トップページ

2006/11/7 China Chemical Reporter

JFE Coal Tar Project Puts

into Trial Production

On October 20th, 2006,

the 300 000 t/a coal tar deep-processing project put into trial

production in Shandong JFE Zhenxing Chemical Company Ltd. located

in Weifang, Shandong province, eastern China. With a registered

capital of RMB164 million, Shandong JFE Zhenxing Chemical Company

Ltd. is a Sino-Japan JV jointly funded by Weifang Zhenxing Coking

& Chemicals Co., Ltd., a subsidiary of Shandong Haihua Group

Co., Ltd. and JFE of Japan, split by 40% and 60%.

On August 3rd, 2005, the

contract on the 300 000 t/a coal tar deep-processing unit was

signed in Weifang. With a total investment of RMB400 million, the

project started construction on October 12th, 2005. It is the

first-phase project of their cooperation. In the second phase, a

150 000 t/a crude benzene deep-processing unit will be built. In

the third phase, a 300 000 t/a coal tar deep-processing project,

a 50 000 t/a project and a 10 000 t/a water reducer unit will be

followed to make the product portfolio versatile. The total

investment of the 3 phases is planned to reach RMB2.09 billion.

タールおよびタール蒸留製品の生産、販売

会社名:山東傑富意振興化工有限公司

JFE Zhenxing Shandong Chemical CO., LTD.

場所 :山東省 坊市

坊市

出資者:JFEケミカル 60%

山東海化集団 坊振興焦化有限公司

40%

坊振興焦化有限公司

40%

能力 :30万トン/年(中国最大級)

http://www.jfe-steel.co.jp/release/2005/08/050803.html

2006/10 生産開始

Platts 2006/11/7

China's first coal-to-olefins project to break ground in H1 2007

China's Sino Biopharmaceutical Ltd expects to begin construction of

the country's first coal-to-olefins project in March or April

2007, a company source said Monday.

"Primary preparation work has already begun, but since the

weather has turned cold, we will need to wait until next spring

to actually start construction work," the source said.

The plant will be located in Yulin city in

north China's Shaanxi Province.

The first phase of the project will cost about Yuan 5 billion

($632 million) and targets producing 600,000 mt/year of

methanol

from coal--which will then be processed into 100,000 mt/year of

ethylene and 100,000 mt/year's propylene.

The smallest shareholder, Shannxi New Coal Chemical Science

and Technology Development Company Ltd, which holds a 5% share, had

spearheaded the development of the new dimethyl

ether/methanol-to-olefin (DMTO) technology to be used in the

project and had been a partner in the first industrial trials of

DMTO technology in China.

China Chemical Reporter

2006/11/15

Three Coal Chemical

Projects Kick off in Shaanxi

On November 2nd, 2006, a 3 million t/a DMTO

(dimethyl

ether/methanol to olefin) commercial demonstrative project, a 600 000 t/a

methanol project

and a

200 000 t/a acetic acid project started construction in

Yuheng Industry Park, Yulin, Shaanxi province.

The 3 million t/a DMTO project is undertaken by Shaanxi Xinxing

Coal & Olifin Co., Ltd. With a total investment of RMB5

billion, the first phase will construct a full-process DMTO

demonstrative project with the 600 000 t/a methanol processing

capacity, which is scheduled to complete in 3 years. The project

adopts the technology provided by Dalian Institute of Chemistry

and Physics, CAS.

China Chemical Reporter

2006/11/8

Tessenderlo Expands Gelatin Business in China

PB Gelatins, a part of the Specialities business section of Tessenderlo Group of Belgium, and Zhejiang Feipeng

Gelatin Company Ltd., located in Aojiang Port State-level Spark

Sci-tech District near Wenzhou of Zhejiang 浙江省温州

province,

south-eastern China, are setting up a joint venture (JV) to be

known as PB Gelatins (Pingyang) Co., Ltd. Both parties said on October

28th, 2006.

Located in outskirts of Wenzhou, the new JV is to produce

high-quality gelatin. Its equity split is 80: 20, between

Tessenderlo Group and Zhejiang Feipeng Gelatin Company.

2006年11月10日 化学工業日報

ペトロマテリアル、中国でポバール事業開始

ペトロマテリアル(三宅靖樺社長)は9日、中国でポリビニルアルコール(ポバール)事業を開始すると発表した。江西省のポバールメーカー、江繊高科股〓有限公司に資本参加することで基本合意した。出資額は約9億円で、出資比率は35%。

同社は油井管など石油開発用資材を主力業務としているが、石油化学分野への参入により次の成長を図る考え。このため多くの取引先を持つ中国で需要が拡大するポバール事業へ進出する。

ペトロマテリアル

当社は石油開発に使う器材の製造と販売をコアビジネスにして主に次の事業を行っています。

1994年2月

有限会社東京貿易として設立

2000年3月

株式会社に組織変更、資本金を300万円から1000万円に増資

2005年12月

ペトロマテリアル株式会社に社名変更

「人民網日本語版」2006年11月10日

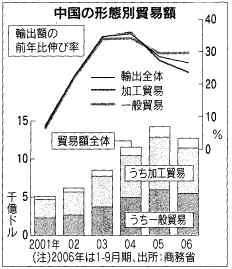

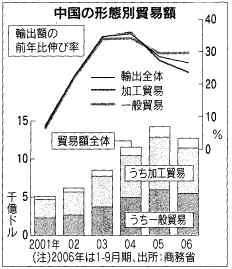

商務部など、新「加工貿易禁止類目録」を発表

商務部、税関総署、国家環境保護総局から新たに発表された「加工貿易禁止類目録」(2006-11-01 公告2006年第82号

実施期日2006-11-22)が関心を集めている。商務部産業司の王琴華司長はこれについて以下のように解説する。

今回発表された目録は輸出に伴う税金の還付が廃止された商品が主体となっており、関連商品は804品目。輸入禁止、輸出禁止、輸出入禁止の三種類に細分される。

輸入禁止商品は77品目で、虎骨、鉱砂、繊維廃棄物など国際条約で輸入が禁止されているものや加工段階の汚染が大きいもの。

輸出禁止商品は503品目で、板材、硫黄、粘土、石材、金属原料など高度加工の初期原料として用いられるもの。加工貿易企業が輸入するこれらの原料商品は引続き税率の優遇が受けられる。

輸出入禁止商品は224品目で、ミネラルウォーター、石炭、アスファルト、可燃ガス、農薬など加工レベルが低く、高エネルギー消費量、高汚染の商品。

新たな禁止目録に関連する商品は輸出入商品全体の6.5%に及ぶ。原料商品の管理方式は輸出禁止となっており、加工貿易企業が原料を輸入して高度加工生産をするのには影響を及ぼさない。新目録は高エネルギー消費量、高汚染の化学工業製品や金属精錬製品に関連するものが主体となる。現在中国の加工貿易の75%を機械電気製品が占めているため、新目録の発表が加工貿易に与える影響は大きくない見込み。

加工貿易禁止類目録 http://cys.mofcom.gov.cn/accessory/200611/1162540012749.xls

2006/11/20 日本経済新聞夕刊

中国 加工貿易の優遇縮小 組み立て型一部除外 付加価値高い産業へ転換

2006-11-09 新華社

China, Russia make

historic breakthroughs in oil co-op

In 2006,

China and Russia have made "historic breakthroughs" in

investment and cooperation in the petroleum industry, Zhou

Jiping, deputy general manager of the China National Petroleum

Corporation (CNPC), said in Beijing on Thursday.

So far this year, the two

countries have signed a series of agreements on setting up two

joint venture companies involving oil and gas

exploitation

and the

construction of a pipeline transporting Russian crude oil to the

Chinese border,

according to the CNPC official.

Leaders of Chinese and Russian oil

companies attending the on-going third meeting for promoting

investment in China and Russia were optimistic about the

prospects of the two countries' cooperation in the oil sector.

Zhou said that Sino-Russian

cooperation in the oil industry will help stabilize both the

regional and global oil markets.

Sergei Bogdanchikov, president of

Russian oil giant Rosneft, said China is a stable and

rapidly-growing market for Russian oil. He pledged to go all out

to promote cooperation in oil industry.

According to official figures,

Russia is the world's largest gas exporter and second largest oil

exporter, while China is the third largest oil importer in the

world.

In the first nine months of the

year, Russia's oil output was 358 million tons while China's was

140 million tons.

October

17, 2006 Rosneft

Rosneft and CNPC Have Signed Protocol on Creation of Joint Venture Company

On October 16, 2006, Sergey Bogdanchikov, president of OJSC

Rosneft, and Chen Geng, president of China National Petroleum

Company (CNPC), signed a protocol on the creation of Vostok Energy

Ltd.

