance, the National Development and Reform

Commission, the Ministry of Commerce, the General Administration

of Customs and the State Administration of Taxation has jointly

announced the cut down on rebates rate of export tax for some

products in China, which effective on Sep. 15.

These products include steel, ceramics, textile, furniture,

plastics and so on. The reduction of export tax rebates on

plastics, which include PE, PP, PVC, PS, PET and PC, is from 13%

to 11%. Rebates of textiles are also reduced to 11% from 13%.

Also, government has abolished tax rebates for silicon paraffin

wax, coal and natural gas.

According to the analyst, China lower export tax rebates for the

products aimed to reduce the financial burden on government, and

to improve industrial structure and to keep the balance between

imports and exports, and then reduce the trade surplus. The move

would also be in line with its 11th five year plan (2006-2010),

which will focus on domestic demand for economic growth.

For chemicals exporter, however, would be impacted by this move,

as the reduction of export tax will raise costs and cause higher

export prices, and then reduce the competitiveness of exports.

中国には日本の消費税に似た付加価値税(増価税)制度がある。

中国で財の販売、輸入及びサービスの提供を行う者は、増価税を支払う義務を有する。一般の財、サービスの場合の税率は17%で、穀物や燃料、肥料・農薬・農業用機械・農業用フィルム、新聞・書籍等は13%となっている。

増価税の支払いの際には、その財の生産のために購入した財・サービスの価格に含まれる増価税を差し引く。

製品の輸出の場合は輸出そのものに対する増価税はゼロとなっている。

この場合、その製品を生産するために購入した財・サービスの価格に含まれる増価税に関して払い戻すのが増価税リベートである。

日本の消費税の場合は、日本での消費にのみ課せられるため、中国と同様に輸出そのものには消費税はかからず、その製品を生産するために購入した財・サービスの価格に含まれる消費税(及び製造設備に対する消費税)は全額控除される。

これに対して中国では、全額控除ではなく、政策的にリベートの率を決めており、これまで原料等の購入価格に含まれる17%の増価税のうちの13%を戻していたのを、今回、11%に変更するもの。

石炭や天然ガスは、輸出価格を引き上げて、中国からの流出を防ぐ目的と思われる。

(なお、塩はリベート廃止の対象外で13%のまま、セメントは13%から11%に引き下げ。)

2006/9/18 Network Center of MOFCOM

Major Readjustment on China Export Tax-refund Policy

http://english.hbdofcom.gov.cn/file/2006/9-18/155927.htmlOn Sep 14, Circular on China's Tax-refund Policy for Export was issued jointly by MOF, NDRC, MOFCOM, GAC and STA of China. Tax-refund rate of some exports were readjusted and supplement forbidden commodity catalogue of processing trade.

Circular noted that, the readjustment on tax-refund for export and tax policy of processing trade was one of the overall measures for macro control policy implemented by State Council in 2006. It was advantageous for further optimizing industrial structure, promoting growth pattern of foreign trade, and pushing equal development of foreign trade.

First it issued that, excluding non-metal minerals like salt and cement, canceling refund tax-refund policy for exports in the 25th article (関税番号25xx)of customs import and export tariff, including coal, natural gas, olefin, asphaltum, silicon, srsenic, stone material, ferrous metal, scrap, 25 kinds of pesticide and medical intermedia, leather product, lead storage battery, mercury oxide battery, thin goal wool, Charcoal, rail sleeper, cork product, primary wooden product, etc.

Secondly, it reduced tax-refund rate from 11% down to 8% for export of steel in 142 tariff Nos.;

reduced from 13% to 8% and 11% of pottery, some leather product and cement, glass respectively;

reduced from 13% to 5%, 8% and 11% of some ferrous metals;

reduced from 13% to 11% of textile, furniture, plastic product, lighter, specific wooden product;

and reduced from 17% to 13% of handcart and parts.

Thirdly, tax-refund rate for export increased from 13% to 17% on significant technical equipment, some IT product, biological medical product and high-tech product which encouraged exporting by national industrial policy. And tax-refund rate of exporting processing product with agricultural material increased from 5% or 11% to 13%.

The Circular made it clear that listing canceled tax-refund export before and this time in forbidden catalogue of processing trade. Collected import tariff and import linkage tax on all commodities listed in forbidden catalogue of processing trade.

