Olin http://www.olin.com/about/history.asp

Olin is one of the world's best basic materials companies and a leading North American producer of copper alloys, ammunition and chlorine and caustic soda. In 2005, Olin posted sales of approximately $2.4 billion. The company has approximately 5,800 employees working in the United States.

To begin with, Olin spun off to shareholders our former Ordnance and Aerospace divisions as Primex Technologies, Inc.

We also announced the sale of our TDI and ADI isocyanates businesses to Arco Chemical for $565 million in cash.Olin used the proceeds from the TDI sale and other divestments to repurchase Olin common stock, to pay down debt, and to purchase DuPont's 50% share in Niachlor -- a joint venture chlor alkali plant in Niagara Falls, N.Y. The company also invested in a new chlor alkali plant in McIntosh, Alabama. The new Sunbelt plant was built for $200 million as a joint venture between Olin and Geon, a major Olin customer in the polyvinyl chloride (PVC) market.

In mid-1998, Olin announced that it would spin off its specialty chemical businesses as a separate, publicly traded company.

On February 8, 1999, Olin spun off its specialty chemical businesses as Arch Chemicals, Inc.

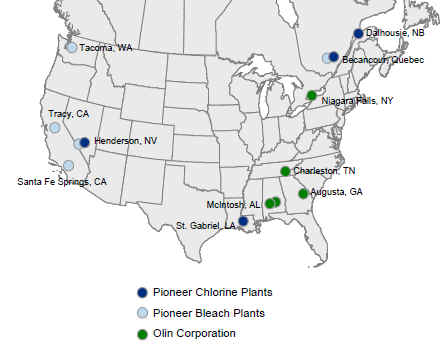

2007/5 Olin Corporation to acquire chlor-alkali producer Pioneer

Impact of the Combination

on Olin

The

combination would make Olin the third largest producer of

chlor-alkali in North America

Enhanced Operational and

Geographic Platform

Strengthens

Olin’s position in core businesses and

adds a strong bleach business in the West

|

* Sunbelt Chloralkali is a 50:50 joint venture between PolyOne and Olin Corporation |

AstraZeneca PLC was formed on 6

April 1999 through the merger of Astra AB of Sweden and Zeneca Group PLC of the UK. The merger represented the

combination of two companies with similar science-based cultures

and a shared vision of the pharmaceutical industry.

The AstraZeneca Board believes that the merger will improve the

combined companies' ability to generate long-term growth and

shareholder value through:

Global power & reach in sales and marketing

・ Major primary care

presence, particularly in gastrointestinal, cardiovascular and

respiratory medicine

・ Leading position in a

number of specialist/hospital markets, including oncology and

anaesthesia

・ Ability to deliver the

potential of existing and future products through the power and

reach of a combined global sales and marketing resource

・ Widespread class

coverage in key therapy areas, such as cardiovascular and

respiratory disease, due to complementary nature of products

Stronger R&D platform for innovation led growth

・ Substantial research

and development (R&D) expenditure - over $2.5 billion

annually

・ Strong combined

development pipeline

・ Potential for further

strengthening of the pipeline by enhanced discovery and

development capability through greater scale and focus on

selected areas and technologies - in particular, complementarity

in cardiovascular, respiratory, central nervous system and

anaesthesia/ analgesia R&D should help to deliver significant

benefits

・ Research partnerships -

to supplement its own R&D expertise, AstraZeneca will

continue to work with external partners, such as academic

institutions and other pharmaceutical companies, to broaden its

range of early exploratory research and to allow access to a

wider base of scientists and new technologies

Greater financial strategic flexibility

・ Financial strength and

scale to give AstraZeneca's management greater strategic

flexibility to drive long-term earnings growth

・ Substantial operational

efficiencies resulting in cost savings

AstraZeneca http://www.astrazeneca.com.au/AboutUs/1990s.htm

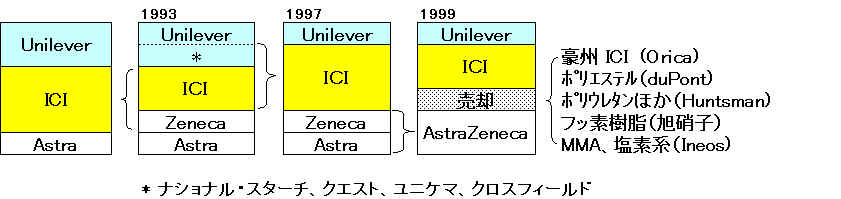

At Zeneca

In 1993, ICI demerged three of its businesses (Pharmaceuticals, Agrochemicals and Specialties) to form a separate company, Zeneca.At Astra of Sweden

Early in this decade, the organisation of Astra's international marketing was expanded, and several licensing agreements renegotiated to give the company control over the marketing of its products in major markets.

On 6 April 1999, Astra officially merged with Zeneca to form AstraZeneca. The merger represented the combination of two companies with science-based cultures and a shared vision of the pharmaceutical industry.

ICI Completes Acquisition of Unilever Speciality

Chemicals Businesses

http://www.ici.com/pressoffice/news/08_07_1997.htm

ICI has completed the acquisition of the Speciality Chemicals businesses of Unilever for a debt free price of $8 billion (£4.9 bn). The businesses are:-

・ National Starch, a world leader in industrial adhesives and number one in specialty starches

・ Quest, one of the world's leading fragrance, food ingredient and flavours companies

・ Unichema, a global leader in oleochemicals

・ Crosfield, a major producer of silicates, zeolites and silicas

Pfizer to acquire Pharmacia Corporation

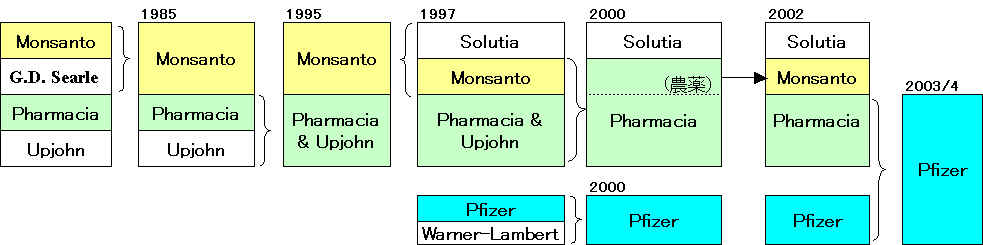

spin-off of its remaining 84% ownership of Monsanto to its current shareholders.

http://www.pharmacia.com/about/history.asp

The roots of Pharmacia Corporation date back almost 150 years to 1853 when a leading Italian pharmacist, Carlo Erba, started his own company, which later became Farmitalia Carlo Erba. This company would later unite with Kabi Pharmacia, which began in 1931. These two companies, along with Pharmacia Aktiebolag, form the three main points of origin for Pharmacia AB, a Swedish-based company.

In 1995, Pharmacia & Upjohn was formed through the merger of Pharmacia AB and The Upjohn Company.

Monsanto was formed in 1901 when a high-school dropout and entrepreneur, John F. Queeny, founded the company in St. Louis, Missouri (USA), and began producing saccharin, an artificial sweetener.

In 1985, G.D. Searle & Co. became the pharmaceutical unit of Monsanto.

(モンサント社とアメリカン・ホーム・プロダクツ社の合併 破談)

Monsanto further defined itself when, in August 1997, shareowners of the company approved the spin-off of its chemical business, Solutia Inc. In less than 100 years, Monsanto established itself as a proven leader in the agricultural and pharmaceutical businesses.

On April 3, 2000, Monsanto and Pharmacia & Upjohn completed a merger creating a dynamic and powerful new competitor in the pharmaceutical industry. This new companyーPharmacia Corporationーis a high-performance competitor.spin-off of its remaining 84% ownership of Monsanto to its current shareholders. → spin-off

Pfizer to acquire Pharmacia Corporation

Monsanto Company To Acquire Delta And Pine Land Company For $1.5 Billion In Cash

Monsanto Reaches Agreement With U.S. DoJ for Acquisition of Delta and Pine Land Company

BASF and Monsanto Announce R&D and Commercialization Collaboration Agreement in Plant Biotechnology

Company History

| 1901 | John F. Queeny founds the original Monsanto. His wife was Olga Monsanto Queeny. The first product of that company was saccharine. | ||||||||

| 1945 | The original Monsanto produces and markets agricultural chemicals, including 2,4D. | ||||||||

| 1960 | The Agricultural Division is established. | ||||||||

| 1964 | Ramrod herbicide is introduced, beginning the use of Western theme names for the original Monsanto's brands of herbicides. | ||||||||

| 1968 | Commercialization of Lasso herbicide in the U.S. begins the trend toward reduced-tillage farming. | ||||||||

| 1976 | Roundup herbicide is commercialized in the U.S. | ||||||||

| 1982 | Scientists working for the

original Monsanto are the first to genetically modify a

plant cell. The original Monsanto acquires the Jacob Hartz Seed Co., known for its soybean seed. |

||||||||

| 1985 | G.D. Searle & Co.

became the pharmaceutical unit of Monsanto.

|

||||||||

| 1987 | The original Monsanto conducts the first U.S. field trials of plants with biotechnology traits. | ||||||||

| 1997 | The original Monsanto spins off its industrial chemical and fibers business as Solutia Inc. | ||||||||

| 2000 | The original Monsanto enters

into a merger and changes its name to Pharmacia Corporation. A new Monsanto Company, based on the previous agricultural division of Pharmacia, is incorporated as a stand-alone subsidiary of the pharmaceutical company. (Pharmacia itself eventually becomes a subsidiary of Pfizer, in 2003). |

||||||||

| 2002 | The new Monsanto Company is spun off from Pharmacia and is now a separate company. | ||||||||

| 2005 | Monsanto acquires Seminis, Inc.,

a global leader in the vegetable and fruit seed industry. Monsanto acquires the Stoneville cotton business, including it's NexGen brand. Monsanto completes its sale of Monsanto Enviro-Chem Systems Inc. to a new company formed by the Enviro-Chem management team and an outside investor. The new company is MECS, Inc. |

As Pharmacia Completes Monsanto

SpinOff, Monsanto CEO Says Company Retains Focus and Strategic

Direction

http://www.monsanto.com/monsanto/layout/media/02/08-13-02.asp

As previously announced, at the close of business today Pharmacia Corporation will distribute its 84-percent stake in Monsanto Company to Pharmacia shareowners via a special stock dividend. This distribution will complete Pharmacia's spinoff of Monsanto and establish Monsanto as a 100-percent publicly traded company.

2003/4/17 Aventis

Aventis Reduces its Shareholding in

Rhodia, Retains Economic Interest

http://www.aventis.com/main/page.asp?pageid=67535076542191440347&lang=en

Aventis announces today the reduction of its stake in Rhodia to 15.3% from 25.2% following a definitive sale and purchase agreement with Credit Lyonnais concerning 17.8 million Rhodia shares (40% of its Rhodia shareholding).“This transaction is an important step in our continued focus on our core pharmaceutical activities and reaffirms our commitment to our shareholders to exit the non-core industrial activities. In addition, this transaction is a first step to comply with the requirement to reduce the Aventis shareholding in Rhodia to below 5% by April 2004, pursuant to the 1999 agreement with EU and US antitrust authorities.

May 14, 2003 Financial

Times

In pole position/ PKN Orlen, Poland.

PKN Orlen is the largest chemical establishment in Poland.

The company has the largest refinery in Poland and it is the most efficient of its type in Europe

PKN Orlen holds 75% of Zaklady Azotowe Anwil, which has the biggest polyvinyl chloride (PVC) plant in Poland, and also makes nitrogen fertilizers and polyethylene (PE) packaging, using ethylene from PKN Orlen.

PKN Orlen and Basell have established a 50:50 joint venture (jv) Basell Orlen Poliolefins to construct a 400,000 polypropylene (PP) plant and a 320,000 tonnes/y high density polyethylene (HDPE) plant using the Spheripol and Hostalen Basell technology, and starting up in 1H 2005.

Millennium Chemicals Lyondell and Millennium Announce Agreement to Combine

http://www.millenniumchem.com/About+Us/Profile/Profile_EN.htm

Millennium

Chemicals (MCH - NYSE) is one of the leading chemical companies

in the world.

We supply millions of pounds of chemicals each year to

manufacturers for use in thousands of consumer and industrial

products. In short, we work hard to improve the fundamentals of

daily life.

Millennium Chemicals is… 概要

| ・ | The world's second-largest producer of titanium dioxide (TiO2) and the largest merchant seller of titanium tetrachloride (TiCl4) in North America and Europe. |

| ・ | A leading producer of fragrance chemicals |

| ・ | The second-largest producer of acetic acid and vinyl acetate monomer in North America, and through its partnership interest in LaPorte Methanol Company, LP, a partner in a leading U.S.A. producer of methanol. |

| ・ | A 29.5% owner of Equistar Chemicals, LP, the second-largest producer of ethylene and the third-largest producer of polyethylene in North America. |

Millennium Chemicals' corporate headquarters are located in Red Bank, New Jersey. Millennium Chemicals' global network includes 4,000 employees on five continents. View our directory for a complete listing of office and manufacturing locations.

Ciba to focus on Asia for all new plants

Asia's fundamental importance to the growth plans of Swiss specialty chemicals company Ciba was underlined here on Tuesday by chairman and chief executive Armin Meyer when he said all future capacity expansions would be concentrated in the region.

Meyer, who was speaking at the company's annual results press conference, said investments in the traditional regions of Europe and the US would focus primarily on maintaining world-class standards and process improvements.

Ciba has budgeted around SF250m ($198m/Euro160m) on annual capital expenditure over the next two to three years, said Meyer. About 60% will be spent on maintaining or improving environmental health and safety, debottlenecking and further automation.

The remaining 40% will be invested in new production lines, mainly in the home and personal care, plastic additives and coating effects segments.

日本経済新聞 2004/2/16

米コーニング

忍耐の成果 赤字でも開発 収益源に成長

液晶パネル用ガラス基板 14年

排ガス浄化セラミックス 25年

通信不況で業績がどん底に落ち込んだ光ファイバー世界最大手、米コーニングが復活しつつある。原動力は液晶パネル向けガラス基板とディーゼル用排ガス浄化セラミックス。成長が期待できるデジタル家電、環境の両分野でシェア世界一の基幹部品作りに成功した。その裏には赤字でも研究開発にこだわり続ける「忍耐経営」がある。

長期開発を支えた要素は二つ。一つは「ロードマップ(行程表)」と呼ぶ技術動向予測だ。ガラス基板の事業本部を東京に移し、日本、韓国、台湾の電機メーカーなどとの議論を通じ、5年、10年後に主流になる技術を探った。90年代半ばに事業の先行きへの不安が強まったが、「テレビやパソコンで液晶パネルの時代が必ず来る」と撤退を踏みとどまった。

もう一つは「ペイシェント・マネー(忍耐資金)」と名付けた研究開発費制度だ。業績の最悪期でも売上高の約10%を研究開発にあててきたが、その3分の1を本杜直轄の忍耐資金とし、すぐには利益を生まない開発テーマに投じてきた。

Corning

http://www.corning.co.jp/jp/

コーニングとは

コーニングの原動力。それは、まだ発見されていない可能性の追求です。グローバル市場のリーダーとして、私たちはコーニングのブランドを確立し、ブランドの基本理念でもある有意義かつ容ある技術により人類への貢献を実現させるために、たゆまぬ探求を続けています。

