トップページ

Platts 2004/1/21

Indonesia's Petrowidada assessing

damage at PA complex after fire

Indonesia's Petrowidada said early Wednesday it was still

assessing the damage caused by a major fire Tuesday at its

140,000 mt/yr phthalic anhydride complex at Gresik, Surabaya,

that killed two people and injured about 70 others. The fire,

which followed two explosions, hit the complex at around 1800

local time

Petrowidada

http://www.eterindo.com/pwd/

Petrowidada is the Southeast Asia's major

producer of Phthalic Anhydride (PA). At the beginning, Petrowidada produced PA

commercially in 1989 with initial installed capacity of 30,000

MTPA. Due to the increase of PA demand throughout the region and

worldwide, Petrowidada, having operated its facility above its

capacity of 70,000 MTPA since 1996, now it is awaiting to see the

completion of its most advanced third PA plant which is scheduled

to be completed in the 3rd quarter of 2001 and started its

commercial production in the 4th quarter of 2001. This PA III

plant will give additional production capacity of 70,000 MTPA

making Petrowidada become one of the biggest PA producers in the

world. Petrowidada currently is the sole PA producer in

Indonesia.

PA is a colorless, crystalline organic compound and is an

essential raw material in the production of plasticizers,

unsaturated polyester resins, alkyd resins, dyes and pigments,

and other chemical products such as herbicides, polyester polyol,

etc. Up to now, there is still no substitution ingredient for PA.

Strategic Partnership

One of Petrowidada's underlying strengths is the support and

strategic business competencies of its shareholders, which

comprise of PT Eterindo Wahanatama Tbk, Daewoo Corporation, PT

Petrokimia Gresik (persero), PT Wisma Pintu Sembilan and PT

Justus Kimia Raya. Being one

of the subsidiaries of PT Eterindo Wahanatama Tbk, Petrowidada

has strengthened and widened the Eterindo group strategic

integration plan.

1985

PT Petrowidada was established by Daewoo Corporation,

Petrokimia Gresik (persero) and PT Witulan.

1993

PT Eterindo Wahanatama Tbk purchased new shares issued by

Petrowidada and became the major shareholder.

1996

First expansion of production facility was realized by the

completion of the second PA line. New PA plant gives

additional capacity of 40,000 MTPA, making a total of 70,000 MTPA production capacity.

2001

Construction of third PA line is in progress and expected to

be completed by Q3 this year and commercial production of

such line will be commenced in Q4-2001 by the time this plant

is completed, PT. Petrowidada will have another edition of

70,000 MTPA in capacity.

PT Eterindo Wahanatama Tbk

http://www.eterindo.com/

PT Eterindo Wahanatama Tbk

was incorporated in 1992 as the flagship company of the

Eterindo group. Eterindo group's activities was initiated

actually in 1965 when the Sridjaja family started their

trading business of chemical products. Through a continuous

learning process and abundance of business experience,

nowadays, with its current four operating companies as its

subsidiaries, Eterindo manifests into one among the largest

and most integrated Specialty Chemicals manufacturers in

Southeast Asia producing upstream and midstream chemical

products used in the manufacture of many consumer and

industrial goods.

The generic chemical products are : Phthalic Anhydride,

Plasticizers, Unsaturated Polyester Resins, Alkyd/Amino

Resins, Synthetic Latex Resins, and Specialty Plasticizers.

While Phthalic Anhydride and Plasticzers (DOP) are two

commodity products because they are massively produced, the

resins are considered as specialty chemical products since

they are tailor-made to suit the request from customers.

中国・ASEANニュース速報 2004年11月2日

【インドネシア】フンプスのナフサ事業、年内再開は絶望

ナングル・アチェ・ダルサラーム州アルン産コンデンセート(*)の不足で2002年から操業を停止しているフンプス・アロマティックのインドラ社長は、今年6月に公表した韓国LGカルテックス・ケミカルとの提携合意が遅れたため、操業再開は第4四半期ではなく、来年初旬以降にずれ込むとの見通しを示した。インベストール・デイリーが伝えた。

提携のLGがパラキシレン用のナフサをフンプスの設備を利用して精製するが、原料のコンデンセートはLGが自前で用意する形態。

フンプス・アロマティックの設立には当時のフンプス・グループ所有者のフトモ・マンダラ・プトラ受刑者(スハルト元大統領の三男、通称トミー)が8億米ドルを投じたが、トミー受刑者の債務処理の一環として2000年4月に傘下7社とともに銀行再編庁(BPPN)に移管された経緯がある。

*

コンデンセートとは、天然ガスの採取・精製の過程で得られる常温・常圧で液体の炭化水素をいう。

Dow Jones Business News March

26, 1997

Bechtel, Indonesia Humpuss In Pact On $1.2B Aromatics Plant

Indonesia's Humpuss group has reached an agreement with the U.S.'

Bechtel Corp. which will allow it to complete construction of the

first stage of a planned US$1.2 billion aromatics plant in

northern Sumatra,

breaking a near year-long delay over the project, sources

familiar with the deal told Dow Jones.

Bechtel declined comment on the reported agreement and referred

all inquiries to Humpuss, a business group owned by President

Suharto's youngest son, Hutomo Mandala Putra, also known as

'Tommy'.

PT Humpuss Aromatic managing director Suyatno was also

unavailable, but the sources say a Bechtel affiliate will buy naphtha from the

$350 million condensate splitter in what amounts to a counter-trade deal

that will get Humpuss over financial difficulties it encountered

last year with construction about 80% complete.