The charter capital of Vostok Energy was set at RUR 10

million. Rosneft will hold a 51% stake in the company, and CNPC will hold

49%. The

company's board of directors will be comprised of five

persons, three of whom will come from Rosneft and two from

CNPC.

The new joint venture company was established primarily to

conduct exploration work in Russia and obtain licenses for

various types of subsoil resource use. Moreover, Vostok

Energy intends to undertake production and sales of

hydrocarbons, as well as implement new technologies leading

to increased effectiveness of exploration and production. In

the future, the company's operations will promote increased

foreign investment in Russia, as well as greater employment

opportunities for Russian citizens.

On March 21 in Beijing, Sergey Bogdanchikov and Chen Geng

signed an agreement on general principles of creating joint

venture companies in Russia and China in order to expand

cooperation between Rosneft and CNPC.

Platts 2006/11/13

China Dahua's new paraxylene, QTA units due on-stream in mid-2008

China's Dahua Group 大化集団 expects to complete its new 450,000 mt/year

paraxylene

plant in May or June of 2008, a source close to the company said

Friday.

The PX produced by the new plant will be captively used as

feedstock for a downstream 500,000 mt/year quality

terephthalic acid plant

that is also scheduled for construction and which is expected to

come on-stream in the latter half of 2008.

大化集団/大連福佳企業集団

Benzen 200,000、OX 100,000、PX 450,000

浙江逸盛化学75%/大化集団 QTA 500,000大化集団 coal-based

methanol 300,000

|

2006/11/16

China Chemical Reporter

PO Integrated Project

Kicks off in Jiangsu 下記

On November 9th, 2006,

the propylene oxide(PO)integrated project started construction in

Nanjing

GPRO Kumho Petrochemical Company Ltd. located in Nanjing Chemical

Industry Park, Jiangsu province.

On September 19th, 2006,

Kumho Petrochemical Co., Ltd. of Korea and Jiangsu GPRO Group 金浦集團sign an agreement in Jiangsu

province on jointly operating the PO integrated project. With a

total investment of US$200 million, the project is the largest

investment for Kumho Petrochemical Co., Ltd. of Korea in China.

The first-phase project is scheduled to be completed and come on

stream by the end of 2007 with the capacity of 100 000 t/a PO, 50

000 t/a polyether polyol and 100 000 t/a caustic soda.

2006/7/25

KKPC Constructs First Production Base in China

http://inews.mk.co.kr/CMS/eng/com/7499929_4136.php

Korea Kumho Petrochemical

Co. Ltd. (KKPC) has planned to set up its first overseas

production base in Nanjing, Eastern China.

KKPC reached a Memorandum of Understanding (MOU) with the

president of China's Jiangsu GPRO Group Company (GPRO). A 50-50 joint

venture

between the two companies was established.

Roughly $50 million will be invested each by KKPC and GPRO to

construct a 60,000 pyeong plant within Nanjing Chemical Industry

Park (NCIP).

* a pyeong is 3.31 square metres

The plant is expected to be operational in 2008, and is

forecasted to produce 80,000 tons of propylene oxide,

50,000 tons of polyptopylene glycol and 100,000 ton of caustic

soda annually.

Polypropylene glycol, the main material for the polyurethane (PU)

is used for refrigerator, automobile parts, roads and furniture,

while propylene oxide and caustic soda are used to produce

polyptopylene glycol.

To rapidly advance into the Chinese market, KKPC is currently

considering constructing additional plants throughout China.

In Korea, KKPC operates a plant in Ulsan(SK

complex) which is said to produce 45,000 tons of polypropylene

glycol per year.

Jiangsu GPRO Group was established in 1992 and has developed

rapidly through acquisitions and mergers.

2008/6/30 Asia Pulse

Data Source via COMTEX blog

Korea Kumho

Petrochemical sets up first overseas plant in China

Korea Kumho

Petrochemical Co., a South Korean chemicals producer, said

Sunday that it has completed the construction of its first

overseas plant in China, which it says will help tap the

rapidly growing Chinese market.

The

factory will annually produce 50,000 tons of

polypropylene glycol, used for shoes, furniture,

auto parts and refrigerators. It will also churn out 80,000 tons of

propylene oxide and

100,000

tons of caustic soda, materials used to produce

polypropylene glycol, Korea Kumho Petrochemical said.

Platts 2006/11/16

China's Jinzhou Petrochemical to start-up new SM unit in Dec 2006

(PetroChina 錦州石化)

China's Jinzhou

Petrochemical Company was set to start up its 80,000 mt/year

styrene monomer plant in Northeast China's Liaoning

Province in early December 2006, a company source said late

Thursday.

"Construction at the new SM plant was basically completed in

early November and we should have commercial SM output by January

2007 if the plant runs smoothly," the source said.

The plant was built with an investment of Yuan 393.88-mil

($49.235-mil) and construction begun in August 2005.

Most of the company's SM product was expected to be sold into the

East and South China domestic markets, said the source.

Jinzhou Petrochemical Company is one of the subsidiaries of

China's state-owned oil and petrochemical company PetroChina.

2007-11-20 CCR

Jinzhou Petrochemical

Starts up 80 000 T/A Styrene Unit

On November 4th 2007 the 80 000 t/a ethyl benzene-styrene

unit of CNPC Jinzhou Petrochemical Company Ltd. was completed

and went on stream in Jinzhou, Liaoning province.遼寧省

錦州

With a total

investment of RMB394 million and an area of 36 000 m2, the

construction on the unit was started on August 23rd, 2005.

2006/11/17 China Chemical

Reporter

Sinopec Corp. to Build

Bio-energy Project

On November 8th, 2006, China

Petroleum & Chemical Corporation (Sinopec Corp.) signed a

Framework Agreement on Bio-energy with Chengdu Municipal

Government of Sichuan province.

Under the agreement, both parties

intend to build a fuel alcohol project with a

capacity of 600 000 t/a and a bio-diesel facility with a capacity

of 100 000 t/a during

2006-2010, to meet energy demand in Sichuan province for the

local oil demand is short of supply.

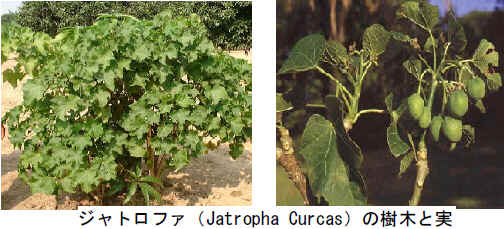

Sichuan province has abundant

batatas サツマイモ and jatrophasジャトロファ豆. The fuel alcohol project will

use batata as raw materials and the bio-diesel unit will use

jatropha as raw materials.

jatrophas のBio-energy Project

http://www.h7.dion.ne.jp/~fomfc/03JatrophaOilProject(JP).pdf

http://www.biomass-hq.jp/foreign/pdf/biomass_india.pdf

Platts 2006/11/20

China's Xinjiang

Petroleum completes methanol plant test runs

China's Xinjiang

Petroleum Administrative Bureau completed test runs at its new 200,000 mt/year

methanol plant

in Xinjiang, a company source said on Friday.

The plant is situated in Xinjiang Karamay (克拉瑪依)Petrochemical

Industry Park of

Northwest China, and is the first project entering the park, the

source said.

Xinjiang Petroleum Administrative Bureau is asubsidiary of

state-owned China National Petroleum

Corporation.

China Chemical Reporteer

2006/12/5

Methanol Expansion

Project Starts up 新疆ウイグル自治区CNPC Tuha

Oilfield Co

On November 26th,

2006, the 240 000 t/a methanol expansion project (from 80 000

t/a to 240 000 t/a) started up in CNPC Tuha

Oilfield Co., Ltd. located in Turpan and Hami

basins in the eastern part of Xinjiang新疆ウイグル自治区トゥルパン、ハミ.

The existing capacity of methanol unit was 80 000 t/a. Starting

from April 2005, the expansion project put into trial operation

on October 10th, 2006. Qualified methanol product was produced on

November 5th, 2006. The whole unit operated steadily today.

It is released that the total consumption amount of natural gas

has decreased by 20% - 30% after expansion so that the stride

development of the downstream products in Tuha Oilfield can be

effectively promoted.

2006-11-20 China Chemical

Reporter

Nanning Chemical to expand caustic soda unit 広西チワン族自治区南寧

On November 9th,

2006, Nanning Chemical Industry Co.,

Ltd. announced

that it plans to issue up to 70 million A Share in a non-open way

at a price of less than RMB3.62 per share, and raise fund of

approximately RMB250 million.

The raised fund intends to be used in expanding 100 000 t/a

ion-membrane caustic soda phase II project, multi pole ion-membrane caustic

soda electrolytic tank, the innovation of concentration process

for salt solution, chlorine and hydrogen, as well as new

thermoelectricity facility.

Asia Chemical Weekly

2006/11/24 CNPC

Lanzhou's ethylene unit conducts intermediate handing-over

PetroChina Lanzhou starts

up new ethylene project

Lanzhou Petrochemical Co. - a subsidiary of PetroChina, has

started up its new ethylene project and produced on-spec products

in Lanzhou city, Gansu Province.

Construction for this project was started in Q2 2005. Earlier,

Lanzhou Petrochemical planned to build a new project with

capacity of 360 000 tonne/year, while the plan was revised later

and the new project is 450 000 tonne/year.

With total investment of around USD 788 million (RMB 6.3

billion), this project adds 450 000 tonne/year ethylene capacity

and makes Lanzhou total ethylene capacity to 690 000 tonne/year.

Besides this new one, Lanzhou Petrochemical has a 240 000

tonne/year cracker already.

Feedstock will be self-supplied by its refinery; Lanzhou

Petrochemical has 10.5 million tonne/year refining capacity in

existence.

The derivatives for the new cracker as follows:

-All

density PE (HDPE/LLDPE swing) 300 kt/a

-LDPE

200 kt/a (Basell technology)

-PP

300 kt/a (Basell technology)

-Butadiene

extraction 90 kt/a, and

-Gasoline

hydrogenation 340 kt/a*

* The gasoline hydrogenation project includes

207.5 kt hydrogenated gasoline, 92.3 kt/a C5 product

and 33 kt/a C9 product,

with a total capacity around 333 kt/a. It is

announced 340 kt/a.

PetroChina will sale the downstream products to midland and

Southwest China market.

Also, the company has the plan to further expand ethylene

capacity to 1 m tonne/year and refining capacity to 12 million

tonne/year by 2010.

Chian Chemical Reporter

2006/12/1

COFCO Enters Bio-energy Business

BBCA Biochemical Co., Ltd. (BBCA Biochemical) announced on November 21st, 2006

that its shareholder Anhui BBCA Group, Anhui Bengbu Municipal

Government and China National Cereals, Oils &

Foodstuffs Corporation (COFCO) signed a Framework Agreement on

November 20th. Under the agreement, three parties have agreed

that COFCO or its appointed companies purchase 200 million shares

in BBCA Biochemical from BBCA Group that owns 24.7% equity in

BBCA Biochemical. Upon completion of the transaction, COFCO will

acquire a 20.7% stake in BBCA Biochemical, while BBCA Group's

interests in BBCA Biochemical will reduce to 3%.

COFCO will input capital to support and strengthen BBCA

Biochemical's bio-energy and biochemical business.

Located in Bengbu, Anhui province安徽省蚌埠, BBCA Biochemical engages in

further processing of agricultural products through advanced

bio-fermentation and modern chemical separation techniques to

produce bio-energy and biomaterial. It is one of the

manufacturers appointed by the state to produce fuel ethanol for

ethanol gasoline, supplying fuel ethanol required in Anhui,

Shandong, Jiangsu and Hebei. Due to the production of fuel

ethanol and sodium glutamate, the company suffered a loss.

Headquartered in Beijing, COFCO is a leading cereals, oils and

foodstuffs producer and trader in China, focusing on agricultural

products trading, bio-energy developing, foodstuffs processing

and real estate as well as finance services. Since promoting and

using fuel ethanol in China, the company has a strong commitment

to strengthen biochemical operation and also pledges to be the

main provider and leader of bio-energy in China.

2006/12/7 Asia Chemical Weekly

Two Coal to

Chemicals projects launched in Shaanxi

On early Nov. 2006, there are two Coal-to-Chemicals projects

launched at Yuheng Industrial Park (楡橫工業園) , Yulin, Shaanxi Province.

One is DMTO based coal-to-olefin industrial project invested by Shaanxi Xinxing Coal Chemicals Co.

(Xinxing),

which includes a 600 000 tonne/year coal based methanol, a 600

000 tonne/year Methanal-to-Olefins by using the DMTO technology,

100 000 tonne/year PE and 100 000 tonne/year PP units.

* DMTO(Dimethyl Ether /Methanol to Olefin) technology developed by Dalian Institute of Chemistry and Physics

(DICP), CAS

This is the first stage project of Xinxing, with investment of

around USD 625 million (RMB 5 billion), it is expected to start

up in 2009. Totally, Xinxing planned to invest USD 2.75 billion

(RMB 22 billion) for a 3 million tonne/year methanol-to-olefins

project.

Another is the coal based methanol project invested by Zhonghua

Yiye (中化益業) Energy Investment Co. (Zhonghua

Yiye). It includes 600 000 tonne/year methanol by using GE's

gasification technology (former Texaco technology), and a

thermal-power station.

With investment of around USD 287.5 million (RMB 2.3 billion),

this is also the first stage project of Zhonghua Yiye, and it is

scheduled to start up in 2009. The company will eventually build

total 2.4 million tonne/year of methanol and 800 000 tonne/year

of olefins at the site.

Zhonghua Yiye is a jv between Hong Kong based Benefit Sales

investment company and China National Chemical Engineering Group

Corp (CNCEC). CNCEC is a major chemical engineering and

construction firm in China.

2006/12/13 Asia Chemical Weekly

Sinopec

plans gas based MTO project in Sichuan

On early Dec., Sinopec has signed a letter of intent with the

Dazhou municipal government, to build a mega-methanol and large

scale methanol-to-olefins (MTO) project in Dazhou (達州) city, Sichuan province.

Different with coal based methanol and MTO projects in China,

this proposed project will be based on natural

gas. Given

there is a huge gas field named as Puguang (普光) in Dazhou, which is owned by

Sinopec.

The project will have investment of around USD 1 billion (RMB 8

billlion), capacities include 1.8 million tonne/year gas based

methanol and 600,000 tonne/year of olefins (ethylene and

propylene). Sinopec aims to start work on the project in 2007,

while the exact dates for kickoff and startup are not clear yet.

Research Institute of Petroleum Processing (RIPP), a subsidiary

of Sinopec, is researching and developing MTO technology. So,

Sinopec is inclined to use the self-developed MTO technology;

while DICP's DMTO should be another choice.

The proven gas reserves of Puguang gas field is more than 350

billion cbm. In the coming years, according to Sinopec, it will

invest more than USD 8.75 billion (RMB 70 billion) to exploit and

utilize the natural gas resources in Sichuan province.

2006/12/18

Asia Chemical Weekly

NDRC

approved Shenhua MTO project in Baotou

Recently, NDRC has given the final approval to Shenhua神華集団

for its large scale

methanol and MTO project in Baotou, Inner Mongolia

内蒙古自治区包頭市.

With total investment of is around USD 1.55 billion (RMB 12.4

billion), the project includes 1.8 million ton

coal-based methanol, 600,000 ton MTO, 300,000 ton PE and 300,000

ton of PP.

The methanol to olefins project will use DMTO technology, which

is jointly developed by Shaanxi Xinxing Coal Chemical Co.,

SINOPEC Luoyang Engineering Co., and Dalian Institute of Chemical

and Physics (DICP) of CAS 中国科学院大連化学物理研究所.

The project is operated by Baotou Shenhua Coal Chemical Company包頭神華石炭化学, which is a 76:24 jv of Shenhua

Group and Shanghai Huayi Group上海華誼集団公司. It is scheduled to start up in

2010.

On 28 Oct,

2005, Shenhua Group has broke ground for this project. While

after then, the investors changed, Shanghai-listed Baotou

Tomorrow Technology Company exit, and it was replaced by Shanghai

Huayi. Also, at that time, the expected licenser of MTO

technology is UOP, while finally Shenhua chose the DMTO

technology from DICP, CAS for this project.

本計画は2005年8月に、神華集団が包頭でのCoal-to-Olefins

(CTO)計画の一次認可を受けた。計画は石炭からメタノールを生産し、メタノールからオレフィンを生産するものであった。

同社は2005年10月に先ず、180万トンのCoal to Methanol 計画の承認を受け、建設を開始した。MTO計画については未承認のままで、とりあえず、UOP技術を導入する覚書を締結した。

当時の提携先はKerry Group とBaotou Tomorrow Technology Co

(包頭明天科技)であった。その後、後者が撤退し、代わりに上海華誼集団公司が参加した。更に、政府が外国企業の投資を望まないことから、Kerryも離脱した。

2006年7月、政府は石炭化学産業を規制する通達を発表した。年間300万トン未満の石炭液化計画、年間100万トン未満の石炭からのメタノール又はDMT生産計画、年間60万トン未満の石炭からのオレフィン生産計画を承認しないとしたが、同時に国産技術の採用を指導した。

これに基づき、神華集団ではUOP技術ではなく、今回の国産のDMTO技術を採用することとし、このたびの認可に至った。

なお、以前のパートナーのKerry

Group

はマレーシアの華僑 Robert

Kuok(郭鶴年)の会社で、アジアで幅広く農園、食品、ホテル、不動産等の事業を行っている。

ーーー

神華集団とダウは2004年10月に、共同で中国でのCoal-to-Olefin 事業実施のFSを行うと発表している。

両社は現在もFSを継続中で、情報筋の話ではダウは上記のDMTO技術を評価中とのこと。

The Kerry Group is a

multi-billion pound conglomerate controlled by Malaysian

Chinese businessman Robert Kuok郭鶴年, with interests in hotels,

property, media, and food stuffs across Asia. The Kerry Group

is the controlling shareholder of three listed companies in

Hong Kong: Shangri-La, the Asian luxury hotel chain; Kerry

Properties; and South China Morning Post, Hong Kong's leading

English newspaper.

In addition to holdings in listed companies, the Kerry Group

also has substantial unlisted businesses, including an edible

oils business in China; a regional logistics and warehousing

business; and palm oil and sugar plantations and refineries

in Southeast Asia. Kerry is Coca-Cola's bottling partner in

several territories in China.

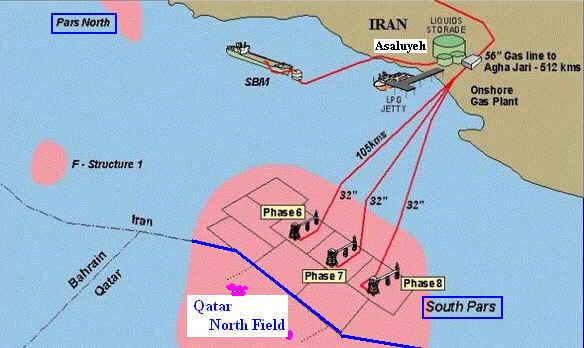

「人民網日本語版」2006年12月22日

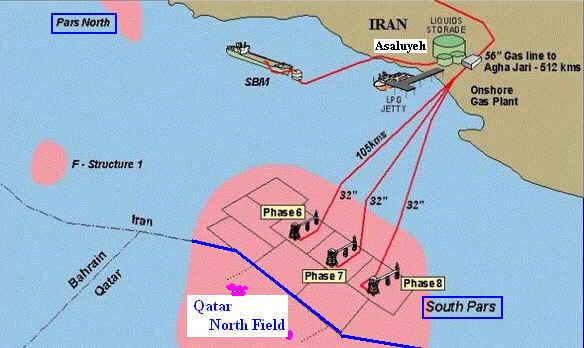

中国海洋石油、イランと天然ガスで提携 160億ドル

中国海洋石油総公司(CNOOC)はこのほどイランと、総額160億ドルに上る液化天然ガス事業の協力了解覚書に調印した。覚書に基づき、海洋石油はイランのノースパースガス田(North Pars)

開発やガス輸送設備の建設を進め、液化天然ガスを中国に輸入する。北京の日刊紙「京華時報」が伝えた。

ノースパースガス田はサウスパースガス田に次ぐイラン第二の油ガス田プロジェクトで、天然ガス埋蔵量は48兆立方メートルに達する。同プロジェクトは期間8年で、全体を4つの時期に分けて進められる。海洋石油は液化天然ガスの生産工場建設、輸送、販売を担当し、イラン側は今後25年にわたり海洋石油に天然ガスを提供する予定。

2006年12月25日 朝日新聞

中海油は約8年をかけて、イラン第2のガス田とされる「北パルス」を開発し、LNGの輸送施設を建設、生産量の半分を取得できる。22日に明らかになった覚書によると、契約期間は25年間で、詳細はまだ交渉中、という。

また、中国石油天然ガスも12月初め、イラン国営天然ガス輸出会社との間で、イラン最大のガス田「南パルス」から毎年300万トンのLNGを、11年から25年間にわたって購入する契約に合意した。中国石油化工も04年末、イランのヤダバラン油田の石油・天然ガスの開発・輸入について、覚書を結んでいる。

Dow Jones

Newswires

December

20, 2006

Iran and China's

CNOOC Sign $16 Billion Gas Deal

North Pars is

estimated to have some 48 trillion cubic feet of gas, according to the U.S. Energy

Information Administration.

The Iranian oil

official said that of the $16 billion cost of the

development, $5 billion will be spent on the upstream and the

balance on the downstream development of the field. The

development will be made over an eight-year time span.

Iran

currently has no LNG facilities and their development in the

country has been hobbled by U.S. sanctions slapped on Iran

several years ago. Most LNG plants globally use processes

developed by U.S. companies.

South

Pars is believed to contain at least 280 trillion cubic feet

and over 17 billion barrels of liquids reserves. Sales from South Pars are

currently expected to earn Iran around $11 billion a year

over the next three decades, according to Iranian oil

ministry data cited by the U.S. Energy Information

Administration.

イラン:

中国とエネルギー関連MOU調印、LNGプロジェクトの早期実現目指す

イランのZanganeh石油相は、2004年10月28日から30日にかけて中国を訪問し、中国政府との間で石油・天然ガス分野での協力に関する覚書(MOU)を締結した。「LNGパッケージ取引」の形態となっているのが特徴である。

① Sinopecは、イラン産LNGを25年間にわたり年間1,000万トン購入する。

② イランはこれの見返りとして、Sinopecに対し、イラン南西部陸上の既発見未開発油田であるYadavaran油田(*)開発プロジェクトへの事業参加権(参加比率は50%を予定)を付与し、さらに、同油田の開発完了後25年間にわたり、同油田産出原油のうち15万b/dを優先的に販売する。Yadavaran油田開発事業はバイバック契約により実施され、且つ、Sinopecとともに、他の国際石油企業がオペレーター乃至パートナーとして参加することが条件付けられる。

③ イランと中国は、Bandar Abbas地域にコンデンセート製油所(精製能力30~35万b/d)を建設することに合意する。投資規模は15億ドル、建設期間は約3年間。

2005/1/7 The Hindu

India,

Iran reach pact for LNG supply

http://www.hindu.com/2005/01/08/stories/2005010804091700.htm

India has tied up

with Iran for supply of 7.5 million tonnes annually of

liquefied natural gas for 25 years as part of the

bilateral cooperation between the two countries through

several agreements inked today. The supplies are likely

to start in 2009.

Under the

agreement, Iran will supply the LNG at $1.2 plus $0.0625

of Brent per million British thermal unit (mBtu). Tehran

has also agreed to give India 20 per cent stake in the

development of its biggest onshore oilfield, Yadavaran.

State-run Indian

Oil Corporation and Iranian firm Petropars will by

February 28 submit a plan to develop a gas block in the

gigantic South Pars gas field of Iran and sell LNG from

it. It is planned to set up LNG liquefaction facilities

with a capacity of nine million tonnes annually. The

project is estimated to cost $3.2 billion.

|

December 02, 2006 Reuters

Iran signs LNG export

deal with CNPC

China signed a deal to purchase 3 million

tonnes per year of Iran's Liquified Natural Gas (LNG) for a

25-year period,

state television reported.

Malaysia's Petronas and

France's Total hold the stakes of Iran's Pars LNG project. Total announced in September

it will start development of Iran's South Pars LNG II project

in 2011.

'Iran's National Gas Export Company (NIGEC) and China's Petro

China signed a deal to purchase 3 million tonnes of LNG,'

state television said.

'The price of the LNG will be calculated according to crude

oil prices,' state television quoted Nosratollah Seifi, the

director of NIGEC as saying.

'The executive phases of this project will begin early next

year (beginning March 2007),' Seifi was quoted by the state

television as saying.

Petro China is an affiliate of China's National Petroleum

Company (CNPC).

SHANA, Iranian oil ministry's official Web site, reported

that the NIGEC-Petro China deal, signed on November 28,

included exports of 3 million tonnes of LNG per year for a

25-year period.