コーニングは、世界市場において最も著しい成長を遂げる数々の最先端技術を発明しています。通信業界向け光ファイバー、ケーブル、光通信接続機器類を始め、コンピュータ機器向け高性能ガラス、テレビスクリーン、情報端末ディスプレイ、半導体業界および化学分野などで使用される高純度合成石英ガラス、自動車業界向け特殊ガラスセラミック素材、理化学用実験器材など、先端技術を供給する世界有数の企業です。

また、私たちは、環境、科学、生命科学の各市場にも参入しています。先端材料市場におけるコーニングの先端技術は、超大型天体望遠鏡などに使用されるゼロ膨張ガラスなども生み出しています。

コーニングでは現在、世界16 カ国 50

社以上の製造・販売・サービス関連企業などと提携し、拠点を配置しています。

発見の150年

1851年、コーニングの創設者エイモリー・ホートンは、ガラス製造会社への投資をきっかけに、今なお先端技術で注目され続ける企業コーニング社を誕生させました。

当時、ホートンが描いた夢は、将来的に最先端技術を継続して世に紹介できる企業を自らの手で起業することでした。あれから一世紀半以上が経った今、電球やテレビのブラウン管製品を始め、世界最大規模の光通信関連製品を製造する企業となったコーニングを、彼自身も想像できなかったことでしょう。

2004/2/17 Novartis 日本

Novartis completes strategic

acquisition to strengthen number two position in global medical

nutrition business

http://dominoext.novartis.com/NC/NCPRRE01.nsf/44aff02a639be034c1256b4b007b5f4d/f56ae6505bad1277c1256e3d00226082?OpenDocument

・ New presence in US retail

medical nutrition channel, access to Japanese market and strong

brand portfolio benefit Novartis Medical Nutrition

Novartis has completed the acquisition of Mead Johnson & Company's global adult medical

nutrition business in a USD

385 million cash transaction. No divestments were required to

obtain regulatory approval of the deal, which officially closed

February 13, 2004.

The acquisition adds strong brands like Boost® , Isocal® and Ultracal® to Novartis Medical Nutrition's portfolio

and expands its ability to meet the medical nutritional needs of

a growing outpatient and ageing population.

Mead Johnson Nutritionals

http://www.meadjohnson.ca/about/Mead_Johnson_Nutritional_Heritage.htmMead Johnson Nutritionals' worldwide leadership in nutrition can be traced back nearly a century - to Edward Mead Johnson himself, the company's namesake and founder. In 1888, the life of E. Mead's baby son, Ted, was in danger because he was not thriving on his feedings and had to be fed a cooked "gruel" mixture. Years later, memory of this experience would inspire E. Mead to develop a product that would eventually lead to today's worldwide leader in infant formula sales, of Enfamil and Enfalac.

E. Mead first co-founded Johnson & Johnson with his brother. After a third brother joined the company, E. Mead decided to pursue other interests and formed the American Ferment Company, which he renamed Mead Johnson & Company in 1905. As he started his company, he explored a variety of products; however, his strongest interest was in scientifically based nutritional products.Mead Johnson & Company became a wholly owned subsidiary of Bristol-Myers Company (now Bristol-Myers Squibb Company) in 1967. Bristol-Myers Squibb is a diversified worldwide health company. It is a leading maker of innovative therapies for cardiovascular, metabolic and infectious diseases, central nervous system and dermatological disorders, and cancer, as well as osmotic care, wound management, nutritional supplements, and infant formulas.