2006/2/2

シンガポールのテマセク、チャンドラ・アスリを買収

インドネシアの報道によると、シンガポールの政府系投資機関のテマセク・ホールディングスは、インドネシアのチャンドラ・アスリの株式

50.45% を

7億ドルで買収した。コメルツバンク・インターナショナルの所有する

24.59% と Glazers & Putnam Investment Ltd.(マレーシア)の所有する

25.86% を買収したもので1月27日に株の受け渡しを行った。

チャンドラ・アスリはインドネシア唯一のエチレンセンターで、1989年にスハルト元大統領の一族と丸紅主導の日本インドネシア石油化学投資が設立し、1995年に稼動を開始した。能力はエチレン

51万トン、ポリエチレン 30 万トン。

同社は経営不振により2001年に財務リストラを行ったが、2005年4月に丸紅がシンガポールのコメルツバンク・インターナショナルとの間でパルプ事業経営権と交換することで合意、10月に取引を完了している。

チャンドラ・アスリの残りの49.55% はBarito group の

PT Inter Petrindo Inti Citra が所有している。

2006/1/30 INDONESIA

PRESS

Temasek Buys 50.45%

Stk In Chandra Asri

Temasek Holdings Pte.

Ltd., Singapore's state-owned investment company, has

completed a 50.45% acquisition in Indonesia's debt-laden

petrochemical company PT Chandra Asri, with a transaction

value of $700 million, reports the Investor Daily newspaper.

"The

transfer of shares was conducted Friday," the newspaper

quotes Suhat Miyarso, Chandra Asri's corporate secretary as

saying.

Temasek bought

the shares from several shareholders, including Commerzbank

International Trust Singapore Ltd., the report says.

INDORAMA SPL Group http://www.indorama.co.in/group.htm

INDORAMA SPL Group was

started about two decades ago in Indonesia by Lohia Family. Today, it is a US$ 600 million

conglomerate with core business of Polyester and

Textile. The

group is also involved in Chemicals, Cement, Rubber Products,

Marine farming, Real estate development and other Infrastructure

projects. The Group has manufacturing facilities in Indonesia,

Thailand, India, Turkey, Sri Lanka and marketing offices in

Europe, Africa, Latin America, Hongkong and Singapore.

INDORAMA's Products

are exported to over seventy countries across the world. The

company has gained acceptance in global financial markets and has

built a formidable reputation as a supplier of high quality

products.

Indorama Synthetics

is one of the Indonesia's leading business, voted as one of the

best managed companies in Indonesia by Asia Money's poll of fund

managers every year since 1992 since the poll was introduced.

The INDORAMA Group is

managed by a team of highly qualified professionals ,led by Mr. S. P. Lohia, INDORAMA's dynamic Chairman who

is responsible for globalizing the group.

Lohia Family, which is a well established

Indonesian business group of Indian origin

OP Lohia's Indo Rama Synthetics (India) Ltd.

OP Lohia is SP

Lohia's brother.

Indorama SPL close

to buying Nigerian chem co for $225m

IFC Invests $155 Million in

Eleme Petrochemicals

Indorama SPL Group

| Indonesia

|

Real

Estate(Jakarta) |

Real Estate |

| Indorama

Synthetics(West Java) |

PET Resin

Filament yarns

Polyester Fiber

Spun yarns

Fablics |

| Medisage(Medan) |

Medical gloves |

| India

|

Real

Estate(New Delhi) |

Real Estate |

| Indorama

Cement (Mumbai) |

Cement |

| India * |

Indo Rama

Synthetics (India) Ltd. |

Polyester |

| Srilanka |

Isin

Lanka (Colombo) |

Spun yarns |

| Thailand |

Indopoly(nakhonpathom) |

Filament yarns

Polyester Fiber |

| Indorama

Petrochem (Mapthaphut) |

PTA |

Indorama

Polymers PCL

S.P.Lohiaの弟のAloke Lohia(APL)の事業 |

PET Polymers

PET Preforms

HDPE Closures |

| Turkey

|

Indorama

Iplik (Corlu) |

Spun yarns |

| Nigeria

|

Indorama

Polyolefins (Port Harcout) |

Polyolefins |

| Egypt

|

Indorama

Egypt Petrochemicals (New Damietta) |

Ammonia |

* OP Lohia (SP Lohia's brother)が経営(別経営)

The Plastics

Exchange 2006/2/18

Indorama SPL close to buying Nigerian chem co for $225m

Close on the heels of Dr Reddy's acquisition of

Germany's betapharm, another company with Indian

links is on the verge of a major buyout overseas. It is

reliably learnt that the SP

Lohia-promoted Indorama SPL group, based in

Indonesia,

is close to acquiring Nigeria's state-owned Eleme

Petrochemicals company for $225m.

Eleme Petrochemicals company

http://www.bpeng.org/CGI-BIN/companies/Oil%20and%20Gas/Eleme%20Petrochemicals%20Company%20LTD.pdf

The design capacities

of the complexes’ plants are as follows:

| Plants |

Design plant

Capacities |

| Olefins |

300,000Tonnes/Year |

| Polyethylene |

250,000 |

| Polypropylene |

80,000 |

Reuters

2006/5/4

Nigeria petchem plant to restart in 3 mths-Indorama

Indonesia's Indorama within the next three months will

restart the moribund Eleme Petrochemicals Company Ltd (EPCL)

it acquired for $225 million, Nigeria's privatisation agency

said on Thursday.

The Bureau for Public Enterprises (BPE) said Indorama Group,

which won a 75 percent stake in the firm at an auction in

December, has assumed management control. It will work with a

interim board headed by S.P. Lohia, until July when it will

formally takeover the the plant.

Indorama, Indonesia's largest polyester producer, acquired

the troubled firm without liabilities, after out-bidding

local firm Dangote Group.

