トップページ

2005/4/1 Asia Chemical Weekly

Zhejiang Hualian Sunshine starts

up PTA plant 浙江省紹興市 浙江華聯サンシャイン石化

Following to the Yisheng's PTA plant

in Ningbo, Zhejiang Hualian Sunshine Petrochemical has started up

its 600,000 tonne/year PTA plant in Shaoxing, Zhejiang Province.

The facility was planned firstly to come onstream in the fourth

quarter of 2004, but it was delayed to the first quarter of 2005

for some reasons, industrial sources think it was due to tight

feedstock supply and mechanical glitches.

The plant is based on Eastman Chemica's EPTA (Eastman proprietary

terephthalic acid) technology. At the present, the operating rate

has not reached 100% yet, and it's not revealed when on-spec

production would be achieved.

Before Hualian Sunshine, Yisheng Petrochemical's 600,000 tonne/year plant in Ningbo

started up about ten days earlier.

According to the planning of the company, Hualian Sunshine plans

to build two more lines at its site, lifting its total capacity

of PTA to more than 2m tonne/year by 2006-2007.

For more information, please see the homepage: http://www.sunshine-pec.com

*Zhejiang Yisheng Chemical 浙江省寧波市 浙江逸盛化学

Zhejiang Hualian

Sunshine Petro-chemical Co., Ltd. is a robust large-scale

petroleum enterprise founded in 2003 with a registered

capital of 500 million RMB. As a JV of Shenzhen Hualian Stock

Co., Ltd., Zhejiang Zhanwang Industrial Group Co., Ltd.浙江展望産業集団

and Zhejiang

Jiabaili Textile Products Co., Ltd.加佰利紡績, it boasts an advantageous

location at Binghai Industrial Park in Shaoxing County.

Qiantang River is close in north, Huhangyong Highway is close

in south, Caoe River is close in east, and Hangzhou is close

in west. The largest Light Textile City in Asia is only 18km

away from it. Hualian Sunshine's 450000(→600,000) ton PTA project will

be carried out in a 118.21hm2 area. Sanxin is dedicated to

manufacturing, processing and selling PTA, polyester slices,

chemical fibers and other raw materials. Its entire staff

always persists in the enterprise spirit " respecting

occupation, pulling together, working diligently, achieving

high efficiency."

It invested 2.43 billion yuan in annual 450000(→600,000) ton PTA project after

approved by State Department on September 18,2002. As the

largest chemical material, chemical fiber and textile product

base in China, Shanxing is also the largest consumption

center of PTA. This project will effectively enhance the

overall competitiveness in textile industry of Shaoxing.

China Chemical

Reporter 2006/10/16

浙江省紹興市 浙江華聯サンシャイン石化

600 000 T/A PTA

Unit Puts on Stream in Zhejiang

On October 7th,

2006, the second-phase 600 000 t/a PTA (purified terephthalic

acid) project put into trial production in Zhejiang Hualian

Sunshine Petrochemical Co., Ltd. in Shaoxing, Zhejiang

province, which is originally planned to put into trial

production at the end of 2006. After the completion of the

second phase, the PTA capacity of the two phases will reach

1.2 million t/a. The company will plan to become the largest

PTA production base in China by project construction and unit

expansion.

2005/4/5 China Chemical Reporter

All-density Polyethylene Project

Kicked off in Daqing

The 200 000 t/a all-density polyethylene project, which occupied

an area of 20,128 m2 and employed the global leading patent

technology from Uniwersen (*) of American, recently started

construction in the Plastics Factory of CNPC Daqing Petrochemical

Company, Ltd. Its process is featured with high catalyst

activity, short cut, fewer facilities, lower requirement

standards on raw materials, low energy consumption, high products

quality. After its completion, the unit will be able to

manufacture 5 varieties or 53 specifications of polyethylene

products that can be used to make of high performance grinding

materials, pipes, vessels, cables, packages of foodstuff.

* Univationが正しい。

2005/4/11 Asia Chemical Weekly Release

China’s Bluestar starts the construction for POM

project POM

China’s Bluestar (藍星) Group has started construction for the 60 000 tonne/year POM project in Shanghai Xinhuo Development

Zone (上海星火開發區)

on March 25.

According the introduction of

Bluestar, the company has been developing the research and

production of POM since late 1990s, the project is based on its

own technology.

The Bluestar’s project has a total investment of RMB910

million (USD 110 million). After the completion of the project,

the company will become one of the biggest POM producers in

China.

Besides the Bluestar’s POM project, PTM Engineering Plastics, a

joint venture company, which comprises Polyplastics, MGC, Korea

Engineering Plastics and Ticona, has completed its 60 000

tonne/year POM plant in Nantong, Jiangsu province in the end of

2004.

With the development of the domestic

economy and the requirement of chemical new materials, the

consumption of POM in China is making a rapid growth. During the

10 years from 1992 to 2001 the consumption of POM in the domestic

market increased from 16 000 tonnes to more than 100 000 tonnes a

year. It is expected that the consumption will be more than 180

000 tonnes in 2005.

China’s net imports for POM are about 127 kt in

2002, 143 kt in 2003 and 174 kt in 2004.

2008-4-17 CCR

Shanghai Bluestar Starts up POM Project

On March 29th, 2008 the 40 000 t/a polyoxymethylene (POM)

project of Shanghai Bluestar Chemical New Material Plant

(Shanghai Bluestar) was completed and went on stream in

Pudong New Area, Shanghai.

The project is the company's first-phase POM project, and the

second-phase 60 000 t/a POM project with a total investment

of more than RMB1.2 billion was launched in 2007.

China Bluestar

60 000 T/A POM Project

Ground Breaking in Shanghai

http://www.china-bluestar.com/en/pop/pop.asp?infoid=322

|

The 60 000 t/a

polyoxymethylene (POM) project of China Bluestar started

construction in Shanghai Xinghuo Development Zone on

March 25. The launching of the project is another

important move in the vigorous development of the

chemical new materials sector in the company and also a

measure taken by Shanghai Solvent Plant in the support of

the World Expo to be held in Shanghai and in the effort

to do relocation and renovation, divide one plant into

two plants, conduct product upgrading, readjust

industrial structure and alleviate difficulty through

reform.

POM resin is one of the most

comprehensive applied engineering plastics with methanol

as a key raw material. It is a high-tech incentive fine

chemical product. It has excellent both of mechanical and

electric properties, as well as good abrasion resistance

and chemical resistance, and is therefore a thermoplastic

resin with unique comprehensive properties. POM is an

ideal engineering plastic that can replace nonferrous

metals such as copper, aluminum and zinc and their

alloys. It is extensively used in electronic/electric,

mechanical processing, automobile manufacturing and

apparatus/instrument sectors. It has always held the fame

of "metal in plastics".

With the development of the

domestic economy and the requirement on chemical new

materials in new economic sectors, the consumption of POM

in China is making a rapid growth. During the 10 years

from 1992 to 2001 the consumption of POM in the domestic

market increased from 16 000 tons to 100 000 tons a year.

It is expected that the consumption will reach 170 000

tons in 2005. The development of the POM sector in China

started as early as the 1950s. Due to restrictions from

factors such as production scale and technology, however,

the output of POM in China is less than 70 000 tons a

year today, falling far short of the demand.

China Bluestar has been developing

the production and research of POM since late

1990s. With the 1 900 t/a

production unit in its subordinate Shanghai Solvent Plant

as the basis, an advanced copolymerized POM production

process route with more extensive applications has

finally been developed. The project has a total

investment of RMB910 million. Partial equipment will be

introduced from abroad and a 60 000 t/a copolymerized POM

unit will be constructed. The project will enable the

corporation to fully employ the advantage in scale of

economics and sharpen the competitive edge of products.

After the completion of the project, the sales revenue is

expected to increase by RMB840 million and a net profit

of over RMB100 million will be accomplished a year. The

corporation will become the biggest POM producer in

China. Besides, the project will also further strengthen

the main force of the corporation in the chemical new

materials sector. |

2005/4/11 Foster

Wheeler 内蒙古計画

Foster

Wheeler/Huanqiu JV Awarded Coal-to-Liquids Study Contract in

China

http://www.corporate-ir.net/ireye/ir_site.zhtml?ticker=fwhlf.ob&script=417&layout=-6&item_id=693845

Foster Wheeler Ltd.

announced today that its UK subsidiary, Foster Wheeler Energy

Limited, in a joint venture with China Huanqiu Contracting &

Engineering Corp., has been awarded a feasibility study

Stage I contract

by Sasol Synfuels International

(Proprietary) Limited (Sasol) and its Chinese partners, China Shenhua Coal Liquefaction

Corporation Ltd.

and Ningxia

寧夏Luneng Energy and

High Chemistry Investment Group Co., Ltd. (jointly called

"the Combined Chinese Working Team").

The contract is related to two 80,000 barrels per

day coal-to-liquids (CTL) facilities to be located at Ningxia Autonomous

Region and Shaanxi Province, respectively, both in the

coal-rich western part of the People's Republic of China.

China Chemical Reporter

2005/9/12

CTO Became a Spotlight in China

On September 1st China Coal Research Institute Beijing Branch disclosed the Coal Chemicals

Research Center of Ningxia Coal Group, jointly established with Ningxia Coal Group was inaugurated formally in

Beijing. Ningxia Coal Group said the RMB28.8 billion Ningxia coal indirect

liquefaction project would use the indirect liquefaction

technology licensed from Sasol of South

Africa, with a annual capacity of 3.2

million tons of oil products. Presently the project is under the

feasibility study, and planned to start construction in 2008 and

scheduled for start-up by 2011.

Shenhua Group, a local forerunner of coal to

oil (CTO), began to make preparations in 2000 for a CTO project with a capacity of 1 million t/a

in Inner

Mongolia,

which started up for construction in 2004 after receiving the

approval from the government in April 2002.