日本における「成人向け医療用栄養食品」事業の移管について

http://www.novartis.co.jp/pdf/pr040218-2.pdf

2004年2月14日より、ミードジョンソン株式会社(ブリストル・マイヤーズスクイブ(有)の100%子会社)の上記事業が、ある一定期間、ノバルティスファーマ(株)に移管され、将来的に、ノバルティスグループの中の別会社に移管される予定です。

Bristol-Myers Squibb

http://www.bms.com/aboutbms/content/data/ourhis.html

Bristol-Myers Squibb Plans To Divest U.S. And Canadian Consumer Medicines Business

| BRISTOL-MYERS In 1887 William McLaren Bristol and John Ripley Myers decided to sink $5,000 into a failing drug manufacturing firm called the Clinton Pharmaceutical Company, located in Clinton, New York. The company was officially incorporated on December 13, 1887, with William Bristol as president and John Myers as vice president. In May 1898 came a new name: Bristol, Myers Company (a hyphen would replace the comma after Myers's death in 1899, when the company became a corporation). Not until 1900 did Bristol-Myers break through into the black -- where it has remained ever since. |

SQUIBB

In 1856 Edward

Robinson Squibb founded a

pharmaceutical company in Brooklyn, New York, dedicated to the

production of consistently pure medicines.

In 1895 Squibb passed most of the responsibility for managing the

firm to his sons, Charles and Edward. The company became known as

E.R. Squibb

& Sons.

BRISTOL-MYERS SQUIBB

In 1989

Bristol-Myers merged with Squibb, creating a global leader in the health

care industry. The merger created what was then the world's

second-largest pharmaceutical enterprise.

2005/1/11 Bristol-Myers Squibb

Bristol-Myers Squibb Plans To Divest U.S. And Canadian Consumer

Medicines Business

http://www.bms.com/news/press/data/fg_press_release_5305.html

Bristol-Myers Squibb Company

(NYSE:BMY) today announced that it intends to divest its U.S. and

Canadian consumer medicines business. Over the coming weeks, the

company will contact prospective buyers for this business.

The company's consumer

medicines businesses in Japan, China, Latin America Europe,

Middle East and Africa are not included in this divestiture. These businesses remain an important part

of the company's pharmaceutical business within each region.

Bristol-Myers Squibb's primary consumer medicine brands in the

U.S. and Canada are ExcedrinR, KeriR, ChoiceR and ComtrexR. For

the year ended December 31, 2003, sales of consumer medicines

brands in the U.S. and Canada totaled approximately $240 million.

Bristol-Myers Squibb is a global pharmaceutical and related

health care products company whose mission is to extend and

enhance human life.

Roche

Bayer to Acquire Roche Consumer Health

Roche makes offer to acquire all outstanding shares of Genentech

日本経済新聞 2004/2/21

海外会社研究 ロシュ

中外製薬

合併より利益率重視 中外製薬通じ日本事業拡大

規模ではなく質を追うーー。世界的な製薬業界再編のうねりを横目に、スイスの製薬大手ロシュが自社の中核事業強化を進めている。ライバルのスイス製薬大手ノバルティスからの合併提案をかたくなに拒否。医薬品と診断薬の2部門で足場を固める戦略だ。

▼合従連衡とは一線

▼中核部門を強化

▼市場は好意的

大手同士の合従連衡は否定するが、部門強化のための小規模な事業買収にはむしろ積極的。昨年、スイスの医療機器メーカーで糖尿病治療用インスリンポンプ世界2位のディセントロニックを12億ドルで傘下に収めた。また、このほど14億ドルを投じて、米検査機器ベンチャーのアイジェン・インターナショナルの買収を完了した。

2002年秋に傘下に収めた中外製薬との連携効果にも期待を寄せる。

ノバルティスとの合併話が棚上げになってからも株価は影響を受けていない。ノバルティスはロシュの議決権株の33.3%を持つが、同社のバセラ会長は「いまのところ買い増す予定はない」という。ロシュ側に配慮する形で、合併は両社経営陣の合意が前提という姿勢をとっている。

だが、ロシュが株式の3分の1をライバルに握られているという事実は揺るがない。大手同士の再編の流れと無縁でいられるかどうかは予断を許さない。