Feb 22, 2007

AllAfrica Global Media

IFC Invests $155 Million in Eleme Petrochemicals

International Finance Corporation (IFC), the investment arm

of the World Bank, will invest $155million in Eleme

Petrochemical Company Limited (EPCL). The company will also

fund a comprehensive turnaround programme designed to return

the firm to profitability.

The statement said "IFC will provide a $50 million

loan and

has raised commitments for an additional $80

million from commercial lenders for Indorama Petro Limited, a special purpose vehicle

created for the acquisition that is wholly owned by Indorama

International Finance."

"In addition, IFC will provide $25 million in

debt directly to Eleme for its turnaround capital

expenditure program. Eleme produces petrochemicals, such as

polyethylene and polypropylene that are used for a wide range

of industrial and household products."

日本経済新聞 2006/9/12

インドネシア最大級石油精製所建設計画 ベネズエラも参画へ

インドネシア国営石油会社プルタミナがイラン国営石油会社と合弁でジャワ島に計画中の国内最大級の石油精製所建設に新たにベネズエラ石油公社が参画する。12日にもウィーンで調印する。イランとベネズエラで産出した原油をインドネシアで精製し、日本など東アジアで販売する計画で、日本側にも参画を呼び掛けている。

プルタミナによると、石油精製所の日産能力は30万バレルで総投資額は約40億ドル(約4700億円)。当初インドネシア、イランの合弁で事業を進める計画だったが、原油確保や資金不足が問題となり、ベネズエラ石油公社が投資額の25%、原油の50%を提供することになった。

国際開発センター(IDCJ)(2006年5月17日掲載)

インドネシア・イラン首脳会談とD8首脳会議

http://www.idcj.or.jp/1DS/11ee_josei060517.htm

インドネシアとイランの首脳会談が5月10日、ジャカルタで開催された。会談では、イランの核問題と両国の通商問題が中心に扱われたが、通商問題でイランは、インドネシアに対し約40億ドルの投資を表明した。投資は、石油・天然ガス産業を中心に、その他にも低迷するインドネシア産業活動を活性化させる複数プロジェクトへの投資が含まれている。

インドネシアは産油国でありながら、国内精製システムの整備は遅れている。その理由は、同国の製油所がこれまで低硫黄分の国産原油処理を前提として設計されていることである。プルタミナ(インドネシア国営石油会社)は、2010年までに既存製油所の改造・拡張を計画している。今後、国産原油生産がさらに減少し、原油輸入の増加を余儀なくされることから、輸入代金の削減のため効率的な操業の必要を迫られている。イランとの製油所建設協力は、新規製油所建設、および既存製油所の拡張に向けた中東産油国との協力関係強化の一環と位置づけられる。

2006/2/22 Indonesia Today

CITIC to Acquire Kazakhstan Oil

Assets

Hashim to sell

Nations Energy US$2 billion

http://yosef-ardi.blogspot.com/2006/02/hashim-to-sell-nations-energy-us2.html

Very few in Indonesia

aware that Hashim Djojohadikusumo has become an oil baron. He has

been disapeared from public eyes in the last few years. While

most of his assets in Indonesia have been taken over or pledged

to Indonesia Bank Restructuring Agency (IBRA) following the

financial crisis in 1997, Hashim has huge assets overseas.

One of them is Nations Energy Co. Ltd., founded in 1996 as a

private Canadian company to pursue international oil and gas

exploration and production projects. Hashim is the chairman and

president of Nations Energy.

JSC karazhanbasmunai, a 94.6% owned subsidiary in Kazakhstan, was

purchased in 1997 where it has grown from an average of 4,900 bpd

in 1999 to over 50,000 bpd at the end of 2004. Hashim's older

brother Prabpowo Subianto is the chairman of JSC

Karazhanbasmunai.

In 2003, Nations Energy started additional oil field activity in

Azerbaijan. In 2003, Nations Energy also invested in a publicly

traded Canadian company with oilfield activity in California,

USA.

Early last month, media reported that Chaina National Overseas

Oil Company (CNOOC) was about to buy Nations Energy at US$2

billion. But early this month CNOOC denied the report.Media then

speculated that India's Oil and Natural Gas Company may enter the

bidding.OAO Lukoil, Russia's biggest oil producer, is also

interested in Nations Energy.

Nations Energy proven reserves in Khazakhstan and Azerbaijan

exceeds 400 million barrels.

The question, why Hashim want to sell these oil fields while

they're profitable ?

Some says he want to comeback and buyback his assets in

Indonesia, including the recently-started Tuban Petrochemical

Complex and financing his brother's ailing PT Kiani Kertas

through Merrill Lynch.

PT.

Kiani Kertas

元スハルト大統領の女婿(スハルトの末娘

Siti Hediati Haryadi=Titiek. Prabowo の夫)で軍の特殊部隊の司令官を務めていたプラボオ元中将Prabowo Subianto (Hasimの兄)が所有するパルプ会社。

PT.KIani Kertasはスハルトのクローニー(お仲間)であるボブ・ハッサン(現在服役中)が所有していた会社であるが、通貨・経済危機時に破綻をきたし、2億ドルの融資をマンディリ銀行から棒引きしてもらって再建をはたし、現在はプラボオの所有になっている。

Kiani Kertas

Formerly, it belonged to the empire of timber baron Bob Hasan, one of Suharto’s buddies. Using state

funds for

his Kiani Kertas was one of the crimes for which Bob Hasan

was eventually brought behind bars. Other Kiani Kertas

headlines concerned the horrendous debts that the factory had

amassed and the violence that the local population has been

subjected to. That the factory had to halt production when it

had barely started operating came as a surprise only to those

who did not know that Kalimantan, depleted of its rainforest,

could no longer provide the necessary raw material to feed

the hungry paper mill. Now Kiani Kertas has made it once more

into the headlines, as it is amidst a process of

restructuring its ownership relations.

The solution for the

problem came in the shape of two well known high-ranking

military officers. In December 2003, General Luhut B.

Panjaitan, former Minister for Industry under Suharto, and Prabowo

Subianto,

former Commander of the Special Forces KOPASSUS and former

son-in-law of Suharto, took over the management.

2006/11/27 Indonesia

Today by Yosef Ardi

Agus Anwar to

acquire Kiani Kertas?

http://yosef-ardi.blogspot.com/2006/11/agus-anwar-to-acquire-kiani-kertas.html

Believed to be hiding

in Singapore in the last few years, someone told me this

afternoon that the fugitive Agus Anwar (accused of embezzling

Rp3.2 trillion in state funds) has approached Prabowo

Subianto to acquire the debt-ridden pulp producer PT

Kiani Kertas.

Agus was Hashim Djoyohadikusumo's (Prabowo's brother) partner

in the troubled banks (PT Bank Pelita & Istimarat).

I could only

say, so far, this is a rumor! But that would not be a

surprise if he does. History told us that Indonesians hiding

overseas were the masterminds of major assets buybacks from

Indonesia Bank Restructuring Agency (IBRA). Anwar also owes

Rp300 billion + USD47 million to state-owned investment

company PT Bahana Pembinaan Usaha Indonesia (BPUI).

That's why when

I told my friend, he's senior business journalist, about the

rumor, he said, "So, he use the embezzled money to

purchase Kiani Kertas. It makes sense," he sighed.

上記へのコメント December 02, 2006

"Agus

Anwar to acquire Kiani Kertas?"

Are

forgetting something in here? Whoever wants to acquire

Kiani, you will need to get Bank Mandiri on board. With

Mandiri and Bahana serve the same master, do we actually

believe that Anwar would stand a chance?

Let's not

forget Hashim just got $2 billion

richer from selling his oil stake in Kazakhstan to CNOOC. I'm sure he can spare a

small change to bail out his little bro's pulp company.

So why would he need Anwar for this?

From what I

can gather, one of the reasons that Kiani has not been

restructured is that Mandiri insists on Kiani to pay the

default interest and demands that the debt to pay off

asap and at par. This I found, from a financial

restructuring perspective, is laughable.

HIDEAWAYS OF THE

RICH AND INFAMOUS

AsiaViews, Edition: 08/II/February/2005

・・・・

For Indonesia,

having an extradition treaty with Singapore is not only

connected with the matter of terrorism, but is also a

part of the effort to eliminate corruption. Neighboring

Singapore has long been a haven for Indonesians involved

in corruption cases.

Take for example Bambang

Sutrisno,

the Vice Commissioner of Bank Surya, who was sentenced to

life in prison. The judges could only wring their hands,

because Bambang fled to Singapore before the sentence

could be read. The judge could only read the sentence to

an empty chair.

Jakarta was outraged when it was reported that Agus Anwar, the owner of Bank

Istimarat, had obtained Singaporean citizenship. Whereas,

in Indonesia, he was entangled in a legal case for

embezzling Rp700 billion in funds from PT Bahana

Pembinaan Usaha Indonesia (BPUI), a state-owned finance

company. A wave of protest issued from Jakarta. "In

any case, it feels unethical that someone is involved in

robbing state funds, and our neighbors readily provide

them with shelter, even citizenship," said

Indonesian Minister of Foreign Affairs, Noer Hassan

Wirajuda.

Singapore did not openly admit that Agus had received

citizenship. However, they recently invited the

Indonesian government to file a lawsuit against Agus

Anwar in a Singaporean court. In addition to these two, a

number of suspected corrupters have elected to lay over

in Singapore. If an extradition treaty is not made any

time soon, fleeing to Singapore will continue to be a

corruptor's favorite last resort.

2007/1/23 Indonesia

Today by Yosef Ardi

Hashim bails out Prabowo's Kiani

Hashim Djojohadikoesoemo, younger brother of Prabowo Subianto

(controlling shareholder of PT Kiani Kertas), is reportedly

bailing out Kiani's USD216 million debt to PT Bank Mandiri

Tbk."It's Hashim who helps Kiani to serve its debts at

Mandiri," an investment banker close to the group

said.Hashim just got USD1.9 billion from divestment of

Nations Energy Ltd to CITIC. People close to the deal said

Hashim and his partners (Al Njoo, Honggo, and Prabowo) got

net proceed of USD1.3 billion.

On Jan 10, Kiani paid USD37 million overdue interest to

Mandiri and would settle the remaining USD180 million in a

foreseeable future. No information available on Kiani's

source of funding.But the move has eased Mandiri's pressure

for Kiani divestment as reflected in Mandiri CEO Agus

Martowardojo's statement today. "Nothing we can do. As

long as they pay the debts," a foreign investment banker

commented.

After Kiani, Hashim and friends might go after PT Tuban

Petrochemical Industries he established but lost the

ownership to IBRA due to massive debts. PT Perusahaan

Pengelola Aset (PPA) holds majority shares in the splitter

& aromatic center with Pertamina and Japanese trading

houses as partners.

Indonesia Today

by Yosef Ardi 2007/01/27

"Tirtamas major comeback"

Hashim Djoyo, Al Njoo, and Honggo are partners who

established Tirtamas, one of the strongest group during

Soeharto years. They lost almost all of their assets to

settle huge debts to IBRA. But the group gets out of the

financial collapse and comeback in a big way. Giant

petrochemical assets at PPA* (successor of IBRA) such

as polypropylene producer Polytama and aromatic center

Tuban Petrochemical may well on the top of the list.

* Asset Management Company ("PPA") is tasked

with selling state assets formerly managed by the

Indonesian Bank Restructuring Agency to help cover the

state badget deficit.

2002年にティルタマス・グループは金融再編庁(IBRA)との協議の結果、同社を再編して新会社PT

Tuban Petroを設立、その70%をIBRAが保有、残り30%をティルタマスの元のオーナー・Honggo Wendratnoが個人保証をした上で保有することとなった。

これにより、Tuban Petroは、ティルタマスが株主であったTPPIの59.5%、PP会社のPT

Polytama Propindoの80%(残り10%は日商岩井、10%はBP),ブタノール等のPT

Petro Oxo Nusantaraの50%(残り50%はエテリンド),

ポリエステル繊維のPT Pacific Fibretamaの50%を保有することとなった。

|

2007/03/12

Indonesia Today

"Polyprima deal"

PT

Polyprima is

the second largest purified therephthalic acid (PTA) producer in

Indonesia with 450,000 t/y capacity behind Mitsubishi Chemical

(600,000 t/y). While the company has been integrated with a PET

resin plant (90,000 t/y), the company has to rely on raw material

supply from other company. Pertamina, Petronas, and Ashmore

are competing to control the company. But whoever takes over the

company needs to integrate upward with paraxylene facility. Why?

2007/3/28 豊田通商

子会社の異動(譲渡)に関するお知らせ

当社は、本日開催の当社取締役会において、当社の子会社であるPT.

Styrindo Mono Indonesia(以下「SMI」という)の株式の全部を譲渡することを決議いたしましたので、下記のとおりお知らせいたします。

2.SMI の概要

① 商号 :PT. Styrindo Mono Indonesia

② 代表者 :田村善保

③ 所在地 :Jalan Prapanca Raya No.12 Jakarta Indonesia

④ 設立年月日 :平成2 年6 月23 日

⑤ 主な事業の内容

:スチレンモノマーの製造・販売

⑥ 決算期 :3 月

⑦ 従業員数 :282 人(平成18 年3月)

⑧ 資本金 :US$313,820,000.-

⑨ 発行済み株式数 :313,820 株

⑩ 大株主構成及び所有割合:豊田通商 100%

⑪ 最近の業績 : (単位:US$ 1,000)

| |

平成17 年12 月期 |

平成18 年3 月期 注1 |

| 売上高 |

344,591 |

48,452 |

| 営業利益 |

▲27,410 |

▲1,516 |

| 当期純利益 |

▲127,721 |

▲1,274 |

注1:2006 年3

月期は決算期変更のため1-3

月の変則決算となっております。

⑫ 株式の譲渡先

(ア) 商号 :PT. Chandra Asri

(イ) 代表者 :Ms. Loeki S. Putera

(ウ) 所在地 :Wsima Barito Tower A 7th Floor, jl.

Let. Jend.

S. Parman Kav. 62-63 Jakarta

11410 Indonesia

(エ) 主な事業

:エチレン、プロピレン、ポリエチレンの製造・販売

⑬

譲渡株式数、譲渡価額及び譲渡前後の当社所有株式の状況

①譲渡前の所有株式数 313,820株

(所有割合 100%)

②譲渡株式数 313,820株 (譲渡価額 US$95

百万)

③譲渡後の所有株式数 0 株 (所有割合 0%)

⑭ 譲渡の日程 平成19 年4月上旬予定

⑮ 業績への影響

本件による平成19 年3

月期の当社連結および単体の業績に与える影響はありません。

インドネシアのSMIが復活!2008年から輸出を再開する見込みです。

シェア・ホルダーが、豊田通商からチャンドラ・アスリーに変わり、原料がパイプラインで買えるようになること、および、燃料を重油から天然ガスに変えたことによりVC削減が可能となった結果、現在の1系列運転から2系列運転となる見込みです。

日本オキシラン SM営業部 秋山 正芳 昨日のマーケット(07/06/20)

|

2007/4/6 Bangkok

Post

Indorama to build plant

in N. America

Goal is to become world's third largest

Indorama Polymers Plc (IRP), a manufacturer of polyethylene

terephthalate (PET) polymers, will invest US$105 million (3.69

billion baht) to build a new plant in North America with a

capacity of 300,000 tonnes per year.

The exact investment cost, taking into account the plant

location, could be finalised in the next quarter when the

feasibility study is finished, he said.

IRP will be able to

manufacture 540,000 tonnes of PET polymers by the end of the year

and capacity would increase to 603,000 tonnes per year in 2008.

According to Mr Lohia, the company controls a 4.5% share of the

world market at present. It aims to increase its market share to

7% and become the world's third largest PET polymers producer in

2009, when it expands its annual production capacity to 1.22

million tonnes.

Indorama Polymers

Public Company Limited (IRP), formerly known as Indo Pet

(Thailand),

has been manufacturing PET Polymers since 1995. Headquartered

in

Thailand,

it was promoted by the APL Group (the major shareholder). IRP

is also the parent company of StarPet in USA, OrionPet in

Europe, AsiaPet and Petform in Thailand. Together they form a

524,000 tons per year producer of PET Polymers and has

jointly been referred to as ゜Indorama’.

May 30, 2007 AP 事前ニュース

Indorama to

Build N. America Plastic Plant

Indorama Polymers PCL said Wednesday its

board of directors has approved setting up a new plastic plant in

North America.

The US$140 million (euro103.6 million) facility will produce 420,000 metric

tons of

amorphous PET polymers a year, the company said in a filing to

the Stock Exchange of Thailand.

PET polymers are used in drinks and food packaging among other

applications.

The plan for the facility includes a new solid-state

polymerization plant with a capacity of 420,000 tons a year to

produce the raw materials for PET polymers production.

The exact location of the plant has yet to be decided, but it

will be in the U.S. or Canada, said an Indorama corporate

executive who insisted on anonymity, citing company policy.

