Reliance Industries Ltd

会社概要

http://www.prdomain.com/companies/r/reliance_ind/news_releases/pr_ril_nr_index.htm

Mukesh Ambani is the chairman and managing director of Reliance Industries Limited, India's largest private sector company.

2002/5 Reliance buys Indian Petrochemicals Corp

Reliance mulls PVC plant expansion at ICPL's site

2003/5 Reliance and DuPont Polyester Technologies sign agreement for R&D strategic alliance

Reliance aims to be world's largest polyester producer

2004/1 リライアンス、NOCILから石化・樹脂事業を買収

2004/6 JSR Reliance Industries Limited にブタジエン製造技術を供与

2004/6 Reliance to acquire Trevira (Europe)

2005/8 Reliance set to acquire BP's France, Belgium facilities

2005/12 India's Reliance to start up new polypropylene line by Feb/Mar

2006/1 インドのReliance、製油所とPP(100万t/y)建設

2006/4 Chevronが共同事業者として参加

2006/4 Dow Chemical may invest Rs5,000 crore in Reliance's Jamnagar SEZ

2006/4 India's Reliance on track to start up new PTA plant by end-May

2007/1 Inida's Reliance Industries eyeing GE's Plastics unit

2007/2 RIL board approves $3bn cracker project in Jamnagar.

2007/3 Reliance and IPCL to merge?

2007/5 Reliance selects Dow technology for polypropylene

2007/9 Reliance makes a strategic acquisition in East Africa

2007/10 Petroperu says looking to partner with Reliance on oil, petchems

2007/12 GAIL - RIL Sign MoU To Set Up Petrochemical Plants globally

2008/6 Reliance to add 900,000 tonnes/yr polypropylene capacity at Jamnagar

2008/7 Reliance plans a 200 kt/yr PET plant for Kinston, NC by end 2009

2010/4 Reliacne Industries and Atlas Energy announce Marcellus Shale Joint Venture

2010/5 RIL and Sibur to jointly pioneer Butyl Rubber production in India

2010/12 Reliance Industries and SIBUR in a Joint Venture for Butyl Rubber Production in India

2012/2 SIBUR and Reliancе form a Joint Venture to produce butyl rubber in India

2010/6 Reliance Industries and Pioneer Natural Resources announce Eagle Ford Shale Joint Venture

2011/2 BP and Reliance Industries

Announce Transformational Partnership in India

| http://www.indokeizai.com/Z-Ambani.htm 新興財閥で、アンバニ Ambani 財閥とも言われています。

■リライアンスエネルギー ■IPCL The Government of India handed over the

Management control to Reliance group on June 4, 2002,

since then the company is being

managed by Reliance. The new

management team has re-endorsed the company's mission to

create value for all stakeholders. All out efforts are

being made to enhance productivity and control cost for

superior value addition. ■リライアンス・エネルギー (SENSEX指数銘柄) |

source: http://www.indiainfoline.com/comp/rein/mr01.html

RIL is the leading player in petrochemicals and man-made fibers in India. In FY01, despite the devastating earthquake in the state of Gujarat, where Reliance’s major plants are located, company set new production records with total production volume crossing at 10.4 million tons- an increase of 16% over the previous year.

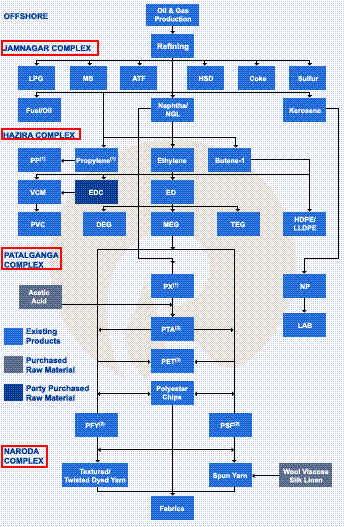

Plant locations

Hazira complex manufactures PVC, PP, HDPE, LLDPE, and MEG using ethylene as the key input.

Patalganga complex has integrated facilities for PSF/ PFY and LAB. Key input is naphtha. It has surplus capacity for PTA.

Naroda (near Ahmedabad) plant has spinning and weaving facilities. It uses PSF/ PFY along with cotton, wool, viscose from outside to produce fabric, yarn and textile products.

Jamnagar Complex has PX and PP facilities adjacent to 27 million TPA refinery.

Polymers (Plastics)

RIL manufactures PP, PVC and PE (HDPE and LLDPE). It also manufactures ethylene oxide, which is an intermediate for manufacture of MEG, a key input for PSF/PFY. Reliance is the largest polymer manufacturer in the country, with the market share of 52%. It is the 6th largest producer of PP in the world with a capacity of nearly 1 million tons. It has 400,000 TPA of PE capacity and 300,000 TPA of PVC capacity.

RIL sources ethylene (major raw material) from its own cracker at Hazira having installed capacity of 750,000 TPA of ethylene. Company is also planning to set up an EDC (ethylene di-chloride) project, which has been the missing link in company’s backward integration for manufacturing PVC.

Cracker products

Polyester and fiber intermediates

RIL is the largest producer of PSF and PFY

RIL is the only manufacturer of PTA in India.

Others

Textiles:

Chemicals:

RIL manufactures LAB

Reliance Petroleum (RPL)

Oil and Gas

Power

Telecom

Reliance Infocom

Reliance

buys Indian Petrochemicals Corp

http://www.bday.co.za/bday/content/direct/1,3523,1088772-6078-0,00.html

India's largest private company Reliance Industries has tightened its hold on the domestic petrochemicals market after acquiring control of Indian Petrochemicals Corp. Ltd. (IPCL), analysts said Monday.

Reliance Industries Ltd. agreed on Saturday to pay the government 14.91 billion rupees ($304.3-million) for a 26 percent stake in the second-biggest chemicals maker.

Reliance, which will take over management control of IPCL, will have two-thirds of India's three million tonne-a-year polymer market as a result of the deal. The group has also emerged as one of the largest producers in Asia of ethylene, a key petrochemical, with a capacity of 1.58 million tonnes a year.Reliance Industries bought a 26 per cent stake in IPCL in 2002 from the government, and has subsequently raised its stake to over 46 per cent.