JOGMEC 2005/1/11

Pars LNG http://oilresearch.jogmec.go.jp/information/pdf/2004/0501_out_f_ir_india_lng_yadavaran.pdf

LNGプロジェクトを巡る動き

イランのLNGプロジェクトを巡っては、政府間の動きだけでなく、外国石油企業が主導するプロジェクトも進展しつつある。

Total(仏)とPetronas(マレーシア)は2004年12月、NIOCとの間で、イランでLNG液化トレーンを建設する‘Pars LNG'プロジェクトおよび関連する上流開発を進めるための枠組み合意(framework agreement)に調印した。LNGプロジェクト実施に向けての必要事項とスケジュールを定めたものであり、今後LNG設備建設と上流開発の双方についてFSを実施し、1年後に最終的な投資決定を行う。

3社は昨年2月、LNG事業の合弁会社‘Pars LNG'を、NIOC 50%、Total 30%、Petronas 20%の出資比率で設立することで合意したが、今回の合意で、上流についても、South Parsガス開発のフェーズ11を対象に、Total(60%)、Petronas(40%)が開発を行うことが決定した。

これに先立つ昨年9月、RD/ShellとスペインRepsol-YPFはNIOCと、‘Persian LNG'プロジェクト実施に関する枠組み合意に調印した。LNG液化トレーンの建設(NIOC50%、Shell 25%、Repsol 25%)

およびSouth Parsガス田フェーズ13の開発(Shell、Repsol各50%)に関して合意したものであり、2年以内に最終的な方針を決定する予定である。

また、上述のイランと中国およびインドとの合意に基づき供給されるLNGは、NIOC(100%)が進める'NIOC LNG'プロジェクトで生産される予定である。現時点ではNIOC単独のプロジェクトであるが、同社はLNGプロジェクトの経験やノウハウを有しておらず、今後、外資が参入する可能性が高い。これまで、BGが参加を検討と伝えられたほか、上流のSouth Parsガス田開発フェーズ12には、Eni参加の可能性が報道されている。

表-1 イランのLNGプロジェクトの動向

| 名称 |

対象ガス田 |

参加企業 |

総投資額 |

生産能力 |

備考 |

| NIOC

LNG |

South

Pars

(フェーズ12) |

NIOC(100%) |

約10億ドル |

900~1000万t/年

(450~500万t/年×2) |

・ 現状NIOC100%のプロジェクトだが、これまで、BG、Eni(上流)が参加の見通しとの報道あり。

・ 2004年10月、IOC(印)がPetropars(イラン)と、South Pars上流開発およびLNG液化プラント建設参加で合意(総投資額30億ドル規模)。

・ HSBC(英)より20億ドルローン供与で合意間近。

・ 2008年操業開始予定。 |

| Pars

LNG |

South

Pars

(フェーズ11) |

NIOC(50%)、

Total(30%)、

Petronas(20%) |

約20億ドル |

800万t/年

(400万t/年×2) |

・ 2004年2月、SHA締結。2004年12月枠組み合意。1年以内の決定目指す

・ 生産能力は1,000万t/年に引き上げの可能性。

・ 2010年(2009年との報道も)操業開始予定。 |

| Persian

LNG |

South

Pars

(フェーズ13) |

NIOC(50%)、

Shell (25%)

Repsol-YPF(25%) |

30-40億ドル |

700~800万t/年

(350~400万t/年×2) |

・ 2004年10月、枠組み合意締結。2年以内の決定目指す。

・ 2010年(2009年との報道も)操業開始予定。

・ LNGプラントはShell独自のDMR液化技術により建設。Bandar Tonbak(Assaluyehの北70km)に建設予定。 |

| Iran

LNG |

South

Pars |

NIOC(50%)、

BP(25%)

Reliance(印)(25%) |

n.a. |

1,000万t/年

(500万t/年×2) |

・

他の3プロジェクトと同様、FSは実施するも、具体的な進展なし。

・ BPがイラン投資に慎重姿勢のためとの見方。 |

(注)

・「総投資額」は2004年初め頃の情報に基づくもので、正式アナウンスはされていない。

・

「生産能力」は報道によりばらつきがあるが、ここではMEES(2004年11月22日付け)の記述によった。

・ 2004年10月イラン・中国政府間で、2005年1月イラン・インド政府間で相次ぎ合意。(Sinopecがイラン産LNGを25年間1,000万t/年購入およびYadavaran油田開発へ参加。IOC、GAILが25年間、年間750万t/年購入およびYadavaranおよびJuffair油田開発へ参加)。

出所:各種資料より作成

2006/12/26 Asia

Chemical Weekly

Sinopec and

Garson start up SM jv project in Hainan 既報

In

Oct., 2006, Sinopec and Garson have started up their 50:50 jv SM

project and produced on-spec product at Yangpu Economic

Development Zone, Hainan province.

The project started construction in Apr. 2005. With total

investment of around USD 49 million (RMB 390 million), the

commissioned project has SM capacity of 80,000 ton/year, and it

also includes ethylbenzene production unit and other facilities.

It is operated by the jv of Sinopec and Garson in Hainan, which

named as Hainan Shihua Garson Chemical Co Ltd.

Feedstock will be sourced from the nearby refinery ? Sinopec

Hainan Refining Chemical Company (HRCC). HRCC has started up an 8

million ton/year refinery earlier; it will supply benzene

feedstock with ethylene being extracted from the off-gas of the

refinery.

The SM product will supply to the Garson EPS plant in Jiangyin,

Jiangsu province. Garson operates two EPS lines with a total

capacity of around 150,000 ton/year, and it also plans to add a

third line of 60,000-80,000 ton/year. Currently, Garson partly

imports SM from the suppliers of Japan and South Korea for its

EPS plant in Jiangyin; the startup of new project will reduce the

feedstock imports.

Also, Garson associates with Norway based chemical Logistics

services provider Odfjell, are building a jv chemical terminal in

Jiangyin Economic Development Zone, Jiangyin, Jiangsu Province.

The terminal is located on the south bank of the Yangtze River,

in the first phase, it will have two 50 000 dwt berths, and 100

000 cbm of chemical storage capacity.

Sinopecと江蘇省江陰市の江陰嘉盛化工(Garson) の50/50の合弁会社、海南実華嘉盛化工(Hainan

Shihua Garson Chemical )の新しいSMプラントと原料エチルベンゼンプラントは10月に完成、11月中旬から順調に生産を行っている。

立地は海南島の海南洋浦経済開発区で、SMの能力は年産8万トン。

原料は隣接するSinopecの製油所の Hainan Refining Chemical

Company (HRCC)から供給している。HRCC はこれより前に800万トンの製油所を完成させている。

JVでは中国科学院大連化学物理研究所が開発した技術を使い、HRCCのベンゼンとFCCドライガスからのエチレンからSMを製造している。

SMは江蘇省江陰市のGarsonの発泡PS用に供給される。同社では2系列合計15万トンのEPSプラントを持っており(更に6万ー8万トンの第3系列を検討中)、これまでは一部のSMを日本や韓国から輸入していた。今回の完成で輸入量は減少する。

Garsonでは別途、ノルウエーの化学品物流会社

Odfjell とのJV、Odfjell Garson (Odfjell 55%、Garson 45%)を設立し、江陰市の江蘇経済開発区にケミカルターミナルを建設している。第1期として、50 000 dwt バース と100 000 cbm タンクを建設している。

なお、海南実華嘉盛化工の設立時には、SMプラント完成後に、10万トンのPSプラント建設の噂が出ていたが、現在は話は進んでいない模様。

日本経済新聞 2006/12/28

中国、シノペックに50億元支給

中国政府は国有石油大手、中国石油化工(シノペック)に対し、石油精製事業の赤字を補填するために50億元(約750億円)を支給した。補てん資金は同社の2006年決算に計上される。政府が統制している国内の石油製品価格が国際相場を下回り、精製部門が赤字だったため。昨年は100億元を支給している。補てん資金が海外の油田買収に使われるとの見方もある。

参考

94.15億元

日本経済新聞 2006/12/29

石油代替燃料DME 東洋エンジ、最大プラント中国で受注 年産100万トン

東洋エンジニアリングは石油代替燃料の一つであるジメチルエーテル(DME)で、中国の石油化学大手、瀘天化集団

Lutianhua Corporation

が計画している世界最大の製造プラントを近く受注する。設備は年産100万トン規模で総事業費は800億ー1000億円、東洋エンジの受注額は最大で100億円程度の見込み。

東洋エンジは、同集団とプラント受注の前段階となる技術供与契約を結んだ。同集団は早ければ2010年の稼働を目指し内蒙古自治区で設備建設を計画、中国政府に認可申請中。認可は来年半ばの見通しで、東洋エンジは認可が出れば正式受注し、基本設計を担当するほか製造工程で必要な触媒も納入する。

生産するDMEはパイプラインで北京など都市近郊に運ばれ、発電や自動車向けの燃料として使われる見込み。

東洋エンジは今年3月、瀘天化集団向けに中国で初めてとなる年産11万トンのDME量産設備を稼働させていた。

China Chemical Reporter

2007/1/9

BBCA

BBCA Biochemical

MEG Project Kicks off

On December 28th,

2006 construction was started on the 180 000 t/a

monoethylene glycol (MEG) project in BBCA (Suzhou)

Biochemical Company Ltd. located in Suzhou, Anhui province. With

a total investment of RMB1.318 billion, the MEG project need 600 000 tons of

corn per

year. Adopting advanced technologies and making use of starches

as raw materials, it is a demonstrative project for manufacturing

petrochemicals to substitute petroleum with bright product

prospect. After completion, the project will help the company

realize its annual sales revenue of RMB1.8 billion.

2007/1/17 Asia Chemical

Weekly

China BBCA starts

construction for Bio-MEG project in Anhui

On 28, Dec. 2006, Anhui BBCA (安徽豐原) Biochemical company (BBCA

Biochem) has started construction for its bio-based MEG project

in Suzhou (宿州), Anhui Province.

With total investment of around USD 170 million (RMB 1.32

billion), the project has MEG capacity of 180 000 t/a. It uses

corn or cassava (タピオカ)as raw materials through

biochemical routine to produce methanol, and then ethylene and

finally MEG. This project will consume 600 000 ton of corn per

year. It will take around one year and a half to build this

project, so it is expected to start up in 2008.

BBCA Biochem produces 440 000 t/a fuel ethanol and operates a 20

000 t/a bio-EO unit. Currently, the company is still a subsidiary

of BBCA Group. BBCA Group is large-scale biochemistry

manufacturer that focuses on Bio-energy, biomaterial and

biological pharmacy.

The company may become a subsidiary of China National Cereals,

Oils & Foodstuff Corp (COFCO 中国糧油食品集団) in the coming future, as COFCO

has signed a framework agreement with BBCA Group to buy 20.74%

stake in BBCA Biochemical. The deal is waiting for approval from

the government.

As the development of PET production, over the past few years,

China imported lots of MEG to make up the market shortage. In

China, the import of MEG was 3.39 million ton in 2004, 4 million

in 2005, and it maybe reached 4.1 million ton in 2006.

http://www.bbca.com.cn/main-1.htm

BBCA Group is

large-scale biochemistry manufacturer. Its development

direction focus on Bio-energy, biomaterial and biological

pharmacy,with a staff of 19,200, it consists essentially of

seven major production enterprises plus a The National

Engineering Research Center of Fermentation Technology. The

seven major production enterprises are:

BBCA Biochemical

BBCA Pharmaceutical

BBCA Food

Suzhou Biochemical (Bio-Ethylene)

Jiangshan Pharmaceutical (VC)

BBCA Edible Oil and

BBCA Gelatin.

In 2005, BBCA Group

realized total sales revenue of RMB6.5 billion. All the

products from BBCA have been provided to international famous

food , pharmacy , beverage , scour ,precise chemical industry

and cosmetic enterprises for a long time.

BBCA Biochemical is the core enterprise of BBCA

Group, being engaged mainly in further processing of

agricultural products by using advanced bio-fermentation and

modern chemical separation techniques to produce bio-energy

and biomaterial.

The major products includes

1) Food additives: citric acid & its derivatives,

L-lactic acid & its derivatives, MSG, starch sugar etc;

2) Feed additives: lysine & its salts, corn gluten powder

etc;

3) Bio-energy: fuel ethanol, bio-diesel etc;

4) Biochemical products range: bio-ethylene & its

derivatives, poly lactic acid (PLA) bio-degradable plastics,

poly lactic acid polymer fiber fabrics etc.

BBCA Biochemical is the unique fuel ethanol

producer authorized by the Government in the east region of

China.

BBCA will be responsible for the supply of fuel

ethanol in Anhui,Shandong,JiangSu and Hebei provinces. The

capacity of 440,000 tons/year

BBCA Pharmaceutical has 38 production lines which are

up to GMP standard, and in possession of two new medicines of

Class One, more than 70 new medicines of Class Two and Three.

And the total kinds of western medicine and Chinese

traditional medicines are around 360.

And the products has six categories

and hundreds of varieties, including medicine for allaying a

fever and easing pain, antibiotic, medicine of tumor

prevention, preparation of Chinese traditional medicines,

cardiovascular drug, nervous system drug etc.

BBCA Food's products

includes biscuits, confectionary, coarse fiber puffed foods,

natural vegetable protein and cereal breakfast, jelly,

lemonade and so on.

The product lines include biscuits,

confectionary, coarse fiber puffed foods, natural vegetable

protein and cereal breakfast, jelly, lemonade and so on. At

present, BBCA food has 5,000mt/year cereal breakfast

producing capacities, 30,000mt/year concentrated pear juice

capacities, and so on.

BBCA (Suzhou)

Biochemical is the first liner,

producing Ethene,

Ethylene Oxide, Glycol with the capacity 20,000MT/year which

is made from corn and the other starchiness material. Suzhou

Biochemical is built up and put into production in Nov 2004,

being as high-tech Biochemical enterprise.The production

liner already become the former of Ethene liner in China.

BBCA Edible Oil

With the cutting-edge oil material

processing equipment and testing apparatus, BBCA Edible Oil

relies on BBCA Group' strong strength and itself geographical

advantage and utilizes traditional squeeze technique to

produce high quality edible oils including, corn embryo,

rapeseeds, peanuts and soya beans. the processing and

production capacity of oil materials has reached 600,000 mt/y

as well as 180,000mt edible oil products /year including corn

embryo, rapeseeds, peanuts and soya beans, etc.

BBCA Gelatin Company

has gelatin and bone glue series products with secondly

producing capacity in China. The main products include

medical gelatin, edible gelatin and photo gelatin etc.

Jiangsu Jiangshan Pharmaceutical Co., Ltd

(Jiangshan Pharma), a large pharmaceutical enterprise, was

founded in 1990, jointly invested by Jiangsu Worldbest

Pharmaceutical Co., Ltd, Jiangsu Medicines-health Products

Imp&Exp (Group) Corporation, Resistor Technology Limited,

Expert Assets Limited and Jingjiang Xinlan Biochemical Co.,

Ltd, with a registered capital of USD26,06 million and total

investment of USD49,80 million.

Jiangshan Pharma mainly manufactures and markets Vitamin C,

VC series of products, medicines and health products, among

which the capacity of Vitamin C ranks top worldwide, making

the company one of the global leading Vitamin C manufacurers.

June 26, 2005

Anhui BBCA Pharmaceutical Co., Ltd announced on June 9

that the company had signed a "transfer

agreement" in Hefei with Anhui BBCA Group and

Jiangsu Zhonglian International Development Group Co.,

Ltd.

BBCA Pharmaceutical will use RMB166.619 million to purchase 100% equity and

related liabilities held by

Zhonglian International Development Group Co., Ltd. at

the request of BBCA Group in

Resistor Technology Limited (RT

Co., Ltd.).

RT Co., Ltd. is the overseas shareholder in Jiangsu

Jiangshan Pharmaceutical Co., Ltd.

The deep processing capacity has reached to 3.6

million mt/year on agricultural products under the

development of past ten years. Products are mainly used in

food additives; feed additives, detergent, fine chemical,

pharmaceutical raw material industries etc. At present, due

to the shortage of un-regenerated resource as petroleum and

the requirements of agricultural development, BBCA Group

takes the advantage of own bio-technology to stress

development of bio-material such as corn, cassava, sorgo,

stalk etc) to produce fuel alcohol, bio-ethene and its

ramification, fibre-polyester, degradable plastic, nontoxic

plastic and paint solvent ect, and most of products mentioned

above can replace petroleum chemical products.

2006-06-30

China's BBCA group

interested in producing ethanol in Brazil

http://ethanol-news.newslib.com/story/6938-4622/

Chinese group

BBCA, which has headquarters in Anhui province, is

interested in producing sugar cane ethanol in Brazil, an

official told Macauhub Thursday.

The director of the industrial business center (CIN) of

Rio de Janeiro, Amaury Temporal said that the Chinese

group planned to buy an area to grow sugar cane.

Currently BBCA produces ethanol from maize, through

Suzhou Biochemical, one of the six divisions of BBCA, and

one of China's main chemical product manufacturers.

BBCA also controls the divisions BBCA Biochemical, BBCA

Pharmaceutical, BBCA Food, Jiangshan Pharmaceutical (VC)

and BBCA Gelatin, as well as a research center.

Last year total sales at BBCA were around US$6.5 billion.

Brazil is currently the world's largest producer of

ethanol from sugar cane, and exports of the product are

expected to total some 250,000 cubic meters this year.

China Chemical Reporter

2007/1/9

ChemChina Joins

Hands with Guangyuanfa

On January 2nd,

2007, China National Chemical Corporation (ChemChina) signed an

agreement with Qingdao Guangyuanfa Group, on forming a joint

venture (JV) Qingdao Anbang Petrochemical Co.,

Ltd.

Under the

agreement, Guangyuanfa Group incorporates its five

subsidiaries into the new JV and hold 33% equity. They are Guangyuanfa

Petrochemical Co., Ltd., Lufa Asphalt Co., Ltd., Chengyang

District Petroleum Co., Ltd., Penglai Luanjiakou Oil Port Co.,

Ltd. and Penglai Asphalt Co., Ltd.

ChemChina's subsidiary ChemChina Petroleum & Gas Corporation

enters the new JV as warrantor and ChemChina acquires 67%

interests in the new JV.