明細 http://www.mofcom.gov.cn/accessory/200609/1158299499802.xls

China Chemical

Reporter 2006/9/18

Sinochem

to Build Fluoride Chemicals

A

signing ceremony for jointly building a fluoride chemicals base

at Jianyang, Fujian province, southeast China was held between

Fujian Jianyang Municipal Government福建省建陽市, Sinochem Shanghai Corporation

and Hangzhou Kings Industrial Co., Ltd. on September 9th, 2006.

Sinochem

Shanghai, which is directly subordinate to Sinochem Corporation

that is one of top 500 companies of the world, plans to invest

RMB50 million within 1 - 2 year for building anhydrous

hydrogen fluoride (HF) facility with a capacity of 15 000

t/a, and spend RMB150 million in next 3 - 5 years for

constructing electronic application grade HF project with a capacity

of 2 000 t/a and a 5 000 t/a fluoro-benzene unit. Sinochem Shanghai

plans to further input RMB200 million in building intermediates

production lines for fluoro-based pharmaceutical and pesticide.

Headquartered

in Hangzhou (杭州)of Zhejiang province, Hangzhou

Kings Industrial Co., Ltd. is a private company and

establishes Fujian Kings Fluoride Industry Co., Ltd. after

purchasing Jianyang Fluorite Mine. Fujian Kings Fluoride Company

is a leading fluorine producer in Fujian province. It owns a

fluorite mine, a fluorite flotation plant, a HF manufacturing

plant and a fluorine products factory. The capacities are 15 000

t/a of HF, 8 000 t/a of fluoride products, 50 000 t/a of acid

grade fluorite powder, and 80 000 t/a of metallurgical grade

fluorite ore.

China Chemical

Reporter 2006/9/20

CNOOC Oil Base to Build Biodiesel Base

On September 12th, 2006, the CNOOC Oil Base Group Limited (CNOOC

Oil Base), a subsidiary of China National Offshore Oil

Corporation (CNOOC) signed an agreement with Panzhihua Municipal

Gorvernment 四川省攀枝花市

on

"Jatropha-based biodiesel

production project in western Panzhihua".

Under the agreement, both parties will develop the jatropha

forest with the planting land area of 33 thousand hectares

further expansion to 480 thousand hectares from the existing 15.9

thousand hectares, for building biodiesel production base with

the capacity of approximately 100 000 t/a. The project is

expected to invest around RMB2.347 billion.

ジャトロファ(南洋アブラギリ)は、インド国内で豊富に自生し、乾燥地帯のやせた土地でも生育する植物。Bio

Diesel Fuel用の原料植物として最も注目されている。「ジャトロファ・プログラム」と呼ばれるさまざまな取組みがインド国内で展開されている。

日本経済新聞 2006/9/22

中国海洋石油 LNG輸入を拡大 インドネシアなどと合意

インドネシアの天然ガス田、タングーで生産されるLNGを2009年から年間260万トン輸入する。契約期間は25年。CNOOCが福建省で建設するLNG基地で受け入れてガス化し、中国南部地域に供給する。

マレーシアの国営石油会社ペトロナスとは09年前後からLNGを輸入することで基本合意。輸入量は年間300万トン前後の見込みだ。CNOOCが上海で建設するLNG基地で受け入れ、上海やその周辺地域に供給する。CNOOCはすでに年間370万トンの豪州産LNG輸入を開始し、広東省に供給している。

| September 28, 2006 BNamericas.com |

CVRD forms Chinese JV for 1.2Mt/y pellet plant

Brazilian diversified

miner CVRD has signed a partnership to build a pellet plant in China, its first iron ore

investment in the Asian country, CVRD said in a statement. (鉄鉱石の粉を水と粘結剤で固めた鉄鋼原料)

The 1.2Mt/y plant

is expected to start operations in 2008.

CVRD will have a 25% stake in a new joint venture company, Zhuhai YPM (ZYPM), through its subsidiary

iron ore miner MBR. Other partners are Zhuhai Yueyufeng

Iron and Steel plus Pioneer Iron & Steel (PSG) with 40% and 35% respectively.

The Brazilian miner is due to invest US$4mn in the project and

supply at least 70% of the iron ore to feed the pellet plant over

a 30-year contract period.

"The initiative illustrates CVRD's strategy to support the

development of the steel industry in China," the miner said.

IMPORTANT MOVE

Despite the project's small size, CVRD's move into China is

positive as a means to strengthen its position in the Asian

country, Daniel Lemos, an investment analyst with Brazilian

brokerage Socopa, told BNamericas.

"I believe the announcement is positive because CVRD will

enter [a project] in China, its strongest market, rather than the

business project itself," the analyst

said.

Furthermore CVRD could develop a similar project in China, Lemos

said, adding the JV project size is not very significant for

CVRD, the world's biggest iron ore producer.