* Ningxia Coal Group, a

state-owned large group in northwest China's Ningxia Hui

Autonomous Region

* 下記の陝西省との共同のCombined Chinese

Working Team

とは別。

*石炭液化技術

Coal-to-liquids

(CTL) project 2005/9/14

http://www.engineeringnews.co.za/eng/essentials/update/?show=67617

| Name of the project and

location |

| : |

Coal-to-liquids

(CTL) project, China. |

| |

|

| Project description |

| |

The

project involves the proposed building of two plants,

each with capacities of 70 000-to-80 000 barrels of oil

per day. The plants will be built in the Shaanxi

province 陝西省 and the

Ningxia autonomous region 寧夏回族自治区. |

| |

|

| Value |

| |

The

project is estimated at between $3-billion and $4-billion

per plant. |

| |

|

| Duration |

| |

The

project is still in the proposal stage. A prefeasibility

study is under way into the economic viability of the

project. |

| |

|

| Client |

| |

Shenhua

Coal Liquefication Corporation, the Ningxia Coal Group

Company. |

| |

|

| Latest developments |

| |

The Shenhua Coal

Liquefication Corporation and Ningxia

Coal Group Company signed separate contracts

with RoyalDutch/Shell Group and Sasol to study the

building of the CTL plants.

In September 2004, Sasol and the Combined

Chinese Working Team (CCWT) signed a

memorandum of understanding to evaluate the feasibility

of the project. The CCWT represents two provinces in

China with significant coal reserves as the locations for

the proposed CTL plants and was established to

investigate the possibility of applying Sasol’s

technology to the two CTL projects.

In November 2004, Shell and the Chinese companies signed

an agreement to complete the prefeasibilty study on the

market, economics, technical solutions, regulations and

possible sites for the project.

Foster Wheeler Energy, in a joint venture with China

Huanqiu Contracting & Engineering Corp, has been

awarded a

feasibility study Stage I contract by Sasol and the CCWT.

The Foster Wheeler/Huanqiu joint venture will evaluate

the available technologies for the projects and complete

feasibility study Stage I work to integrate these with

the associated utilities and infrastructure systems in

order to maximise the value of the project to its

shareholders.

Huanqiu will provide gasification experience together

with the essential local technical, commercial and

legislative information to ensure the study’s conclusions are robust.

The study is scheduled for completion by the end of the

year. |

Asia Chemical Weekly 2005/4/18 当初分

China's CCFA revised the

Investment Warning System in 2005

On May 2004, China Chemical Fibre Association (CCFA) launched a color-marked Investment

Warning System, as a guide

for investors to make decisions for chemical fibre projects.

The system categorized projects into five groups ranging from

those that are strongly encouraged to those which are extremely

risky. Every group represent by different color as the following:

Red : Extremely risky

Orange : Highly risky

Yellow : With some risks

Green : Encouraged

Double Green : Strongly

encouraged

Recently, as the market environment has been changed, CCFA

revised the Investment Warning System. In general, CCFA raise the

minimum capacities for some projects, and added the acrylonitile

(ACN) as a strongly encouraged product.

The red mark represents that the projects are extremely risky.

These include the common -grade PET fibre projects with or less

than capacities of 400 tonne/day (comparing to 300 tonne/day in 2004), and

the PET-film for packing uses, and common-grade of spandex.

The orange mark represents that the projects are highly risky.

These include PET fibre grade projects with capacities of 400-500 tonne/day (comparing to 300-400 tonne/day in 2004),

PET-bottle grade chips, PFY chips, common grade of viscose fibre

filament, nylon fibre yarn for industrial uses and PP-fibre

filament yarn.

The yellow mark means that the projects with some risks. These

include the PET-fibre grade units with capacities of 500-600 tonne/day (comparing to 400 tonne/day in 2004),

certain PET-film grade units, PSF chips, viscose staple fibre,

and certain grades of nylon filament yarn, and PP staple fibre,

and common grade acrylic fibre, and polyvinyl alcohol (PVA).

The green mark represents that the projects are strongly

encouraged. These include:

-Purified terephthalic acid (PTA) units with minimum capacities

of 500 000 tonne/year;

-Polyethylene terephthalate (PET) units with capacities of at

least 900

tonne/day (comparing to 600

tonne/day in 2004) integrated with facilities to produce

polyester filament yarn (PFY), polyester staple fibre (PSF);

-Direct-spinning PSF units with capacities of at least 200 tonne/day (comparing to 150 tonne/day in 2004), and

Nylon staple fibre units, and Units producing polypropylene (PP)

fibre for industrial use, and some special fibre such as

ultra-high molecular weight polyethylene fibre, optical fibre.

The double-green mark means that the projects are strongly

encouraged. These projects include the raw materials for fibre

production such as paraxylene (PX), monoethylene glycol (MEG), acrylonitrile (it¨s new in 2005), and polyester differential

yarn (PDY), new-style fibre, such as PTT, PEN, CO-PET (these products was grouped to Green

Mark-Encouraged) and some special fibres such as carbon fibre,

PLA fibre (polylactic acid) and PBO fibre

(polyphenylenebenzobisoxazole).

According to the CCFA, the content of warning system will be

adjusted with development of the market.

China Chemical Reporter 2005/4/18

Xianyang Signed An Agreement on 520 000 T/A Methanol Project 陝西省咸陽市

Recently Shaanxi 陝西省Investment Group Corp. and Xianyang City咸陽市

Government signed an agreement to

jointly invest RMB1.552 billion in constructing a thermal

generation plant and a 520 000 t/a methanol unit that will be

manufactured from coal and natural gas by making using of local

rich resource. The project will locate in the chemical industry

zone of Xianyang, Shaanxi province, western China. The thermal

generation plant will be construct to match with the methanol

unit.

It is disclosed that the 520 000 t/a methanol project will

totally invest RMB1.115 billion to construct a 200 000 t/a coal

to methanol production line and a 200 000 t/a natural gas to

methanol production line. The two lines will be combined into one

line in their synthetic stage. The advanced combination

technology will solve the surplus hydrogen problem in natural gas

transformation line and the surplus carbon problem in coal

transformation line, and increase the final production capacity

to 520 000 t/a while remaining the consumption on raw materials

unchanged, significantly saving energy and reducing cost with a

good profit making effect.

Platts 2005/4/20

China may become net methanol exporter in several years: Tecnon

Methanol

imports in China have slipped

from 1.80-mil

mt in 2002 to 1.40-mil mt in 2003 and to 1.36-mil mt in 2004. The trend is likely to continue as Chinese

methanol producers are expanding their plants' capacities over

the coming years. However, as Chinese traditional methanol

producers use gas retrieved from coal-gas as feedstock, they need

a minimum

methanol price of around $140-150/mt to break even.

2005年04月22日

Chemnet Tokyo

陝西省楡林市で13日、メタノール年産60万トンプラントの起工式が行われた。豊富な石炭ガスを原料とした、230万トン・プロジェクトの第1期計画で、山東省に本拠を置く山東エン州炭坑社が投資、2007年の生産開始を目指す。

楡林市では、すでに陝西楡林天然ガス社が天然ガスを原料とする40万トンのメタノールを生産している(石炭原料の20万トン増設計画あり)。また陝西省咸陽市では、既報の通り石炭と天然ガスを原料とする52万トン計画が調印されたばかりだ。

このほか重慶では三菱ガス化学が85万トン、香港のKing

Board Chemicalが75万トン計画を具体化させるなど、中国ではメタノール大型計画が林立している。

中国のメタノールの輸入は2002年が180万トンであったが、2003年は140万トン、2004年には136万トンと減少している。これらの計画が完成する数年後には供給過剰となるのは必至と見られる。

なお世界的にも本年央から年末にかけて、メタネックス社のチリの84万トン設備、メタノール・ホールディング社のトリニダードの189万トン設備が完成、それに合わせて停止する設備もあるものの、需給はゆるむとみられている。

Asia Chemical Weekly 2005/4/23

China's GPRO group, Yangzi Petchem

to form SBR jv company

China's GPRO Group is expected to set up a joint-venture company

with Yangzi Petrochemical for

their styrene

butadiene rubber (SBR) project in Nanjing, Jiangsu province, at the end of May or

in early June, a GPRO source said on Tuesday.

The source added that the project

will be a

60:40 joint venture between Yangzi and GPRO, which is a domestic private company.

Both companies plan to build a 200,000 tonne/year facility in two phases. The source

clarified that each phase will have a capacity of 100,000

tonne/year.

Yangzi said earlier that the first

phase will produce 120,000 tonne/year of SBR, and the second

phase 80,000 tonne/year.

The GPRO source said design work had

started on the first phase and construction work would commence

once the joint venture company was established.

He added that it was not possible to

start up the first phase in March 2006 as earlier planned. The

schedule was to start trial runs in September 2006 and start

production in December 2006, according to the source.

The first phase will require 60,000

tonne/year of butadiene which will be provided by Yangzi.

Yangzi and GPRO have not decided on

the startup date for the second phase. The companies said this

would depend on market conditions.

GPRO group (江蘇・金浦グループ) 石油化学、不動産業など

http://www.gpro.com.cn/

Asia Chemical Weekly

2005/8/3 事前情報

YPC and GPRO formed

jv for the SBR project

Yangzi Petrochemical Corp (YPC) has formed a 60:40 jv with

Jiangsu GPRO Group (金浦集團) for their SBR project in

Nanjing, Jiangsu province. The jv named as YPC-GPRO rubber (揚子石化金浦橡膠) Co., Ltd.

YPC is a subsidiary of Sinopec; while GPRO is a private

company in Jiangsu province.

The SBR project, which with the total investment of USD 78

million (RMB 633 million), will be located in Nanjing

Chemical Indusrty Park (NCIP). In long run, the capacity of

the SBR project would be 200 kt/a. But the project would be

built by two phases; and each phase will have a capacity of

100 kt/a.

The first phase of the project ? 100 kt/a SBR facility ? is

expected to start construction on October this year, and to

be commissioned in the Q1 2007. Both YPC and GPRO have not

confirmed the startup date for the second phase, it would

depend on market conditions.

The first phase project will require 60 kt/a of butadiene, it

will be sourced from YPC.

Asia Chemical Weekly

2006/4/10

YPC-GPRO starts

construction for SBR project in Nanjing

YPC-GPRO Rubber Co. has started construction for SBR project

in Nanjing Chemical Industry Park (NCIP), Nanjing, Jiangsu

Province.

The SBR project has the SBR capacity of 100 000 tonne/yr and

investment is about USD 79 million (RMB 633 million). In the

future, depend on market conditions, YPC-GPRO maybe build

another 100 000 tonne/yr SBR project in the same site, make

the total SBR capacity reach 200 000 tonne/yr.

YPC-GPRO was set up in July 2005, which is a 60:40 jv between

Sinopec Yangzi Petrochemical Corp (YPC) and GPRO Group.

The project is expected to start up by the end of 2006 and

begin commercial production in H1 of 2007. YPC will provide

the feedstock and the utilities for the jv. And the SBR

products will supply to tyres producers around Nanjing.

China Chemical

Reporter 2007/3/22

SBR Project Conducts Intermediate Handing-Over

On March 9th, 2007 the 100 000 t/a styrene butadiene rubber

(SBR) project was conducted intermediate handing-over in YPC

GPRO Rubber Co., Ltd. 揚子石化金浦橡膠 located in Nanjing Chemical

Industry Park, Jiangsu province, suggesting that a large

rubber production base is completed in Nanjing. After the

completion of the unit, the products varieties will be

increased in the Sinopec Yangzi Petrochemical Co., Ltd.(YPC)

during the Eleventh Five-year Program (2006-2010). The

development of automotive industry and other related

industries will be promoted in Nanjing and neighboring

regions.

YPC GPRO Rubber Co., Ltd. was built jointly by YPC and

private-owned Jiangsu GPRO Group based on 6:4 equity rate.

Both parties of the JV signed memorandum of understanding in

May 12th, 2004. The feasibility research report of the

project was approved by Sinopec Group in March 24th, 2005.

Both parties signed JV contract in July 26th, 2005.

江蘇金浦集團(Jiangsu GPRO Group)は江蘇省南京市に本拠を置く化学会社で、従業員3,000人。プロピレンオキサイド、ポリエーテル、PP、ガソリン添加剤、潤滑油、酸化チタン等々を生産している。

2006年7月に韓国の錦湖石化と江蘇金浦集團

が50/50合弁会社「南京GPRO錦湖石化」の設立の覚書を締結し、9月に契約を締結した。

2006/11/28 「韓国の錦湖石油化学、南京でPO生産

」

2007/3/28 Asia

Chemical Weekly 中国のSBRまとめ

YPC-GPRO finished

construction for SBR project in Nanjing

YPC-GPRO Rubber

Co. has finished the construction for its SBR project in

Nanjing Chemical Industry Park (NCIP), Nanjing, Jiangsu

Province.

The project has

SBR capacity of 100 000 tonne/year and investment is about

USD 82 million (RMB 633 million).

Currently, it

is preparing for production. Originally, the project is

scheduled to start up by the end of 2006 and begin commercial

production in early 2007. The delay of this project is caused

by problems in design work.

YPC-GPRO was

founded up in July 2005, which is a 60:40 jv between Sinopec

Yangzi Petrochemical Corp (YPC) and GPRO Group. The company

has intention to build another 100 000 tonne/yr SBR project

in the same site, and expand total SBR capacity to 200 000

tonne/year.

The SM and

butadiene feedstock sourced from YPC, and the utilities for

the jv, and the SBR products will supply to tyres producers

nearby Nanjing or Yangtze Delta area.

YPC has

existing 100 000 tonne/year butadiene capacity and has start

to expand to 200 000 tonne/year by building of a new 100 000

tonne/year facility. YPC-BASF has existing 120 000 tonne/year

SM capacity and plans to expand to 300 000 tonne/year bu

building of a new 180 000 tonne/year facility in the future.

2007/6/12 China

Chemical Reporter

YGC Starts up SBR Project in NCIP

On May 28th, 2007 the 100 000 t/a emulsion polymerized

styrene butadiene rubber (SBR) unit

conducted wet commissioning and manufactured qualified

products in YPC-GPRO

(Nanjing) Rubber Co., Ltd. (YGC)

located in Nanjing Chemical Industry Park (NCIP), Jiangsu

province. With a total investment of over RMB600

million, YGC was built jointly by YPC and Jiangsu GPRO Group

based on 6:4 equity rate. The 100 000 t/a emulsion

polymerized SBR project is composed of three parts - process

production unit, public facilities and some related

facilities. Shandong Qilu Petrochemical Engineering Co., Ltd.

undertakes the design work of the project.

2005/4/27

内蒙古で年産100万トンのDME計画スタート

4月24日、中国内蒙古のオルドス(Erdos:鄂尓多斯)で年産100万トンのDME(ジメチルエーテル)計画がスタートした。ロックフェラーと山東省の 久泰化工(Jiutai Chemical)のJVの久泰能源(内蒙古)社(Jiutai

Energy)によるもので、ロックフェラーは31%を出資している。

現地の豊富な石炭を原料に、シェブロン・テキサコの石炭ガス化技術を使い、100万トンのDMEと150万トンのメタノールを生産する。投資額は677百万ドル。

Jiutai Energy http://www.jiutaichem.com/

Shandong Jiutai Chemical

Company Limited

formerly named as

Linyi Luming Chemical Company, is located in Linyi, Shangdong

in the east of China.

Rockefeller & Co. http://www.rockco.com/

2005-4-26 China

Chemical Reporter

1 Million T/A

Dimethyl Ether Project Launches

On April 24, the 1

million t/a dimethyl ether project was launched in Erdos,

Inner Mongolia, by Jiutai Energy (Inner Mongolia) Company,

Ltd. that is a joint venture invested by Rockefeller &

Co. and Jiutai Chemical Company, Ltd. ,in which Rockefeller

holds 31% share. Occupying an area of 200 hectares, it will

be the largest dimethyl ether production base in the world up

to now, with the capacity of 1 million t/a dimethyl ether and

1.5 million t/a methanol. Using coal as raw material, the

project adopts the advanced process of liquid-phase complex

acid dehydration catalyzing.

The project investment will total to RMB5.6 billion. After

the completion of the first phase, the annual sales revenue

and profit will reach RMB1.02 billion and RMB375 million

respectively.

March 21, 2005 Green Car

Congress

Rockefeller Invests in

Chinese Synthetic Fuel Company

http://www.greencarcongress.com/dme/

The Rockefeller family is

taking a $100 million stake (31%) in China's Shandong Jiutai

Chemical Co, and teaming up on the construction of a

$677-million (5.6 bln yuan) dimethyl ether (DME) production

facility.

DME is a clean-burning,

synthetic substitute for diesel.

The new project, with an

annual capacity of one million metric tons (approximately

20,600 barrels per day), is scheduled to start soon. Jiutai

produced 50,000 metric tons of DME last year. An additional

100,000 tons of capacity will be added by April.

Coal-gasification using

Chevron texaco technology provides the syngas feedstock for

the DME conversion. Given its enormous coal resources, China

is keenly interested in coal liquefaction technologies for

synthetic fuels.

Demand for DME in China is

estimated to reach 5.0-10 mln tons (103-206 thousand barrels

per day) within five years.

2007/4/18 Asia

Chemical Weekly

Jiutai kicks of DME

project in Zhangjiagang 久泰能源

On Apr. 12, Jiutai

Energy 久泰能源 started construction for the

DME project in Jiangsu Yangtze River International Chemical

Industrial Park, Zhangjiagang, Jiangsu Province.

The project is operated by Jiutai Energy

(Zhangjiagang)

company, which is a nominal 55:45 jv invested by Shandong

Jiutai Chemical Company and China Energy

Limited.

Jiutai Chemical listed in Singapore as the name of China

Energy, so in fact, Jiutai Energy (Zhangjiagang) is the whole

owned subsidiary of Shandong based Jiutai Chemical.

( China Energyは実質同社の100%の事業だが、今までは外国資本とのJVは税務上の恩典が受けられたのでJVとした。今後は税率が統一され、恩典はなくなる。)

With total

planned capacity of 1 million tonne per year, the project will be

conducted by two stages. In the first stage, Jiutai will

build a 300,000 tonne/year facility with investment of

USD 48.72 million, and aim to start up by the end of 2007. In

the second stage, the company will build a 700,000

tonne/year

facility; it will start construction at the beginning of 2008

and start up by the end of 2008.

Jiutai has 250,000 tonne/year methanol and 150,000 tonne/year

DME capacities in Linyi, Shandong province.

Jiutai Chemical is

building a 200,000 tonne/year DME plant at Guangzhou Nansha

Economic & Technological Development Zone, Guangzhou,

Guangdong Province, which was started construction in H1

2006.

The company also is building large scale Methanol/DME project in Erdos, Inner Mongolia with

planned Methanol capacity of 1.5 million and DME capacity of

1 million tonne per year, which was started in H1 2005.

China Chemical Reporter

2005/5/12

5,000T/A PPS Resin Project in Sichuan 四川省徳陽市 四川徳陽科技

On May 5, a ceremony of

breaking ground was held in Deyang, Sichuan province by Sichuan

Deyang Sci-Tech Company Ltd., for the 5,000 t/a polyphenylene

sulfide (PPS) project, which the company developed the

technology by itself.

The company started to construct a 1,000 t/a PPS resin production

line in 2002, and actualized commercial production in 2003. On

the basis of this line, Deyang Sci-Tech put into an investment of

RMB480 million to construct the 5,000 t/a PPS resin project.

After its start-up scheduled in 2006, the sales revenue is

expected to increase by RMB500 million per year.

Through cooperating with feedstock suppliers and users, Deyang

Sci-Tech will develop other PPS products including granule

materials, film and fiber products so as to profile the PPS

products chain, promoting the development of the special

engineering plastics sector and new polymer material sector.

2005/5/13 Sinopec

Sinopec Chemical Sales Branch Company Set Up in Beijing

http://english.sinopec.com/en-newsevent/en-news/2518.shtml

On 10 May 2005, China

Petroleum & Chemical Corporation (Sinopec) had its Chemical Sales

Branch Company

(Chemical Sales Branch) officially set up in Beijing.

Over more than past 2 decades, Sinopec has embraced quick

business expansions and also undergone multiple reforms, and has

now turned out China’s largest manufacturer and seller

of oil products, and chemical products. In terms of oil refining

capabilities and ethylene producing capabilities, Sinopec has

been ranked in the 4th place and the 6th place respectively among

other players in the world. Seen from the perspectives of oil

refining and sale of finished oil products, Sinopec has already

built up a oil products marketing network comprising oil

refineries, pipelines, oil depots, and petro stations. Besides,

Sinopec is now obtaining even stronger abilities in dominating

the domestic market of finished oil products. Seeing from the

perspectives of production and sale of chemical products, Sinopec’s ethylene production capacity has

accounted for 4.25 million tons/year in 2004, constituting more than 70% of

the country’s total in the same year. As the

Yangzhou-based BASF project and Secco-based ethylene project were

put into production already, and with the launch of new ethylene

projects and also expansion of certain existing ethylene

projects, Sinopec’s chemical products are going to

expand an increasingly expanding share in the market.

Due to many reasons (in historical and other terms) however,

Sinopec has always had its chemical products distributed in a

separated way,

and failed

to lick into

shape a “one-fits-all” distribution network, set up a uniform “Sinopec Brand”, and establish its

marketing edges

by means of its established competitive edges in terms of product

technology. As a consequence, Sinopec has been impeded from readjusting its

product mix,

developing

new products, exploring the market into depth, distributing its

resources, managing its customer base, constructing its

distribution network, planning out and optimizing its operation

strategy and marketing strategy, bringing into play its overall

advantages established

in the chemicals segment and gaining even stronger competitive

forces in the market; in the meanwhile, a vast number of Sinopec’s customers have also suffered

much inconvenience in purchasing products turned out by Sinopec.

China Chemical Reporter

2005/5/20

Forthcoming Petrochemical Integrated Project in Xinjiang 新疆ウイグル自治区

http://www.ccr.com.cn/news_view.asp?ID=659

According to the news

released by the Development and Reform Committee of Xinjiang

Production and Construction Corps on May 9, in the 6 years from

2005 to 2010 the corps will make an investment of nearly RMB30

billion in the construction of 5 major industrial projects

including a 1.2 million t/a PVC integrated chemical project and a

co-generation project. It will be taken as a move to participate

in the development of advantageous resources such as oil, gas and

coal, accelerate the industrialization process and build the new

industrial framework in Xinjiang.

Major projects to be constructed by Xinjiang Production and

Construction Corps from today to the end of the Eleventh

Five-year Plan period mainly include a 1.2 million t/a

PVC integrated chemical project with a total investment of RMB15.2

billion and an annual sales revenue of RMB9.5 billion, a 1.2 million t/a

coke comprehensive chemical project in Dahuangshan with a total

investment of RMB1.66 billion and an annual sales revenue of

RMB1.5 billion and projects of 800 000 t/a

methanol and 520 000 t/a urea in South Xinjiang petroleum and

chemical base using rich oil/gas resources in Wenshu of South

Xinjiang.

Platts 2005/5/26

Taiwan GPPC expanding China ABS capacity by 100 kt/yr by H2 2006

Taiwan's Grand Pacific Petrochemical Corp 国喬石油化学

is in course of

expanding its ABS plant capacity in Zhenjiang 江蘇省鎮江市, China by 100,000 mt/yr

to 250,000 mt/yr,

a source close to the company said Thursday.

The debottlenecking project is scheduled for completion in late

2006, and would require adding a reactor and 100,000 mt/yr line

to the existing plant.

GPPC plans to ship styrene feed from its own plant in Tashe to

Zhenjiang.

GPPC has two styrene plants in Tashe 大社, as well as a 80,000 mt/yr ABS

plant and 25,000 mt/yr polystyrene plant. In addition, GPPC's

wholly-owned subsidiary BC Chemical has the capacity to produce

70,000 mt/yr of PS in Lu Chuh Hsiang, near Tashe.

「人民網日本語版」2005年5月27日 中国最大の民営石油連合企業「長聯石油」が発足

中国初 民間資本の石油グループ、6月設立へ

「競報」の報道によると、中国で初めてとなる民営の石油企業グループが今年6月に設立される見通しだ。

中華全国工商業聯合会石油業商会のキョウ家竜会長が26日、第8回北京国際科学技術産業博覧会で開かれた「中国エネルギー戦略フォーラム」で明らかにしたところによると、この民営石油企業グループの社名は「長城聯合石油集団公司*」。現在は準備の最終段階に入っており、民営石油企業数十社が株式参加の意向を示している。新会社の資本金は約100億元の見込み。

新会社は中国石油業で初めての総合的な民営グループ企業で、川上から川下までの産業をカバーし、調査、採掘、精製、輸送、大口・小売販売、輸出入を一体化した大型多国籍石油企業グループを目指す。時機を見て上場も目指す。

中国の民営企業が参入している石油関連分野は主に川中・川下産業、つまり精製油の加工や大口販売に集中している。川上分野は主に3大国有石油企業(中国石油、中国石油化工、中国海洋石油)で占められている。

(キョウ家竜会長のキョウは「龍」の下に「共」)

* 社名変更 「長聯石油」

2005/6/2

SINOPEC

、カナダのオイルサンド事業を買収

人民日報オンライン版によると、SINOPEC(中国石油化工集団)

は1日、カナダのアルバータ州ノーザンライツにおけるオイルサンド事業の権益の40%を1億5千万カナダドル(約130億円)で買収した。これは中国海洋石油に続く、中国石油大手による同国オイルサンド事業への参入となる。

中国海洋石油は本年4月に、カナダのオイルサンド開発企業・MEGエナジーの株式の16.69%を1億5千万カナダドルで買収した。MEGエナジーは推定40億バレル以上のビチューメン(れき青)を含有するオイルサンドの採掘借地権を100%保有している。

2005/6/15 China

Chemical Reporter

Sinopec Gets Canadian

Resources

SinoCanada Petroleum

Corp., a subsidiary wholly owned by SIPC, and Synenco of

Canada jointly announced on May 30 that both sides have

reached a series of cooperation agreements and will establish

a partnership enterprise to jointly develop the North Pole

Star oil sand project located in Alberta of Canada.

According to

the agreements reached by both sides, SIPC will subscribe

around 150 million Canadian dollars and acquire 40% equity in North Pole Star

partnership enterprise. Synenco will subscribe the assets of

the project, acquire 60% equity and also act as operator of

the project.

Synenco is a

Canadian energy company established specially for the

development of the North Pole Star project. Evaluation of oil

sand resources was launched in 1999 and early-stage

preparations of the project were started in 2003.

China Chemical Reporter

2005/6/7

30 000 T/A Butanone

Project Put on Stream

Recently the 30 000

t/a butanone (methyl ethyl ketone) project completed by Hebei

Zhongjie Petrochemical Group Company Ltd. 河北中捷石化集団公司

was put on stream

in Cangzhou Coastal-port Chemical Industry Zone, Hebei province河北省滄州市

with a total

investment of RMB280 million. It is the current largest butanone

project in China.

The project adopts

the advanced secondary butyl alcohol hydration process, and cut

the production cost of butanone by RMB1 000 per ton by means of

using the byproducts and some auxiliary facility in MTBE (methyl

tert-butyl ether) production.

2005/6/12 Asia Chemical

Weekly

Sinopec、南京の2子会社を統合;PVC

30万トン計画

Sinopec has

reorganized its two Nanjing subsidiaries by the merger of Nanjing

Chemical Industrial Co (NCIC) and Nanjing Chemical Plant (NCP).

Both the two companies are Sinopec's oldest subsidiaries. NCIC

produces chemical fertilizers, organic and inorganic chemical raw

materials, catalysts; while Nanjing Chemical Plant (NCP) produces

rubber chemicals, chlor-alkali products as well as organic

intermediates. According to Sinopec, the merger will enhance the

competitivess of both Nanjing-based companies.

The new company name will be NCIC. Sinopec will inject Rmb600m

($72.5m) into the new NCIC; in turn, the new NCIC will spend

Rmb400m in new investments for its coal-based chemicals, benzene

derivatives and chlor-alkali products.

Nanjing government had requested for NCP's plant facilities to be

relocated to NCIC's site in Dachang district. One of the projects

is NCP's 60,000 tonne/year chlor-alkali plant to NCIC's site and increases the

capacity to 100 kt/a

by end-2005.

Besides the expansion of chlor-alkali plant, NCIC also plans to

build a 300 kt/a PVC project in Nanjing, and the company aimed

to bring the project onstream in 2007.

The proposed PVC projcet would be based on the ethylene-route and

the ethylene feedstock will be sourced from another Nanjing-based

Sinopec subsidiary - Yangzi Petrochemical Co (YPC). YPC runs a

650 kt/a cracker and also operates a 600 kt/a cracker in a jv

with BASF.

2005/6/16 Asia Chemical Weekly

三菱化学、中国寧波のPTA建設開始

三菱化学主導の寧波三菱化学有限公司は8日、浙江省寧波市大シャ島での高純度テレフタル酸60万トンプラントの建設を開始した。寧波三菱化学有限公司は日本側投資会社・寧波PTA投資が90%、中国中信集団(CITIC)が10%のJVで、寧波PTA投資には三菱化学が

61%、伊藤忠商事が 35%、三菱商事が 4%を出資している。

同社は第1次事業計画申請書の批准を2003年6月に受けており、2004年央にも最終承認を受ける予定であったが、承認手続きが遅延し、ようやく本年2月1日に最終事業家計画書の認可を受けた。最終承認は遅れたものの、三菱化学では当初予定通り2006年9月までにスタートできるとしている。

中国の最新統計では、中国のPTA輸入は、ポリエステルの好況を受けて増加しており、2004年は572万トンと前年を大きく上回っている。輸入量は03年が455万トン、02年が430万トン、01年が310万トンだった。

しかしながら中国ではPTAの増設計画が目白押しで、2004年末の能力600万トンに対して、明らかになっている2007年までの増強計画を合計すると1,240万トンで、合計能力は1,840万トンに達する。(添付資料参照)

このすべてが実現するとは思えないが、2007年頃には国産能力は著しく増大し、欧米との繊維輸出規制問題の帰趨等、今後の需要の動向にもよるが、業界筋では輸入量が100万トン程度に減ると見ており(需要によっては輸入は不要となる可能性も;下記注参照)、アジアのPTAの需給状況が激変する可能性が強い。

(Chemnet Tokyo注 )

2005/5のMETI

「世界の石油化学製品需給動向」 では2007年の中国のPTAの需給を

能力 12,296千トン(発表された計画ベース)

生産 9,837千トン

需要 12,527千トン とみている。

一方、Asia Chemical Weeklyでは2007年について

能力 18,400千トン

生産 14,000千トン

需要 15,300千トン

となっており、需要予想にも差がある。

中国のPTA増設計画 2005/6 Asia

Chemical Weekly

| |

Facility location |

capacity

千トン |

On stream |

Status |

Jiangsu

Shenghong Chemical Fibre

|

Wujiang; Jiangsu

|

600

|

past-05

|

study

|

Yisheng

Petrochemical

|

Ningbo; Zhejiang

|

530

|

2005

|

underway

|

Yizheng Chemical Fibre Co Ltd

|

Yizheng; Jiangsu

|

600

|

|

engineering

underway

→1,000

|

Formosa Plastics

Industrial Co (Ningbo)

|

Ningbo; Zhejiang

|

600

|

past-05

|

engineering

underway

|

Guangdong

Maoming Petrochemical Industrial Zone

|

Maoming;

Guangdong

|

450

|

past-05

|

study

|

Huvis Corp

|

Zigong; Sichuan

|

600

|

past-05

|

study

|

Invista Far

Eastern Petrochemicals Ltd

|

Ningbo; Zhejiang

|

600

|

past-05

|

construction

underway

|

Liaoyang

Petrochemical Co

|

Liaoyang;

Liaoning

|

800

|

past-05

|

construction

underway

|

Oriental

Petrochemical

|

Pudong; Shanghai

|

500

→600

|

past-05

|

Taiwan's Far

Eastern Group

|

Yangzi

Petrochemical Co Ltd

|

Nanjing; Jiangsu

|

600

|

past-05

|

engineering

underway

|

Zhejiang Hualian

Sunshine Petrochemical Co Ltd

浙江華聯サンシャイン石化 No.2

|

Shaoxing;

Zhejiang

|

600

|

2005

|

construction

underway

|

Zhejiang Hualian

Sunshine Petrochemical Co Ltd

浙江華聯サンシャイン石化 No.3

|

Shaoxing;

Zhejiang

|

600

|

1-Aug-06

|

construction

underway

|

Zhejiang Tongkun

Group Co

|

Zhejiang

|

600

|

past-05

|

study

|

Zhejiang

Zongheng Textile Group

|

Shaoxing;

Zhejiang

|

120

|

2006

|

engineering

underway

|

Beijing Jialong

Investment Co Ltd

|

Quanzhou; Fujian

|

600

|

past 2006

|

study

|

BP Zhuhai

Chemical Co Ltd

BP 珠海化学

|

Zhuhai;

Guangdong

|

900

|

2007

|

study

(feasibility)

|

China National

Blue Star (Group) Corp

|

Dagang; Tianjin

|

530

|

2007

|

planned

|

Ningbo

Mitsubishi Chemical Co Ltd

|

Ningbo; Zhejiang

|

600

|

2006

|

engineering

underway

|

Shandong Zibo

Wanjie Industrial Co Ltd

|

Zibo; Shandong

|

530

|

2007

|

study

|

Urumqi

Petrochemical Complex

|

Urumqi; Xinjiang

|

800

|

2007

|

study

|

Xianglu

Petrochemicals Corp

翔鷺石油化学

|

Xiamen; Fujian

|

150

|

2007

|

planned

2006年 300

|

Yisheng

Petrochemical

浙江逸盛化学)

|

Ningbo; Zhejiang

|

530

|

2007

|

study

|

| Total |

|

12,440

|

|

|

| 追加 |

Jiangsu

Hailun (海倫) Chemical

|

Jiangyin,

Jiangsu

|

600

|

H2

of 2007

|

started

the construction

|

China Chemical Reporter

2005/6/21

100 000 T/A PP

Project Comes on Stream in Shaanxi 陝西省

100 000 t/a PP

(polypropylene) project was completed by Yanlian Petrochemical

Co., Ltd, a subsidiary of Shaanxi Yanchang 陝西延長Petroleum Industry Group

Corporation, with the total investment of RMB500 million, and

came on stream in Luochuan 洛川 county, Shaanxi province. The

qualified PP products were outlet on June 9.

The project adopts

the global advanced Himont technology from Italy, using SPP

double loop tube process and DCS central integrated distributive

control system.

2005/6/23 Asia Chemical Weekly

中国・盤錦エチレン、エチレン増設計画を変更

遼寧省の盤錦エチレンPanjin Ethylene Industry Corp

(PEIC) はエチレン増設計画を変更した。同社では当初、既存の16万トンプラントを40万トンに増設する計画であったが、この場合6ヶ月程度操業を休止する必要があるため、新しく30万トンプラントを新設することとし、政府に申請を行った。既存プラントは10月の定修中にデボトルネックで能力を2万トン増やし18万トンとする。新プラントが完成すると合計能力は48万トンとなる。(更に450 000 に変更)

盤錦エチレンは遼寧省政府所有の遼寧 Huajin

化工集団 http://www.huajinchem.com の子会社で石油精製会社の傘下でない唯一のエチレンセンター。

(その他の中国のエチレンセンターはすべてCNPC:PetroChinaか

SINOPECの傘下。外資とのJVではBASF-YPC と上海 Secco

は SINOPEC

とのJVで、中海シェル石油化学は中国海洋石油とのJV)

盤錦エチレンは現在、原料ナフサをPetroChinaの大連、大慶両製油所から供給を受けているが、新増設に関してナフサをどうするかが問題となる。このため新設プラントをナフサソースとのJVとする可能性もある。サウジのSABICと大連實德グループの連合が参加するのではとの噂もある。(両社は大連地区で石化事業を検討中)

盤錦エチレンは現在、ブタジェン25千トン、PE

125千トン、PP 50千トン、SM 60千トン、PS

30千トン、ABS 50千トン、BTX 80千トンを生産している。

2007/4/19 Shaw Group

Shaw Ethylene

Technology Selected for New Grassroots Plant in China 盤錦エチレン

The Shaw Group

Inc. announced today that its Shaw Stone & Webster

business unit's technology has been selected for a new

grassroots ethylene plant by Liaoning Huajin Chemicals

Corporation (LHC). The planned plant capacity is 450,000

metric tons of ethylene annually and will be constructed as

part of a major expansion to LHC's existing petrochemical

facility in Panjin City, Liaoning Province, China.

Under this contract, Shaw will provide the process design

package, including related engineering and detailed design

services for key components. Together with the engineering

package, Shaw will also supply its proprietary equipment,

technical services and training to the client during the

execution of the project. The value of Shaw's contract was

not disclosed.

2006/10/24 Asia

Chemical Weekly

着工

HuajinChem will add

ethylene capacity to 630kt 華錦化工集団(HuajinChem:通称盤錦エチレン)

Huajin Chemical

Group (HuajinChem) will expand ethylene capacity to 630 000

tonne/year

from 180 000 tonne/year in Panjin, Liaoning Province, by

building a new 450 000 tonne/year

facility,

rather than earlier announced a new 300 000 tonne/year unit.

The company has

signed an engineering contract with China HuanQiu Contracting

& Engineering Corp (HQCEC), for the new ethylene project.

This project is expected to break ground in March, 2007 and

completed construction by the end of 2008.

The HuajinChem

ethylene plant, also named as Panjin Ethylene Industry

Company (PEIC), has ethylene capacity of 180 000 tonne/year.

It was debottlenecked from 160 000 tonne/year in Q4 2005.

Currently,

HuajinChem is a subsidiary of China North

Industries Group Corporation (CNGC:中国北方工業公司), it was merged by CNGC in

Q1, 2006. It is said that CNGC would secure the feedstock

from overseas market for the new ethylene project.

At present,

HuajinChem operates 900 000tonne/year ammonia, 1.5

million/year urea, 180 000 tonne/year ethylene, 130 000

tonne/year PE, 70 000 tonne/year PP, 75 000 tonne/year of SM,

30 000 tonne/year PS, and 50 000 tonne/year ABS units, etc.

China HuanQiu

Contracting & Engineering Corp (HQCEC)

CNPC傘下の建設会社 http://www.hqcec.com/EN/

中国北方工業公司(CNGC:China North

Industries Group Corporation)

http://www.norincogroup.com.cn/english/

CNGCは国営企業で主業務は中国軍への兵器納入であるが、民事用の機械、化学品、建設機械、その他も扱っている。

2007/5/7 Asia Chemical Weekly

HuajinChem starts construction for ethylene and refinery

projects

On Apr. 28, 2007, Huajin

Chemical Group (HuajinChem) started

construction for its 460,000 tonne/year ethylene project and

a 5 million tonne/year refinery in Panjin, Liaoning Province.

The announced capacity of this ethylene project is 450,000

tonne per year earlier. By building the new facility,

HuajinChem will expand total capacity to 640,000 tonne per

year from the current 180,000 tonne per year.

With total investment of USD 609 million (RMB 4.7 billion),

the ethylene project was approved by government in Aug. 2005.

It includes derivatives like HDPE, PP, EO/MEG, ABS, Butadiene

and BTX facilities. There are expected to start up in Q1

2009.

According to the

industrial sources, the derivative units of Huajinchem

new ethylene show as the following.

HDPE 300,000 tpa

PP 250,000 tpa

SM 120,000 tpa

Butadiene 65,000 tpa

BTX 250,000 tpa

PVC project is shelved and other derivatives capacities

are unknown.

(2003/12時点ではPVC計画あり)

The feedstock will be

sourced from the integrated 5 million tonne/year refinery,

which costs USD 613 million (RMB 4.73 billion), will provide

1.76 million cracker feedstock (includes naphtha and

hydrogenation residue) for the ethylene project. The refinery

is expected to start up by the end of 2008.

At present,

HuajinChem operates 900,000 tonne/year ammonia, 1.5

million/year urea, 180,000 tonne/year ethylene, 130,000

tonne/year PE, 70,000 tonne/year PP, 75,000 tonne/year of SM,

30,000 tonne/year PS, and 50,000 tonne/year ABS units.

HuajinChem was merged by China North Industries Group

Corporation (CNGC) in Q1, 2006. CNGC will secure the

feedstock from overseas market for the refinery.

Also, on Mid Apr. 2007, Liaoning North Jinhua

Polyurethanes,

a jv between HuajinChem and CNGC, has started construction

for its 50,000 tonne/year TDI project in Huludao; Liaoning,

it is expected to startup in late 2008 or early 2009.

China Chemical

Reporter 2007/5/15

Liaoning Launches

Three Projects

A ceremony for

launching the 460 000 t/a ethylene project and the 5.0

million t/a oil chemical project in Liaoning Huajin Group

and the 50 000 t/a TDI project in

Liaoning North Jinhua Group was held in Panjin of

Liaoning province on April 28th, 2007.

The 460 000 t/a ethylene

project got the approval from the National Development

and Reform Commission on August 2nd, 2005. It is composed

of 10 units including HDPE, PP, EO/EG, bulk ABS,

butadiene and aromatic extraction. Huajin's annual total

output of major products such as polyolefins will be

increased from 300 000 tons today to 1.1 million tons.

The project is planned to be completed in March 2009.

The 5.0 million t/a

refining project uses the heavy oil conversion and

refining-chemical integration process route. The

all-hydrogenation mode combining hydrocracking and

delayed coking will be used to achieve crude oil

processing for the production of ethylene raw materials.

After the completion of the project, nearly 2.0 million

t/a of high-quality cracking raw materials such as

naphtha and hydrogenated tail oil will be provided for

the ethylene production. The problem of raw material

availability in the existing unit will also be solved.

The project is composed of 9 units and

storage/transportation facilities. Except the UOP

technology used in continuous reforming, all other units

will use domestic technologies. The refining project is

planned to be started construction in July 2007 and be

completed at the beginning of 2009.

「人民網日本語版」2005年6月23日

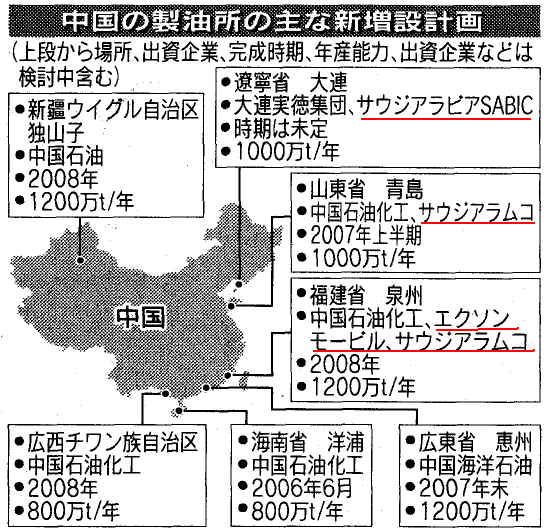

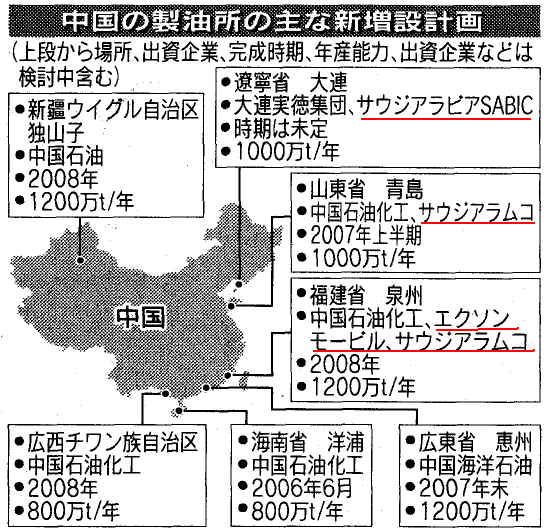

青島で国際製油事業 1千万トン級の工場に着工

1

千万トン級の製油工場などを建設する「青島大製油プロジェクト」の起工定礎式が22日、山東省青島市で行われた。同事業は中国石化公司、山東省国際信託投資有限公司、青島市国信実業公司が共同で出資して進めるもので、サウジアラビアの国営石油会社・サウジアラムコとの合弁協力が予定される大型の対外協力プロジェクトだ。1千万トン級の製油工場が建設されるのは、今世紀では国内初となる。

1期工事では、年間の原油加工量1千万トン、製品油生産量760万トン、化学工業向け軽油生産量100万トンを目標としている。また、排ガス基準「ユーロ3」のクリアも目指している。

日本経済新聞 2005/6/24

ユノカル買収

中国参戦 中国海洋石油が名乗り

シェブロンと対決 米政府・議会に懸念の声も

米石油大手ユノカル買収に中国海津石油(CNOOC)が再び参戦、買収に合意済みの米シェブロンと争うことになった。世界的に油田開発が困難ななか、米国を舞台に、資源確保に熱心な中国を巻き込んだ再編競争が始まった。米政府・議会には国営企業による買収は安全保障上好ましくないとの議論もあり、米中関係にも影響しそうだ。

ユノカルの昨年の確認可採埋蔵量は原油換算で約17億5400万バレルで、そのうち半分近くがアジア地域にある。CNOOCは地元に近い地域に新規の開発投資をせず有力油田を手中に収めることができる。生産量は2倍、埋蔵量も8割増やせる。

中国海洋石油 資源確保を最優先

野へ参入。収益の先行きは不透明感が強い。2006年までに16の海底油田で操業を始める計画をまとめるなど事業拡大に必死だ。

今回の買収案に政府の意向が強く働いたのは間違いない。中国は5月に「エネルギー指導小組」を設置し温家宝首相が組長に就任。同組織の最重要課題は石油の安定確保のために海外油田開発を強化すること。買収資金についてある国有金融機関は「石油のためならいくらでも貸す」としている。

The Union Oil Company

of California was founded on Oct. 17, 1890.

To form Union

Oil, co-founders Lyman Stewart, Thomas Bard, and Wallace

Hardison merged their holdings.

Stewart and

Hardison met in the Pennsylvania oil fields, which boomed

after the country's first oil well was drilled near

Titusville in 1859. The partners built up modest oil

fortunes, then sold out and moved west in the 1880's to seek

greater opportunities in California.

In 1890,

Stewart and Hardison combined their oil assets with those of

Thomas Bard, a prominent businessman, to form the Union Oil

Company of California. The company was incorporated on

October 17, 1890, in the small town of Santa Paula, located

about 100 miles northwest of Los Angeles.

日本経済新聞 2005/8/3

中国海洋石油、ユノカル買収を断念・米議会の反発で

米石油大手ユノカルに買収提案していた中国海洋石油(CNOOC)は2日、買収を断念したと発表した。米議会からの反発が予想以上に強く、条件を引き上げても成功の見込みは薄いと判断した。

ユノカルは8月10日に株主総会を開き、シェブロンによる買収の承認を株主に求め最終決定する。

2005/6/29 Vopak

Vopak starts development

of sixth terminal in China

江蘇省張家港

http://www.vopak.com/press/137_591.php

* Vopak starts

development and construction of new chemicals terminal in

Zhangzijagang, China

* Vopak’s sixth terminal in China and the

first fully-owned

* Terminal to be

operational in 2008

人民日報 2005/7/7

山西省、年間売上高500億元の石炭化学工業を育成

伝えられるところによると、山西省の関係部門は、2005年~2007年の間に、石炭化学工業に92.4億元を投じて、石炭産業チェーンを完備させ、2007年の石炭化学工業の売上高を500億元に増やすことを計画している。

年初に、山西省は『山西省の優位のある石炭化学工業の推進加速に関する3カ年計画』を打ち出した。その内容は、「天脊」、「三維」、「山焦」、「太化」、「豊喜」など石炭化学工業の大手を重点的にサポートし、これらの企業の年間売上高の30億元突破に協力すること。「化学肥料、メチルアルコール、エチレン、ベンゼン、コールタール」の五大基礎的製品をめぐって、20のプロジェクトを重点的に実施し、石炭化学工業の産業群を形成させ、山西省の石炭化学産業の持続可能な発展を実現することなどである。

この計画が達成されれば、2007年には、山西省の高濃度化学肥料の総生産量は600万トン、メチルアルコール及びその下流製品の総生産量は200万トン、ポリ塩化ビニールの総生産量は100万トン、クロロプレンゴムの総生産量は5万トン、ポリビニールアルコールの総生産量は10

万トン、ベンゼン及びその下流製品の加工能力は80万トン、コールタールの精加工能力は80万トンになる。そして、この年の山西省の石炭化学産業の売上高は500億元に達し、現在の売上高より350億元増えることとなる。

China Chemical Reporter

2005/7/6

Hotung Plans to Increase Investments in Nanjing 台湾ホートン・ケミカル

The Letter of Intent

signed by Taiwan Hotung Chemical Corporation on June 10 has a

total investment of US$183.5 million and covers petrochemical and

bio-drug sectors.

In 1993 Hotung Chemical Corporation made an investment through

its wholly-owned subsidiary and established Nanjing

Jintung Petrochemical Co., Ltd. 南京金桐石化 in collaboration with Sinopec

Jinling Petrochemical Limited Corp金陵石化. The new company has a registered

capital of RMB168.2 million and the equity ratio between Hotung

Chemical Corporation and Jinling Petrochemical Limited Corp. is 60 : 40. Leading products in the company

are alkylbenzene series products. The total output

value was RMB684 million and the net profit was RMB27 million in

2004. Totung Chemical Corporation has therefore become the second

biggest alkylbenzene producer in the world. It is reported that

Jintung Petrochemical Co., Ltd. is the biggest joint venture

project launched by Sinopec together with Taiwan petrochemical

enterprises.

Asian Specialty

Chemicals Newsletter 2001/11/7

Jin Tung

Chemical Corp, an affiliate of Taiwan's Ho Tung Chemical

Corp, is expected to open a new 72 000 tpa linear alkyl

benzene (LAB) plant in Nanjing, China, sometime in Q3 2002.

The company has commenced construction of the plant, which

will source feedstock from Jinling Petrochemical. The new

plant is a joint venture between Jinling Petrochemical of

China and Ho Tung Chemical.

Shandong Business Net 2005/6/30

中国最大の民営石油連合企業が発足

http://www.trade.gov.cn/japanese/php/show.php?id=567

30余社の民営石油企業が加盟する「長聯石油株式会社」(英語名:Great

United Petroleum Holding Co. LTD、略称:長聯石油、GUPC)が6月29日北京で設立され、これはこれまでのところで、中国最大の民営石油連合企業であると見られている。

長聯石油株式会社(略称:「長聯石油」)は数多くの民営石油・天然ガス企業が共同で設立したもので、石油の探査・採掘、精製・石化、石油の輸入貿易、卸売り・小売を主な営業内容とし、「逐次拡大する」というパターンで上流、中流、下流の民営石油企業を加盟させ、さまざまな民営石油企業に「オープンな平等に参与し、協力して共にメリットを手にする」という受け皿をつくるものである。

長聯石油株式会社は石油・天然ガスの探査・採掘、原油の加工、精製、石油液化ガス、液化天然ガス、石油製品、燃料オイル、加工済みの石油製品(ガス、石炭、ディーゼル・オイル)、潤滑油の生産、卸売り、小売り、備蓄、輸送、石油産業への投資、情報提供、コンサルティングを主な経営内容としている。同企業の現在の資産規模は50-100億元で、経営資産は1000億元に達する。

*当初の社名案は Great

Wall United Oil Group Corporation

日本経済新聞 2005/7/13

中国石油事業 外資が攻勢

米エクソンとサウジアラムコ

シノペックと共同 精製・小売り一貫で

米エクソンモービル、サウジアラビア国営石油会社(サウジアラムコ)、中国石油化工(シノペック)の3社は福建省で石油精製、石化製品生産、小売りの一貫事業を共同で展開することで合意した。外資側は別の製油施設への出資も検討中で、成長市場に攻勢をかける。中国政府には石油資源を持つ欧米の石油メジャーや産油国企業を引き込み、原油の安定調達につなげる狙いもある。

2005/7/24 Asia Chemical Weekly

中国/台湾のJV、江蘇省で60万トンPTAプラント建設開始

On 17 July 2005,

Jiangsu Hailun (海倫) Chemical Co. started the

construction for its 600 kt/a PTA project in Jiangyin (江陰), Jiangsu Province.

The total

investment for the PTA project is USD 600 million, and the

project is expected to be commissioned by H2 of 2007.

Hailun Chemical is

a 50:50 jv of Jiangsu based Sanfangxiang (三房巷) Group and Taiwan

based Dragon Group.

Located in

Jiangyin, Jiangsu Province, Sanfangxiang is a major PET producer

in China. It has the advantages of Port and Logistics as Jiangyin

is an important Port of Yangtze River.

Dragon Group

produces PX, PTA and PET products; it has a subsidiary Dragon

Special Resin (DSR) in Haicang Industrial Zone (海倉工業區) in Xiamen, Fujian Province福建省廈門

(the same site as

Xianglu Chemical Fibre).

Dragon Special Resin

Founded in April

2002, Dragon Special Resin (Xiamen) Co., Ltd. (DSR), approved

by Xiamen City Government and by the Ministry of Commerce, is

a foreign investment enterprise. Located in the Haicang

Investment Zone of Xiamen city, the DSR facility occupies a

total site area of 24 hectares. With the investment totaling

US$274 million, DSR has several nationally promoted projects,

such as the Specialty Resin Production Line, capable of

producing 320,000 tons of specialty polyester annually, and

the Centralized Utility Center in the South Industrial Zone

of Haicang.

The main

products of DSR are Bottle Grade Chips, Industrial Grade

Chips as well as other related high quality products. DSR

also provides public utility such as steam, heat through

heat-transferring medium and electricity.

日本経済新聞 2005/7/26

大型石油精製所 インドネシアに建設 中国石油化工、10億ドル投資

インドネシア政府は25日、2007年までの完成を目指し、中国国有石油2位の中国石油化工(シノペック)が東ジャワ州トゥバンに大型石油精製所を建設することを明らかにした。精製能力は日量最大20万バレルで投資額は約10億ドル(約1116億円)。中国企業が石油精製所に本格投資するのは初めて。中国勢のインドネシア向け石油関連投資が加速しそうだ。

ユドヨノ大統領が27日に訪中した際に合意書を交わす。インドネシア国営石油会社プルタミナが協力し、シノペックが石油精製所を建設・運営する。年末にも着工する。東ジャワ州で2008年に生産を始める。チェプ油田などの石油精製に当たる。

インドネシアでは中国海洋石油など中国系の原油ガス開発会社が投資を積極化している。中国海洋石油は同国の原油生産量で現在3位。大型石油・精製所の建設で、中国の東南アジアでのエネルギー開発の主導権が一段と強まりそうだ。

China Chemical Reporter

2005/7/27

Xinjiang and ChemChina Sign Cooperation Agreement 新疆ウイグル自治区

Xinjiang and

ChemChina signed an agreement on overall strategic cooperation on

July 13. It shows that ChemChina has started to make full-scale

participation in the development of related sectors in Xinjiang.

According to the agreement, ChemChina will establish 3 industrial

bases of chlor-alkali and PVC, radial tires and soda ash in

Xinjiang. The final capacity will reach 600 000 t/a PVC, 500 000

t/a caustic soda, 1.0 million sets/a radial tires and 600 000 t/a

soda ash. The total project investment will be around RMB9.0

billion. After the completion of these projects, the sales

revenue will be RMB8.0 billion and the profit and tax will be

around RMB2.0 billion a year.

ChemChinaは昨年5月に国営のChina National Blue Star

(Group) (藍星グループ)と

China Haohua

Chemical Industrial (Group) (昊華化工)が統合したもの。

中国化工集団公司 http://www.chemchina.com.cn/job.htm

China Chemical Reporter

2005/7/28

200 000 T/A LDPE

Project Launched in Daqing 大慶石油化学

The 200 000 t/a LDPE (low density polyethylene)

project has been launched in Daqing Petrochemical Co., Ltd. in

July 2005, with a total investment of RMB1.28 billion. Because of

its completion, the company’s annual output of polyolefin will

increase from 480 000 tons to 680 000 tons, and the output of specialty

material will account for over 40% in the company’s polyolefin output. Adopting Lupotech T

technology from Basel Company, the project can manufacture 5

categories, 43 types of LDPE products, with the characteristics

of good catalyst capability, short process flow, simple facility,

less request on the precision of raw materials, and low energy

consumption. Besides, using the Lupotech T technology, LDPE

homopolymer and ethylene-vinyl acetate copolymer (EVA) can be

produced.

* Lupotech T - high pressure tubular

reactor process for the production of LDPE homopolymers and

EVA-copolymers

Platts 2005/8/2

China Garson defers

indefinitely third EPS unit on over-capacity 嘉盛石化

China's Garson

Petrochemical

has postponed indefinitely the start up of its third expandable

polystyrene unit in Jiangyin, pending a sustained recovery in

cash margins, a source close to the company said Tuesday.

Asia Chemical Weekly

2004/4/23

China's

Jiasheng defers launch of EPS line by 5 months to Aug-Sep

China's Jiangsu

Jiasheng

Petrochemical Industry (嘉盛石化) has deferred by five months the

commissioning of its second expandable polystyrene line in

Jiangyin, to August or September, a company source said.

Jiasheng, also known as

Garson Petrochemical Industry, plans to start up its third

EPS line in May-June next year. All three EPS lines have

identical nameplate capacities of 60,000 mt/yr each. They

will eventually be linked to form a single plant. Jiasheng's

first line was operating at 70% capacity on Monday due to

weak negative cash margins. Early Monday, China's styrene

monomer and EPS markets were pegged at Yuan 9,000/mt ex-tank

and Yuan 8,900/mt ex-work, respectively. This meant that

local EPS producers were making losses of about Yuan 900/mt

($108/mt).

China Chemical Reporter

2005/8/9

PTMEG Project Startup in Jilin

Recently the 20,000 t/a PTMEG (polytetramethylene ether glycol)

project was groundbreaking for its starting construction in Jilin

Qianguo(前郭) Refinery (JLQR). The project

adopts the advanced process from America and Korea. The main

material obtained from abundant corn in Songyuan(松源市), Jilin province where JLQR is

located.

* JRQRはCNPC(PetroChian)子会社

* とうもろこしの芯→フルフラール→THF→PTMEG→Spandex

* 通常は1,4ブタンジオール→THF

BASF上海はブタン→THF

◎ 中国の状況

Platts

2005/8/11

China's Yizheng plans 1-mil mt/yr PTA plant startup by end-2007

儀征化繊 →900,000tpa

China's Yizheng

Chemical Fibre Co Ltd has scheduled to start up a new 1-mil mt/yr

purified terephthalic plant at its site in Jiangsu by the end

of 2007, a company source said Thursday. Approval from the

central government, however, was still pending although it is

considered a formality, the source added, with works expected to

start at the end of the year. Yizheng operates two PTA lines in

Nanjing. Its No 1 line has capacity of 325,000 mt/yr, while its newly-debottlenecked No 2 line's has

585,000 mt/yr

capacity, up 135,000 mt/yr since April of this year. All of

Yizheng's PTA output is for captive use, as the company is one of

the largest producer of PET chips and resins in China. Yizheng

Chemical Fibre Co Ltd is a subsidiary of Sinopec Corp.

Meanwhile, Yizheng has started up its new 160,000 mt/yr

polyethylene terephthalate bottle grade plant at its site in

Jiangsu early August, the source said. This will boost its total PET to 1.73-mil

mt/yr. Given

that its total PTA capacity is at 910,000 mt/yr while its

downstream PET capacity is 1.57-mil mt/yr, Yizheng still has a

large gap in feedstock needs.

2001年3月14日 社名変更

旧社名:Yizheng

Chemical Fibre Company Ltd./儀征化繊(イージエン・ケミカル)

新社名:Sinopec

Yizheng Chemical Fibre Co. Ltd./儀征化繊(イージエン・ケミカル)

主要株主:

China Petroleum

& Chemical Corp (42.00%)

HKSCC Nominees Limited (33.62%)

China International Trust and Investment Corporation (18.00%)

中国のアパレル産業用の天然繊維不足を解消するため、中国政府が打ち出した緑化プロジェクト推進組織として、1978年に設立された。同社の主な活動は、中国におけるポリエステル・チップとポリエステル主体繊維の製造と販売である。同社は、中国最大、世界第5位のポリエステル製造会社である。同社の製品は、中国全土で販売されており、広範な顧客基盤を持つ。また、海外にも製品を輸出している。同社の本社と製造工場はイージェン市内にある。

Platts

2006/8/30

China's Sinopec

Yizheng awaits go-ahead on 900,000 mt/yr PTA unit 儀征化繊

China's Sinopec

Yizheng is now awaiting headquarters' approval prior to

commissioning its newest 900,000 mt/year

purified terephthalic acid plant in Yizheng City of east

China's Jiangsu Province, a company source said Wednesday.

The PTA plant

received approval by the Country's National Development and

Reform Commission in 2004, but construction works have been

delayed by Sinopec specifications that require at

least 70% of the plant components to be domestically

produced.

2005/8/14 Asia Chemical

Weekly

Zhenjiang's ABS producers

further impacted by new rule

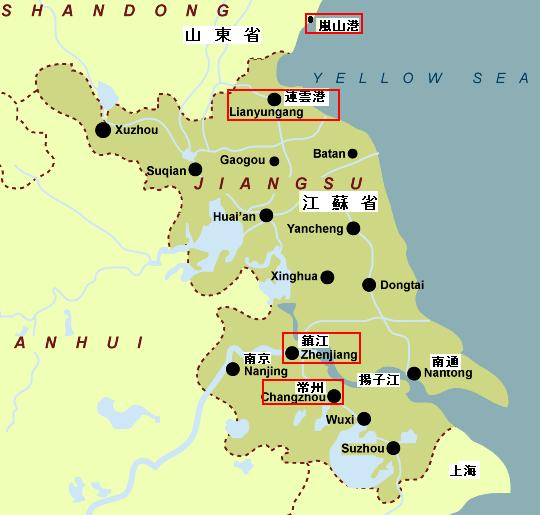

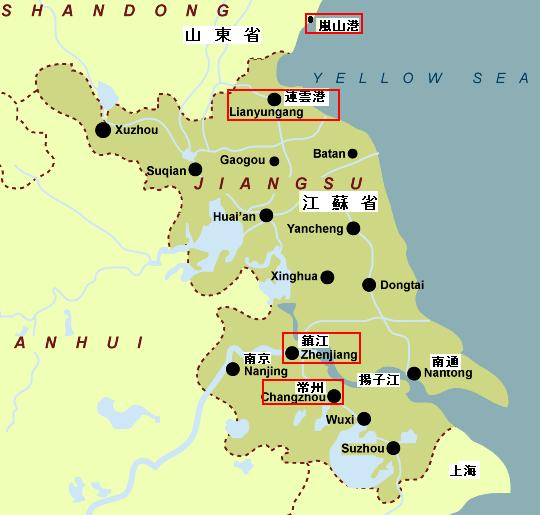

On 12 July, China's

Ministry of Communications (MOC) released the No.9 announcement

in 2005. It announced a new rule which restricts the capacity of

trucks carrying hazardous products (includes ACN). The new rule

started effect on 1 August.

According to the new

rule, each truck can carry only 10 tonne of ACN or

other hazardous chemicals presently, down from 30-50 tonne

previously. The rule does not apply to ISO-certified trucks,

which can carry up to 17 tonne of goods.

Since 1 June 2004, China's government had banned the

transportation of ACN along the waterway of Yangtze River, and imposed a US$10/tonne

surcharge on ground transportation due to the environmental

concerns. Two Taiwanese ABS producers in Zhenjiang - Chi Mei and

Grand Pacific Petrochemical Corp (GPPC) - were most impacted by

the Yangtze River ban of ACN.

This time, the users of

ACN, especially the ABS producers located along the Yangtze

River, have been impacted further by the new transportation rule.

Because there are no enough ISO-certified trucks to meet market

demand; the ACN buyers have to hire more trucks to carry the ACN

feedstock and that means higher logistics costs.

Besides Chi Mei and GPPC

in Zhenjiang, other companies are impacted by the new rule

include Shinho Changzhou Petrochemical whick produces ABS in

Changzhou (also along Yangtze River), and Zhenjiang Nantex

Chemical, which produces NBR in Zhenjiang.

Currently, Chi Mei and

GPPC imports ACN feedstock by Lianyungang port (連雲港), Jiangsu Province and Lanshan

Port (嵐山港), Shandong Province, and then

transports to Zhenjiang through the ground way.

China

Chemical Reporter 2005/8/17

Tianjin Lingang Industry Zone Starts Construction 天津臨港産業区

Tianjin Lingang Industry

Zone, the first offshore new chemical city in China, has passed

the examination of the State Council for the seawater utilization

right. 6 well-known domestic and foreign enterprises have made

investments in the zone. The total investment has reached nearly

RMB20.0 billion. After the completion of these projects, the

industrial total output value will be RMB65.0 billion and the

profit and tax will be nearly RMB3.0 billion a year.

Lingang Industry Zone is located in shallows south of the estuary

of the Hai River in Tanggu (塘沽) District. It is totally formed through the

land reclamation from the sea, being the first example in China.

The long-term development area is 79 km2 and a land area of 21.66

km2 has already been formed today.

6 domestic and foreign enterprises have signed agreements on

project investment. Projects include the 350 000 t/a

thermal-process VCM project funded by Tianjin LG Bohua Chemical Co.,

Ltd.,

the 200 000(300,000?) t/a PS project

funded by Taiwan Loyal Group, the relocation

project of Tianjin Soda Plant, the 2.0 million t/a ship building

and 300 000 t/a ship repair project in Tianjin Xingang Shipyard

and the lubricant project funded by Korean

companies.

Besides, ChemChina, SK

Group of Korea and Oil Company of the United Arab Emirates are

planning to jointly construct a 1.0 million t/a ethylene and 10.0

million t/a oil refining project.

Taiwan Loyal Group

Taiwan Loyal Group, the beggest EPS manufacturer of Asia,

came racing to Tianjin Economic-Technological Development

Area

http://en.investteda.org/informationcenter/newsletter/2004/t20050408_2739.htm

Taiwan Loyal Group, the largest EPS manufacturer

of Asia and the second largest of the world, has invested in

its 8th enterprise in mainland China in the Chemical

Industrial Park of TEDA(Tianjin

Economic-Technological Development Area).

Taiwan Loyal Group established Tianjin

Longqiao Engineering Plastic Co., Ltd. in Tianjin with a total

investment of 29.98 million dollars, a registered capital of

12 million dollars and an area of approximately 100,000

square meters. The expected annual output is 120,000 tons

for Phase I of the project, and 180,000 tons for Phase II. The company is expected to be

ready to go into operation within this year.

The investor, Taiwan Loyal Group, was founded in Kaohsiung,

Taiwan, in July 1974 to produce expandable polystyrene (EPS)

and then Phenolic Resins (PF) and Furan Resin (FR) two years

later. EPS is applied in the packing industry, building

industry, agriculture and fishery, and technical industies,

while PF/FR in foundry industry. Up to now the Long Wang

Brand EPS holds an annual output of 640,000 tons which ranks

the first in Asian and the second in the world. It is

reported that the domestic annual demand for EPS goes up at

10% of an annual growth rate, and thus the annual demand will

reach one million tons by 2010.

寧波新橋化工 Ningbo He-Qiao Chemical

Industrial Company

EPS樹脂

(三菱商事7.8%、トーホー商事7.8%、台湾ロイヤル84.8%)

http://www.loyal.com.tw/serv03.htm

Loyal's China

business grew quickly, and by 1990, Mr. Y.C. Liao began

searching for a joint venture partner to set-up an EPS

manufacturing site in China. He found the perfect partners in

the Mitsubishi Corporation, one of the largest trading

firms in the world, and the Toho

Industries Ltd.,

the largest EPS molding company in Japan.

In May of 1992, the Ningbo He-Qiao Chemical Industrial

Company was founded and production began in October, 1993.

The Ningbo factory was Loyal's first overseas project and the

first endeavor with foreign investors. Both have turned out

to be a great success. Mitsubishi and Toho have found Loyal

to be a reliable partner in the He-Qiao factory.

Setup time:

1990/05/22

Address:Ningbo

Economic and Technic Development C1 Zone, Jia Jiang Province,

PRC.

Product:

Expandable Polystyrene

Capacity:

180,000 MT/year

Tianjin Soda Plant

http://tjsoda.en.alibaba.com/aboutus.html

Founded in 1917,

Tianjin Soda Plant is the first large-scale soda manufacturer

in East Asia. It is located in Tanggu District, Tianjin City,

where is only 5 kilometers away from Tianjin Port.

天津エチレン計画

1)Sinopec計画 1million

tonne/year ethylene project

The Project Proposal have been sent to the

NDRC of China, and Sinopec is waiting for the approval of

NDRC. The proposed project will cost the total investment

of USD 2.48 billion (RMB 20.1 billion) and it is expected

to start up in 2008.

2) Dow Chemical 見送り?

3) The consortium of ChemChina,

SK Group

and UAB Oil Company.

Platts 2005/8/26

China's Liaoyang to start PX line in Nov, capacity up to 650kt/yr

遼陽石油化学( PetroChina

group)

China's Liaoyang Petrochemical Co will commission a new

350,000 mt/yr paraxylene line by October or November this year,

a company source said Friday. This would boost its total PX

capacity to 650,000 mt/yr.

Plans have also been drawn up to start up another 530,000 mt/yr PTA line this year, although further

details were unclear. The company's downstream production

capacity at its site in Liaoning遼寧省, northeastern China, include 270,000 mt/yr of

purified terephthalic acid, 100,000 mt/yr of monoethylene glycol

and 300,000 mt/yr of polyethylene terephthalate. Liaoyang Petrochemical comes

under the umbrella of PetroChina and represents the biggest fiber

production base in North China.

2007/4/19 China

Chemical Reporter

Liaoyang

Petrochemical Completes PTA Expansion

On April 12th, 2007

CNPC Liaoyang Petrochemical Co., Ltd. (Liaoyang

Petrochemical) completed its 530 000 t/a purified terephthalic acid

(PTA) expansion project in Liaoyang, Liaoning province. Up to

now, the total PTA capacity of the company therefore reached 800

000 t/a.

On September 10th, 2004 construction on the 530 000 t/a PTA

expansion project was started, when the company owned a 270

000 t/a PTA production unit. This expansion project was

originally planned to be put on stream in December 2006.

December 23,

2003 UOP

PetroChina Liaoyang Petrochemical Company to Add Additional

Para-xylene Capacity Using UOP Technology

http://www.uop.com/pr/releases/PR.LIAOHUA.final.pdf

UOP LLC has been

selected by PetroChina Liaoyang Petrochemical Company