China Chemical Reporter

2007/1/11

PetroChina/Sinopec JV

PetroChina Breaks

Ground on Refining Project

On December 30th,

2006 PetroChina Company Limited announced a groundbreaking for a

new refining project with a 10 million tons per year capacity in

Qinzhou city in Guangxi Zhuang Autonomous Region, Southwest

China.広西壮族(チワン族)自治区欽洲市

With a single set

confignration, it comprises of ten large-scale main installations

which include a 10 million ton per year atmospheric vacuum unit

and the projects comprising of an oil wharf and tank farm. The

main installations boast the largest in China.

Upon completion,

the new plant will provide 7.6 million tons per year of refined

product oil, LPG, polypropylene and other petrochemicals to

southwest China market.

August 21, 2006

Dow Jones Energy Service

PetroChina, Sinopec To

Collaborate On Key Refinery

PetroChina Co. is

expected to join forces with China Petroleum & Chemical Corp.

or Sinopec, to build a large oil refinery in China's southwest by

2010, in what would be the first collaboration between the

country's top two oil companies.

The two state-owned

oil giants had previously planned to independently build

their own refineries

in southwestern Guangxi Zhuang Autonomous Region, but the Chinese

government, concerned about overcapacity and overinvestment,

intervened.

"The central

government has directed the two companies to jointly build the

refinery, with 70% of investment from PetroChina

and 30% from Sinopec,"

an industry official familiar with the matter told Dow Jones

Newswires recently.

The refinery, to be

built in the coastal city of Qinzhou, will have an annual output

capacity of 10 million metric tons. Estimated to cost around

CNY10 billion ($1.25 billion), it will process crude oil from

Sudan where

China National Petroleum Corp., the parent company of PetroChina,

has a number of assets.

2006/12/22 JOGMEC

http://oilresearch.jogmec.go.jp/information/pdf/2006/0611_out_g_sd_asia_nocs.pdf

スーダン:アジア国営石油企業の活躍で原油生産量倍増へ

スーダンは、1970年代から80年代にかけ、Agip(現Eni)、ChevronやTotalなどの欧米石油企業が紅海やMuglad盆地で探鉱活動を行った。現在、生産量の大半を占めるBlock1/2/4のUnity/Heglig油田はChevronが1980年代に発見したものである。

しかし、1984年に南北内戦が勃発、鉱区の設定された南部はゲリラによる攻撃が行われ、死傷者が出た。Totalは1985年以降、探鉱活動を休止、Chevronは1992年に同国から撤退した。

2006 年、スーダンでは Palogue 油田、Thar

Jath 油田などが相次いで生産を開始した。

同国の原油生産量は、2005 年末の 38

万バレル/日から、2006 年には約50

万バレル/日に増加する見通しである。

現在、同国で石油の探鉱開発を行っているのは、主に

CNPC(中国)や

Petronas(マレーシア)、ONGC(インド)などアジアの国営石油会社である。3

社は油田の探鉱開発のみならず、製油所や原油パイプラインの建設も手がけており、3

社がスーダンの石油産業を支えていると言っても過言ではない。

スーダン原油の最大の輸入者は中国で2005年にはスーダンの原油生産量の4割に相当する約13万バレル/日を輸入(中国の原油輸入全体の5.2%)した。インドが数万バレル/日を輸入している他、政府間合意によりエチオピアに輸出されている模様である。

January 19, 2007

UOP

UOP

Selected by PetroChina for New Aromatics Project

New Complex to Include World's Largest Para-xylene Production

Plant

UOP LLC, a Honeywell company, announced today that PetroChina

Company Ltd., a subsidiary of the China National Petroleum Corp.

(CNPC), has selected UOP to supply technology, basic engineering

services and equipment for an aromatics project to be installed

at PetroChina's Urumqi facility.

The new plant will produce one million metric tons per annum

of para-xylene and will include the

largest-capacity, single-train adsorption unit for para-xylene

production in the world. The ParexTM process will be used for the

adsorption unit. Para-xylene is a key ingredient in the

production of PTA (purified terephthalic acid), which is used to

make polyester for fabric and PET (polyethylene terephthalate)

chips for carbonated soft drink and water bottles. The new plant

will also produce 360 thousand metric tons per

annum of benzene.

This will be the second aromatics complex UOP has designed for

PetroChina's subsidiary, the Urumqi Petrochemical Co., Ltd.

(UPC). UPC started up the first

aromatics complex in western China in 1995, which contained units

using the Parex, Isomar, and TatorayTM processes designed and

licensed by UOP. Globally, UOP has licensed more than 725

individual process units for the production of aromatics.

2007/1/22 Asia Chemical

Weekly

Xuzhou Luheng kicks off

mega methanol project in Jiangsu

On late 2006, Luheng Energy and Chemical Engineering Ltd. (Luheng

Energy) kicked off its large-scale methanol project in Peixian

(Aa?h), Xuzhou City 徐州市沛県, Jiangsu Province.

With total investment of USD 890 million (RMB 6.92 billion), the

project has planned total methanol capacity of 1500 000 t/a. It also includes Integrated

Gasification Combined Cycle (IGCC) facility.

Integrated Coal

Gasification Combined Cycle:石炭を高温高圧のガス化炉で可燃性ガスに転換し、そのガスを燃料としてガスタービンと蒸気タービンによる複合発電を行うシステム

In the first stage, the

company invests around USD 450 million (RMB 3.47 billion), to

build a 760 000 t/a methanol plant and a 120 MW IGCC power

facility. It is expected to start up by 2009. In the second

stage, the methanol capacity will be expanded to 1500 000 t/a by

2011.

The coal based project uses gasification and liquid phase

synthesis process, and the gasification technology is sourced

from GE Energy (former Texaco Gasification), and liquid phase

synthesis process is licensed from Air Product. GE Energy will

also provide technology for the IGCC power unit.

The Xuzhou government is planning a Coal Chemical Park in the

same site, and a 1 million t/a DME project is also considered for

the purpose of developing methanol downstream industry.

China Chemical

Reporter 2007/1/25

Liquid-Phase Methanol Project Kicks off

Construction was recently started on a 1.5 million t/a liquid-phase methanol and IGCC project with a total

investment of RMB6.92 billion in Economic Development Zone of

Pei county, Xuzhou, Jiangsu province. It indicates the start

of the only coal chemical industry park in the province.

The project is funded by Hong Kong Luheng Energy Co., Ltd.

and uses the world's most advanced technologies for coal

gasification, liquid-phase methanol synthesis and IGCC power

generation. The first-phase investment is RMB3.47 billion and

the construction period is 3 years. A capacity of 1.5 million

t/a liquid-phase methanol can be formed in 5 years. The plant

area planned today is 10 km2.

2007/1/22 China Chemical

Reporter

Petrochina and SFA Sign Agreement 国家林業局

On January 11th,

2007, PetroChina Company Limited announces that it has entered

into a Framework Agreement with the State Forestry Administration

(SFA), on the development of forest bio-fuel. Under the agreement, both

parties will officially start to construct the first batch of

tree breeding bases for bio-fuel in Yunnan province and Sichuan

province.

As an essential part of China's alternate energy strategy, the

development of bio-fuel based forest offers an potential in the

energy resources and enjoys the sustainable growth of economy and

protection of ecological environment. PetroChina and the SFA will

work hand in hand in the cultivation and development of forest

bio-fuel resources, and contribute to China's energy resources

and ecological development.

PetroChina, a largest oil and gas producer and supplier in China,

is pledged to work on the development of renewable energy. The

agreement is another step forward in its strategy to develop the

bio-fuel resources.

By the end of 2010, PetroChina plans to build ethanol project

with a capacity of approximately 2 million t/a based non-grain, accounting for more than 40% of

the national total, and construct bio-diesel commercial facility

with a capacity of 200 000 t/a based forest as well as support

the establishment of raw material bases with a area of 400 000

hectares for bio-fuel.

At the same time, PetroChina and SFA will jointly set up China

Green Carbon Foundation, for promoting tree planting, carbon

dioxide emission reduction and the improvement of ecological

environment as well as easing the global climate change.

2007/1/23 Asia Chemical

Weekly

Gaoqiao Petchem starts up

ABS project in SCIP

Shanghai Gaoqiao Petrochemical Co. (Gaoqiao Petrochem), a

subsidiary of Sinopec, has started up its 200 000 t/a ABS project

at Shanghai Chemical Industry Park (SCIP), Caojing, Shanghai. It

has produced on-spec product On 18 Jan.

Gaoqiao Petrochem broken ground its 200 000 tonne/year ABS and

100 000 t/a SBR projects in Dec. 2004. The SBR project has

commissioned earlier.

The ABS project has total investment of USD around 200 million

(RMB1580 million). Using Dow Chemical's polymerization

technology, it comprised of three production lines and with the

maximum capacity of 75 000 t/a for each.