2006/10/12 China Chemical

Reporter

JPC Constructs Acrylonitrile Expansion Project

With a total investment of RMB760 million, the 320 000 t/a

acrylonitrile expansion project started construction in Jilin

Petrochemical Company Ltd. (JPC). After the completion, the

project will help the company increase its sales revenue and

profit by RMB1.161 billion and RMB159 million respectively.

Acrylonitrile has always been a major product but the existing

acrylonitrile capacity was 66 000 t/a in JPC. After 3 large-scale

renovations, the acrylonitrile capacity reached 212 000 t/a at the

end of 2003.

The expansion project adopts world's advanced process and

technology, matched with tail gas recovery system and sulfuric

acid production unit from waste water.

2006/10/18 Asia Chemical Weekly

Jihua Group begins ANM

expansion project

Jihua (吉化

Jilin Chemical)

Group, a subsidiary of PetroChina, has started ANM expansion

project in Jilin City, Jilin Province.

With the investment of USD 95 million (RMB 0.76 billion), Jihua

will expand its ANM capacity to 320 000 tonne/year from 212 000 tonne/year. The

project is expected to complete by the end of 2007.

Originally, Jihua had ANM capacity of 66 000 tonne/year, and then

it was expanded to 212 000 tonne/year in 2003. After the ongoing

expansion, Jihua will exceed Secco, become the largest ANM

producer in China. Currently, with capacity of 260 000

tonne/year, Secco is the top ACN producer in China.

Feedstock of propylene will be partly sourced from Daqing

Petrochemical, which is another subsidiary of PetroChina, while

the ANM product will supply to the planned ABS project. Jihua

plans to expand the ABS capacity to 540 000 tonne/year from the

currently 180 000 tonne/year, by building a new 360 000

tonne/year ABS project.

In 2005, the total ANM capacity reached 1 million tonne/year.

Approximately, China produced about 870 000 tonne and consumed

1.15 million tonne ANM product at the same year.

2006/10/13 China Chemical Reporter

ChinaSalt Zhenjiang to Build Salt Chemical Base 鎮江

On September 18th, 2006, ChinaSalt

Zhenjiang Salt Chemical Co., Ltd.(ChinaSalt Zhenjiang), a

subsidiary of China National Salt Industry

Corporation (ChinaSalt) signed a cooperation agreement on

building a Salt Alkali Integrated Project, with Shanghai Chlor-Alkali

Chemical Co., Ltd. and Zhenjiang Municipal Government.

Located

in Dantu District, Zhenjiang of Jiangsu province, occupying 96

hectares, the Salt Alkali Integrated Project will conduct in two

phases with an investment of RMB2.8 billion. Its first phase will

build 1 million t/a vacuum salt 真空塩 facility, 100 000 t/a

diaphragm 隔膜法

caustic

soda unit

and matching facilities. The second phase will construct a new 150 000 t/a ion

membrane caustic soda unit and 100 000 t/a

epoxypropane unit.

ChinaSalt Zhenjiang engages in the

production and sale of liquid salt and vacuum salt, its 85%

equity controlled by ChinaSalt, that is a leading salt producer

in China across Asia with the salt output of approximately 10

million tons. Shanghai Chlor-Alkali is a leading chlor-alkali

chemical manufacture in China and experiences in salt chemical.

