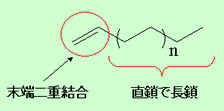

アルファオレフィン(α-olefine)

オレフィン系炭化水素のうち二重結合がαの位置(一番端の炭素と次の炭素の間)にあるものの総称。炭素数に応じて合成洗剤、界面活性剤等に使用される。また可塑剤や洗剤に使用される高級アルコールの原料となる。エチレンを重合して製造する。炭素数によって気体、液体、固体となる。

LAO

2003/5/7 BP

BP Strengthens Asian PTA Presence

http://www.bp.com/centres/press/p_r_detail.asp?id=982

BP announced today that it has increased its interests in its Taiwanese and Korean PTA joint ventures. BP now owns 59.02 per cent of China American Petrochemical Company (CAPCO) in Taiwan and 47.41 per cent of Samsung Petrochemical Company (SPC) in Korea. As a result of the two deals, BP's equity PTA capacity in Asia has increased by 14 per cent to around three million tonnes a year.

CAPCO is the largest producer of PTA in Asia operating six production units with a total capacity of 2.1 million tonnes per annum. BP acquired the incremental 9.02 per cent interest in CAPCO from Central Investment Holding Company (CIHC). As a result, BP now controls 59.02 per cent of the equity in CAPCO while Chinese Petroleum Corporation and CIHC retain 25.00 per cent and 15.98 per cent respectively.

SPC is the third largest producer of PTA in Asia operating four PTA units in Korea to produce a total of 1.4 million tonnes per annum. BP and SPC recently completed a number of transactions with minority shareholders of SPC increasing BP's ownership of SPC from 35 per cent to 47.41 per cent. BP's ownership of SPC is now equal with Samsung's.

2004/2/12 BP

BP Licenses Innovene Technology For Sasol Polymers Polypropylene

Expansion

BP and Sasol Polymers have signed an agreement to license BP's Innovene polypropylene process technology for the expansion of Sasol's polypropylene facilities located in Secunda, Republic of South Africa. The new plant will have an annual capacity of 300,000 tonnes, produce homopolymers, random copolymers and impact copolymers, and start up in 2006. Sasol will use BP's proprietary high activity CD catalyst to realize the full benefits of the technology.

2004/4/27 BP New 'Twin-Track' Strategy

BP Plans To Sell

Over 50% Of Petrochemicals Business And Prepares For IPO

http://www.bp.com/genericarticle.do?categoryId=120&contentId=2017971

BP announced

today that it plans to consolidate the Olefins and Derivatives

(O&D) division of its petrochemicals business into a

stand-alone entity able to operate separately from the BP Group.

BP said it plans to sell O&D in due course, possibly through

an Initial Public Offering, depending on market circumstances and

necessary approvals, in the second half of 2005.

At a strategy presentation on March 29, 2004, Lord Browne said

future investment would focus more on so-called “advantaged products”, including paraxylene, PTA and acetyls which were strong in

growing Asian markets and where BP has a proprietary

technological lead, and less on olefins and derivatives which

dominated the company’s portfolio in the more

fragmented and lower-growth European markets.

BP focuses on seven core products -purified terephthalic acid (PTA), paraxylene (PX), acetic acid,(残す)

acrylonitrile, ethylene, high-density polyethylene (HDPE) and polypropylene (PP)(売却)

Platts 2004/11/16

BP chemicals spin-off to include

Grangemouth, Lavera refineries

BP plans to include two of its

European refineries in a new petrochemicals

business being spun off

from the main group, the company said Tuesday. The new unit

comprising BP's olefins and derivatives businesses is due to be

sold, possibly through an initial public offering, in the second

half of 2005.

The company has now decided to

include its refineries at Grangemouth in Scotland and Lavera in

southern France in the new venture.

Petro Chemical News 2004/4/15 (Vol. 42, No. 14)

BP Plans Sale of

LAO/PAO Business Under New 'Twin-Track' Strategy

http://www.petrochemical-news.com/P-V42N14.pdf

BP last week

announced its intention to sell its linear alpha olefins (LAO)

and polyalphaolefins (PAO) business under a new twin-track strategy for its petrochemicals

sector.

Under this strategy, explained BP, the company will now approach aromatics and acetyls

differently from olefins and derivatives (O&D), and will reduce total

annual organic capital expenditures to about $750-million in 2006

from the current level of approximately $1-billion.

BP's plan to consolidate olefins business 'no surprise': sources

BP plans

announced Tuesday to consolidate the olefins and derivatives

division of its petrochemicals business into a stand-alone

entity, came as no surprise to many of the Asian participants,

according to Platts polls on Wednesday.

One source close to the company said that murmurs of the move

have been heard a while back already.

Meanwhile, market sources were concerned that BP's plan to sell

its O&D division in the second half of 2005 might not be able

to attract sufficient buying interest.

BP Steps Up

Investment In China

http://www.bp.com/genericarticle.do?categoryId=120&contentId=2018233

BP announced today that it has signed a number of agreements

covering investments totalling around $1 billion which will

deepen its presence in the growing Chinese energy market.

Building on the highly encouraging results from the BP and Sinopec acetic acid joint venture

in Chongqing where the capacity is already being

increased from 200,000 tonnes a year to 350,000 tonnes a year, BP today signed a heads

of agreement to build a 500,000 tonnes a year acetic acid plant in Nanjing, Jiangsu

province, through a 50/50 joint venture with Sinopec.

The company also signed a letter of intent to examine the viability of expanding production at the BP Zhuhai PTA plant from 350,000 tonnes a year to 1.2 million tonnes a year.

BP’s two Chinese retail service station ventures also took a step forward

with the signing of the joint venture contracts and articles of

association for both the BP Sinopec Zhejiang Petroleum Company

Limited and the BP PetroChina Petroleum Company Limited.

In a separate move, BP also announced that it has agreed to be a

partner in a hydrogen

vehicle demonstration project being established by the Chinese Ministry

of Science and Technology.

Asia Chemical

Weekly 2005/4/26

BP revised the capacity of No2 PTA project in Zhuhai

BP Zhuhai Chemical has revised the capacity of its No 2 PTA

project to 900 000 tonne/year in Zhuhai Harbour Industrial Zone (珠海臨港工業區), Guangdong, China, according to the

industry sources.

Originally, BP Zhuhai Chemical got the approval for the

pre-feasibility study on a 600 000 tonne/year PTA project in June

2003. But recently, in order to get greater economy of scale, the

company has increased the capacity of the proposed project to 900

000 tonne/year in a revised feasibility study.

If the company gets the approval smoothly, the work on the

project maybe starts in Q3 2005, and the starts-up date due in H2

2007.

Acetic acid for the proposed plant could be sourced from BP’s jv - Yangtze River Acetyls Co (Yaraco) -

in Chongqing, China. Yaraco is to up its acetic acid capacity

from 200 000 tonne/year to 350 000 tonne/year in April 2005.

BP has already a PTA plant in Zhuhai, the No1 plant has the

capacity of 350 000 tonne/year.

BP Zhuhai is an 85:15 jv between BP and China’s Fu Hua Group (富華集團).

The imports of PTA in China reached 3.1 Mt PTA in 2001, 4.3 Mt in

2002, 4.55 Mt in 2003, and 5.72 Mt in 2004.

BP Announces

Phased Exit from Two Manufacturing Plants at Hull, U.K.

http://www.bp.com/genericarticle.do?categoryId=120&contentId=7002580

BP today

announced a phased exit from its DF2 and DF3 acids and acetone

manufacturing operations at Saltend, Hull, and with it a phased withdrawal from its formic

acidギ酸 , propionic acidプロピオン酸 and acetone businesses, leading to a reduction in

its European acetic acid production capacity.

The DF2 and DF3 plants were commissioned in 1967 and 1972

respectively. They

use naphtha as a feedstock to produce acetic acid, formic acid,

propionic acid and acetone. The propionic acid, formic acid and

acetone businesses will be exited. BP is committed to ensuring

continuity of supply to its customers until the final closure

date. Acetic

acid will continue to be produced on other manufacturing assets on the site.

2004/11/30 BP BP、NOVAとの提携でLLDPE生産性アップ

Grangemouth Grows Linear Low Density

Polyethylene to Meet Rising Demand

http://www.bp.com/genericarticle.do?categoryId=120&contentId=7002583

BP has introduced higher rate

production runs of linear low density polyethylene at

Grangemouth, Scotland, to meet growing market demand. This has

been possible due to the successful introduction of a new best-in-class

catalyst, NOVACAT® T, jointly developed between BP and NOVA

Chemicals.

It is particularly suited for producing BP’s range of linear low density blown and

cast polyethylene film grades.

The Innovene 4 production unit uses proprietary BP Innovene® gas phase technology and has achieved daily and monthly

production records throughout this year. Sales in 2004 from this

unit are expected to be around 10% up on 2003, with further

growth expected in 2005.

BP announced its Ziegler-Natta catalyst collaboration with NOVA

Chemicals in 2001 and extended this collaboration to Metallocene

and single site catalysts in 2002.

BP has licenced BP Innovene PE technology to 25 licensees in 15

countries.

BP’s gas phase Innovene

plant at

Granegmouth has a capacity of 320,000 tonnes per year which

produces hexene-based LLDPE.

BP has a second European plant using gas phase BP Innovene

technology of 220,000

tonnes capacity, located at Koln, Germany which produces

butene-based LLDPE.

Last month, BP and NOVA Chemicals announced plans to form a European styrene polymers joint venture starting in 2005.

BP to Close U.S. Linear Alpha

Olefin Production Capacity

http://www.bp.com/genericarticle.do?categoryId=120&contentId=7003032&PC=100e177441a00

BP announced today that it would

close its Linear Alpha Olefin (LAO) production facility in Pasadena, Texas, by the end of 2005. The company will

continue the manufacture of linear alpha olefins at its other two

facilities in Alberta, Canada and Feluy, Belgium.

Closure of the Pasadena site will reduce BP’s global linear alpha olefin capacity by 500,000 tonnes (1.1 billion pounds) per year.

According to George Tacquard, Senior Vice President of BP’s Global Derivatives business, the closure

is the result of an extensive review of the company’s global linear alpha olefins business and

prospects for the LAO industry.

“The LAO industry has faced

a very difficult environment for the past few years, with overcapacity, slow demand

growth, and high feedstock and energy costs. The Pasadena site is our oldest production

site, and the closure of these older assets will allow our LAO

business to focus resources on keeping our two newer sites at

Feluy and Joffre competitive,” Tacquard said.

After the restructuring, BP will have an annual linear alpha

olefin production capability of 300,000 tonnes (660 million pounds) at

Feluy, Belgium and another 250,000 tonnes (550 million pounds) at

the Joffre, Alberta plant.

アルファオレフィン(α-olefine)

オレフィン系炭化水素のうち二重結合がαの位置(一番端の炭素と次の炭素の間)にあるものの総称。炭素数に応じて合成洗剤、界面活性剤等に使用される。また可塑剤や洗剤に使用される高級アルコールの原料となる。エチレンを重合して製造する。炭素数によって気体、液体、固体となる。LAO

2005/3/21 BP

BP Announces New Identity for Petrochemicals Company

http://www.bp.com/genericarticle.do?categoryId=2012968&contentId=7004959&PC=102c9a208a400

BP announced today that the name

of its new olefins and derivatives subsidiary will be Innovene.

Innovene will be formed as a separate entity within the BP Group

in April, with more than $9 billion in assets and $15 billion in

third-party sales globally. The new company will be headquartered

in Chicago and have more than 8,500 employees at 26 principal

sites around the world.

Notes to editors:

Innovene will be created as a wholly owned subsidiary of BP on

April 1, 2005. BP expects to sell the company later in 2005,

possibly by way of an IPO, subject to necessary approvals and

market conditions.

Innovene's major manufacturing sites include Grangemouth in

Scotland, Lavera in France, Koln in Germany and Lima, Chocolate

Bayou and Green Lake in the US. SECCO, the joint venture with

Sinopec and SPC in Shanghai and the largest petrochemical complex

in China to date, is due to become fully operational in the next

few months.

Innovene manufacturers petrochemicals, including olefins

(ethylene and propylene) and their derivatives such as

polyethylene, polypropylene, acrylonitrile, linear alpha olefins,

polyalphaolefins, and solvents, as well as gasoline, diesel and

other refined products made in the Grangemouth and Lavera

refineries. These chemicals are used to make a wide variety of

plastic goods, including food and drink containers and wrappings,

pipe work, automotive parts and mouldings of all kinds.

May 19, 2005 Nova

BP and NOVA Chemicals sign binding agreements for European

Styrenics Joint Venture

New venture names two senior officers

http://www.novachemicals.com/08_news/NI_0505.html

BP and NOVA Chemicals

Corporation today announced they have signed binding agreements

to

merge their European styrenic polymers businesses into a 50:50

Joint Venture.

As previously announced in November 2004, the transaction to form

the Joint Venture will be cashless.

The Joint Venture will be named NOVA Innovene, after its shareholders NOVA

Chemicals and Innovene, BP's newly formed olefins and derivatives

business.

Shanghai Secco Olefins JV

to Stay with BP After Innovene Spin-Off

BP says its 50% stake in the

Shanghai Secco Petrochemical joint venture will remain with

the BP group following

the spin-off of BP's Innovene olefins and derivatives business

later this year. BP originally intended to include the Secco

stake with Innovene.

Secco also builds on BP's strong relationship with Sinopec, BP says. That includes the Yaraco acetyls jv at Chongqing, China and an acetic acid jv that is under construction at Nanjing, China.

Yahoo Finance September 2, 2005

India's Reliance may be

preparing to bid for BP unit Innovene

Reliance Industries Ltd is believed to be putting together the

finishing touches of a plan to bid for Innovene, the wholly-owned

subsidiary of BP PLC, the Economic Times reported, citing

industry sources.

Though BP had committed to Innovene employees at the time of the

separation that it would list the company through an IPO

and not sell it to a strategic investor, the company may be keeping other

options also open, the newspaper cited industry sources as

saying.

Reuters 2005/9/12

BP chemical unit Innovene sets $1 billion IPO

The main petrochemical subsidiary of oil giant BP Plc, Innovene

Inc., said late on Monday it was planning a U.S. initial public

offering (IPO)

to raise $1 billion.

The filing with the U.S. Securities and Exchange Commission also

follows Innovene's deal earlier this year to build a $2 billion plastics plant in

Saudi Arabia

in a move to orient the unit toward fast-growing Asian markets.

On Aug. 28, the Times of India said Reliance

Industries, flagship of the Ambani family's Reliance group and

India's largest company, may be close to launching a bid for an unnamed business that bore

a close resemblance to Innovene.

"If Reliance is serious about Innovene, then they should be

moving in quickly. If you wait for the company to get listed then

it would bring about a lot more legal formalities and even

valuations could go higher," Sharma said.

BP Confirms Plans for

Second Zhuhai PTA Plant

http://www.bp.com/genericarticle.do?categoryId=2012968&contentId=7009855

BP is planning a second

world-scale PTA (purified terephthalic acid) plant at their BP Zhuhai

Chemical Company Limited (BP Zhuhai) site in Guangdong

Province, China.

BP Zhuhai, a joint venture between BP (85 per cent) and Fu Hua

Group (15 per cent), currently operates a 350,000 tonnes a year

PTA plant at the site and will also own and operate the new

plant. 富華集団

The new plant, with

a capacity of 900,000 tonnes a year, will be the first to

employ BP’s latest generation PTA technology

and, subject

to final approval from the Chinese Government, is expected to

come on stream at the end of 2007 to meet PTA demand growth in

China.

Notes to editors

| * | PTA is the preferred raw material used to manufacture polyethylene terephthalate, a widely used polyester polymer for the production of textiles, bottles, packaging and film products. In China, 90 per cent of PTA production is used in the textile industry. Government statistics show that China’s PTA consumption in 2004 exceeded 10 million tonnes, of which only around 40 per cent was supplied by domestic production. |

| * | BP Zhuhai was formed as a joint venture between BP and Fu Hua in 1997. The venture’s first PTA plant, with initial capacity of 350,000 tonnes a year (tpa), began production in 2003 and has the capability to expand to 500,000 tpa. The site’s combined PTA production capacity after the completion of the new plant will be more than 1.2 million tpa, confirming Zhuhai as one of the major PTA production centres in China. |

| * | BP has been a leader in PTA for over 30 years, with a global market share of 21 per cent on an equity basis (or 31 per cent including joint ventures). BP operates 21 PTA plants located in Asia, the Americas and Europe with a total combined annual production capacity of more than 9 million tonnes. |

| * | BP is one of the world’s largest oil, gas and petrochemicals groups, generating 2004 profits of over $16 billion and revenues of over $280 billion. BP employs about 103,000 people worldwide and has activities in more than 100 countries. The company is one of the leading foreign investors in China, having invested over $3 billion in commercial projects in the country. Its activities in China include production and importation of natural gas, supply of aviation fuel, import and marketing of LPG, fuels retailing, lubricants blending and sales, and petrochemical manufacturing. BP employs over 3,000 staff in China, either directly or through joint ventures. |

| * | Fu Hua Group Ltd was established in 1986 and became the first Zhuhai company to be listed on the Shen Zhen Exchange in the People’s Republic of China in 1993 with a registered capital of 345 million RMB and total assets of 1.2 billion RMB. Fu Hua Group, the former Fu Hua Polyester Fibre Plant, has been developed into a comprehensive enterprise group with main activities in the fields of harbour transportation, real estate development, import and export, pharmaceutical production and distribution. |

日本経済新聞 2005/10/14

BP、中国石油大手と提携交渉

英系メジャー(国際石油資本)のBPと中国の中国石油化工集団(シノペック)が提携交渉に入ったと、英フィナンシャル・タイムズ紙などが13日に報じた。同紙やロイター通信によると、BPが海外で持つ油田権益と交換に、シノペックの株式を取得することが提携の柱になるという。

Reuters 2005/10/13

BP in Talks Over China Partnership - FT

http://today.reuters.com/news/newsArticleSearch.aspx?storyID=132613+13-Oct-2005+RTRS&srch=bpBritain's BP Plc has held talks with Chinese officials over a possible partnership with top oil refiner Sinopec Corp., the Financial Times reported on Thursday.

A partnership with Sinopec, China's largest refiner and marketer, would give BP unparalleled access to the most important growing market in the world, the report said.

Sinopec would benefit from BP's upstream exploration activities, according to the FT.

Financial times 2005/10/13

LORD BROWNE LINES UP ANOTHER AUDACIOUS DEAL FOR OIL MAJOR

News that Lord Browne is negotiating a big deal with China's Sinopec will come as no surprise to observers of his decade-long tenure as chief executive, writes Thomas Catan in London. Lord Browne, 57, has come to be known for his audacious takeovers of companies around the world, which saw BP emerge as the second-largest publicly traded oil company in the world.

ジョン・ブラウン卿 BP p.l.c.グループ最高経営責任者。

2006/3/20 BP

Restatement of

historical results following 2006 resegmentation.

http://www.bp.com/sectiongenericarticle.do?categoryId=2012027&contentId=2017688

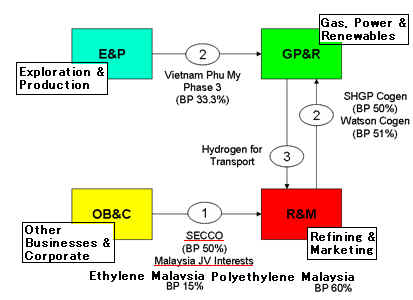

Following the launch of BP Alternative Energy in November 2005 and the sale of Innovene to INEOS in December 2005, certain assets have been transferred between segments to reflect the operational structure of the Group. These transfers are effective from 1 January 2006. Financial information for 2005 and 2004 has been restated to reflect these transfers.

| Summary of the 2006 asset transfers: | |

| 1. | following the sale of Innovene to INEOS, the SECCO and Malaysia JV interests, previously held in other businesses and corporate (OB&C) are transferred to refining and marketing (R&M) |

| 2. | the formation of BP alternative energy has resulted in the transfer of certain mid-stream assets and activities to gas, power and renewables (GP&R): |

| ・South Houston green power

(SHGP) cogeneration facility (Cogen) (in Texas City

refinery) from R&M ・Watson Cogen (in Carson refinery) from R&M ・Phu My phase 3 in Vietnam from exploration and production (E&P) |

|

| 3. | transfer of hydrogen for transport from GP&R to R&M |

These three transfers are

illustrated below:

| Descriptions of the transferred assets: | ||

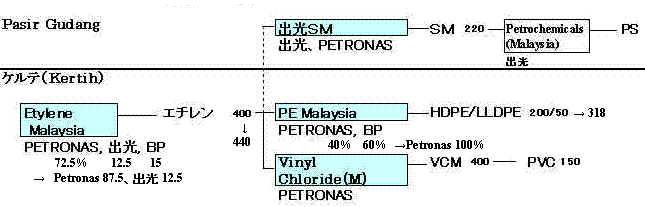

| ・ | Shanghai Ethylene Cracker Complex (SECCO) is an integrated olefins and derivatives site with a 900kte Ethylene cracker and a number of downstream derivative facilities. It is a JV between BP (50%), Sinopec (30%) and Sinopec Shanghai Petrochemical Company (20%). The site commenced operation in 2005 | |

| ・ | Malaysia Interests comprise: | |

| a | 430 kte Ethylene cracker through the Ethylene Malaysia Sdn. Bhd. (EMSB) associated undertaking between BP (15%), Petronas (72.5%) and Indemitsu (12.5%); and | |

| b | 310 kte Polyethylene cracker through the Polyethylene Malaysia Sdn. Bhd. (PEMSB) associated undertaking between BP (60%) and Petronas (40%) | |

| ・ | Watson Cogen in the Carson refinery is a 410MW cogeneration facility providing steam and power to BP's Carson refinery in Los Angeles, CA. (and to third parties). The cogen plant is jointly owned by BP (51%) and Edison-Mission (49%) and first entered operation in the mid-1980s | |

| ・ | South Houston Green Power (SHGP) Cogen in the Texas City refinery is a 700MW cogeneration facility supplying steam and power to BP's Texas City refinery in Texas (and to third parties). The cogen plant is a JV between BP (50%) and Cinergy (50%) and first entered commercial operation in 2004 | |

| ・ | Phu My phase 3 is a 720MW gas-fired CCGT located in Vietnam. The plant is an Equity Accounted associated undertaking between BP (33.3%), Semcorp (33.3%) and Kyushu Electric (33.3%). The plant began commercial operation in 2003 | |

| ・ | the Hydrogen for Transport team participates in demonstration projects across Europe, Asia and the US, in partnership with both governments and auto manufacturers. BP provides the infrastructure for these projects through hydrogen refuelling stations | |

2006/4/12 BP

BP Expanding European PTA and Paraxylene Production

http://www.bp.com/genericarticle.do?categoryId=2012968&contentId=7016994

BP today confirmed that

it is proceeding with its project for a major increase in purified

terephthalic acid (PTA) production capacity at its Geel,

Belgium, plant and also announced that it has recently completed

a significant increase in the plant's paraxylene (PX) production capacity.

The planned debottleneck of PTA production at Geel will increase

capacity by more than 350,000 tonnes a year, making the total PTA

production capacity of the Geel site some 1.4 million

tonnes a

year.

As well as expanding PTA production capacity, application of the

latest advances in BP's proprietary paraxylene production technology to Geel’s PX unit in 2005 has now

increased capacity of the unit to 560,000 tonnes

a year -

over 30 per cent higher than the original design capacity of the

unit, commissioned in 2000. The use of BP's PX crystallisation

technology has made the plant one of the most energy-efficient PX

plants now operating.

BP has been a leader in PTA for over 30 years, with a strong

record of growth and innovation in this business. BP has a global

PTA production capacity share of 21 per cent on an equity basis

(or 31 per cent including joint ventures). BP operates 21 PTA

plants located in Asia, the Americas and Europe with a total

combined annual production capacity of more than 9 million

tonnes.

BP is also a leader in the PX Business with a global production capacity

share of 11%. BP's PX assets are in the Americas and Europe with

a total combined annual production capacity of 2.9 million

tonnes.

Geel

(Belgium) is

the integrated production site for BP's PTA and PX manufacturing

in Europe. Its annual production capacity for PTA & PX has

grown from 300.000 to 1.4 million tonnes over the timespan of a

decade. Cost effective rail and road connections reach all major

European markets, and make the site very attractive in terms of

logistics. The Geel site is also advantaged as part of BP's

extensive PTA & PX technology and manufacturing networks,

contributing to developments on safe, reliable and cost &

energy effective manufacturing.

BP produces PTA from plants in the US, Belgium, Brazil, Korea, Indonesia, China, Malaysia and Taiwan. We successfully commissioned our latest PTA production units in early 2003. These are the Zhuhai joint venture in southern China with capacity of 350,000 tonnes a year and the sixth train at our CAPCO joint venture in Taiwan with capacity of 700,000 tonnes a year.

26 September 2005

BP Zhuhai, a joint venture between BP (85 per cent) and Fu Hua Group (15 per cent), currently operates a 350,000 tonnes a year PTA plant at the site and will also own and operate the new plant.

The new plant, with a capacity of 900,000 tonnes a year, will be the first to employ BP's latest generation PTA technology and, subject to final approval from the Chinese Government, is expected to come on stream at the end of 2007 to meet PTA demand growth in China.

The purified terephthalic acid (PTA) plant is located in the State of Pahang on the east coast of the Malaysia peninsula, 25 km from Kuantan town. This BP wholly owned unit began production in 1996 with an annual PTA capacity of 600,000 tons.

07 May 2003

BP announced today that it has increased its interests in its Taiwanese and Korean PTA joint ventures. BP now owns 59.02% of China American Petrochemical Company (CAPCO) in Taiwan and 47.41% of Samsung Petrochemical Company (SPC) in Korea. As a result of the two deals, BP's equity PTA capacity in Asia has increased by 14% to around three million tonnes a year.

CAPCO is the largest producer of PTA in Asia operating six production units with a total capacity of 2.1 million tonnes per annum. BP acquired the incremental 9.02% interest in CAPCO from Central Investment Holding Company (CIHC). As a result, BP now controls 59.02% of the equity in CAPCO while Chinese Petroleum Corporation and CIHC retain 25.00% and 15.98% respectively.SPC is the third largest producer of PTA in Asia operating four PTA units in Korea to produce a total of 1.4 million tonnes per annum. BP and SPC recently completed a number of transactions with minority shareholders of SPC increasing BP's ownership of SPC from 35% to 47.41%. BP's ownership of SPC is now equal with Samsung's.

BP participates in a joint venture in PT Amoco Mitsui (PT AMI) to produce purified terephthalic acid (PTA) in Indonesia. PTA is the preferred intermediate used in the manufacture of polyester resin for fibres, films, and packaging. Our partners (and equity) in this PTA joint venture are BP (50%), Mitsui Chemicals (MCI 45%), and MBK 5%. This venture headquarter is located in Jakarta while the plant is situated in Merak. The plant started up in August 1997 with an annual production capacity of 350,000 tons of PTA.

The Cooper River plant, about 25 minutes north of Charleston, South Carolina, is home to the worlds largest single purified terephthalic acid (PTA) unit. PTA is the preferred intermediate used in the manufacture of polyester resin for fibers, films, and packaging. This facility, located on a 5000 acre site, has two production units which combine to manufacture approximately 2.8 billion pounds of PTA per year as well as associated shipping, utility, and waste treatment facilities. The product is sold both domestically and internationally by rail hopper cars and bulk sea containers.

Rhodiaco Indústrias Químicas in Paulínia, São Paulo, Brazil, is a joint venture between BP (49%) and Rhodia-Ster/M&G (51%).The 250,000 tons per year plant is the only South American manufacturer of purified terephthalic acid (PTA). PTA is the preferred intermediate used in the manufacture of polyester resin for fibers, films, and packaging.

2006/7/18 BP

BP to Market Share of SPC in Korea

BP announced today that it has decided to pursue a sale of its

47.41% equity interest in Samsung Petrochemical Co., Ltd.

(SPC), its

joint venture with Samsung located in South Korea. SPC is one of

the leading producers of purified terephthalic acid (PTA) in Asia

with a total production capacity in excess of 1.8 million tonnes

per year. PTA is the preferred raw material used to manufacture

polyester.

Dave Miller, president of BP's global PTA business said,"SPC

is an excellent business with a solid performance track record

and is well-positioned for continued growth. BP and Samsung

however have different views of SPC's future strategy and BP believes if it is able to

achieve an appropriate price, exiting is in the best interest of

SPC and its shareholders.

Note to editors

SPC

is currently owned by BP (47.41%), Samsung (47.41%) and Shinsegae

(5.18%). It

is staffed by Samsung personnel, headquartered in Seoul and

operates four PTA plants on two separate sites; Ulsan

Petrochemical Complex (approximately 400 km from Seoul) and

Daesan Petrochemical Complex (approximately 145 km from Seoul and

400 km from China) with a total production capacity in excess of 1.8 million tonnes

per year).

* Ulsan 1,100千トン、Daesan 700千トン

BP has enjoyed more than 30 years of success in South Korea and remains fully committed to the country. BP's other activities in South Korea - Samsung BP Chemicals, Asian Acetyls, K-Power, lubricants and shipping - are unaffected by the decision to exit SPC.

In the power sector, we acquired a 35% stake in K-Power, which is a joint venture with SK Corp (65%) to build and operate a 1,074 MW power plant. The plant is located at POSCO’s LNG terminal, enjoying competitive LNG prices as well as technological benefits. It is scheduled to start full operation by July 2006 and will be the first merchant plant in Korea

The BP group began marketing lubricants here in 1977. We now operate a blending facility (opened by Castrol in 1989), which has a capacity of 65,000 mtpa. We market automotive lubricants primarily through the Castrol brand. We have also supplied high quality industrial lubricants - metal working fluid and general industrial oils- to most industries since 1984, including Hyundai/Kia Motors and POSCO. Our International Marine team provides bunkers and lubricants at ports worldwide to major Korean shipping customers. We have a dedicated third-party marine lubricant blender in Busan, supplying around 30,000 KL a year to contracted vessels, including those newly built.

BP Shipping has been building ships in Korea since 1997.

BP

Agrees Major Exploration and Production Deal with Libya

BP's single biggest exploration

commitment," says BP group chief executive.

BP and its Libyan partner, the Libya Investment Corporation

(LIC), today signed a major exploration and production agreement

with Libya's National Oil Company (NOC). The initial exploration

commitment is set at a minimum of $900million, with significant

additional appraisal and development expenditures upon

exploration success.

日本経済新聞 2007/6/23

BP、ロシアのガス田売却 ガスプロムに 事業の独占進む

Kovykta project Gazprom

石油メジャーの英BPは22日、ロシアの合弁会社が保有する東シベリアのコビクタ・ガス田などの権益をロシア政府系エネルギー会社、ガスプロムに売却し、同ガス田の開発から撤退する、と発表した。

政府の撤退圧力に譲歩

権益を手放したのは2003年にロシア石油大手と合弁で設立したTNK-BP。同社は1兆9千億立方メートルの世界有数の埋蔵量を持つコビクタ・ガス田の権益(62.9%分)とガスの輸送・販売会社、東シベリアガスの株式の50%をガスプロムに譲渡する。売却額は7億−9億ドル(約870億ー1100億円)。

BP側は当初、コビクタから中国などアジア向けに輸出する予定だったが、輸送網を独占するガスプロムに阻止され、増産できない状態に陥っていた。

| パイプライン計画 |

|

22 June

2007 BP

BP and TNK-BP Plan Strategic

Alliance with Gazprom as TNK-BP Sells its Stake in Kovykta Gas

Field

BP and TNK-BP today announced that

they have signed a memorandum of understanding to create

a strategic alliance with the Russian gas giant, Gazprom, to

invest jointly in major long-term energy projects or swap assets

around the world.

Under the terms of the agreement

signed by all parties, TNK-BP agreed to sell

Gazprom its 62.89 per cent stake in Rusia Petroleum, the

company which holds the licence for the Kovykta

gas field in East Siberia. It will also sell its 50 per

cent interest in East Siberian Gas Company (ESGCo), the

company constructing the regional gasification project.

| TNK-BP is the

major shareholder of RUSIA Petroleum; besides, Interros

and the Irkutsk Region Administration are among the

company''s shareholders. Interros is a major Russian private investment company. TNK-BP owns and operates five refineries (four in Russia and one in Ukraine) and has a retail network of approximately 1,600 sites spread across Central Russia and Ukraine, with a particularly strong position in the Moscow market. |

Gazprom

will pay between $700-$900 million, subject to adjustments, for

TNK-BP's interests in Rusia and ESGCo.

Notes to editors:

Gazprom is

Russia's largest company and the world's largest producer of

natural gas. It holds about one quarter of total world gas

reserves. Gazprom exports gas to 32 countries within and beyond

the FSU. In 2005 the company sold 156.1 billion cubic metres of

gas to European countries and with 76.6 billion cubic metres to

the CIS and Baltic states.

TNK-BP is the

third largest oil company in Russia. In 2006 it produced 1.9

million barrels of oil equivalent a day. It is owned and managed

jointly by BP and Alfa Access Renova group.

The Kovykta gas field is located

some 450 kilometres from the city of Irkutsk in the north of the

Irkutsk region of Eastern Siberia. It has estimated resources of

approximately 2 trillion cubic metres of gas in place.

On

September 1, 2003, BP, one of the largest international oil

companies, and Alfa Access Renova (AAR) announced the

creation of a strategic partnership to jointly hold their oil

assets in Russia and Ukraine. As a result, TNK-BP was created.

Today, TNK-BP is Russia’s third largest

oil company in terms of reserves and crude oil production.

BP and AAR each own an equal interest in TNK-BP. AAR contributed

its holdings in TNK International, Onaco and Sidanco, its share

in RUSIA Petroleum (which holds licenses for the Kovykta gas

condensate deposit and the Verkhnechonsk oil and gas deposit),

its stake in the Rospan gas field in West Siberia (the New

Urengoy and East Urengoy deposits).

BP contributed its holding in Sidanco, its stake in RUSIA

Petroleum and its BP Moscow retail network. In January 2004, BP

and AAR reached an agreement to incorporate AAR’s 50% stake in Slavneft into

TNK-BP. Slavneft, which has operations in Russia and Belarus, was

previously owned jointly by AAR and Sibneft. Under the

transaction terms, BP is committing cash as well as its own

shares as future payments.

The independent audit conducted by DeGolyer and MacNaughton

confirmed that as of December 31st 2006, TNK-BP’s total proved reserves were 7.810

bn bbls or 1.0 bn tons of oil equivalent on a SEC (US Securities

and Exchange Commission) life-of-field basis; 8.949 bn bbls or

1.19 bn tons of oil equivalent on a SPE (Society of Petroleum

Engineers) basis.

In 2004, the company produced approximately 72 mmtpa of oil or

1.47 mmbd, in 2005 ? 75 mmtpa or 1.58 mmbd. TNK-BP’s principal refining assets are

located in Ryazan (near Moscow), Nizhnevartovsk (West Siberia),

Nyagan (Khanty-Mansiysk), Saratov (Saratov region) and Lisichansk

in Ukraine. Throughput in 2005 totaled 632 kbd or 30.89 mmtpa.

The company’s retail network

includes approximately 1,600 filling stations located primarily

in Central European Russia and in Ukraine.

In the near future, TNK will further develop its asset base in

Russia and the CIS, pursue an aggressive production growth

strategy through broader use of technology across the business,

expand its operations in East Siberia, add reserves to its

portfolio and pursue new strategic projects.

TNK-BP’s five-year

strategy aims at enhancing the company’s long-term value. While the

company is implementing an aggressive short-term plan, it

continues to invest in large-scale and longer-term projects. This

strategy will help create the underlying conditions for

sustainable growth and profitability in the period beyond the

company’s five-year

horizon.

http://oilresearch.jogmec.go.jp/glossary/english/t.html#22115-1

ロシアのTNK(チュメニオイル)とイギリスのBP(ブリティッシュ・ペトロリアム)が折半出資する民間石油企業。

上流部門から下流部門まで一貫操業を行ない、生産子会社15社、精製子会社5社(うちロシア国内は4社)、販売子会社11社を保有する。

2005年における同社の原油生産量は7,460万トン(国内シェア15.5%)、精製能力は69万B/D(3,450万トン/年)であった。TNKはロシアの金融資本アルファグループに属する財閥系企業で、1995年に西シベリアのハンティ・マンシ自治管区の強い要請で100%ロシア国営企業として発足した。1997年、1999年に政府株は公開され、AAR(アルファグループ(Alfa Group)と米国のAccess-RENOVAの折半出資企業)が買い取った。

TNKはかつて年産2,000万トン前後の中堅石油企業であったが、大規模な方向転換(経費削減の強化、垂直統合、生産・精製資産への資本投資、生産会社の吸収合併、破産法を利用した企業買収)を行い、年産4,000万トンまで拡大した。

チュメニオイルは、オナコ(Onako)、コンドペトロリアム(Kondopetroleum)、シダンコ(Sidanko)などを買収したほか、2002年末にはシブネフチ(Sibneft)と折半出資でスラブネフチ(Slavneft)株式74.95%を18.6億ドルで落札したが、2006年6月現在、スラブネフチ資産の分割は行われておらず、TNK-BPとガスプロムネフチによる同社資産の共同経営が続いている。

2003年2月、TNKとBPは折半出資で新会社「TNK-BP」を設立すると発表し、2003年8月にTNK-BPは政府に設立が認められた。Access IndustriesはLen Blavatnik が設立し、所有する投資会社である。

Len Blavatnikは本年49歳、ロシアで生まれ、21歳の時に米国に移住し米国籍をとった。ハーバードビジネススクールのMBAを取り、1986年にAccess Industriesを設立した。

その後、ロシアの友人及びロシアの富豪と組んで Tyumen Oil Co. (TNK) を設立、更にBPとTNKの合弁で2003年にTNK-BP を設立した。

TNK-BP は現在ロシア第二の石油会社で西シベリア、ボルガーウラル地区、東シベリア、樺太等で石油の採掘をしており、ロシアとウクライナに5つの製油所を所有している。

http://www.knak.jp/blog/2006-6-2.htm#basellアルファ・グループ・コンソーシアム(アリファ・グループ、Alfa Group)は、ロシアの新興財閥。ロシア最大の金融産業コングロマリットのひとつ。中心企業であるアルファ銀行に代表される商業及び投資銀行業の他、石油及びガス、消費財取引、保険業、小売業と電気通信分野などグループ企業は広範である。 アルファ・グループの総帥は、オリガルヒのひとりでもあるミハイル・フリードマンと、ロシア連邦対外経済関係相などを務めた後、実業界に転身したピョートル・アーヴェン(ピョートル・アベン)である。1988年にフリードマンが設立したトレーディング・カンパニー、アルファ・エコAlfa-Ecoが最初で業務を拡大していった。本社はモスクワにある。

Renova Holding は、ロシア経済を背景とするベンチャーキャピタル

会長Viktor Feliksovich VEKSELBERG ヴェクセルベルク氏の個人資産はおよそ81億フラン ( 約7800億円 ) で、ロシアの長者番付では第5位。石油とアルミで財をなした。プーチン大統領とも顔見知りだ。現在はチューリヒに豪華なマンションを購入して住んでいる。2003年2月

・BPとAlfa group & Access/Renovaが合弁会社設立へ

英BPとロシアの持株会社 Alfa group とAccess/Renova は、合弁石油会社を設 立する意向を明らかにした。

"Alfa group" と "Access/Renova"は、現在保有している石油大手TNK株97%と シダンコ株56%を新会社に委譲する。また、両社が取得しているサハリン4、サハリン 5プロジェクトの事業権益も新会社に移る予定。

一方、BPは新会社に、現在保有しているシダンコ株25%、サハリン5の事業権益、モスクワのガソリンスタンドを委譲する。

BPの新合弁会社への投資額は67億5,000万米ドル。同社は、契約締結後30億米ドルを直接投資。その後年間12億5,000万米ドル分の自社株を3年間、"Alfa group" と "Access/Renova"に譲渡する。

新会社への出資比率は、BPが50%、"Alfa group" と"Access/Renova"が50%。 契約が締結されるのは今年夏になる予定だ。

BP

2007/6/27

BP, ABF and DuPont Unveil $400

Million Investment in UK Biofuels

The wide spread availability of

biofuels in the UK took a major step forward today as BP,

Associated British Foods (ABF) and DuPont

announced major investment plans, totalling around $400 million,

for the construction of a world scale bioethanol

plant alongside a high technology

demonstration plant to advance development work on the next

generation of biofuels.

The bioethanol plant, in which BP

and ABF subsidiary British Sugar would

each hold 45 per cent with DuPont owning the remaining 10 per

cent, will be built on BP's existing chemicals site at Saltend,

Hull. Due to be commissioned in late 2009, it will have an annual

production capacity of some 420 million litres from

wheat feedstock.

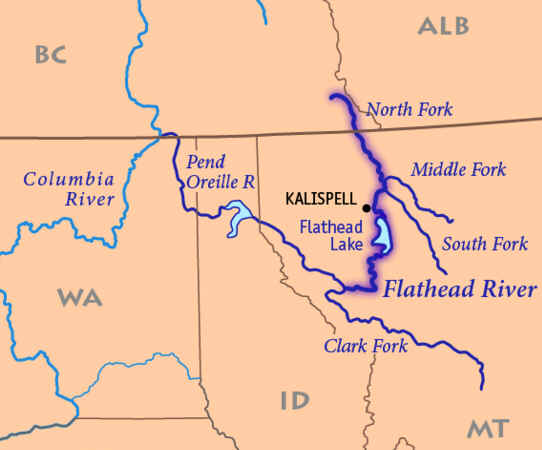

BP Formalizes Coal-Bed Methane Plans

The coal-bed methane

exploration that British Petroleum has talked about undertaking

in southeastern British Columbia, to the alarm of some Montana

officials, is now a formal proposal.

BP would be required to inject into the ground the water brought forth in coal-bed methane work, Eichenberger said Wednesday at a meeting of the Flathead Basin Commission, which is charged with monitoring Flathead water quality and working to safeguard it.

ーーー

Methane from coalbed reservoirs can be recovered economically, but disposal of water is an environmental concern.

Most gas in coal is stored on the internal surfaces of organic matter. Because of its large internal surface area, coal stores 6 to 7 times more gas than the equivalent rock volume of a conventional gas reservoir. Gas content generally increases with coal rank, with depth of burial of the coalbed, and with reservoir pressure. Fractures, or cleats, that permeate coalbeds are usually filled with water; the deeper the coalbed, the less water is present, but the more saline it becomes. In order for gas to be released from the coal, its partial pressure must be reduced, and this is accomplished by removing water from the coalbed. Large amounts of water, sometimes saline, are produced from coalbed methane wells, especially in the early stages of production.

While economic quantities

of methane can be produced, water disposal options that are

environmentally acceptable and yet economically feasible, are a

concern.

Water may be discharged on the surface if it is relatively fresh,

but often it is injected into rock at a depth where the quality

of the injected water is less than that of the host rock. Another

alternative, not yet attempted, is to evaporate the water and

collect the potentially saleable solid residues; this scheme

might be feasible in regions having high evaporation rates.

June 29 2007 BP BP's answer to food-based ethanol

BP、D1オイルズ、合弁企業設立へ

−バイオディーゼル原料ヤトロファ(Jatropha)を開発−

BPとD1オイルズは29日、50%ずつの出資で、D1-BP

Fuel Crops Limitedという合弁企業を設立し、ヤトロファ

jatropha の栽培を推進すると発表しました。ヤトロファは、食用には適さない油種のできる干ばつに強い木です。肥沃な農地を食用作物から奪うこともなく、熱帯雨林への悪影響もありません。より持続可能なバイオディーゼル原料をより広範囲で確保することが狙いです。

「輸送部門では、複数のバイオ原料の混合が、数少ない現実的な前進のための選択肢の1つになっています。BPは今週、英国ハル市に世界規模のバイオエタノール工場を、バイオブタノール実証工場に隣接して建設する計画を発表し、ガソリンに代わるバイオ燃料の幅広い供給が現実に一歩近づきました。今回の合弁企業は、バイオディーゼルの世界で同様の進歩を可能にすることでしょう。」

合弁企業は主に東南アジア、アフリカ南部、中南米、インドを中心に、ヤトロファを栽培していきます。今後4年間で、100万ヘクタールに作付けが行われると見込まれています。その後の作付けは、年間30万ヘクタールと推定されています。

プランテーションで栽培したヤトロファ油は、地元のバイオディーセルの需要を満たすだけでなく、欧州などの海外市場向けにも利用されるでしょう。今後予想される環境規制の強化によって、バイオ燃料需要は2010年以降、年間約1,100万トンと見込まれており、国内の菜種油や廃油では賄いきれなくなることが予想されるからです。

編集者への注記:

Oil Yield (ton/ha/yr)

Yield Palm oil (Malaysia) 3.75 Rapeseed (EU) 1.33 Soyabean (USA) 0.46 Sunflower (Argentina) 0.66 Jatropha 1.44 MPOB マレーシアパームオイル委員会

September 7 2007 Fortune Magazine

BP's answer to food-based

ethanol

The oil giant believes an inedible plant called jatropha can ease

global fuel demands. It could boost incomes in Africa and other

impoverished regions too.

Can a poisonous plant become a biodiesel hero and help African

economies in the process?

BP thinks so. It believes jatropha - an inedible plant used for

hedges that was spread around the world centuries ago by

Portuguese sailors - can dent global fuel demands without using

up foodstuffs such as corn, soy and sugar cane, plus boost

incomes in Africa and other impoverished regions.

BP Reinforces its Commitment to China

BP announced today during a ceremony in the Great Hall of People in Beijing that it had signed a series of agreements to enhance its commitment to China. These agreements involve strategic integration and commercialisation of clean coal conversion technologies, wind power generation and world-class acetic acid production.

Clean

Energy Commercialisation Centre

BP and the China Academy of Sciences (CAS) signed an agreement to undertake

a feasibility study into a proposed Clean Energy

Commercialization Centre (CECC) joint venture. This represents a

major step forward following the signing of a Memorandum of

Understanding in Shanghai last August.

Under the agreement, CECC is intended to integrate individual

clean energy related technologies - coal gasification,

coal to liquids, coal to chemical, carbon capture and storage,

coal bed methane and underground gasification - from CAS institutes and other

organizations both within and outside the PRC, into competitive

integrated feedstock manufacturing and product distribution

systems and solutions such as polygeneration complexes. The CECC

would also serve as an international platform to foster

collaboration among research institutes, enterprises and other

institutions to improve indigenous Chinese innovation

capabilities and market applications in areas such as clean coal

conversion, zero emission and carbon capture and storage.

Wind

Power

BP signed a framework agreement with Beijing Tianrun

New Energy Investment Co., a subsidiary of Goldwind Science

and Technology Co., Ltd., with the intention of jointly

investing, constructing, and operating three 49.5 megawatt wind

power plants near Bayan Obo in Inner Mongolia. The two parties

have also agreed to explore further wind power investment

opportunities in other areas of Inner Mongolia.

Acetic

Acid

BP and Sinopec signed a Memorandum of Understanding to add a new 650k tonnes

acetic acid plant at their YARACO joint Venture in Chongqing, upstream Yangtze

River, Southwest China. This marks another major milestone in

strengthening the existing partnership in acetic acid production

and follows on from the successful investment in Yangtze River

Acetyls Company (YARACO) in Chongqing, and in the BP Yangtze

Petrochemicals Acetyls Company (BYACO) in Nanjing.

中国の酢酸の需給状況は以下の通り。(単位:千トン)

生産 輸入 輸出 消費 2001 860 200 - 1,060 2002 840 350 - 1,190 2003 947 500 - 1,447 2004 1,152 525 16 1,661 2005 1,370 542 35 1,877 2006 1,438 707 28 2,117 2007 1,628 499 138 1,989

BP and AAR Move to

Resolve Joint-Venture Dispute

An overhaul of the governance structure of Russia's third largest

oil company, TNK-BP, has been agreed in principle by

the two main owners, BP and Alfa Access-Renova (AAR). The aim is to better align their

respective interests and improve the transparency of TNK-BP's

equity.

Alfa Access Renova は3社の連合。 ・ Alfa Group は、ロシアの新興財閥で、ロシア最大の金融産業コングロマリットのひとつ。中心のアルファ銀行のほか、石油及びガス、消費財取引、保険業、小売業と電気通信分野などグループ企業は広範である。 ・ Access Industries はロシア生まれの Len Blavatnik が設立し所有する米国の投資会社で、Basellを買収した。

Len Blavatnik はLyondell Chemical の株式を購入し、話題となっている。

参考 2006/6/15 Basellの買収

2007/5/16 Access Industries の会長、Lyondell Chemical の株式を購入・ Renova Holding はロシアの長者番付では第5位のViktor Feliksovich Vekselberg の所有するベンチャーキャピタル。

A memorandum of understanding (MOU) signed today and due to be finalised in detail over the coming months, envisages the re-structuring of the TNK-BP board through the appointment of three new directors independent of either side.

JOGMEC 2008年8月20日 ロシア:TNK-BPの株主間抗争とその背景

AAR(Alfa-Access/Renova)とは? BPに対するAAR側の不満 |

2008/9/4 共同

英BP系最高経営責任者が辞任へ 合弁石油、ロシア圧力に譲歩

国際石油資本(メジャー)の英BPは4日、ロシア側株主との対立で経営が混乱している合弁企業TNK−BPについて、BP出身のダドリー最高経営責任者(CEO)の年内辞任などでロシア側と合意し、覚書に署名したと発表した。

後任には独立系のCEOを選ぶとしており、BPの主導権を崩そうとするロシア側株主にBPが譲歩をした形となった。

新CEOはBPが指名、取締役会が承認する。ロシア語を話し、ロシアでのビジネス経験が豊富との条件も付けた。取締役会はBPとロシア側の4人ずつのほか、新たに双方と関係のない社外取締役3人を加える。

TNK−BPはロシア第3の石油企業で、BPとロシア側が折半出資。ロシア側株主はダドリーCEOの辞任を要求、ロシア当局が脱税容疑などの捜査で圧力を加え、7月にはダドリー氏はロシアを出国していた。

英BP ロシア側株主に譲歩

折半出資石油会社 経営問題で和解 CEO退任容認石油メジャーの英BPは4日、折半出資するロシア石油大手TNK-BPの経営問題で、ロシア側,株主と和解したと発表した。ロシア側が求めていたダドリー最高経営責任者(CEO)の退任を容認するなどBPが譲歩した。将来的にロシア側が経営権の取得などを追加要求する可能性はなお残っている。

BPとロシア側株主は同日、基本合意書を交わした。TNK-BP経営陣の承認を前提にBPが新CEOを任命することに加え、経営委員会メンバーを現行の14人から大幅に削減することなどを含む。いずれもBPの影響力を大幅に低下させかねない内容だ。

TNK-BPは折半出資だが、CEOの任命権をBPが持ち、多くの経営幹部や技術者がBP出身であるなど、BP主導で運営してきた。だが、投資政策などを巡ってBP側とロシア側の対立が先鋭化し、ロシア側はBP出身のダドリーCEOの辞任を強硬に要求。その後、ロシア司法当局がダドリー氏の就労ビザ更新を認めなかったため、ダドリー氏は出国を余儀なくされ、ロシア国外から経営にあたる異例の事態となっていた。

TNK-BPは、BPの全原油・ガス生産の4分の1を占める。BP本体への影響も大きいため、ヘイワードCEOは7月下旬のダドリーCEOの出国に際し「問題を解決するためにあらゆる方策を検討する」と徹底抗戦の構えを見せていた。----

TNK-BP is a leading Russian oil company and is among the top ten privately-owned oil companies in the world in terms of crude oil production. The company was formed in 2003 as a result of the merger of BP’s Russian oil and gas assets and the oil and gas assets of Alfa, Access/Renova group (AAR). BP and AAR each own 50% of TNK-BP. The shareholders of TNK-BP also own close to 50% of Slavneft, a vertically integrated Russian oil company.

TNK-BP is a vertically integrated oil company with a diversified upstream and downstream portfolio in Russia and Ukraine. The company’s upstream operations are located primarily in West Siberia (Khanty-Mansiysk and Yamalo-Nenets Autonomous Districts, Tyumen Region), East Siberia (Irkutsk Region), and Volga-Urals (Orenburg Region). In 2007 the company produced on average 1.6 mboed. Including its 50% share in Slavneft, average production was 1.8 mboed.

Under PRMS (formerly SPE) criteria, Total Proved Reserves were 9.982 bn bbl of oil equivalent. This represents a Total Proved PMRS reserves replacement ratio of 297%.

TNK-BP controls 675 thousand bbl/day in installed refining capacity, with principal refining assets located in Ryazan (near Moscow), Saratov (Volga-Urals), Nizhnevartovsk (West Siberia) and Lisichansk in Ukraine.

TNK-BP operates a retail network of approximately 1,600 filling stations Russia and Ukraine working under the BP and TNK brands. The company is one of the key suppliers to the Moscow retail market and is a market leader in Ukraine.

TNK-BP is headquartered in Moscow and is governed by a multinational management team with experience of working in over 50 different countries. A blend of the best international and Russian talent ensures accelerated introduction of world-class technology, project management, corporate governance and best Health, Safety and Environment practices.

TNK-BP employs approximately 65,000 people, mostly located in eight major areas of Russia and Ukraine.

-------On 1 September 2003, BP and Alfa, Access, Renova (AAR) announced the creation of a strategic partnership to jointly hold their oil assets in Russia and Ukraine. As a result, TNK-BP was created. Today, TNK-BP is Russia’s third largest oil company (after Rosneft and Lukoil) in terms of reserves and crude oil production.

BP and AAR each own an equal interest in TNK-BP. AAR contributed its holdings in TNK International, ONAKO and SIDANCO, its share in RUSIA Petroleum (which holds licenses for the Kovykta gas condensate deposit and the Verkhnechonsk oil and gas deposit), its stake in the Rospan gas field in West Siberia (the New Urengoy and East Urengoy deposits).

BP contributed its holding in SIDANCO, its stake in RUSIA Petroleum and its BP Moscow retail network. In January 2004, BP and AAR reached an agreement to incorporate AAR’s 50% stake in Slavneft into TNK-BP. Slavneft, which has operations in Russia and Belarus, was previously owned jointly by AAR and Sibneft (now Gazprom Neft).

Since 2003, TNK-BP has significantly increased production by almost 250% on a barrel of oil equivalent basis (adjusted for divestments of assets) - from close to 1.3 mboe/d in 2003 to 1.6 mboe/d in 2007 (exluding Slavneft production).

In the near term, TNK-BP will continue to develop its brownfield base, managing decline rates and ensuring reserves replacement rate in excess of in-year production. Simultaneously, we will continue to develop new greenfield projects to ensure sustainable growth in the longer term. We expect the first of our new greenfield projects to come on line in 2009; until then TNK-BP's production is expected to stay generally flat.

BP shutting 600,000

mt/year of US PX production: sources

BP is idling 600,000 mt/year of US paraxylene production because

of increased capacity coming on line in the Far East, market

sources said Friday. BP declined to comment on the closures.

Market sources on Friday said BP would be shutting 350,000

mt/year of production in Texas City and 250,000 mt/year of

production in Decatur, Alabama.

BP is also idling 150,000 to 200,000 mt/year of PTA production in

Decatur, the sources said.

BP

to Sell Malaysian Ethylene and Polyethylene Interests to Petronas

BP today announced that it has

agreed to sell its interests in ethylene and polyethylene

production in Malaysia to PETRONAS.

The agreement concerns BP's 15

per cent interest in Ethylene Malaysia Sdn Bhd (EMSB) and 60 per

cent interest in Polyethylene Malaysia Sdn Bhd (PEMSB), both of

which are operated by PETRONAS, and are located at Kertih, on the

east coast of Malaysia. This announcement does not affect BP's

other businesses in Malaysia.

Under

the terms of the agreement, PETRONAS will, at closing, pay $363m in

cash to BP, inclusive of a balance

sheet adjustment of $13m and the repayment of a shareholder loan

of $53m. Subject to certain conditions, both parties anticipate

completing the transaction by the end of 2010. Additionally, BP

will also receive an EMSB pre-closing dividend payment amounting

to $48m, subject to EMSB Board approval.

Sue Rataj, President of BP's Global Petrochemicals Business,

said: ''Whilst these are attractive businesses with strong

domestic and regional markets, BP recognizes that PETRONAS is

their natural owner, with various integration opportunities

uniquely available to them at the Kertih site. BP will continue

to focus on the development and expansion of our olefins and

derivatives business in China, and other large rapidly growing

markets, and pursue opportunities in China and India to extend

our leading world positions in aromatics and acetyls.''

EMSB's olefins cracker, commissioned in 1995, has production capacity of approximately 440,000 tonnes per annum (tpa) of ethylene, a basic petrochemical feedstock. The company is owned by PETRONAS (72.5 per cent), BP (15 per cent) and Idemitsu (12.5 per cent). PEMSB, whose polyethylene plant also began operation in 1995, is owned by BP (60 per cent) and PETRONAS (40 per cent). The plant has a production capacity of some 318,000 tpa of polyethylene, used primarily for packaging and film manufacture. Ethylene feedstock for the plant is supplied by EMSB.

BP has been present in Malaysia since the 1960s and now has over 850 staff in the country. BP is currently in the process of growing its Asian Business Service Centre in Kuala Lumpur, which supports business and functional operations both regionally and globally. BP owns a 600,000 tpa purified terephthalic acid plant in Kuantan and has a 70 per cent interest in a 560,000 tpa acetic acid plant in Kertih. BP also has a lubricants plant at Port Klang and the company's lubricants brands, Castrol, BP and Duckhams, hold a significant market share in the country.

February 21, 2011

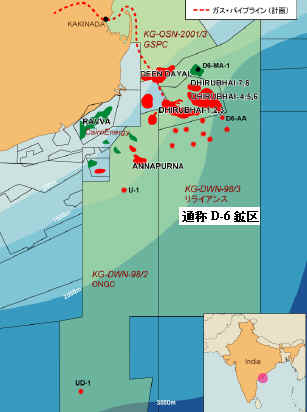

BP and Reliance Industries Announce Transformational Partnership

in India

Reliance Industries Limited and BP to participate across the gas

value chain in India

BP to take a 30 per cent stake in 23 oil and gas blocks

Reliance Industries Limited and BP today announced a historic

partnership between the two companies. Mr. Mukesh Ambani,

Chairman and Managing Director of Reliance Industries Limited,

and Mr. Robert Dudley, BP Group Chief Executive, signed the

relationship framework and transactional agreements in London.

The partnership across the full value chain comprises BP taking a

30

per cent stake in 23 oil and gas production sharing contracts that Reliance operates in India,

including the producing KG D6 block(Krishna

Godavari D6 block) , and the

formation of a 50:50 joint venture between the two companies for the

sourcing and marketing of gas in India. The joint venture will

also endeavour to accelerate the creation of infrastructure for

receiving, transporting and marketing of natural gas in India.

The partnership will combine BP's world-class deepwater

exploration and development capabilities with Reliance's project

management and operations expertise.

Mukesh Ambani said: "We are delighted to partner with BP,

one of the largest energy majors and one of the finest deep water

exploration companies in the world. This partnership combines the

skills of both companies and will be focused on finding more

hydrocarbons in the deep water blocks of India and significantly

contribute to India's energy security."

For BP, Reliance is a natural partner in India, given its strong

position in the Indian market.

"This partnership meets BP's strategy of forming alliances

with strong national partners, taking material positions in

significant hydrocarbon basins and increasing our exposure to

growing energy markets," said Mr. Carl-Henric Svanberg,

Chairman of BP.

BP will pay Reliance Industries Limited an aggregate

consideration of US$7.2 billion, and completion adjustments, for

the interests to be acquired in the 23 production sharing

contracts. Future performance payments of up to US$1.8

billion

could be paid based on exploration success that results in

development of commercial discoveries. These payments and

combined investment could amount to US$20 billion.

BP's confidence in India is evident from the fact that the

transaction constitutes one of the largest foreign direct

investments into India.

The 23 oil and gas blocks together cover approximately 270,000

square kilometres. This will make the partnership India's largest

private sector holder of exploration acreage.

So that the joint venture can capitalise on Reliance's

outstanding project management track record and operations

expertise, Reliance will continue to be the operator under the

production sharing contracts, whose blocks lie in water depths

ranging from 400 to over 3,000 metres. These currently produce

about 1.8 billion cubic feet of gas per day (bcf/d), over 30 per

cent of India's total consumption, and over 40 per cent of

India's total production.

"India is one of the fastest growing economies in the world.

By allying ourselves with Reliance, we will access the most

prolific gas basin in India and secure a place in the fast

growing Indian gas markets, creating a genuinely distinctive BP

position," said Bob Dudley. "BP looks forward to a long

and successful working partnership with Reliance."

Completion of the transactions is subject to Indian regulatory

approvals and other customary conditions.

2011/2/22 日経

英BP インドに6000億円投資

現地企業と提携・合弁 石油、ガス権益取得

英BPは21日、インドの石油精製・石油化学最大手リライアンス・インダストリーズ(RIL)と提携し、インドでの石油・ガス開発を拡大すると発表した。RILが保有する油田・ガス田の一部を72億ドル(約6千億円)で取得するとともに、合弁会社を設立し、インド市場でのガス販売の市場調査などを実施する。

インド南部沖合のクリシュナ・ゴダバリ(KG)海盆の「KG-D9」鉱区など、RILが保有する23カ所のガス田・油田の権益のうち30%を72億ドルで取得。さらに開発や販売の進展に沿って最大18億ドルを支払う。

BPは深海での探鉱開発で技術協力し、RILは事業のとりまとめや操業を担当する。

BPの投資額は将来の開発費も合わせると総額200億ドルになる見通し。BPはメキシコ湾での流出事故後、ロシア石油最大手ロスネフチと北極大陸棚の探鉱・開発で提携するなど、経済が拡大している新興国周辺の油田・ガス田の権益拡大を急いでいる。

April 01 2011 BP

BP Accesses Four Coalbed Methane Production Sharing Contracts in

Indonesia

BP confirmed today that it has signed four new coalbed methane

(CBM) production sharing contracts (PSCs) in the Barito basin of

South Kalimantan, Indonesia.

BP and co-owner Pertamina were jointly

awarded the Tanjung IV CBM PSC through a direct award from the

Government of Indonesia. BP will hold a 44 per cent participating

interest in the PSC with Pertamina holding the remaining 56 per

cent.

BP and co-owner PT Sugico Graha (Sugico) were jointly awarded the

Kapuas I, II and III CBM PSCs through a direct offer from the

Government of Indonesia. BP will hold a 45 per cent participating

interest in the PSCs with Sugico holding the remaining 55 per cent.

CBM PSC BP Pertamina Sugico

GrahaTanjung IV 44% 56% - Kapuas I, II and III 45% - 55%

Bob Dudley, BP group

chief executive, said: “Today’s agreements follow on from BP’s recent agreements to access new

resources in Indonesia, China, India and Australia. BP has

significant experience and expertise in the development of

unconventional gas, including coalbed methane, and we look

forward to working with our partners to apply this to the

potential of Indonesia's coal resources.”

Together, the four

PSCs cover an area of approximately 4,800 square kilometres.

“BP

is very pleased to be extending our working relationship with

Pertamina in the development of Indonesian CBM resources, and

also to cooperate with Sugico in creating a material CBM position

in a highly prospective basin. These four PSCs complement BP’s existing CBM position in

Indonesia, allowing us to leverage our 30-plus years of CBM

experience to deepen our portfolio in Kalimantan,”

said William Lin,

BP's President of Asia Pacific Exploration & Production.

These awards mark BP’s first CBM access in Indonesia

outside its joint venture with ENI, VICO, which in late 2009 was

awarded the Sanga Sanga CBM PSC near the Bontang LNG plant in

East Kalimantan.

Notes to editors:

BP has over 35 years of experience in Indonesia and is one of the

largest foreign investors in the country. Activities are

dominated by its exploration and production business, notably the

Tangguh LNG operations in Papua Barat province.

BP has pioneered CBM technology with over 30 years of operating

experience in the San Juan Basin, Colorado in the United States.

In the San Juan basin, BP produces approximately 650 million

cubic feet of gas a day (gross) from approximately 1300

company-operated wells,

VICO Indonesia is a joint venture between BP and ENI, in which BP

has a 38 per cent interest. VICO’s oil and gas production is

centered in the Sanga Sanga PSC, East Kalimantan basin with wells

located in Badak, Nilam, Semberah and Mutiara fields. Most of the

natural gas is delivered to PT Badak NGL's plant at Bontang where

LNG and LPG are produced and shipped.

Pertamina is Indonesia’s state-owned integrated oil and

gas company with more than 50 years experience in the challenging

geological environment of Indonesia and in pioneering the

development of LNG. Pertamina has operations and facilities

throughout Indonesia, and serves the energy needs of over 220

million Indonesians.

In the 2009 sale of BP’s interests and operatorship of

the Offshore North West Java PSC to Pertamina, the two companies

also agreed to cooperate on developing CBM in Indonesia.

PT Sugico Graha (Sugico) is an Indonesian-based mining and energy

company formed in 1986. In partnership with other companies,

Sugico has engaged in CBM exploration in Sumatra and Kalimantan.

2011/5/17 BP

BP and AAR Reaffirm

Commitment to Growth and Success of TNK-BP as Talks Continue with

Rosneft Following Expiry of Agreement

BP and Alfa- Access- Renova (“AAR”) announced today that they would

intensify their efforts to ensure TNK-BP’s continued success following the lapse of the BP-Rosneft

share swap transaction (and the related Arctic exploration

opportunity) originally announced on 14 January

2011.

In recent months, BP has conducted detailed negotiations with AAR

and Rosneft to seek a reasonable and businesslike solution that

would allow the agreements to proceed to the satisfaction of all

parties. Such a solution has not been found at this time,

although talks will continue.

BP and AAR each acknowledge the active engagement and support

provided by Rosneft throughout the recent discussions. Both BP

and AAR see significant advantages in continuing to deepen this

dialogue and cooperation with Rosneft.

Bob Dudley, BP group chief executive said: “BP remains committed to Russia, to

working constructively with AAR in TNK-BP and to our existing

good relationship with Rosneft. All parties have worked hard to

reach an acceptable resolution, as we believe it could offer

significant benefits to BP shareholders, to Rosneft, AAR and

Russia.

“TNK-BP

has been an excellent investment for all parties since 2003 and

it is gratifying that both BP and AAR have agreed to look beyond

the disagreements of the past few months and to fully focus on

this important and successful business we have built together. At

the same time, we look forward to continuing our work with

Rosneft in our Sakhalin joint venture, running our new joint

German refining business, and considering other future projects.”

Mikhail Fridman,

Chairman of Alfa Group, said: “AAR remains dedicated to the

success of TNK-BP, one of the most dynamic and successful oil

companies in the world. As we have always stated, AAR is a

long-term strategic investor, and we look forward to working with

BP on delivering the next phase of TNK-BP’s growth, both in Russia and

internationally. AAR also sees significant benefit to developing

cooperation with Rosneft within the framework of the TNK-BP

Shareholder Agreement, and we plan to continue discussions about

potential collaboration among BP, Rosneft and AAR.”

| Notes to editors: | |

| ・ | Since its establishment in 2003, TNK-BP has delivered consistently high returns to its shareholder. |

| ・ | From 2003 to 2011, TNK-BP has paid more than $100 billion in duties and excise taxes. |

| ・ | Last year, TNK-BP increased production of oil and gas by 3.1 per cent and replaced 134 per cent of its reserves. Its first quarter profit was $2.4 billion, a 91 per cent increase relative to Q1 2010. |

| ・ | The deadline for the 14th January share swap agreement, and related cooperation agreement and framework agreements, was May 16, 2011. As the conditions precedent for these agreements have not been satisfied, these agreements have now lapsed. |

TNK-BP はロシアで3番目に大きい石油会社で、BPとAlfa Access Renova group が50%ずつ所有している。

Alfa

Access Renova は下記の3社の連合。

| Alfa Group | ロシアの新興財閥で、ロシア最大の金融産業コングロマリットのひとつ。 Mikhail Fridman と German Khan が50%ずつ保有。 |

| Access Industries | ロシア生まれの Len Blavatnik が設立し所有する米国の投資会社で、Basellを買収した。 |

| Renova Holding | ロシアの長者番付では第5位のViktor Feliksovich Vekselberg (SUALの大株主)のベンチャーキャピタル。 |

-----

On Tuesday, Rosneft said it was talking to Shell and Exxon about bringing them in to replace BP, after the British and Russian companies failed to reach an agreement before Monday night's deadline.

----

2011/5/17 日本経済新聞

英BP、ロシア石油最大手ロスネフチとの提携白紙に

合弁株主と和解できず

英石油大手BPとロシアの石油最大手ロスネフチが1月に合意した資本業務提携が白紙になった。提携に反対するBPのロシア合弁会社の株主と和解できなかったため。BPはなお交渉を継続したい意向だが、ロスネフチは他の提携相手を模索するとの報道もある。昨年のメキシコ湾での石油流出事故後に打ち出したBPの最大の成長戦略が暗礁に乗り上げた。

BPとロスネフチの提携を巡る流れ

1月14日

株式相互持ち合いと北極大陸棚共同開発で合意

27日 AARが提携差し止めを請求

3月24日 裁判所が差し止め命令

4月14日 株式交換の期限を5月16日に延長

5月 6日 仲裁裁判所がTNK―BPの北極大陸棚事業への参加を条件に株式交換認める

16日 株式交換の期限、合意できず

BPと、ロシア合弁会社TNK―BPの株主である資産家集団AARは17日、BPとロスネフチが目指していた総額約160億ドル(1兆3000億円)の株式相互持ち合いの実施期限だった16日までに交渉がまとまらなかったと発表。付随する北極大陸棚での油田共同開発も失効したことを伝えた。

BPとロスネフチは1月に提携に合意していたが、AARは「BPのロシア事業はTNK―BPを優先するとの株主間合意がある」と主張して提訴し、裁判所が提携を差し止めていた。

3社はTNK―BPの北極大陸棚での事業参加や、AARが保有するTNK―BP株のBPとロスネフチによる買い取りを軸に和解交渉を進めた。事業参加にはロスネフチが難色を示し、株式の買い取り価格が焦点になった。欧米メディアによるとBP側は200億ドル台後半から320億ドルに歩み寄ったが、AARは拒否したという。

提携は白紙となったが、BPはロスネフチとの形を変えた提携を目指し、交渉を継続する。ボブ・ダドリー最高経営責任者(CEO)は、「ロスネフチと将来の事業を検討していく」と声明で述べた。AARの幹部も、「(3社の)潜在的な提携について議論を継続する」という。ただ、具体的な解決方法は見えていない。ロスネフチの出方も不明で、インタファクス通信はロスネフチに近い人物の話として「ロスネフチには新しい提携先を探す用意がある」と伝えた。

BPはメキシコ湾の事故後、新興国の未開発の油田への投資を積極化しており、なかでもロシアを事業戦略上の最重要地域と定めている。2011年1〜3月では石油・天然ガスの生産量のうち27%をロシアが占め、将来の拡大に向け権益獲得を狙っている。

今回の提携で共同開発の対象とした地域は、ロシア西北部の南カラ海の3地域。12万5000平方キロメートルと英国北部の北海油田並みの広さがあり、同規模の石油産出量が期待できるという。大型の油田開発となるだけに提携が破談に終われば、BPの事業戦略への打撃は大きい。

4 August 2011 BP

BP and JBF Group Agree to Build New Co-Located PET Facility in Geel, Belgium

BP has entered into agreements with JBF RAK LLC under which JBF RAK LLC is to

build a new 390,000 tonne per year polyethylene terephthalate (PET) production

unit in Geel, Belgium, subject to required approvals.

The agreements provide JBF rights to build and operate this PET unit on BP’s

existing petrochemicals complex in Geel, adjacent to BP’s world-class purified

terephthalic acid (PTA) facility. BP will in return supply PTA directly to this

new PET manufacturing unit. Startup of the unit is scheduled in 2014.

Frédéric Baudry, Vice-President for BP Petrochemicals Europe said: “We are

delighted that JBF has decided to invest in Geel. This new PET plant leverages

BP’s scale, technology and location advantages at Geel to deliver a

competitively integrated PX-PTA-PET manufacturing complex in Europe. Such a

complex will help maintain and develop BP’s position in the region and underpins

BP’s long term commitment to its merchant customers.”

Patrick Van Acker, Manufacturing Director of BP Geel, said: “This agreement

demonstrates that our region can attract significant investments by looking for

synergies with foreign investors. Moreover, by avoiding unnecessary PTA

transportation in the PET supply chain and by reducing the corresponding

environmental impact, we create a sustainable and long term anchorage for PTA

and PET production in Geel.”

BP in Geel belongs to the BP group of companies. The company in Geel employs

more than 400 people. BP in Geel produces paraxylene and PTA. Paraxylene is the

main raw material to produce PTA. In Europe, PTA is mainly used to make PET.

Worldwide PTA’s main use is in the manufacture of polyester.

ーーー

JBF RAKThe plant set up has a capacity of 1200 Tonnes per day continuous polymerization plant for manufacturing polyester resin for packaging, with downstream integration into a plant for producing 1000 Tonnes per day of Polyester SSP (bottling) grade Chips and 200 Tonnes per day of Polyester Film incorporating the latest technology. The facilities are located at Emirate of Ras Al Khaimah, U.A.E. The plant was commissioned and operational by Jan 2007.

JBF RAK produces 360000 TPA of finest Bottle Grade PET Resin, and 72000 TPA of BOPET Film under the brand name ARYAPET. The best-suited infrastructure has been set-up to meet the requirements of the customers.---

BP、ベルギーのPTA工場にPETプラントを誘致

BPは8月4日、JBF RAK LLC との間でベルギーのGeel に年産39万トンのPETプラント建設で合意した。

BPは同地にPTA 1,400 千トン、パラキシレン

560千トンのプラントを有しているが、JBF RAKがこのコンプレックスにPETプラントを建設し、BPはこれに原料のPTAを供給する。

2014年スタートを目指す。

両社の協力で、Geel工場を欧州における競争力ある PX-PTA-PET 統合コンプレックスとする。

ーーー

JBF RAK はインドのポリエステルチップ、ポリエステル糸のメーカーのJBF Industries Ltd とアラブ首長国連邦のRas Al Khaimah首長国の王子が所有するRAKIA (Ras Al Khaimah Investment Authority) のJVである。

JBF Industries Ltd は1982年に設立された。

工場はインド西部のSarigam, Gujarat にある。

繊維グレード及びボトルグレードPET 625千トン

ポリエステル 部分延伸糸 (POY) 200千トン

ポリエステル 延伸糸 (FDY) . 50千トン

同社は最近、年産112万トンのPTAプラントをMangalore SEZ(Special Economic Zone) に建設することを決めた。

同社はまた、Oman Oil

Companyとの間で、約680百万ドルを投じてOmanに年産120万トンのPTAプラントをJVで建設する覚書を締結した。

工場は Oman Aromatics のプラントに隣接し、同社からパラキシレンの供給を受ける。

Oman Aromatics はOman Oil が60%、LGが20%出資するJVで、Benzene 210千トン、Paraxylene 810千トンを生産している。

JBF RAK はRas Al Khaimahに以下の工場を持っている。

Bottle Grade PET Resin 年産400千トン (一部はフィルム用、残りはボトルグレード)

BoPET(二軸延伸PETフィルム) 72千トン

2011/8/30 BP 2011/2/28 BP、インドでのガス・石油開発でRelianceと提携

BP and Reliance Commence Strategic Alliance for IndiaKG deep-sea Krishna-Godavari basin fields

This significant step will commence the planned alliance which will operate across the gas value chain in India, from exploration and production to distribution and marketing. The completion of the deal delivers one of the largest ever foreign direct investments into India.

The two companies will also form a 50:50 joint venture for the sourcing and marketing of gas in India which will also accelerate the creation of infrastructure for receiving, transporting and marketing natural gas.

Mukesh Ambani, Chairman and Managing Director, Reliance Industries, said “The alliance with BP will boost our efforts to realize the true potential of India’s hydrocarbon reserves. The globally renowned expertise of BP and the in-depth domestic experience of Reliance make for a formidable alliance which will deliver unparalleled value for the country in its pursuit of energy security.”

“This is the beginning of what we expect to be a long and successful working partnership with Reliance, building on the strengths of each company,” said Bob Dudley, BP group chief executive. “This major investment is directly aligned with our strategy of creating long-term value by forming alliances with strong national partners, gaining material positions in significant hydrocarbon basins and increasing our exposure to growing energy markets.”

BP will pay RIL an aggregate consideration of US$7.2 billion, subject to completion adjustments, for the interests to be acquired in the 21 production sharing contracts. Further performance payments of up to US$1.8 billion could be paid based on exploration success that results in development of commercial discoveries.

Notes to Editors

The 21 oil and gas blocks cover approximately 220,000 square kilometres and lie in water depths ranging from 400 to over 3,000 metres. They include the KG D6 block that currently produces about 1.6 billion cubic feet of gas per day (bcf/d), over 40 per cent of India’s total gas production. RIL will remain operator of the PSCs and BP will bring its global deepwater, sub-surface and gas expertise to enhance exploration and development of the blocks.

With respect to the remaining two blocks in February’s announcement, there are ongoing discussions between RIL and the Indian Government with a decision expected at a later date.

14 September 2011

BP to Expand Activities in Biofuels, Buying Out Remaining Shares in Brazil's

Tropical Bioenergia S.A.

BP announced today that it has agreed to increase its share in

Brazilian biofuel company Tropical BioEnergia S.A. to 100 per cent, by

acquiring the remaining 50 per cent of the company from its current joint

venture partners for a total cash consideration of approximately US$71 million.

BP's current joint venture partners in Tropical BioEnergia S.A. are Maeda S.A.

Agroindustrial (25 per cent) and LDC-SEV Bioenergia S.A. (25 per cent).

After the deal is completed, subject to regulatory approval and agreed closing

conditions, BP will become the 100 per cent owner of Tropical BioEnergia S.A.

and operator of its producing ethanol mill, located in Edéia, Goiás state. BP

intends to double the size of the operations at Tropical BioEnergia to a

capacity of five million tonnes of crushed cane, or 450 million litres of

ethanol equivalent, per year and also to expand operations in the region.

This acquisition takes the number of producing mills in BP's Brazilian ethanol

portfolio to three, all of which are located in Goiás and Minas Gerais states in

the centre-south of the country.

Philip New, Vice President of BP Biofuels, commented, "This is another

significant milestone in BP's global biofuel strategy as we expand our

operations base and demonstrate our genuine commitment to Brazil's ethanol

industry, which can deliver sustainable and competitive biofuels into the global

market."

Mario Lindenhayn, who heads BP Biofuels in Brazil, continues: "We have a major

growth agenda for our biofuels business in Brazil. This transaction, together

with other recent acquisitions, gives us a strong platform from which to expand

our capacity to supply both domestic and international fuels markets."

Key facts about the acquisition