The feedstock are sourced from SECCO, which is running a 900 000

year ethylene complex in SCIP. SECCO has 90 000 t/a Butadiene and

500 000 t/a SM, as well as 260 000 t/a ACN capacity.

China imported 1.96 million ton ABS in 2004 and 1.99 million ton

in 2005. In 2006 the imports of ABS will be reached to 2 million.

China Chemical Reporter

2007/1/24

Israel Chemicals and

Taizhou Bailly Form JV

On January 19th, 2007

Taizhou Bailly Chemical Co., Ltd.泰州百力化学有限公司and Israel Chemicals

Ltd.

held a signing ceremony for forming a joint venture (JV) Taixing Like

Company Ltd.

The new JV has an investment of US$50 million, between Israel Chemical

(60%) and Taizhou Bailly Chemical (40%).

The first phase of the facility is scheduled for startup by the

end of 2007, and will produce 5 000 tons of

decabromo-diphenyl-ethane per year臭素系難燃剤, 1 500 tons of

diphenylethane

per year, 8 000 tons of hydrobromic acid per year 臭化水素酸and 500 tons of

melamine cyanurate (MCA)

per year, with an initial investment of US$15 million. The second

phase will be completed and put on stream in 2008 while the third

phase completed in 2009.

Israel Chemicals Ltd.

(ICL)

ICL is a global group engaged in the development manufacture

and marketing of fertilizers, industrial products,

performance products and metallurgy.

Ownership

Structure

ICL is a public company traded on the Tel Aviv Stock

Exchange. The Israel Corporation, a public company controlled

by the Ofer

Group,

is the main shareholder (approximately 52.14 percent). The

remaining equity is held by Potash Corporation of

Saskatchewan (approximately 10 percent),

institutional investors and the general public.

A major player on world markets, ICL through its

subsidiaries, accounts for:

35 percent of world bromine production; 臭素

11 percent of

world potash production, and 13% of international potash

trade (excluding the cross-border trade between the US and

Canada); カリ

9 percent of

western world primary magnesium consumption;

3 percent of world phosphate rock production, 3 percent of

international phosphate rock trade (excluding the

cross-border trade between the US and Canada);

One of the world’s most integrated

manufacturers and suppliers of phosphate products.

ICL’s operations also make it a

leading supplier of fertilizers in Europe and a major player

in numerous specialty chemical market segments. In Israel,

ICL is the leading supplier of fertilizers.

China Chemical Reporter 2007/1/23

Coal Chemical Project Conducts Ignition

The 1.0 million t/a coal chemical project in Wulan 烏蘭

funded by Qinghai

Qinghua Co., Ltd. conducted ignition in Chahannuo Qinghua Coal

Chemical Industry Park located in Wulan county, Qinghai province 青海省

on January 9th,

2007. An investment of RMB878 million is already completed in the

first phase. Construction was also started on a 3.0 million t/a

coal washing plant on the same day.

The project is based on rich coal and salt-lake

resources in

Qinghai province and construction was started on January 8th,

2006. As a leading project in a series of resources development

projects in the company, the project plans to have a total

investment of around RMB2.5 billion. It includes a 2.0 million

t/a coking unit, a 200 000 t/a coke-oven gas

methanol synthesis unit, a 3.0 million t/a clean coal

washing plant and a 100 000 t/a coal tar unit. After the

completion of these units, the company will expand the capacity

of the coking unit to 3.0 million t/a to further promote the

integrated development of the coal chemical sector and the salt

chemical sector. 70% of coal resources needed in the project come

from the Muli Coal Mine.

2007/1/9 Basell

Liaoning Huajin selects

Basell's Spheripol technology for new 250 kt/a PP plant in China

盤錦エチレン

Liaoning Huajin Chemical

(Group) Corporation has selected Basell's Spheripol technology

for a new 250 KT per year polypropylene plant it plans to build

in Panjin, Liaoning Province in the People's Republic of China.

Start-up is expected in 2009.

"The Spheripol

process is the most widely used polypropylene technology in the

world, with more than 18.5 million tonnes of licensed capacity

and we are pleased that the largest chemical group in Liaoning

province has joined the extensive list of Spheripol process

licensees," said Just Jansz, president of Basell's

Technology Business.

He added, "In the

highly competitive polypropylene market, the superior product

range, and cost-effectiveness of the Spheripol process continue

to have a major impact in our industry. The Spheripol process

offers licensees an elegant and economical method of producing a

wide range of polypropylene products. Through the refinement of

bulk liquid and gas-phase polymerization reactors this technology

includes features that reduce both resource consumption and

emissions from process."

2007/2/5 Asia Chemical Weekly

Hualian Sunshine starts

up third PTA project in Zhejiang 浙江省紹興市

On Jan. 28, Hualian

Sunshine PetroChemical Co. (浙江華聯サンシャイン石化)

has started its

third PTA project in Shaoxing , Zhejiang Province.

Using Invista technology, the new commissioned project has PTA

capacity of 600,000 t/a. It is in trial running and expected to

begin commercial production in the coming days. So far, the total

PTA capacity of Hualian Sunshine reached to 1.8 million t/a.

In existence, Hualian Sunshine has operated two terephthalic acid

plants with total annual capacity of 1.2 million ton at the same

site. The first 600,000

t/a plant

commissioned in 2005, using Eastman proprietary terephthalic acid

(EPTA). The second 600,000

t/a facility

came on-stream in Q3 2006, using Invista PTA technology.

Comparing to PTA product, EPTA has production cost

competitiveness, while PTA has premium-quality than EPTA.

Hualian Sunshine is jointly owned by three Chinese partners.

Shenzhen-based China Union Holdings Ltd.(深セン華聯)

holds 51% share of

Hualian Sunshine, while Zhejiang Jiabaili Textile Industry(浙江加佰利紡績)

and Shaoxing

Zhanwang Enterprise Group (浙江展望産業集団)hold 24.5% each.

China imported 5.72 million ton PTA in 2004, 6.49 million ton in

2005 and 7.00 million ton PTA in 2006.

ーーー

PTA output, capacity and

consumption of China (2007.2.4 estimate kt)

| |

Output |

Import |

Capacity |

Consumption |

| 2004 |

4600 |

5700 |

6000 |

10300 |

| 2005 |

5560 |

6490 |

6600 |

12050 |

| 2006 |

6400 |

7000 |

8800 |

13400 |

| 2007 |

9000 |

6000 |

12700 |

15000 |

2005/6/16 Asia Chemical Weekly's estimate

for 2007

Capacity 18,400

Output 14,000

Consumption 15,300

The last time forecast

was too optimistic for the capacity growth in China.

In fact, some planned projects are postponed and other

constructing projects are delayed. The reasons include

environment safety, technology and the shortage of capitals etc.

So, the forecasted imports are around 6000 kt in 2007.

Besides the reasons mentioned in the last

email, the PX feedstock is another important factor to impact the

PTA projects in the future in China. As the growth in capacity,

PX would be the next bottleneck in the Chemical fiber industrial

chain. (PX-PTA-PET) For example, Hualian Sunshine

delayed the starts-up date for the sake of PX feedstock, and

Xianglu Petrochemical start the planning for back integration for

PTA by constructing PX project in Xiamen.

Furthermore, the government should control the investment of PTA

in the coming years for the sake of oversupply risks.

ーーー

Top 10 PTA producer

in China (As of 2007.2.1)

| Producer |

Location |

Capacity

kt |

Hualian

Sunshine

|

Shaoxing

|

1800

|

Xianglu

Petrochem

|

Xiamen

|

1500

|

Sinopec

Yangzi Petrochem

|

Nanjing

|

1050

|

Sinopec

Yizheng Chemical Fiber

|

Yizheng

|

950

|

Yisheng

Petrochem

|

Ningbo

|

600

|

Oriental

Petrochemical

|

Shanghai

|

600

|

Mitsuishi

Chemical

|

Ningbo

|

600

|

BP

Zhuhai

|

Zhuhai

|

500

|

Sinopec

Shanghai Petrochem

|

Shanghai

|

400

|

Sinopec

Luoyang Petrochem

|

Luoyang

|

350

|

In Nov. 2006, Yisheng Dahua (a jv between Yisheng and Dahua)

has start construction for a 500,000tpa PTA project in Dalian.

過去の報道

On 17 July 2005,

Jiangsu Hailun Chemical Co. started the

construction for its 600 kt/a PTA project in Jiangyin, Jiangsu

Province.

The total investment for the PTA project is USD 600 million, and

the project is expected to be commissioned by H2 of 2007.

→Hailun PTA project in Jiangyin is

expected to be delayed as it is not going

smoothly (maybe the problem of capitals).

![]() 坊市

坊市 ![]() 坊振興焦化有限公司

40%

坊振興焦化有限公司

40%