The Indorama plant will be built next to a plant producing PTA

plastics, the raw material for PET production, he said.

An announcement will be made in the third quarter of this year as

to the location of the plant and the PTA-supply partner. The

Indorama facility will be fully owned by Indorama.

Financing for the plant will be up to US$100 million (euro74

million) in a long-term loan, with the remaining US$40 million

(euro29.6 million) coming from the company, according to the

release.

Production is scheduled for the first quarter of 2009.

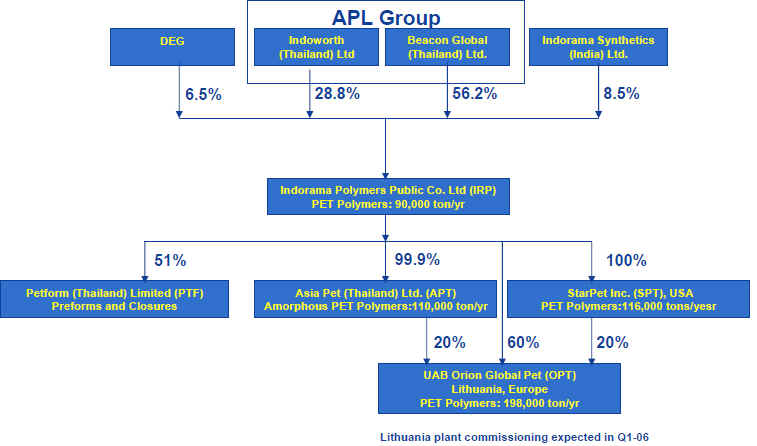

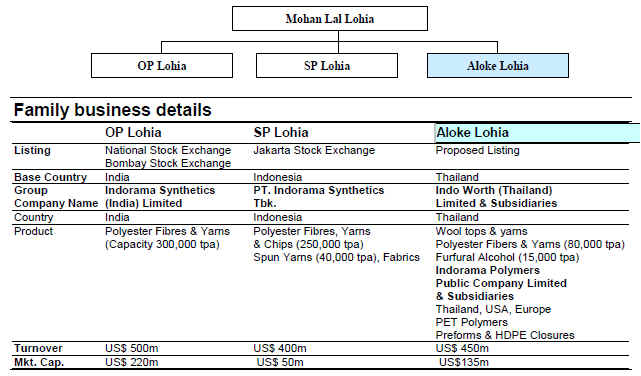

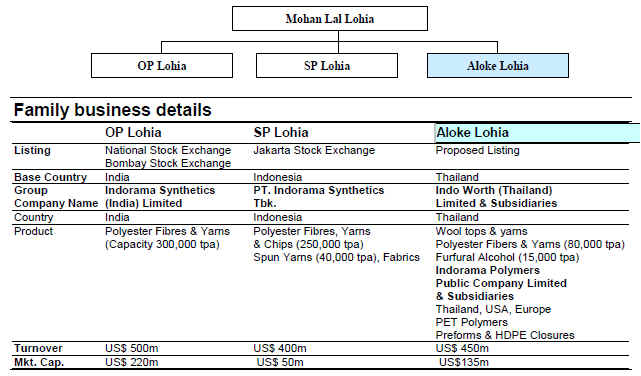

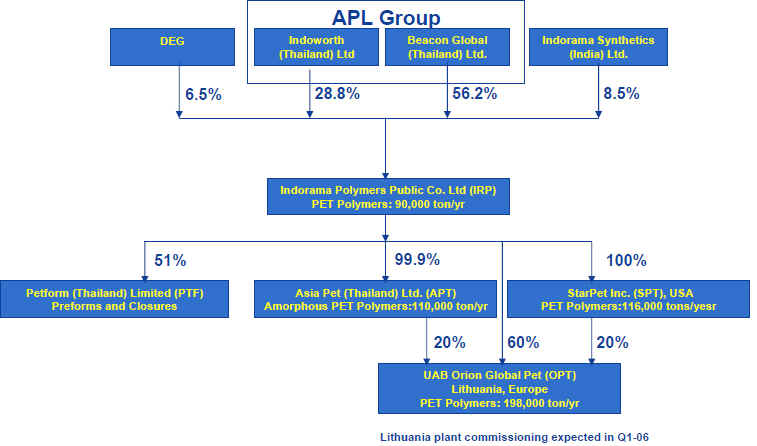

Lohia family

structure

The Lohia family business, Indorama Group, was

established in India by Mohan Lal Lohia and his

uncle, NR Lohia, in 1974.

ML Lohia distributed three businesses in India,

Indonesia and Thailand to his three sons; OP Lohia,

SP Lohia and Aloke Lohia (APL) respectively. http://www.knak.jp/blog/2006-5-3.htm#indoramaAlthough all the

family businesses are in similar industries -

polyester textiles, wool, PTA, PET polymer etc, they

are run independently

without significant cross holdings or questionable

intra-group transactions.

|

http://www.indoramapolymers.com/pdf/Presentation_4July2005.pdf

原料PTAはSP Lohia のIndorama

Petrochem (Map Ta Phut )

Petform (Thailand)

Limited

Petform produces PET Preforms and HDPE Closures for PET

bottles. Its production capacity is 348 million Preform and

540 million Closure per year. It was incorporated on August

5, 1996. It was a joint venture between IRP, Serm Suk Public

Company Limited and DEG. Serm Suk Public Company Limited is

the exclusive bottler of PEPSI beverages in Thailand and is

the major end user of Preforms and Closures. It uses PET

bottles for filling carbonated soft drinks, water and other

beverages. This has enabled IRP to work with end users on

developing product specifications to meet international

quality standards. To facilitate continuous production

process and cost efficiency Petform is located in the same

area as IRP's factory in Lopburi Province.

Asia Pet

(Thailand) Limited

AsiaPet produces Amorphous PET Polymers and is a backward

integration for IRP. AsiaPet was incorporated on July 2, 2001

and it started commercial operations in May 2003. AsiaPet has

a production capacity of 110,000 tons per annum. It services

the raw material requirements of IRP and also services

external domestic and exports customers with different grades

of Amorphous PET polymers. Asiapet is located in the same

area as IRP's factory in Lopburi province. It smoothes out

the process of production and adds to cost efficiency.

StarPet Inc. ,

USA

In order to spread its operations across the globe, Indorama

decided to acquire Starpet, an integrated plant that

manufactures PET in Asheboro, North Carolina in USA. The

plant has a production capacity of 80,000 tons per annum. The

integrated plant has both the Continuous Polycondensation

(CP) plant and the Solid State Polymerization (SSP) plant.

UAB Orion

Global Pet, Lithuania, Europe

In continuation of its globalization strategy, Indorama is

building a green field PET polymers integrated plant in

Klaipeda, Lithuania, Europe. Klaipeda is a free economic zone

for industrial activity and has an all weather seaport. It is

also well connected by rail and road to Europe in the West

and Russia in the East. The plant at Klaipeda will have both

the Continuous Polycondensation (CP) plant and the Solid

State Polymerization (SSP) plant with a name plate capacity

of 198,000 tons per annum. The construction of the plant has

commenced, all financing in place and contracts for plant,

equipment and construction have been executed. Construction

is in progress and the commercial production is expected to

start in October 2006.

Platts 2007/9/14

Chandra Asri's new

ethylene capacity to come on-stream by end-Oct

Indonesia's Chandra Asri

expects the newly-added ethylene production at its Anyer naphtha

cracker to be on-stream by the end of October, a company source

said Friday.

The mechanical work needed to expand the cracker by 70,000

mt/year, to 590,000 mt/year, has already been completed, the

source said.

Platts

2007/10/26

Indonesia's Chandra

Asri completes naphtha cracker expansion

The plant's ethylene

capacity has been boosted by 70,000

mt/year to 590,000 mt/year, and the propylene capacity

raised by 10-15% from 260,000 mt/year.

日本経済新聞 2008/1/20

石化プラント インドネシアで受注 東洋エンジ、300億円で

東洋エンジニアリングはインドネシアのエンジニアリング大手レカヤサと共同で、同国国営石油会社のプルタミナから石油化学プラントを受注した。隣接する製油所からの排出ガスを原料に年約18万トンのプロピレンを生産。従来発電に使っていた排ガスを付加価値の高い石化製品の原料として利用する。受注額は約300億円とみられる。

平成20 年1 月23 日 東洋エンジニアリング

インドネシア

石油精製・石油化学統合プロジェクトを受注

東洋エンジニアリング株式会社(TEC、取締役社長

山田

豊)は、インドネシア国営石油会社プルタミナ(PT PERTAMINA)から、インドネシアの大手エンジニアリング会社であるレカヤサ(PT Rekayasa Industri)と共同で、バロンガン製油所向けプロピレン増産プロジェクトを受注いたしました。

本プロジェクトは、ジャワ島西部チレボン近郊に位置するバロンガン製油所の流動接触分解装置(RCC)の排ガスを原料とし、年産179,000 トンのプロピレンを増産するプラントを建設するもので、石油精製・石油化学統合プロジェクトです。

<受注概要>

客先:

インドネシア国営石油会社(プルタミナ)PT PERTAMINA

受注者: TEC、レカヤサ(PT Rekayasa Industri)コンソーシャム

建設地: インドネシア、ジャワ島、バロンガン

対象設備: プロピレン製造設備 年産179,000 トン

関連付帯設備

摘要技術: 米国ルーマス社OCT(Olefins Conversion Technology)プロセス

役務内容:

設計、機器資材調達、工事、試運転助成までの一括請負い

完成予想: 2010年中頃

契約金額: 約3億ドル

受注の意義: * プルタミナからの2 件目のプラント受注

*

長年のパートナーであるレカヤサとの共同受注案件

* インドネシアで初のOCT プロセス採用

June 24, 2009

Unipol PP process from

Dow selected by Pertamina for Balongan PP Project in Indonesia

UNIPOL(TM) Polypropylene

Process Technology from Dow Basic Plastics has been selected by PT PERTAMINA for its new 250 KTA

polypropylene

facility at its Balongan complex in West Java, Indonesia. A license agreement

for the facility was signed earlier this month.

When the project is completed in 2011, the facility will produce

a mix of polypropylene products including homopolymer, random

copolymer and impact copolymers. Products will be marketed

primarily in the domestic market.

"Pertamina chose the UNIPOL PP Process because the

technology will enable them to build and operate the most

competitive and advantaged facility capable of producing a full

range of performance polypropylene products to serve the market's

ever changing needs," said Karen Shepard Jackson, global

commercial director, Dow Polypropylene Licensing and Catalyst

business. "Producers like Pertamina appreciate proven

technology with a strong track record of reliability,

flexibility, safety and advantaged economics. UNIPOL(TM)

Polypropylene Technology and the advanced SHAC(TM) Catalyst

Systems give licensees the capability to achieve economies of

scale and offer a full range of products to customers."

When this plant and others currently in the execution stage enter

service, the technology will be used to produce nearly 11 million

metric tons of polypropylene per year, which will represent more

than 17 percent of total global capacity.

Polypropylene is a versatile plastic used in packaging, durable

goods, automotive parts, non-wovens, fibers, and consumer

applications.

About Pertamina

PT PERTAMINA is the state-owned oil and gas company (National Oil

Company) of Indonesia, established in 1957. Pertamina's scope of

business incorporates an upstream sector covering oil, gas and

geothermal energy exploration and production both domestically

and overseas, and a downstream sector that includes processing,

marketing, trading and shipping. Pertamina owns seven oil

refineries and is one of the world's largest producers of natural

gas. Pertamina's products include a wide range of fuels, LPG,

LNG, chemicals, additives and retail products.

Polypropylene with the brand POLYTAM is produced

by the PERTAMINA Polypropylene Plant in Plaju.

May 2, 2008 Reuters

Pertamina plans to

build polypropylene plant

Indonesian state oil firm Pertamina plans to build a

polypropylene plant near its 125,000 barrels-per-day Balongan

refinery complex in West Java, a senior company official said

on Friday.

"The prospects for the polypropylene market are good.

That is why we plan to build a polypropylene unit to meet

domestic demand of plastic," Pertamina chief Ari

Soemarno told reporters.

"Pertamina will expand its propylene output for

feedstock for the planned polypropylene plant."

He gave no details.

Another Pertamina official said the polypropylene plant will

cost around $200 million with a production capacity of around

200,000 tonnes a year.

Indonesia currently has a production capacity of around

600,000 tonnes per year of polypropylene.

Indonesia is Asia Pacific's only member of OPEC, but ageing

fields and lack of investment has made the country a net

crude oil importer in recent years, although it is still a

net energy exporter, thanks to a huge supply of natural gas

and coal.

There are three producers of PP resin in Indonesia--PT

Tri Polyta Indonesia (TPI), PT Polytama Propindo and PT

Pertamina (Plaju). TPI is the largest producer.

PT Tri Polyta Indonesia

PT Tri Polyta Indonesia (TPI) came on line in 1992 in

Cilegon, Banten. It uses the gas technology of UNIPOL

developed by Union Carbide Corporation and Shell Chemical

company, TPI started operation operating two production

lines with annual production capacity of 200,000 tons.

In 1995, its third production facility came on stream

increasing its production capacity to 360,000

tons per

year.

Its founding shareholders were PT Bima Kimia Citra

(31.22%) from the Bimantara Group, Prayogo Pangestu

(8.51%), Commerzbank (SEA) Ltd. (7.08%), Henry Pribadi

(6.73%), Ibrahim Risjad (5.31%), Wilson Pribadi (3.89%),

Johny Djuhar (2.13%), Henry Halim (0.71%) and investing

public (34.42%). In June, 2001 PT Bima Kimia Citra and

Henry Pribadi sold their stakes.

In December, 2003, its shareholders included Prajogo

Pangestu (46.46%), Commerszbank (SEA) Ltd. (7.08%),

Ibrahim Risjad (5.31%), Wilson Pribadi (3.89%), Johny

Djuhar (2.13%), Henry Halim (0.71%) and the public

(34.42%). PT

Chandra Asri は同国のPPメーカー

Tri Polyta の株式の

75.95% を取得する。

Chandra

Asri の大株主のBarito group の総帥

彭雲鵬 (Prajogo

Pangestu) が所有する Tri Polyta 株式のうち、5%を除き、Chandra Asri に譲渡する。残りは創業者一族が所有している。

2008/6/7 インドネシア

Chandra Asri

の状況

TPI

produces PP resin in the form of Homopolymer, Random

Copolymer and Block Copolymer, using the brand of

Trilene. The product is used as feedstock for plastic

film, injection moulding, Sheet thermoforming, plastic

yarn and fiber multifilament, etc.

PT Polytama Propindo

PT Polytama Propindo is he second largest producer of PP

resin in Indonesia with an annual production capacity of

180,000 tons in 1996. In 2005, the production capacity

was increased to 200,000 tons.

PT Polytama Propindo is located in Balongan, Indramayu,

West Java near the refinery of Pertamina Exor 1, which

supplies propylene for PT Polytama Propindo.

PT Polytama Propindo established as a joint venture

between PT Tirtamas Majutama (80%), which owned by young

tycoon Hashim S. Djoyohadikusumo and Nissho

Iwai Corp. Japan (10%) and BP Chemical Co. from Britain

(10%).

PT Pertamina--Plaju

The polypropylene plant of Pertamina in Plaju, South

Sumatra, was build in 1971 with an annual production

capacity of 20,000 tons. In 1994, it underwent revamping

to expand its capacity to 45,000

tons

per year.

The basic material for Pertamina Plaju in the form of Raw

Propane propylene is supplied from the FCCUS plant,

Sungai Gerong, South Sumatra.

Pertamina Plaju produces Polytam/Polypropylene pellet,

which is produced through polymerization of propylene

with several additives namely antioxidant, stabilizer,

lubricant, anti-block and slip agent.

http://goliath.ecnext.com/coms2/gi_0199-6684451/Developments-of-polypropylene-PP-resin.html

|

2010/10/4 The

indonesiatoday

Pertamina & Chandra

Asri Invite Saudi Aramco to Join Banten Refinery Project

State-owned oil and gas firm Pertamina and petrochemical company PT Chandra Asri have reportedly invited Saudi

Aramco to join the proposed refinery project in Banten province.

Edy Setyanto, Processing Director of Pertamina, told Bisnis

Indonesia that both companies have offered Saudi Aramco a

possible cooperation in the refinery, which will be located at

Chandra Asri's site in Merak.

The project has earlier been offered to National Iranian Oil

Refining and Distribution (NIORDC).

Chandra Asri, controlled by Prajogo Pangestu, plans to have

equity participation between 20% and 25% in the project.

The US$7 bln refinery will have a

processing capacity of 300,000 bpd of crude oil, and downstream

products including naphtha to feed the petrochemical plant.