Singapore (Platts)--Oct 1 2002

India Reliance mulls PVC plant expansion at ICPL's site

India's Reliance Industries is mulling a PVC plant expansion project at newly acquired Indian Petrochemicals Corp Ltd's PVC site at Gandhar, a source close to the company said Tuesday. IPCL currently operates a 150,000 mt/yr PVC plant at the Gandhar petrochemical complex in Dahej, Gujarat. The expansion plan would entail adding a further 150,000 mt/yr PVC capacity, either by debottlenecking or integrating a new plant to the existing one at the complex.

Reliance and

DuPont Polyester Technologies sign agreement for R & D

strategic alliance

http://www.prdomain.com/companies/r/reliance_ind/news_releases/200305may/pr_20030519.htm

Reliance Industries Ltd. (RIL) and DuPont Polyester Technologies (DPT) today announced they have entered into a strategic R&D alliance to jointly develop advanced polyester process and product technologies in India.

This world-class facility will incorporate the latest polyester research equipment as well as pilot lines for high speed POY, FDY, PSF and bicomponent spinning and several unique polymerization pilot plants including one featuring the revolutionary new NG-3 PET resin technology by DuPont.

June 10, 2003 Financial

Times

Reliance aims to be world's largest polyester producer/ Ties up

with DuPont for joint research

Reliance Industries Ltd has said it plans to become the largest polyester producer in the world. The company plans to spend $30 million on research at the Reliance Technology Centre set up here to develop new polyester technology.

リライアンス、NOCILから石化・樹脂事業を買収

インドのリライアンス・インダストリーズは、同国のNOCIL(ナショナル・オーガニック・ケミカル)の石油化学と樹脂事業を買収する。NOCILは2002年から採算悪化を理由に石油化学プラントの稼働を中止しており、リライアンスはグループの生産技術を投入して設備を近代化し、自社の生産ネットワークに組み入れる。

* リライアンスは既にIPCLを買収している。

2004/1/7 Reliance

Reliance Associate signs MoU with NOCIL to take over

Petrochemicals and Plastics Products divisions

http://www.ril.com/eportal/media/NewsDetails.jsp?page_id=72&id=N329

Sunbright, a business associate

of Reliance, has signed a Memorandum of Understanding (MoU) with

National Organic Chemicals Industries Limited (NOCIL) to take

over its Petrochemicals and Plastics Products Divisions.

Under this proposal, the assets of NOCIL's Petrochemical

Division, certain liabilities of the Company, and the business

and undertaking of the Plastic Products Division as a going

concern basis will be demerged from NOCIL and will be vested in

Nocil Petrochemicals Limited (NPL), a wholly owned subsidiary of

NOCIL. Sunbright will invest in equity of NPL after the process

of demerger is completed.

The board of directors of NOCIL at its meeting held today has

approved the restructuring proposal and the offer of Sunbright.

NOCIL will be shortly filing a petition in the Bombay High Court

under section 391 / 394 of the Companies Act, 1956, to give

effect to this proposal after obtaining the necessary approval of

the shareholders and creditors.

The proposed take over of NOCIL's petrochemical and plastics

products division will provide significant synergies with

existing petrochemicals businesses of Reliance Industries Ltd

(RIL) and Indian Petrochemicals Corporation Ltd

(IPCL).

NOCIL's petrochemicals complex has total petrochemicals capacity

of 300,000 tonnes per annum (tpa), which include an ethylene

cracker of 80,000 tpa, value added chemicals 90,000 tpa, and

fibre intermediates 20,000 tpa. In addition, the complex has a

polymer capacity of 80,000 tpa. The Plastics products division at

Akola, Maharashtra has a capacity of about 10,000 tonnes per

annum of processed polymer products.

NOCIL's petrochemicals division, which is currently not in

operation, will immensely

gain from Reliance group's technical and manufacturing expertise.

Already an ethylene pipeline links NOCIL's Petrochemicals

Division in Navi Mumbai to IPCL's Nagothane plant.

Background information

Reliance Industries Ltd. (RIL) is India's largest private sector

company on all major financial parameters with gross turnover of

Rs 65,061 crore (US$ 13.7 billion), cash profit of Rs 7,565 crore

(US$ 1.6 billion), net profit of Rs 4,104 crore (US$ 864

million), net worth of Rs 30,327 crore (US$ 6.4 billion) and

total assets of Rs 63,737 crore (US$ 13.4 billion). RIL features

in the Forbes Global list of world's 400 best big companies and

in FT Global 500 list of world's largest companies.

RIL has emerged as the 'Best Managed Company' in India in a study

by Business Today and A.T. Kearney. RIL was named in the World's

Most Respected Companies list published by Financial Times based

on a global survey and research conducted by

PricewaterhouseCoopers. RIL also emerged as the most respected

among Indian companies and amongst the 10 most respected energy

and chemical companies in the world.

Reliance Group

The Reliance Group founded by Dhirubhai H. Ambani (1932-2002) is

India's largest business house with total revenues of Rs 80,000

crore (US$ 16.8 billion), cash profit of over Rs 9,800 crore (US$

2.1 billion), net profit of over Rs 4,700 crore (US$ 990 million)

and exports of Rs 11,900 crore (US$ 2.5 billion). The group's

activities span exploration and production (E&P) of oil and

gas, refining and marketing, petrochemicals (polyester, polymers,

and intermediates), textiles, financial services and insurance,

power, telecom and infocom initiatives. Reliance has emerged as

India's Most Admired Business House, for the third successive

year in a TNS Mode survey for 2003.

2004/06/09 JSR

インド Reliance Industries Limited

にブタジエン製造技術を供与

http://release.nikkei.co.jp/detail.cfm?relID=73591

JSR(株)(社長:吉田 淑則)は、この度、インドの

Reliance Industries Limited向けにブタジエン製造技術のライセンス供与に関して次のとおり契約を締結しました。同技術を使ったプラントの建設は6月より着工する予定です

1)相手先:インド Reliance Industries Limited

2)対象技術:年産14万トン、ブタジエン抽出技術

3)プラントサイト:インド グジャラート州ハジラ

(70万トン/年のナフサクラッカーのダウンストリーム)

4)本技術採用の理由:

本技術は、JSR(株)が独自に開発した、混合溶剤を用いるものです。従来の技術に比較し省エネルギー性に優れており、特に電気の使用量が、1/2から1/3になる最新鋭の画期的なものです。Reliance Industries Limited が建設するブタジエン製造装置はインド国内で最大の生産能力を持ち、CO2削減など、地球環境にやさしい本技術が評価され採用されました。

本技術は、中国、ロシア、韓国などに実績があります。

5)プラント着工:2004年6月を予定

6)プラント完成:2005年初めを予定

7)Reliance Industries Limited の概要

会長:Shri Mukesh Ambani

インド最大の財閥

事業内容:石油・ガス、石油精製、石油化学、繊維、紡績、電力、通信、金融、保険

売上:13 billion US$(約1兆4千億円)

Platts 2005/12/15 Jamanagar製油所

India's Reliance to

start up new polypropylene line by Feb/Mar

Reliance plans to start up its fourth 280,000 mt/yr polypropylene (PP) line in

Jamnagar by late February or early March 2006, a company source

said Thursday. Three PP lines of total capacity of 770,000 mt/yr in the same site were restarted

in early December from debottlenecking.

The Jamnagar complex primarily has a 27-million tonnes per annum refinery of RPL that is fully integrated with downstream petrochemicals units of RIL, which manufacture naphtha-based aromatics as well as propylene-based polymers.

2006/1/23 Reliance

Reliance Group Announces A Unique Value Creating Opportunity

http://www.ril.com/rportal/jsp/eportal/media/PressRelease.jsp?id=368

Reliance Industries

Limited today announced that Reliance Petroleum Limited (RPL),

it's newly formed wholly owned subsidiary, would be entering the

capital market with its IPO sometime in the first half of

2006-07.

RPL is setting up an export oriented Refinery (27

MMTPA) and Polypropylene

Plant (1 MMTPA)

('Project'), in a Special Economic Zone (SEZ) in Jamnagar,

Gujarat at an estimated cost of USD6 billion. (approx. Rs27,000

crore).

Platts 2006/4/25

India's Reliance on track to start up new PTA plant by end-May

Indian refiner and petrochemicals giant Reliance

Industries

was set to start up its new 650,000 mt/year purified terephthalic

acid plant by end-May, said a company source on Tuesday. The

plant will be part of Reliance's petrochemical complex at Hazira,

near Surat in Gujarat, India.

In the past five weeks, two new PTA plants have been successfully started up in Asia. China's Oriental Petrochemical (Shanghai) Corp has successfully brought onstream its 600,000 mt/year PTA plant in Shanghai. The plant started producing on-spec material on April 1. So far, operations have been smooth and OPC is expected to start selling PTA in the market by early May. The plant, which cost slightly less than $300 million, will run at 100% capacity once initial testing and start-up operations are completed. OPC was set up in January 2003 by the Taiwan's Far Eastern Group.

In mid-March, Indorama Thailand also successfully started up its 700,000 mt/year PTA plant at Rayong, Thailand. Its current operating rate was around 95%.

Reliance to acquire

Trevira (Europe)

To emerge as the Number One Global Polyester Fibre Producer

Reliance is to acquire Trevira, a leading producer of branded polyester fibres in Europe. An announcement to this effect was made by Mr. Mukesh Ambani, Chairman and Managing Director, Reliance Industries Limited, at the company's Annual General Meeting in Mumbai on June 24, 2004.

Trevira has a

manufacturing capacity of 130,000 tonnes per annum (polyester

staple fibres, filament yarns, chips) spread over four locations

in Europe namely Bobingen and Guben (Germany), Silkeborg

(Denmark) and Quevaucamps (Belgium). In addition, it has a

state-of-the-art research and development (R&D) facility at

Bobingen. The agreement to acquire Trevira is subject to certain

conditions, including the receipt of regulatory approval from the

European Union. This acquisition, when consummated, will be the

second international acquisition by Reliance and the first

international acquisition in polyester.

2005/8/28 The

Hindu Business Line

Reliance set to acquire BP's France, Belgium facilities

RELIANCE Industries Ltd is zeroing in on acquiring the refinery

and petrochemicals facilities of BP Plc in France and Belgium.

Sources familiar with the development told Business Line that the

due diligence exercise of BP, which had been on in Mumbai for the

past few weeks, was now over.

Reliance Industries は2006年1月、既存のJamanagar製油所に近接した経済特区に新設する製油所(580万bpd)を建設・運営するReliance Petroleum を新たに設立した。

The Jamnagar complex primarily has a 27-million tonnes per annum refinery of RPL that is fully integrated with downstream petrochemicals units of RIL, which manufacture naphtha-based aromatics as well as propylene-based polymers.

April 12, 2006 Chevron Chevronが共同事業者として参加

Chevron Announces

Agreements with Reliance to Purchase 5 Percent Stake in India

Refinery and Collaborate on Energy Projects

Chevron invests $300 million to

acquire position in Jamnagar export refinery with rights to increase stake

to 29 percent

Chevron Corporation today announced that it will spend

approximately $300 million to purchase five percent of

Reliance Petroleum Limited (RPL), a company formed by Reliance

Industries Limited (Reliance) to own and operate a new export

refinery being constructed in Jamnagar, India. RPL plans to

commence an initial public offering (IPO) with the net offering

to the public of 10 percent of the company from April 13, 2006

until April 20, 2006.

RPL plans to develop a 580,000 barrels per day crude

capacity refinery,

which is expected to begin operation in December 2008. Chevron

has future rights to purchase additional shares to increase its

equity ownership to 29 percent.

2006/3/10

Indian Business Insight

政府はDow

Global との技術提携契約の申請を承認

インドの化学・石油化学省は、Reliance

Petroleum がJamnagar経済特区に建設するPP装置のために申請していたDow

Global Technologies との技術提携契約を承認した。

RPL is setting up a polypropylene plant at Jamnagar with a capacity of 9 lakh tonnes per annum (tpa). 90万トン

Dow Chemical may invest Rs5,000 crore in Reliance's Jamnagar SEZ

Dow Chemical, the US-based

chemical major, may set up a large petrochemical facility in the

Jamnagar SEZ of Reliance, next to the proposed Reliance Petroleum

(RPL) refinery. According to unconfirmed media reports, Dow may

invest up to Rs5,000 crore in the project.

(crore =

1000万ルピー, 20万ドル RS5,000crore

=1 billion $)

Reliance had invited global petrochemical companies like Dow, Shell, Exxon Mobil and Mitsubishi Chemical to set up downstream units in the SEZ.

A manufacturing presence in India would offer these companies proximity to the fast growing Asian markets including China and India. They are also assured of feedstock from RPL's mega-refinery unlike western countries which are struggling from lack of refining capacity.

Dow is the technology vendor to the 9-lakh tonnes per annum polypropylene plant being set up by RPL as part of the refinery complex. RPL would pay $26.5 million for the technology.

The Dow Chemical Company is one of the largest specialty chemicals company in the world, known for its research and product innovation capabilities. The company has an asset base of $46 billion and total revenues for the year 2005 stood at $46.3 billion. The company employs more than 42,000 people globally and has a market cap of $39.5 billion.

Dow ranks 36 in the Fortune 500 list of largest American companies.

In 2001 Dow Chemical took over Union Carbide, the company behind the Bhopal gas tragedy. In March this year, a group of US-based investment funds wrote to Dow Chemical to pay $500 million to the victims of the gas tragedy. The company has refused to accept any liability so far.

2002/12/6

Global Funds Tell Union Carbide To Settle Bhopal Gas Leak Claims

http://www.financialexpress.com/fe_full_story.php?content_id=23259A group of international investor funds which includes Trillium Asset Management, Domini Social Investments and the Calvert Group (together managing a combined asset value of $13 billion) have advised Union Carbide to settle claims of economic, health and environmental liabilities of over $500 million (Rs 2,500 crore) stemming out of the Bhopal gas leak. The company risks losing billions of dollars in market capitalisation if it fails to do so.

Reliance Industries

Limited operates world-class manufacturing facilities at Naroda,

Patalganga, Hazira and Jamnagar, all in western India.

The Naroda

facility, near Ahmedabad, houses a textile plant on a 150 acre

site. The Patalganga complex, near Mumbai, has polyester, fibre

intermediates and linear alkyl benzene manufacturing plants and

is spread over 200 acres of land. The Hazira complex, near Surat,

has a naphtha cracker feeding downstream fibre intermediates,

plastics and polyester plants and is spread over 700 acres of

land. The Jamnagar complex has a petroleum refinery and

associated petrochemical plants making plastics and fibre

intermediates. It is spread over 7,400 acres of land.

The Jamnagar complex primarily has a 27-million tonnes per annum refinery of RPL that is fully integrated with downstream petrochemicals units of RIL, which manufacture naphtha-based aromatics as well as propylene-based polymers.

Reliance plans to start up its fourth 280,000 mt/yr polypropylene (PP) line in 2006.

Three PP lines of total capacity of 770,000 mt/yr in the same siteRPL is setting up an export oriented Refinery (27 MMTPA) and Polypropylene Plant (1 MMTPA), in a Special Economic Zone (SEZ) in Jamnagar, Gujarat at an estimated cost of USD6 billion. (approx. Rs27,000 crore).

ーーー

The

Hazira complex

of Reliance Industries is spread across 1000 acres of land on the

banks of river Tapi, near Surat in Gujarat. The complex

manufactures a wide range of Polymers, Polyesters, Fibre

Intermediates and Petrochemicals.

The first phase of

the complex was commissioned in 1991-92 to generate power/utility

and to manufacture Ethylene Oxide (EO), Mono Ethylene Glycol

(MEG), Vinyl Chloride Monomer (VCM), Poly Vinyl Chloride (PVC)

and High Density Polyethylene (HDPE). A jetty was built for

loading and unloading operation of raw material and final

products.

The second phase of

the project, started in 1995, involved commissioning of the

Polyester Complex (POY & PSF) and continued in full backward

integration with commissioning of the new Polypropylene (PP),

Naphtha Cracker, Purified Terephthalic Acid (PTA) plants and also

involved expansion of existing phase 1 plants.

Total Investment

Over US$ 3 billion

has been invested at RIL, Hazira.

Plants and Capacities

| Plants | Licensor Technology | Startup | Capacity ( KTA ) Installed |

| CPP & U | May 1991 | 60 MW | |

| MEG 1 | Shell | Sep. 1991 | 100 |

| PVC | Geon | Dec. 1991 | 160 |

| VCM | Geon | Apr. 1992 | 160 |

| PE 1 | Du Pont | Jul. 1992 | 160 |

| POY | Du Pont | Dec. 1995 | 120 |

| PP | UCC | Sep. 1996 | 360 |

| PSF | Du Pont | Sep. 1996 | 160 |

| PTA 1 | ICI | Jan. 1997 | 350 |

| CPP 2 | 1996-1998 | 190 MW | |

| Cracker | S & W | Mar. 1997 | 750 |

| Aromatics | HRI/Mobil | Mar. 1997 | 350 |

| MEG 2 | Shell | Mar. 1997 | 120 |

| PE 2 | Nova | May 1997 | 200 |

| PET | Sinco | Oct. 1997 | 80 |

| PFF | Du Pont | Oct. 1997 | 30 |

| MEG 3 | Shell | Oct. 1997 | 120 |

| PTA 2 | ICI | Nov. 1997 | 350 |

ーーー

Patalganga

| Plant | Process Licenser | Start up date |

| Polyester Filament Yarn (PFY) | Du Pont | Oct.1982 |

| Polyester Staple Fiber (PSF) | Du Pont | Mar.1986 |

| Purified Terephthalic Acid (PTA) | ICI (U K) | Feb.1988 |

| Paraxylene Plant (PX) | U.O.P (USA) | Nov.1988 |

| Linear Alkyl Benzene Plant (LAB) | U.O.P (USA) | Nov. 1987 |

| L A B (Front End) | U.O.P (USA) | Mar.1992 |

| A-3 Tank Farm | May 1992 | |

| Reliance Industrial Infrastructure Limited Pipe line from BPCL to PG | May 1992 |

ーーー

Naroda

complex

represents the largest investment in the textile industry at a

single location.

Naroda complex is

India’s most modern textile complex - a

recognition bestowed by the World Bank.

RIL board approves $3bn

cracker project in Jamnagar.

To

set up largest integrated 2 MMTPA petrochemical complex

RIL

Board approves 12 Crore Preferential Warrants to promoters

Dr.

R A Mashelkar appointed Director on RIL Board

| The Board of Directors of the Company met today and took the following decisions: | |

| 1. | Confirm the decision taken on 9th November, 2006 to raise US $2 billion to finance the capital expenditure plan for oil and gas business through External Commercial Borrowings by way of debt. |

| 2. | Raise further equity by way of preferential issue of 12 crore warrants exercisable into equal number of equity shares of Rs.10 each of the Company to the Promoters as per SEBI guidelines for Preferential Issues, subject to shareholders approval. An amount equivalent to 10% of the price would be paid on allotment of warrants and the remaining 90% would be paid at the time of subscription to equity shares on exercise of rights attached to the warrants within a period of 18 months. On exercise of such rights the paid up capital of the Company will increase from Rs 1393 crores to Rs 1513 crores. |

| 3. | Build one of the largest integrated cracker and petrochemicals complex with a total capacity of 2 mmtpa in the SEZ at Jamnagar. This cracker will use refinery off gases and other byproducts as feedstock to manufacture ethylene, propylene and its downstream commodity and speciality derivatives. The proposed facility will be built at a capital cost of US $ 3 billion and is expected to go on stream by 2010 -11. This unique integration with the refinery will place the proposed cracker complex at par with the most efficient producers of olefins and derivatives in the world including those in the Middle East and will enable the Company to achieve one of the most competitive cost positions. |

| 4. | Appoint

Dr. R.A. Mashelkar as an independent director on the

Company’s board, subject to

necessary Government approvals. |

MARCH 08, 2007 REUTERS Reliance-IPCL merger in pipeline

Reliance and IPCL to merge?

Plans by Reliance

Industries Ltd to absorb its Indian Petrochemicals Corp Ltd

(IPCL) unit have been long expected and so were unlikely to

significantly boost the unit's shares, analysts said.

Reliance, India's top petrochemicals maker, said on Wednesday its

board would meet on March 10 to consider the amalgamation of IPCL

with itself.

"This merger was always on the cards and the markets are not

in a phase today where they will blindly take stocks

higher," said V K Sharma, head of research at Anagram Stock

Broking Ltd.

Analysts said IPCL shares may not see much upside on Thursday as

the amalgamation would be in Reliance's favour, and that current

stock prices could be the benchmark for the share swap ratio.

"Reliance's history shows that it always takes the cake when

it merges some or the other entity with itself," Sharma

said. Indian media said the market was speculating on a merger

ratio of one share of Reliance for anywhere between three and six

shares of IPCL.

"I don't want to speculate, but everyone knows that

Reliance's share price is trading 6.5 times higher than

IPCL's," said Jigar Shah, head of research at brokerage firm

K R Choksey.

Reliance Industries bought a 26 per cent stake in IPCL in 2002

from the government, and has subsequently raised its stake to

over 46 per cent.

In June 2002, the Government of India as a part of its disinvestment programme divested 26% of its equity shares in favour of Reliance Petroinvestments Limited (RPIL), a Reliance Group Company, India's fastest growing and most admired private sector group founded by visionary entrepreneur Shri Dhirubhai H. Ambani. RPIL acquired an additional 20% equity sh

India Times 2007/5/16 ブログ

RPL selects Dow

technology for polypropylene

Reliance Petroleum Ltd, a unit of Reliance Industries building a

refinery and petrochemical complex at Jamnagar in Gujarat, has

selected Dow Chemical's technology for production of

polypropylene.

RPL has selected the UNIPOL-PP Process for its 900,000

tons per annum polypropylene production unit at the special economic zone

adjacent to RIL's existing Jamnagar complex. 既報では100万トン

"Startup is

scheduled in December 2008," Dow Global Technologies

Inc, a wholly-owned subsidiary of Down Chemical Co, said in a

press release here.

RIL, Asia's largest producer of polypropylene, currently operates

four UNIPOL PP Process lines at its Jamnagar complex and two

UNIPOL PP Process lines at its Hazira complex.

"The new facility will produce a full range of homopolymers

to supply the growing markets in Asia," it said.

Licensees of the UNIPOL PP Process operate more than 35

production lines around the world, accounting for more than 5.5

million tons of global polypropylene production.

September 4, 2007

Reliance

Reliance makes a strategic acquisition in East Africa

Towards global ambitions in the petroleum sector

Reliance has acquired a Majority stake and Management control of Gulf Africa

Petroleum Corporation (GAPCO), a company which has a significant

presence in East Africa in the petroleum

downstream sector.

The acquisition has been made through a wholly owned subsidiary,

Reliance Industries Middle East, Dmcc (RIME), a company

registered in United Arab Emirates.

GAPCO, an entity based in East and Central Africa with

headquarters in Mauritius, owns and operates large storage

terminalling facilities and a retail distribution network in

several countries - including Tanzania, Uganda, Kenya. It also

owns and operates large storage terminals in Dar Es Salaam

(Tanzania), Mombassa (Kenya), Kampala (Uganda) and has other well

spread depots in East & Central Africa. It also operates more

than 250 Outlets covering retail and industrial segments.

The deal, which is one of the biggest mergers in recent years in the region, will see Reliance controlling a 51% majority stake in the Gapco Group, while the Kotak family will now remain with 49%.

Gapco Group is a regional multinational company which has heavily invested in Tanzania, Uganda, Rwanda, Burundi, Kenya, Zambia, Malawi and Sudan.

GAIL - RIL Sign MoU To Set Up Petrochemical Plants globally

Reliance Industries

Limited (RIL) and GAIL (India) Limited today signed a Memorandum

of Understanding (MoU) for Joint Co-operation in Petrochemicals.

Under the MoU, GAIL and RIL will explore opportunities for setting up

petrochemical complexes outside of India in feedstock rich

countries. Identified

opportunities will be examined by a Working Group, consisting of

representatives from both the companies. GAIL and RIL will set up

a Special Purpose Vehicle (SPV) for setting up petrochemical

complexes abroad.

The Working Group is examining such opportunities in Middle East,

Russia and FSU (former

Soviet Union) countries.

In addition, the two companies will also examine the

possibilities of mutual co-operation in the domestic market.

Dec.17, 2007 economictimes.indiatimes.com

Reliance, GAIL identify 10 countries for petrochemical plant

Reliance Industries, India's most valued company, and state-run gas firm GAIL India have identified 10 countries including Qatar, Australia and Russia for setting up a multi-billion-dollar petrochemical plant.

An MoU signed by RIL and GAIL on December 4 lists Qatar, Abu Dhabi, Bahrain, Vietnam, Australia, South Africa, Angola, Mexico, Russia and Former Soviet Union countries as areas where the two would explore jointly establishing up to 2 million tons chemical plant.

Back home, the two companies would also cooperate in areas of distribution and marketing of petrochemicals, including 'product-swapping'.

Jun 12, 2008 Thomson Financial via COMTEX

Reliance says to add 900,000 tonnes/yr polypropylene capacity at Jamnagar

Reliance Industries Ltd.

said the company will commission a 900,000 tonne per

annum polypropylene facility

this year at its flagship Jamnagar site in the western state of

Gujarat, making it the world's third-largest producer.

At the company's AGM on Thursday chairman Mukesh Ambani said it

will also commission a 580,000 barrels per day oil

refinery at Jamnagar "earlier

than scheduled" this year.

The 7th largest manufacturer of Polypropylene (PP) in the world, Reliance would shortly be amongst the top five global producers of PP with the capacity reaching 2835 KTA from the present capacity of 1,735 KTA (上記増設前)

Reliance Polymers offers the entire range of Polyethylene (PE) viz. High Density Polyethylene (HDPE), Linear Low-density Polyethylene (LLDPE) and Low Density Polyethylene (LDPE) with a total capacity of 990 KTA.

Reliance Polymers is India's largest manufacturer of suspension grade Polyvinyl Chloride (PVC), with a capacity of 625 KTA per annum and a wide range of viscosities.

Reliance plans a 200 kt/yr PET plant for Kinston, NC by end 2009

India's Reliance

Industries plans to build and have online a 200,000 mt/year

bottle resin PET plant in Kinston, North Carolina, by

the end of 2009, a source close to the company said Tuesday.

The site currently produces polyester yarn (POY) but Reliance

plans on taking the spinning machines from Kinston back to India

where the company would produce POY to sell in India's growing

polyester market.

June 21, 2008 journalnow.com

Unifi Kinston LLC subsidiary sold to Reliance Industries

Unifi Inc. said in a regulatory filing that its Unifi Kinston LLC subsidiary has sold its polyester-manufacturing plant in Kinston for $12.2 million to Reliance Industries USA Inc.

Unifi said that the subsidiary would pay E.I. DuPont de Nemours about $3.7 million to satisfy certain demolition and removal obligations created by the sale of the assets.

Unifi said that it expects to record a gain of about $6.9 million when the sale closes in the first half of 2009.

2010/2/5

Reliance submits interest in Canada firm Value Creation

Energy major Reliance Industries Ltd has submitted a $2 billion

expression of interest for private Canadian firm Value

Creation Inc,

a television channel reported on Friday.

The Canadian firm holds oil sands assets, the report said.

Value Creation Inc. (VCI) is a private Alberta company established in 1998. VCI is part of the Value Creation Group of Companies (the "Group"), which is focused on transforming the oil sands industry by applying its breakthrough proprietary technology to resource development and to bitumen upgrading. The Group’s vision is to be a pre-eminent oil sands developer, differentiating itself with innovative technologies and creative applications to create enhanced value in the full oil sands development value chain.

VCI’s extensive resource base

positions VCI to become a major oil sands player. Its

wholly-owned oil sands resources cover 430 square miles - one of

the largest oil sands resources held by an independent Canadian

company. The largest block of leases, Terre de Grace, covers

approximately 290 square miles in the western part of the

Athabasca region.

Advanced technology is the key to lower oil sands production

costs and lower bitumen upgrading costs. Together with its

affiliate, Technoeconomics Inc., VCI has developed proprietary

technology designed to achieve these goals.

The first commercial application of the Value Creation Group

technology has been spearheaded by BA Energy with its Heartland

Upgrader, currently being constructed in Strathcona County,

northeast of Edmonton, Alberta. VCI also plans to apply its

breakthrough technology and synergistic integration with Steam

Assisted Gravity Drainage (SAGD) to develop its extensive oil

sands leases, commencing with its first development project at

Terre de Grace near Fort McMurray, Alberta.

Value Creation acquires BA Energy

Value Creation Inc. announces that BA Energy Inc. has become a whollyowned subsidiary of Value Creation effective February 26, 2008. BA Energy is constructing the Heartland Upgrader, a merchant bitumen upgrader using proprietary upgrading technologies developed by Value Creation in Strathcona County, northeast of Edmonton, Alberta.

(Upgrader ではアスファルト状のビチュメンから合成石油を生産する。 )

Press Trust of India,

March 17, 2010

BP Plc beats RIL for majority stake in Value Creation

Supermajor BP Plc will pick up a majority stake in ailing

Canadian oil sands company Value Creation Inc, a property for

which Reliance Industries too was said to be in race.

BP will pay an undisclosed amount for a majority stake in the

185,000-acre Terre de Grace oil sands property in northern

Alberta, closely held Value Creation said in a statement.

Earlier, it was reported that RIL had made a $2 billion bid for

majority stake in Value Creation. Though, the company

spokesperson declined to confirm if it had actually put in a bid.

Canada's oil sands has the largest crude reserves outside the

Middle East.

The news comes within days of RIL's takeover bid for bankrupt

chemical maker LyondellBassel being snubbed by its management.

2010/4/9 Reliance

Reliacne Industries and Atlas Energy announce Marcellus Shale

Joint Venture

Reliance Industries Limited (RIL) today announced that its

Subsidiary, Reliance Marcellus LLC, has executed definitive

agreements to enter into a joint venture with United States based

Atlas Energy, Inc., of

Pittsburgh, Pennsylvania under which Reliance will acquire a 40%

interest in Atlas' core Marcellus Shale acreage position.

三井物産は2月16日、三井石油開発とのJVのMitsui E&P USA を通して、Anadarko Petroleum が米国ペンシルベニア州のMarcellus Shaleエリアにおいて開発・生産中のシェールガス事業に参画すると発表した。

http://knak.cocolog-nifty.com/blog/2010/02/post-2727.html

For an acquisition cost

of $339 million and an additional $1.36 billion capital costs

under a carry arrangement for 75% of Atlas’capital costs over an anticipated

seven and a half year development program, Reliance becomes a

partner in approximately 300,000 net acres of undeveloped

leasehold in the core area of the Marcellus Shale in southwestern

Pennsylvania. Low operating costs and proximity to U.S. northeast

gas markets combine to make the Marcellus one of the most

economically attractive unconventional natural gas resource plays

in North America. The acreage will support the drilling of over

3,000 wells with a net resource potential of approximately 13.3

tcfe (5.3 tcfe net to Reliance).

The transaction is anticipated to close by the end of April 2010.

While Atlas will serve as the development operator for the joint

venture, Reliance is expected to begin acting as development

operator in certain regions in the coming years as part of the

joint venture.

Under the framework of the joint venture, Atlas will continue

acquiring leasehold in the Marcellus region and Reliance will

have the option to acquire 40% share in all new acreages.

Reliance also obtains the right of first offer with respect to

potential future sales by Atlas of around 280,000 additional

Appalachian acres currently controlled by Atlas, (not included in

the present joint venture). The Reliance-Atlas joint venture thus

has the potential to become one of the largest prime acreage

holders in the Marcellus Shale.

Commenting on the joint venture, Mr. PMS Prasad, Executive

Director, Reliance Industries said, "Reliance is very

pleased to enter one of the fastest growing opportunities

emerging in the U.S. unconventional gas business and that too

with one of the largest, most experienced energy producers in the

Appalachian Basin as partner.

This joint venture will materially increase Reliance's resources

base and provide Reliance with an entirely new platform from

which to grow its exploration and production business while

simultaneously enhancing its ability to operate unconventional

projects in the future."

Barclays Capital Inc. acted as exclusive financial advisor to

Reliance for the transaction and Vinson & Elkins LLP acted as

legal counsel to Reliance. Bank of America Merrill Lynch provided

strategic and financial advise to RIL in respect of this

investment.

RIL and Sibur to jointly pioneer Butyl Rubber production in India IIR(isobutylene-isoprene rubber)

Reliance Industries Ltd.

(RIL), India's largest private sector company, and Sibur,

Russia's leading petrochemical company, have signed a Memorandum

of Understanding (MoU) to set up a joint venture in India. This

new joint venture will produce butyl rubber at Reliance's

integrated petrochemical site in Jamnagar, India.

According to the MoU, Sibur will provide proprietary

technology

for butyl rubber polymerisation and its finishing, while RIL will

supply monomers and provide the JV with world class

infrastructure and utilities.

Commenting on the initiative, RIL Spokesperson said, “Reliance is committed to serving

the Indian rubber industry. This industry is growing rapidly on

the back of automobile demand in India and the sub-continent.

This step reinforces RIL's commitment to the synthetic rubber

industry in India. It is also a significant milestone in taking

forward the vision of our Chairman, Mr. Mukesh D. Ambani, for the

Elastomer industry.”

“The creation of

new capacity in close proximity to the Asian markets provides

both Sibur and Reliance with exciting opportunities. Rubber

consumption in Asia has shown strong growth in recent years,

triggered by increased volumes of tyre production”, Dmitry Konov, President of

Sibur, said.

About Sibur

Sibur is the leading petrochemical company in Russia and Eastern

Europe. The Company operates across the entire petrochemical

value chain from gas processing to the production of monomers and

plastics, synthetic rubbers, mineral fertilizers, tyres and

industrial rubber goods, as well as the processing of plastics.

Sibur produces over 2000 different types of products. The Company

processes more than half of Russia's APG and produces 23% of

propylene and polypropylene, 17% of polyethylene, 30%- 49% of

different synthetic rubbers, 34% of tyres, 16% of nitrogen

fertilizers, and a considerable number of other petrochemical

products for the Russian market.

Sibur operates plants in 20 regions of Russia. The Company is

managed along product division lines - Hydrocarbon Feedstock,

Synthetic Rubbers, Plastics and Organic Synthesis Products,

Mineral Fertilisers and Tyres.

Gazprombank

Group is the principle shareholder of Sibur Holding JSC and owns more

than 95

% of the Company.

Sibur Holding JSC is managed by Sibur LLC which acts as the

holding Company's sole executive body.

Over recent years, the Company has consistently delivered healthy

financial and operational results. In 2009, Sibur Group plants

processed 16.8 billion m3 of APG, produced 15 million tons of

petrochemicals and dry gas. In 2009, Sibur had revenues of more

than 150 billion rubles.

June 24, 2010 Reliance Reliacne

Industries and Atlas Energy announce Marcellus Shale Joint

Venture

Reliance Industries and Pioneer Natural Resources announce Eagle

Ford Shale Joint Venture

Reliance Industries Limited (RIL) today announced that its

subsidiary, Reliance Eagleford Upstream LP, has executed

definitive agreements to enter into a joint venture with United

States based Pioneer Natural Resources

Company, of Irving, Texas under which Reliance will acquire a 45%

interest in Pioneer's core Eagle Ford Shale acreage position in

two separate transactions. Pioneer and Newpek LLC, Pioneer’s current partner in the Eagle

Ford, will simultaneously convey 45% of their respective

interests in the Eagle Ford to Reliance. Newpek, a wholly owned

subsidiary of ALFA, S.A.B. de C.V., currently owns an approximate

16% non-operated interest in Pioneer’s core Eagle Ford Shale acreage.

Following the transactions, Pioneer, Reliance and Newpek will own

46%, 45% and 9% of the joint venture interests, respectively. The

joint venture will have an approximate net working interest of

91% in 289,000 gross acres implying 263,000 net acres.

Reliance will pay $1.315 billion for its implied share of 118,000

net acres. This upstream transaction consideration will include

combined upfront cash payments of $263 million and deferred

payments of $1.052 billion associated with a carry arrangement

for 75% of Pioneer’s and Newpek’s capital costs over an

anticipated four years. The joint venture’s leasehold, which is largely

undeveloped, is located in the core area of the Eagle Ford Shale

in south Texas. Low operating costs, significant liquids content

(70% of the acreage lies within the condensate window) and

excellent access to services in the region combine to make the

Eagle Ford one of the most economically attractive unconventional

resource plays in North America.

Pioneer believes the acreage will support the drilling of over

1,750 wells with a net resource potential to the joint venture of

approximately 10 tcfe (4.5 tcfe net to RIL).

The joint venture plans to increase the current drilling program

to approximately 140 wells per year within three years. Also

included in the transaction is current production of 28 mmcfe/d

(11 mmcfe/d net to Reliance) from five currently active

horizontal wells.

While Pioneer will serve as the development operator for the

upstream joint venture, Reliance is expected to begin acting as

development operator in certain areas in the coming years as part

of the joint venture.

Additionally, Reliance and Pioneer have executed definitive

agreements to form a midstream joint venture that will service

the gathering needs of the upstream joint venture. Reliance’s subsidiary, Reliance Eagleford

Midstream LLC, will pay $46 million to acquire a 49.9% membership

interest in the joint venture. Pioneer and

Reliance will have equal governing rights in the joint venture

and Pioneer will serve as operator.

Under the framework of the joint venture, Pioneer will continue

acquiring leasehold in the Eagle Ford Shale and Reliance will

have the option to acquire a 45% share in all newly acquired

acres.

Commenting on the joint venture, Mr. PMS Prasad, Executive

Director, Reliance Industries said, "Reliance is very

pleased to establish a long-term partnership with Pioneer in the

Eagle Ford shale. This transaction represents another significant

milestone in Reliance's efforts to grow its North American shale

gas perations."

Barclays Capital Inc. and UBS Securities LLC acted as financial

advisors to Reliance. Baker Botts LLP acted as legal counsel to

Reliance.

December 21, 2010

MOU

Reliance Industries and SIBUR in a Joint Venture for Butyl Rubber

Production in India IIR

The trade relations between India and Russia were given a boost

during the official visit of Russian President Dmitry Medvedev to

India, as the country’s largest private sector company

Reliance Industries Limited (RIL) and the leading Russian

petrochemical company SIBUR today announced a joint venture

for the production of butyl rubber in India.

The joint venture facility will have an initial capacity of 100,000 tons of

butyl rubber at

RIL’s integrated

refining-cum-petrochemical site in Jamnagar, India and is

expected to be commissioned by 2013. Estimated investment in the

project will be US $ 450 mn. The plant will initially produce

regular butyl rubber and is expected to manufacture other types

of butyl rubber specialities in the future. SIBUR will provide

its proprietary technology for butyl rubber polymerization and

finishing, while RIL will supply monomers and provide the JV with

world-class infrastructure and utilities. RIL will have a

majority stake in

the joint venture.

Commenting on this development, Mr. N. R. Meswani, Executive

Director, RIL, said “This is a significant step towards

Reliance’s commitment to service India’s growing automotive sector by bringing in complex

technologies, available with only a very few companies globally.

The setting up of domestic manufacturing of butyl rubber will

fulfil a long standing demand of the Indian tyre and rubber

industry and this investment is part of Reliance’s vision of emerging as a

significant global payer in the synthetic rubber business.”

"We are

satisfied with the dynamics of the creation of the joint venture

and hope to begin construction soon," said SIBUR's President

Dmitry Konov commenting on the joint venture. "SIBUR has

unique technologies for the production of synthetic rubber, which

in partnership with Reliance will cater the growing needs of the

Indian tyre industry with high-quality raw material."

About SIBUR

SIBUR is the largest petrochemical company in Russia and Eastern

Europe. The value chain of the company covers gas processing, the

production of plastics, synthetic rubbers, nitrogen fertilizers,

tyres, rubber products, and plastics processing. In 2009, SIBUR

has processed more than 16.8 billion m3 of associated petrol gas

and produced more than 15 million tons of various petrochemical

products. SIBUR's revenue in 2010 is projected to reach over 220

billion roubles (over US$ 7 billion).

| 2004年06月09日 |

| JSR、インド・リライアンスにブタジエン技術供与 |

JSRは9日、インド最大の石油・石油化学会社リライアンス(Reliance Industries)向けに、ブタジエン製造技術のライセンス供与を行うと発表した。同国グジャラート州ハジラ地区の工場敷地内に年産14万トン規模の ブタジエン抽出プラントを建設する。6月に着工し、2005年初完成の予定。 ライセンスするのは、JSRが独自に開発した混合溶剤を用いる技術で、省エネ効果が高く、電力使用量が従来法に比べて2分の1から3分の1で済む画期的な技術だとしている。 |

2012/2/21 Reliance 2010/12 合意

SIBUR and Reliancе form a Joint Venture to produce butyl rubber in India

SIBUR, Russia and Eastern Europe's largest

petrochemical company, and Reliance Industries Limited (RIL), India's largest

private company, have agreed to form a joint venture named

Reliance Sibur Elastomers Private Limited to produce 100,000 tons of

butyl rubber per year in Jamnagar, India.

The JV will be the first manufacturer of butyl rubber in India and the fourth

largest supplier of butyl rubber in the world.

The JV will cater to the demand for synthetic rubber from the Indian automotive

industry of over 75,000 tonnes per year, which is currently satisfied by

imports. Investment in the JV is in line with Reliance’s vision of emerging as a

significant player in the global synthetic rubber market.

Reliance share in the JV will total 74.9%, while Sibur will account 25.1%. The

JV will invest US$450 million to construct the facility, which is expected to be

commissioned in mid-2014.

Reliance and SIBUR also signed a technology licence agreement facilitating use

by the JV of SIBUR's proprietary butyl rubber production technology at the new

production facility. SIBUR will develop basic engineering design for the

facility and also train the JV’s personnel at SIBUR’s production site in

Togliatti, Russia.