China Salt Kicks off Its First Phase PVC Project

Brief Introduction of China National Salt Industry Corporation

| Established in 1950 and

monopolizing the nation's table salt production and

operation, China National Salt Industry Corporation is

China's largest salt producer and seller and it's the

only salt enterprise directly owned by the central

government. As a state-owned central enterprise, China National Salt Industry Corporation commits to China's table salt monopolization as well as production and operation of salt and salt chemicals. Even since its establishment, China National Salt Industry Corporation has been playing an administrative role for the salt industry and promoting the industry to develop in a sustainable, steady and healthy way. Since the 1990s in particular, it has organized China's salt industry in carrying out the table salt monopolization policy to ensure the national supplies of iodized salt, making considerable outstanding contributions for fighting the hazard of iodine deficiency in a sustainable way, with remarkable achievements recognized both at home and abroad. At the same time, it has kept pioneering and innovating, accelerating its development speed and trying to become bigger and stronger. By June 2005, China National Salt Industry Corporation has a total assets of RMB10 billion, an 10-million-ton production capacity of various salt products and a 1.4-million-ton table salt wholesale capacity, ranking the first in Asia, along with a more than 500,000 ton production capacity for various salt chemical products, ranking top of the world in terms of metallic sodium production capacity. With years of high-speed development, China National Salt Industry Corporation has owned 31 wholly-owned and holding subsidiaries, including 9 rock salt enterprises, one lake salt enterprise, 2 sea salt enterprises, 9 salt wholesalers and distributors, 9 research institutions and 8 other enterprises, basically growing into a large-scale group of salt enterprises with a sound resource configuration, optimized structure integrating production, supply, sales, technology, industry and trade. To promote development of China's salt industry, optimize resources configurations for salt industry and improve the industry's business planning efficiency and international/home market competitiveness, after years of preparation and capital operation by China National Salt Industry Corporation, China National Salt Group has been formally established with China Salt Industry Corporation as its parent company. The new group has now 64 enterprises, including 31 provincial salt companies and 33 for-profit and non-profit organizations, with a total assets of RMB24 billion, an annual sales income of RMB14.5 billion and 128,4000 employees, accounting for more than 50% of the nation's salt outputs. For the new century, China National Salt Industry Corporation has established the "two-step" development target, with maintaining table salt monopolization as its mission, enabling high-speed development as its focus, boosting economic efficiency as its core, market demands as its orientation, industrial structure upgrade as its main line, integrating the industry resources and accelerating capital operation and expansion as its means and deepening reforms and scientific and technological advances as its driving force, to operate fully in accordance with scientific development views, promote system, mechanism, management and cultural innovations, take an intensive and sustainable development road for the new-type industrialization, and build itself into the world's first-class salt and salt chemical enterprise with two 3-5 year periods. |

日本経済新聞 2006/10/18

ロスネフチと中国石油天然気 ロシアに合弁設立 石油・ガス共同開発

ロシアの国営石油会社ロスネフチは17日、中国石油天然気集団(CNPC)と合弁会社を設立したと発表した。ロスネフチが新会社の51%の株式を確保し、ロシア国内の石油・ガス田の開発・生産に乗り出す計画。同社を通じて中国が本格的にロシアでエネルギー開発に参加することになる。

「人民網日本語版」2006年10月18日

中国石油、ロシア石油大手と合弁会社設立

中国石油天然気集団公司とロシアの国営石油大手・ロスネフチ(Rosneft)は16日、合弁会社の設立をめぐる合意文書に調印した。合意に基づき、両社は1千万ルーブル(約4400万円)を出資して新会社「東方能源公司」(Vostok Energy Ltd.)を設立する。出資比率は中国石油が51%、ロスネフチが49%。

新会社は今後、ロシア境界内で石油探査事業を進めるとともに、さまざまな深層石油資源の採掘許可証を取得する計画だ。原油の生産や関連商品の販売も手がける予定。また新技術を応用して、探査と生産の効率向上を図るとしている。

2009/02/28

天津に中ロ合弁の製油所、2010年着工へ

中国石油大手、中国石油天然気集団(CNPC)は、ロシア国営石油会社ロスネフチとの合弁製油所の建設に2010年に着工する。北方網が伝えた。

天津市政府がこのほど発表した2009年の重点準備事業の72件の一つに同事業が含まれていた。それによると、同建設事業は2010年の着工、2012年の完成を予定。建設地は天津臨港工業区内で、年間精製能力1000万トンの製油所と、関連施設を建設する。

CNPCとロスネフチは2006年、天津に合弁製油所を建設することで合意。07年11月に同プロジェクトの建設、運営母体となる中ロ東方石化(天津)有限公司を天津に設立し、準備作業に着手した。

中国、有害廃棄物輸入で海外企業を処分

国家質量監督検疫検験総局(SAQSIQ:State

Administration of Quality Supervision, Inspection and Quarantine)は有毒・有害廃棄物が中国へ流入することを防ぐため現場検査を行った結果、登録した廃物原料と実際の状況が一致しないことが明らかになったとして海外17社の廃物原料国外供給企業登録資格(中国向けスクラップ輸出に関する資格)の停止、取消を行った。

資格の一時停止処分を受けたのは日本の日中再生資源株式会社のほか、韓国企業1社、スウェーデン企業4社、、英国企業2社の合計8社。また登録した廃物原料と実際の状況の不一致が深刻だったことから、日本の揚州加藤現代農芸有限公司と、ベルギー企業3社、ドイツ企業2社、スウェーデン企業1社、英国企業2社の合計9社の資格が取り消された。

SAQSIQ によると本年初めから、21社が資格取消、8社が資格の一時停止の処分を受けている。

資格停止: