トップページ

Xinhua 2009-05-08

China

puts ceiling on output of minerals

China said Thursday it

would impose a ceiling on the output of mineral resources like tungsten, antimony

and rare earth

in 2009 amid shrinking demand.

The move is aimed to

protect China's reserves of these minerals, the Ministry of Land

and Resources 国土資源部 said in an online statement.

The country's tungsten

ore concentrate output is limited to 68,555 tons this year; rare

earth ore to 82,320 tons, and antimony ore to 90,180 tons, said

the ministry.

These quotas on output

were based on decreasing demand across the world as a result of

the ongoing global financial crisis, said the ministry.

The ministry said it

would also not take any license applications before June 30, 2010

for exploring the three resources.

China holds 40.5 percent

of the world's proven tungsten reserves, and is the world's

biggest antimony producer. The nation has a proven rare earth

reserve of 52 million tons, or about 58 percent of the world's

total.

The country started to

cap the annual output of tungsten in 2002 and that of rare earth

in 2006. It is the first time such restrictions have been placed

on antimony.

The ceiling on tungsten

ore concentrates (with tungsten trioxide content above 65

percent) last year was 66,850 tons, and that on rare earth ore at

87,620 tons.

The ministry said such

caps are intended to stabilize global demand and supply of these

products and ensure their sustainable use.

2009-5-7 CCR

Sichuan Chemical Holdings

Kicks off 600 000 T/A Methanol Project

Sichuan Chemical Holdings

Group Co., Ltd. (Sichuan Chemical Holdings) recently began the

construction of its 600 000 t/a coal based methanol project in Linhe District,

Bayannaoer バヤナオル市 of Inner Mongolia.

Sichuan Chemical Holdings plans to construct a chemical base with

coal as raw material, and the project with an investment of

around RMB3.0 billion is the first phase of the chemical base.

On October 18th, 2007 the 200 000 t/a dimethyl ether project in

Inner Mongolia Tianhe Chemical Co., Ltd. (subsidiary of Sichuan

Chemical Holdings) was completed and went on stream in

Bayannaoer, Inner Mongolia.

2009-05-09 Xinhua

Construction on

controversial PX plant starts in Fujian

Construction of a

controversial chemical plant started Friday in Zhangzhou, Fujian

province, two years after work to build an identical plant was

halted in another Fujian city nearly 100 km away.

Authorities in Xiamen,

site of the first aborted factory plan, had to called off the

project in 2007 after protests over potential pollution and

health problems.

2007/6/11 中国のインターネット反対運動が石化計画を止める

2009/1 China environmental authority gave

nod for Fujian PX/PTA relocation project

Construction on the

paraxylene (PX) plant sparked no protests or disputes in Gulei

peninsula,

which has a population of 135,000,an official with the local

publicity department said, declining to give his name.

The peninsula is more

than 100 km from Zhangzhou's urban area, which has a population

of about one million.

The PX plant passed an

environmental impact assessment by the Ministry of Environmental

Protection in January, and gained approval from the National

Development and Reform Commission two month later.

Officials in Zhangzhou

have since then made every effort to convince residents that the

plant's environmental impact would be under control.

They also put up bulletin

boards in residential areas to brief villagers with basic

knowledge of PX.

The plant involves a 13.8

billion yuan ($2 billion)investment by the Tenglong Aromatic PX

(Xiamen) Co Ltd and has a designed annual production capacity of 800,000 tonnes.

The official told Xinhua

that of the total, 830 million yuan will be earmarked for

tackling environmental problems.

Construction on another

massive chemical plant in the city also begun Friday. The plant

will use PX to produce annually 1.5 million

tonnes of purified terephthalic acid (PTA), commonly used in polyester

coatings and resins.

Investment on the PTA

project, including sewage treatment and environmental management

facilities, totals 5 billion yuan.

The PX plant provoked

heated protests by residents in Xiamen in May 2007. They argued

it would be detrimental to the environment and public health.

After a series of public

hearings and debates, the plant in the densely populated coastal

city was suspended in May 2007, and in Dec 2007, it was announced

that it would be built in Zhangzhou instead.

2009-05-09 Xinhua

Ansteel gets nod to up

stake in Gindalbie

Australian Treasurer

Wayne Swan announced on Friday his approval on the Chinese steel

maker Anshan Iron and Steel Group Corporation (Ansteel 鞍山鋼鉄公司)'s acquisition of an additional

stake in Australian iron ore miner

Gindalbie Metals Ltd.

Ansteel had agreed on a

number of undertakings that would support Australian mining jobs

and protect Australia's investment participation in the Chinese

resources market, Swan said.

"My approval under

the Foreign Acquisitions and Takeovers Act 1975 is conditional

upon Ansteel supporting the wider development of infrastructure

in the Mid-west (of Australia), and maintaining agreed levels of

Australian participation in a green fields joint venture in

China's Liaoning province," Swan said in a statement.

Swan said this foreign

investment decision has allowed Ansteel to have a stake of up to 36.28

percent in Gindalbie

(from current 12.6 percent), conditional upon legally enforceable

undertakings by Ansteel.

Ansteel was also a 50 percent partner

in a joint venture with Gindalbie to develop the Karara Iron Ore

Project.

The Karara Iron Ore

Project has been a A$1.8 billion ($1.4 billion) development in

the Mid-west region of Western Australia.

As part of the FIRB

approval, Gindalbie and AnSteel have undertaken to support

the development of Oakajee Port and use the new deepwater

port when it becomes available to export Karara production.

The partners have also undertaken that the proposed 50:50

ownership structure of the planned joint venture Pellet Plant

to be built in China cannot be altered without Australian

Government approval.

2009-05-08 Xinhua

NDRC expounds new oil

pricing mechanism

China's top economic

planner Friday announced details of the country's new oil pricing

mechanism, for the first time after the new pricing system kicked

in at the beginning of this year.

In a statement on its

website, the National Development and Reform Commission (NDRC)

said China would adjust domestic fuel prices when global crude

prices reported a daily fluctuation band of more than 4 percent

for 22 working days in a row.

The commission said

refiners would enjoy "normal" profit when global crude

prices are below $80 per barrel, but would face narrower profit

margins when the crude prices rise above $80 per barrel.

However, fuel prices

would not go further up, or only be raised by a small margin,

when crude prices rise above $130 per barrel, and fiscal and tax tools would

be used to ensure supplies, the NDRC said.

Light, sweet crude for

June delivery rose 37 cents a barrel to settle at $56.71 on the

New York Mercantile Exchange Thursday after reaching a six-month

high of $58.57.

Crude prices staged

strong rally on news of upbeat economic data in the United

States, rising more than 10 percent in two weeks.

The NDRC statement also

came a day after it denied an online report claiming imminent

price hike.

C1 Energy, an energy

information website, Thursday reported that the Chinese

government would raise fuel prices as of midnight Thursday, but

said later the price adjustment had been canceled, with reasons

unknown.

Xu Kunlin, deputy head of

NDRC's pricing department, said the new oil pricing mechanism is

not to be followed "word by word" without any

flexibility, when asked whether the commission would soon adjust

fuel prices at a press conference held in Beijing.

"There has been

pressure to raise domestic fuel prices as crude prices continued

to rise," Xu said, "however, the final decision will

depend on developments in crude prices in coming days."

Friday's statement did

not say how the global crude prices would be measured.

Xu declined to reveal

details on the basket of crude prices for evaluating

international price changes, and said such details would remain a

secret in a bid to prevent speculation.

The NDRC said in the

statement that the government would continue to control fuel

prices at the current stage, because of insufficient market

competition and imperfect market mechanisms.

However, fuel prices

would eventually be determined by market forces only in the long

run under the new pricing mechanism, which is aimed to bring in

more market forces, said the NDRC.

China's fuel prices, with

taxes included, are at a relatively lower level among major oil

importers, said the NDRC.

Domestic fuel prices are

lower than in Japan, the Republic of Korea, India, Mongolia, and

many European countries, but higher than in oil exporters in the

Middle East and than some cities in the United States, according

to surveys by the NDRC.

China's retail fuel

prices vary in different regions. Currently, gasoline 93, the

most commonly used type of gas, sells for 5.56 yuan (81.8 cents)

per liter in Beijing.

2009/5/11 Shanghai

China to Eliminate Small

Refineries to Upgrade Refining Industry

On May 3, 2009, National Development and Reform Commission (NDRC)

announced that the China government will rule out the outdated

plants, industries including steel, non-ferrous metal, paper

making, textile and petrochemicals, so as to upgrade industrial

structure at the same time to boost efficiency and lower

pollution.

As per petrochemical industry, China will remove the small

refineries to upgrade refining industry. According to NDRC said,

as of the end of 2008, China had shut outdated oil-refining

plants with total annual capacity more than 10 Mt. In the coming

years, the steps will go ahead.

The government plans to eliminate the low-efficiency and outdated

oil refineries which with capacity of 1 Mt and below by 2011.

Besides, the government will "actively guide"

all refining

facilities with annual processing capacity ranging from 1 Mt to 2

Mt will be shut down, halted, merged or transformed in the same

schedule. And also, China Government will ban any new refining

projects in the name of asphalt and heavy oil processing.

These small refineries main are local companies which located

mostly in North China, particularly in Shandong, Liaoning and

Shaanxi Provinces. Currently in China, the small has combined

annual capacity of about 80 Mt.

In Feb. 2009, China government approved a petrochemical stimulus

package, which aimed to support the petrochemical industry

revival and redevelopment during the global economic downturn.

2009/2/25 中国政府、石油化学産業の景気刺激策を承認

The package aims

the domestic oil and petrochemical sector grows by about 15% per

year in the next 3 years in order to raise the sector's revenue

to RMB 1.75 trillion (USD 257 billion) by 2011. While the

government will restructure the industry by closing down some

outdated petrochemical capacity.

In the sitimulus package, some large scale refinies are included:

1. Guangdong Huizhou 12 Mt/a refining by CNOOC

2. Xinjiang Dushanzi 10 Mt/a refining and 1 Mt/a ethylene by

PetroChina

3. Fujian 12 Mt/a refining project by Sinopec, Saudi Aramco and

ExxonMobil

4. Tianjin 12.5 Mt/a refining and 1Mt/a ethylene by Sinopec

5. Guangxi 10,000,000t/a refining by PetroChina

May 04, 2009 Xinhua

China sets long-term target for scrapping outdated producers

China's government will eradicate more obsolete industrial plants

in the next three years to maintain economic growth and boost

industrial restructuring and upgrading, the country's top

economic planner said.

The government would eliminate 72 million tonnes of obsolete iron

capacity and 25 million tonnes of obsolete steel capacity by

2011, said the National Development and Reform Commission (NDRC)

in an announcement on its website late Sunday.

Blast furnaces smaller than 300 cubic meters, and electric arc

furnaces and converters of up to 20 tonnes capacity would be

gradually eliminated, said the statement.

The plan also requires an elimination of 300,000 tonnes of

obsolete copper-producing capacity this year, while that of lead

would be reduced by 600,000 tonnes and zinc by 400,000 tonnes in

two years.

The light industry and textile industry is also required to slash

2 million tonnes of obsolete paper production capacity and 7.5

billion meters of obsolete textile-printing capacity by 2011,

according to the announcement.

Oil refiners with annual processing capacity of less than 1

million tonnes will be shut down in the next three years, it

said.

Obsolete capacity elimination and industrial upgrading are seen

as the focus of the government's efforts in energy conservation

and emission cuts this year, an unidentified NDRC official told

Xinhua.

The government would shut down coal-burning power stations with a

total production capacity of 1.5 million kilowatts by the end

of2009, according to an earlier government report.

It was also aiming to eliminate obsolete capacity of iron

production this year by 10 million tonnes, steel production by 6

million tonnes and paper production by 500,000 tonnes, it said.

2009/5/12 上海

中国科学院、石炭からMEG生産(Coal-to-MEG)に成功

中国科学院は5月7日、記者会見を行い、世界で初めて石炭からのモノエチレングリコール生産(Coal-to-MEG)に成功したと発表した。10,000トン/年のデモンストレーションプラントでの生産に成功、専門パネルの評価に通った。

この製法は中国科学院

福建物質構造研究所と江蘇省の丹化(Danhua)グループ及び上海のGEM Chemical

Technology により開発された。石炭ベースのsysgas からMEGを生産する。

丹化グループ側で300トン/年のパイロットプラントと、10,000トン/年のデモンストレーションプラントを建設、後者は2007年12月から1年以上にわたり、順調に操業を続け、このたび、この製法が成功したと評価された。

中国では余り不思議なことではないが、一方で新製法のテストをしながら、その結果を確認する前に、2007年8月に通遼

GEM Chemical が内蒙古の通遼

(Tongliao)経済開発地域で240百万ドルを投じて200千トン/年のCoal-to-MEGプラントの建設を開始した。

同社は中国科学院と丹化グループ及びGEM Chemical のJVで、当初は2008年下期にスタートする予定であったが、現在も建設中で、2009年末にスタートの予定となっている。

原料として褐炭を使用するもので、5年のうちに能力を120万トン/年に拡張する計画。

中国のMEG の生産量と輸入量は以下の通り。(単位:100万トン)

Year 生産量 輸入量

2006

1.58 4.06

2007 1.88

4.80

2008 1.95

5.22

2009/12/24 上海

通遼GEM

Chemical、世界初のCoal-to-MEG試運転に成功

通遼GEM

Chemicalは12月7日、内蒙古自治区通遼経済開発地域で石炭からのMEG製造の試運転を開始、1週間運転して、オンスペックとなった。今後手直しの後、2回目の試運転を行い、2010年第2四半期に商業生産を開始する。

褐炭からMEGを生産するもので、世界で最初のプロジェクトとなる。

同社は中国科学院(CAS)、上海GEMケミカル(鴻元集団)、江蘇丹化集団のJV。

当初、第一段階としてMEG20万トンとされていたが、MEG15万トンとシュウ酸10万トンに変更された。

5年内に能力を120万トンに拡大する。

この技術は中国科学院福建物質構造研究所と上海GEMケミカル、江蘇丹化集団が共同で開発し、丹化集団が300トンのパイロットプラントと、10,000トンのデモンストレーションプラントを建設、後者は2007年12月から1年以上にわたり、順調に操業を続けた。

本年5月に中国科学院が成功したと発表した。

3社はテストと並行して2007年8月に240百万ドルを投じてCoal-to-MEGプラントの建設を開始した。

May 12, 2009 Xinhua

PetroChina sets

up joint venture with Venezuela national oil company

PetroChina

and PDVSA,

the national oil company of Venezuela, have established a joint venture on

oil exploration and development, said Jiang Jiemin, Chairman of

PetroChina Company Limited here Tuesday.

PetroChina held 40 percent of the new company's shares, Jiang

told Xinhua at the annual shareholders meeting.

According to Jiang, a joint venture transporting oil and two joint

refineries would

also be established. PetroChina would hold 50 percent stake in

the former and 60 percent in the latter two.

One of the refineries would be located in eastern Guangzhou

Province, Jiang said.

PetroChina is expected to produce 40 million tons of crude oil

from Venezuela annually, Jiang said.

He also noted that construction of the China part of the pipeline

transmitting crude oil from Russia to China will be started this

month and the transmission capacity is expected to expand from

the current annual 15 million tons.

Taking advantages of the decreased prices of oil and gas,

PetroChina would expand its overseas business, and strengthen

cooperation with both energy producers and international energy

giants such as ExxonMobile, BP and Shell, Jiang said.

PetroChina is the Hong Kong and Shanghai-listed subsidiary of

China National Petroleum Corporation, China's largest oil

producer.

http://www.pdvsa.com/index.php?tpl=interface.en/design/salaprensa/readesp.tpl.html&newsid_obj_id=4768&newsid_temas=54

Agreements signed in

the Venezuelan-Chinese VI Joint Committee

Fourteen agreements were signed and four of them correspond

to the hydrocarbons sector:

- Agreement

between PDVSA and Sinopec for the quantification and

certification study of the existing oil fields in the

Junin 8 Block of the Orinoco Oil Belt.

- Agreement

between PDVSA and China National United Oil

Corporation (Chinaoil), to supply fuel oil to the

Chinese market.

- Memorandum of

Understanding between PDVSA and China National

Petroleum Company (CNPC:PetroChina) to enlarge energy

cooperation.

- Alliance

agreement to Transport Crude and Products between PDV

Marina and Petrochina International Company.

Other agreements

- Crude and fuel

oil supply. Venezuela hopes to increase its crude

exports to China to 1 million barrels per day in

2012.

- Creation of the

Investment Fund between the People's Republic of

China and Venezuela. China will contribute $4 billion

and Venezuela will contribute $2 billion to promote

development projects.

- Quantification

and certification of 36 billion barrels of Original

Petroleum in Site in the Block Junin 4 of the Orinoco

Oil Belt.

- Trade agreement

between China National Petroleum Corporation (CNPC)

and Petroleos de Venezuela, S.A. (PDVSA) to purchase

13 well drilling rigs. This includes training of 200

Venezuelans in China to support the manufacturing of

drilling equipment in Venezuela.

- Construction of

ships between PDVSA and the Chinese company Rongshen

Shipyards.

2009-5-21 CCR

Donghua Energy Kicks off

1.2 Million T/A Methanol Project

On May 11th, 2009 Inner

Mongolia Donghua Energy Co., Ltd. (Donghua Energy) started the

construction of 1.2 million t/a coal based methanol project in

Jungar Banner, Erdos of Inner Mongolia.

According to a source, a signing ceremony on coal chemical and

Shiyangou coalmine integrated project between municipal and

banner governments in Erdos City, and Donghua Energy was held at

the end of 2008. At present, approval for project, land, and

other supporting documents have been completed.

With a total investment of around RMB9.5 billion, the integrated

project is designed to produce 1.2 million tons of methanol, 400

000 tons of acetic acid and 10 million tons of raw coal a year

and is expected to go on stream by the end of 2013.

After completion of integrated project, the production value will

be added by RMB10.0 billion a year for the company

2009/5/21 Shanghai

Sinopec gets nod for 600

kt PX project in Hainan

On May 15, 2009, Sinopec got authorization from National

Development and Reform Commission for its PX project in Yangpu

Economic Development Zone, Hainan Province.

The PX project was approved by Ministry of Environmental

Protection (MEP) in Jan. 2009, according to the information

released by official website of MEP, the project will have

environmental investment of USD 5.5 million.

With the estimated investment of USD 390 million (RMB 2.65

billion), the PX project will have capacity of 600 kt/a. The PX

project will be operated by Sinopec Hainan Refining Chemical

Company (HRCC). It will be located at the site of existing

refinery of HRCC which has refining capacity of 8 Mt/a.

Currently, in the same site, Sinopec and Garson operate a 50:50

jv SM plant with capacity of 80 kt/a which was started up in

2006.

* シノペックと江陰嘉盛化工(Garson)

の50/50の合弁会社、海南実華嘉盛化工(Hainan

Shihua Garson Chemical )

Sinopec also

planned to add a 1 Mt ethylene facility in its Hainan refinery.

In 2008, Sinopec and Hainan Provincial Government signed a

framework agreement for the proposed cracker. The feasibility

study is ongoing and both sides hope the 1 Mt ethylene project

will be approved by the central government and then start it up

by 2013. If the ethylene project is confirmed, HRCC may expand

the existing refinery to 12 Mt/a in the future from the current 8

Mt/a for enough naphtha feedstock supply.

2008/4/14 Sinopec

の新しいエチレン計画

China imported 3.4 Mt and

exported 448 kt PX in 2008, and imported 2.9 Mt and exported 252

Kt PX in 2007.

May 25 2009

CNOOC to develop SNG

project in Shanxi

On May 15, 2009, CNOOC New Energy Investment Company (CNOOC New

Energy), Datong Coal Mine Group and Datong Municipal Government

signed an agreement for their Coal Based Clean Energy Project in

Datong, Shanxi Province.

The project will jointly invested by CNOOC New Energy and Datong

Coal Mine, with total investment of USD 4.38 Billion (RMB 30

billion), which will include 40bn Nm3/a of coal-based Synthetic

Natural Gas (SNG) and by-produced such as industrial gas,

gasoline, diesel and fine chemicals, as well as 2 x 10Mt/a mines

and attached coal floatation facilities and gangue-burning power

generation plants.

The SNG product will supply to target via pipeline markets in

Shanxi Province and the Bohai Bay Rim area, North China.

The schedule of this project is not disclosed, but according to

Datong Government, it will do the best in promoting the project,

and make sure kick off construction as soon as possible.

CNOOC New Energy is headquartered in Beijing as a whole

subsidiary of CNOOC Group. It is founded in 2006 with registered

capital of RMB 80 million, and the business mainly covers Coal

Based Clean Energy, Hydrogen Energy, Biomass Energy, Wind Energy

and Solar Energy etc.

Datong Coal Mine is located in Datong, Shanxi Province, which is

one of the coal majors in China, and produced 122 million ton

coal in 2008. The other business of Datong Coal Mine also

includes Power Generation, Coal Chemical, Metallurgy and

Mechanical Manufacture etc.

Before this project, in April 8 2009, Shenhua Group held a

groundbreaking ceremony for a coal-based SNG project in Ordos,

Inner Mongolia. Shenhua SNG project is designed to produce SNG as

a clean energy to supply town-gas and industrial fuel-gas market.

The project has capacity of 2 billion Nm3/a and is expected to

start up in 2012.

According to the data from ASIACHEM Consulting, from 2000 to

2008, China's Natural Gas consumption was growing in an averaged

annual rate of nearly 16% while the growth rate of output in the

same period was around 13%. In 2008, China consumed 77.5 billion

Nm3 of natural gas and output 76 billion Nm3 with 1.5 billion Nm3

import.

2009-6-11 CCR

Ningbo Shunze Kicks off

50 000 T/A NBR Project

On June 9th, 2009 Ningbo

Shunze Rubber Co., Ltd. (Ningbo Shunze) held the ground breaking

ceremony for its 50 000 t/a NBR (acrylonitrile-butadiene rubber)

project in Ningbo Chemical Industry Zone.

The RMB570 million project uses advanced technology from Russia

and its raw material sources from 1.0 million t/a ethylene

project in Sinopec Zhenhai Refining & Chemical Co., Ltd.

According to a source from Ningbo Shunze, the project is

scheduled to start operation at the end of June 2010, and after

completion of the project, Ningbo Shunze will become a leading

NBR supplier in China.

2009/6/12 Platts

China's Shenhua to invest

$58.5 bil on 7 coal conversion centers

China's largest coal

producer, the Shenhua Group, plans to invest Yuan 400 billion

($58.5 billion) in developing seven coal

conversion centers

in the country to produce oil products, natural gas, methanol and

olefins, Chinese official news agency Xinhua reported Thursday.

The centers will be located in the Inner Mongolia autonomous region and Shanxi province in northern China, as

well as Shaanxi province, Ningxia Hui and Xinjiang Uygur autonomous regions in northwestern

China, the report said quoting vice president of project planning

with Shenhua Coal Liquefaction Corp. (Beijing), Zhang Diankui. He

was speaking at an industry conference in Inner Mongolia's Hohhot

city.

Work

on most CTL projects in China was halted since September 2008 as the

central government asked local governments not to approve any new

coal-to-liquids projects, saying "coal liquefaction is a

technology-, talent-and capital-intensive project, and most

domestic enterprises lack advanced technologies, management

experience and equipment."

The only exceptions then were two involving the Shenhua Group:

the

Erdos facility

and the

80,000 b/d Ningdong coal liquefaction project jointly planned by the group's

subsidiary Shenhua Ningxia Coal Group and South African oil and

gas major Sasol.

The 1

million mt/year (22,000 b/d) first phase of the Erdos CTL

plant in Inner Mongolia

---

2009-06-12 Xinhua

Shenhua's coal-to-oil

project to start trial operation in July

The coal-to-oil

project of Shenhua Group, the country's largest coal

producer, is expected to start trial operation in July, a

company executive said Thursday.

The project's first

production line will convert 3.5 million tons of coal to 1.08

million tons of diesel and naphtha annually, said Zhang

Diankui, vice president (Project Planning) of Shenhua Coal

Liquefaction Corp (Beijing).

The project has a

designed annual production capacity of 5 million tons, Zhang

told a coal chemical forum. But the first three production

lines in the first phase would produce 3.2 million tons of

coal chemical products annually.

The project is in

Ejin Horo Banner in north China's Inner Mongolia autonomous

region.

Shenhua Group would

expand its oil and chemicals production capacity to 30

million tonnes in 2020, Zhang said.

The group planned to

invest 400 billion yuan to build seven coal chemical

production bases in regions, including Inner Mongolia,

Ningxia, Xinjiang, Shaanxi and Shanxi, he added.

2009-6-18 CCR

Jilin Petrochemical Opens

Carbon Fiber Plant

On June 14th, 2009 CNPC

Jilin Petrochemical Co., Ltd. (Jilin Petrochemical) opened its

carbon fiber plant to operate a 100 t/a carbon fiber project.

Jilin Petrochemical began the construction of the carbon fiber

project in June 2008, and the project was completed and went on

stream in May 2009.

2009/6/26 Shanghai

BlueStar started up

55,000 t/a BDO Project in Nanjing

Recently, BlueStar Nanjing New Chemical Matericals Co. (BlueStar

Nanjing NCM) has started up its 1, 4-butanediol (BDO) project and

produced on-spec products in Nanjing Chemical Industry Park

(NCIP), Nanjing, Jiangsu Province.

With total investment of RMB 670 million, the project has BDO

capacity of 55,000 t/a, it used the DAVY's maleic anhydride

esterification/hydrogenolysis process. According to the company,

the project was kicked off construction of the 55,000 t/a BDO

project in November 2006, and was expected to start up by the end

of 2008.

This is the 1st project of BlueStar Nanjing NCM. It also planned

the 2nd stage project at the same site in NCIP. With total

investment of RMB 1.46 billion, the 2nd stage project will have

44,000 t/a THF and 30,000 t/PTMEG capacities. The THF and PTMEG

projects are expected to start construction in 2009. The products

will mainly supply to the East and South China market.

BlusStar Nanjing NCM is subsidiary of China National BlueStar

Group, while the latter is controlled by China National Chemical

Corporation (ChemChina).

Also, recently, BlueStar is pushing forward another 50,000 t/a

BDO project in Daqing, Heilongjiang Province, which is conducted

by its subsidiary - Daqing BlueStar Petrochemical Co. The

environment assessment is approved, and the Huntsman/DAVY process

is proposed in the Daqing unit.

Besides, Shaanxi BDO Chemical Company ? a subsidiary of Shaanxi

Coal & Chemical Industry Group has started up its 30,000 t/a

BDO project and produced on-spec product recently. With total

investment of RMB 570 million, this project was started

construction in 2007. It is based on the Reppe process which uses

acetylene as feedstock.

このほか、Bluestar Tianjin Chemical

Materials の計画(PTMEG:30,000t/a、1-4 BDO:55,000t/a )があるが、建設開始の情報はない。

2008/3/28 Bluestar Group (藍星集団)の活動一覧

2009-6-29 CCR

Jiangsu Sanfangxiang to

Build Polysilicon Project in Hunan

Jiangsu Sanfangxiang

Group Co., Ltd. plans to build a 3 000 t/a plant for

semiconductor grade polysilicon in the Jizhuang Industrial Park

in Jishou Economic Development Zone, Hunan province.

2009-7-1 CCR

Suhua to Start up 100 000

T/A Hydrogen Peroxide Project

On June 26th, 2009

Jiangsu Suhua Group Co., Ltd. (JSGC 江蘇蘇化集團) announced that Suzhou Suling

Peroxides Co., Ltd., a joint venture between JSGC and Mitsubishi

Gas Chemical Company, Inc. (MGC) completed construction on its 100 000 t/a hydrogen peroxide

project.

This project has an investment of US$28 million and adopts the

late anthraquinone process of MGC to produce hydrogen peroxide

with impurity content more than one-tenth of that of average

quality.

立地:江蘇省張家港市

Jiangsu

Suhua Group Co., Ltd. deals mainly in pesticides and pesticide intermediates,

chlor-alkali products, synthetic heat carrier, food

additives, rubber auxiliaries and PVC profiles, being one of

major enterprises of manufacturing pesticide and 520

key-pointed national enterprises.

ーーー

当初計画は上海

November 7, 2004

World Largest Hydrogen

Peroxide Project Settles Down in Shanghai Chemical

Industry Park

SCIP and Mitsubishi Gas

Chemical Company signed the strategic cooperation contract in

Japan, unveiling the construction of the world's largest hydrogen

peroxide project in SCIP. Shanghai economic and trade delegation

headed by Mr. Hu Yanzhao, Vice Mayor of Shanghai attended the

signing ceremony. The project with the capacity of 100,000 t/a

and total investment at 10 billion Japanese Yen, is scheduled to

startup in October, 2007. Hydrogen peroxide is widely used in

paper making, bleaching and other manufacturing industry.

2009-7-2 CCR

100 000 T/A PPG Project

Kicks off in Hebei

On June 28th, 2009

Zhengzhou Guangyang Industry Co., Ltd. and Hebei Yadong Chemical

Group Co., Ltd held the ground breaking ceremony for 100 000 t/a

PPG (polyether polyol) project in Jizhou of Hebei province.

According to a source from Zhengzhou Guangyang, the project is

expected to go on stream by the end of 2009.

2009-07-04

China fund takes stake in

Canadian miner

Canadian mining company Teck Resources Ltd said Friday it is selling a 17

percent stake to China Investment Corp for C$1.74 billion ($1.5 billion)

in a bid to reduce its debt.

The Vancouver-based company said CIC, the world's largest

commodity buyer, will buy 101.3 million class B voting shares for

C$17.21 each. CIC will hold onto the stock for at least a year,

said the mining company.

The proceeds from the private placement will go towards paying

down nearly $10 billion in bank debt and will also give the

company a chance to forge a partnership with a major foreign

investor, said Teck's chief executive in a conference call.

"We will have a financial relationship with a very

deep-pocketed investor who would potentially participate in

future development projects," said CEO Don Lindsay.

The sale, which is still subject to regulatory approval, is

slated to close on July 14.

Teck has been selling assets and cutting costs to pay down the

debt acquired after the $9.8 billion purchase of Fording

Canadian Coal Trust

last year.

After the deal was struck in July, prices for most commodities

tanked. The deal closed in October, after the company received

its financing and just as Canada entered what has turned out to

be a severe recession.

Last month, Teck struck a deal to sell a one-third

interest in its Waneta Dam in southeastern British Columbia to BC

Hydro for $710 million.

Teck has also made about $700 million from the recent sale of many of

its gold-assets.

Earlier this year, Teck was granted reprieve 猶予

from its lenders on

a portion of its debt, which included a $4 billion senior term

loan facility and $5.81 billion senior bridge loan facility.

The deal reduced payments due this October to about $1.9 billion

from $6.3 billion.

Teck also remains on the lookout for a minority partner to take

about a 20 percent stake of its coal business.

About CIC

CIC is an investment institution established under the Chinese

Company Law in September 2007. It seeks stable and long term

risk-adjusted financial return and it is operated strictly on a

commercial basis.

ーーー

Teck Resources Limited

本社 Vancouver, BC

設立 2001年

主要生産物

石炭・銅・鉛・亜鉛・モリブデン・金

Teck Resources(テック・リソーシズ)はカナダの資源大手であり、世界最大級の亜鉛生産企業。原料炭の海上輸送シェア世界2位。旧Teck

Cominco。2009年4月にTeck Resourcesへ社名変更している。

北米、特にカナダを中心に中南米でも事業展開。

Teck-Hughes金鉱山生産のため1913年に設立されたTeck-Hughes Gold Minesと、Sullivan亜鉛・鉛鉱山開発を主体としたCominco(設立当初はConsolidated Mining and Smelting Company

of Canada、1906年設立)がTeck

Resourcesの前身。

Teck-Hughes Gold Minesはメイン資産であるTeck-Hughes鉱山をはじめとする金生産が主体であり、1950年代から銅や銀、亜鉛など取り扱う資源を多角化。また世界最大級のニオブ鉱山であるNiobec鉱山の権益なども取得、資産規模を拡大させていく(Niobec鉱山は2001年に売却)。1980年代には石炭事業にも参入、他企業の買収を通して成長を遂げている。

Comincoは銀や亜鉛、鉛生産を主体とした企業であり、特にSullivan鉱山は2001年までの間100年近く操業を行っている。1980年代には現企業Teck

Resourcesの主力であるValley鉱山(現Highland Valley銅鉱山)や世界最大の亜鉛鉱山である米国のRed Dog亜鉛鉱山などから生産を開始することで資源生産量を拡大させていく。なおComincoは1980年代に業績が低迷し、1986年にTeckが他企業と組んでComincoの株式を取得している。

2001年にTeckとComincoが合併し、亜鉛、鉛、銅など取り扱うそれぞれの資源において世界最大級の生産企業Teck

Comincoとなっている。設立当初からの資産は閉山または売却しているものの、Red

Dog鉱山やペルーのAntamina銅鉱山など生産規模の大きな数多くの鉱山権益を所有している。

2008年には石炭事業のJVパートナーであるFording Canadian Coal Trustを買収して石炭資産を拡大。同時に金資産のJV権益の売却を進めており、カナダで権益を所有していたHemlo金鉱山は2008年にJVパートナーである産金企業Barrick

Goldに売却。また2009年には残り唯一生産を行っている金鉱山である米国・アラスカ州のPogo鉱山の権益もJVパートナーである日本の住友金属鉱山へ売却を発表している。

負債の圧縮のため、2009年7月に中国政府系ファンドCICの出資を受けることで合意している。CICはTeck

Resourcesの株式所有比率は17.2%となる見通し。

2009年4月30日

住友金属鉱山、米国アラスカ州ポゴ金鉱山の全権益を取得

住友金属鉱山は、カナダのテック・リソーシズ社との間で、住友金属鉱山が子会社を通じて保有する米国アラスカ州ポゴ金鉱山の全権益の取得について基本合意した。

これにより同社を主体とした日本企業のみで100%の権益を保有する。

基本合意における権益の取得価格は、2億4500万米ドルに譲渡成立日における運転資金を加えた金額。

今後、同社はテック・リソーシズ社との間で正式契約を締結し、6月末までに権益取得を完了する予定。権益取得の後、同社がオペレーターとしてポゴ金鉱山の運営、操業を行う。

ポゴ金鉱山の概要

1)位置:米国アラスカ州フェアバンクスの南東約145キロ

2)権益比率:住友金属鉱山アメリカ社(住友金属鉱山100%子会社)51%

テック・リソーシズ社40%

SCミネラルズアメリカ社(住友商事100%子会社)9%

3)埋蔵金量:109t(2008年末鉱量計算結果)

4)年間生産金量:11~12t/年

5)開発投資額:約378百万ドル(うち、住友金属鉱山51%、住友商事9%負担)

6)現地における鉱石処理:採掘後、選鉱→青化浸出→電解採取を経てドーレ(金品位約94%、銀品位約6%)として回収

7)テック・リソーシズ社の概要

① 設立:2001年7月(2009年4月23日テック・リソーシズに社名変更)

② 資本金:1,810百万カナダドル

③ CEO:ドナルド・R・リンゼイ

④ 本社所在地:カナダ バンクーバー

⑤

事業内容:北米および南米で、銅・亜鉛・金の鉱山、精錬所および石炭鉱山を経営

1991年に探鉱を開始、1997年にアラスカでテックコミンコと提携し、探鉱及び企業化調査を進めてきた。住友金属鉱山にとっては海外で初の主導的な開発プロジェクトとなる。

CIC 中国投資有限責任公司

China Investment

Corporation (CIC) is an investment institution established as a

wholly state-owned company under the Company Law of the People's

Republic of China and headquartered in Beijing.

The mission of CIC is to make long-term investments that maximize

risk adjusted financial returns for the benefit of its

shareholder.

CIC was established on September 29th 2007 with the issuance of special bonds

worth RMB 1.55 trillion by the Ministry of Finance. These

were, in turn, used to acquire approximately USD 200 billion of

China's foreign exchange reserves and formed the foundation of its

registered capital. Because its financing is grounded in

financial instruments and subject to commercial obligations, CIC

maintains a strict commercial orientation and is driven by purely

economic and financial interests.

CIC is committed to maintaining the high professional and ethical

standards in corporate governance, transparency, and

accountability.

CIC selects investments based on established investment

principles and values. under CIC usually does not take a

controlling role - or seek to influence operations - in the

companies in which it invests.

CIC's fundamental approach is to hold, manage, and invest its

mandated assets to maximize shareholder's value.

この政府系ファンドは2007年9月29日に公式に運用を開始した。6月、30億ドルでBlackstone groupの筆頭株主になった。

Blackstoneは本年5月に中国政府から30億ドルの出資を受け入れた。中国の外貨準備は昨年末で約1兆700億ドルと日本を上回って世界一だが、運用先は米国債に偏り利回りが低いため、シンガポールなどを真似て外貨準備の積極運用に動き始めたもの。

中国政府は2007年9月29日、巨額の外貨準備を海外で運用する国有投資会社「中国投資」(CIC)を設立した。資本金は2,000億ドル(約23兆円)で、米投資会社

Blackstoneに30億ドルを出資する方針が決まっており、海外への積極投資が本格化することになる。

資本金には、政府が特別国債を発行し、中国人民銀行(中央銀行)から買い取った外貨準備が充てられた。経営トップの会長には、前財務次官で国務院副秘書長の楼継偉氏が就任した。同社関係者は「政府から独立して外貨投資事業に取り組む」などとしている。

June 2nd 2009 CIC

purchases $1.2 billion Morgan Stanley common stock

On Dec 19th, 2007,CIC

purchased $5.6 billion mandatory

convertible securities into MS common stock,

representing approximately 9.86% equity ownership in MS.

Following

Mitsubishi UFJ Financial Group, inc.'s investment in MS in

October 2008, CIC's equity ownership was diluted to

approximately 7.68%. This new purchase will bring

CIC's equity ownership in MS back to approximately 9.86%,

effectively reducing CIC's overall cost basis and increasing

the returns potential.

MS is a leading global financial service firm providing a

wide range of investment banking, securities, investment

management and wealth management services. MS is widely

expected to be able to leverage on its strengthened financial

position and will be on the road of resuming its successful

trajectory amid the dramatic restructuring of the

international financial services industry.

CIC has further strengthened its relationship with MS through

the new investments. CIC remains optimistic in MS'

future growth

and progress.

日本経済新聞 2009/7/6

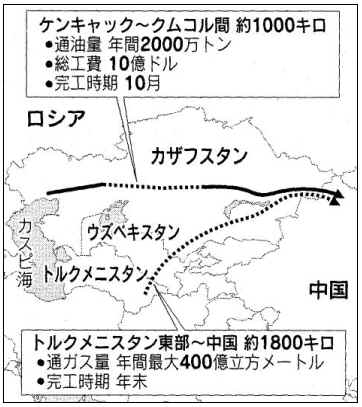

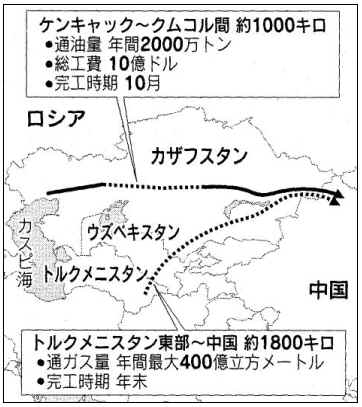

トルクメン ガス、カザフ

原油 パイプラインで対中輸出

東アジア向け初、年内完成 中国、資金援助で影響力

中央アジア諸国が中国とのエネルギー協力を本格化する。トルクメニスタンは天然ガスの、カザフスタンは原油のパイプラインを年内に完成、対中輸出を始める見通し。。

トルクメンからウズベキスタン、カザフを経由し中国・新疆ウイグル自治区に至るガスパイプラインは年末に完工の予定。

トルクメンからウズベキスタン、カザフを経由し中国・新疆ウイグル自治区に至るガスパイプラインは年末に完工の予定。

カザフのカスピ海沿岸と中国西部を結ぶバイプラインは、すでに稼働している東西2区間をつなぐ中央区間が10月に稼働予定で、全線が開通する。中国企業が権益を持つパイプライン沿いの油田の原油を輸出する。金融危機の影響が大きいカザフのナザルバエフ大統領は中国を訪問。100億ドルの融資を得る一方、CNPCに大手石油ガス会社の約半数の株式を譲渡することで合意した。

Jul 1, 2009 Reuters

Kazakhstan expands China

oil pipeline link

* Kazakhstan expands key pipeline to China

* China gets access to Caspian Sea oil fields

China secured access to vast oil deposits in western Kazakhstan

on Wednesday after the energy-rich Central Asian nation said it

had completed the expansion of a major oil pipeline to its

eastern neighbour.

A Kazakh company in charge of the project said the first test

shipment of oil had been successfully completed through the newly

built Kenkiyak-Kumkol pipeline.

"The implementation of this project will have tremendous

influence on the whole oil and gas industry, providing new

opportunities for oil exports," KazStroyService said in a

statement.

The new link, which starts near the Kenkiyak field

operated by China's CNPC, gives China better access to

Kazakhstan's oil provinces in the west and follows Beijing's

intensified efforts to boost energy supplies from Central Asia.

The first phase of the

pipeline, between central Kazakhstan and China's

western Xinjiang region, was completed in 2006. The latest link expands this

pipeline to Caspian Sea oil fields.

2006/5/29 中国-カザフ石油パイプライン正式稼動

Chinese oil companies

such as CNPC own stakes in several Kazakh oil producers,

including CNPC-AktobeMunaiGaz, the operator of Kenkiyak and

Zhanazhol fields, and PetroKazakhstan, which operates the Kumkol group

of fields.

2006/11/8 中国中信集団(CITIC)、カザフスタンの油田買収

CNPCはカザフスタンに油田の権益を持つカナダのペトロカザフスタン買収

1997 年:CNPC、Aktobemunaigaz(ケンキャック鉱区)を買収

Kazakhstan, hit hard by

the global economic crisis, has stepped up contacts with China

for fresh investment.

Beijing further strengthened its foothold in the former Soviet

republic in April after it agreed to lend

Kazakhstan $10 billion in a "loan-for-oil" deal during Kazakh President

Nursultan Nazarbayev's visit.

As part of the deal, CNPC bought a stake in MangistauMunaigas, a company whose fields are also

close to the starting point of the extended pipeline.

Kazakhstan and China agreed to build the 3,000 km pipeline in

1997 and have said they would later double the capacity of the

combined pipeline from the current 10 million tonnes a year.

Kazakhstan, which produced 71 million tonnes of oil last year,

plans to double output within the next decade and seeks to

diversify its exports as well as sources of investment in the

industry dominated by Western oil majors.

China is also building a pipeline to import up to 40 billion

cubic metres of Central Asian gas a year. The link originates in

Turkmenistan and goes through Kazakhstan and Uzbekistan.

2009年04月23日

CNPC=カザフスタン資源会社の株式買収、7月前に完了見通し

カズムナイガスは今年1月、Central Asia

Petroleum社からMangistaumunaigas社の株式52%を取得することで合意。その後、中国石油天然気集団はカズムナイガスに50億

米ドルの融資を行う見返りとして、Mangistaumunaigas社の株式を共同買収する権利を得ていた。買収に当たっては、カズムナイガスと中国石油天然気集団の両社が合弁会社を設立してMangistaumunaigas社の株式を保有する。

Mangistaumunaigas社はカザフスタンの主要油田を開発する会社のひとつで、同社が権益を保有する油田の数は36カ所。うち15カ所で開発を進めている。同社保有の油田の可採埋蔵量は1億9400万トンとされる。

中

国では近年、融資を行う見返りに海外資源を獲得するケースが目立つ。うち中国とロシアは今年2月、ロシアが中国に20年間にわたり石油を供給する見返り

に、中国がロシアの国有石油会社ロスネフチと同国の石油輸送を独占するトランスネフチに総額250億米ドルを融資する契約を締結し、両国間を結ぶパイプラインの建設でも合意していた。

In April, CNPC agreed

to lend $5bn to KazMunaiGas, the Kazakh

national energy company. The two companies also agreed

to acquire MangistauMunaiGas, a Kazakh oil and gas

producer, from Indonesia's Central Asia

Petroleum.

CNPC, which already

holds a 67 per cent interest in the

Kazakh oil producer PetroKazakhstan, has recently said it saw

central Asia as its key overseas oil and gas production base,

shifting its focus from Africa.

ーーー

August 30, 2007

CNPC Starts

Building Turkmenistan-China Gas Pipeline

In

a simple ceremony Wednesday morning, Turkmenistan and China

started building a pipeline that would begin transporting Turkmen

natural gas to China in January 2009.

The

inauguration ceremony took place at the Bagtyarlyk gas territory

at the right bank of Amudarya River.

Bagtyarlyk

territory, containing at least five gas fields, is supposed to

hold more than 1.3 trillion cubic meters of gas, more than enough

to feed the China pipe for 30 years at 30 billion cubic meters

per annum.

The

Chinese experts have independently verified the volume of

reserves at Bagtyarlyk.

CNPC

will develop some of the fields, and lead the pipeline

construction. According to the information available so far, CNPC

is doing the project without any investment or expertise from the

western companies.

The

pipeline - China calls it Central Asia Gas

Pipeline

- will run some 7000 kilometers. It will have two branches, one

going through Kazakhstan and the other through Uzbekistan.

Bagtyarlyk

territory was leased to China in July this year. It contains some

fields that are already productive such as Samandepe and Altyn

Asyr. These two fields, after reconstruction, will provide 13

billion cubic meters per annum for the pipe. The remaining 17

billion cubic meters will come from development of new fields in

the contract territory.

In

addition to building the pipeline, the CNPC will provide

financing and technical know-how for the gas processing and

purification facilities, pumping and compression stations and

boosters.

TurkmenGaz

and CNPC have already signed gas sale-purchase agreement but the

price has not been disclosed. Some reliable sources told that the

price would be above US $ 100 per 1000 cubic meters.

President

Berdymuhamedov said that the pipeline would bring economic

benefits to Uzbekistan and Kazakhstan and would encourage

2009/7/6 Shanghai

Jincheng Coal Starts up

Methanol to Gasoline project in Shanxi

On Jun. 28, Jincheng Anthracite Mining Group (Jincheng Coal 山西省晋城無煙炭集団) started up methanol-to-gasoline

(MTG) project and produced on-spec gasoline projects in Jincheng,

Shanxi Province.

With total investment of RMB 1.7 billion, the project has coal

based methanol capacity of 300,000 t/a, and 93 octane high

quality gasoline capacity of 100,000 t/a. Besides the gasoline,

the other byproduct includes LPG and sulfur. The project will

consume 500,000 ton coal per year with both the methanol

feedstock and the fuel use.

According to the MTG

process, about 3 ton methanol convert in to 1 ton

gasoline(plus LPG), so the 300,000 ton methanol will totally

used for the 100,000 ton gasoline plant.

After the China

policy (mthanol less than 1 million tpa not approved)

released, the investors taked a flexible measures. Generally,

in the feasibility study and application sent to

government, the investor said it planned a 1 Mt/a project

but would conducted by 3 or more stages, the 1st stage is 20,000 or 30,000

t/a. However, when the 2nd or 3rd will be conducted, it is

determind by the investors (maybe short term, maybe long

term). So, you can see many small scale projects got approval

even after the policy effective. For Jincheng Coal,

orginally, the company announced that the 100,000 t/a

gasoline is its 1st stage project, and the 2nd project will

be expansion to 1 Mt/a gasoline (need 3 Mt/a methanol). But

up to now, the detailed 2nd planning has not disclosed yet.

In this project, Methanol

is the intermediate product as it is converted into gasoline by MTG process, which is developed by ExxonMobil

Research & Engineering (EMRE) and Uhde. EMRE provides

technology license for MTG Technology and catalysts for the MTG

process, while Uhde is responsible for the license, the

engineering, supply of key process equipment and technical

assistance for this project.

In China, another local MTG process also is developed and

achieved important progress. Shanxi Institute of Coal Chemistry,

Chinese Academy of Sciences (ICC-CAS 中国科学院山西石炭化学研究所) and SEDIN Engineering (China

Second Design Institute of Chemical Industry 化學工業第二設計院) have jointly developed a

single-stage MTG process where methanol is converted into

gasoline and a small LPG fraction by one step under the action

catalyst. A pilot unit of 3.5kt/a located in Jiehua Company雲南煤化工集団, Yunnan Province, using ICC-CAS

MTG process was successfully started up at the end of 2007. A

200kt/a industrial project is planned by Jiehua Company.

China consumed gasoline 55.5 Mt in 2007 and 63.4 Mt in 2008.

2009-7-6 CCR

Chalco Plans Share

Placement to Support Alumina Project

Aluminum Corporation of

China (Chalco) plans to issue up to 1 billion domestic shares to

raise no more than RMB10 billion, it said in a stock exchange

filing on July 1st.

The proceeds will be used to fund an 800 000 t/a

alumina project in Chongqing, another alumina plant in Xing

county, Shanxi province, and an expansion project by its

Zhongzhou subsidiary on the ore dressing Bayer process system ¨C a typical chemical metallurgical

process for alumina production. About RMB2 billion of the

proceeds will be used to replenish working capital.

2009-7-10 CCR

Qinghua Kicks off

Coal-to-Gas Project in Yilin

Xinjiang Qinghua Coal

Chemical Co., Ltd. under Qinghua Group began construction on the

first phase of a 5.5 billion cubic meters a year coal-to-gas

project in Yining county, Xinjiang Uygur Autonomous Region on

July 1st.

2009/7/14 Shanghai

天津でGreenGen 計画 建設開始

石炭ガス複合発電システムと二酸化炭素分離回収貯留システムの実証化を目指した「GreenGen計画」が7月6日、天津臨港産業区で建設を開始した。

21億人民元を投じるもので、250MWの石炭ガス複合発電(IGCC:Integrated

Gasification Combined Cycle)を建設する。2011年スタートを目指している。

GreenGen計画のために設立されたGreenGen Company が75%出資し、残り25%を天津市政府が本計画のために設立した天津津能(Jinneng)が出資する。

この計画は本年5月にNDRCに承認され、国務院によりアジア開発銀行の融資計画候補(150百万米ドル)に挙げられている。

IGCCは石炭をガス化し、コンバインドサイクル発電(ガスタービン発電と蒸気タービン発電を組み合わせた発電方式)と組み合わせることで従来型石炭火力に比べ高効率化を図るもの。

先ず、日産2,000トンの粉炭ガス化設備、ガス洗浄、中/低熱価ガス燃焼タービンなどの主要設備のシステムを統合し、250MWのIGCC実証発電所を建設する。その後、実証運転に基づき、石炭ベースの水素発生、燃料電池、CO2捕捉・貯蔵(CCS)などの開発、テストを行い、IGCCシステム全体の長期的な安定操業のテストを行う。

GreenGen Companyは国家プロジェクトのGreenGen計画のために設立された会社で、世界の10大電力会社の1つであり、中国最大の発電会社の華能グループ(Huaneng

Group)が51%を出資、他に、中国大唐集団 (Datang

Group)、中国華電集団(Huadian)、中国国電電力(Guodian

Corp)、中国電力投資集団(China Power Investment)の発電会社と、神華集団(Shenhua

Group)、中国国家石炭集団(ChinaCoal Group)、国家開発投資(State

Development Investment)などが出資する。

大唐集団(7%)、華電集団(7%)、国電集団(7%)、中国電力投資集団(7%)、神華集団(7%)、国家開発投資公司(7%)、中煤能源集団(7%)

このほか、外資としては唯一、Peabody

Energyが6%を出資している。Peabodyは世界最大の民営石炭企業で、石炭による発電は米国の電力の約10%、世界の電力の2%以上を占めている。昨年度に238百万トンの石炭を出荷した。

中国ではこのほかに、2つのIGCC Polygeneration(複数のエネルギーを併給する熱電併給システム)がある。

1つは石炭化学ベースで、エン礦集団有限公司(Yankuang

Group)が山東省滕州市に2005年に建設したもので、80MWの発電と年産24万トンのメタノール、20万トンの酢酸を生産している。国のハイテク研究発展計画(「863計画」)の支援を受けている。

もう1つはシノペック/ExxonMobil/サウジアラムコの石油精製・石油化学JVの福建煉油化工(Fujian

Refining & Petrochemicals)によるもので、製油所からのアスファルトをベースに、280MWの発電を行い、80,000Nm3/hの水素、その他窒素、酸素等を生産している。

2009-7-14 CCR

Dynamic Chemical Starts

up EB and EBA projects

In early July 2009,

Dynamic (Nanjing) Chemical Industry Co., Ltd. (Dynamic Chemical)

commenced the production of its 60 000 t/a ethylene glycol

monobutyl ether (EB) project and 40 000 t/a of ethylene glycol

monobutyl ether acetate (EBA) project in Nanjing, Jiangsu

province.

The projects were launched in September 2007.

2009/7/15Reuters

Suspended death sentence

for ex-Sinopec boss

A former chairman of top

Asian oil refiner Sinopec Corp was sentenced to death on Wednesday with a two-year

reprieve for

accepting more than $28m in bribes, one of the harshest penalties

meted out to a senior Chinese official in years.

Chen Tonghai 陳同海, 61, held a rank equivalent to a

cabinet minister before he was abruptly removed from the helm of

the state-owned refiner two years ago.

He took Rmb195.7m

($28.6m) in bribes, the official Xinhua news agency said, during

a period when the company was rapidly expanding its plants.

The reprieve, announced

by the Beijing No. 2 Intermediate People's Court, usually means the sentence will

be commuted to life after two years' good behaviour.

"The government

wants to send the message that it will not be lenient towards

ministerial-level officials," said a Beijing-based industry

executive who requested anonymity.

Mr Chen, an engineer,

headed a refinery in eastern China in the early 1980s and served

as mayor of the booming coastal city Ningbo before becoming

Sinopec chairman in 2003.

He had also served as

deputy chairman of the State Planning Commission, later renamed

the National Development and Reform Commission, which oversees

economic planning.

"Chen took an

extremely large amount of bribes; severe enough for a death

sentence... But as he confessed and repented, provided tips about

other people's criminal acts, and returned all the bribes, a

reprieve was granted," Xinhua said.

Mr Chen was not the first

executive of a state-owned company to be given the death

sentence.

Yu Weiping, vice-chairman

of Yunnan Copper Group, China's third-largest copper producer,

was sentenced to death in December for accepting bribes and

embezzling about $10.3m.

In 2006, Shanghai's

former Communist Party boss, Chen Liangyu, a member of the

decision-making Politburo, was jailed for 18 years for taking

bribes and abuse of power after a scandal over the misuse of

social securities funds.

Sinopec supplies nearly

half the world's second-largest oil market and industry experts

remembered Mr Chen as a strong leader.

"We believed Chen

could have been a strong candidate for the energy minister's

job," said a Beijing-based oil consultant who provides

services for Sinopec.

Many in the industry had

hoped Beijing would set up an energy ministry similar to the US

Department of Energy to handle an increasingly complex and

strategic sector. A weaker, semi-ministry-level National Energy

Administration was set up in 2008 instead.

Mr Chen was replaced by

Su Shulin, formerly an oil explorer at rival CNPC.

"When he vanished,

there was instant shock within the company," said an

industry executive who had business encounters with Mr Chen.

"But then the

company moved on. His name was not mentioned any more. It was as

if the man never existed."

2009-07-17 China Daily

CNPC to expand Liaoyang

project 遼陽市

China National

Petroleum Corp (CNPC), the country's largest oil and gas

producer, yesterday said it had started expansion of its Liaoyang

refinery in northeastern China to prepare for more oil imports

from Russia.

The company will add some facilities to the project, including

hydrocracking unit, hydrorefining unit, and sulphur removing and

recovering unit. It will also add other facilities, including

reserve tanks, CNPC said on its web site yesterday.

After completion at the end of 2010, the Liaoyang project will be

able to

process 10 million tons of crude every year, with feedstock coming

from Russia, said the company.

An

oil pipeline linking Russia's far east to China's northeast is

set to start operation by the end of 2010, Zhou Jiping, vice-general

manager of CNPC earlier said in Beijing.

The pipeline will transport 15 million tons of crude oil annually from Russia to China from

2011 to 2030.

中国は本年2月、ロシアとの間で政府間協定を結んだ。

中国開発銀行がロシア国営石油会社

Rosneft に150億ドル、東シベリア太平洋パイプラインを運営するTransneftに100億ドルを低利で融資する見返りに、Rosneft

は20年間、毎年15百万トンの原油の供給を行い、Transneftはパイプラインを中国に延長する。

China and Russia signed

several energy cooperation agreements in February, which included

the pipeline construction project, a long-term crude oil trading

deal and a financing plan between the two countries.

China is further diversifying sources to ensure sustainable

supplies. The Middle East, Africa and Asia-Pacific are presently

its three main suppliers of crude.

The gap between domestic consumption and production is the main

cause for the increase in imports. Statistics showed that China's

oil consumption experienced around 5 percent annual growth in

recent years. However, the country's crude oil production only

saw 2 percent increase year-on-year.

Last year China imported around 179 million tons of oil, and

imports accounted for 51 percent of total crude oil demand.

China imported 11.6 million tons of crude oil, mostly via rail,

from Russia in 2008, down 20 percent from a year earlier, Chinese

customs data showed.

2009-7-17 CCR

BlueStar NCM to Build Two

Silicone Projects

BlueStar New Chemical

Material Co., Ltd. (BlueStar NCM) said on July 11th that its

Jiangxi Blue Star Chemical Work plans to build a 400 000 t/a

silicone monomer project phase I and a 120 000 t/a

facility for silicone downstream products.

The first phase - 200 000 t/a silicone monomer

project will

cost RMB2.37 billion. Construction will last 18 months.

The 120

000 t/a silicone downstream project would need total investment of

RMB1.48 billion, including 27.13 million Euros.

2009/7/23 Shanghai ブログ

PetroChina Expands

Refining and ABS Capacities in Jilin

On Jul. 17, 2009, PetroChina Jilin Petrichemical held a

groundbreaking ceremony for its refinery, ABS and SM expansion

projects in Jilin City, Jilin Province.

The refinery expansion project is expected to start up in Oct.

2010, which will expand the capacity to 10 Mt/a by adding 3 Mt/a

capacity. The crude oil feedstock will be mainly sourced from

PetroChina Daqing Oilfield. After the refinery expansion, Daqing

is to be supplied 6.5 Mt per year while the rest will be supplied

from Russia.

The ABS expansion project is expected to start up in Oct. 2011,

which will expand the ABS capacity to around 580,000 t/a by

adding two 200,000 t/a lines. The SM expansion project is also

expected to start up in Oct. 2011, which will expand the SM

capacity to 460,000 t/a by adding 320,000 t/a capacity.

PetroChina Jilin has existing oil refining capacity about 7 Mt/a,

and ethylene capacity 850,000 t/a, ABS capacity around 190,000

t/a and SM capacity 140,000 t/a.

| 単位:千トン |

| メーカー |

能力 |

計画 |

立地 |

|

| Zhenjiang

Chi Mei |

700 |

|

江蘇省鎮江 |

台湾 奇美実業 |

| LG Yongxing (LG甬興化工) |

580 |

120 |

浙江省寧波 |

韓国 LG

Chem |

| CNOOC & LG

Petrochemicals |

- |

300 |

広東省恵州 |

| Ningbo Formosa |

250 |

|

浙江省寧波 |

台湾 Formosa

Plastics |

| Sinopec

Gaoqiao |

200 |

|

上海 |

|

| PetroChina

Jilin |

190 |

400 |

吉林省吉林 |

|

| PetroChina

Daqing |

105 |

|

黒龍江省大慶 |

|

| Shinho Changzhou 新湖(常州)石化 |

70 |

|

江蘇省常州 |

韓国 SH

Energy & Chemical |

| Huajin

Group (華錦化工集団) |

50 |

|

遼寧省盤錦 |

|

| PetroChina

Lanzhou |

50 |

|

甘粛省蘭州 |

|

| Total |

2,195 |

820 |

|

|

|

2009-07-28

Sinochem in talks

with Oz's Nufarm

| 24 July, 2009 Nufarm has been approached

by Sinochem (on a confidential, preliminary and

incomplete basis) in relation to the potential

acquisition of Nufarm.

There is no certainty that any agreement will be reached

or that an offer or proposal will be put to Nufarm

shareholders.

The Nufarm Board will consider any offer or proposal it

receives having regard to all the alternatives available

to the company.

Nufarm will keep its shareholders fully informed and a

further announcement will be made in the event of any

material developments.

|

Sinochem Corp, the

country's leading chemicals trader, was in preliminary talks with

Nufarm for a possible takeover, marking the second attempt by a

Chinese company to buy Australia's biggest farm chemicals

supplier in two years.

中国中化集団公司(Sinochem)

元国営の石油トレーディング企業で、石油の探鉱開発,生産,精製まで一貫操業を目指す

"Sinochem and Nufarm

are in early stage discussions regarding a potential acquisition

of Nufarm. These discussions are incomplete and there is

absolutely no certainty that matters will progress," the

Beijing-based Sinochem said in a statement on Sunday.

"This is one of a range of potential growth opportunities

that Sinochem is currently exploring," the company stated.

Nufarm also said earlier that Sinochem had approached it in

relation to the potential acquisition.

Analysts said the deal would expand the Chinese company's

manufacturing facilities of pesticides and herbicides, as well as

extend its overseas network.

"It would enable Sinochem to have a foothold in Australia

and the Americas. It is in line with the company's overseas

strategy," said Chen Lei of China Galaxy Securities.

Nufarm now has manufacturing facilities in 14 countries,

marketing operations in 20 countries and product sales in over

100 countries. The company's market value was around $2 billion.

Nearly 28 percent of Nufarm's revenues were generated in

Australasia, 29 percent in North America, and 23 percent in South

America in the six months ending in January this year.

This is the second time that a Chinese company has shown interest

in Nufarm. In 2007, China National Chemical Corp (ChemChina) and

two US private equity firms agreed to pay A$3 billion in cash for

the company.

2007/12/15 ChemChina 等の豪州の農薬会社Nufarm

買収交渉、破談

ChemChina has adhered to

the strategy of internationalization and successfully acquired

four overseas businesses, including Adisseo in France, Qenos in

Australia and the organic silicone business of Rhodia in France.

2006/10/30 中国化工集団公司(ChemChina)の海外進出

Chinese companies have

had a mixed track record in acquiring Australian assets.

State-owned Aluminum Corp of China's $19.5-billion investment in

Rio Tinto Group was rejected last month after Rio decided to seek

a share sale and a joint venture with BHP Billiton Ltd.

2009/6/6 中国アルミのRio

Tinto への出資 取り止め

China Minmetals Group had

to revise a bid for assets of Oz Minerals Ltd after the

Australian government ruled a mine is close to a weapons-testing

range.

2009/4/25 豪州政府、中国五鉱集団による豪州OZ Minerals 買収を条件付で承認

2009-08-01 China Daily

CNPC signs pact to

develop South Azadegan oilfield

China National Petroleum Corp (CNPC) has signed a memorandum of

understanding (MOU) with National Iranian Oil Company (NIOC) over

the development of South Azadegan oilfield, under which the

Chinese company will cover 90 percent of development costs

and take 70-percent stake in the project.

Currently, NICO holds 90 percent share in the

project with Inpex of Japan having the remaining 10 percent. Under the MOU, CNPC will buy 70

percent of NICO share, Iranian Oil Ministry website Shana said in

a report.

Naji Sadouni, managing director of Oil Engineering and

Development Co of NIOC, said the project needs an investment of $2.5 billion. The field will produce 260,000

barrels of oil a day all together (150,000 barrels in first phase

and 110,000 barrels in second), said the report.

The report did not disclose financial details.

South Azadegan oilfield development has budgeting problems and

NICO cannot afford 90 percent of the project. The Japanese

helped NICO with $3 billion. But as the world economic conditions

have changed, it is not possible to fund the project through this

strategy, said Sadouni.

CNPC on Friday declined to comment on the report. But a CNPC

manager in Beijing told Reuters that the MOU was actually signed

in early spring of this year and the two sides made no real

breakthrough in the negotiations since then.

CNPC won a deal in January to develop the North Azadegan

oilfield.

CNPC signed a $2

billion agreement with Iran in January to develop the North

Azadegan oil field to produce 75,000 barrels of oil per day

over the next four years.

Analysts said the move

indicates that Chinese companies are showing increasing attention

on the Middle Eastern region, which boasts the largest oil

reserves in the world.

With footholds in Iran, China can diversify its oil supplies to

enhance energy security, said Han Xiaoping, a veteran energy

analyst in Beijing.

---

Based on the NIOC plan

field is divided in two areas for development.

In the

January of 2009, Chinese oil firm China National Peroleum Corp

(CNPC) signed a deal to develop north part of the Azadegan oil

field.

Under the first phase lasting 48 months, crude output capacity

would reach 75,000 barrels per day.

Project capex is estimated to be 1.760 Billion US Dollars and

contractor agreed ROR is reported to be 14.98%.The period for

development and reimbursement would be 12 years.

"This contract has

been signed in the form of the new buy- back (terms)," Mehr

News Agency said.

Under so-called

buy-backs, companies hand over operations of fields to NIOC after

development and then receive payment from oil or gas production

for a few years to cover their investment.

1999年に発見されたアザデガン油田はイラン西部のフージスタン省に位置し、世界最大の油田の1つだ。数年前、イランは北アザデガン油田をアザデ

ガン油田から分離している。イランメディアによると、北アザデガン油田の石油埋蔵量は60億バレルと推定され、日産7万5000バレルで計算すれば、25

年間石油を生産することができるという。

ノザリ石油相によると、この2段階の開発プロジェクトが完成すると、北アザデガン油田の日産は15万バレルに達する見込みだという。

2009/8/10 Reuters

Sinopec, Kuwait pick China's Zhanjiang for refinery

* Donghai Island of Zhanjiang chosen, project to cost $9 bln 湛江市東海島

* Decision follows

Beijing's order to relocate

* Beijing's final approval expected within months (Adds industry

comment)

China's Sinopec Group said on Monday its planned $9 billion

refinery with OPEC member Kuwait would be built in Zhanjiang city

in the southern province of Guangdong, months after Beijing's

order to resite the plant on environmental concerns.

The project will be completed in 2013, and the partners hoped to

win Beijing's final approval within months, Sinopec said in a

statement.

"From this week, the two sides will start feasibility

studies for the new site and an evaluation report on enviromental

impact," said Sinopec, parent of top Asian refiner Sinopec

Corp.

The project, a 300,000 barrels-per-day refinery and one million

tonne-per-year ethylene complex that produces plastics

and chemical fibre, first picked Nansha, in the provincial

capital Guangdzhou at the heart of densely populated Pearl River

Delta.

But the companies were forced to relocate the plant around May

after strong opposition from environmentalists and residents as

well as neighbouring Hong Kong and Macao over potential damages

to the state protected wetland where Nansha is located.

Two industry officials said the final pick of Donghai Island of

Zhanjiang city, in the less economically developed western part

of Guangdong, China's export hub, followed a close call with

another competing site, Maoming 茂名市, which was favoured by Sinopec.

"Sinopec has long wanted it to happen in Maoming, but I

believe the Guangdong government wants it in Zhanjiang,"

said one official familiar with the development.

Sinopec Corp already runs a major refinery of 270,000 barrels per

day in Maoming city and had hoped to expand it further, utilising

existing terminal facilities and utilities.

湛江市

中国の広東省の4大国家級経済開発区である湛江経済技術開発区の拡張が決まった。

現在の開発区の対岸にある東海島に新たに10平方キロメートルを開発するもので、同区設立22年来の拡張となる。

天然の良港という地理的条件を生かし、臨海重化学工業区にする計画である。

同開発区は国務院が1984年に、沿海都市14市に設立を決めた初めての国家級の経済技術開発区の一つとなった。開発面積は9.2平方キロメートルで、広東西部の新興工業区として発展してきた。

区内には現在、1000社近くの企業が進出し、累計の投資額は、実行ベースで10億米ドルに達している。

代表的な企業には、中国海洋石油総公司の子会社で中海石油湛江燃料油、ロシアの化学肥料大手の子会社で湛江米克化能、中国石油化工集団系の湛江新中美化工、建設・建設保守資材のヒルティ(HILTI)などが進出している。

港湾インフラの整備も急ピッチで進めており、湛江港では30万トン級の石油製品用ふ頭、25万トン級船舶の通航が可能な深水航路、20万トン級の鉄鉱石用ふ頭の建設が完成している。

東海島への拡張は、国務院が2006年6月に批准した。11月24日に行われた同開発区東海島新区投資環境説明商談会では、同区の主要誘致産業として、石化、造船、鉄鋼、ハイテク産業、物流項目が紹介された。

同開発区管理委員会によると、批准が下りた段階で海洋石油による重交通用アスファルト年産300万トン、石油備蓄設備200万立方メートル、潤滑油40万トン、キシロール45万トンなどの事業のほか、自動車用ホイールやタイヤ、エンジンなどの事業が決まっているという。

2009-8-10 CCR

Sinopec Yizheng Chemical

Fibre to Expand PBT Production

Sinopec Yizheng Chemical

Fibre Co., Ltd. will build an additional PBT facility, with a

capacity of 60 000 t/a.

The chemical fiber producer currently has a 20 000 t/a PBT facility in Yizheng, Jiangsu

province.

The timetable for the proposed plant has not been confirmed.

Construction may be started in the third quarter.

2009/8/14 Shanghai

シノペック儀征化纖、PBT増設着工

シノペック儀征化纖(Yizheng Chemical &

Fibers )は8月6日、江蘇省儀征市でPBT増設の起工式を行った。

同社は現在年産20千トンのPBT設備を持っているが、第二プラントは能力が60千トンで、2010年第2四半期に生産開始の予定。

第一プラントはLurgi Zimmer の技術を採用したが、今回は日立プラントテクノロジーの技術を使用する。

両社は8月3日にライセンス契約を結んだ。日立はPTAと1,4-ブタンジオールの直接エステル化を含む新しい製造プロセスを開発している。

シノペック儀征化纖はポリエステルチップ、ポリエステル繊維、及び原料のPTAの製造販売会社で、2008年末現在の製造能力は以下の通り。

重合設備 1,722千トン

固相重合設備 420千トン

紡糸延伸設備 754千トン

ポリエステルフィラメント加工設備 85千トン

PTA 959千トン

中国の現在のPBTの能力は以下の通り。

Bluestar

New Materials

(江蘇省南通市) 80千トン(2008年に60千トン増設後)

Sinopec

Yizheng (江蘇省儀征市) 20千トン

Jiangsu

Sanfangxiang (江蘇省江陰市)

10千トン

なお、中国のPBTの輸入数量は以下の通り。

2007 155千トン

2008 147.3千トン

日立プラントテクノロジーはPET、PC、PBTなどの製造プロセス、プラントを開発し、多数納入している。

笠戸生産統括本部(山口県下松市)内のパイロットプラントを活用して開発しているもので、PETプラントでは世界最大級(年産20万トン)を含め、これまで100系列以上を国内外に納入、PBTプラントも世界最大級(年産6万トン)のものを、国内、東南アジアに納入している。

同社は本年3月に河南省の医療衛生用品メーカーにポリ乳酸製造のライセンスを供与、主要機器を受注している。稼動時の能力は1万トンだが、将来的には15万トンまで拡充される予定。PET製造技術等をベースに2004年に開発した。

2009-08-13 China Daily

Sinopec, CPC ink Oz

exploration deal

Mainland's second largest

oil company, Sinopec Group, yesterday said it had agreed with Taiwanese oil

producer CPC Corp

to jointly explore an offshore block off northern

Australia,

the second cooperation deal between the two companies.

Under the agreement, CPC will buy a

40-percent stake in Sinopec's NT/P76 offshore block, Sinopec said in a statement

yesterday. It gave no financial details.

The block, which is

located in the Bonaparte basin about 330 kilometers from Darwin

city, has geological gas reserves of 13 trillion cubic feet, said

the statement. It has a water depth of 80 to 530 meters.

Sinopec first cooperated

with CPC in 2004, when the two companies jointly explored a block in

Australia named AC/P21. The area was operated by Italy's

biggest oil company Eni SpA, said the statement.

With around 15,000

employees, CPC Corp forms the core of Taiwan's petrochemical

industry.

A Sinopec spokesman

yesterday declined to make further comments on the deal. The two

companies have yet to discuss details of their cooperation, Lin

Maw-wen, the Taiwanese company's vice-president, said yesterday.

China

National Offshore oil Corp (CNOOC), a leading offshore oil and gas

producer, earlier said it had signed four oil exploration

agreements with CPC Corp.

The agreements included a

letter of intent for closer cooperation, a revised contract

on joint exploration in the Tainan Basin and the

Chaozhou-Shantou Basin off Guangdong coast, joint study on the

Wuqiuyu Basin off Fujian coast, and transfer of a

30-percent stake of CNOOC's onshore block 9 in Kenya to CPC.

Meanwhile, Sinochem Corp, China's biggest chemicals trader,

offered to buy Emerald Energy Plc for 532 million pounds ($875

million) to expand its oil and gas drilling operations in the

Middle East and South America.

Sinochem plans to buy

Emerald for 750 pence a share, an 11.1 percent premium to the

London-listed company's closing share price of 675 pence on Aug

11, the Beijing-based trader said in a statement yesterday.

Emerald Energy

Plc is a UK based company engaged

in the exploration and production of hydrocarbons.

2009/8/14 Shanghai

Bluestar starts

construction for Integrated Silicones Project in Jiangxi

On Aug. 9, 2009, Bluestar - the subsidiary of ChemChina, started

construction for its Integrated Silicones Project in Xinghuo (星火) Industry Park, Jiujiang (九江), Jiangxi Province. 江西省

The Integrated

Silicones Project will be conducted by two stages. In the 1st

stage, Bluestar will invest RMB 4 billion, to build a new 200 kt/a

silicone monomer project and a new 120 kt/a silicone derivatives

project in Jiujiang, Jiangxi. Also, Bluestar will

expand the existing 200 kt/a silicone monomer

plant to 300 kt/a.

So, after the completion of the 1st stage, Bluestar will totally

have 500 kt/a silicone monomer capacity in Xinhuo, Jiujiang,

Jiangxi Province. The 1st stage project is expected to start up

in by the end of 2010. The technology will sourced from France

based Bluestar Silicones International (BSI the former Rhodia

Silicones)

In the 2nd stage, Bluestar will build another 200 kt/a silicone monomer capacity, and

make the total silicone monomer capacity to 700 kt/a.

In 2008, Bluestar had announced to set up a jv to build a

large scale silicones project in Lingang Industrial Park, Tianjin, which was proposed to

have silicone monomer capacity of 400 kt/y, it will be conducted

by two stages with 200 kt/y for each, and had got the approval

from government. But now, Bluestar has stopped to the Tianjin

project, and shift it totally to Jiujiang, Jiangxi.

同社は2004年10月にフ

ランスのローディアと覚書を締結し、天津に年産20万トンのシリコーンモノマー工場を建設するFSを開始した。

両社はそれぞれのシリコーンの上流及び下流分野での活動をグローバルに戦略統合する可能性について2006年央までに検討することとした。

その後の話し合いの結果、2006年10月に藍星集団はローディアのシリコーン事業を買収する契約を締結した。

ローディアのシリコーン事業は藍星集団の子会社

Bluestar Silicones

International となり、フランスに Bluestar France

を持つ。

2008年3月に、藍星は子会社 Bluestar OrganoSilicone

(Tianjin) を設立し、Bluestar

France

の技術を使用して、天津の臨港工業区に能力400千トン(第1期

200千トン、第2期 200千トン)のシリコーンモノマー工場の建設を決めた。

既に政府の承認も得ているが、この天津計画を取り止め、九江市に集約することとした。

2009/8/17 CCR

Shandong Hualu to Expand

Acetic Acid Business 山東華魯恒升集團有限公司

Shandong Hualu Hengsheng

Chemical Co., Ltd. said on August 12th it plans to expand its 200 000 t/a acetic

acid facility to 800 000 t/a and build a auxiliary coal

gasification project to expand in the coal-based chemicals

business.

Shandong

Hualu-Hengsheng Chemical Co., Ltd., a large-scale integrated

enterprise mainly engaged in manufacturing chemical

fertilizers and in chemical industry, is one of China’s top 500 chemical industrial

enterprises. Its products cover three series and more than

ten varieties, such as carbamide, carbinol,

formaldehyde, DMF, methylamine, oxygen, nitrogen, argon,

hydrogen and carbon monoxide. It is one of the largest

chemical fertilizer manufacturers nationwide and the largest

DMF suppliers worldwide. Its leading product, “Youyi”

Brand

carbamide, is named the China Top Brand and a national

inspection-free product.

With strong technical

strength and solid management foundation, the company has

formed a mature management mode with distinct

characteristics, built solid strategic partnerships, and won

customers. It owns many national patents and some innovations

have won the State Management Modernization Innovation

Achievement Award and the Scientific & Technological